Buckreef Gold Commences Commissioning of Expanded Processing Plant

October 20 2021 - 6:30AM

Tanzanian Gold Corporation (TSX:TNX) (NYSE American:TRX) (TanGold

or the Company) is pleased to provide an update on Buckreef Gold

Company Limited’s (Buckreef Gold) processing plant and the

commencement of the commissioning phase of the new expanded

processing plant by 360 tonnes per day (tpd). The Company and

Buckreef Gold continue to advance the previously disclosed 1,000+

tpd operation.

During October, Buckreef Gold completed

construction of the 360 tpd processing plant expansion. Buckreef

Gold also continued to operate the 120 tpd processing plant

subsequent to concluding the test period, which achieved a 90% gold

recovery rate, as previously disclosed in September 2021. The

existing 120 tpd processing plant has been integrated into the new

processing plant circuit.

The new expanded processing plant construction

was completed in line with the scheduled completion date of late

September/October 2021 and within project capital expenditures

guidance of US$1.3-1.6 million. This includes completion of all

major construction activities associated with the processing plant

expansion, including the ongoing execution of dry, cold and hot

commissioning performance tests.

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/e2ff150c-ea1d-4f3e-a4f4-8a358a939a11

Highlights of Processing Plant

Expansion:

- Low-Cost

Expansion: $1.6 million in project capital expenditures to

increase throughput by 360 tpd;

- Increased Gold

Production: Expanded throughput expected to increase

production to 750-800 ounces of gold per month1 upon final

commissioning and prior to construction of the 1,000+ tpd

processing plant;

- Attractive Cost

Profile: Total Cash Costs2 expected to average

US$725-825/oz;

- Improved Cash

Flow: Operating cash flow from the expanded processing

plant is anticipated to mitigate the negative cash flow from the

testing period of the 120 tpd processing plant;

- Project

Reinvestment: Anticipated cash flow generated from the

larger plant will be reinvested in Buckreef Gold with a focus on:

(i) exploration and drilling; (ii) enhanced CSR/ESG programs; and

(iii) additional capital programs focused on growth and

efficiencies;

- Short Expansion

Timeframe: A five-month timeline from ordering the major

components of the 360 tpd operation to the start of project

commissioning in October 2021; and

- In-House

Construction: The 360 tpd processing plant expansion was

completed by the Buckreef Gold and TanGold teams in conjunction

with key consultants/contractors, including: (i) Ausenco; (ii) Solo

Resources; and (iii) CSI Energy Group. In-house execution resulted

in an accelerated construction timeline which has enabled advanced

production over initially envisioned timelines and the ability to

maintain continuity of the workforce.

Stephen Mullowney, TanGold Chief Executive

Officer commented: “The dedication and hard work of the Buckreef

Gold and TanGold teams in the construction of the 360 tpd

processing plant expansion is a very exciting milestone. The

increased processing capacity is expected to allow us to advance

the mine plan and increase near-term production in a cost-effective

and efficient manner. The increased anticipated cash flow from the

new larger plant will enable us to speed up the advancement of

Buckreef Gold, including exploration at the Buckreef Main Zone,

Buckreef West and Anfield Zone.”

Buckreef Gold will continue with plans to

advance a 1,000+ tpd operation while simultaneously operating the

360 tpd operation. The 1,000+ tpd operation is expected to be

capable of producing 15,000 - 20,000 ounces of gold per year based

on the initial mine plan and grade profile.

__________________________________________

1 The 360 tpd Plant estimates have not been

prepared in accordance with the results of the Company’s 2018

Prefeasibility Study, reflected in the Company’s May 15, 2020

Updated Mineral Resource Estimate. The 18-Month mining plan which

was utilized for the estimates are based upon an internal mine

model reviewed by SGS Canada and cost inputs as validated by actual

mining and processing costs from the 120 tpd test plant over the 9

months ended May 31, 2021. See ‘Forward Looking Statements’ at the

end of this Press Release.2 ‘Total Cash Cost’ includes mine site

operating costs such as mining, processing and local administrative

costs, royalties, production taxes, mine standby costs and current

inventory write downs, if any. Production costs are exclusive of

depreciation and depletion, reclamation, capital and exploration

costs. Total cash costs are net of by-product sales and are divided

by gold ounces sold to arrive at a per ounce figure. Total Cash

Costs is a non-IFRS financial performance measure often used in

conjunction with conventional IFRS measures to evaluate

performance. Total Cash Cost does not have a standardized meaning

under IFRS and therefore may not be comparable to similar measures

of performance disclosed by other issuers; it is intended to

provide additional information and should not be considered in

isolation or as a substitute for measures of performance prepared

in accordance with IFRS.

About Tanzanian Gold Corporation

Tanzanian Gold Corporation along with its joint

venture partner, STAMICO is building a significant gold project at

Buckreef in Tanzania that is based on an expanded Mineral Resource

base and the treatment of its mineable Mineral Reserves in two

standalone plants. Measured Mineral Resource now stands at 19.98MT

at 1.99g/t gold containing 1,281,161 ounces of gold and Indicated

Mineral Resource now stands at 15.89MT at 1.48g/t gold containing

755,119 ounces of gold for a combined tonnage of 35.88MT at 1.77g/t

gold containing 2,036,280 ounces of gold. The Buckreef Project also

contains an Inferred Mineral Resource of 17.8MT at 1.11g/t gold for

contained gold of 635,540 ounces of gold. The Company is actively

investigating and assessing multiple exploration targets on its

property. Please refer to the Company’s Updated Mineral Resources

Estimate for Buckreef Gold Project, dated May 15, 2020, for more

information.

Tanzanian Gold Corporation is advancing on three

value-creation tracks:

- Strengthening its balance sheet by

expanding near-term production to 15,000 - 20,000 oz. of gold per

year from the processing of oxide material from an expanded oxide

plant.

- Advancing Sulphide Development for

a stand-alone plant that is substantially larger than previously

modelled and targeting significant annual gold production.

- Continuing with a drilling program

to further test the potential of its property, Exploration Targets

and Mineral Resource base by: (i) infill drilling to upgrade

Mineral Resources currently in the Inferred category in Buckreef

Main; (ii) step-out drilling in the northeast extension of Buckreef

Main; (iii) infill drilling program of Buckreef West; (iv) develop

exploration program for the newly discovered Anfield Zone; (v)

upgrade historical resources at Bingwa and Tembo; (vi)

identification of new prospects at Buckreef Gold Project and in the

region.

For further information, please contact Michael Martin, Investor

Relations, m.martin@tangoldcorp.com, 860-248-0999, or visit the

Company website at www.tangoldcorp.com

Andrew M. Cheatle, P.Geo., the Company’s COO and

Director, is the Qualified Person as defined by the NI 43-101 who

has reviewed and assumes responsibility for the technical content

of this press release.

The Toronto Stock Exchange and NYSE American

have not reviewed and do not accept responsibility for the adequacy

or accuracy of this release.

This press release contains certain

forward-looking statements as defined in the applicable securities

laws. No assurance can be given that Tanzanian Gold will be able to

achieve the same level of gold recovery in the future as it did

during the testing phase for the 120 tpd plant during the months of

July and August 2021 or that the 1,000+ tpd process plant will be

completed and operated at the anticipated completion and operating

costs. The actual achievements of Tanzanian Gold or other future

events or conditions may differ materially from those reflected in

the forward-looking statements due to a variety of risks,

uncertainties and other factors. These risks are set forth under

Item 3.D in Tanzanian Gold’s Form 20-F for the year ended August

31, 2020, as amended, as filed with the SEC and other reports that

we subsequently file with the SEC. You can review and obtain copies

of these filings from the SEC's website at

http://www.sec.gov/edgar.shtml.

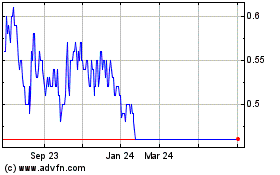

TRX Gold (TSX:TNX)

Historical Stock Chart

From Nov 2024 to Dec 2024

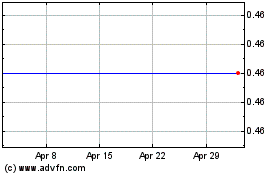

TRX Gold (TSX:TNX)

Historical Stock Chart

From Dec 2023 to Dec 2024