Dacha Provides an Update With Respect to its Annual and Special Meeting of Shareholders

November 28 2012 - 9:37AM

Marketwired Canada

Dacha Strategic Metals Inc. ("Dacha" or the "Company") (TSX

VENTURE:DSM)(OTCQX:DCHAF) reports that, as a result of discussions with the TSX

Venture Exchange, at the meeting of shareholders (the "Meeting") scheduled to be

held today, at 10:00 a.m., Dacha will seek the approval of disinterested

shareholders with respect to a resolution confirming termination payments to

certain executive consultants of Dacha and authorizing the grant of a general

security interest over all the assets of Dacha Strategic Metals Ltd. (the

"Subsidiary"), a direct wholly-owned subsidiary of Dacha, to secure such

payments. Dacha also announced that it will propose an amendment to the

Company's 10% rolling stock option plan (the "Option Plan") to make it a fixed

plan and to make certain amendments to the termination provisions of the Option

Plan, as more particularly described below.

Grant of Security Interest

In accordance with the resolution agreement (the "Resolution Agreement") dated

as of November 12, 2012 among Dacha, Goodwood Inc. ("Goodwood") and others, as

announced by Dacha in a press release on the same date, certain executives and

consultants (the "Executive Consultants") of Dacha who had change of control

termination arrangements with Dacha have agreed to reduce the amounts payable to

them such that an aggregate of $4.85 million (the "Termination Payments") will

be paid by Dacha to those executives and consultants in connection with the

termination of their prior arrangements on a pro-rated basis as outlined in the

Resolution Agreement:

The Resolution Agreement provides that the Termination Payments must be paid by

Dacha as soon as reasonably practicable following the conclusion of the Meeting

based upon its cash availability, provided that the Termination Payments must be

fully paid by Dacha no later than four months following the conclusion of the

Meeting (the "Maturity").

The Resolution Agreement contemplates that Dacha will grant (and cause the

applicable subsidiary or subsidiaries to grant) in favour of the Executive

Consultants, as soon as possible, a security interest on rare earth inventory to

secure the Termination Payments as may be allowable by applicable regulatory

authorities and/or in accordance with applicable law and regulations, subject to

the security documentation related thereto being in a form satisfactory to

Dacha's counsel and Goodwood's counsel, each acting reasonably.

Accordingly, Dacha will provide promissory notes (the "Notes") to each of the

Executive Consultants in respect of the obligations of Dacha to pay the

Termination Payments. The Notes are non-interest bearing unless the Company

fails to pay the Termination Payments by the Maturity or on the occurrence of an

event of default. Events of default under the Notes and the GSI (as described

below) include failure to pay the Termination Payments by the Maturity, breach

of covenants, ceasing to carry on business, as well as a bankruptcy event. The

obligations owed to the Executive Consultants under the Notes will be guaranteed

by the Subsidiary pursuant to a guarantee (the "Guarantee"). As security for the

obligations of the Subsidiary under the Guarantee, the agent for the Executive

Consultants will be issued a general security interest (the "GSI") by the

Subsidiary under which the agent will be granted a security interest in all the

present and after acquired property of the Subsidiary (the "Collateral"). Until

an event of default occurs, the Subsidiary will have the right to possession and

enjoyment of the Collateral for the purpose of conducting the ordinary course of

its business. After the occurrence of an event of default, the GSI provides the

Executive Consultants with certain rights and remedies with respect to the

Collateral.

Amendments to Dacha's Stock Option Plan

Under the current provisions of Dacha's Option Plan, the maximum number of

common shares issuable from time to time under the Option Plan is equal to 10%

of the number of issued and outstanding common shares of Dacha at the date on

which an option is effectively granted. Pursuant to the policies of the TSX

Venture Exchange, because it is a rolling option plan, Dacha is required to

obtain shareholder approval for the Option Plan at the Meeting. Instead of

re-approving the Option Plan, Dacha will be proposing that the Option Plan be

amended to fix the number of common shares of the Company issuable under the

Option Plan at a maximum of 7,512,671 (i.e. 10% of the current shares issued and

outstanding of Dacha).

As contemplated by the Resolution Agreement, Dacha will also be proposing that

the Option Plan be amended to provide that (i) upon the resignation of the

departing directors and termination of the Executive Consultants as directors

and/or officers, as applicable, the options previously granted to each of them

as directors, officers and/or consultants, to the extent such options originally

had an expiry date of later than November 28, 2013, shall remain exercisable

until November 28, 2013, and (ii) in the event any other officer, employee or

consultant of the Company is terminated within 90 days of November 12, 2012, all

options granted to such officer, employee or consultant, to the extent such

options originally had an expiry date more than 12 months following the date of

termination, shall remain exercisable for 12 months from the date of

termination.

The resolution to re-approve the Option Plan at the Meeting will be amended to

reflect the foregoing amendments.

About Dacha

Dacha Strategic Metals Inc. is an investment company focused on the acquisition,

storage and trading of strategic metals with a primary focus on Rare Earth

Elements. Dacha is in the unique position of holding a commercial stockpile of

Physical Rare Earth Elements. Its shares are listed on the TSX Venture Exchange

under the symbol "DSM" and on the OTCQX exchange under the symbol "DCHAF".

Except for statements of historical fact relating to the Company, certain

information contained herein constitutes "forward-looking information" under

Canadian securities legislation. Forward-looking information includes, but is

not limited to, statements with respect to the Company's ability to trade in

rare earth elements, the realization value of Dacha's physical inventory

portfolio, proposed investment strategy of the Company, and general investment

and market trends. Generally, forward-looking information can be identified by

the use of forward-looking terminology such as "plans", "expects" or "does not

expect", "is expected", "budget", "scheduled", "estimates", "forecasts",

"intends", "anticipates" or "does not anticipate", or "believes", or variations

of such words and phrases or statements that certain actions, events or results

"may", "could", "would", "might" or "will be taken", "occur" or "be achieved".

Forward-looking statements are based on the opinions and estimates of management

as of the date such statements are made. Forward-looking information is subject

to known and unknown risks, uncertainties and other factors that may cause the

actual results, level of activity, performance or achievements of Dacha to be

materially different from those expressed or implied by such forward-looking

information. Although management of Dacha has attempted to identify important

factors that could cause actual results to differ materially from those

contained in forward-looking information, there may be other factors that cause

results not to be as anticipated, estimated or intended. There can be no

assurance that such statements will prove to be accurate, as actual results and

future events could differ materially from those anticipated in such statements.

Accordingly, readers should not place undue reliance on forward-looking

information. Dacha does not undertake to update any forward-looking information,

except in accordance with applicable securities laws.

Certain information on parties other than Dacha contained in this press release

has been obtained or quoted from publicly available sources, independent

publications, media articles third party websites (collectively, the

"Publications"). In certain cases, these sources make no representations as to

the reliability of the information they publish. Further, the analyses and

opinions reflected in these Publications are subject to a series of assumptions

about future events. There are a number of factors that can cause the results to

differ materially from those described in these publications. None of the

Company or its representatives independently verified the accuracy or

completeness of the information contained in the Publications or assume any

responsibility for the completeness or accuracy of the information derived from

these Publications.

FOR FURTHER INFORMATION PLEASE CONTACT:

Dacha Strategic Metals Inc.

Scott Moore

President and CEO

(416) 861-5903

smoore@dachametals.com

www.dachametals.com

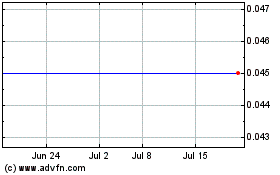

Deep South Resources (TSXV:DSM)

Historical Stock Chart

From Jun 2024 to Jul 2024

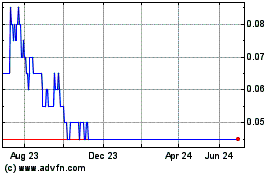

Deep South Resources (TSXV:DSM)

Historical Stock Chart

From Jul 2023 to Jul 2024