Azincourt Energy Closes $5.1M Private Placement and Announces 2.5-to-1 Share Consolidation

March 31 2022 - 4:30PM

AZINCOURT ENERGY CORP.

(“

Azincourt” or the “

Company”)

(TSX.V: AAZ, OTCQB: AZURF, FSE: A0U2) is pleased to announce that

it has closed a non-brokered private placement with certain

institutional investors for proceeds of C$5,101,000 (the

“

Offering”).

In connection with closing of the Offering, the

Company has issued 63,762,500 flow-through units (each, a

“FT Unit”). Each FT Unit was offered at a

price of $0.08. Each FT Unit consists of one common share and

one share purchase warrant entitling the holder to acquire an

additional common share of the Company at a price of $0.10 until

March 31, 2024.

The gross proceeds from the Offering will be

used for Canadian exploration expenses (within the meaning of the

Income Tax Act (Canada)), which will be renounced with an effective

date of no later than December 31, 2022, to the purchasers of the

FT Units. If the qualifying expenditures are reduced by the

Canada Revenue Agency, the Company will indemnify each subscriber

of FT Units for any additional taxes payable by such subscriber as

a result of the Company's failure to renounce the qualifying

expenditures. It is expected that funds from the Offering will be

applied directly to the current drill program at the East Preston

uranium project, and the upcoming initial drill program at the

Hatchet Lake uranium project, both located in Athabasca basin,

Saskatchewan, Canada.

All securities issuable in connection with the

Offering are subject to a statutory hold period, in accordance with

applicable securities laws, until August 1, 2022. In connection

with closing of the Offering, the Company paid finders’ fees

totaling $320,000 and issued 1,025,000 finder’s shares and

5,025,000 finders’ warrants. Each finders’ warrant is

exercisable into one common share of the Company at a price of

$0.10 until March 31, 2024.

Share Consolidation

The Company also announces that its board of

directors has approved a restructuring of the Company though a

consolidation of its outstanding common share capital (the

“Share Consolidation”) on the basis of one

(1) post-Share Consolidation common share for every two and

one-half (2.5) pre-Share Consolidation common

shares outstanding.

Assuming completion of the Share Consolidation

on a 2.5-for-1 basis, the Company would have approximately

227,000,000 common shares outstanding. Completion of the Share

Consolidation remains subject to the approval of the TSX

Venture Exchange. The Share Consolidation is expected to be

implemented on or before April 15, 2022, and the Company will

provide further information on the effective date of the Share

Consolidation once confirmed.

Any fractional interest in common shares

resulting from the Share Consolidation will be rounded down to the

nearest whole common share. Registered shareholders will receive a

letter of transmittal from TSX Trust Company, Azincourt’s transfer

agent, with information on how to replace their old share

certificates with the new share certificates. Brokerage firms will

handle the replacement of share certificates on behalf of their

shareholder’s accounts.

About Azincourt Energy

Corp.

Azincourt Energy is a Canadian-based resource

company specializing in the strategic acquisition, exploration, and

development of alternative energy/fuel projects, including uranium,

lithium, and other critical clean energy elements. The Company is

currently active at its majority controlled joint venture East

Preston uranium project in the Athabasca Basin, Saskatchewan,

Canada, and the Escalera Group uranium-lithium project located on

the Picotani Plateau in southeastern Peru.

ON BEHALF OF THE BOARD OF AZINCOURT

ENERGY CORP.

“Alex Klenman”Alex Klenman, President & CEO

Neither the TSX Venture Exchange nor its

regulation services provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

This press release includes “forward-looking

statements”, including forecasts, estimates, expectations and

objectives for future operations that are subject to a number of

assumptions, risks and uncertainties, many of which are beyond the

control of Azincourt. Investors are cautioned that any such

statements are not guarantees of future performance and that actual

results or developments may differ materially from those projected

in the forward-looking statements. Such forward-looking information

represents management’s best judgment based on information

currently available. No forward-looking statement can be

guaranteed, and actual future results may vary materially.

For further information please

contact:

Alex Klenman, President & CEOTel:

604-638-8063info@azincourtenergy.com

Azincourt Energy Corp.1430 – 800 West Pender

StreetVancouver, BC V6C 2V6www.azincourtenergy.com

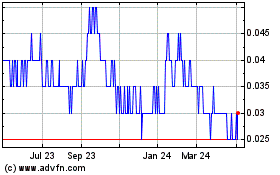

Azincourt Energy (TSXV:AAZ)

Historical Stock Chart

From Dec 2024 to Jan 2025

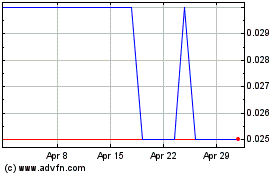

Azincourt Energy (TSXV:AAZ)

Historical Stock Chart

From Jan 2024 to Jan 2025