Pinetree Capital Ltd Announces Unaudited Financial Results for the Period Ended, September 30, 2018

November 12 2018 - 4:34PM

Pinetree Capital Ltd. (TSX:PNP) (“Pinetree” or the “Company”) today

announced its financial results for the three and nine month period

ended September 30, 2018. All financial information provided

in this press release is unaudited and all figures are in $’000

except per share amounts and shares outstanding.

Unaudited financial results for the period ended

September 30, 2018

The following information should be read in

conjunction with our annual audited Consolidated Financial

Statements, prepared in accordance with International Financial

Reporting Standards (“IFRS”) and our annual Management Discussion

and Analysis for the year ended December 31, 2017, which can be

found on SEDAR at www.sedar.com.

Selected Financial Information

|

|

Three months endedSeptember 30, |

Nine months endedSeptember

30, |

|

|

2018 |

2017 |

2018 |

2017 |

| Net investment

gain (loss) |

(2,503 |

) |

285 |

|

(1,834 |

) |

(1,090 |

) |

|

Other income |

80 |

|

24 |

|

201 |

|

619 |

|

|

Total expenses |

176 |

|

281 |

|

346 |

|

701 |

|

|

Net income (loss) for the period |

(2,599 |

) |

28 |

|

(1,979 |

) |

(1,172 |

) |

|

Income (loss) per share – basic & fully diluted |

(0.29 |

) |

0.00 |

|

(0.22 |

) |

(0.19 |

) |

The net investment loss for the three months

ended September 30, 2018 was $2,503 (three months ended September

30, 2017 – net investment gains of $285) as a result of a net

change in unrealized gains and realized losses on investments as

described below.

Approximately 53% of the net investment loss was

due to the write down of one legacy investment to $0 as at

September 30, 2018 (December 31, 2017 - fair value of $1,323).

While the investee company completed a merger and a financing in

2017, it is the opinion of management that the investment has

since become materially impaired.

For the three months ended September 30, 2018,

the Company has $697 net realized losses on disposal of investments

as compared to nil for the three months ended September 30,

2017.

For the three months ended September 30, 2018,

the Company had a net change in unrealized losses on investments of

$1,806 as compared to a net change in unrealized gains of $285 for

the three months ended September 30, 2017.

For the three months ended September 30, 2018,

other income (comprised of interest and dividend income) totalled

$80 as compared to $24 for the three months ended September 30,

2017.

|

|

As at September 30, 2018 |

As at December 31, 2017 |

| Total assets |

|

16,780 |

|

18,697 |

|

Total liabilities |

|

454 |

|

392 |

|

Net asset value |

|

16,326 |

|

18,305 |

|

Shares outstanding |

|

9,045,198 |

|

9,045,198 |

|

Net asset value per share – basic* |

$1.80 |

$2.02 |

As at September 30, 2018, the Company held

investments at fair value totaling $9,567 as compared to $9,268 as

at December 31, 2017, a 3% increase, attributable to purchases in

the investment portfolio offset by net investment losses during the

period ended September 30, 2018.

The following is Pinetree's NAV per share and Operating Expenses

per NAV for the eight most recently completed interim financial

periods:

|

|

Shares Outstanding |

Net Asset Value (NAV) |

Operating

Expenses2(excluding F/X

g(l)) (OpEx) |

NAV per share – basic1 |

QuarterlyOpEx per NAV1 |

|

|

|

$'000s |

$'000s |

$ |

% |

|

Sept-30-18 |

9,045,198 |

16,326 |

171 |

1.80 |

1.0 |

|

Jun-30-18 |

9,045,198 |

18,925 |

121 |

2.09 |

0.6 |

|

Mar-31-18 |

9,045,198 |

18,639 |

139 |

2.06 |

0.7 |

|

Dec-31-17 |

9,045,198 |

18,305 |

195 |

2.02 |

1.1 |

|

Sep-30-17 |

9,045,198 |

18,867 |

209 |

2.09 |

1.1 |

|

Jun-30-17 |

9,045,198 |

18,839 |

130 |

2.08 |

0.7 |

|

Mar-31-17 |

4,522,599 |

10,154 |

246 |

2.25 |

2.4 |

|

Dec-31-16 |

4,522,599 |

10,649 |

311 |

2.35 |

2.9 |

1 Refer to “Use of Non-GAAP Financial Measures”Shares

Outstanding and Net Asset Value amounts are as at the Quarter End

date

Operating Expenses amounts are for the Three

months ending the Quarter End date2Operating Expenses do not

include Foreign Exchange gain (loss) on financial assets other than

investments

During the nine months ended September 30, 2018,

the Company continued to take a disciplined approach to capital

management in order to fund ongoing operations of the Company.

Forward Looking Statements

Certain statements herein may be “forward

looking” statements that involve known and unknown risks,

uncertainties and other factors that may cause the actual results,

performance or achievements of Pinetree or the industry to be

materially different from any future results, performance or

achievements expressed or implied by such forward-looking

statements. Forward-looking statements involve significant

risks and uncertainties, should not be read as guarantees of future

performance or results, and will not necessarily be accurate

indications of whether or not such results will be achieved.

A number of factors could cause actual results to vary

significantly from the results discussed in the forward-looking

statements. These forward-looking statements reflect current

assumptions and expectations regarding future events and operating

performance and are made as of the date hereof and Pinetree assumes

no obligation, except as required by law, to update any

forward-looking statements to reflect new events or

circumstances.

Non-IFRS Measures, Non-GAAP

Measures

NAV (net asset value per share) is a non-IFRS

(international financial reporting standards) measure calculated as

the value of total assets less the value of total liabilities

divided by the total number of common shares outstanding as at a

specific date. The term NAV does not have any standardized meaning

according to IFRS and therefore may not be comparable to similar

measures presented by other companies. There is no comparable

IFRS measure presented in Pinetree’s consolidated financial

statements and thus no applicable quantitative reconciliation for

such non-IFRS financial measure. The Company has calculated

NAV consistently for many years and believes that NAV can provide

information useful to its shareholders in understanding its

performance and may assist in the evaluation of its business

relative to that of its peers.

About Pinetree Capital Ltd.

Pinetree is a diversified investment and

merchant banking firm focused on the small cap market, with early

stage investments in technology, and resource companies.

Pinetree’s common shares are listed on the Toronto Stock Exchange

(TSX) under the symbol “PNP”

For further information:

Damien LeonardChief Executive

Officer416-941-9600ir@pinetreecapital.comwww.pinetreecapital.com

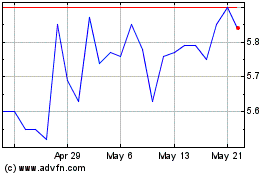

Pinetree Capital (TSX:PNP)

Historical Stock Chart

From Nov 2024 to Dec 2024

Pinetree Capital (TSX:PNP)

Historical Stock Chart

From Dec 2023 to Dec 2024