December 13, 2021 -- InvestorsHub NewsWire -- via NetworkNewsWire

Editorial Coverage: Every generation is witness to some type of

earth-shattering developments, many from which investors can

benefit. For the demographics that made up the Depression Era, the

world may have moved slower than today, but those decades still

gave way to monumental breakthroughs such as insulin, television,

solar cells, antibiotics, hard drives and much more — even

sliced bread. From Gen X forward, the internet became part of

everyday life, with one technology accelerating the development of

the next to reshape how the world functions. Online shopping

effected physical malls so significantly that Newsweek declared them obsolete in 2008. In

fairness, no change in a multitrillion-dollar industry happens

overnight, and brick-and-mortar store sales still outstrip those

online, but ecommerce sales continues to

grow each year. Those who missed the early days of

ecommerce can take heart that new technologies are disrupting other

huge industries, including the gaming market. In the

business-to-business segment, Software-as-a-Service (SaaS)

technology company Playgon Games Inc. (TSX.V: DEAL)

(OTCQB:

PLGNF) (Profile) is emerging as a leader,

developing and licensing unique digital content for the iGaming

market for companies. The market is massive in scale, with

companies and consumers clamoring for gaming content from the likes

of Playgon, Rush

Street Interactive Inc. (NYSE:

RSI), MGM

Resorts International (NYSE:

MGM), Las

Vegas Sands Corp. (NYSE:

LVS) and Evolution ADR (OTC:

EVVTY), especially after the COVID-19 pandemic shook

the market hard, causing a spike in users that caught many gaming

providers off guard.

- Grandview Research estimates that global online gaming revenue

stood at $75 billion in 2021 and will reach $127.3 billion by

2027.

- With its mobile-first, streaming, high-definition platform,

Playgon is disrupting the $6 billion live-dealer casino

market.

- Playgon has already cleared the high barrier of market entry,

with its platform of more than two dozen live operators in Europe

and South Africa.

- Playgon offers a complementary suite of eTable games and is

also in the $20 billion DFS market with turnkey product for daily

fantasy sports.

Click here to view the custom infographic of

the Playgon Games Inc. editorial.

Double-Digit Growth Ahead

According to industry analyst firm Grandview Research, the

global online gaming industry, or iGaming as it’s frequently

called, presently generates approximately $75 billion in revenue

each year. Grandview forecasts 11.94% compound annual growth from

2021 to 2026, predicting the industry will reach $127.3 billion by

2027. Growth drivers abound, including the COVID-19 pandemic,

increasing and evolving regulations, technological developments and

incessant consumer demand, with Millennials (those born between

1981 and 1996) now the largest generation.

This generation, comprised of 72.3

million people in America alone, is complemented by 67.1

million Gen Z’ers, a group that would barely recognize a world void

of iGaming. Better yet for businesses, the 135.6 million Baby

Boomers and Gen X’ers are becoming increasingly familiar and

comfortable with a digitized world, as measured by 21% of

respondents aged 45 to 64 in a Statista

survey reporting they are gamers and 7% over 65 years old

saying they are too.

Last year will live in infamy for the outset of the COVID-19

pandemic on a global scale. Lockdown orders went into effect in

most countries, leaving people shuttered in their homes to eat,

sleep, work and entertain as “nonessential” businesses were forced

to close for months on end owing to fears of contagion. Not

surprisingly, online gaming experienced a boom in demand and

disruption that will never be undone, as cutting-edge streaming

gaming content moving into the forefront to satisfy gamers appetite

from a safe distance.

Playgon Games Inc. (TSX.V: DEAL)

(OTCQB:

PLGNF) is emerging on the other end of the

pandemic stronger than ever with new gaming content delivered to

new customers. In fact, while many companies folded under the

pressures of the pandemic, Playgon matured, now employing more than

80 staffers who are developing, selling and servicing turnkey

products and offering a multitenant gateway that allows online

operators the ability to offer their customers innovative iGaming

software solutions.

Playgon offers a diverse software platform that includes

live-dealer casino games, eTable games and daily fantasy sports.

Through frictionless integration at the operator level, DEAL

clients are afforded easy, secure access to the platform without

sharing or compromising any sensitive customer information.

Recognizing desktops are a fading consumer trend, with 2021

market share projections showing that 59% of global

gaming revenue will come from mobile phones. Playgon has

centered its platform on mobile, using leading-edge tech to build

and deliver content. As one of the few pure B2B digital content

providers clearly differentiated from peers, Playgon enjoys the

fact that is has zero customer acquisition costs, which is great

for margins. Current and future DEAL customers include online

casinos, sportsbook operators, land-based operators, media groups

and big database companies, just to name a few.

Give ‘Em What They Want: Live Dealers

Gamers and gamblers alike crave that feeling of being at a

venue. To that point, legacy gaming technology was lacking until

the invention of live-dealer games, which continue to grow in

popularity. The growth is evidenced in the numbers, which show a

market segment at an inflection point and serving as a driver for

the broader online casino industry.

The young live-dealer online casino market is estimated to be on

track to expand 60% from $5 billion in 2019 to $8 billion in 2023.

The market is dominated by three companies – Evolution Gaming,

Microgaming and Playtech – although this trio generally offers

products that are somewhat similar and often look alike with no

clear standout product.

Playgon intends to capitalize where others have moderated.

Playgon has stepped up the game in a number of ways, starting with

a proprietary mobile user interface and user experience that

replaces outdated technology of peers that primarily was designed

for desktop units. Featuring the most advanced products to date,

the company launched its studio in Las Vegas featuring 10 live

tables and three auto tables that deliver streaming video of

live-dealer content in high definition for its virtual patrons to

play along. DEAL’s platform uses state-of-the-art AR (augmented

reality) gambling technology. Live dealers are available for

players of some of the most popular table games Vegas has to offer,

namely blackjack, roulette, baccarat and Playgon’s proprietary

Tiger Bonus Baccarat(TM).

Moreover, Playgon has taken a page from successful SaaS

companies in moving its platform to the cloud for accessibility and

scalability. All DEAL games are mobile focused, work on any device

and are built for portrait-mode, one-handed play. While many

companies plan to do similar things, DEAL has done them.

The company hurdled the high barriers to entry in the iGaming

market, with its new platform now live under contracts with

multiple online casino operators through four content aggregator

clients in South Africa and Europe. More are expected to be

onboarded in the coming months, according to DEAL management. In

aggregate, Playgon products are live today with 26 operators, a

number that will rise to 34 as soon as 8 more operators complete

integration of the technology.

While the initial focus has been on the highly sought-after

live-dealer games, Playgon also offers eTable versions of the four

aforementioned games that include gaming features unique to each.

At the same time, Playgon developers are working on a suite of 25

more games, comprised of popular table games such as craps, 3-card

poker and hold ‘em poker that will be added to the product

lineup.

Getting in the $20 Billion DFS Mix

Playgon’s portfolio of offerings also include daily fantasy

sports (“DFS”) games. These games, whose popularity has evolved

into a social phenomenon that spawned a global army of die-hard

fantasy sports players from every walk of life.

DFS is simply an abridged version of season-long fantasy

leagues, where teams draft players from different organizations (a

virtual all-star team of sorts) and then compete against other

teams with scoring based upon what the player does in real-life

games. The difference with DFS is it has a much shorter duration,

often only a couple hours with players picked from two opposing

teams. According to Research & Markets, the global fantasy

sports market is expected to grow from $20.36 billion in 2020

to $22.31

billion in 2021.

Much like its gambling casino gambling products, Playgon has its

own premium B2B fantasy sports platform that its operator clients

can license. Custom designed for regulated markets, the DFS

platform initially caters to soccer (or football for those outside

the U.S.) and golf.

More specifically, the platform integrates players, games and

data from five European football leagues — the Premier League,

Bundesliga, Ligue 1, Serie A, La Liga — as well as the PGA and

European golf tours. Adding DFS provides operators the opportunity

to attract gamers that normally wouldn’t visit their platform for

cross-sale, in addition to the opportunity to collect additional

data that can be used to optimize operations, grow sales, and widen

profit margins.

Speaking of Margins and Revenue…

Whereas B2C (business-to-consumer) companies often spend large

to acquire and keep players, Playgon is free from this capital

burden. Playgon generates revenue through a SaaS license model in

which iGaming operators from around the world license DEAL’s fully

integrated live casino solutions.

Over time, SaaS has emerged as the business model of choice

where one-time sales are replaced by recurring licensing and

support fees. SaaS licenses typically generate much higher margin

revenue than straight sales. In the case of Playgon, the company’s

fees range from 6%–12% of gross gaming revenue, defined as the

player’s bet minus the player’s win before operating expenses.

Where a customer lands in the range is dependent on different

factors, such as addressable market size.

In addition, Playgon’s leadership team cannot go overlooked or

understated for what it brings to the table. CEO Darcy Krogh

cofounded Chartwell Technology, a TSX-listed company that pioneered

browser-based digital content for the iGaming market. Amaya (now

called Stars Group) acquired Chartwell in 2011, keeping Krogh as VP

of business development until the B2B asset portfolio of the

company was sold to NYX Gaming Group in 2016. Krogh left for his

next endeavor as founder of Global Daily Fantasy Sports, which has

evolved into Playgon Games.

The executive team also includes chief product officer Guido

Ganschow, an expert in live-dealer technology with more than 13

years of direct experience, including the cofounding of a

Macau-based casino consortium. Playgon’s chief operating officer

Steve Baker was previously the VP of operations at Shaw

Communications where he was instrumental in growing the company

from 350 employees to more than 13,000 and annual revenue growth

from $300 million to $2.8 billion.

A Really Big Sandbox

At $75 billion and growing nearly 12% per year, the online

gaming market is plenty big enough to support multiple winners.

There is a common thread insomuch that companies, whether they are

B2B, B2C, omni-channel or purely digital, are all moving quickly to

monetize demand and win customers’ trust by integrating the latest

technology that ensures functionality and security encased in

premium user interfaces and experiences.

Rush Street

Interactive Inc. (NYSE:

RSI) last month was named

iGaming Operator of the Year for North America at the

Gaming Intelligence Awards 2021. The Awards highlight the most

successful operators and suppliers around the world. The Gaming

Intelligence Award isn’t the only global recognition RSI has

recently received. The company was recognized as Sportsbook of the

Year at the SBC Latinoamérica Awards 2021 last month and is on the

short list Casino Operator of the Year, Social Operator of the Year

and Leader of the Year at the SBC Awards North America to be held

this month.

MGM

Resorts International’s (NYSE:

MGM) sports betting and iGaming operator, BetMGM,

just announced

the opening of the BetMGM Sportsbook at Vee Quiva. BetMBM

is partnering with Gila River Hotels & Casinos for the first

opening of a BetMGM retail sportsbook in Arizona and Phoenix’s

first in-casino sportsbook. The BetMGM Sportsbook at Vee Quiva

boasts 25 large screen displays, a massive media wall and seating

for more than 100 guests. Guests can view games and events from all

major U.S. and international sports. The sportsbook also features

20 betting kiosks and ticket writers present to assist guest with

placing bets.

Las Vegas

Sands Corp. (NYSE:

LVS) launched an

initiative to invest in digital opportunities earlier this

year. The effort is aimed to position the company as a strategic

investor in digital gaming technologies, focused primarily in the

B2B business space. As part of the effort, the company is putting

together a digital gaming investment team. “Sands is determined to

grow its leadership position within the industry and is committed

to doing that through strategic steps we think best position the

company for future growth,” said Sands chair and CEO Robert

Goldstein.

Evolution ADR (OTC:

EVVTY) recently launched

Lightning Blackjack, the latest addition to its

award-winning Lightning game series. The new offering is available

in both live and first-person versions, and is a unique,

electrifying, scalable version of blackjack that features enhanced,

multiplied payouts. First-person Lightning Blackjack is a superior

3D-animated version of the game. Players enjoy the same exciting

gameplay and chance of multiplied payouts but in an RNG-based game

that includes a Go-live button that can take them directly to the

live-dealer Lightning Blackjack table.

The fact is that many gamblers will say that nothing can replace

the sights, sounds and excitement of a casino. However, there’s a

change in sentiment that picked up some strong tailwinds during the

pandemic. Technology is bringing the feel of a live casino to a

player’s living room, and while bricks-and-mortar casinos aren’t

going anywhere, both gamblers and investors alike are astutely

aware of the fun and money to be had in the world of virtual

gaming.

For more information about Playgon Games,

please visit Playgon

Games Inc.

About NetworkNewsWire

NetworkNewsWire (“NNW”) is a financial news and

content distribution company, one of 50+ brands within

the InvestorBrandNetwork (“IBN”), that

provides: (1) access to a network of wire

solutions via InvestorWire to reach all target markets,

industries and demographics in the most effective manner

possible; (2) article and editorial

syndication to 5,000+ news outlets; (3)

enhanced press release solutions to ensure maximum

impact; (4) social media distribution via IBN

millions of social media followers; and (5) a

full array of corporate communications solutions. As a multifaceted

organization with an extensive team of contributing journalists and

writers, NNW is uniquely positioned to best serve private and

public companies that desire to reach a wide audience comprising

investors, consumers, journalists and the general public. By

cutting through the overload of information in today’s market, NNW

brings its clients unparalleled visibility, recognition and brand

awareness. NNW is where news, content and information converge.

To receive SMS text alerts from NetworkNewsWire, text

“STOCKS” to 77948 (U.S. Mobile Phones Only)

For more information, please visit https://www.NetworkNewsWire.com

Please see full terms of use and disclaimers on the

NetworkNewsWire website applicable to all content provided by NNW,

wherever published or re-published: http://NNW.fm/Disclaimer

NetworkNewsWire (NNW)

New York, New York

www.NetworkNewsWire.com

212.418.1217 Office

Editor@NetworkNewsWire.com

NetworkNewsWire is part of the InvestorBrandNetwork

DISCLAIMER: NetworkNewsWire (NNW) is the source of the Article

and content set forth above. References to any issuer other than

the profiled issuer are intended solely to identify industry

participants and do not constitute an endorsement of any issuer and

do not constitute a comparison to the profiled issuer. The

commentary, views and opinions expressed in this release by NNW are

solely those of NNW. Readers of this Article and content agree that

they cannot and will not seek to hold liable NNW for any investment

decisions by their readers or subscribers. NNW is a news

dissemination and financial marketing solutions provider and are

NOT registered broker-dealers/analysts/investment advisers, hold no

investment licenses and may NOT sell, offer to sell or offer to buy

any security.

The Article and content related to the profiled company

represent the personal and subjective views of the Author, and are

subject to change at any time without notice. The information

provided in the Article and the content has been obtained from

sources which the Author believes to be reliable. However, the

Author has not independently verified or otherwise investigated all

such information. None of the Author, NNW, or any of their

respective affiliates, guarantee the accuracy or completeness of

any such information. This Article and content are not, and should

not be regarded as investment advice or as a recommendation

regarding any particular security or course of action; readers are

strongly urged to speak with their own investment advisor and

review all of the profiled issuer’s filings made with the

Securities and Exchange Commission before making any investment

decisions and should understand the risks associated with an

investment in the profiled issuer’s securities, including, but not

limited to, the complete loss of your investment.

NNW HOLDS NO SHARES OF ANY COMPANY NAMED IN THIS RELEASE.

This release contains “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E the Securities Exchange Act of 1934, as amended and

such forward-looking statements are made pursuant to the safe

harbor provisions of the Private Securities Litigation Reform Act

of 1995. “Forward-looking statements” describe future expectations,

plans, results, or strategies and are generally preceded by words

such as “may”, “future”, “plan” or “planned”, “will” or “should”,

“expected,” “anticipates”, “draft”, “eventually” or “projected”.

You are cautioned that such statements are subject to a multitude

of risks and uncertainties that could cause future circumstances,

events, or results to differ materially from those projected in the

forward-looking statements, including the risks that actual results

may differ materially from those projected in the forward-looking

statements as a result of various factors, and other risks

identified in a company’s annual report on Form 10-K or 10-KSB and

other filings made by such company with the Securities and Exchange

Commission. You should consider these factors in evaluating the

forward-looking statements included herein, and not place undue

reliance on such statements. The forward-looking statements in this

release are made as of the date hereof and NNW undertakes no

obligation to update such statements.

SOURCE: NetworkNewsWire

Editorial Coverage

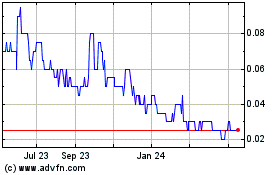

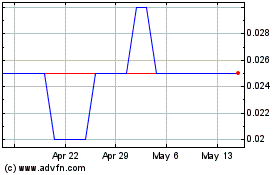

Playgon Games (TSXV:DEAL)

Historical Stock Chart

From Nov 2024 to Dec 2024

Playgon Games (TSXV:DEAL)

Historical Stock Chart

From Dec 2023 to Dec 2024