MONTREAL, QUEBEC (TSX: QBR.B)

Financial year 2007 highlights

- Quebecor Media Inc. posts revenues of $3.37 billion, a $367.3

million (12.2%) increase from 2006.

- Operating income increases by $164.3 million (20.5%) to record

$963.9 million.

- Net income totals record $327.1 million, compared with $169.7

million net loss in 2006, a $496.8 million improvement.

- Cable segment: operating income up $130.2 million (25.4%);

customer base increases by 238,600 for cable telephone service,

141,000 for cable Internet access, 65,700 for all cable television

services combined (including a 144,600 customer increase for illico

Digital TV), 33,900 phones for wireless telephone service.

- Federal government establishes conducive conditions for

competition in wireless telephone industry by setting aside segment

of new 3G spectrum for market entrants.

- Nurun Inc. taken private: on February 19, 2008, Quebecor Media

acquired 91.54% of the outstanding shares of Nurun it did not

already hold for a total consideration of $69.5 million.

Quebecor Media's revenues increased by $367.3 million (12.2%) to

$3.37 billion in 2007. All of Quebecor Media's business segments

reported higher revenues. Operating income grew by $164.3 million

(20.5%) to $963.9 million in 2007, mainly because of significantly

improved results in the Cable segment, where operating income

increased by $130.2 million (25.4%). Operating income also

increased in Newspapers (by $18.3 million or 8.8%), primarily as a

result of the acquisition of Osprey Media Income Fund ("Osprey

Media"), and in Broadcasting ($17.3 million or 41.1%) and Leisure

and Entertainment ($7.7 million or 39.9%). Excluding Osprey Media's

operating income and the impact of the consolidated stock option

plan, operating income increased by 20.0% in 2007, compared with

11.0% in 2006.

"In 2007, Quebecor Media posted the strongest increase in

operating income since the acquisition of Groupe Videotron ltee,"

said Pierre Karl Peladeau, President and Chief Executive Officer of

Quebecor Inc. "Our excellent results are mainly due to robust,

sustained growth in the Cable segment, which continues to register

substantial customer base increases for all services, year after

year. The Newspapers segment was boosted by the favourable impact

of the acquisition of Osprey Media, which closed in August 2007, as

well as increased operating income from its regular operations, on

a comparable basis. In addition, the Broadcasting and Leisure and

Entertainment segments both reported significant improvements in

operating income. The results testify to the success of the

convergence strategy Quebecor Media has been pursuing for several

years. Meanwhile, Quebecor Media welcomed the federal government's

decision to create favourable conditions for new players to enter

the Advanced Wireless Services (AWS) market and recommitted to

making a major investment in this communications platform to

support its future business growth."

Quebecor Media recorded net income of $327.1 million in 2007,

compared with a $169.7 million net loss in 2006. The favourable

variance of $496.8 million was due primarily to the favourable

impact on the comparative numbers for 2007 of the recognition in

2006 of a $342.6 million loss on debt refinancing ($219.0 million

net of income tax and non-controlling interest) and of a $180.0

million charge for impairment of goodwill and broadcasting licences

in the Broadcasting segment ($156.6 million net of income tax and

non-controlling interest). The $164.3 million increase in operating

income in 2007 also contributed to the improvement. These

favourable factors were partially offset by, among other things, a

$29.7 million increase in the amortization charge and a $15.4

million increase in financial expenses.

Quebecor Media Inc.

Highlights, 2002 - 2007 (in millions of Canadian dollars)

------------------------------------------------------------------------

------------------------------------------------------------------------

2007 2006 2005 2004 2003 2002

------------------------------------------------------------------------

Revenues $3,365.9 $2,998.6 $2,695.4 $2,456.9 $2,291.9 $2,253.0

Operating income $963.9 $799.6 $732.1 $697.2 $611.6 $572.4

------------------------------------------------------------------------

------------------------------------------------------------------------

Financial ratios according to financial statements, 2002 - 2007

------------------------------------------------------------------------

------------------------------------------------------------------------

2007 2006 2005 2004 2003 2002

------------------------------------------------------------------------

Debt (1) 3.7 3.9 4.3 4.4 5.1 5.9

Interest coverage(2) 4.1 3.6 2.7 2.5 2.1 1.9

------------------------------------------------------------------------

------------------------------------------------------------------------

(1) Long-term debt (including the fair value of derivative financial

instruments) / operating income.

(2) Operating income / interest on long-term debt (including amortization

of discount and financing costs).

The debt ratio was reduced from 5.9 in 2002 to 3.7 in 2007.

During the same period, the interest coverage ratio increased from

1.9 to 4.1. Despite substantial investments related to cable

networks and newspaper printing facilities, as well as the business

acquisitions made by Quebecor Media during the period, Quebecor

Media's financial ratios improved significantly between 2002 and

2007. The excellent performance was mainly due to sustained growth

in operating income during the period. Between 2002 and 2007,

Videotron Ltd. made capital investments totalling $1.2 billion in

order to maintain its technological leadership and deliver the best

service and the best customer experience. The Newspapers segment

also invested $344.7 million during the period in order to provide

industry-leading print quality for its largest daily

newspapers.

Fourth quarter 2007

Quebecor Media's revenues increased $120.7 million (14.3%) to

$964.9 million in the fourth quarter of 2007, mainly as a result of

higher revenues in Cable ($64.4 million or 17.7%) and Newspapers

($59.8 million or 24.2%). Quebecor Media's operating income rose by

$48.9 million (20.5%) to $287.2 million in the fourth quarter of

2007, primarily as a result of increases in the Cable segment

($35.9 million or 25.7%) and the Newspapers segment ($13.1 million

or 20.6%). The increases in the Newspapers segment's revenues and

operating income in the fourth quarter of 2007 were mainly due to

the acquisition of Osprey Media.

Quebecor Media recorded net income of $112.4 million in the

fourth quarter of 2007, compared with a $97.1 million net loss in

the same period of 2006. The $209.5 million improvement was due

primarily to the favourable impact on the comparative numbers for

2007 of the recognition in 2006 of a $180.0 million non-cash charge

for impairment of goodwill and of broadcasting licences in the

Broadcasting segment ($156.6 million net of income tax and

non-controlling interest). The $48.9 million increase in operating

income in the fourth quarter of 2007 and the approximately $22.2

million favourable impact of the decrease in federal tax rates also

contributed to the improvement.

Impact on Quebecor Media Inc. and Quebecor Inc. of Quebecor

World Inc.'s decision to place itself under the protection of the

Companies' Creditors Arrangement Act in Canada

On January 21, 2008, Quebecor World Inc. placed itself under the

protection of the Companies' Creditors Arrangement Act. Quebecor

World and some of its U.S. subsidiaries also placed themselves

under the protection of Chapter 11 of the Bankruptcy Code in the

United States.

These procedures will have no material impact on the operations

of Quebecor Media.

In light of the rejection by Quebecor World's bank creditors of

the rescue plan announced on January 11, 2008, Quebecor did not

consider it to be in the interests of its shareholders to enhance

its offer and increase the risk associated with its investment in

Quebecor World. In light of Quebecor World's decision to place

itself under the protection of the Companies' Creditors Arrangement

Act, Quebecor will have to exclude Quebecor World from the scope of

its consolidation as of January 21, 2008.

Since the events involving Quebecor World occurred after

December 31, 2007, Quebecor will have to consolidate financial data

for Quebecor World as of December 31, 2007 and for the financial

year ended on that date.

The carrying value of Quebecor's investment in Quebecor World as

of September 30, 2007, for consolidation purposes, was $429.0

million, and net losses on foreign exchange in the amount of

approximately $350.0 million related to this investment had been

accumulated as of that date in other comprehensive income. The

total net loss before taxes that will ultimately be recognized in

Quebecor's results in connection with the events involving Quebecor

World should not exceed the total of these amounts. This net loss

will have no impact on Quebecor's cash and cash equivalents.

The release of Quebecor's consolidated financial results for

2007 will be dependent on the production by Quebecor World of its

financial results for the year ended December 31, 2007. In view of

the recent events involving Quebecor World, Quebecor anticipates

that the publication of its annual financial documents, including

its audited consolidated financial results, its Management

Discussion and Analysis and its press release, will be delayed.

Quebecor cannot guarantee that, for the 2007 financial year, it

will be able to meet its reporting obligations by the prescribed

deadline since it has no control over Quebecor World's ability to

report its own financial results.

Dividends declared and paid by Quebecor Media Inc. in 2007

The Board of Directors of Quebecor Media declared and paid

dividends totalling $110.0 million in 2007.

Conference call for investors and webcast

Quebecor Inc. will hold a conference call to discuss Quebecor

Media's results for the fourth quarter and financial year 2007 on

February 26, 2008, at 8:30 a.m. EST. There will be a question

period reserved for financial analysts. To access the conference

call, please dial 1 877 293-8052, access code 70041#. A tape

recording of the call will be available from February 26 through

March 28, 2008, by dialling 1 877 293-8133, access code 610525#.

The conference call will also be broadcast live on the Quebecor

Inc. website at

www.quebecor.com/InvestorCenter/QIConferenceCall.aspx. It is

advisable to ensure the appropriate software is installed before

accessing the call. Instructions and links to free player downloads

are available at the Internet address shown above.

Forward-looking statements

The statements in this press release that are not historical

facts are forward-looking statements and are subject to significant

known and unknown risks, uncertainties and assumptions which could

cause Quebecor Inc.'s actual results for future periods to differ

materially from those set forth in the forward-looking statements.

Certain factors that may cause actual results to differ from

current expectations include seasonality (including seasonal

fluctuations in customer orders), operating risk (including

fluctuations in demand for Quebecor Inc.'s products and pricing

actions by competitors), risks associated with capital investment

(including risks related to technological development and equipment

availability and breakdown), environmental risks, risks associated

with labour agreements, commodity risks (including fluctuations in

the cost and availability of raw materials), credit risk, financial

risks, debt risks, risks related to interest rate fluctuations,

foreign exchange risks, government regulation risks, risks related

to tax changes and changes in the general political and economic

environment. Investors and others are cautioned that the foregoing

list of factors that may affect future results is not exhaustive

and that undue reliance should not be placed on any forward-looking

statements. For more information on the risks, uncertainties and

assumptions that could cause Quebecor Inc.'s actual results to

differ from current expectations, please refer to Quebecor Inc.'s

public filings available at www.sedar.com and www.quebecor.com

including, in particular, the "Risks and Uncertainties" section in

Quebecor Inc.'s Management Discussion and Analysis for the year

ended December 31, 2006 and the "Risk Factors" section of Quebecor

Inc.'s 2006 Annual Information Form.

The forward-looking statements in this press release reflect

Quebecor Inc.'s expectations as of February 26, 2008, and are

subject to change after that date. Quebecor Inc. expressly

disclaims any obligation or intention to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by applicable

securities laws.

Quebecor Inc.

Quebecor Inc. (TSX: QBR.A, QBR.B) is a holding company with

interests in two companies, Quebecor Media Inc. and Quebecor World

Inc. Quebecor holds a 54.7% interest in Quebecor Media, which owns

operating companies in numerous media-related businesses: Videotron

Ltd., the largest cable operator in Quebec and a major Internet

Service Provider and provider of telephone and business

telecommunications services; Quebecor Media's Newspapers segment,

the largest publisher of newspapers in Canada; TVA Group Inc.,

operator of the largest French-language over-the-air television

network in Quebec, a number of specialty channels, and the

English-language over-the-air station SUN TV; Canoe Inc., operator

of a network of English- and French-language Internet properties in

Canada; Nurun Inc., a major interactive technologies and

communications agency with offices in Canada, the United States,

Europe and Asia; companies engaged in book publishing and magazine

publishing; and companies engaged in the production, distribution

and retailing of cultural products, namely Archambault Group Inc.,

the largest chain of music stores in eastern Canada, TVA Films, and

Le SuperClub Videotron ltee, a chain of video and console-game

rental and retail stores. Quebecor World is a commercial print

media services company with operations in North America, Europe,

Latin America and Asia.

SEGMENTED ANALYSIS

Cable segment

The Cable segment's revenues increased by $243.1 million (18.6%)

to $1.55 billion in 2007, mainly because of customer growth.

Operating income increased by $130.2 million (25.4%) from $512.5

million in 2006 (a margin of 39.1% as a proportion of revenues) to

$642.7 million (or 41.4% of revenues) in 2007, mainly because of

the growth in the customer base for all services, increases in some

rates, and a $12.6 million favourable variance related to

non-recognition in 2007 of current Canadian Radio-television and

Telecommunications Commission ("CRTC") Part II licence fee accruals

following the notice issued on October 1, 2007. These positive

factors more than offset the $20.9 million unfavourable impact of

expenses related to Quebecor Media's stock option plan. Excluding

the stock option expense, the Cable segment's operating income

increased by 28.6% in 2007, compared with 26.9% in 2006.

In 2007, the Cable segment added:

- 238,600 customers to its cable telephone service (234,800 in

2006);

- 141,000 customers to its cable Internet access service

(154,000 in 2006);

- 65,700 customers for all cable television services combined

(66,300 in 2006), i.e., net increase for analog service and illico

Digital TV, including 144,600 more customers for illico Digital TV

(149,000 in 2006);

- 33,900 phones to its wireless telephone service (11,800 in

2006).

Cable segment customer numbers, 2002 - 2007

(in thousands of customers)

------------------------------------------------------------------------

------------------------------------------------------------------------

2007 2006 2005 2004 2003 2002

------------------------------------------------------------------------

Cable television

Analog 869.9 948.8 1,031.5 1,118.9 1,183.3 1,259.4

Digital 768.2 623.6 474.6 333.7 240.9 171.6

------------------------------------------------------------------------

Total cable

television 1,638.1 1,572.4 1,506.1 1,452.6 1,424.2 1,431.0

Cable Internet 933.0 792.0 638.0 502.6 406.3 305.1

Cable telephone 636.4 397.8 163.0 - - -

Wireless telephone 45.7 11.8 - - - -

------------------------------------------------------------------------

------------------------------------------------------------------------

Over the past five years, the Cable segment's total

subscriptions to all its services have nearly doubled, from 1.7

million in 2002 to 3.3 million in 2007.

The Cable segment's average monthly revenue per user ("ARPU")

increased by $10.09 (16.4%) from $61.43 in 2006 to $71.52 in

2007.

In the fourth quarter of 2007, the Cable segment increased its

revenues by $64.4 million (17.7%) to $427.3 million and its

operating income by $35.9 million (25.7%) to $175.7 million.

On November 28, 2007 and December 14, 2007, Industry Canada

released a policy framework and a licensing framework,

respectively, for the auction of spectrum licences for Advanced

Wireless Services in the 2 GHz range. Several of the framework

elements are expressly intended to encourage new entrants into the

Canadian mobile wireless industry, most notably the setting aside

of 40 MHz (out of a total of 105 MHz) of spectrum nationally for

new entrants, and a decision to mandate digital roaming and antenna

tower and site sharing by way of new licence conditions applicable

to all existing and new mobile wireless licensees. These licence

conditions are to be finalized prior to the March 10, 2008 deadline

for applications to participate in the spectrum auction. The

auction is scheduled to commence on May 27, 2008. Implementation of

the technology will enable Canada to catch up with other major

industrialized nations in terms of the quality of advanced wireless

services and competitive pricing.

Quebecor Media has announced that it will participate, through

Videotron, in the spectrum auction. If Quebecor Media is awarded

spectrum, it anticipates investing, through Videotron,

approximately $500.0 million (including licenses and initial

operating losses) to build a third-generation (3G) network in

Quebec with the latest technologies, thereby becoming a

facilities-based wireless provider offering its Quebec customers

integrated mobile multimedia services. Quebecor Media currently

anticipates that this new network would be fully operational within

18 months following the end of the auction.

Newspapers segment

The Newspapers segment's revenues rose by $99.9 million (10.8%)

to $1.03 billion in 2007, mainly as a result of the acquisition of

Osprey Media. Excluding the impact of the acquisition, revenues

increased by $4.4 million in 2007. Commercial printing and other

revenues combined increased by 12.9%. Advertising revenues grew by

1.2% while circulation revenues decreased by 5.8%. The revenues of

the urban dailies declined by 1.5% in 2007. Excluding the

acquisition of Osprey Media, the revenues of the community

newspapers increased by 1.1% in 2007. Within the urban dailies

group, revenues of the free dailies increased by 62.7% in 2007 due

to excellent results posted by the Montreal, Toronto and Vancouver

dailies, and the launch of free dailies in Ottawa and

Ottawa-Gatineau in November 2006, and in Calgary and Edmonton in

February 2007.

The Newspapers segment's operating income totalled $225.9

million in 2007, an $18.3 million (8.8%) increase. The favourable

impact of the acquisition of Osprey Media ($25.3 million) was

partially offset by investments and one-time charges, including

investments related to the launch of four new free dailies in

Ottawa, Ottawa-Gatineau, Calgary and Edmonton and the launch of

Quebecor MediaPages, the impact of the labour disputes at Le

Journal de Montreal and Le Journal de Quebec in 2006 and 2007

respectively, and variances in the charge for Quebecor Media's

stock option plan. Excluding these items, operating income was

$225.2 million in 2007, compared with $214.2 million in 2006. The

$11.0 million (5.1%) increase mainly reflects lower newsprint

costs, the impact of restructuring initiatives and the decrease in

operating losses at the free dailies, on a comparable basis (i.e.,

at the Montreal, Toronto and Vancouver dailies), which were

partially offset by costs related to the implementation of certain

projects. Operating income from the dailies in the Western Group

increased by 13.8%. Osprey Media's operating income increased by

12.6% in 2007, on a comparable basis, testifying to the strategic

value of the acquisition for Quebecor Media's Newspapers segment.

Excluding the launch of the four new free dailies and the impact on

results of the labour disputes at Le Journal de Montreal and Le

Journal de Quebec, operating income increased by 5.5% at the urban

dailies. Excluding the impact of the acquisition of Osprey Media,

operating income increased by 6.3% at the community newspapers.

In the fourth quarter of 2007, the Newspapers segment's revenues

increased by $59.8 million (24.2%) to $306.5 million, mainly as a

result of the impact of the acquisition of Osprey Media, which

closed in August 2007. Excluding the impact of that acquisition,

combined revenues from commercial printing and other sources

increased by 29.5%, advertising revenues were flat, and circulation

revenues decreased by 8.8%.

The Newspapers segment's operating income totalled $76.6 million

in the fourth quarter of 2007, a $13.1 million (20.6%) increase

attributable primarily to the impact of the acquisition of Osprey

Media ($15.9 million). Excluding the acquisition of Osprey Media

and investments and one-time charges, including investments related

to the launch of four new free dailies (in Ottawa, Ottawa-Gatineau,

Calgary and Edmonton) and of Quebecor MediaPages, charges related

to Quebecor Media's stock option plan, and the impact of the labour

disputes at Le Journal de Montreal and Le Journal de Quebec in 2006

and 2007 respectively, operating income was $70.1 million in the

fourth quarter of 2007, compared with $66.7 million in the same

quarter of 2006. The $3.4 million (5.1%) increase was essentially

due to the decrease in newsprint costs. Despite the labour dispute

at Le Journal de Quebec, operating income increased by 6.9% in the

fourth quarter of 2007, compared with the same period of 2006.

Quebecor Media announced on October 11, 2007 the creation of a

new subsidiary, Quebecor MediaPages, to consolidate all its print

and online directory operations. Quebecor MediaPages plans to

launch 30 new local directories under the MediaPages name in

Quebec, Ontario and Alberta in 2007 and 2008.

Broadcasting segment

The Broadcasting segment recorded revenues of $415.5 million in

2007, an increase of $22.2 million (5.6%). Revenues from

broadcasting operations rose $11.7 million, primarily as a result

of higher advertising revenues at the TVA Network and SUN TV,

higher subscription and advertising revenues at the specialty

channels (Mystere, ARGENT, Prise 2, LCN, mentv and Mystery), and

higher revenues from video on demand, from Shopping TVA and from

commercial production. Revenues from distribution operations

increased by $5.5 million due to a larger number of theatrical

releases in 2007 than in 2006 and increased revenues from video

releases. Revenues from publishing operations increased by $1.8

million in 2007. The favourable impact of the acquisition of the

interest in TV Hebdo and TV 7 Jours not already held by TVA Group

Inc. was partially offset by a decrease in revenues from newsstand

sales.

The Broadcasting segment recorded operating income of $59.4

million in 2007, a $17.3 million (41.1%) increase. Operating income

from broadcasting operations increased by $7.2 million, mainly

because of the impact of the higher revenues from the specialty

channels, SUN TV and video on demand, and the non-recognition in

2007 of current Canadian Radio-television and Telecommunications

Commission ("CRTC") Part II licence fee accruals following the

notice issued on October 1, 2007, for a favourable variance of $4.1

million. Operating income from distribution operations improved by

$3.0 million, mainly because of higher revenues from video

releases. Operating income from publishing operations increased by

$6.5 million, essentially because of reductions in some operating

expenses, including printing costs.

The Broadcasting segment's revenues increased $4.2 million

(3.5%) to $124.1 million in the fourth quarter of 2007 and its

operating income rose by $3.9 million (20.6%) to $22.8 million.

The business environment for conventional television continues

to be cause for concern, as indicated by the 2.6% decline in

advertising revenues from TVA Group's conventional television

operations in the fourth quarter of 2007, despite the fact that the

TVA Network has 25 of the 30 top-rated shows in Quebec and remains

Quebec's leading general-interest television network, seven days a

week.

Leisure and Entertainment segment

The revenues of the Leisure and Entertainment segment increased

by $14.0 million (4.4%) to $329.8 million in 2007, mainly because

of an 11.1% increase in the revenues of Quebecor Media Book Group.

At Archambault Group Inc., revenues grew by 0.8%. The increase in

the revenues of Quebecor Media Book Group in 2007 was mainly due to

higher revenues in the academic segment and at Messageries A.D.P.

inc., due in the latter case to the distribution of several

successful releases, including the French translation of the

international bestseller The Secret by Rhonda Byrne, which sold

more than 343,000 copies in 2007.

The Leisure and Entertainment segment's operating income

amounted to $27.0 million in 2007, compared with $19.3 million in

the previous year. The $7.7 million (39.9%) increase was mainly due

to the impact of the revenue increases, as well as decreases in

some operating costs.

In the fourth quarter of 2007, the Leisure and Entertainment

segment's revenues decreased by $1.7 million (-1.6%) to $103.4

million and its operating income increased by $0.3 million (3.0%)

to $10.3 million.

In 2007, Pierre Marchand was appointed President, Music

Division, of Archambault Group. In early 2008, Celine Massicotte

was appointed President and Chief Operating Officer of Groupe

Sogides inc.

Interactive Technologies and Communications segment

The Interactive Technologies and Communications segment recorded

revenues of $82.0 million in 2007, an $8.1 million (11.0%) increase

which reflects the recruitment of new customers and the positive

impact of the acquisition of Crazy Labs Web Solutions S.L. in July

2006, partially offset by the impact of lower volume in the United

States.

The segment's operating income totalled $2.8 million in 2007, a

$4.7 million (-62.7%) decrease due to lower volume in the U.S., the

impact of a change in the stock option plan, and one-time charges

related to Quebecor Media's purchase of some of Nurun's shares, as

well as an increase in the conditional compensation charge related

to the acquisition of Ant Farm Interactive LLC in 2004. Recognition

in 2006 of federal research and development tax credits from

previous years was also a factor in the decrease in operating

income in 2007. These unfavourable variances were partially offset

by the impact of increased revenues from new customers.

In the fourth quarter of 2007, the Interactive Technologies and

Communications segment recorded revenues of $20.1 million,

essentially unchanged from the same quarter of 2006. Nurun's

operating income decreased from $3.3 million in the fourth quarter

of 2006 to nil in the fourth quarter of 2007.

On February 19, 2008, Quebecor Media acquired 91.54% of the

outstanding shares of Nurun it did not already hold at a price of

$4.75 per share, for a total cash consideration of $69.5

million.

Internet/Portals segment

The Internet/Portals segment recorded total revenues of $48.3

million in 2007, a $6.7 million (16.1%) increase. Revenues from the

special-interest portals and the general-interest portals rose by

23.8% and 6.5% respectively from 2006. Among the special-interest

portals, jobboom.com recorded significant increases in revenues

from packages and other revenue streams.

Operating income decreased by $3.2 million (-31.7%) to $6.9

million in 2007. The revenue growth did not entirely offset the

unfavourable impact of increases in some operating costs, including

labour and advertising and promotion costs. These cost increases

were caused in part by the introduction of a new business

development strategy and investments in new products.

In the fourth quarter of 2007, the revenues of the

Internet/Portals segment increased by $2.1 million (18.1%) to $13.7

million and its operating income by $1.3 million (86.7%) to $2.8

million.

On November 28, 2007, Quebecor Media officially launched

canoe.tv, Canada's first webcaster. It will carry exclusive content

as well as programming from conventional sources.

Financing activities

Quebecor Media completed, on October 5, 2007, a placement of

US$700.0 million aggregate principal amount of Senior Notes. The

Senior Notes were sold at a price equivalent to 93.75% of face

value for net proceeds of $672.2 million (including accrued

interest of $16.6 million and before financing expenses of $9.8

million). The Notes bear interest at 7 3/4% (an effective rate of

8.81%) and mature on March 15, 2016. Quebecor Media used the net

proceeds from the placement, as well as its cash and cash

equivalents, to repay in full advances drawn on the Senior Bridge

Facility entered into by Quebecor Media to finance the acquisition

of Osprey Media for a total consideration of $414.4 million, to

repay, on October 31, 2007, US$179.7 million drawn on Sun Media

Corporation's term loan "B", and to settle the $106.0 million

liability related to derivative financial instruments connected to

the term loan "B."

DEFINITIONS

Operating income

In its analysis of operating results, Quebecor Inc. defines

operating income, as reconciled to (net loss) net income under

Canadian generally accepted accounting principles ("GAAP"), as (net

loss) net income before amortization, financial expenses, reserve

for restructuring of operations, impairment of assets and other

special charges, (loss) gain on re-measurement of exchangeable

debentures and of a portfolio investment, loss on debt refinancing,

(loss) gain on sales of businesses and other assets, impairment of

goodwill and intangible assets, income taxes, dividends on

Preferred Shares of a subsidiary, net of income tax,

non-controlling interest and the results of discontinued

operations. Operating income as defined above is not a measure of

results that is consistent with Canadian GAAP. It is not intended

to be regarded as an alternative to other financial operating

performance measures or to the statement of cash flows as a measure

of liquidity. It should not be considered in isolation or as a

substitute for measures of performance prepared in accordance with

Canadian GAAP. Management believes that operating income is a

meaningful measure of performance. Quebecor Inc. considers its

business segments as a whole and uses operating income in order to

assess the performance of its investment. Quebecor Inc. management

and its Board of Directors use this measure in evaluating its

consolidated results as well as results of Quebecor Inc.'s

operating segments. This measure eliminates the significant level

of non-cash depreciation of tangible assets and amortization of

certain intangible assets, and is unaffected by the capital

structure or investment activities of Quebecor Inc. and its

segments. Operating income is also relevant because it is a

significant component of Quebecor Inc.'s annual incentive

compensation programs. A limitation of this measure, however, is

that it does not reflect the periodic costs of capitalized tangible

and intangible assets used in generating revenues in Quebecor

Inc.'s segments. Quebecor Inc. also uses other measures that do

reflect such costs, such as cash flows from segment operations and

free cash flows from operations. In addition, measures like

operating income are commonly used by the investment community to

analyze and compare the performance of companies in the industries

in which Quebecor Inc. is engaged. Quebecor Inc.'s definition of

operating income may not be the same as similarly titled measures

reported by other companies. The table below reconciles Quebecor

Media's operating income with the closest Canadian GAAP

measure.

Quebecor Media Inc.

Reconciliation of operating income with net income (net loss) as disclosed

in the consolidated financial statements

(in millions of Canadian dollars)

-------------------------------------------------------------------------

-------------------------------------------------------------------------

2007 2006 2005 2004 2003 2002

-------------------------------------------------------------------------

Operating Income

Cable $642.7 $512.5 $413.3 $363.8 $289.7 262.8

Newspapers 225.9 207.6 222.2 227.8 224.8 219.4

Broadcasting 59.4 42.1 53.0 80.5 81.5 78.9

Leisure and

Entertainment 27.0 19.3 27.0 22.7 14.7 14.5

Interactive

Technologies

and Communications 2.8 7.5 3.9 2.3 1.1 1.5

Internet / Portals 6.9 10.1 9.0 4.5 2.9 (2.6)

Head Office (0.8) 0.5 3.7 (4.4) (3.1) (2.1)

-------------------------------------------------------------------------

963.9 799.6 732.1 697.2 611.6 572.4

Amortization (290.4) (260.7) (231.9) (225.9) (226.6) (224.6)

Financial expenses (240.0) (224.6) (285.3) (314.6) (300.1) (323.4)

Reserve for

restructuring of

operations,

impairment of

assets and other

special charges (11.6) (18.9) 0.2 (2.8) (1.8) (36.9)

(Loss) gain on debt

refinancing and on

repurchase of

redeemable

preferred shares

of a subsidiary (1.0) (342.6) (60.0) (4.8) 144.1 -

Gain (loss) on sale

of businesses and

other assets 0.4 2.2 0.1 9.3 (1.1) 3.6

Impairment of

goodwill and

intangible assets (5.4) (180.0) - - (0.5) (178.1)

Income taxes (74.8) 53.7 (43.5) (37.4) 12.5 (4.4)

Non-controlling

interest (19.2) (0.4) (16.2) (31.7) (34.6) (30.5)

Income (loss) from

discontinued

operations 5.2 2.0 1.0 (1.1) 0.4 (7.9)

-------------------------------------------------------------------------

Net income (loss) $327.1 $(169.7) $96.5 $88.2 $203.9 (229.8)

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Average monthly revenue per user

ARPU is an industry metric that Quebecor Inc. uses to measure

its average cable, Internet and telephony revenues per month per

basic cable customer. ARPU is not a measurement that is consistent

with Canadian GAAP, and Quebecor Inc.'s definition and calculation

of ARPU may not be the same as identically titled measurements

reported by other companies. Quebecor Inc. calculates ARPU by

dividing its combined cable television, Internet access and

telephony revenues by the average number of its basic cable

customers during the applicable period, and then dividing the

resulting amount by the number of months in the applicable

period.

QUEBECOR MEDIA INC. AND ITS SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME

(in millions of Canadian dollars)

Three months ended Twelve months ended

December 31 December 31

-------------------------------------------------------------------------

-------------------------------------------------------------------------

2007 2006 2007 2006

-------------------------------------------------------------------------

(unaudited) (unaudited) (audited) (audited)

REVENUES

Cable $427.3 $362.9 $1,552.6 $1,309.5

Newspapers 306.5 246.7 1,028.1 928.2

Broadcasting 124.1 119.9 415.5 393.3

Leisure and

Entertainment 103.4 105.1 329.8 315.8

Interactive

Technologies and

Communications 20.1 20.0 82.0 73.9

Internet/Portals 13.7 11.6 48.3 41.6

Head office and

inter-segment (30.2) (22.0) (90.4) (63.7)

-------------------------------------------------------------------------

964.9 844.2 3,365.9 2,998.6

Cost of sales and

selling and

administrative

expenses 677.7 605.9 2,402.0 2,199.0

Amortization 75.9 68.3 290.4 260.7

Financial expenses 72.2 57.6 240.0 224.6

Reserve for

restructuring of

operations and

other special charges (3.5) 9.5 11.6 18.9

Loss on debt

refinancing 1.0 0.5 1.0 342.6

Gain on sale of

businesses and

other assets - (1.2) (0.4) (2.2)

Impairment of

goodwill and

other intangible

assets 5.4 180.0 5.4 180.0

-------------------------------------------------------------------------

INCOME (LOSS) BEFORE

INCOME TAXES AND

NON-CONTROLLING

INTEREST 136.2 (76.4) 415.9 (225.0)

Income taxes:

Current 14.0 1.3 11.3 5.4

Future 1.6 27.3 63.5 (59.1)

-------------------------------------------------------------------------

15.6 28.6 74.8 (53.7)

-------------------------------------------------------------------------

120.6 (105.0) 341.1 (171.3)

Non-controlling

interest (8.2) 6.8 (19.2) (0.4)

-------------------------------------------------------------------------

INCOME (LOSS) FROM

CONTINUING

OPERATIONS 112.4 (98.2) 321.9 (171.7)

Income from

discontinued

operations - 1.1 5.2 2.0

-------------------------------------------------------------------------

NET INCOME (LOSS) $112.4 $(97.1) $327.1 $(169.7)

-------------------------------------------------------------------------

-------------------------------------------------------------------------

QUEBECOR MEDIA INC. AND ITS SUBSIDIARIES

SEGMENTED INFORMATION

(in millions of Canadian dollars)

Three months ended Twelve months ended

December 31 December 31

-------------------------------------------------------------------------

-------------------------------------------------------------------------

2007 2006 2007 2006

-------------------------------------------------------------------------

(unaudited) (unaudited) (audited) (audited)

Income before

amortization,

financial expenses,

reserve for

restructuring of

operations and

other special

charges, loss

on debt

refinancing,

gain on sale

of businesses

and other assets,

and impairment

of goodwill and

other intangible

assets

Cable $175.7 $139.8 $642.7 $512.5

Newspapers 76.6 63.5 225.9 207.6

Broadcasting 22.8 18.9 59.4 42.1

Leisure and

Entertainment 10.3 10.0 27.0 19.3

Interactive

Technologies and

Communications - 3.3 2.8 7.5

Internet/Portals 2.8 1.5 6.9 10.1

General corporate

(expenses) revenue (1.0) 1.3 (0.8) 0.5

-------------------------------------------------------------------------

$287.2 $238.3 $963.9 $799.6

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Amortization

Cable $55.6 $52.1 $219.4 $198.4

Newspapers 13.6 9.2 44.7 36.5

Broadcasting 3.4 3.8 13.2 14.3

Leisure and

Entertainment 1.9 1.7 7.9 7.2

Interactive

Technologies and

Communications 0.8 1.1 3.0 2.3

Internet/Portals 0.5 0.5 1.6 1.1

Head Office 0.1 (0.1) 0.6 0.9

-------------------------------------------------------------------------

$75.9 $68.3 $290.4 $260.7

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Additions to property,

plant and equipment

Cable $94.3 $85.8 $330.1 $302.6

Newspapers 63.7 15.9 111.4 116.3

Broadcasting 6.5 3.6 16.2 9.0

Leisure and

Entertainment 1.5 1.1 2.9 3.4

Interactive

Technologies and

Communications 0.7 0.9 3.3 1.8

Internet/Portals 1.5 0.7 4.6 1.9

Head Office 0.1 0.2 0.2 0.5

-------------------------------------------------------------------------

$168.3 $108.2 $468.7 $435.5

-------------------------------------------------------------------------

-------------------------------------------------------------------------

QUEBECOR MEDIA INC. AND ITS SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(in millions of Canadian dollars)

Three months ended Twelve months ended

December 31 December 31

-------------------------------------------------------------------------

-------------------------------------------------------------------------

2007 2006 2007 2006

-------------------------------------------------------------------------

(unaudited) (unaudited) (audited) (audited)

Net income (loss) $112.4 $(97.1) $327.1 $(169.7)

Other comprehensive

income, net of

income taxes

Unrealized (loss)

gain on translation

of net investments

in foreign

operations - 1.0 (2.0) 1.2

Unrealized gain on

derivative

instruments, net of

income tax of

$6.7 million in the

three-month period

ended December 31,

2007 and including

income tax recovery

of $11.5 million

in the twelve-month

period ended

December 31, 2007 30.3 - 48.0 -

-------------------------------------------------------------------------

30.3 1.0 46.0 1.2

-------------------------------------------------------------------------

COMPREHENSIVE INCOME

(LOSS) $142.7 $(96.1) $373.1 $(168.5)

-------------------------------------------------------------------------

-------------------------------------------------------------------------

CONSOLIDATED STATEMENTS OF DEFICIT

(in millions of Canadian dollars)

Three months ended Twelve months ended

December 31 December 31

-------------------------------------------------------------------------

-------------------------------------------------------------------------

2007 2006 2007 2006

-------------------------------------------------------------------------

(unaudited) (unaudited) (audited) (audited)

Deficit at

beginning of

period, as

previously

reported $2,576.1 $2,620.7 $2,731.5 $2,538.1

Cumulative effect

of changes in

accounting

policies - - 14.3 -

-------------------------------------------------------------------------

Deficit at beginning

of period, as

restated 2,576.1 2,620.7 2,745.8 2,538.1

Net (income) loss (112.4) 97.1 (327.1) 169.7

-------------------------------------------------------------------------

2,463.7 2,717.8 2,418.7 2,707.8

Dividends 65.0 13.7 110.0 23.7

-------------------------------------------------------------------------

Deficit at end

of period $2,528.7 $2,731.5 $2,528.7 $2,731.5

-------------------------------------------------------------------------

-------------------------------------------------------------------------

QUEBECOR MEDIA INC. AND ITS SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in millions of Canadian dollars)

Three months ended Twelve months ended

December 31 December 31

-------------------------------------------------------------------------

-------------------------------------------------------------------------

2007 2006 2007 2006

-------------------------------------------------------------------------

(unaudited) (unaudited) (audited) (audited)

Cash flows related

to operations

Net income (loss)

from continuing

operations $112.4 $(98.2) $321.9 $(171.7)

Adjustments for:

Amortization of

property, plant

and equipment 69.6 65.2 275.4 251.2

Amortization of

deferred charges

and of other

assets 6.3 3.1 15.0 9.5

Impairement of

goodwill and

intangible assets 5.4 180.0 5.4 180.0

Net loss (gain)

on derivative

instruments and

on foreign

currency

translation of

financial

instruments 2.1 (3.0) 4.7 1.2

Loss on revaluation

of the Additional

Amount payable - 8.1 5.2 10.5

Loss (gain) on sale

of businesses,

property, plant

and equipment,

and other assets 4.7 (0.4) 4.7 (0.4)

Loss on debt

refinancing 1.0 0.5 1.0 342.6

Repayment of

accrued interest

on Senior Discount

Notes - - - (197.3)

Amortization of

financing costs

and long-term

debt discount 1.8 1.0 4.8 7.3

Future income taxes 1.6 27.3 63.5 (59.1)

Non-controlling

interest 8.2 (6.8) 19.2 0.4

Other (0.7) (1.2) (1.4) 0.3

-------------------------------------------------------------------------

212.4 175.6 719.4 374.5

Net change in

non-cash balances

related to

operations 74.2 47.9 32.7 (22.2)

-------------------------------------------------------------------------

Cash flows provided

by continuing

operations 286.6 223.5 752.1 352.3

Cash flows provided

by discontinued

operations - 1.2 1.4 2.1

-------------------------------------------------------------------------

Cash flows provided

by operations 286.6 224.7 753.5 354.4

-------------------------------------------------------------------------

Cash flows related

to investing

activities

Additions to

property, plant and

equipment (168.3) (108.2) (468.7) (435.5)

Business

acquisitions, net

of cash and

cash equivalents (2.1) (1.2) (438.6) (10.5)

Proceeds from

disposal of a

business 0.8 0.5 8.5 0.5

Net decrease

(increase) in

temporary

investments - (1.3) 1.2 39.2

Proceeds from

disposal of assets 2.5 0.9 6.1 9.4

Acquisition of tax

deductions from

parent company (14.9) - (14.9) (16.1)

Decrease in advance

receivable from

parent company - - - 15.9

Other (0.3) (0.8) (1.5) (3.4)

-------------------------------------------------------------------------

Cash flows used in

investing activities (182.3) (110.1) (907.9) (400.5)

-------------------------------------------------------------------------

Cash flows related

to financing

activities

Net increase

(decrease) in bank

indebtedness 9.2 (2.6) (6.6) 7.9

Net (repayments)

borrowings under

revolving and

bridge bank

facilities (556.9) (85.0) (56.7) 38.4

Issuance of

long-term debt,

net of financing

fees 745.3 0.1 756.1 1,225.8

Repayment of

long-term debt

and unwinding of

hedging contracts (281.9) (28.3) (301.3) (1,201.2)

Repayment of the

Additional Amount

payable - - (127.2) -

Net decrease in

prepayments under

cross-currency

swap agreements - - - 21.6

Dividends and

reduction of

Common Shares

paid-up capital (65.0) (13.7) (110.0) (105.0)

Dividends paid to

non-controlling

shareholders (1.1) (1.2) (4.0) (4.5)

Other - 0.2 (3.1) (0.6)

-------------------------------------------------------------------------

Cash flows (used in)

provided by financing

activities (150.4) (130.5) 147.2 (17.6)

-------------------------------------------------------------------------

Net decrease in cash

and cash equivalents (46.1) (15.9) (7.2) (63.7)

Effect of exchange

rate changes on cash

and cash equivalents

denominated in

foreign currencies - 0.5 (0.8) 0.4

Cash and cash

equivalents at

beginning of period 72.2 49.5 34.1 97.4

-------------------------------------------------------------------------

Cash and cash

equivalents at end

of period $26.1 $34.1 $26.1 $34.1

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Cash and cash

equivalents consist of

Cash $6.8 $13.9 $6.8 $13.9

Cash equivalents 19.3 20.2 19.3 20.2

-------------------------------------------------------------------------

$26.1 $34.1 $26.1 $34.1

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Cash interest

payments $99.1 $47.6 $243.3 $446.3

Cash income tax

payments (net of

refunds) 2.0 (1.6) (0.5) 7.0

-------------------------------------------------------------------------

-------------------------------------------------------------------------

QUEBECOR MEDIA INC. AND ITS SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(in millions of Canadian dollars)

December 31 December 31

-------------------------------------------------------------------------

-------------------------------------------------------------------------

2007 2006

-------------------------------------------------------------------------

(audited) (audited)

ASSETS

CURRENT ASSETS

Cash and cash equivalents $26.1 $34.1

Temporary investments 0.2 1.4

Accounts receivable 496.0 426.2

Income taxes 10.5 17.3

Amounts receivable from parent company and

companies under common control 1.9 -

Inventories and investments in televisual products

and movies 169.0 158.7

Prepaid expenses 32.7 24.4

Future income taxes 153.6 65.9

-------------------------------------------------------------------------

890.0 728.0

PROPERTY, PLANT AND EQUIPMENT 2,110.2 1,830.1

FUTURE INCOME TAXES 57.4 61.1

OTHER ASSETS 422.0 243.6

GOODWILL 4,081.3 3,721.1

-------------------------------------------------------------------------

$7,560.9 $6,583.9

-------------------------------------------------------------------------

-------------------------------------------------------------------------

LIABILITIES AND SHAREHOLDERS' EQUITY

CURRENT LIABILITIES

Bank indebtedness $16.3 $20.6

Accounts payable and accrued charges 756.0 592.4

Deferred revenue 202.7 177.6

Income taxes 19.2 8.8

Amounts payable to parent company and companies

under common control - 11.9

Additional Amount payable - 122.0

Current portion of long-term debt 24.7 23.1

-------------------------------------------------------------------------

1,018.9 956.4

LONG-TERM DEBT 3,002.8 2,773.0

DERIVATIVE FINANCIAL INSTRUMENTS 538.7 231.3

OTHER LIABILITIES 103.5 125.2

FUTURE INCOME TAXES 292.5 118.9

NON-CONTROLLING INTEREST 154.2 142.1

SHAREHOLDERS' EQUITY

Capital stock 1,752.4 1,752.4

Contributed surplus 3,217.2 3,217.2

Deficit (2,528.7) (2,731.5)

Accumulated other comprehensive loss 9.4 (1.1)

-------------------------------------------------------------------------

2,450.3 2,237.0

-------------------------------------------------------------------------

$7,560.9 $6,583.9

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Contacts: Quebecor Media Inc. Louis Morin Executive Vice

President and Chief Financial Officer 514-380-1912 Quebecor Media

Inc. Luc Lavoie Executive Vice President, Corporate Affairs

514-380-1974 514-947 6672 (mobile) lavoie.luc@quebecor.com

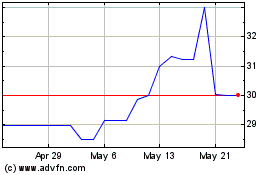

Quebecor (TSX:QBR.A)

Historical Stock Chart

From Jun 2024 to Jul 2024

Quebecor (TSX:QBR.A)

Historical Stock Chart

From Jul 2023 to Jul 2024