Atico Mining Corporation (the “Company” or “Atico”) (TSX.V: ATY |

OTC: ATCMF) is pleased to report of an updated NI 43-101 mineral

resource and reserve estimate as on March 12th 2024 for the El

Roble Mine located in Colombia.

“Our infill and mine vicinity exploration

drilling at El Roble mine has yielded very good results

intercepting additional high-grade mineralization in proximity to

current mining activity. What is particularly exciting is that we

still continue to intercept further mineralization beyond the

cutoff date of this report which is telling us that these areas

remain open at depth and along strike,” said Fernando E. Ganoza,

CEO. “Aggressive mine vicinity drilling will continue this year

looking for additional massive sulphide deposits and to replace

what is currently being mined.”

Resource and Reserve Estimate

Highlights

- Measured and Indicated Mineral

Resources are estimated at 881 thousand tonnes averaging 3.40% Cu,

and 2.98 g/t Au.

- Proven and Probable Mineral

Reserves are estimated at 828 thousand tonnes averaging 2.49% Cu,

and 2.20 g/t Au.

- A conversion rate of 88% of

Measured and Indicated resources to Proven and Probable reserve

categories over the current resource estimate.

- Life of Mine extended until first

quarter of 2027

El Roble Resource and Reserve Estimate

The updated mineral resource and reserve

estimate for El Roble was prepared by staff and consultants of

Miner SA, an Atico Mining operating subsidiary. Mr. Thomas Kelly

(SME Registered Member 1696580) has reviewed the reserve estimate

and Mr. Antonio Cruz (AIG Registered Member 7065) has reviewed the

resource estimate and both have acted as the qualified persons as

defined by Canadian National Instrument 43-101. The Mineral

Reserves reported herein were estimated using the Canadian

Institute of Mining, Metallurgy and Petroleum (CIM) Standards on

Mineral Resources and Reserves, Definitions and Guidelines prepared

by the CIM Standing Committee on Reserve Definitions and adopted by

CIM Council. This reserve estimate is based on all data available

through March 12, 2024.

|

Category |

Tonnes (000) |

Cu Eq. (%) |

Cu (%) |

Au (g/t) |

|

Proven |

528 |

3.31 |

2.47 |

1.92 |

|

Probable |

300 |

3.75 |

2.54 |

2.71 |

|

Proven + Probable Reserves |

828 |

3.47 |

2.49 |

2.20 |

|

Category |

Tonnes (000) |

Cu Eq. (%) |

Cu (%) |

Au (g/t) |

|

Measured Resources |

500 |

4.39 |

3.28 |

2.63 |

|

Indicated Resources |

381 |

5.10 |

3.56 |

3.45 |

|

Measured + Indicated Resources |

881 |

4.69 |

3.40 |

2.98 |

- Mineral Resources and Mineral

Reserves are as defined by CIM definition Standards on Mineral

Resources and Mineral Reserves 2014.

- Mineral Resources and Mineral

Reserves are estimated provided above have an effective date of

March 12th 2024. The Mineral Resource estimates and the Mineral

Reserve estimates were prepared by the Company's Internal QPs, who

have the appropriate relevant qualifications, and experience in

resource mineral estimation and reserves mineral estimation.

- The Mineral Reserves were estimated

from the M&I portions of the Mineral Resource estimates.

Inferred Mineral Resources were not considered to be converted into

Mineral Reserve estimates.

- Mineral Reserves are reported using

an NSR breakeven cut-off value of 130.11 USD/t (basis 2023 cost)

this value is considered for the Zeus, A, B, D, D2, Afrodita and

Rosario ore bodies and using an NSR breakeven cut-off value of

74.43 USD/t is considered for the Maximus, Maximus Sur, Perseo,

Goliath ore bodies.

- Mineral Resources are reported

using an NSR cut-off grade value of US$51.05/t, this value is

considered for the Maximus, Maximus Sur and Perseo deposits. And

using an NSR cut-off grade of US$72.59/t for A, B, D, D2, Afrodita,

Rosario and Principal ore body.

- Metal prices used were

US$1,991.00/troy ounce Au and US$ 4.12/t Cu.

- Metallurgical recoveries have been

considered based on historical results as of 2023. For the mine

designated as low zone (Zeus, Maximus, Maximus South, Goliath and

Perseus ore bodies) Cu recovery is 91.67% and Au recovery is

59.74%. For the mine designated as high zone (Principal, A, B, D,

D2, Afrodita and Rosario orebodies) Cu is 93% and Au is 63%.

- Metal payable recovery used 92.40%

for gold and 94.03% for copper (2023 commercialization basis).

- The average density for the

ore-body was designated as follows; Goliath = 3.34t/m3, Maximus =

3.50t/m3, Maximus Sur = 3.26t/m3, Zeus = 3.53t/m3 and Perseo =

3.35t/m3. for A, B, D, D2, Afrodita, Rosario and Principal ore body

the density was estimated using IDW.

- Mineral Resources, as reported, are

undiluted.

- Mineral Resources are reported to

0.87% CuEq cut-off for ore-body Zeus. 0.61% CuEq cut-off for

ore-bodies Goliath, Maximus, Maximus Sur and Perseo. 0.86%CuEq

cut-off for ore-bodies A, B, D, D2, Afrodita, Rosario and Cuerpo

Principal.

- CuEq for each block was calculated

by multiplying one tonne of mass of each block-by-block grade for

both Au and Cu by their average recovery, metal payable recovery

and metal price. If the block was higher than CuEq cut-off, the

block is included in the estimate (resource or reserve estimate as

appropriate).

- CuEq is estimated considering metal

price assumptions, metallurgical recovery for the corresponding

mineral type/mineral process and the metal payable of the selling

contract. (a) The AgEq grade formula used was: CuEq Grade = Cu

Grade + Au Grade * (Au Recovery * Au Payable * Au Price) / (Cu

Recovery * Cu Payable * Cu Price). (b) Metal prices considered for

Mineral Reserve estimates were US$4.12/lb Cu and US$1,991/oz Au for

all sites. (c) Other key assumptions and parameters include:

metallurgical recoveries; metal payable terms; direct mining costs,

processing costs, and G&A costs.

- Modifying factors for conversion of

resources to reserves included consideration for planned dilution

which is based on spatial and geotechnical aspects of the designed

stopes and economic zones, additional dilution consideration due to

unplanned events, materials handling and other operating aspects,

and mining recovery factors. Mineable shapes were used as geometric

constraints.

- Mineral Resources are not Mineral

Reserves and do not have demonstrated economic viability.

- There is no certainty that all or

any part of the Mineral Resources estimated will be converted into

Mineral Reserves.

- There are no known political,

environmental or other risks that could materially affect the

development and mining of the Mineral Reserves in the El Roble

mine.

- Figures in the table are rounded to

reflect estimate precision; small differences are not regarded as

material to the estimates.

- Reserves are estimated based on

mining material that can be mined, processed and smelted.

Resource and Reserve Estimation

Methodology

The Mineral Resource estimation considers

channel and core samples, in addition to the underground mine

mapping for the construction of three-dimensional wireframes of the

lithology and mineralized bodies. Estimation of grades in the block

models only considers samples located inside the mineralized bodies

solid, which are applied to anomalous grade or top cut treatment

and a further compositing process. The model was constructed using

2m x 2m x 2m blocks, which represents the selective mining unit

(SMU). The orebodies estimation is conducted separately body by

body and element by element (Cu and Au). The methods used for grade

estimation are cubic inverse distance (Goliath, Maximus, Maximus

Sur, Perseo, A, B, D, D2, Afrodita, Rosario and Cuerpo Principal

Orebodies) and Ordinary Kriging (Zeus Orebody).

A specific density factor was assumed for each

site to convert block volumes to tons for the bodies: Goliath =

3.34 t/m3, Maximus = 3.50 t/m3, Maximus Sur = 3.26 t/m3 , Zeus =

3.53 t/m3 and Perseus = 3.35 t/m3. For mineralized bodies A, B, D,

D2, Afrodita and Rosario the densities were estimated with IDW.

Mineral resources are reported with a limit of 0.87% CuEq cut-off

for ore-body Zeus, 0.61% CuEq cut-off for ore-body Goliath,

Maximus, Maximus Sur and Perseo and 0.86%CuEq cut-off for ore-body

body A, B, D, D2, Afrodita, Rosario and Cuerpo Principal. For each

block, the CuEq value was calculated by multiplying one ton of mass

of each block grade by its average recovery, payable metal

recovery, and metal price. Blocks with a CuEq grade higher than the

CuEq limit were included in the resource estimate.

Proven and Probable Mineral Reserves were

derived from the Measured and Indicated Resources by applying

modifying factors related to mining methods, mining dilution and

historical operating costs detailed as follows: mining for Zeus, A,

B, D, D2, Afrodita, Rosario y Cuerpo Principal (US $61.72/t) and

mining for Maximus, Maximus Sur, Goliath and Perseo (US $33.82/t) ,

processing (US $31.93/t), general services (US $16.79/t), on-site

administration and indirect (US $10.99/t), selling and concentrate

shipping (US $8.68/t). Operating costs total and comprise the lower

NSR value for reserve reporting purposes. Mining dilution was

estimated at variable percentages depending on the mining activity

and labor.

The resource and reserve models have been

validated by reconciliation against actual mined production

continuously for several years with reconciliation results being

acceptable for all ore bodies that have experienced a significant

amount of production.

A full NI 43-101 report reviewed and approved by

Mr. Thomas Kelly will be available on www.sedar.com within 45

days of this news release.

El Roble Mine

The El Roble mine is a high grade, underground

copper and gold mine with nominal processing plant capacity of

1,000 tonnes per day, located in the Department of Choco in

Colombia. Its commercial product is a copper-gold concentrate.

Since obtaining control of the mine on November

22, 2013, Atico has upgraded the operation from a historical

nominal capacity of 400 tonnes per day to 850 tons per day by

mechanizing and modernizing their mining operations and

processes.

El Roble has Proven and Probable reserves of 828

thousand tonnes grading 2.49% copper and 2.20 g/t gold, at a

cut-off grade of 2% copper equivalent this value is considered for

the Zeus, A, B, D, D2, Afrodita and Rosario ore bodies and 1.1% is

considered for the Maximus, Maximus Sur, Perseo and Goliath ore

bodies as of March 12th 2024. Mineralization is open at depth and

along strike and the Company plans to further test the limits of

the deposit.

On the larger land package, the Company has

identified a prospective stratigraphic contact between volcanic

rocks and black and grey pelagic sediments and cherts that has been

traced by Atico geologists for ten kilometers. This contact has

been determined to be an important control on VMS mineralization on

which Atico has identified numerous target areas prospective for

VMS type mineralization occurrence, which is the focus of the

current surface drill program at El Roble.

Qualified Persons

Mr. Thomas Kelly (SME Registered Member

1696580), advisor to the Company and a qualified person under

National Instrument 43-101 standards, is responsible for ensuring

that the technical information contained in this news release is an

accurate summary of the original reports and data provided to or

developed by Atico.

Mr. Antonio Cruz (AIG Registered Member 7065),

employee of the Company and a qualified person under National

Instrument 43-101 standards, is responsible for ensuring that the

technical information contained in this news release is an accurate

summary of the original reports and data provided to or developed

by Atico.

About Atico Mining Corporation

Atico is a growth-oriented Company, focused on

exploring, developing and mining copper and gold projects in Latin

America. The Company generates significant cash flow through the

operation of the El Roble mine and is developing its high-grade La

Plata VMS project in Ecuador. The Company is also pursuing

additional acquisition of advanced stage opportunities. For more

information, please

visit www.aticomining.com.

ON BEHALF OF THE BOARD

Fernando E. GanozaCEOAtico Mining

Corporation

Trading symbols: TSX.V: ATY | OTC: ATCMF

Investor RelationsIgor DutinaTel:

+1.604.633.9022

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

No securities regulatory authority has either

approved or disapproved of the contents of this news release. The

securities being offered have not been, and will not be, registered

under the United States Securities Act of 1933, as amended (the

‘‘U.S. Securities Act’’), or any state securities laws, and may not

be offered or sold in the United States, or to, or for the account

or benefit of, a "U.S. person" (as defined in Regulation S of the

U.S. Securities Act) unless pursuant to an exemption therefrom.

This press release is for information purposes only and does not

constitute an offer to sell or a solicitation of an offer to buy

any securities of the Company in any jurisdiction.

Cautionary Note Regarding Forward

Looking Statements

This announcement includes certain

“forward-looking statements” within the meaning of Canadian

securities legislation. All statements, other than statements of

historical fact, included herein, without limitation the use of net

proceeds, are forward-looking statements. Forward- looking

statements involve various risks and uncertainties and are based on

certain factors and assumptions. There can be no assurance that

such statements will prove to be accurate, and actual results and

future events could differ materially from those anticipated in

such statements. Important factors that could cause actual results

to differ materially from the Company’s expectations include

uncertainties relating to interpretation of drill results and the

geology, continuity and grade of mineral deposits; uncertainty of

estimates of capital and operating costs; the need to obtain

additional financing to maintain its interest in and/or explore and

develop the Company’s mineral projects; uncertainty of meeting

anticipated program milestones for the Company’s mineral projects;

and other risks and uncertainties disclosed under the heading “Risk

Factors” in the prospectus of the Company dated March 2, 2012 filed

with the Canadian securities regulatory authorities on the SEDAR

website at www.sedar.com

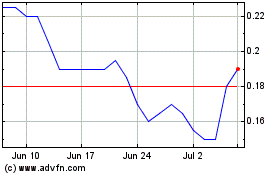

Atico Mining (TSXV:ATY)

Historical Stock Chart

From Nov 2024 to Dec 2024

Atico Mining (TSXV:ATY)

Historical Stock Chart

From Dec 2023 to Dec 2024