Sabre Gold Mines Corp. (TSX: SGLD, OTCQB: SGLDF) (“

Sabre

Gold” or the “

Company”) announces the

closing of the first tranche of its previously announced

non-brokered private for gross proceeds of a minimum of $680,000

and a maximum of $1.5 million (the “

Offering”).

The Company also announces that William M. Sheriff has resigned as

a director and Chairman of the Board of the Company effective

immediately.

“After many years of service, Mr. Sheriff has

resigned due to his increasing workload and focus in the uranium

sector,” said Andrew Elinesky, CEO of Sabre Gold. “On behalf of the

board of directors and management team, I would like to thank him

for his contributions and wish him the best in his future

endeavours.”

The Company completed the first tranche of the

Offering (the “First Tranche”) consisting of the

sale of 4,166,238 units of the Company (the

“Units”) at a price of $0.17 per Unit for total

gross proceeds of $708,260. Each Unit consists of one common share

of the Company (a “Common Share”) and one-half of

one Common Share purchase warrant (each whole warrant, a

“Warrant”).

Each Warrant shall entitle the holder to acquire

an additional Common Share at a price of $0.30 for a period of 24

months following the closing of the First Tranche, provided that,

if at any time the Common Shares trade on a stock exchange at a

volume weighted average trading price of $0.45, or greater, per

Common Share for a period of 20 consecutive trading days, the

Company may accelerate the expiry date of the Warrants by issuing a

press release announcing the reduced Warrant term and in such case

the Warrants will expire on the 30th day after the date on which

press release is issued.

A total of 2,091,206 Units were issued to

directors and officers of the Company under available prospectus

exemptions and 2,075,032 Units were issued by way of the “listed

issuer financing exemption” under National Instrument 45-106 –

Prospectus Exemptions. All of the Units issued under the Offering

are not subject to a statutory hold period under applicable

Canadian securities legislation.

The Offering has been conditionally approved by

the Toronto Stock Exchange (“TSX”) but remains

subject to final approval from the TSX.

The issuance and sale of 2,091,206 Units under

the Offering to certain officers and directors of the Company

constituted related party transactions within the meaning of

Multilateral Instrument 61-101- Protection of Minority Security

Holders in Special Transactions (“MI 61-101”). The

Company is relying on the exemptions from the valuation and

minority shareholder approval requirements of MI 61-101 contained

in sections 5.5(a) and 5.7(1) (a) of MI 61-101, as the fair market

value of the participation in the Offering by each insider will not

exceed 25% of the market capitalization of the Company, as

determined in accordance with MI 61-101. The Company did not file a

material change report in respect of the related

party transaction at least 21 days before the

closing of the Offering, which the Company deems reasonable in the

circumstances so as to be able to avail itself of the proceeds of

the Offering in an expeditious manner.

The proceeds from the sale of the Units will be

used for advancing the engineering at the Company’s Copperstone

Project, permitting work at the Company’s Brewery Creek Project and

general working capital purposes.

In connection with the Offering, the Company

paid to eligible finders an aggregate cash commission of $2,244 and

also issued to eligible finders a total of 13,200 warrants of the

Company (the “Broker Warrants”). Each Broker

Warrant entitles the holder thereof to purchase one common share in

the capital of the Company at a price of $0.20 for a period of 24

months from the date of closing. The Broker Warrants and securities

issuable thereunder shall be subject to a hold period of four

months and a day from the date of closing.

The securities described herein have not been,

and will not be, registered under the United States Securities Act,

or any state securities laws, and accordingly, may not be offered

or sold within the United States except in compliance with the

registration requirements of the U.S. Securities Act and applicable

state securities requirements or pursuant to exemptions therefrom.

This press release does not constitute an offer to sell or a

solicitation to buy any securities in any jurisdiction.

Early Warning Report

Fahad Al-Tamimi, an insider of the Company, has

acquired 1,764,706 Units for gross proceeds of $300,000.

Immediately prior to the closing of the First Tranche, Mr.

Al-Tamimi beneficially owned 6,327,346 Common Shares and 460,000

options of the Company (representing approximately 10.00% of the

total issued and outstanding Common Shares on a non-diluted basis,

or approximately 10.65% of the total issued and outstanding Common

Shares on a partially diluted basis). The acquisition of 1,764,706

Units by Mr. Al-Tamimi in connection with the First Tranche will be

considered a "related party transaction" pursuant to MI 61-101. The

Company is also relying on the exemption from minority shareholder

approval requirements under MI 61-101, as the fair market value of

the participation in the First Tranche by Mr. Al-Tamimi does not

exceed 25% of the market capitalization of the Company, as

determined in accordance with MI 61-101.

Following the acquisition of Units pursuant to

the First Tranche, Mr. Al-Tamimi beneficially owns 8,092,052 Common

Shares, 882,353 Warrants and 460,000 options of the Company

(representing approximately 12.00% of the total issued and

outstanding Common Shares on a non-diluted basis, or approximately

13.71% of the total issued and outstanding Common Shares on a

partially diluted basis). The Units were acquired by Mr. Al-Tamimi

for investment purposes, and depending on market and other

conditions, he may from time to time in the future increase or

decrease his ownership, control or direction over securities of the

Company through market transactions, private agreements, or

otherwise. In satisfaction of the requirements of the National

Instrument 62-104 - Take-Over Bids and Issuer Bids and National

Instrument 62-103 - The Early Warning System and Related Take-Over

Bid and Insider Reporting

Issues, an early warning report respecting the

acquisition of Units by Mr. Al-Tamimi will be filed under the

Company’s SEDAR Profile at www.sedar.com.

About Sabre Gold Mines

Corp.

Sabre Gold is a diversified, multi-asset

near-term gold producer in North America which holds 100-per-cent

ownership of both the fully licensed and permitted Copperstone gold

mine located in Arizona, United States, and the Brewery Creek gold

mine located in Yukon, Canada, both of which are former producers.

Management intends to restart production at Copperstone followed by

Brewery Creek in the near term. Sabre Gold also holds other

investments and projects at varying stages of development.

Sabre Gold’s two advanced projects have

approximately 1.5 million ounces of gold in the Measured and

Indicated categories, and approximately 1.2 million ounces of gold

in the Inferred category. Additionally, both Copperstone and

Brewery Creek have considerable exploration upside with a combined

land package of over 230 square kilometers that will be further

drill tested with high-priority targets currently identified. Sabre

Gold is led by an experienced team of mining professionals with

backgrounds in exploration, mine building and operations.

For further information please visit the Sabre

Gold Mines Corp. website: (www.sabre.gold).

Andrew ElineskyCEO and President416-904-2725

Cautionary Note Regarding Forward Looking

Statements

This news release contains forward-looking

information under Canadian securities legislation including

statements concerning the Company’s expectations with respect to

the Offering; the use of proceeds of the Offering; insider

participation in the Offering; completion of the Offering and the

date of such completion. These forward-looking statements entail

various risks and uncertainties that could cause actual results to

differ materially from those reflected in these forward-looking

statements. Such statements are based on current expectations, are

subject to a number of uncertainties and risks, and actual results

may differ materially from those contained in such statements.

These uncertainties and risks include, but are not limited to:

regulatory approval for the Offering; completion of the Offering;

the strength of the Canadian economy; the price of gold;

operational, funding, and liquidity risks; reliance on third

parties, exploration risk, failure to upgrade resources, the degree

to which mineral resource and reserve estimates are

reflective of actual mineral resources and reserves; the degree to

which factors which would make a mineral deposit commercially

viable are present, and the risks and hazards associated with

underground operations and other risks involved in the mineral

exploration and development industry. Risks and uncertainties about

Sabre Gold’s business are more fully discussed in the Company’s

disclosure materials, including its annual information form and

MD&A, filed with the securities regulatory authorities in

Canada and available at www.sedar.com and readers are urged to read

these materials. Sabre Gold assumes no obligation to update any

forward-looking statement or to update the reasons why actual

results could differ from such statements unless required by

law.

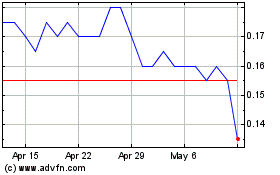

Sabre Gold Mines (TSX:SGLD)

Historical Stock Chart

From Jan 2025 to Feb 2025

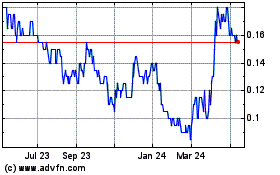

Sabre Gold Mines (TSX:SGLD)

Historical Stock Chart

From Feb 2024 to Feb 2025