Reserves Estimated at 38.8 Million Ounces

Gold, 10.2 Billion Pounds Copper and 183 Million Ounces

SilverBase Case Life of Mine Cash Operating Costs

Estimated at US$277 Per Ounce of Gold

ProducedTotal Cost (Including all Capital,

Operating and Closure Costs) Estimated at US$673 Per Ounce of Gold

ProducedLower Metal Prices Offset by Exchange Rate

Adjustments When Compared to 2012 Study

Seabridge Gold Inc. (TSX:SEA) (NYSE:SA) announced today the results

of an updated Preliminary Feasibility Study (the “2016 PFS”) for

its 100% owned KSM project located in northern British Columbia,

Canada. The 2016 PFS incorporates many design improvements over the

2012 PFS and the updated financial projections confirm that KSM is

an economic project at current metal prices.

The 2016 PFS was prepared by Tetra Tech, Inc.

(“Tetra Tech”), the firm that had also authored the 2012 PFS. The

NI 43-101 Technical Report will be filed at www.sedar.com. The 2016

PFS results released herein do not include material from recent

higher-grade discoveries at Deep Kerr and Iron Cap Lower Zone which

are expected to have a positive impact on project economics. An

analysis of the integration of these deposits into the proposed

project design will be included as a Preliminary Economic

Assessment (“PEA”) forming part of the NI 43-101 Technical Report.

Results of this PEA level analysis will be finalized and released

shortly.

As background, in 2012 Seabridge completed a

Preliminary Feasibility Study (the “2012 PFS”) that was used as the

basis for submitting its application for an Environmental

Assessment (“EA”). The KSM Project received its environmental

assessment approvals from the provincial and federal governments in

July and December 2014, respectively. The approvals were granted

after a rigorous joint harmonized federal-provincial EA review and

both decisions concluded that the KSM Project would not result in

significant adverse effects. Subsequent to the 2012 PFS, Seabridge

continued exploration activities at KSM which led to the discovery

of the higher-grade Deep Kerr and Lower Iron Cap deposits.

Seabridge Gold Chairman and CEO Rudi Fronk noted

that the 2016 PFS has answered a number of important questions

about KSM. “Projected capital costs are down despite substantial

enhancements to meet environmental improvements we committed to in

the EA process. Gold and copper reserves are up slightly despite

lower metal prices. Base Case estimated total cost, at US$673 per

ounce of gold produced, remains well below the industry average for

operating mines. The Base Case after tax payback period is

approximately 6.8 years, a remarkably low 13% of the 53 year mine

life and a key benefit to large producers. Overall, the 2016 PFS

confirms that KSM is an economic project with an unusually long

life in a low risk jurisdiction.”

The 2016 PFS was started in 2015, using most of

the 2012 PFS consulting team members. Notable changes in the 2016

PFS include:

- Capital and operating costs and metal prices have been updated

to the 2016 economic environment. Estimated Base Case initial

capital costs including pre-production mining costs are about 12%

lower despite major enhancements while estimated Base Case total

cost per ounce of gold produced is US$673, up 13% from the 2012

PFS. The increase in the Base Case total cost is due primarily to

lower base metal credits from price declines partially offset by a

reduction of approximately 9% in per unit life of mine (LOM)

operating costs;

- Improved mine sequencing decreases the early strip ratio while

increasing gold grade 4% and copper grade 1% through the payback

period;

- Increased operational flexibility is achieved by switching ore

transport between the mine and the process plant from conveying to

automated trains allowing a flexible ore delivery rate to the plant

while maintaining ore source scheduling functionality. Additional

benefits are more efficient movement of people, fuel and other

consumables;

- Designs and costs have been updated to reflect the commitments

made in the 2014 approved EA. This includes higher initial capital

for water management consisting of provision of increased water

retention capacity and capability for increased treatment rate for

improved environmental protection, during mining operations and

after closure.

The 2016 PFS envisages a combined

open-pit/underground block caving mining operation that is

scheduled to operate for 53 years. During the initial 33 years of

mine life, the majority of ore would be derived from open pit mines

with the tail end of this period supplemented by the initial

development of underground block cave mines. Ore delivery to the

mill during year 2 to year 35 is designed to be maintained at an

average of 130,000 metric tonnes per day (tpd). After depletion of

open pits, the mill processing rate would be reduced to 95,000 tpd

for 10 additional years before ramping down to just over 60,000 tpd

for the remaining few years of stockpile reclaim at the end of the

mine life. Over the entire 53-year mine life, ore would be fed to a

flotation and gold extraction mill. The flotation plant would

produce a gold/copper/silver concentrate for transport by truck to

a nearby sea port at Stewart, B.C. for shipment to Pacific Rim

smelters. Extensive metallurgical testing confirms that KSM can

produce a clean concentrate with an average copper grade of 25%

with a high gold and silver content, making it readily saleable. A

separate molybdenum concentrate and gold-silver doré would be

produced at the KSM processing facility.

Mineral ResourcesThe 2016 PFS

includes updated resource estimates that are based US$1,300 per

ounce gold, US$3.00 per pound copper, US$20.00 per ounce silver and

US$9.70 per pound molybdenum. In addition, the resources are

constrained by conceptual open pit shapes for material that could

potentially be mined from surface, and conceptual block cave shapes

for material that could potentially be mined from underground. The

methodology for establishing block cave resources and the material

definition of Net Smelter Return ("NSR") have been described in a

news release dated March 8, 2016 (see

http://seabridgegold.net/News/Article/580/).

Measured and Indicated Mineral Resources at KSM

are estimated at 2.9 billion tonnes grading 0.54 grams per tonne

gold, 0.21% copper and 2.7 grams per tonne silver (49.8 million

ounces of gold, 13.6 billion pounds of copper and 253 million

ounces of silver). An additional 2.7 billion tonnes are estimated

in the inferred resource category grading 0.35 grams per tonne

gold, 0.32% copper and 2.0 grams per tonne silver (30.8 million

ounces of gold and 19.2 billion pounds of copper and 178 million

ounces of silver). A detailed table of KSM’s mineral resources can

be found at the end of this news release.

Mineral ReservesUpdated

reserves for the project are based on open pit mining and

underground block caving for the Mitchell deposit, open pit mining

for the Sulphurets and Kerr deposits and underground block caving

for the Iron Cap deposit. Approximately 70% of the stated proven

and probable reserves would come from open pit operations and 30%

from underground block caving. Waste to ore cut-offs were

determined using a NSR for each block in the model. NSR is

calculated using prices and process recoveries for each metal

accounting for all off-site losses, transportation, smelting and

refining charges. Metal prices of US$1,200 per ounce gold, US$2.70

per pound copper, US$17.50 per ounce silver and US$9.70 per pound

molybdenum were used in the NSR calculations.

Lerchs-Grossman (“LG”) pit shell optimizations

were used to define open pit mine plans in the 2012 PFS and the

same limits were confirmed by LG in the PFS. Ultimate open pits

have been modified slightly to implement design changes from the EA

review and updated geotechnical study. Reserves have been

calculated using the updated pit designs and the 2016 resource

models. These include mining loss and dilution that varies by pit

ranging from 2.2% to 5.3% for loss and 0.8% to 3.9% for dilution. A

dynamic cut-off grade strategy has been applied with a minimum NSR

of Cdn$9 per tonne.

The underground block caving mine designs for

both Mitchell and Iron Cap are based on modeling using GEOVIA’s

Footprint Finder (FF) and PCBC software. The ramp-up and maximum

yearly mine production rates were established based on the rate at

which the drawpoints are constructed, and the initial and maximum

production rates at which individual drawpoints can be mucked. The

values chosen for these inputs were based on industry averages

adjusted to suit the anticipated conditions. Mitchell is estimated

to have a production ramp-up period of 6 years, steady state

production at 20 million tonnes per year for 17 years, and

then ramp-down production for another 7 years. Iron Cap is

estimated to have a production ramp-up period of 4 years,

steady state production at 15 million tonnes for 10 years, and

then ramp-down production for another 9 years. The underground

pre-production period would be 6 years with first underground

ore production from Mitchell and Iron Cap in years 23 and 32,

respectively. The mining NSR shut-off is Cdn$15.00 per tonne for

the Mitchell underground mine and Cdn$16 per tonne for the Iron Cap

underground mine. Mitchell reserves include 59 million tonnes of

non-mineralized dilution at zero grade (13%) and 7 million tonnes

of mineralized dilution (2%). Iron Cap reserves include 20 million

tonnes of dilution at zero grade (9%) and 25 million tonnes of

mineralized dilution (11%). Mineral Reserves for the KSM project

are stated as follows.

| |

| KSM Proven and

Probable Mineral Reserves as of July 31, 2016 |

| Zone |

Mining Method |

Reserve Category |

Tonnes (millions) |

Average Grades |

Contained Metal |

|

Gold (gpt) |

Copper (%) |

Silver (gpt) |

Moly (ppm) |

Gold(million ounces) |

Copper(million pounds) |

Silver(million ounces) |

Moly(million pounds) |

| Mitchell |

Open Pit |

Proven |

460 |

0.68 |

0.17 |

3.1 |

59.2 |

10.1 |

1,767 |

45 |

60 |

|

Probable |

481 |

0.63 |

0.16 |

2.9 |

65.8 |

9.7 |

1,677 |

44 |

70 |

|

Block Cave |

Probable |

453 |

0.53 |

0.17 |

3.5 |

33.6 |

7.7 |

1,648 |

51 |

34 |

|

Iron Cap |

Block Cave |

Probable |

224 |

0.49 |

0.20 |

3.6 |

13.0 |

3.5 |

983 |

26 |

6 |

|

Sulphurets |

Open Pit |

Probable |

304 |

0.59 |

0.22 |

0.8 |

51.6 |

5.8 |

1,495 |

8 |

35 |

|

Kerr |

Open Pit |

Probable |

276 |

0.22 |

0.43 |

1.0 |

3.4 |

2.0 |

2,586 |

9 |

2 |

| Totals |

Proven |

460 |

0.68 |

0.17 |

3.1 |

59.2 |

10.1 |

1,767 |

45 |

60 |

|

Probable |

1,738 |

0.51 |

0.22 |

2.5 |

38.2 |

28.7 |

8,388 |

138 |

147 |

|

Total |

2,198 |

0.55 |

0.21 |

2.6 |

42.6 |

38.8 |

10,155 |

183 |

207 |

| |

|

|

|

|

|

|

|

|

|

|

|

Note: The Mineral Reserves tabulated above are

included in the tabulated Mineral Resources. All Mineral Reserves

stated above account for mining loss dilution.

Estimated Proven and Probable Mineral Reserves

of 38.8 million ounces of gold and 10.2 billion pounds of copper

(2.2 billion tonnes at an average grade of 0.55 grams of gold per

tonne and 0.21% copper per tonne) are slightly above 2012

estimates. Proven and Probable Mineral Reserves are derived from a

total undiluted Measured plus Indicated Mineral Resource of 49.8

million ounces of gold and 13.6 billion pounds of copper contained

in 2.9 billion tonnes at an average grade of 0.54 grams of gold per

tonne and 0.21% copper per tonne. Mineral Resources which are not

Mineral Reserves do not have demonstrated economic viability. Most

of the Deep Kerr and Lower Iron Cap Mineral Resources are

classified as Inferred Mineral Resources and are excluded from the

reserves.

ProductionThe mine production

plan starts in lower cost open pit areas using conventional large

scale equipment before transitioning into block cave underground

bulk mining later in the mine life. Starter pits have been selected

in higher grade areas and cutoff grade strategy optimizes revenues

to minimize the payback duration. Improvements since the 2012

PFS focus on reducing open pit pre-production requirements within

the project description approved by permitting authorities.

At an average of 130,000 tonnes per day, annual

throughput for the mill after ramp up during the initial 35 years

of mine life is estimated at 47.5 million tonnes. KSM’s mine life

is estimated at approximately 53 years. At Mitchell, open pit

production is scheduled from inception through year 24, followed by

underground block caving production through year 53. Open pit

production from Sulphurets will augment Mitchell open pit

production from start-up through year 17. Open pit production from

Kerr is designed for years 24 through 34. Iron Cap underground

block caving production begins in year 32 through year 53,

essentially replacing Sulphurets and Kerr production. Final

production years are dominated by stockpile reclaim and underground

production.

At Mitchell, a near-surface higher grade gold

zone outcrops allowing for gold production in the first seven years

that is substantially above the mine life average. The mine plan is

specifically designed for mining highest gold grade first to

facilitate a quick capital investment payback. The project’s

post-tax payback period is approximately 6.8 years for the Base

Case or less than 13% of mine life. A payback period representing

less than 20% of mine life is considered highly favorable. Metal

production for the first seven years, compared to life of mine

average production, is estimated as follows:

| |

| Average Annual

Metal Production |

|

|

Years 1-7 Average |

Life of Mine

Average |

|

Average Grades: |

|

|

|

Gold (grams per tonne) |

0.82 |

0.55 |

|

Copper (%) |

0.24 |

0.21 |

|

Silver (grams per tonne) |

2.8 |

2.6 |

|

Molybdenum (parts per million) |

48 |

43 |

|

Annual Production: |

|

|

|

Gold (ounces) |

933,000 |

540,000 |

|

Copper (pounds) |

205 million |

156 million |

|

Silver (ounces) |

2.6 million |

2.2 million |

|

Molybdenum (pounds) |

1.6 million |

1.2 million |

| |

|

|

Capital CostsInitial capital

cost (including contingency of US$671 million and preproduction

mining costs) is estimated at US$5.0 billion, approximately 12%

lower than the initial capital estimate in the 2012 PFS. This

results from the 2016 estimate being 14% higher than the 2012

estimate on a Canadian dollar basis through scope additions that

are more than offset by the benefit of a lower foreign exchange

rate (0.80 US$ to Cdn$ vs 0.96 previously). Major scope

changes comprise: (i) initially building the Water Storage Facility

("WSF") to its final crest elevation; (ii) the addition of the

Mitchell Valley Diversion Tunnel for diverting contact water under

the Rock Storage Facility ("RSF") to the WSF; and (iii) changing

the Mitchell-Treaty tunnel ("MTT") ore conveyance to a train system

that has the advantages of scalable ore transfer rate, and ability

to effectively transport personnel and consumables. Scope

modifications that influence costs both positively and negatively

include improved water capture design at the inlet to Mitchell

Diversion Tunnel east of the Mitchell open pit (-57% tunnel

excavation volume), initially building the Water Treatment Plant

rate to 5.4 m3/s (4.3 m3/s in the 2012 PFS), replacement of the

Mitchell coarse ore stockpile with underground ore bins above the

MTT, improved process plant layout reducing footprint costs and

modifications to small tunnels at the WSF and Tailings Management

Facility. In addition to scope changes, notable cost changes

include a 12% lower fully burdened hourly cost for all construction

staff.

Sustaining capital over the 53 year mine life is

estimated at US$5.5 billion and is dominated by capitalizing the

underground mine expansions midway through the mine life for the

Mitchell and Iron Cap block caves. Notable additions to sustaining

capital are a water treatment plant for removing selenium, a

collection system in the RSF for capturing a specific portion of

the RSF seepage to direct to the selenium treatment plant and our

contribution to the Northwest Transmission Line overrun (Tariff

Supplement 37). In addition to sustaining capital, a further US$688

million has been charged against the project including US$528

million set aside in a sinking fund during the production

period to pay for estimated water treatment obligations which

continue after closure and US$160 million for physical

reclamation after mining operations have ceased.

Initial capital and sustaining capital estimates

are summarized as follows:

| |

| Capital Costs

(US$ million) |

|

Direct Costs: |

|

|

Mine Site |

1,218 |

|

Process |

1,336 |

|

Tailing Management Facility |

441 |

|

Environmental |

15 |

|

On-site Infrastructure |

23 |

|

Off-site Infrastructure |

120 |

|

Permanent Electrical Power Supply and Energy Recovery |

159 |

|

Total Direct Costs |

3,311 |

|

Indirect Costs: |

|

|

Construction Indirect Costs |

449 |

|

Spares |

34 |

|

Initial Fills |

20 |

|

Freight and Logistics |

99 |

|

Commissioning and Start-up |

6 |

|

Engineering Procurement and Construction Management (EPCM)

|

231 |

|

Vendor’s Assistance |

23 |

|

Total Indirect Costs |

862 |

|

Owner’s Cost |

160 |

|

Contingency |

671 |

|

TOTAL INITIAL CAPITAL |

5,005 |

|

TOTAL LIFE OF MINE SUSTAINING CAPITAL |

5,503 |

| |

|

Operating CostsAverage mine,

process and G&A operating costs over the project’s life

(including waste mining and on-site power credits, excluding

off-site shipping and smelting costs) are estimated at US$12.36 per

tonne milled (before base metal credits). Estimated unit operating

costs decreased 9% from the 2012 PFS primarily due to foreign

exchange differences. A breakdown of estimated unit operating costs

is as follows:

| |

| LOM Average Unit

Operating Costs (US$ Per Tonne Milled) |

|

Mining |

|

4.59 |

(*) |

| Process |

|

5.34 |

|

| G&A |

|

1.03 |

|

| Site Services |

|

0.44 |

|

| Tailings

Storage/Handling |

|

0.13 |

|

| Water

Management/Treatment |

|

0.80 |

|

| Energy Recovery |

|

(0.12 |

) |

|

Provincial Sales Tax |

|

0.15 |

|

|

Total Operating Costs |

|

12.36 |

|

|

*excluding pre-production cost of both open pit and

underground mining |

|

|

Economic AnalysisA Base Case

economic evaluation was undertaken incorporating historical

three-year trailing averages for metal prices as of July 31, 2016.

This approach is consistent with the guidance of the United States

Securities and Exchange Commission, adheres to National Instrument

43-101 and is consistent with industry practice. Two alternate

cases were constructed: (i) a Recent Spot Case incorporating recent

spot prices for gold, copper, silver and the US$/Cdn$ exchange

rate; and (ii) an Alternate Case that incorporates higher metal

prices to demonstrate the project’s sensitivity to rising prices.

The pre-tax and post-tax estimated economic results in U.S. dollars

for all three cases are as follows:

Projected Economic Results (US$'s)

| |

|

Base Case |

Recent Spot |

Alternate |

| |

Metal Prices: |

|

|

|

| |

Gold ($/ounce) |

|

1,230 |

|

|

1,350 |

|

|

1,500 |

|

| |

Copper ($/pound) |

|

2.75 |

|

|

2.20 |

|

|

3.00 |

|

| |

Silver ($/ounce) |

|

17.75 |

|

|

20.00 |

|

|

25.00 |

|

| |

Molybdenum ($/pound) |

|

8.49 |

|

|

7.00 |

|

|

10.00 |

|

| |

US$/Cdn$ Exchange Rate: |

|

0.80 |

|

|

0.77 |

|

|

0.80 |

|

| |

Cost Summary: |

|

|

|

| |

Operating Costs Per Ounce of Gold Produced (years 1 to 7)

|

$ |

119 |

|

$ |

219 |

|

$ |

51 |

|

| |

Operating Costs Per Ounce of Gold Produced (life of mine) |

$ |

277 |

|

$ |

404 |

|

$ |

183 |

|

| |

Total Cost Per Ounce of Gold Produced |

$ |

673 |

|

$ |

787 |

|

$ |

580 |

|

| |

Initial Capital (includes pre-production mining) |

$ |

5.0 billion |

$ |

4.8 billion |

$ |

5.0 billion |

| |

Sustaining Capital |

$ |

5.5 billion |

$ |

5.3 billion |

$ |

5.5 billion |

| |

Unit Operating Cost (US$/tonne) |

$ |

12.36 |

|

$ |

12.09 |

|

$ |

12.36 |

|

| |

Pre-Tax Results: |

|

|

|

| |

Net Cash Flow |

$ |

15.9 billion |

$ |

16.1 billion |

$ |

26.3 billion |

| |

NPV @ 5% Discount Rate |

$ |

3.3 billion |

$ |

3.5 billion |

$ |

6.5 billion |

| |

Internal Rate of Return |

|

10.4 |

% |

|

11.1 |

% |

|

14.6 |

% |

| |

Payback Period (years) |

|

6.0 |

|

|

5.6 |

|

|

4.1 |

|

| |

Post-Tax Results: |

|

|

|

| |

Net Cash Flow |

$ |

10.0 billion |

$ |

10.1 billion |

$ |

16.7 billion |

| |

NPV @ 5% Discount Rate |

$ |

1.5 billion |

$ |

1.7 billion |

$ |

3.7 billion |

| |

Internal Rate of Return |

|

8.0 |

% |

|

8.5 |

% |

|

11.4 |

% |

| |

Payback Period (years) |

|

6.8 |

|

|

6.4 |

|

|

4.9 |

|

| |

|

|

|

|

|

|

|

|

|

|

Note: Operating and total cost

per ounce of gold are after copper, silver and molybdenum credits.

Total cost per ounce includes all start-up capital, sustaining

capital and reclamation/closure costs. The post-tax results include

the B.C. Mineral Tax and provincial and federal taxes.

The NI 43-101 Technical Report will include

sensitivity analyses illustrating the impact on project economics

from positive and negative changes to metal prices, capital costs

and operating costs.

National Instrument 43-101

Disclosure The updated KSM PFS was prepared by Tetra Tech,

and incorporates the work of a number of industry-leading

consulting firms. These firms and their Qualified Persons (as

defined under National Instrument 43-101) are independent of

Seabridge and have reviewed and approved this news release. The

principal consultants who contributed to the 2016 PFS, and their

Qualified Persons are listed below along with their areas of

responsibility:

- Tetra Tech, under the direction of Hassan Ghaffari (surface and

underground infrastructure, capital estimate and financial

analysis), John Huang (metallurgical testing review, permanent

water treatment, mineral process design and operating cost

estimation for process, G&A and site services, and overall

report preparation), Scott Martin (TMF costs, WSF costs and winter

access road)

- Moose Mountain Technical Services under the direction of Jim

Gray (open pit Mineral Reserves, open pit mining operations, mine

capital and mine operating costs, MTT and rail ore conveyance

design)

- W.N. Brazier Associates Inc. under the direction of W.N.

Brazier (power supply, energy recovery plants, underground

electrical systems and associated costs)

- ERM (Environmental Resources Management) under the direction of

Pierre Pelletier (environment and permitting)

- Klohn Crippen Berger Ltd. under the direction of Graham

Parkinson (design of surface water diversion, diversion tunnels and

seepage collection ponds, tailing dam, water treatment dam and RSF

and tunnel geotechnical)

- Resource Modeling Inc. under the direction of Michael Lechner

(Mineral Resources)

- Golder Associates Inc. under the direction of Ross Hammett

(underground Mineral Reserves; block caving assessments, mine

design and associated costs)

- BGC Engineering Inc. under the direction of Derek Kinakin (rock

mechanics and mining pit slopes)

- Fluor Canada Ltd., under the direction of Rick Hepp

(construction schedule)

- McElhanney Consulting Services Ltd. under the direction of

Robert Parolin (permanent access roads and associated costs)

Seabridge Gold holds a 100% interest in several

North American gold resource projects. The Company’s principal

assets are the KSM property located near Stewart, British Columbia,

Canada and the Courageous Lake gold project located in Canada’s

Northwest Territories. For a breakdown of Seabridge Gold’s mineral

reserves and resources by project and category please visit the

Company’s website at

http://www.seabridgegold.net/resources.php.

All Mineral Reserve and Mineral Resource

estimates reported by the Corporation were estimated in accordance

with the Canadian National Instrument 43-101 and the Canadian

Institute of Mining and Metallurgy Definition Standards. These

standards differ significantly from the requirements of the U.S.

Securities and Exchange Commission. Mineral Resources which are not

Mineral Reserves do not have demonstrated economic

viability.

This document contains "forward-looking

information" within the meaning of Canadian securities legislation

and “forward-looking statements” within the meaning of the United

States Private Securities Litigation Reform Act of 1995. This

information and these statements, referred to herein as

“forward-looking statements” are made as of the date of this

document. Forward-looking statements relate to future events or

future performance and reflect current estimates, predictions,

expectations or beliefs regarding future events and include, but

are not limited to, statements with respect to: (i) the estimated

amount and grade of mineral reserves and mineral resources; (ii)

estimates of the capital costs of constructing mine facilities and

bringing a mine into production, of sustaining capital and the

duration of financing payback periods; (iii) the estimated amount

of future production, both ore produced and metal recovered; and

(iv) estimates of operating costs, net cash flow and economic

returns from an operating mine; and (v) the expected positive

impact on project economics of the Deep Kerr and Iron Cap Lower

Zone and the release of a PEA level analysis of a project design

that includes them. Any statements that express or involve

discussions with respect to predictions, expectations, beliefs,

plans, projections, objectives or future events or performance

(often, but not always, using words or phrases such as “expects”,

“anticipates”, “plans”, “projects”, “estimates”, “envisages”,

“assumes”, “intends”, “strategy”, “goals”, “objectives” or

variations thereof or stating that certain actions, events or

results “may”, “could”, “would”, “might” or “will” be taken, occur

or be achieved, or the negative of any of these terms and similar

expressions) are not statements of historical fact and may be

forward-looking statements.

All forward-looking statements are based

on Seabridge's or its consultants' current beliefs as well as

various assumptions made by them and information currently

available to them. The most significant assumptions are set forth

above, but generally these assumptions include: (i) the presence of

and continuity of metals at the Project at estimated grades; (ii)

the geotechnical and metallurgical characteristics of rock

conforming to sampled results; including the quantities of water

and the quality of the water that must be diverted or treated

during mining operations; (iii) the capacities and durability of

various machinery and equipment; (iv) the availability of

personnel, machinery and equipment at estimated prices and within

the estimated delivery times; (v) currency exchange rates; (vi)

metals sales prices; (vii) appropriate discount rates applied to

the cash flows in the economic analysis; (viii) tax rates and

royalty rates applicable to the proposed mining operation; (ix) the

availability of acceptable financing under assumed structure and

costs; (ix) anticipated mining losses and dilution; (x)

metallurgical performance; (xi) reasonable contingency

requirements; (xii) success in realizing proposed operations;

(xiii) receipt of permits and other regulatory approvals on

acceptable terms; and (xiv) the negotiation of satisfactory terms

with impacted Treaty and First Nations groups. Although management

considers these assumptions to be reasonable based on information

currently available to it, they may prove to be incorrect. Many

forward-looking statements are made assuming the correctness of

other forward looking statements, such as statements of net present

value and internal rates of return, which are based on most of the

other forward-looking statements and assumptions herein. The cost

information is also prepared using current values, but the time for

incurring the costs will be in the future and it is assumed costs

will remain stable over the relevant period.

By their very nature, forward-looking

statements involve inherent risks and uncertainties, both general

and specific, and risks exist that estimates, forecasts,

projections and other forward-looking statements will not be

achieved or that assumptions do not reflect future experience. We

caution readers not to place undue reliance on these

forward-looking statements as a number of important factors could

cause the actual outcomes to differ materially from the beliefs,

plans, objectives, expectations, anticipations, estimates

assumptions and intentions expressed in such forward-looking

statements. These risk factors may be generally stated as the risk

that the assumptions and estimates expressed above do not occur as

forecast, but specifically include, without limitation: risks

relating to variations in the mineral content within the material

identified as mineral reserves or mineral resources from that

predicted; variations in rates of recovery and extraction; the

geotechnical characteristics of the rock mined or through which

infrastructure is built differing from that predicted, the quantity

of water that will need to be diverted or treated during mining

operations being different from what is expected to be encountered

during mining operations or post closure, or the rate of flow of

the water being different; developments in world metals markets;

risks relating to fluctuations in the Canadian dollar relative to

the US dollar; increases in the estimated capital and operating

costs or unanticipated costs; difficulties attracting the necessary

work force; increases in financing costs or adverse changes to the

terms of available financing, if any; tax rates or royalties being

greater than assumed; changes in development or mining plans due to

changes in logistical, technical or other factors; changes in

project parameters as plans continue to be refined; risks relating

to receipt of regulatory approvals or settlement of an agreement

with impacted First Nations groups; changes in regulations applying

to the development, operation, and closure of mining operations

from what currently exists; the effects of competition in the

markets in which Seabridge operates; operational and infrastructure

risks and the additional risks described in Seabridge's

Annual Information Form filed

with SEDAR in Canada (available at www.sedar.com) for the year

ended December 31, 2015 and in the Corporation’s Annual Report Form

40-F filed with the U.S. Securities and Exchange Commission on

EDGAR (available at www.sec.gov/edgar.shtml).

Seabridge cautions that the foregoing list of factors that

may affect future results is not exhaustive.

When relying on our forward-looking

statements to make decisions with respect to Seabridge, investors

and others should carefully consider the foregoing factors and

other uncertainties and potential events. Seabridge does not

undertake to update any forward-looking statement, whether written

or oral, that may be made from time to time by Seabridge or on our

behalf, except as required by law.

ON BEHALF OF THE

BOARD"Rudi Fronk" President & C.E.O.

| |

| KSM Undiluted

Mineral Resources as of May 31, 2016 |

| Zone |

Type of Constraint |

NSR Cut-off (Cdn$/t) |

Tonnes (000 t) |

Grades |

Contained Metal |

|

Au (g/t) |

Cu (%) |

Ag (g/t) |

Mo (ppm) |

Au (000 oz) |

Cu (Mlb) |

Ag (000 oz) |

Mo (Mlb) |

| Measured Mineral Resources |

| Mitchell |

Conceptual LG Pit |

9 |

698,800 |

0.63 |

0.17 |

3.1 |

59 |

14,154 |

2,618 |

69,647 |

91 |

|

Conceptual Block Cave |

16 |

51,300 |

0.59 |

0.20 |

4.7 |

41 |

973 |

226 |

7,752 |

5 |

|

Total Mitchell Measured |

n/a |

750,100 |

0.63 |

0.17 |

3.2 |

58 |

15,127 |

2,844 |

77,399 |

96 |

|

Total Measured |

n/a |

n/a |

750,100 |

0.63 |

0.17 |

3.2 |

58 |

15,127 |

2,844 |

77,399 |

96 |

| Indicated Mineral Resources |

| Kerr |

Conceptual LG Pit |

9 |

355,000 |

0.22 |

0.41 |

1.1 |

4 |

2,511 |

3,208 |

12,555 |

3 |

|

Conceptual Block Cave |

16 |

24,400 |

0.24 |

0.48 |

2.0 |

14 |

188 |

258 |

1,569 |

1 |

|

Total Kerr Indicated |

n/a |

379,400 |

0.22 |

0.41 |

1.2 |

5 |

2,699 |

3,466 |

14,124 |

4 |

|

Sulphurets |

Conceptual LG Pit |

9 |

381,600 |

0.58 |

0.21 |

0.8 |

48 |

7,116 |

1,766 |

9,815 |

40 |

| Mitchell |

Conceptual LG Pit |

9 |

919,900 |

0.57 |

0.16 |

2.8 |

61 |

16,858 |

3,244 |

82,811 |

124 |

|

Conceptual Block Cave |

16 |

124,700 |

0.58 |

0.20 |

4.7 |

38 |

2,325 |

550 |

18,843 |

10 |

|

Total Mitchell Indicated |

n/a |

1,044,600 |

0.57 |

0.16 |

3.0 |

58 |

19,183 |

3,794 |

101,654 |

134 |

|

Iron Cap |

Conceptual Block Cave |

16 |

346,800 |

0.51 |

0.23 |

4.5 |

14 |

5,686 |

1,758 |

50,174 |

11 |

|

Total Indicated |

n/a |

n/a |

2,152,400 |

0.50 |

0.23 |

2.5 |

40 |

34,684 |

10,784 |

175,767 |

189 |

| Measured + Indicated Mineral

Resources |

| Kerr |

Conceptual LG Pit |

9 |

355,000 |

0.22 |

0.41 |

1.1 |

4 |

2,511 |

3,208 |

12,555 |

3 |

|

Conceptual Block Cave |

16 |

24,400 |

0.24 |

0.48 |

2.0 |

14 |

188 |

258 |

1,569 |

1 |

|

Total Kerr M+I |

n/a |

379,400 |

0.22 |

0.41 |

1.2 |

5 |

2,699 |

3,466 |

14,124 |

4 |

|

Sulphurets |

Conceptual LG Pit |

9 |

381,600 |

0.58 |

0.21 |

0.8 |

48 |

7,116 |

1,766 |

9,815 |

40 |

| Mitchell |

Conceptual LG Pit |

9 |

1,618,700 |

0.60 |

0.16 |

2.9 |

60 |

31,012 |

5,862 |

152,458 |

215 |

|

Conceptual Block Cave |

16 |

176,000 |

0.58 |

0.20 |

4.7 |

39 |

3,298 |

776 |

26,595 |

15 |

|

Total Mitchell M+I |

n/a |

1,794,700 |

0.60 |

0.16 |

3.1 |

58 |

34,310 |

6,638 |

179,053 |

230 |

|

Iron Cap |

Conceptual Block Cave |

16 |

346,800 |

0.51 |

0.23 |

4.5 |

14 |

5,686 |

1,758 |

50,174 |

11 |

|

Total M + I |

n/a |

n/a |

2,902,500 |

0.54 |

0.21 |

2.7 |

44 |

49,811 |

13,628 |

253,166 |

285 |

| Inferred Mineral Resources |

| Kerr |

Conceptual LG Pit |

9 |

80,200 |

0.27 |

0.21 |

1.1 |

6 |

696 |

371 |

2,836 |

1 |

|

Conceptual Block Cave |

16 |

1,609,000 |

0.31 |

0.43 |

1.8 |

25 |

16,036 |

15,249 |

93,115 |

89 |

|

Total Kerr Inferred |

n/a |

1,689,200 |

0.31 |

0.42 |

1.8 |

24 |

16,732 |

15,620 |

95,951 |

90 |

|

Sulphurets |

Conceptual LG Pit |

9 |

182,300 |

0.46 |

0.14 |

1.3 |

28 |

2,696 |

563 |

7,619 |

11 |

| Mitchell |

Conceptual LG Pit |

9 |

317,900 |

0.37 |

0.09 |

3.0 |

56 |

3,782 |

631 |

30,662 |

39 |

|

Conceptual Block Cave |

16 |

160,500 |

0.51 |

0.17 |

3.5 |

44 |

2,632 |

601 |

18,061 |

16 |

|

Total Mitchell Inferred |

n/a |

478,400 |

0.38 |

0.10 |

3.0 |

55 |

6,414 |

1,232 |

48,723 |

55 |

|

Iron Cap |

Conceptual Block Cave |

16 |

369,300 |

0.42 |

0.22 |

2.2 |

21 |

4,987 |

1,791 |

26,121 |

17 |

|

Total Inferred |

n/a |

n/a |

2,719,200 |

0.35 |

0.32 |

2.0 |

29 |

30,829 |

19,206 |

178,414 |

173 |

| |

|

|

|

|

|

|

|

|

|

|

|

Note: Mineral Resources are reported inclusive

of the Mineral Resources that were converted to Mineral Reserves.

Mineral Resources which are not Mineral Reserves do not have

demonstrated economic viability. It is reasonably expected that the

majority of Inferred Mineral Resources could be upgraded to

Indicated Mineral Resources with continued exploration.

For further information, please contact:

Rudi P. Fronk, President and C.E.O.

Tel: (416) 367-9292 • Fax: (416) 367-2711

Email: info@seabridgegold.net

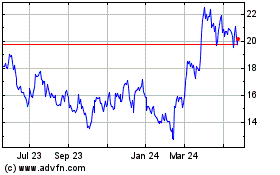

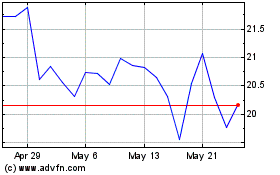

Seabridge Gold (TSX:SEA)

Historical Stock Chart

From Dec 2024 to Jan 2025

Seabridge Gold (TSX:SEA)

Historical Stock Chart

From Jan 2024 to Jan 2025