Copper Fox Metals Inc. (‘Copper Fox’ or the

‘Company’) (TSX-V:CUU) (OTC:CPFXF) through its wholly

owned subsidiary

Desert Fox Van Dyke Co. has

retained NV5, Inc. of Phoenix, Arizona to commence preparation of

the documentation to obtain the permits required to complete a five

well pilot scale in-situ leach (“ISL”) test on its 100% owned Van

Dyke oxide copper project located in Miami, Arizona.

The Preliminary Economic Assessment (“PEA”) for the

Van Dyke project (see News Release dated November 25, 2015)

recommended completion of a pre-feasibility study including a pilot

scale five well in-situ leach test. The results of the PEA

suggests that Van Dyke is a technically sound in-situ leach project

with low cash costs and robust pre-tax and post-tax net present

value (“NPV”) and internal rate of return (“IRR”). The PEA

identified a number of parameters, including copper recoveries that

with positive results could impact project economics.

Mr. Elmer Stewart, President and CEO, said “With

the 2017 Schaft Creek Joint Venture program underway, Copper Fox

has the possibility to create additional shareholder value by

advancing its Van Dyke project. The potential of increasing copper

recoveries, along with positive results from other parameters of

the proposed ISL pilot test, should significantly advance the

technical understanding and economic aspects of the project. For

example, the main copper minerals at Van Dyke are 100% soluble

which is significantly higher than the 68% soluble copper recovery

used in the PEA, which was at the low end of soluble copper

recoveries achieved in 2014.

The three previous in-situ leaching and production

tests have made a significant amount of hydrogeological and water

quality data available for the Van Dyke project, which if

applicable could significantly reduce the estimated cost of

obtaining the UIC and APP permits.”

The permitting for the pilot leach test is

prescribed by Federal US Code (“USC”) laws, the US Code of Federal

Regulations (“CFR”) and Arizona Revised Statutes (“ARS”). The

environmental permitting process is managed by the United States

Environmental Protection Agency (“USEPA”) and the Arizona

Department of Environmental Quality (“ADEQ”). The main

permits required for the pilot ISL test are:

- Aquifer Protection Permit (“APP”) for leaching operations and

surface impoundments; ADEQ.

- Underground Injection Control Permit (“UIC”) for injection

wells; USEPA.

Highlights:

- The estimated cost to acquire the APP and UIC permits is

$US425,000.

- The estimated time period required to obtain the APP and UIC

permits is one year.

- The historical information on file with ADEQ could be used to

build the APP and UIC permit applications provided that the

proposed in-situ leach test is located in that area of the project

where previous in-situ testing and production operations were

conducted.

- The historical information will assist in summarizing ground

water quality and preparation of a hydrogeological model for the

Van Dyke project as required by Arizona statutes.

Other federal and state agencies could become

involved in the permitting process requiring additional

environmental authorizations. An Environmental Management

Plan will be developed to comply with environmental legislation

during the permitting process.

The main objectives of the in-situ pilot test is to

further investigate soluble copper recovery, refine well field

design, determine the extent of rock stimulation required, if any,

and further define operating procedures.

The results of the PEA are preliminary in

nature as they include an inferred mineral resource which is

considered too speculative geologically to have the economic

considerations applied that would enable them to be categorized as

mineral reserves. There is no certainty that the PEA

forecasts will be realized or that any of the resources will ever

be upgraded to reserves. Mineral resources that are not

mineral reserves do not have demonstrated economic

viability.

Permitting History of Van Dyke

project:

ADHS Groundwater Quality Protection Permit

G-0003-04 (“predecessor to the APP”): The Van Dyke

project was permitted for pilot scale in-situ leach tests by

Occidental Minerals between 1978 and 1980 and included a five

injection and one recovery well test that was operated for

approximately 22 months. Kocide Chemical Corporation obtained

a five year Groundwater Quality Protection Permit for the Van Dyke

project in November 1986 and conducted in-situ leaching operations

between 1988 and 1990. The last APP permit application for

the Van Dyke project was withdrawn by Arimetco in July 1999 due to

technical deficiencies experienced by Arimetco at Van Dyke and

their other operating sites in Arizona.

UIC Permit:The EPA’s database

entry on April 29, 1994 for the UIC permit for the Van Dyke project

shows four active “5x25 Experimental Technology” wells (Class V UIC

wells) and five additional wells were listed as “Under

Construction”. The Last Data Update for the Van Dyke project

on the EPA database was June 3, 2010.

Qualified Person: Elmer B.

Stewart, MSc. P.Geo., President of Copper Fox, is the Company’s

non-independent, nominated Qualified Person pursuant to National

Instrument 43-101, Standards for Disclosure for Mineral Projects,

and has reviewed and approves the scientific and technical

information disclosed in this news release.

About Copper Fox:

Copper Fox is a Tier 1 Canadian resource company

listed on the TSX Venture Exchange (TSX-V:CUU) focused on copper in

Canada and the United States with offices in Calgary, Alberta and

Miami, Arizona and currently hold interests in the following

assets:

- 25% interest in the Schaft Creek Joint Venture with Teck

Resources Limited on the Schaft Creek copper-gold-molybdenum-silver

project located in northwestern British Columbia.

- 100% ownership of the Van Dyke oxide copper project located in

Miami, Arizona.

- 65.4% of the shares of Carmax Mining Corp. who in turn own 100%

of the Eaglehead copper-molybdenum-gold project located in northern

British Columbia.

- 100% ownership of the Sombrero Butte copper project located

east of Mammoth, Arizona.

- 100% ownership of the Mineral Mountain copper project located

east of Florence, Arizona.

For additional information please contact: Lynn

Ball at 1-844-464-2820 or 1-403-264-2820.

On behalf of the Board of Directors

Elmer B. StewartPresident and Chief Executive

Officer

Neither TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking

Information

This news release contains forward-looking

statements within the meaning of the Section 27A of the Securities

Act of 1933 and Section 21E of the Securities Exchange Act of 1934,

and forward-looking information within the meaning of the Canadian

securities laws (collectively, “forward-looking

information”). Forward-looking information in this news

release includes statements about the results of the Preliminary

Economic Assessment of the Van Dyke project; significantly

advancing the technical and economic aspects of the project; an

estimated cost to acquire the APP and UIC permits of $US425,000;

obtaining the APP and UIC permits in approximately one year; using

the historical hydrologic and water quality data for APP and UIC

permit applications, for summarizing ground water quality and for

preparation of a hydrogeological model for the Van Dyke project;

the possibility of creating additional shareholder value; and

developing an Environmental Management Plan.

In connection with the forward-looking information

contained in this news release, Copper Fox has made numerous

assumptions, regarding, among other things: the geological,

metallurgical, engineering, and financial advice that Copper Fox

has received is reliable, and is based upon practices and

methodologies which are consistent with industry standards; the

cost and expediency of permitting authorities; and the

applicability of historical data. While Copper Fox considers these

assumptions to be reasonable, these assumptions are inherently

subject to significant uncertainties and contingencies.

Additionally, there are known and unknown risk

factors which could cause Copper Fox’s actual results, performance

or achievements to be materially different from any future results,

performance or achievements expressed or implied by the

forward-looking information contained herein. Known risk

factors include, among others: the results of the Preliminary

Economic Assessment of the Van Dyke project may not be achieved as

expected or at all; the uncertainty of the estimated cost to

acquire the APP and UIC permits; the uncertainty of the time

required to obtain the APP and UIC permits; the uncertainty that

most of the historical information can be used in a new application

with some additional new data specific to the proposed area of

operations; the uncertainty that historical information on file at

ADEQ can be used to build the APP and UIC permit applications for

the proposed ISL test; the uncertainty that the historical

information will assist in summarizing known past discharging

activity; the creation of additional shareholder value may not be

achieved as expected or at all; the need to obtain additional

financing and uncertainty as to the availability and terms of

future financing; uncertainty as to timely availability of permits

and other governmental approvals.

A more complete discussion of the risks and

uncertainties facing Copper Fox is disclosed in Copper Fox's

continuous disclosure filings with Canadian securities regulatory

authorities at www.sedar.com. All forward-looking information

herein is qualified in its entirety by this cautionary statement,

and Copper Fox disclaims any obligation to revise or update any

such forward-looking information or to publicly announce the result

of any revisions to any of the forward-looking information

contained herein to reflect future results, events or developments,

except as required by law.

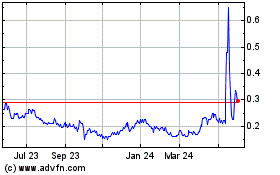

Copper Fox Metals (TSXV:CUU)

Historical Stock Chart

From Dec 2024 to Jan 2025

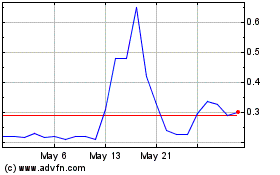

Copper Fox Metals (TSXV:CUU)

Historical Stock Chart

From Jan 2024 to Jan 2025