Copper Fox Metals Inc. (“Copper Fox” or the

“Company”) (TSX-V:CUU) (OTC:CPFXF) is pleased to announce

that it intends to complete, subject to the approval of the TSX

Venture Exchange, a non-brokered private placement to raise up to

$1,200,000 in gross proceeds (the “Offering”). The Offering

will consist of up to 12,000,000 units (each a “Unit”) at a price

of $0.10 per Unit. Each Unit will consist of one common share

in the capital of the Company (a “Common Share”) and one-half (1/2)

common share purchase warrant (a “Warrant”).

Each whole Warrant will entitle the holder

to purchase one Common Share for an exercise price of $0.12 during

the first 12 month period after the closing of the Offering and

$0.15 during the second 12 month period after the closing of the

Offering. In the event that the 20-day volume weighted

average price of the common shares listed on the TSX Venture

Exchange is above $0.20, the expiry date of the Warrants will be

accelerated to a date that is 30 days after the first date such

threshold is met.

Copper Fox is making the Offering available to

subscribers under a number of available prospectus exemptions,

including the accredited investor exemption, family and close

personal friends and business associates of directors and officers

of the Company. The Offering is also available to all

existing shareholders of Copper Fox who, as of the close of

business on May 2, 2018 (the “Record Date”), held shares (and who

continue to hold such shares as of the closing date) in accordance

with the provisions of the “Existing Shareholder Exemption”

contained in the various corresponding blanket orders and rules of

participating jurisdictions.

The Company advises that there are conditions

and restrictions when subscribers are relying upon the Existing

Shareholder Exemption, including, among other criteria: (a) the

subscriber must be a shareholder of the Company on the Record Date

(and still be a shareholder), (b) be purchasing the units as a

principal - for his or her own account and not for any other party,

and (c) may not purchase more than $15,000 value of securities from

the Company in any 12-month period. There is an exception to

the $15,000 subscription limit. In the event that a

subscriber wishes to purchase more than a $15,000 value of

securities, then he or she may do so provided that the subscriber

received suitability advice from a registered investment dealer,

and, in this case, subscribers will be asked to confirm the

registered investment dealer's identity and employer.

Subscribers purchasing Units using the Existing Shareholder

Exemption will need to represent in writing that they meet the

requirements of the Existing Shareholder Exemption. There is

no minimum subscription amount. As the Existing Security

Holder Exemption contains certain restrictions and is only

available in certain jurisdictions in Canada, others that do not

qualify under the Existing Security Holder Exemption may qualify to

participate under other prospectus exemptions, such as the

accredited investor exemption.

Subscriptions will be accepted by the Company on

a “first come, first served basis”. Therefore, if the

Offering is over-subscribed it is possible that a shareholders

subscription may not be accepted by the Company.

Additionally, in the event of an imbalance of large

subscriptions compared to smaller subscriptions, management

reserves the right in its discretion to reduce large subscriptions

in favour of smaller shareholder subscriptions.

The Offering is expected to close by the end of

May, 2018. In accordance with applicable securities

legislation, securities issued pursuant to the Offering are subject

to a hold period of four months plus one day from the date of the

completion of the Offering. The net proceeds raised from the

Offering will be used for ongoing activities and general corporate

purposes of the Company.

The Offering may include one or more

subscriptions by insiders of the Company, which will include a

subscription by Mr. Ernesto Echavarria, a director, insider and a

control person of the Company (as defined by the policies of the

TSX Venture Exchange) of a minimum of 7,200,000 Units.

Subscriptions completed by insiders in the

Offering, including the subscription by Mr. Echavarria, may

constitute a “Related Party Transaction” under Policy 5.9 of the

TSX Venture Exchange which adopts Multilateral Instrument 61-101

(“MI 61-101”) as a policy of the TSX Venture Exchange. In

completing such transactions, Copper Fox intends to rely on the

applicable exemptions from the valuation requirement and minority

security holder approval requirements available under Sections

5.5(a) and 5.7(a) of MI 61-101, respectively, on the basis that the

participation in the private placement by insiders will not exceed

25% of the Company’s market capitalization.

About Copper FoxCopper Fox is a Tier 1 Canadian

resource company listed on the TSX Venture Exchange (TSX-V:CUU)

focused on copper exploration and development in Canada and the

United States. The principal assets of Copper Fox and its

wholly owned Canadian and United States subsidiaries, being

Northern Fox Copper Inc. and Desert Fox Copper Inc., are the 25%

interest in the Schaft Creek Joint Venture with Teck Resources

Limited on the Schaft Creek copper-gold-molybdenum-silver project

located in northwestern British Columbia and a 100% ownership of

the Van Dyke oxide copper project located in Miami, Arizona. For

more information on Copper Fox’s other mineral properties and

investments visit the Company’s website at

http://www.copperfoxmetals.com.

For additional information contact: Investor

line 1-844-484-2820 or Lynn Ball, at 1-403-264-2820.

On behalf of the Board of Directors

Elmer B. StewartPresident and Chief Executive Officer

Neither TSX Venture Exchange Inc. nor

its Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange Inc.) accepts responsibility

for the adequacy or accuracy of this release.

This news release does not constitute an

offer to sell or a solicitation of an offer to sell any of the

securities described herein in the United States. The

securities described in this news release have not been and will

not be registered under the United States Securities Act of 1933,

as amended (the "U.S. Securities Act") or any state securities laws

and may not be offered or sold within the United States or to U.S.

Persons unless registered under the U.S. Securities Act and

applicable state securities laws or an exemption from such

registration is available. This news release is not for

distribution in the United States or over United States

newswires.

Cautionary Note Regarding

Forward-Looking InformationThis news release contains

“forward-looking information” within the meaning of the Canadian

securities laws. Forward-looking information is generally

identifiable by use of the words “believes,” “may,” “plans,”

“will,” “anticipates,” “intends,” “budgets”, “could”, “estimates”,

“expects”, “forecasts”, “projects” and similar expressions, and the

negative of such expressions. Forward-looking information in

this news release includes, without limitation, statements about:

the expected size and terms of the Offering and the use of the

proceeds therefrom; the anticipated closing time of the Offering;

the terms of the subscription agreements to be executed by

shareholders relying on the “Existing Security Holder Exemption”;

the expected subscription by one or more insiders, including Mr.

Echavarria in the Offering; and the exemptions in MI 61-101

intended to be relied upon by Copper Fox in completing the

Offering.

In connection with the forward-looking

information contained in this news release, Copper Fox has made

numerous assumptions. Additionally, there are known and

unknown risk factors which could cause Copper Fox’s actual results,

performance or achievements to be materially different from any

future results, performance or achievements expressed or implied by

the forward-looking information contained herein.

Known risk factors include the possibility that:

approval for the Offering will not be obtained from the TSX Venture

Exchange; the Offering will not complete at the time or in the

amount expected, or at all; Mr. Echavarria will not subscribe for

the number of Units currently expected, or at all; and the

exemptions intended to be relied upon by Copper Fox under MI 61-101

in completing the Offering may not be available.

A more complete discussion of the risks and

uncertainties facing Copper Fox is disclosed in Copper Fox's

continuous disclosure filings with Canadian securities regulatory

authorities at www.sedar.com. All forward-looking information

herein is qualified in its entirety by this cautionary statement,

and Copper Fox disclaims any obligation to revise or update any

such forward-looking information or to publicly announce the result

of any revisions to any of the forward-looking information

contained herein to reflect future results, events or developments,

except as required by law.

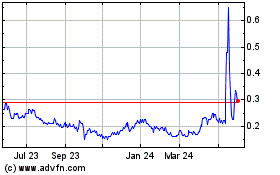

Copper Fox Metals (TSXV:CUU)

Historical Stock Chart

From Dec 2024 to Jan 2025

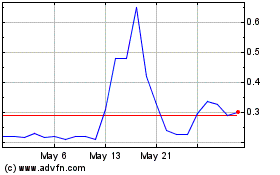

Copper Fox Metals (TSXV:CUU)

Historical Stock Chart

From Jan 2024 to Jan 2025