Court Approves Plan of Arrangement For Acquisition of Velan by Flowserve

May 16 2023 - 6:58PM

Velan Inc. (“

Velan”) (TSX: VLN) today announced

that the Superior Court of Québec has issued a final order

approving the previously announced plan of arrangement attached to

the arrangement agreement made as of February 9, 2023 among Velan,

14714750 Canada Inc. (the “

Purchaser”) and

Flowserve US Inc., as amended by the first amendment to the

arrangement agreement dated March 27, 2023 (the

“

Arrangement Agreement”) pursuant to which all of

Velan’s issued and outstanding shares of Velan (the

“

Shares”) would be acquired for $13.00 per Share

in cash by the Purchaser, a wholly owned subsidiary of Flowserve

Corporation (the “

Arrangement”).

The Arrangement remains subject to customary

closing conditions, including the regulatory approvals and

clearances. The completion of the Arrangement is expected to occur

in the third quarter of 2023 (calendar year).

Further information regarding the Arrangement

can be found in the management information circular filed by Velan

on April 4, 2023, which is available at

https://www.velan.com/en/company/investor_relations and under

Velan’s profile on SEDAR at www.sedar.com.

ABOUT VELAN

Founded in Montreal in 1950, Velan Inc. is one

of the world’s leading manufacturers of industrial valves. Velan

Inc. is a family-controlled public company, employing approximately

1,650 people with manufacturing facilities in 9 countries. Velan

Inc. is a public company with its shares listed on the Toronto

Stock Exchange under the symbol VLN.

CAUTION REGARDING FORWARD-LOOKING

STATEMENTS

Certain statements made in this news release may

constitute forward-looking information or forward-looking

statements within the meaning of applicable securities laws,

including, but not limited to, statements with respect to the

timing of various steps to be completed in connection with the

Arrangement, the completion of the Arrangement and other statements

that are not material facts. Often, but not always, forward-looking

statements can be identified by the use of forward-looking

terminology such as “may”, “will”, “expect”, “believe”, “estimate”,

“plan”, “could”, “should”, “would”, “outlook”, “forecast”,

“anticipate”, “foresee”, “continue” or the negative of these terms

or variations of them or similar terminology.

Although Velan believes that the forward-looking

statements in this news release are based on information and

assumptions that are current, reasonable and complete, these

statements are by their nature subject to a number of factors that

could cause actual results to differ materially from management’s

expectations and plans as set forth in such forward-looking

statements, including, without limitation, the following factors,

many of which are beyond Velan’s control and the effects of which

can be difficult to predict: (a) the possibility that the

Arrangement will not be completed on the terms and conditions, or

on the timing, currently contemplated, and that it may not be

completed at all, due to a failure to obtain or satisfy, in a

timely manner or otherwise, required, regulatory approvals and

other conditions of closing necessary to complete the Arrangement

or for other reasons; (b) significant transaction costs or unknown

liabilities, (c) the ability of the board of directors to consider

and approve, subject to compliance by Velan with its obligations

under the Arrangement Agreement, a Superior Proposal (as defined in

the Arrangement Agreement) for Velan; (d) the failure to realize

the expected benefits of the Arrangement; (e) risks related to tax

matters; (f) the possibility of adverse reactions or changes in

business relationships resulting from the announcement or

completion of the Arrangement; (g) risks relating to Velan’s

ability to retain and attract key personnel during the interim

period; (h) credit, market, currency, operational, liquidity and

funding risks generally and relating specifically to the

Arrangement, including changes in economic conditions, interest

rates or tax rates; (i) business, operational and financial risks

and uncertainties relating to the COVID 19 pandemic; and (j) other

risks inherent to the business carried out by Velan and/or factors

beyond its control which could have a Material Adverse Effect (as

defined in the Arrangement Agreement) on Velan or its ability to

complete the Arrangement. Failure to obtain the necessary

regulatory, or the failure of the parties to otherwise satisfy the

conditions for the completion of the Arrangement or to complete the

Arrangement, may result in the Arrangement not being completed on

the proposed terms or at all. In addition, if the Arrangement is

not completed, and Velan continues as an independent entity, there

are risks that the announcement of the Arrangement and the

dedication of substantial resources by Velan to the completion of

the Arrangement could have an impact on its business and strategic

relationships, including with future and prospective employees,

customers, suppliers and partners, operating results and activities

in general, and could have a Material Adverse Effect (as defined in

the Arrangement Agreement) on its current and future operations,

financial condition and prospects. Should one or more of these

risks or uncertainties materialize, or should assumptions

underlying the forward-looking information prove incorrect, actual

results may vary materially from those described herein as

intended, planned, anticipated, believed, estimated or

expected.

Readers are cautioned not to place undue

reliance on the forward-looking statements and information

contained in this news release. Velan disclaims any obligation to

update any forward-looking statements contained herein, whether as

a result of new information, future events or otherwise, except as

required by law.

NO OFFER OR SOLICITATION

This announcement is for informational purposes

only and does not constitute an offer to purchase or a solicitation

of an offer to sell Velan Shares.

FOR FURTHER INFORMATION:

Laurel Hill Advisory GroupNorth American

Toll-Free Telephone: 1-877-452-7184Outside North America:

+1-416-304-0211E-mail: assistance@laurelhill.com

Velan Inc.Rishi SharmaChief Financial

OfficerE-mail: rishi.sharma@velan.com

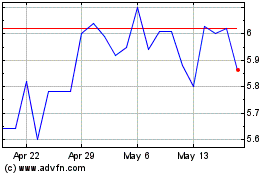

Velan (TSX:VLN)

Historical Stock Chart

From Nov 2024 to Dec 2024

Velan (TSX:VLN)

Historical Stock Chart

From Dec 2023 to Dec 2024