Seabridge Gold Closes $12 Million Bought Deal Flow-Through Equity Financing

May 19 2016 - 8:42AM

NOT FOR DISTRIBUTION TO U.S. NEWS WIRE

SERVICES OR FOR DISSEMINATION IN THE UNITED

STATES

Seabridge Gold Inc. (TSX:SEA) (NYSE:SA) (the

"Company") announced today that it has closed its previously

announced bought deal flow-through financing (the “FT Offering”),

including the full amount of the over-allotment option, for

aggregate gross proceeds of $12,040,000. A total of 500,000

flow-through common shares of the Company (the "Flow-Through

Shares"), including those pursuant to the exercise of the

over-allotment option, were issued and sold at a price of $24.08

per Flow-Through Share (a 30% premium to the closing price on the

TSX the day the FT Offering was announced). The FT Offering was

completed through a syndicate of underwriters led by Canaccord

Genuity Corp. and included National Bank Financial Inc. and

Paradigm Capital Inc.

The gross proceeds from the FT Offering will be

used to fund the 2016 exploration program at the Company's KSM

Project and, subject to completion of the Company’s acquisition of

SnipGold Corp., the Iskut Property of SnipGold Corp. in

Northwestern British Columbia, Canada.

Seabridge Chairman and CEO Rudi Fronk noted that

“This financing enables us to proceed with our exploration plans

for this year. The main focus at the KSM Project is on expanding

higher grade zones that have the potential to enhance projected

economics. We also expect to complete our first drill program on

the Iskut property this summer assuming we close our proposed

acquisition of SnipGold. At Iskut, our primary target is discovery

of high grade gold similar to what was mined historically. Once

again, this year’s program has been designed to generate additional

gold resources that will more than offset the share dilution

required to finance it. Growing gold ownership per share continues

to be a key objective for Seabridge."

The Offering was made by way of private

placement in Canada. The Flow-Through Shares issued under this FT

Offering are subject to a four-month hold period expiring on

September 20, 2016.

Seabridge holds a 100% interest in several North

American gold resource projects. The Company's principal assets are

the KSM Project located near Stewart, British Columbia, Canada and

the Courageous Lake Project located in Canada's Northwest

Territories.

Neither the Toronto Stock Exchange, New York Stock Exchange, nor

their Regulation Services Providers accepts responsibility for the

adequacy or accuracy of this release.

Statements relating to the estimated or expected

future production and operating results and costs and financial

condition of Seabridge, planned exploration work at the Company's

projects and the expected results of such work, including potential

impacts on projected economics and the expected exploration work on

properties the Company has agreed to acquire and the results of

such exploration are forward-looking statements within the meaning

of the United States Private Securities Litigation Reform Act of

1995. Forward-looking statements are statements that are not

historical facts and are generally, but not always, identified by

words such as the following: expects, plans, anticipates, believes,

intends, estimates, projects, assumes, potential and similar

expressions. Forward-looking statements also include reference to

events or conditions that will, would, may, could or should occur,

including in relation to the use of proceeds from the FT Offering.

These forward-looking statements are necessarily based upon a

number of estimates and assumptions that, while considered

reasonable at the time they are made, are inherently subject to a

variety of risks and uncertainties which could cause actual events

or results to differ materially from those reflected in the

forward-looking statements, including, without limitation:

uncertainties related to raising sufficient financing to fund the

planned work in a timely manner and on acceptable terms; changes in

planned work resulting from logistical, technical or other factors;

the possibility that results of work will not fulfill

projections/expectations and realize the perceived potential of the

Company's projects; uncertainties involved in the interpretation of

drilling results and other tests and the estimation of gold

reserves and resources; risk of accidents, equipment breakdowns and

labour disputes or other unanticipated difficulties or

interruptions; the possibility of environmental issues at the

Company's projects; the possibility of cost overruns or

unanticipated expenses in work programs; the need to obtain permits

and comply with environmental laws and regulations and other

government requirements; fluctuations in the price of gold and

other risks and uncertainties, including those described in the

Company's December 31, 2015 Annual Information Form filed with

SEDAR in Canada (available at www.sedar.com) and the Company's

Annual Report Form 40-F filed with the SEC on EDGAR (available at

www.sec.gov/edgar.shtml).

ON BEHALF OF THE BOARD

"Rudi Fronk" Chairman and CEO

For further information please contact:

Rudi P. Fronk, Chairman and CEO

Tel: (416) 367-9292 • Fax: (416) 367-2711

Email: info@seabridgegold.net

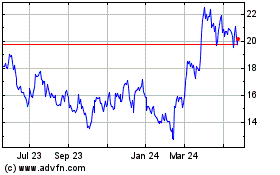

Seabridge Gold (TSX:SEA)

Historical Stock Chart

From Dec 2024 to Jan 2025

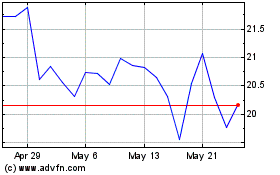

Seabridge Gold (TSX:SEA)

Historical Stock Chart

From Jan 2024 to Jan 2025