Seabridge Gold Files First Quarter Report to Shareholders and its Financial Statements and MD&A

May 13 2016 - 5:22PM

Seabridge Gold (TSX:SEA) (NYSE:SA) reported today that it has

filed its Report to Shareholders, Financial Statements and

Management’s Discussion and Analysis for the three months ended

March 31, 2016 on SEDAR (www.sedar.com).

Quarterly and Recent Highlights

- Deep Kerr’s inferred resource grows to 1.01 billion tonnes

grading 0.53% copper and 0.35 g/T gold

- KSM’s design of major structures receives vote of confidence

from independent review

- Seabridge enters into Plan of Arrangement to acquire

SnipGold

- Updated KSM Preliminary Feasibility Study nearing

completion

- Balance sheet significantly strengthened with new equity

financings

During the three month period ended March 31,

2016 Seabridge posted a net loss of $2.5 million ($0.05 per share)

consistent with a loss of $2.5 million ($0.05 per share) for the

same period last year. During the 1st quarter, Seabridge invested

$3.5 million in mineral interests, primarily at KSM, compared to

$2.4 million during the same period last year. At March 31, 2016,

net working capital was $14.0 million compared to $17.8 million at

December 31, 2015.

Subsequent to the end of the quarter, Seabridge

arranged two equity financings. The first financing consisted of

500,000 common shares issued at a price of $17.40 per share for

gross proceeds of $8.7 million. This financing closed on April 29.

The second financing is a bought deal flow-through financing

consisting of 450,000 shares at $24.07 per share (representing a

30% premium to the market price on the day it was announced) for

gross proceeds of $10.8 million. The underwriters have an option to

increase the size of the financing by an additional 50,000 shares

at the same price. This financing is expected to close on or about

May 19, 2016.

To view the Report to Shareholders, financial

statements and management’s discussion and analysis for the three

and three months ended March 31, 2016 on the Company’s website,

please see: www.seabridgegold.net/sharefinrep.php.

The Company’s principal assets are the 100%

owned KSM property located near Stewart, British Columbia, Canada

and the 100% owned Courageous Lake gold project located in Canada’s

Northwest Territories. For a breakdown of Seabridge’s mineral

resources by project and resource category please visit the

Company’s website at www.seabridgegold.net/resources.php.

All resource estimates reported by the

Corporation were calculated in accordance with the Canadian

National Instrument 43-101 and the Canadian Institute of Mining and

Metallurgy Classification system. These standards differ

significantly from the requirements of the U.S. Securities and

Exchange Commission. Mineral resources which are not mineral

reserves do not have demonstrated economic viability.

Statements relating to the estimated or

expected future production and operating results and costs and

financial condition of Seabridge, planned work at the Corporation’s

projects and the expected results of such work are forward-looking

statements within the meaning of the United States Private

Securities Litigation Reform Act of 1995. Forward-looking

statements are statements that are not historical facts and are

generally, but not always, identified by words such as the

following: expects, plans, anticipates, believes, intends,

estimates, projects, assumes, potential and similar expressions.

Forward-looking statements also include reference to events or

conditions that will, would, may, could or should occur.

Information concerning exploration results and mineral reserve and

resource estimates may also be deemed to be forward-looking

statements, as it constitutes a prediction of what might be found

to be present when and if a project is actually developed. These

forward-looking statements are necessarily based upon a number of

estimates and assumptions that, while considered reasonable at the

time they are made, are inherently subject to a variety of risks

and uncertainties which could cause actual events or results to

differ materially from those reflected in the forward-looking

statements, including, without limitation: uncertainties related to

raising sufficient financing to fund the planned work in a timely

manner and on acceptable terms; changes in planned work or the

timing of completion of planned work resulting from

logistical, technical or other factors; the possibility

that results of work will not fulfill projections/expectations and

realize the perceived potential of the Corporation’s projects;

uncertainties involved in the interpretation of drilling results

and other tests and the estimation of gold reserves and resources;

risk of accidents, equipment breakdowns and labour disputes or

other unanticipated difficulties or interruptions; the possibility

of environmental issues at the Corporation’s projects; the

possibility of cost overruns or unanticipated expenses in work

programs; the need to obtain permits and comply with environmental

laws and regulations and other government requirements;

uncertainties regarding potential acquisitions by the Corporation;

fluctuations in the price of gold and copper; and other risks and

uncertainties, including those described in the Corporation’s

December 31, 2015 Annual Information Form filed with SEDAR in

Canada (available at www.sedar.com) and the Corporation’s Annual

Report Form 40-F filed with the U.S. Securities and Exchange

Commission on EDGAR (available at

www.sec.gov/edgar.shtml). Forward-looking

statements are based on the beliefs, estimates and opinions of the

Corporation’s management or its independent professional

consultants on the date the statements are made.

ON BEHALF OF THE

BOARD

"Rudi Fronk"Chairman & C.E.O.

For further information please contact:Rudi P. Fronk, Chairman

and C.E.O.Tel: (416) 367-9292Fax: (416)

367-2711Email: info@seabridgegold.net

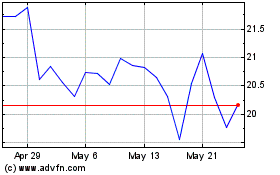

Seabridge Gold (TSX:SEA)

Historical Stock Chart

From Dec 2024 to Jan 2025

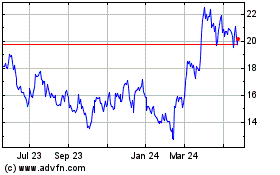

Seabridge Gold (TSX:SEA)

Historical Stock Chart

From Jan 2024 to Jan 2025