NuVista Energy Ltd. (“NuVista” or the “Company”) (TSX:NVA) is

pleased to announce record-setting financial and operating results

for the three and six months ended June 30, 2022, and to provide a

number of updates which demonstrate continued material advancement

of our Pipestone and Wapiti Montney development. Commodity prices

in 2022 have remained volatile but strong. Adjusted funds flow and

production growth continues to set new records, well returns are

very high, rapid debt reduction continues, and we have begun to buy

back shares. NuVista is continuing through 2022 with strength and

increasing momentum.

During the quarter ended June 30, 2022, NuVista:

- Produced 65,032 Boe/d, slightly

above the guidance range of 62,500 – 65,000 Boe/d, and similar to

the first quarter level. This was achieved despite planned downtime

associated with six maintenance outages at NuVista and midstreamer

facilities during the quarter. Production was 26% higher than the

second quarter of 2021;

- Achieved a record $200 million of

adjusted funds flow(1) in the second quarter ($0.87/share,

basic(4)), including $84 million of free adjusted funds flow(2).

This represents a free adjusted funds flow increase of 30% over the

prior quarter;

- Achieved net earnings of $178

million ($0.78/share, basic) compared to $70.3 million

($0.31/share, basic) in the prior quarter;

- Delivered a corporate netback(3) of

$33.76/Boe for the quarter, an improvement of 7% and 185% compared

to the prior quarter and the second quarter of 2021,

respectively;

- Closed the quarter with $57 million

drawn on our long term credit facility and a favorable net debt(1)

to annualized second quarter adjusted funds flow(1) ratio of

0.4x;

- Commenced for the first time in our

corporate history the execution of a Normal Course Issuer Bid

(“NCIB”) with approval from the TSX received in June. During the

second quarter, NuVista repurchased and canceled 2.56 million

shares, and subsequent to the quarter have now increased the total

to 4.61 million shares at an aggregate cost of $47.6 million. This

represents a total of 2.0% of all shares outstanding, and

satisfaction of 25% of the NCIB to date;

- Executed a successful second

quarter capital expenditure(2) program of $115 million, including

the drilling of 12 (11.5 net) wells and the completion of 16 (16.0

net) wells in our condensate rich Wapiti Montney play; and

- Continued to significantly advance

our progress in the areas of environmental, social and governance

(“ESG”), including continued positive strides in reducing GHG and

methane emissions.

Notes:

|

(1) |

Each of "adjusted funds flow", "net debt" and “net debt to

annualized second quarter adjusted funds flow” are capital

management measures. Reference should be made to the section

entitled “Non-GAAP and Other Financial Measures” in this press

release for further information. |

| (2) |

Each of "free adjusted funds

flow" and "capital expenditures" are non-GAAP financial measures

that do not have any standardized meanings under IFRS and therefore

may not be comparable to similar measures presented by other

companies where similar terminology is used. Reference should be

made to the section entitled “Non-GAAP and Other Financial

Measures” in this press release for further information. |

| (3) |

Each of “corporate netback” and

“cash costs” are non-GAAP financial ratios that do not have any

standardized meanings under IFRS and therefore may not be

comparable to similar measures presented by other companies where

similar terminology is used. Reference should be made to the

section entitled “Non-GAAP and Other Financial Measures” in this

press release for further information. |

| (4) |

“Adjusted funds flow per share"

is a supplementary financial measure. Reference should be made to

the section entitled “Non-GAAP and Other Financial Measures” in

this press release for further information. |

| |

|

Operations Update

We are pleased to report that production and

operational performance exceeded our expectations again this

quarter. Production reached the top end of our guidance range at

65,032 Boe/d during a period where planned facility maintenance

occurred in all of our development areas. The continued strength in

our well results coupled with sound execution on the maintenance

projects by ourselves and our mid-stream partners allowed us to

successfully navigate through a complex period. Inflationary

pressures and supply chain constraints have not moderated

throughout the second quarter and early into the third quarter. Our

steady and predictable activity level has allowed us to manage

these pressures throughout the quarter within budget, as average

Drill, Complete and Equip (“DCE”) costs met our expectations which

included 15% inflation (10% net of performance efficiency gains).

We have also been implementing extra measures to combat inflation

and supply change management issues as much as possible. These

measures include early purchases of selected tubulars and goods, as

well as longer term contracting with selected service providers

where appropriate.

We have updated our lookback at payout

multiples(5)(6) to include our second quarter activity which

includes two new pads. Based on an assumed price forecast of

US$85/Bbl WTI and US$4.00/MMBtu NYMEX we anticipate these pads

achieving a first year payout multiple(5)(6) of approximately 1.8x,

which is in line with the pad average of our 2021 capital

program.

Activity levels in the Pipestone area were high,

with Pads #9 and #10 coming on-stream in the quarter. Pad #9, which

is our shortest pad at an average horizontal length of 1,850

meters, reached IP90(7) at 1,110 Boe/d per well(8) including 50%

condensate. Pad #10 has reached IP30 with volumes averaging 2,000

Boe/d including 50% condensate. Final Costs for pad #9 were

reported in the first quarter, while DCE costs for the 7 wells on

Pad #10 averaged a favorable $6.6 million per well, or $2,180 per

horizontal meter, which was inline with what we achieved in

2021.

Pad #11 finished drilling and has been

successfully completed at the beginning of Q3. Final drill costs

for the 5 wells on this pad averaged $710 per horizontal meter

which is within 2% of our previous record pad cost, providing more

evidence of our ability to partially offset inflationary pressures

with continued excellence in operational performance. We are

currently drilling Pad #12 and preparing to drill Pad #13 which

will wrap up drilling the Pipestone area for the year as facilities

will be nearing capacity throughout the fourth quarter.

With our return to drilling in the Wapiti area

we are pleased to see performance at Gold Creek continuing to

surprise to the upside, and importantly drilling inventory

expansion is being underpinned by new results from the Lower

Montney. The 7-14 Gold Creek pad which came on production in May

was on budget with DCE costs of $2,390 per horizontal meter. The

IP30 milestone has been reached on this pad with volumes averaging

1,420 Boe/d(8) including 40% condensate. Of particular note, this

4-well pad included our first Lower Montney test in the Gold Creek

area. IP30 for this well was 1,340 Boe/d(8) including 48%

condensate. This is extremely encouraging as our previous Gold

Creek plans were based on single-zone development in the Middle

Montney. As of the end of 2021, 94 Contingent Resource locations(8)

had been booked in the Lower Montney at Gold Creek, but no Proved

Plus Probable locations had yet been booked in our reserve

report.

Notes:

|

(5) |

"Payout multiple" is a non-GAAP financial ratio that does not have

any standardized meaning under IFRS and therefore may not be

comparable to similar measures presented by other companies where

similar terminology is used. Reference should be made to the

section entitled “Non-GAAP and Other Financial Measures” in this

press release for further information. |

| (6) |

"Payout multiple" is calculated

as: (i) the product of operating netbacks (excluding realized gains

(losses) on financial derivatives) multiplied by production;

divided by (ii) DCET capital invested. |

| (7) |

Five of the seven wells on this

pad have reached IP90 to date. |

| (8) |

See “Advisories Regarding Oil and

Gas Information” in this press release. |

| |

|

ESG Progress Continues

During the quarter NuVista continued to progress

key items in the area of ESG performance improvement, including the

previously announced conversion of our credit facility to a

sustainability linked loan with specific sustainability performance

targets. We have been preparing our 2021 ESG report update, and we

look forward to releasing details of our significant progress with

that report in August.

Executive Succession

Ross Andreachuk, our VP Finance and CFO, has

elected to retire effective Dec 31, 2022 after 16 years with

NuVista. On behalf of the board of directors and the NuVista

management team we would like to extend our sincere appreciation

for the dedication and steady financial leadership Ross has

provided through the many years of NuVista growth and industry

cycles. We wish Ross and family every success and happiness in

retirement.

We are pleased to announce the promotion of our

Controller, Ivan J. Condic, to the role of VP Finance and CFO,

effective January 1, 2023. Ivan has been our Controller since 2014

and has worked closely with Ross and our executive team and the

board throughout the period to ensure his readiness as part of our

ongoing executive and staff succession planning process. Prior to

NuVista, Ivan began his career as a staff accountant at KPMG and

then has held a variety of roles including controller and CFO at

smaller companies in our industry. Ivan will be joining our CEO and

CFO at investor and board meetings throughout the planned fall

transition period. We wish Ivan every success in the new role.

2022 Guidance Update

As discussed above, NuVista is pleased to note

that operations and performance have been strong while both

condensate and natural gas prices have continued at highly

profitable levels. This results in a material increase to projected

adjusted funds flow, tremendous progress in reducing our net debt,

and high velocity of capital investment return. Capital spending

and inflationary assumptions have been on track to prior estimates

thus far.

NuVista’s capital expenditure guidance for 2022

is re-affirmed at a range of $355 - $375 million. We will revisit

this in the fall to assess any changes to inflationary pressures.

Additionally, if commodity pricing and production continue to

perform well, we will review the optionality of moving some planned

activities from the first quarter of 2023 to the fourth quarter of

2022 to again optimize supply chain management and execution

outcomes.

NuVista’s recent well performance has been

strong, and all planned outages for the year have been concluded.

We have set our third quarter production guidance range at 67,000

to 69,000 Boe/d. Full year 2022 guidance is reaffirmed at 67,000 –

69,000 Boe/d.

Free Adjusted Funds Flow Allocation

Framework

Our Board has approved a long term sustainable

target net debt to adjusted funds flow of less than 1.0 times in

the stress test price environment of US$45/Bbl WTI and

US$2.00/MMBtu NYMEX natural gas. In the context of our 2022 plan,

this represents the target base net debt level of $200 million or

less. We believe that the best method for return of capital to

shareholders is initially to repurchase shares, however we will

re-evaluate the uses of free adjusted funds flow closer to year end

when the base targeted net debt level is expected to be achieved.

The re-evaluation will take into account the supply and demand and

pricing environment, and will include all options including

continued disciplined growth beyond existing facility capacity of

90,000 Boe/d, share repurchases, prudent targeted M&A, and

dividend payments.

At current strip prices, NuVista anticipates

being able to direct approximately 50% of remaining 2022 free

adjusted funds flow towards the return of capital to shareholders

while at the same time reaching our targeted net debt of $200

million before or near year end. This is anticipated to result in

the substantial satisfaction of the NCIB prior to year end at the

current strip commodity pricing and share price. Our board of

directors has approved share repurchases targeting a range of 25%

to 50% of quarterly free adjusted funds flow, with the remainder

directed towards debt reduction. The order of priority for free

adjusted funds flow allocation shall be achieving debt reduction

progress, followed by share repurchases. Combined with significant

production and free adjusted funds flow growth, we are confident

the share repurchases will bring significant additional value per

share while returning capital to shareholders.

NuVista has top quality assets and a management

team focused on relentless improvement. We have the necessary

foundation and liquidity to continue adding significant value for

our shareholders. We will continue to adjust to this environment in

order to maximize the value of our asset base and ensure the

long-term sustainability of our business. We would like to thank

our staff, contractors, and suppliers for their continued

dedication and delivery, and we thank our board of directors and

our shareholders for their continued guidance and support. Please

note that our corporate presentation is being updated and will be

available at www.nuvistaenergy.com on August 3, 2022. NuVista’s

financial statements, notes to the financial statements and

management’s discussion and analysis for the quarter ended June 30,

2022, will be filed on SEDAR (www.sedar.com) under NuVista Energy

Ltd. on August 3, 2022 and can also be accessed on NuVista’s

website.

| Financial and

Operating Highlights |

|

|

|

|

|

|

Three months ended June 30 |

Six months ended June 30 |

|

($ thousands, except otherwise stated) |

2022 |

2021 |

% Change |

2022 |

2021 |

% Change |

|

FINANCIAL |

|

|

|

|

|

|

|

Petroleum and natural gas revenues |

463,273 |

|

187,925 |

|

147 |

|

845,100 |

|

339,334 |

|

149 |

|

| Cash provided by operating

activities |

227,668 |

|

58,357 |

|

290 |

|

390,110 |

|

104,508 |

|

273 |

|

| Adjusted funds flow (1)

(4) |

199,833 |

|

55,452 |

|

260 |

|

389,702 |

|

88,709 |

|

339 |

|

|

Per share, basic |

0.87 |

|

0.25 |

|

248 |

|

1.70 |

|

0.39 |

|

336 |

|

|

Per share, diluted |

0.83 |

|

0.25 |

|

232 |

|

1.63 |

|

0.38 |

|

329 |

|

| Net earnings (loss) |

177,954 |

|

(10,941 |

) |

1,726 |

|

248,209 |

|

4,447 |

|

5,481 |

|

|

Per share, basic |

0.78 |

|

(0.05 |

) |

1,660 |

|

1.08 |

|

0.02 |

|

5,300 |

|

|

Per share, diluted |

0.74 |

|

(0.05 |

) |

1,580 |

|

1.04 |

|

0.02 |

|

5,100 |

|

| Capital expenditures (2) |

115,023 |

|

44,344 |

|

159 |

|

234,987 |

|

125,292 |

|

88 |

|

| Net proceeds on property

dispositions |

— |

|

— |

|

— |

|

— |

|

93,578 |

|

(100 |

) |

| Net debt (1) (4) |

|

|

|

349,192 |

|

547,314 |

|

(36 |

) |

|

OPERATING |

|

|

|

|

|

|

| Daily Production |

|

|

|

|

|

|

| Natural gas (MMcf/d) |

225.1 |

|

178.3 |

|

26 |

|

227.0 |

|

173.4 |

|

31 |

|

| Condensate (Bbls/d) |

21,058 |

|

16,296 |

|

29 |

|

21,367 |

|

14,472 |

|

48 |

|

| NGLs (Bbls/d) |

6,463 |

|

5,473 |

|

18 |

|

6,609 |

|

5,315 |

|

24 |

|

| Total (Boe/d) |

65,032 |

|

51,485 |

|

26 |

|

65,811 |

|

48,685 |

|

35 |

|

| Condensate & NGLs

weighting |

42 |

% |

42 |

% |

|

43 |

% |

41 |

% |

|

| Condensate weighting |

32 |

% |

32 |

% |

|

32 |

% |

30 |

% |

|

| Average realized selling

prices (6) |

|

|

|

|

|

|

| Natural gas ($/Mcf) |

7.83 |

|

3.48 |

|

125 |

|

6.80 |

|

3.63 |

|

87 |

|

| Condensate ($/Bbl) |

135.67 |

|

79.00 |

|

72 |

|

127.37 |

|

75.47 |

|

69 |

|

| NGLs ($/Bbl) (5) |

73.09 |

|

28.73 |

|

154 |

|

61.00 |

|

28.76 |

|

112 |

|

| Netbacks ($/Boe) |

|

|

|

|

|

|

| Petroleum and natural gas

revenues |

78.28 |

|

40.11 |

|

95 |

|

70.94 |

|

38.50 |

|

84 |

|

| Realized loss on financial

derivatives |

(12.77 |

) |

(6.13 |

) |

108 |

|

(10.14 |

) |

(5.65 |

) |

79 |

|

| Royalties |

(12.11 |

) |

(2.24 |

) |

441 |

|

(8.81 |

) |

(2.41 |

) |

266 |

|

| Transportation expenses |

(5.59 |

) |

(5.44 |

) |

3 |

|

(5.08 |

) |

(5.27 |

) |

(4 |

) |

| Operating expenses |

(11.55 |

) |

(10.54 |

) |

10 |

|

(11.22 |

) |

(10.81 |

) |

4 |

|

| Operating netback (3) |

36.26 |

|

15.76 |

|

130 |

|

35.69 |

|

14.36 |

|

149 |

|

|

Corporate netback (3) |

33.76 |

|

11.84 |

|

185 |

|

32.71 |

|

10.06 |

|

225 |

|

|

SHARE TRADING STATISTICS |

|

|

|

|

|

|

| High ($/share) |

14.29 |

|

4.01 |

|

256 |

|

14.29 |

|

4.01 |

|

256 |

|

| Low ($/share) |

9.26 |

|

2.00 |

|

363 |

|

6.94 |

|

0.89 |

|

680 |

|

| Close ($/share) |

10.32 |

|

3.98 |

|

159 |

|

10.32 |

|

3.98 |

|

159 |

|

| Average daily volume

('000s) |

1,219 |

|

1,350 |

|

(10 |

) |

1,396 |

|

1,413 |

|

(1 |

) |

| Common

shares outstanding ('000s) |

|

|

|

228,460 |

|

226,256 |

|

1 |

|

|

(1) |

Refer to Note 15 “Capital management” in NuVista's financial

statements and to the sections entitled “Adjusted funds flow” and

“Liquidity and capital resources” contained in this MD&A. |

| (2) |

Non-GAAP financial measure that

does not have any standardized meaning under IFRS and therefore may

not be comparable to similar measures presented by other companies

where similar terminology is used. Reference should be made to the

section entitled “Non-GAAP and Other Financial Measures”. |

| (3) |

Non-GAAP ratio that does not have

any standardized meaning under IFRS and therefore may not be

comparable to similar measures presented by other companies where

similar terminology is used. Reference should be made to the

section entitled “Non-GAAP and Other Financial Measures”. |

| (4) |

Capital management measure.

Reference should be made to the section entitled “Non-GAAP and

Other Financial Measures”. |

| (5) |

Natural gas liquids (“NGLs”)

include butane, propane and ethane revenue and sales volumes, and

sulphur revenue. |

| (6) |

Product prices exclude realized

gains/losses on financial derivatives. |

| |

|

Advisories Regarding Oil And Gas

Information

BOEs may be misleading, particularly if used in

isolation. A BOE conversion ratio of 6 Mcf: 1 Bbl is based on an

energy equivalency conversion method primarily applicable at the

burner tip and does not represent a value equivalency at the

wellhead. As the value ratio between natural gas and crude oil

based on the current prices of natural gas and crude oil is

significantly different from the energy equivalency of 6:1,

utilizing a conversion on a 6:1 basis may be misleading as an

indication of value.

This press release contains a number of oil and

gas metrics prepared by management, including DCE costs, which do

not have standardized meanings or standard methods of calculation

and therefore such measures may not be comparable to similar

measures used by other companies. Such metrics have been included

herein to provide readers with additional measures to evaluate

NuVista's performance on a comparable basis with prior periods;

however, such measures are not reliable indicators of the future

performance of NuVista and future performance may not compare to

the performance in previous periods. DCE includes all capital spent

to drill, complete, and equip a well.

Any references in this press release to initial

production rates are useful in confirming the presence of

hydrocarbons, however, such rates are not determinative of the

rates at which such wells will continue production and decline

thereafter. While encouraging, readers are cautioned not to place

reliance on such rates in calculating the aggregate production for

NuVista.

Reference to current strip prices for 2022 in

this press release reflect July 26, 2022 pricing: WTI US$98.00/Bbl,

NYMEX US$7.30/MMBtu, AECO $5.50/GJ, 1.29 CAD:USD FX .

Contingent Resource

Locations

This press release discloses NuVista's drilling

locations in undeveloped contingent resources (2C) drilling

locations. Undeveloped 2C drilling locations are derived from a

report prepared by GLJ Ltd., NuVista’s independent qualified

reserves evaluator, evaluating NuVista's contingent resources as of

December 31, 2021 ("GLJ Contingent Resource Report"), and account

for undeveloped drilling locations that have associated contingent

resources based on a best estimate of such contingent resources.

There is no certainty that we will drill all drilling locations and

if drilled there is no certainty that such locations will result in

additional oil and gas production. The drilling locations on which

we actually drill wells will ultimately depend upon the

availability of capital, regulatory approvals, seasonal

restrictions, oil and natural gas prices, costs, actual drilling

results, additional reservoir information that is obtained and

other factors. Contingent resources are those quantities of

petroleum estimated, as of a given date, to be potentially

recoverable from known accumulations using established technology

or technology under development, but which are not currently

considered to be commercially recoverable due to one or more

contingencies. In the case of the contingent resources estimated in

the GLJ Contingent Resource Report, contingencies include: (i)

further delineation of interest lands; (ii) corporate commitment,

and; (iii) final development plan. To further delineate interest

lands additional wells must be drilled and tested to demonstrate

commercial rates on the resource lands. Reserves are only assigned

in close proximity to demonstrated productivity. As continued

delineation drilling occurs, a portion of the contingent resources

are expected to be reclassified as reserves. Confirmation of

corporate intent to proceed with remaining capital expenditures

within a reasonable timeframe is a requirement for the assessment

of reserves. Finalization of a development plan includes timing,

infrastructure spending and the commitment of capital.

Determination of productivity levels is generally required before

the Company can prepare firm development plans and commit required

capital for the development of the contingent resources. There is

uncertainty that it will be commercially viable to produce any

portion of the contingent resources.

Basis of presentation

Unless otherwise noted, the financial data

presented in this press release has been prepared in accordance

with Canadian generally accepted accounting principles (“GAAP”)

also known as International Financial Reporting Standards (“IFRS”).

The reporting and measurement currency is the Canadian dollar.

National Instrument 51-101 - "Standards of Disclosure for Oil and

Gas Activities" includes condensate within the product type of

natural gas liquids. NuVista has disclosed condensate values

separate from natural gas liquids herein as NuVista believes it

provides a more accurate description of NuVista's operations and

results therefrom.

Production split for Boe/d amounts referenced in

the press release are as follows:

|

Reference |

Total Boe/d |

% Natural Gas |

%Condensate |

% NGLs |

|

|

|

|

|

|

|

|

Q2 2022 production - actual |

65,032 |

|

58 |

% |

32 |

% |

10 |

% |

|

Q2 2022 production guidance |

62,500 - 65,000 |

|

62 |

% |

30 |

% |

8 |

% |

|

Q3 2022 production guidance |

67,000 - 69,000 |

|

62 |

% |

30 |

% |

8 |

% |

|

2022 revised annual production guidance |

67,000 - 69,000 |

|

62 |

% |

30 |

% |

8 |

% |

|

2022 original annual production guidance |

65,000 - 68,000 |

|

62 |

% |

30 |

% |

8 |

% |

|

2023+ production range |

85,000 - 90,000 |

|

62 |

% |

30 |

% |

8 |

% |

Advisory regarding forward-looking

information and statements

This press release contains forward-looking

statements and forward-looking information (collectively,

“forward-looking statements”) within the meaning of applicable

securities laws. The use of any of the words “will”, “expects”,

“believe”, “plans”, “potential” and similar expressions are

intended to identify forward-looking statements. More particularly

and without limitation, this press release contains forward looking

statements, including management's assessment of: NuVista’s future

focus, strategy, plans, opportunities and operations; projected

adjusted funds flows at current strip prices; our plans to continue

to balance debt repayment, increasing adjusted funds flow through

disciplined production and growth; guidance with respect to 2022

capital expenditure amounts, spending timing and allocation;

guidance with respect to average daily production for 2022;

expectations with respect to future net debt to adjusted funds flow

ratio; expectations with respect to achieving our sustainable net

debt target of less than 1.0 times adjusted funds flow in the

stress test price environment of $US 45/Bbl WTI and $US 2.00/MMBtu

NYMEX natural gas; plans to direct additional available adjusted

funds flow towards a disciplined balance of debt reduction; ESG

plans, targets and expected results from our ESG initiatives; the

anticipated timing of releasing the ESG report and the contents

therein; future commodity prices; anticipated increases in well

costs; anticipated timing and completion of Pad #12 and Pad #13 in

the Pipestone area and the anticipated benefits thereof; plans to

maximize free adjusted funds flow and the return of capital to

shareholders; the ability to re-evaluate the uses of free adjusted

funds flow and anticipating outcomes thereof; the future capacity

of our facilities, that maximum efficiency will be achieved at

flattened production levels of approximately 85,000 – 90,000 Boe/d

and that this will be achieved as early as 2023; the anticipated

benefit that we will generate free adjusted funds flow while

reducing net debt; NuVista’s future realized gas prices; the effect

of our financial, commodity, and natural gas risk management

strategy and market diversification; the satisfaction of the NCIB

and the effects of repurchases of common shares thereunder; 2022

drilling and completion plans, timing and expected results; the

anticipated first year payout multiple of 1.8x for the new pads;

the executive succession and anticipated timing thereof;

anticipated drilling and completions costs; and the ability to

continue adding significant value and improvement. Statements

relating to "reserves" are also deemed to be forward-looking

statements, as they involve the implied assessment, based on

certain estimates and assumptions, that the reserves described

exist in the quantities predicted or estimated and that the

reserves can be profitably produced in the future.

By their nature, forward-looking statements are

based upon certain assumptions and are subject to numerous risks

and uncertainties, some of which are beyond NuVista’s control,

including the impact of general economic conditions, industry

conditions, current and future commodity prices and inflation

rates; the impact of ongoing global events, including European

tensions and COVID-19, with respect to commodity prices, currency

and interest rates, anticipated production rates, borrowing,

operating and other costs and adjusted funds flow, the timing,

allocation and amount of capital expenditures and the results

therefrom, anticipated reserves and the imprecision of reserve

estimates, the performance of existing wells, the success obtained

in drilling new wells, the sufficiency of budgeted capital

expenditures in carrying out planned activities, access to

infrastructure and markets, competition from other industry

participants, availability of qualified personnel or services and

drilling and related equipment, stock market volatility, effects of

regulation by governmental agencies including changes in

environmental regulations, tax laws and royalties, the ability to

access sufficient capital from internal sources and bank and equity

markets, that we will complete the announced dispositions on the

terms and timing contemplated, that we will be able to execute our

2022 drilling plans as expected and including, without limitation,

those risks considered under “Risk Factors” in our Annual

Information Form. Readers are cautioned that the assumptions used

in the preparation of such information, although considered

reasonable at the time of preparation, may prove to be imprecise

and, as such, undue reliance should not be placed on

forward-looking statements. NuVista’s actual results, performance

or achievement could differ materially from those expressed in, or

implied by, these forward-looking statements, or if any of them do

so, what benefits NuVista will derive therefrom. NuVista has

included the forward-looking statements in this press release in

order to provide readers with a more complete perspective on

NuVista’s future operations and such information may not be

appropriate for other purposes. NuVista disclaims any intention or

obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise,

except as required by law.

This press release also contains future-oriented

financial information and financial outlook information

(collectively, "FOFI") about NuVista's prospective results of

operations including, without limitation, its ability to repay

debt, expectations with respect to future net debt to adjusted

funds flow ratios, projected adjusted funds flows at current strip

prices, capital expenditures and corporate netbacks, which are

subject to the same assumptions, risk factors, limitations, and

qualifications as set forth above. Readers are cautioned that the

assumptions used in the preparation of such information, although

considered reasonable at the time of preparation, may prove to be

imprecise and, as such, undue reliance should not be placed on

FOFI. NuVista's actual results, performance or achievement could

differ materially from those expressed in, or implied by, these

FOFI, or if any of them do so, what benefits NuVista will derive

therefrom. NuVista has included the FOFI in order to provide

readers with a more complete perspective on NuVista's future

operations and such information may not be appropriate for other

purposes.

These forward-looking statements and FOFI are

made as of the date of this press release and NuVista disclaims any

intent or obligation to update any forward-looking statements and

FOFI, whether as a result of new information, future events or

results or otherwise, other than as required by applicable

securities law.

Non-GAAP and other financial

measuresThis press release uses various specified

financial measures (as such terms are defined in National

Instrument 52-112 – Non-GAAP Disclosure and Other Financial

Measures Disclosure ("NI 51-112")) including

"non-GAAP financial measures", "non-GAAP ratios”, “capital

management measures" and “supplementary financial measures” (as

such terms are defined in NI 51-112), which are described in

further detail below. Management believes that the presentation of

these non-GAAP measures provide useful information to investors and

shareholders as the measures provide increased transparency and the

ability to better analyze performance against prior periods on a

comparable basis.

Non-GAAP financial measures

NI 52-112 defines a non-GAAP financial measure

as a financial measure that: (i) depicts the historical or expected

future financial performance, financial position or cash flow of an

entity; (ii) with respect to its composition, excludes an amount

that is included in, or includes an amount that is excluded from,

the composition of the most directly comparable financial measure

disclosed in the primary financial statements of the entity; (iii)

is not disclosed in the financial statements of the entity; and

(iv) is not a ratio, fraction, percentage or similar

representation.

These non-GAAP financial measures are not

standardized financial measures under IFRS and might not be

comparable to similar measures presented by other companies where

similar terminology is used. Investors are cautioned that these

measures should not be construed as alternatives to or more

meaningful than the most directly comparable IFRS measures as

indicators of NuVista's performance. Set forth below are

descriptions of the non-GAAP financial measures used in this press

release.

(1) Free adjusted

funds flow

Free adjusted funds flow is adjusted funds flow

less capital and asset retirement expenditures. Refer to NuVista’s

MD&A disclosures under the headings "Adjusted funds flow" and

"Capital expenditures" for a description of each component of free

adjusted funds flow, which components are a capital management

measure and a non-GAAP financial measure, respectively. Management

uses free adjusted funds flow as a measure of the efficiency and

liquidity of its business, measuring its funds available for

capital investment to manage debt levels, pay dividends, and return

capital to shareholders. By removing the impact of current period

capital and asset retirement expenditures, management believes this

measure provides an indication of the funds the Company has

available for future capital allocation decisions.

The following tables set out our free adjusted

funds flows compared to the most directly comparable GAAP measure

of cash provided by operating activities less cash used in

investing activities for the period:

|

|

Three months ended June 30 |

Six months ended June 30 |

|

($ thousands) |

2022 |

2021 |

2022 |

2021 |

|

Cash provided by operating activities |

227,668 |

|

58,357 |

|

390,110 |

|

104,508 |

|

| Cash

used in investing activities |

(107,532 |

) |

(43,504 |

) |

(234,054 |

) |

(26,483 |

) |

|

Excess cash provided by operating activities over cash used in

investing activities |

120,136 |

|

14,853 |

|

156,056 |

|

78,025 |

|

|

|

|

|

|

|

| Adjusted funds flow |

199,833 |

|

55,452 |

|

389,702 |

|

88,709 |

|

| Capital expenditures |

(115,023 |

) |

(44,344 |

) |

(234,987 |

) |

(125,292 |

) |

| Asset

retirement expenditures |

(1,184 |

) |

(265 |

) |

(6,752 |

) |

(4,098 |

) |

|

Free adjusted funds flow |

83,626 |

|

10,843 |

|

147,963 |

|

(40,681 |

) |

(2) Capital

expenditures

Capital expenditures are equal to cash used in

investing activities, excluding changes in non-cash working

capital, other receivable and property dispositions. Any

expenditures on the other receivable are being refunded to NuVista

and are therefore included under current assets. NuVista considers

capital expenditures to be a useful measure of cash flow used for

capital reinvestment.

The following table provides a reconciliation

between the non-GAAP measure of capital expenditures to the most

directly comparable GAAP measure of cash used in investing

activities for the period:

|

|

Three months ended June 30 |

Six months ended June 30 |

|

($ thousands) |

2022 |

2021 |

2022 |

2021 |

|

Cash used in investing activities |

(107,532 |

) |

(43,504 |

) |

(234,054 |

) |

(26,483 |

) |

| Changes in non-cash working

capital |

(7,491 |

) |

276 |

|

(933 |

) |

(2,155 |

) |

| Other receivable |

— |

|

(1,116 |

) |

— |

|

(3,076 |

) |

|

Property dispositions |

— |

|

— |

|

— |

|

(93,578 |

) |

|

Capital expenditures |

(115,023 |

) |

(44,344 |

) |

(234,987 |

) |

(125,292 |

) |

Non-GAAP ratios

NI 52-112 defines a non-GAAP ratio as a

financial measure that: (i) is in the form of a ratio, fraction,

percentage or similar representation; (ii) has a non-GAAP financial

measure as one or more of its components; and (iii) is not

disclosed in the financial statements of the entity. Set forth

below is a description of the non-GAAP ratios used in this press

release.

These non-GAAP ratios are not standardized

financial measures under IFRS and might not be comparable to

similar measures presented by other companies where similar

terminology is used. Investors are cautioned that these ratios

should not be construed as alternatives to or more meaningful than

the most directly comparable IFRS measures as indicators of

NuVista's performance.

Non-GAAP ratios presented on a "per Boe" basis

may also be considered to be supplementary financial measures (as

such term is defined in NI 51-112).

(1) Operating

netback and corporate netback ("netbacks"), per Boe

NuVista calculated netbacks per Boe by dividing

the netbacks by total production volumes sold in the period. Each

of operating netback and corporate netback are non-GAAP financial

measures. Operating netback is calculated as petroleum and natural

gas revenues including realized financial derivative gains/losses,

less royalties, transportation and operating expenses. Corporate

netback is operating netback less general and administrative,

deferred share units, interest and lease finance expense.

Management feels both operating and corporate

netbacks are key industry benchmarks and measures of operating

performance for NuVista that assists management and investors in

assessing NuVista's profitability, and are commonly used by other

petroleum and natural gas producers. The measurement on a Boe basis

assists management and investors with evaluating NuVista's

operating performance on a comparable basis.

(2) Cash costs

(“cash costs”), per Boe

NuVista calculated cash costs per Boe by

dividing the cash costs by total production volumes sold in the

period. Cash costs are a non-GAAP financial measure, calculated as

the sum of operating expenses, transportation expenses, general and

administrative expenses and financing costs.

Management feels that cash costs are a key

industry benchmark and measures of operating performance for

NuVista that assists management and investors in assessing

NuVista's profitability, and are commonly used by other petroleum

and natural gas producers. The measurement on a Boe basis assists

management and investors with evaluating NuVista's operating

performance on a comparable basis.

(3) Payout

Multiple

NuVista calculated payout multiple as: (i) the

product of operating netbacks (excluding realized gains (losses) on

financial derivatives) multiplied by production; divided by (ii)

DCET capital invested. Operating netbacks are a non-GAAP ratio

calculated as the sum of petroleum and natural gas revenues less

royalties, transportation expenses and operating expenses. See

"Operating netback and corporate netback ("netbacks"), per Boe"

above for further information.

Management feels that payout multiple is a

useful indicator of NuVista's operating performance and cost

management and assists management and investors in assessing

NuVista's return on capital invested.

Capital management measures

NI 52-112 defines a capital management measure

as a financial measure that: (i) is intended to enable an

individual to evaluate an entity’s objectives, policies and

processes for managing the entity’s capital; (ii) is not a

component of a line item disclosed in the primary financial

statements of the entity; (iii) is disclosed in the notes to the

financial statements of the entity; and (iv) is not disclosed in

the primary financial statements of the entity.

Please refer to Note 14 "Capital Management" in

NuVista's interim financial statements as at and for the 3 months

ended March 31, 2022 and 2021 for additional disclosure net debt,

adjusted funds flow and net debt to annualized first quarter

adjusted funds flow ratio, each of which are capital management

measures used by the Company in this press release.

NuVista calculates annualized first quarter

adjusted funds flow ratio by dividing net debt by the annualized

adjusted funds flow for the first quarter.

Supplementary financial

measures

This press release may contain certain

supplementary financial measures. NI 52-112 defines a supplementary

financial measure as a financial measure that: (i) is intended to

be disclosed on a periodic basis to depict the historical or

expected future financial performance, financial position or cash

flow of an entity; (ii) is not disclosed in the financial

statements of the entity; (iii) is not a non-GAAP financial

measure; and (iv) is not a non-GAAP ratio.

NuVista calculates: (i) "adjusted funds flow per

share" by dividing adjusted funds flow for a period by the number

of weighted average common shares of NuVista for the specified

period; and (ii) "net debt to adjusted funds flow" by dividing the

net debt at the end of a period by the adjusted funds flow for such

period.

FOR FURTHER INFORMATION CONTACT:

|

Jonathan A. Wright President and CEO(403)

538-8501 |

Ross

L. Andreachuk VP, Finance and CFO (403)

538-8539 |

Mike

J. LawfordChief Operating Officer(403) 538-1936 |

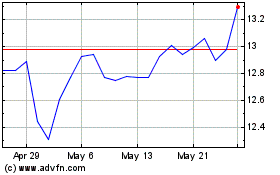

NuVista Energy (TSX:NVA)

Historical Stock Chart

From Oct 2024 to Nov 2024

NuVista Energy (TSX:NVA)

Historical Stock Chart

From Nov 2023 to Nov 2024