Western Copper and Gold Announces Upsize in Bought Deal Public Offering to $40 Million

April 16 2024 - 9:49AM

Western Copper and Gold Corporation (“Western” or the “Company”)

(TSX: WRN; NYSE American: WRN) is pleased to announce that it has

entered into an amended agreement with Eight Capital, on behalf of

a syndicate of underwriters (the “Underwriters”) under which the

Underwriters have agreed to buy from the Company, on a bought deal

basis, 21,055,000 common shares of the Company (the “Common

Shares”) at a price of $1.90 per Common Share for gross proceeds of

$40,004,500 (the “Offering”). The Company has granted the

Underwriters an over-allotment option to purchase up to an

additional 3,158,250 Common Shares, representing 15% of the

Offering, to cover over-allotments, if any, and for market

stabilization purposes, exercisable at any time up to 30 days after

the closing of the Offering.

The net proceeds from the sale of the Common

Shares are expected to be used to advance permitting and

engineering activity at the Company’s Casino Project in the Yukon

and for general corporate and working capital purposes.

The Offering will be made by way of a short form

prospectus (together with any amendments thereto, the “Prospectus”)

filed in all of the provinces of Canada, except Québec, and in the

United States pursuant to a prospectus filed as part of a

registration statement on Form F-10 (together with any amendments

thereto, the “Registration Statement”) under the Canada/U.S.

multi-jurisdictional disclosure system. The Prospectus and the

Registration Statement are subject to completion and amendment.

Such documents contain important information about the Offering.

This news release shall not constitute an offer to sell or the

solicitation of an offer to buy nor shall there be any sale of the

Common Shares in any jurisdiction in which such offer, solicitation

or sale would be unlawful prior to registration or qualification

under the securities laws of that jurisdiction.

The Registration Statement relating to the

Common Shares has been filed with the United States Securities and

Exchange Commission but has not yet become effective. The Common

Shares to be sold pursuant to the Offering described in this news

release may not be sold nor may offers to buy be accepted prior to

the time the Registration Statement becomes effective. Before

readers invest, they should read the Prospectus in the Registration

Statement and other documents the Company has filed with Canadian

regulatory authorities and the United States Securities and

Exchange Commission for more complete information about the Company

and the Offering. The Prospectus is available on SEDAR+ at

www.sedarplus.ca. The Registration Statement is available on EDGAR

at www.sec.gov. Alternatively, the Prospectus and the Registration

Statement may be obtained, for free upon request, from Enoch Lee at

100 Adelaide Street West, Suite 2900, Toronto, Ontario, Canada M4H

1S3.

The Offering is expected to close on or about

April 30, 2024 and is subject to the Company receiving all

necessary regulatory approvals, including that of the Toronto Stock

Exchange and the NYSE American LLC.

ABOUT WESTERN COPPER AND GOLD CORPORATION

Western Copper and Gold Corporation is

developing the Casino Project, Canada’s premier copper-gold mine in

the Yukon Territory and one of the most economic greenfield

copper-gold mining projects in the world.

The Company is committed to working

collaboratively with our First Nations and local communities to

progress the Casino Project using internationally recognized

responsible mining technologies and practices.

For more information, visit

www.westerncopperandgold.com.

On behalf of the board,

“Sandeep Singh”

Sandeep SinghChief Executive OfficerWestern

Copper and Gold Corporation

info@westerncopperandgold.com

Cautionary Disclaimer Regarding Forward-Looking

Statements and Information

This news release contains certain

forward-looking statements concerning the use of proceeds from the

Offering, the necessary regulatory approvals required for the

Offering being received and the expected closing date of the

Offering. Statements that are not historical fact are

“forward-looking statements” as that term is defined in the United

States Private Securities Litigation Reform Act of 1995 and

“forward-looking information” as that term is defined in National

Instrument 51-102 (“NI 51-102”) of the Canadian Securities

Administrators (collectively, “forward-looking statements”).

Forward-looking statements are frequently, but not always,

identified by words such as “expects”, “anticipates”, “believes”,

“intends”, “estimates”, “potential”, “possible” and similar

expressions, or statements that events, conditions or results

“will”, “may”, “could” or “should” occur or be achieved. The

material factors or assumptions used to develop forward-looking

statements include, but are not limited to, the assumptions that

all regulatory approvals of the Offering will be obtained in a

timely manner; all conditions precedent to completion of the

Offering will be satisfied in a timely manner; and that market or

business conditions will not change in a materially adverse

manner.

Forward-looking statements are statements about

the future and are inherently uncertain, and actual results,

performance or achievements of Western and its subsidiaries may

differ materially from any future results, performance or

achievements expressed or implied by the forward-looking statements

due to a variety of risks, uncertainties and other factors. Such

risks and other factors include, among others, risks involved in

fluctuations in gold, copper and other commodity prices and

currency exchange rates; uncertainties related to raising

sufficient capital in a timely manner and on acceptable terms; and

other risks and uncertainties disclosed in Western's AIF and Form

40-F, and other information released by Western and filed with the

applicable regulatory agencies.

Western’s forward-looking statements are based

on the beliefs, expectations and opinions of management on the date

the statements are made, and Western does not assume, and expressly

disclaims, any intention or obligation to update or revise any

forward-looking statements whether as a result of new information,

future events or otherwise, except as otherwise required by

applicable securities legislation. For the reasons set forth above,

investors should not place undue reliance on forward-looking

statements.

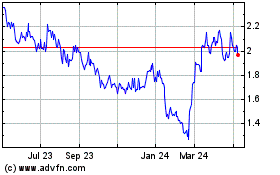

Western Copper (TSX:WRN)

Historical Stock Chart

From Dec 2024 to Jan 2025

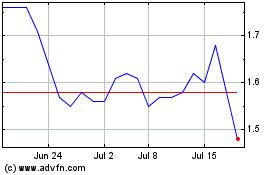

Western Copper (TSX:WRN)

Historical Stock Chart

From Jan 2024 to Jan 2025