Prairie Provident Resources Inc. ("Prairie Provident" or the

"Company") (TSX:PPR) announces its financial and operating results

for the three and nine months ended September 30, 2024. The

Company's condensed interim consolidated financial statements

(“Financial Statements”) for the three and nine months ended

September 30, 2024 and related Management's Discussion and Analysis

("MD&A") for the third quarter are available on its website at

www.ppr.ca and filed on SEDAR+ at www.sedarplus.ca.

THIRD QUARTER 2024 FINANCIAL AND

OPERATING HIGHLIGHTS

- Production averaged 2,173 boe/d

(55% oil and liquids) in the third quarter of 2024, a 38% or 1,350

boe/d decrease from the same period in 2023, primarily due to the

sale of the Evi CGU in the first quarter of 2024.

- Operating expenses of $26.93/boe in

the third quarter of 2024, a decrease of $0.95/boe from the same

period in 2023.

- The Company spent $1.1 million in

the third quarter of 2024 as part of a workover program, which

included both well optimization and workovers, resulting in a 6.3%

increase in the average production for the third quarter of 2024

when compared to the average production of 2,045 boe/d (52% oil and

liquids) in the second quarter of 2024.

- Operating netback1 before the

impact of realized losses on derivatives was $2.6 million or

$13.20/boe for the third quarter of 2024, a decrease of $6.8

million or 72% from the same period in 2023. On a per boe basis,

operating netback decreased by $15.95/boe from the same period in

2023 driven by lower crude oil and natural gas prices and a higher

natural gas production weighting as a result of the sale of the Evi

CGU.

- Net income for the third quarter of

2024 was $5.2 million, compared to a net loss of $2.7 million in

the same period of 2023. The $7.9 million increase was mainly due

to $10.9 million gain on the extinguishment of financial

liabilities as further described in Note 8(c) of the Financial

Statements.

- The Company remained active in its

decommissioning program spending $1.9 million during the first nine

months of 2024.

Note:

(1) Operating netback is a non-GAAP

financial measure, and is defined below under "Non-GAAP and Other

Financial Measures".

SUBSEQUENT TO THE END OF THE

QUARTER

- On October 30, 2024, the Company

announced the appointment of Dale Miller as Executive Chairman of

the Company upon the retirement of Patrick McDonald, its former

Chairman, from the board of directors. Mr. Miller will oversee all

activities of the Company and lead its management team. In

addition, the Company announced the appointment of Amber Wright as

Vice President, Operations & Engineering. Ms. Wright will be

responsible for all development, production operations and

engineering activities of the Company.

- The Company wishes to sincerely

thank Mr. McDonald for his many years of dedicated service and

contributions as a director and Chairman.

- On October 30, 2024, the Company

closed a Rights Offering in which aggregate gross proceeds of

$12,000,000 were raised (inclusive of a $10,000,000 initial

subscription from PCEP Canadian Holdco, LLC (“PCEP”), which closed

on September 27, 2024). Net proceeds from the Rights Offering are

expected to fund a capital program focused on drilling at least two

wells in the Basal Quartz formation (as discussed below), workovers

to enhance the productivity of existing wells and general corporate

purposes. A portion of the net proceeds of the Rights Offering was

also used to settle a US$2.3 million advance under the Company’s

Second Lien Note facility, by way of a $3.13 million setoff (being

the Canadian dollar equivalent of the advance) against the

subscription price paid by PCEP under the Rights Offering.

- The successful closing of the

Rights Offering satisfied all requisite conditions to the

previously announced amendments to the Company’s First Lien Loan.

These amendments consisted of extending the maturity of the First

Lien Loan to March 31, 2026, deferring a portion of the Company’s

cash interest obligations, as well as adjustments to financial

covenants. Similar amendments were also made to the Company’s

Second Lien Notes.

- In Prairie Provident's Michichi

core area, two horizontal wells were drilled and completed for

Basal Quartz oil potential. The two wells are currently being

equipped for production and are expected to be on-stream by the end

of November 2024.

FINANCIAL AND OPERATING

SUMMARY

|

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

|

($000s except per unit amounts) |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

Production Volumes |

|

|

|

|

| Crude oil and condensate

(bbl/d) |

1,118 |

|

2,155 |

|

1,202 |

|

2,237 |

|

| Conventional natural gas

(Mcf/d) |

5,846 |

|

7,685 |

|

6,088 |

|

7,648 |

|

| Natural

gas liquids (bbl/d) |

81 |

|

88 |

|

68 |

|

95 |

|

|

Total (boe/d) |

2,173 |

|

3,523 |

|

2,285 |

|

3,606 |

|

|

% Liquids |

55% |

|

64% |

|

56% |

|

65% |

|

|

Average Realized Prices |

|

|

|

|

| Crude oil and condensate

($/bbl) |

86.44 |

|

97.97 |

|

86.21 |

|

88.93 |

|

| Conventional natural gas

($/Mcf) |

0.69 |

|

2.60 |

|

1.55 |

|

2.69 |

|

| Natural

gas liquids ($/bbl) |

51.56 |

|

54.77 |

|

61.93 |

|

57.85 |

|

|

Total ($/boe) |

48.25 |

|

66.95 |

|

51.33 |

|

62.39 |

|

|

Operating Netback ($/boe)1 |

|

|

|

|

| Realized price |

48.25 |

|

66.95 |

|

51.33 |

|

62.39 |

|

| Royalties |

(8.12) |

|

(9.92) |

|

(8.00) |

|

(8.55) |

|

|

Operating costs |

(26.93) |

|

(27.88) |

|

(33.47) |

|

(31.90) |

|

|

Operating netback |

13.20 |

|

29.15 |

|

9.86 |

|

21.94 |

|

|

Realized losses on derivatives |

— |

|

(0.99) |

|

(0.77) |

|

(0.64) |

|

|

Operating netback, after realized losses on derivatives |

13.20 |

|

28.16 |

|

9.09 |

|

21.30 |

|

Note:(1) Operating

netback is a non-GAAP financial measure and is defined below under

"Non-GAAP and Other Financial Measures"

ABOUT PRAIRIE PROVIDENT

Prairie Provident is a Calgary-based company

engaged in the exploration and development of oil and natural gas

properties in Alberta, including a position in the emerging Basal

Quartz trend in the Michichi area of Central Alberta.

For further information, please contact:

Prairie Provident Resources Inc.Dale Miller, Executive

ChairmanPhone: (403) 292-8150Email: investor@ppr.ca

Forward-Looking Statements

This news release contains certain statements

("forward-looking statements") that constitute forward-looking

information within the meaning of applicable Canadian securities

laws. Forward-looking statements relate to future performance,

events or circumstances, are based upon internal assumptions,

plans, intentions, expectations and beliefs, and are subject to

risks and uncertainties that may cause actual results or events to

differ materially from those indicated or suggested therein. All

statements other than statements of current or historical fact

constitute forward-looking statements. Forward-looking statements

are typically, but not always, identified by words such as

"anticipate", "believe", "expect", "intend", "plan", "budget",

"forecast", "target", "estimate", "propose", "potential",

"project", "seek", "continue", "may", "will", "should" or similar

words suggesting future outcomes or events or statements regarding

an outlook.

Without limiting the foregoing, this news

release contains forward-looking statements pertaining to: Basal

Quartz, drilling opportunities, including estimated payout periods

and first year production on potential Basal Quartz wells; and the

processing of production from successful Basal Quartz drilling.

Forward-looking statements are based on a number

of material factors, expectations or assumptions of Prairie

Provident which have been used to develop such statements, but

which may prove to be incorrect. Although the Company believes that

the expectations and assumptions reflected in such forward-looking

statements are reasonable, undue reliance should not be placed on

forward-looking statements, which are inherently uncertain and

depend upon the accuracy of such expectations and assumptions.

Prairie Provident can give no assurance that the forward-looking

statements contained herein will prove to be correct or that the

expectations and assumptions upon which they are based will occur

or be realized. Actual results or events will differ, and the

differences may be material and adverse to the Company. In addition

to other factors and assumptions which may be identified herein,

assumptions have been made regarding, among other things: results

from drilling and development activities; consistency with past

operations; the quality of the reservoirs in which Prairie

Provident operates and continued performance from existing wells

(including with respect to production profile, decline rate and

product type mix); the continued and timely development of

infrastructure in areas of new production; the accuracy of the

estimates of Prairie Provident's reserves volumes; future commodity

prices; future operating and other costs; future USD/ CAD exchange

rates; future interest rates; continued availability of external

financing and internally generated cash flow to fund Prairie

Provident's current and future plans and expenditures, with

external financing on acceptable terms; the impact of competition;

the general stability of the economic and political environment in

which Prairie Provident operates; the general continuance of

current industry conditions; the timely receipt of any required

regulatory approvals; the ability of Prairie Provident to obtain

qualified staff, equipment and services in a timely and cost

efficient manner; drilling results; the ability of the operator of

the projects in which Prairie Provident has an interest in to

operate the field in a safe, efficient and effective manner; field

production rates and decline rates; the ability to replace and

expand oil and natural gas reserves through acquisition,

development and exploration; the timing and cost of pipeline,

storage and facility construction and expansion and the ability of

Prairie Provident to secure adequate product transportation; the

regulatory framework regarding royalties, taxes and environmental

matters in the jurisdictions in which Prairie Provident operates;

and the ability of Prairie Provident to successfully market its oil

and natural gas production.

The forward-looking statements included in this

news release are not guarantees of future performance or promises

of future outcomes and should not be relied upon. Such statements,

including the assumptions made in respect thereof, involve known

and unknown risks, uncertainties and other factors that may cause

actual results or events to differ materially from those

anticipated in such forward- looking statements including, without

limitation: reduced access to external debt financing; higher

interest costs or other restrictive terms of debt financing;

changes in realized commodity prices; changes in the demand for or

supply of Prairie Provident's products; the early stage of

development of some of the evaluated areas and zones; the potential

for variation in the quality of the geologic formations targeted by

Prairie Provident's operations; unanticipated operating results or

production declines; changes in tax or environmental laws, royalty

rates or other regulatory matters; changes in development plans of

Prairie Provident or by third party operators; increased debt

levels or debt service requirements; inaccurate estimation of

Prairie Provident's oil and reserves volumes; limited, unfavourable

or a lack of access to capital markets; increased costs; a lack of

adequate insurance coverage; the impact of competitors; and such

other risks as may be detailed from time-to-time in Prairie

Provident's public disclosure documents (including, without

limitation, those risks identified in this news release and Prairie

Provident's current Annual Information Form dated April 1, 2024 as

filed with Canadian securities regulators and available from the

SEDAR+ website (www.sedarplus.ca) under Prairie Provident's issuer

profile).

The forward-looking statements contained in this

news release speak only as of the date of this news release, and

Prairie Provident assumes no obligation to publicly update or

revise them to reflect new events or circumstances, or otherwise,

except as may be required pursuant to applicable laws. All

forward-looking statements contained in this news release are

expressly qualified by this cautionary statement.

Non-GAAP and Other Financial

Measures

This news release discloses certain financial

measures that are 'non-GAAP financial measures' or 'supplementary

financial measures' within the meaning of applicable Canadian

securities laws. Such measures do not have a standardized or

prescribed meaning under International Financial Reporting

Standards (IFRS) and, accordingly, may not be comparable to similar

financial measures disclosed by other issuers. Non-GAAP and other

financial measures are provided as supplementary information by

which readers may wish to consider the Company's performance but

should not be relied upon for comparative or investment purposes.

Readers must not consider non-GAAP and other financial measures in

isolation or as a substitute for analysis of the Company's

financial results as reported under IFRS. For a reconciliation of

each non-GAAP measure to its nearest IFRS measure, please refer to

the "Non-GAAP and Other Financial Measures" section of the

MD&A.

This news release also includes reference to

certain metrics commonly used in the oil and natural gas industry,

but which do not have a standardized or prescribed meanings under

the Canadian Oil and Gas Evaluation (COGE) Handbook or applicable

law. Such metrics are similarly provided as supplementary

information by which readers may wish to consider the Company's

performance but should not be relied upon for comparative or

investment purposes.

The following is additional information on

non-GAAP and other financial measures and oil and gas metrics used

in this news release.

Operating Netback – Operating netback is a

non-GAAP financial measure commonly used in the oil and natural gas

industry, which the Company believes is a useful measure to assist

management and investors to evaluate operating performance at the

oil and natural gas lease level. Operating netbacks included in

this news release were determined as oil and natural gas revenues

less royalties less operating costs. Operating netback may be

expressed in absolute dollar terms or a per unit basis. Per unit

amounts are determined by dividing the absolute value by gross

working interest production. Operating netback after gains or

losses on derivative instruments, adjusts the operating netback for

only the realized portion of gains and losses on derivative

instruments. Operating netback per boe and operating netback, after

realized gains (losses) on derivatives per boe are non-GAAP

financial ratios.

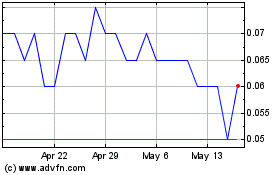

Prairie Provident Resour... (TSX:PPR)

Historical Stock Chart

From Nov 2024 to Dec 2024

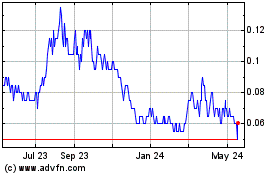

Prairie Provident Resour... (TSX:PPR)

Historical Stock Chart

From Dec 2023 to Dec 2024