Quebecor Inc. Announces First Quarter 2008 Results

June 10 2008 - 12:26PM

Marketwired Canada

This press release discloses Quebecor Inc.'s (TSX:QBR.A)(TSX:QBR.B) consolidated

financial results for the first quarter ended March 31, 2008. It should be noted

that Quebecor Media Inc. reported its financial results for the first quarter of

2008 on May 6, 2008.

On January 21, 2008, Quebecor World Inc. placed itself under the protection of

the Companies' Creditors Arrangement Act in Canada and Chapter 11 of the United

States Bankruptcy Code. In accordance with generally accepted accounting

principles, Quebecor's investment in Quebecor World is no longer consolidated

since that date, the carrying value of Quebecor's investment in Quebecor World

has been reduced to zero and Quebecor World's activities are considered as

discontinued operations in the consolidated financial statements of Quebecor

Inc.

Quebecor World's operating results have been restated and are reported in the

financial statements under the item "Income (loss) from discontinued

operations," and the cash flows provided by these operations have been restated

and are reported in the financial statements under the item "Cash flows provided

by (used in) discontinued operations."

The procedures related to Quebecor World will have no material impact on the

operations of Quebecor Media.

Quebecor Inc. - Continuing operations

The consolidated revenues of Quebecor's continuing operations totalled $877.1

million, an increase of $126.0 million (16.8%). Revenue growth was strongest in

the following segments: Cable (up $71.8 million or 20.0%), reflecting continued

customer growth for all services; Newspapers ($47.1 million or 21.4%), due to

the impact of the acquisition of Osprey Media Income Fund ("Osprey Media") in

August 2007; and Broadcasting ($13.2 million or 14.1%).

Operating income from Quebecor's continuing operations increased by $72.8

million (39.7%) to $256.4 million, mainly as a result of increases in Cable

($46.9 million or 31.5%) due primarily to customer growth, Newspapers ($11.3

million or 32.8%) due to the acquisition of Osprey Media, and Broadcasting ($8.7

million). The fair values of Quebecor Media (based on market comparables) and

Quebecor's shares, decreased in the first quarter of 2008, compared with an

increase in the same period of 2007, resulting in a $24.6 million decrease in

the consolidated stock option expense, including $14.6 million at Quebecor.

Excluding the operating income of Osprey Media and the impact of the

consolidated stock option expense, the increase in operating income in the first

quarter of 2008 was 19.2%, the same year-over-year growth as in the same period

of 2007.

Quebecor recognized a $20.0 million unrealized gain on re-measurement of

debentures and of a portfolio investment in the first quarter of 2008 ($16.6

million after income tax), compared with an unrealized loss of $13.0 million in

the same quarter of 2007 ($10.7 million after income tax).

Financial expenses increased by $18.3 million to $79.6 million mainly because of

the $11.0 million impact of increased indebtedness mostly related to the

acquisition of Osprey Media, recognition of a $6.4 million loss on derivative

financial instruments and foreign currency translation ($2.2 million gain in the

first quarter of 2007) and a reduction in interest capitalized to fixed assets.

These factors were partially offset by recognition by Quebecor Media in the

first quarter of 2007 of a $5.2 million loss on re-measurement of the Additional

Amount payable, which was paid in July 2007.

Income from Quebecor's continuing operations totalled $44.8 million ($0.70 per

basic share) in the first quarter of 2008, compared with income from continuing

operations of $3.2 million ($0.05 per basic share) in the first quarter of 2007.

The increase of $41.6 million ($0.65 per basic share) was mainly due to the

$72.8 million increase in operating income and recognition of the $20.0 million

unrealized gain on re-measurement of exchangeable debentures and of a portfolio

investment (unrealized loss of $13.0 million in the same quarter of 2007), which

were partially offset by the $18.3 million increase in financial expenses and an

$8.2 million increase in amortization charges.

Excluding unusual items, i.e., the reserve for restructuring of operations and

the unrealized gain (loss) on re-measurement of debentures and of a portfolio

investment, income from continuing operations was $28.8 million in the first

quarter of 2008 ($0.45 per basic share), compared with $15.8 million ($0.25 per

basic share) in the same period of 2007, an increase of $13.0 million ($0.20 per

basic share).

Quebecor Inc. - Discontinued operations

The results of discontinued operations include a $17.7 million net loss (net of

non-controlling interest) recognized by Quebecor World for the period of January

1 to 21, 2008, compared with a net loss of $18.1 million (net of non-controlling

interest) reported in the first quarter of 2007.

At January 21, 2008, the Company's consolidated balance sheet included a net

asset deficiency of $761.3 million, representing the excess of the liabilities

and non-controlling interest related to Quebecor World over Quebecor World's

assets. At January 21, 2008, the Company also had net losses accumulated in

other comprehensive income in the amount of $326.5 million, net of income tax,

consisting primarily in accumulated currency translation losses in connection

with the net investment in Quebecor World. Therefore, the results of

discontinued operations for the first quarter of 2008 also include a net gain of

$399.7 million in respect of the difference between the reversal of the net

asset deficiency and the reclassification in the results of the net losses

accumulated in other comprehensive income as of the deconsolidation date,

January 21, 2008, net of the $35.1 million decrease in future income tax assets

related to the investment in Quebecor World.

Detailed financial information

For a detailed analysis of the results of Quebecor Inc. and its Quebecor Media

Inc. subsidiary for the first quarter of 2008, please refer to the Management

Discussion and Analysis and consolidated financial statements of Quebecor Inc.,

available on the Company's website at

http://www.quebecor.com/InvestorCenter/QIQuarterlyReports.aspx.

See also the Company's press release of May 6, 2008 concerning the results of

Quebecor Media Inc.

Quebecor Inc. and Quebecor Media documents are also available on the Company's

website at http://www.quebecor.com/InvestorCenter/QIQuarterlyReports.aspx and

for Quebecor Inc only, from the SEDAR filing service at http://www.sedar.com.

Forward-looking statements

The statements in this press release that are not historical facts are

forward-looking statements and are subject to significant known and unknown

risks, uncertainties and assumptions which could cause the Company's actual

results for future periods to differ materially from those set forth in the

forward-looking statements. Forward-looking statements may be identified by the

use of the conditional or by forward-looking terminology such as the terms

"plans," "expects," "may," "anticipates," "intends," "estimates," "projects,"

"seeks," "believes" or similar terms, variations of such terms or the negative

of such terms. Certain factors that may cause actual results to differ from

current expectations include seasonality (including seasonal fluctuations in

customer orders), operating risk (including fluctuations in demand for the

Company's products and pricing actions by competitors), insurance risk, risks

associated with capital investment (including risks related to technological

development and equipment availability and breakdown), environmental risks,

risks associated with labour agreements, risks associated with commodities and

energy prices (including fluctuations in the cost and availability of raw

materials), credit risk, financial risks, debt risks, risks related to interest

rate fluctuations, foreign exchange risks, risks associated with government acts

and regulations, and changes in the general political and economic environment.

The forward-looking statements in this document are made to provide investors

and the public with a better understanding of the Company's circumstances and

are based on assumptions the Company believes to be reasonable as of the day on

which they are made. Investors and others are cautioned that the foregoing list

of factors that may affect future results is not exhaustive and that undue

reliance should not be placed on any forward-looking statements. For more

information on the risks, uncertainties and assumptions that could cause the

Company's actual results to differ from current expectations, please refer to

the Company's public filings available at www.sedar.com and www.quebecor.com

including, in particular, the "Risks and Uncertainties" section of the

Management Discussion and Analysis for the year ended December 31, 2007 and the

"Risk Factors" section of the Company's 2007 Annual Information Form.

The forward-looking statements in this press release reflect the Company's

expectations as of June 10, 2008 and are subject to change after this date. The

Company expressly disclaims any obligation or intention to update or revise any

forward-looking statements, whether as a result of new information, future

events or otherwise, except as required by applicable securities laws.

The Company

Quebecor Inc. (TSX:QBR.A(TSX:QBR.B) is a holding company with a 54.7% interest

in Quebecor Media Inc., one of Canada's largest media groups. Quebecor Media

owns operating companies in numerous media-related businesses: Videotron Ltd.,

the largest cable operator in Quebec and a major Internet Service Provider and

provider of telephone and business telecommunications services; Sun Media

Corporation, the largest publisher of newspapers in Canada; Quebecor MediaPages,

a publisher of print and online directories; TVA Group Inc., operator of the

largest French-language over-the-air television network in Quebec, a number of

specialty channels, and the English-language over-the-air station Sun TV; Canoe

Inc., operator of a network of English- and French-language Internet properties

in Canada; Nurun Inc., a major interactive technologies and communications

agency with offices in Canada, the United States, Europe and Asia; magazine

publisher TVA Publishing Inc.; book publisher and distributor Quebecor Media

Book Group Inc.; Archambault Group Inc. and TVA Films, companies engaged in the

production, distribution and retailing of cultural products, and Le SuperClub

Videotron ltee, a DVD and console game rental and retail chain.

QUEBECOR INC. AND ITS SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME

(in millions of Canadian dollars, except for earnings per share data)

(unaudited)

Three months ended March 31

--------------------------------------------------------------------

--------------------------------------------------------------------

2008 2007

--------------------------------------------------------------------

REVENUES

Cable $430.6 $358.8

Newspapers 267.4 220.3

Broadcasting 106.5 93.3

Leisure and Entertainment 62.6 65.1

Interactive Technologies and Communications 20.6 21.0

Internet/Portals 12.0 11.4

Head office and inter-segment (22.6) (18.8)

--------------------------------------------------------------------

877.1 751.1

Cost of sales and selling and

administrative expenses 620.7 567.5

Amortization 78.3 70.1

Financial expenses 79.6 61.3

Reserve for restructuring of operations 1.6 7.0

(Gain) loss on re-measurement of exchangeable

debentures and a portfolio investment (20.0) 13.0

Other (0.3) (1.0)

--------------------------------------------------------------------

INCOME BEFORE INCOME TAXES AND

NON-CONTROLLING INTEREST 117.2 33.2

Income taxes:

Current (1.1) (1.9)

Future 45.2 13.5

--------------------------------------------------------------------

44.1 11.6

--------------------------------------------------------------------

73.1 21.6

Non-controlling interest (28.3) (18.4)

--------------------------------------------------------------------

INCOME FROM CONTINUING OPERATIONS 44.8 3.2

Income (loss) from discontinued operations 383.3 (17.8)

--------------------------------------------------------------------

NET INCOME (LOSS) $428.1 $(14.6)

--------------------------------------------------------------------

--------------------------------------------------------------------

EARNINGS PER SHARE

Basic and diluted

From continuing operations $0.70 $0.05

From discontinued operations 5.96 (0.28)

Net income (loss) 6.66 (0.23)

--------------------------------------------------------------------

--------------------------------------------------------------------

Weighted average number of shares

outstanding (in millions) 64.3 64.3

--------------------------------------------------------------------

--------------------------------------------------------------------

QUEBECOR INC. AND ITS SUBSIDIARIES

SEGMENTED INFORMATION

(in millions of Canadian dollars)

(unaudited)

Three months ended March 31

--------------------------------------------------------------------

--------------------------------------------------------------------

2008 2007

--------------------------------------------------------------------

Income before amortization, financial

expenses, reserve for restructuring of

operations, (gain) loss on re-measurement

of exchangeable debentures and a

portfolio investment and other

Cable $195.9 $149.0

Newspapers 45.8 34.5

Broadcasting 11.4 2.7

Leisure and Entertainment (1.6) (0.2)

Interactive Technologies and Communications (0.7) 0.5

Internet/Portals 0.2 1.7

General corporate revenues (expenses) 5.4 (4.6)

--------------------------------------------------------------------

$256.4 $183.6

--------------------------------------------------------------------

--------------------------------------------------------------------

Amortization

Cable $56.5 $54.0

Newspapers 14.7 9.4

Broadcasting 3.4 3.2

Leisure and Entertainment 1.8 2.0

Interactive Technologies and Communications 0.9 0.8

Internet/Portals 0.7 0.3

Head Office 0.3 0.4

--------------------------------------------------------------------

$78.3 $70.1

--------------------------------------------------------------------

--------------------------------------------------------------------

Additions to property, plant and equipment

Cable $96.4 $88.3

Newspapers 34.0 17.2

Broadcasting 2.5 3.5

Leisure and Entertainment 1.4 0.2

Interactive Technologies and Communications 0.5 0.9

Internet/Portals 1.6 0.9

Head office 4.6 3.8

--------------------------------------------------------------------

$141.0 114.8

--------------------------------------------------------------------

--------------------------------------------------------------------

QUEBECOR INC. AND ITS SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(in millions of Canadian dollars)

(unaudited)

Three months ended March 31

--------------------------------------------------------------------

--------------------------------------------------------------------

2008 2007

--------------------------------------------------------------------

Net income (loss) $428.1 $(14.6)

Other comprehensive income (loss), net of

income taxes and non-controlling interest

Unrealized gain (loss) on translation of

net investments in foreign operations 1.3 (0.1)

Unrealized gain on derivative instruments 9.8 5.0

Other comprehensive loss from

discontinued operations - (6.5)

Reclassification to income of other

comprehensive loss related to discontinued

operations 326.5 1.2

--------------------------------------------------------------------

337.6 (0.4)

--------------------------------------------------------------------

COMPREHENSIVE INCOME (LOSS) $765.7 $(15.0)

--------------------------------------------------------------------

--------------------------------------------------------------------

CONSOLIDATED STATEMENTS OF RETAINED EARNINGS

(in millions of Canadian dollars)

(unaudited)

Three months ended March 31

--------------------------------------------------------------------

--------------------------------------------------------------------

2008 2007

--------------------------------------------------------------------

Balance at beginning of period,

as previously reported $412.1 $1,404.5

Cumulative effect of changes in an

accounting policy (20.6) -

--------------------------------------------------------------------

Balance at beginning of period, as revised 391.5 1,404.5

Net income (loss) 428.1 (14.6)

--------------------------------------------------------------------

819.6 1,389.9

Dividends (3.2) (3.2)

--------------------------------------------------------------------

Balance at end of period $816.4 $1,386.7

--------------------------------------------------------------------

--------------------------------------------------------------------

QUEBECOR INC. AND ITS SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in millions of Canadian dollars)

(unaudited)

Three months ended March 31

--------------------------------------------------------------------

--------------------------------------------------------------------

2008 2007

--------------------------------------------------------------------

Cash flows related to operations

Income from continuing operations $44.8 $3.2

Adjustments for:

Amortization of property, plant

and equipment 72.7 67.7

Amortization of deferred charges and

other assets 5.6 2.4

Net loss (gain) on derivative instruments

and on foreign currency translation of

financial instruments 6.4 (2.2)

(Gain) loss on re-measurement of exchangeable

debentures and a portfolio investment (20.0) 13.0

Amortization of financing costs and

long-term debt discount 2.0 1.0

Loss on revaluation of the Additional

Amount payable - 5.2

Future income taxes 45.2 13.5

Non-controlling interest 28.3 18.4

Other 0.4 (2.5)

--------------------------------------------------------------------

185.4 119.7

Net change in non-cash balances related

to operations (143.3) (36.6)

--------------------------------------------------------------------

Cash flows provided by continuing operations 42.1 83.1

Cash flows provided by discontinued operations 20.5 77.4

--------------------------------------------------------------------

Cash flows provided by operations 62.6 160.5

--------------------------------------------------------------------

Cash flows related to investing activities

Business acquisitions, net of cash and

cash equivalents (86.3) (4.0)

Business disposals, net of cash and

cash equivalents 1.2 -

Additions to property, plant and equipment (141.0) (114.8)

Proceeds from disposal of assets 0.2 2.5

Other (7.7) 0.2

--------------------------------------------------------------------

Cash flows used in continuing

investing activities (233.6) (116.1)

Cash flows used in discontinued investing

activities and cash and cash equivalents

of Quebecor World Inc. at the date of

deconsolidation (117.7) (53.2)

--------------------------------------------------------------------

Cash flows used in investing activities (351.3) (169.3)

--------------------------------------------------------------------

Cash flows related to financing activities

Net increase in bank indebtedness 37.5 0.9

Issuance of long-term debt, net of

financing fees 0.5 8.3

Net borrowings under revolving bank

facilities 153.3 42.7

Repayments of long-term debt (8.4) (5.4)

Dividends - (3.2)

Dividends paid to non-controlling shareholders (0.7) (6.1)

Other 2.6 0.1

--------------------------------------------------------------------

Cash flows provided by continuing

financing activities 184.8 37.3

Cash flows provided by discontinued

financing activities 37.3 9.1

--------------------------------------------------------------------

Cash flows provided by financing activities 222.1 46.4

--------------------------------------------------------------------

Net (decrease) increase in cash and

cash equivalents (66.6) 37.6

Effect of exchange rate changes on cash

and cash equivalents denominated in foreign

currencies 0.4 (15.5)

Cash and cash equivalents at beginning

of period 66.5 34.7

--------------------------------------------------------------------

Cash and cash equivalents at end of period $0.3 $56.8

--------------------------------------------------------------------

--------------------------------------------------------------------

Cash and cash equivalents consist of

Cash $ 0.1 $18.5

Cash equivalents 0.2 38.3

--------------------------------------------------------------------

$0.3 $56.8

--------------------------------------------------------------------

--------------------------------------------------------------------

Continuing operations

Cash interest payments $60.1 $58.5

Cash income tax payments (net of refunds) 12.1 (2.3)

--------------------------------------------------------------------

--------------------------------------------------------------------

QUEBECOR INC. AND ITS SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(in millions of Canadian dollars)

(unaudited)

March 31 December 31

--------------------------------------------------------------------

--------------------------------------------------------------------

2008 2007

--------------------------------------------------------------------

ASSETS

CURRENT ASSETS

Cash and cash equivalents $0.3 $66.5

Restricted cash and cash equivalents and

temporary investments 5.4 5.4

Accounts receivable 467.9 1,513.4

Income taxes 7.3 25.9

Inventories and investments in televisual

products and movies 154.9 529.9

Prepaid expenses 41.0 51.1

Future income taxes 142.4 223.7

--------------------------------------------------------------------

819.2 2,415.9

PROPERTY, PLANT AND EQUIPMENT 2,211.4 4,121.1

FUTURE INCOME TAXES 54.6 65.1

RESTRICTED CASH - 53.8

OTHER ASSETS 507.1 664.7

GOODWILL 4,137.7 4,417.8

--------------------------------------------------------------------

$7,730.0 $11,738.4

--------------------------------------------------------------------

--------------------------------------------------------------------

LIABILITIES AND SHAREHOLDERS' EQUITY

CURRENT LIABILITIES

Bank indebtedness $54.4 $88.6

Accounts payable, accrued charges and

deferred revenue 801.7 1,937.8

Income taxes 7.1 58.0

Dividend payable 3.2 -

Future income taxes - 1.2

Short-term secured financing - 453.5

Current portion of long-term debt 24.9 1,028.4

--------------------------------------------------------------------

891.3 3,567.5

LONG-TERM DEBT 3,392.7 4,393.8

EXCHANGEABLE DEBENTURES 38.2 79.4

DERIVATIVE FINANCIAL INSTRUMENTS 419.9 599.8

OTHER LIABILITIES 115.3 407.6

FUTURE INCOME TAXES 422.1 514.7

PREFERRED SHARES OF A SUBSIDIARY - 175.0

NON-CONTROLLING INTEREST 1,271.7 1,563.7

SHAREHOLDERS' EQUITY

Capital stock 346.6 346.6

Retained earnings 816.4 412.1

Accumulated other comprehensive income (loss) 15.8 (321.8)

--------------------------------------------------------------------

1,178.8 436.9

--------------------------------------------------------------------

$7,730.0 $11,738.4

--------------------------------------------------------------------

--------------------------------------------------------------------

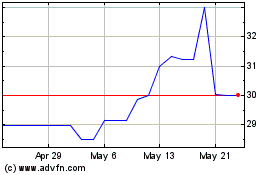

Quebecor (TSX:QBR.A)

Historical Stock Chart

From Jun 2024 to Jul 2024

Quebecor (TSX:QBR.A)

Historical Stock Chart

From Jul 2023 to Jul 2024