(TSX: NFI, OTC: NFYEF, TSX: NFI.DB) NFI Group Inc.

("NFI" or the "Company"), a leader in zero-emission electric

mobility solutions, today announced its unaudited interim condensed

consolidated financial results for the third quarter of 2024.

Key financial metrics for the quarter and for

the last twelve months are highlighted below:

|

|

|

|

|

|

|

|

|

in millions except deliveries and per Share amounts |

2024 Q3 |

Change1 |

2024 Q3 LTM |

Change1 |

|

|

|

|

|

|

|

|

|

Deliveries (EUs) |

|

994 |

|

|

(5 |

%) |

|

4,594 |

|

|

21 |

% |

|

|

|

|

|

|

|

|

|

IFRS Measures3 |

|

|

|

|

|

|

|

Revenue |

$ |

711 |

|

|

0 |

% |

$ |

3,077 |

|

|

19 |

% |

|

Net loss |

$ |

(15 |

) |

|

62 |

% |

$ |

(24 |

) |

|

92 |

% |

|

Net loss per Share |

$ |

(0.13 |

) |

|

69 |

% |

$ |

(0.20 |

) |

|

94 |

% |

|

Net cash (used in) generated from operations |

$ |

(45 |

) |

|

(18 |

%) |

$ |

53 |

|

|

145 |

% |

|

|

|

|

|

|

|

|

|

Non-IFRS Measures2,3 |

|

|

|

|

|

|

|

Adjusted EBITDA2 |

$ |

53 |

|

|

375 |

% |

$ |

185 |

|

|

681 |

% |

|

Adjusted Net Loss2 |

$ |

(5 |

) |

|

88 |

% |

$ |

(23 |

) |

|

83 |

% |

|

Adjusted Net Loss per Share2 |

$ |

(0.04 |

) |

|

90 |

% |

$ |

(0.20 |

) |

|

88 |

% |

|

Free Cash Flow2 |

$ |

2 |

|

|

105 |

% |

$ |

(16 |

) |

|

88 |

% |

|

Total Liquidity2 (including minimum liquidity requirement of $50

million) |

$ |

146 |

|

|

(14 |

%) |

$ |

146 |

|

|

(14 |

%) |

|

Return on Invested Capital2 (ROIC) |

|

5 |

% |

|

6 |

% |

|

5 |

% |

|

6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Footnotes:

|

|

1. |

Results noted herein are for the 13-week period ("2024 Q3”) and the

52-week period ("2024 Q3 LTM”) ended September 29, 2024. The

comparisons reported in this press release compare 2024 Q3 to the

13-week period ("2023 Q3") and 2024 Q3 LTM to the 52-week period

("2023 Q3 LTM") ended October 1, 2023. Comparisons and comments are

also made to the 13-week period (“2024 Q2”) ended June 30, 2024.

The term “LTM” is an abbreviation for “Last Twelve Month

Period”. |

|

|

2. |

Adjusted EBITDA, Adjusted Net Loss, and Free Cash Flow represent

non-IFRS measures; Adjusted Net Loss per Share and Return on

Invested Capital ("ROIC") are non-IFRS ratios; and Total Liquidity

and Backlog are supplementary financial measures. Such measures and

ratios are not defined terms under IFRS and do not have standard

meanings, so they may not be a reliable way to compare NFI to other

companies. Adjusted Net Loss per Share is based on the non-IFRS

measure Adjusted Net Loss. ROIC is based on net operating profit

after tax and average invested capital, both of which are non-IFRS

measures. See “Non-IFRS Measures” and detailed reconciliations of

IFRS Measures to non-IFRS Measures in the Appendices of this press

release. Readers are advised to review the unaudited interim

condensed consolidated financial statements (including notes) (the

“Financial Statements”) and the related Management's Discussion and

Analysis (the "MD&A"). |

|

|

|

|

"The third quarter of 2024 saw significant

improvement in gross margins, Adjusted EBITDA2, ROIC2 and positive

Free Cash Flow2, with another strong performance from the

aftermarket segment. Our backlog remains at record levels, with a

value of nearly $12 billion, positioning us extremely well for 2025

with firm sales now booking into 2026. We also saw a large increase

in our average sale price per transit bus reflecting the

completion of all legacy inflation impacted contracts,” said Paul

Soubry, President and Chief Executive Officer, NFI.

“While our production recovery continued, a seat

significant supplier, specified by our transit customers,

negatively impacted third quarter North American operations. This

disruption, and its cascading impacts, lowered our quarterly

deliveries, new vehicle production rates and led to

higher-than-expected quarter-ending inventory balances. We are

working directly with that supplier’s leadership team to action a

recovery plan that is expected to improve their performance through

early 2025. The plan includes their engagement of an external

operations consultant, the use of third-party labour and dedicated

onsite resources from NFI overseeing production.

“As a result, period ending liquidity2 declined

during the quarter, reflecting higher inventory balances stemming

from the impact of seat disruption, higher cost zero-emission buses

and the expected seasonality impacts of bus builds for private

markets, in advance of the busier fourth quarter. This decline was

somewhat offset by our successful efforts to increase progress

payments and milestone billings from customers plus the use of our

Export Development Canada performance guarantee program.

"We anticipate a busy finish to this year with

improved margin performance as we deliver buses, recover seat

disrupted deliveries, continue our strong aftermarket performance

and add several large-scale multi-year orders to our backlog. We

are also actioning multiple strategic initiatives to capitalize on

record customer demand for NFI’s market leading position, this

includes expanding our Canadian transit bus production which will

free-up U.S. capacity and provide more targeted resources to North

American transit operations. These efforts best position NFI to

generate sustainable financial growth and shareholder value through

2025 and the longer-term," Soubry concluded.

Segment Results

Manufacturing segment revenue

for 2024 Q3 decreased by $9 million, or 2%, compared to 2023 Q3,

driven by lower North American heavy-duty transit bus deliveries,

which were impacted by supply disruption primarily linked to seat

supply. This was offset by higher motorcoach and low-floor cutaway

bus deliveries and higher overall manufacturing segment average

selling price per unit delivered. On an LTM basis revenue increased

by 20.7%, reflecting higher deliveries in all product segments.

Manufacturing operations experienced a net loss

of $5.8 million in 2024 Q3 compared to a net loss of $39.9 million

in 2023 Q3. The reduction in net loss was driven by improved gross

margins and higher motorcoach and low-floor cutaway deliveries.

Manufacturing Adjusted EBITDA2 improved by $32 million, or 222%,

compared to 2023 Q3 and Manufacturing Adjusted EBITDA2 as a

percentage of revenue showed continued improvement, increasing from

(3%) in 2023 Q3 to 3.1% in 2024 Q3. These increases were driven by

improved gross margins and favourable sales mix. On an LTM basis,

Manufacturing net loss and Adjusted EBITDA2 both showed significant

improvement, reflecting higher deliveries and improved gross

margins.

At the end of 2024 Q3, the Company's total

backlog2 (firm and options) of 14,590 EUs increased by 53% from the

prior year. This increase is driven by the record number of awards

received year-to-date (“YTD”). During the quarter, NFI added 1,050

EUs of new orders, an 8.2% year-over-year improvement, supporting

an LTM book-to-bill ratio of 115.4%. Backlog2 for 2024 Q3 has a

total dollar value of $12.0 billion, and the average price of an EU

in backlog2 is now $0.82 million, a 19.5% increase from 2023

Q3.

Aftermarket segment delivered

another quarter of strong revenue of $153 million, an increase of

$10 million, or 7%, compared to 2023 Q3, driven by increased volume

in North American public and private markets. 2024 Q3 Aftermarket

segment net earnings increased by $2.2 million, or 8.1%, compared

to 2023 Q3. The increase was primarily due to improved sales

volume, pricing adjustments and favourable product mix. Aftermarket

Adjusted EBITDA2 was $34 million, an increase of $3 million, or 8%,

year-over-year, primarily driven by the same items that improved

net earnings. Aftermarket Adjusted EBITDA2 as a percentage of

revenue was strong at 23%. On an LTM basis, Aftermarket net

earnings and Adjusted EBITDA2 increased by 22.4% and 20.0%

respectively.

Net Loss, Adjusted Net

Loss2, and Return on Invested

Capital2

In 2024 Q3, the Company incurred a net loss of

$15 million, representing a $25 million, or 62% improvement from

2023 Q3, driven by increases in revenue and gross profit and lower

interest expense.

Adjusted Net Loss2 for 2024 Q3 of $5 million

improved from 2023 Q3 Adjusted Net Loss2 of $38 million, as a

result of the same items that impacted net losses, adjusted for

unrealized fair market gains related to the Company’s prepayment

option on second-lien debt, plus other normalization adjustments

including non-recurring restructuring and past service and pension

costs.

2024 Q3 ROIC2 increased to 5.3% from (1.0%)

in 2023 Q3, primarily due to the increase in Adjusted EBITDA2. The

invested capital2 base increased due to a gradual increase in

long-term debt, temporarily higher working capital balances and an

increase in the fair market value of the prepayment option on the

Company’s second lien debt.

Liquidity2

The Company’s Total Liquidity2 position, which

combines cash on-hand plus available capacity under its senior

first lien credit facilities (without consideration given to the

minimum liquidity requirement of $50 million), was $146 million as

at the end of 2024 Q3, down $33 million from the end of 2024 Q2.

Total Liquidity2 position was negatively impacted by a $35 million

investment in working capital, driven by increased inventory

balances for raw materials and work-in-process, reflecting higher

input costs for ZEB components, the impact of seat supply

disruption and higher carrying balances to support consistent

supply across other components. Offsetting increasing in inventory

were higher deferred revenue amounts of $48 million, reflecting the

Company’s success in improving payment terms with customers.

Outlook

Management anticipates improvements to revenue,

gross profit, Adjusted EBITDA2, Free Cash Flow2, net earnings, and

ROIC2, in the near-and-longer term, as the Company ramps up

production, executes on its backlog2, delivers a higher number of

ZEBs, grows its aftermarket business, and benefits from the growing

demand for its buses, coaches, parts, and services.

Management believes market demand is evident

through the Company’s continued new orders and an extremely strong

public transit funding environment in North America and other

international jurisdictions. This funding environment drives the

Company’s North American bid universe which currently has active

bids of 5,533 EUs, and a five-year forecasted customer demand of

20,690 EUs. In addition, the Company has seen improved competitive

dynamics within the North American market, leading to the Company

recording its highest new awards ever in 2024, with expectations

for further large awards in the fourth quarter of the year. NFI has

also seen overall market demand within private coach and

international transit markets grow, driven by increasing ridership,

travel and return to work initiatives. These demand factors are

expected to drive additional new orders going forward.

As referenced in the Company’s risk disclosure,

the highly customized nature of NFI’s products can result in

specific suppliers having an adverse impact on the Company’s

operations and new vehicle production, as currently evidenced by

seat supply disruption. The Company anticipates that there may

continue to be challenges in receiving certain components as

suppliers recover their operations and as NFI increases production

of ZEBs (where the supply chain is not as established as in

traditional propulsion systems). Overall, NFI has seen a

significant improvement in its moderate and high-risk suppliers,

with only two high risk suppliers remaining out of the Company’s

top 750 suppliers, driven by a combination of improvements in

global supply chain health and actions taken by NFI’s supply and

sourcing teams.

NFI is advancing its program to increase new

vehicle production line entry rates, which were up 6.5%

year-over-year, but down by 9.0% from 2024 Q2, as the Company

manages certain supply disruptions and lower labour efficiency with

new team members improving their production throughput while NFI

increases overall ZEB production.

Updated Financial Guidance

Based on YTD performance and expectations for

the fourth quarter, NFI has updated its financial guidance for

Fiscal 2024, as originally disclosed on January 17, 2024, to

reflect the following:

- Impacts of seat supply disruption

on North American transit operations and expected impact on 2024 Q4

results

- Expected fourth quarter deliveries

reflecting the Company’s inventory, production schedule and

backlog2

- Aftermarket performance and

expected fourth quarter sales

- Timing of certain zero-emission bus

deliveries in North America and the U.K.

Targets for 2025 have remained the same and are

outlined in the table below.

|

|

Previous 2024 Guidance |

|

Updated 2024 Guidance |

|

2025 Targets |

|

|

Revenue |

$3.2 to $3.6 billion |

|

$3.1 to $3.3 billion |

|

~$4 billion |

|

|

ZEBs (electric) as a percentage of manufacturing sales |

30% to 35% |

|

20% to 25% |

|

~40% |

|

|

Adjusted EBITDA2 |

$240 to $280 million |

|

$210 to $240 million |

|

>$350 million (with a $400 million annualized run rate by the

fourth quarter) |

|

|

Cash Capital Expenditures |

$50 to $60 million |

|

$50 to $60 million |

|

~$55 million |

|

|

Return on Invested Capital2 – provided for 2025 targets |

|

|

|

|

>12% |

|

|

|

|

|

|

|

|

|

With YTD Adjusted EBITDA2 of $146 million, NFI

YTD has delivered 61% to 70% of its revised Adjusted

EBITDA2 range of $210 million to $240 million of 2024. NFI expects

to deliver $64 to $94 million of Adjusted EBITDA2 in the fourth

quarter of 2024. This range reflects the impacts of potential

delays in delivering buses impacted by the North American seating

disruption, the percentage of zero-emission buses delivered in the

quarter and the potential impacts of operational efficiencies.

NFI continues to target 2025 Adjusted EBITDA2 of

greater than $350 million based on anticipated volume growth and

margin improvement, underpinned by firm backlog2 and expected

aftermarket performance. In addition, disrupted North American

transit deliveries from 2024 are all contractually sold, and the

units that are not delivered in 2024 will be shipped in 2025. The

Company is currently completing its annual operating plan for 2025,

factoring in the impacts of seat supply disruption, and the

improving competitive dynamics in North America, among other

factors. NFI will provide an update in the first quarter of 2025.

Please refer to the Company's 2023 Q4 and Fiscal 2023 MD&A for

details on the assumptions that drive 2025 targets, as well as

certain applicable risks.

Given the heightened investment in inventory,

NFI is continuing specific actions to improve its near-term

liquidity position including the following:

- Seeking advanced payments from

customers for vehicles impacted by seat disruption that are

currently in inventory

- Advancing discussions on further

milestone payments, deposits and advanced billings from customers

within Canada, the U.S. and the U.K.

- Utilizing the performance guarantee

facility with EDC to lower letter of credit requirements

- Negotiating improved payment terms

with select suppliers in North America and the U.K.

Subsequent to quarter-end, the Company

proactively obtained a waiver for the $50 million liquidity

requirement under its senior secured facilities, effective until

December 31, 2024, providing access to those funds if required.

NFI anticipates that its current cash position

and capacity under its existing credit facilities, combined with

its expected fourth quarter performance, and anticipated

success in obtaining progress payments or milestone payments from

customers, alongside access to capital markets, will be sufficient

to fund operations, meet financial obligations as they come due,

and provide the funds necessary for capital expenditures.

NFI's guidance and targets are subject to the

risk that the current seat supply disruptions are extended and/or

exacerbated beyond management’s current expectations, and the risk

of additional supply or operational disruptions.

In addition, the guidance and targets do not

reflect potential escalated impact on supply chains or other

factors arising directly or indirectly as a result of geopolitical

risks and ongoing conflicts in Ukraine, Russia, Israel, Palestine,

and the Middle East. Although NFI does not have direct suppliers in

these regions, additional supply delays, possible shortages of

critical components or increases in raw material costs may arise as

the conflicts progress and if certain suppliers’ operations and/or

subcomponent supply from affected countries are disrupted further.

In addition, there may also be further general industry-wide price

increases for components and raw materials used in vehicle

production as well as further increases in the cost of labour and

potential difficulties in sourcing an increase in the supply of

labour. See Appendix B Forward Looking Statements for risks and

other factors and the Company's filings on SEDAR at

www.sedarplus.ca.

Third Quarter 2024 Results Conference

Call and Filing

A conference call for analysts and interested

listeners will be held on Thursday, November 7, 2024, at 9:00 a.m.

Eastern Time (ET). An accompanying results presentation will be

available prior to market open on November 7, 2024, at

www.nfigroup.com.

For attendees who wish to join by webcast,

registration is not required; the event can be accessed

at https://edge.media-server.com/mmc/p/oaotv724/. Attendees who

wish to join by phone can dial 1.888.596.4144 and use the

Conference ID 2577984. NFI encourages attendees to join via webcast

as a results presentation will be presented and users can also

submit questions to management through the platform. The results

presentation will be available at www.nfigroup.com.

A replay of the call will be accessible from about

12:00 p.m. ET on November 7, 2024, until 11:59 p.m. ET on November

6, 2025, at https://edge.media-server.com/mmc/p/oaotv724/. The

replay will also be available on NFI's website at:

www.nfigroup.com.

About NFI Group

Leveraging 450 years of combined experience, NFI

is leading the electrification of mass mobility around the world.

With zero-emission buses and coaches, infrastructure, and

technology, NFI meets today’s urban demands for scalable smart

mobility solutions. Together, NFI is enabling more livable cities

through connected, clean, and sustainable transportation.

With over 9,000 team members in ten countries,

NFI is a leading global bus manufacturer of mass mobility solutions

under the brands New Flyer® (heavy-duty transit

buses), MCI® (motor coaches), Alexander

Dennis Limited (single and double-deck buses),

Plaxton (motor coaches), ARBOC®

(low-floor cutaway and medium-duty buses), and NFI

Parts™. NFI currently offers the widest range of

sustainable drive systems available, including zero-emission

electric (trolley, battery, and fuel cell), natural gas, electric

hybrid, and clean diesel. In total, NFI supports its installed base

of over 100,000 buses and coaches around the world. NFI’s common

shares (“Shares”) trade on the Toronto Stock Exchange (“TSX”) under

the symbol NFI and its convertible unsecured debentures

(“Debentures”) trade on the TSX under the symbol NFI.DB. News and

information is available at www.nfigroup.com, www.newflyer.com,

www.mcicoach.com, nfi.parts, www.alexander-dennis.com, arbocsv.com,

and carfaircomposites.com.

For investor inquiries, please contact: Stephen

King P: 204.224.6382 Stephen.King@nfigroup.com

Appendix A - Reconciliation

Tables

Reconciliation of Net Loss to Adjusted EBITDA and

Net Operating Profit after Taxes

Non-IFRS measures in the appendices of this press

release have been denoted with an "NG". Please see the “Non-IFRS

and Other Financial Measures” section.

Management believes that Adjusted EBITDANG, and

net operating profit after taxesNG ("NOPAT") are important measures

in evaluating the historical operating performance of the Company.

However, Adjusted EBITDANG and NOPATNG are not recognized earnings

measures under International Financial Reporting Standards ("IFRS")

and do not have standardized meanings prescribed by IFRS.

Accordingly, Adjusted EBITDANG and NOPATNG may not be comparable to

similar measures presented by other issuers. Readers of this press

release are cautioned that Adjusted EBITDANG should not be

construed as an alternative to net earnings or loss determined in

accordance with IFRS as an indicator of the Company's performance

and NOPATNG should not be construed as an alternative to earnings

or loss from operations determined in accordance with IFRS as an

indicator of the Company's performance. See "Non-IFRS Measures" for

the definition of Adjusted EBITDANG. The following table reconciles

net loss to Adjusted EBITDANG based on the historical financial

statements of the Company for the periods indicated. The

Company defines NOPATNG as Adjusted EBITDANG less depreciation of

plant and equipment, depreciation of right-of-use assets and income

taxes at a rate of 31%.

|

($ thousands) |

2024 Q3 |

2023 Q3 |

2024 Q3 LTM |

2023 Q3 LTM |

|

Net loss |

(14,993 |

) |

(39,926 |

) |

(24,190 |

) |

(286,396 |

) |

|

Addback |

|

|

|

|

|

Income taxes |

360 |

|

(4,546 |

) |

(15,644 |

) |

(31,662 |

) |

|

Interest expense10 |

38,553 |

|

42,932 |

|

140,420 |

|

139,847 |

|

|

Amortization |

18,708 |

|

21,470 |

|

80,234 |

|

83,682 |

|

|

Loss (gain) on disposition of property, plant and equipment and

right of use assets |

11 |

|

(101 |

) |

(94 |

) |

1,261 |

|

|

Gain (loss) on debt modification15 |

- |

|

(10,508 |

) |

1,600 |

|

(10,508 |

) |

|

Loss on debt extinguishment16 |

- |

|

- |

|

234 |

|

- |

|

|

Unrealized foreign exchange (gain) loss on non-current monetary

items and forward foreign exchange contracts |

1,585 |

|

(1,611 |

) |

(5,271 |

) |

(1,493 |

) |

|

Past service costs and other pension costs7 |

- |

|

- |

|

(7,000 |

) |

4,764 |

|

|

Equity settled stock-based compensation |

925 |

|

677 |

|

2,891 |

|

2,314 |

|

|

Unrecoverable insurance costs and other8 |

- |

|

- |

|

1,009 |

|

164 |

|

|

Expenses incurred outside of normal operations12 |

- |

|

308 |

|

132 |

|

3,742 |

|

|

Prior year sales tax provision9 |

- |

|

60 |

|

41 |

|

60 |

|

|

Out of period costs11 |

- |

|

- |

|

- |

|

(938 |

) |

|

Impairment loss on goodwill13 |

- |

|

- |

|

- |

|

103,900 |

|

|

Impairment loss on intangible assets14 |

- |

|

- |

|

1,028 |

|

- |

|

|

Restructuring costs6 |

8,056 |

|

2,412 |

|

9,616 |

|

14,923 |

|

|

Adjusted EBITDA |

53,205 |

|

11,167 |

|

185,006 |

|

23,660 |

|

|

Depreciation of property, plant and equipment and right of use

assets |

(10,718 |

) |

(13,590 |

) |

(48,124 |

) |

(52,406 |

) |

|

Tax at 31% |

(13,171 |

) |

751 |

|

(42,433 |

) |

8,911 |

|

|

NOPAT |

29,316 |

|

(1,672 |

) |

94,449 |

|

(19,835 |

) |

|

|

|

|

|

|

|

Adjusted EBITDA is comprised of: |

|

|

|

|

|

Manufacturing |

17,329 |

|

(14,162 |

) |

60,077 |

|

(83,688 |

) |

|

Aftermarket |

34,333 |

|

31,678 |

|

136,251 |

|

113,589 |

|

|

Corporate |

1,543 |

|

(6,349 |

) |

(11,322 |

) |

(6,241 |

) |

| |

|

|

|

|

|

|

|

|

Free Cash Flow and Free Cash Flow per Share

Management uses Free Cash FlowNG and Free Cash

Flow per ShareNG as non-IFRS measures to evaluate the Company’s

operating performance and liquidity and to assess the Company’s

ability to pay dividends on its Shares, service debt, and meet

other payment obligations. However, Free Cash FlowNG and Free Cash

Flow per ShareNG are not recognized earnings measures under IFRS

and do not have standardized meanings prescribed by IFRS.

Accordingly, Free Cash FlowNG and the associated per Share figure

may not be comparable to similar measures presented by other

issuers. Readers of this press release are cautioned that Free Cash

FlowNG should not be construed as an alternative to cash flows from

operating activities determined in accordance with IFRS as a

measure of liquidity and cash flow. See "Non-IFRS Measures" for the

definition of Free Cash FlowNG. The following table reconciles net

cash generated by operating activities to Free Cash FlowNG.

The Company defines Free Cash Flow per ShareNG

as Free Cash FlowNG divided by the average number of Shares

outstanding.

|

($ thousands, except per Share figures) |

2024 Q3 |

2023 Q3 |

2024 Q3 LTM |

2023 Q3 LTM |

|

Net cash generated by (used in) operating activities |

(45,240 |

) |

(38,785 |

) |

52,974 |

|

(117,433 |

) |

|

Changes in non-cash working capital items2 |

35,445 |

|

11,105 |

|

28,812 |

|

30,348 |

|

|

Interest paid2 |

45,824 |

|

33,076 |

|

110,034 |

|

105,744 |

|

|

Interest expense2 |

(30,837 |

) |

(36,390 |

) |

(125,904 |

) |

(116,609 |

) |

|

Income taxes recovered2 |

9,788 |

|

(21 |

) |

(8,143 |

) |

(17,853 |

) |

|

Current income tax (expense) recovery2 |

(6,206 |

) |

(3,012 |

) |

(7,488 |

) |

17,624 |

|

|

Repayment of obligations under lease |

(3,867 |

) |

(4,046 |

) |

(23,683 |

) |

(20,054 |

) |

|

Cash capital expenditures |

(7,309 |

) |

(8,516 |

) |

(31,914 |

) |

(21,324 |

) |

|

Acquisition of intangible assets |

(3,097 |

) |

(3,402 |

) |

(13,156 |

) |

(11,182 |

) |

|

Proceeds from disposition of property, plant and equipment |

66 |

|

1,045 |

|

1,442 |

|

1,264 |

|

|

Defined benefit funding3 |

975 |

|

996 |

|

3,393 |

|

1,966 |

|

|

Defined benefit expense3 |

(1,237 |

) |

(693 |

) |

(3,523 |

) |

(1,168 |

) |

|

Past service costs and other pension costs7 |

- |

|

- |

|

(7,000 |

) |

- |

|

|

Expenses incurred outside of normal operations12 |

- |

|

308 |

|

132 |

|

3,742 |

|

|

Equity hedge |

- |

|

2,844 |

|

- |

|

3,183 |

|

|

Unrecoverable insurance costs and other8 |

- |

|

- |

|

1,009 |

|

164 |

|

|

Out of period costs11 |

- |

|

- |

|

- |

|

(938 |

) |

|

Prior year sales tax provision8 |

- |

|

60 |

|

41 |

|

60 |

|

|

Restructuring costs6 |

8,056 |

|

2,411 |

|

12,170 |

|

13,358 |

|

|

Foreign exchange gain (loss) on cash held in foreign currency4 |

(406 |

) |

(137 |

) |

(4,895 |

) |

2,433 |

|

|

Free Cash Flow |

1,955 |

|

(43,157 |

) |

(15,699 |

) |

(126,675 |

) |

|

U.S. exchange rate1 |

1.3516 |

|

1.3580 |

|

1.3480 |

|

1.3333 |

|

|

Free Cash Flow (C$) |

2,642 |

|

(58,607 |

) |

(21,326 |

) |

(170,706 |

) |

|

Free Cash Flow per Share (C$)5 |

0.0222 |

|

(0.6224 |

) |

(0.1792 |

) |

(2.0964 |

) |

|

Declared dividends on Shares (C$) |

- |

|

- |

|

- |

|

- |

|

|

Declared dividends per Share (C$)5 |

- |

|

- |

|

- |

|

- |

|

| |

|

|

|

|

|

|

|

|

|

1. |

U.S. exchange rate (C$ per US$) is the average exchange rate for

the period. |

|

|

|

|

2. |

Changes in non-cash working capital are excluded from the

calculation of Free Cash FlowNG as these temporary fluctuations are

managed through the Company’s secured senior credit facilities

which are available to fund general corporate requirements,

including working capital requirements, subject to borrowing

capacity restrictions. Changes in non-cash working capital are

presented on the unaudited interim condensed consolidated

statements of cash flows net of interest and income taxes

paid. |

|

|

|

|

3. |

The cash effect of the difference between the defined benefit

expense and funding is included in the determination of cash from

operating activities. This cash effect is excluded in the

determination of Free Cash FlowNG as management believes that the

defined benefit expense amount provides a more appropriate measure,

as the defined benefit funding can be impacted by special payments

to reduce the unfunded pension liability. |

|

|

|

|

4. |

Foreign exchange gain (loss) on cash held in foreign currency is

excluded in the determination of cash from operating activities

under IFRS; however, because it is a cash item, management believes

it should be included in the calculation of Free Cash FlowNG. |

|

|

|

|

5. |

Per Share calculations for Free Cash FlowNG (C$) are determined by

dividing Free Cash FlowNG by the total number of all issued and

outstanding Shares using the weighted average over the period. The

weighted average number of Shares outstanding for 2024 Q3 was

119,028,532 and 94,169,027 for 2023 Q3. The weighted average number

of Shares outstanding for 2024 Q3 LTM and 2023 Q3 LTM was

118,989,934 and 81,426,753, respectively. Per Share calculations

for declared dividends (C$) are determined by dividing the amount

of declared dividends by the number of outstanding Shares at the

respective period end date. |

|

|

|

|

6. |

Normalized to exclude non-operating restructuring costs. Costs

primarily relate to severance costs, inefficient labour costs,

increased medical costs and right-of-use asset impairments and

inventory impairments associated with restructuring initiatives.

Free Cash FlowNG reconciling amounts are net of right-of-use asset

and property, plant and equipment impairments. |

|

|

|

|

7. |

Costs and recoveries associated with amendments to, and closures

of, the Company's pension plans. 2022 Q2 includes $7.0 million for

the liability related to the closure of MCI’s Pembina facility and

withdrawal from the multi-employer pension plan. In 2023 Q4, the

Company made the decision to continue operations of the Pembina

facility indefinitely, thereby reversing the above adjustments made

in 2022 Q2. Also included in Adjusted EBITDANG is $4.8 million of

pension past service costs incurred during 2023 Q1. |

|

|

|

|

8. |

Normalized to exclude non-operating costs related to an insurance

event that are not recoverable, or are related to the

deductible. |

|

|

|

|

9. |

Provision for sales taxes as a result of a previous state sales tax

review. |

|

|

|

|

10. |

Includes fair market value adjustments to interest rate swaps, cash

conversion option on the debentures, and to the prepayment option

on the Company’s second lien debt. 2024 Q3 includes a loss of $2.8

million and 2023 Q3 includes a loss of $1.9 million for the

interest rate swaps. 2024 Q3 includes a loss of $5.2 million and

2023 Q2 includes a loss of $1.5 million on the cash conversion

option. The prepayment option had a gain of $5.4 million in 2024 Q3

and a loss of $0.5 million in 2023 Q3. |

|

|

|

|

11. |

Includes adjustments made related to expenses that pertain to prior

years. 2022 Q3 and 2022 Q4 includes expenses related to amounts

that should have been capitalized from prior years. |

|

|

|

|

12. |

Includes adjustments made related to items that occurred outside of

normal operations. This includes specified items purchased in

broker markets at a premium and associated broker fees, which the

Company provided to suppliers, and does not normally directly

purchase. Also included is the additional labour costs associated

with the shortage of the specified item. |

|

|

|

|

13. |

Includes 2022 Q4 impairment charges with respect to ARBOC's

goodwill of $23.2 million and the Alexander Dennis manufacturing

cash generating unit ("CGU")'s goodwill of $80.7 million. |

|

|

|

|

14. |

In 2024 Q1, the Company recognized an impairment loss on a New

Product Development (“NPD”) project for $1.0 million. |

|

|

|

|

15. |

As a result of the Company's comprehensive refinancing, the Company

had recognized an accounting gain in 2023 Q3 stemming from the

modification made to its senior secured credit facilities. In 2023

Q4, an accounting loss was recorded to adjust the gain on debt

modification. |

|

|

|

|

16. |

In 2024 Q2, the Company had recognized an accounting loss on the

debt extinguishment of the amendments made to the Manitoba

Development Corporation senior unsecured debt facility (“MDC Senior

Unsecured Facility”). |

|

|

|

Reconciliation of Net Loss to Adjusted Net

Loss

Adjusted Net Earnings (Loss)NG and Adjusted Net

Earnings (Loss) per ShareNG are not recognized measures under IFRS

and do not have a standardized meaning prescribed by IFRS.

Accordingly, Adjusted Net Earnings (Loss)NG and Adjusted Net

Earnings (Loss) per ShareNG may not be comparable to similar

measures presented by other issuers. Readers of this press release

are cautioned that Adjusted Net Earnings (Loss)NG and Adjusted Net

Earnings (Loss) per ShareNG should not be construed as an

alternative to net earnings (loss), or net earnings (loss) per

Share, determined in accordance with IFRS as indicators of the

Company's performance. See Non-IFRS Measures for the definition of

Adjusted Net Earnings (Loss)NG and Adjusted Net Earnings (Loss) per

ShareNG. The following table reconcile net loss to Adjusted Net

Earnings (Loss)NG based on the historical financial statements of

the Company for the periods indicated.

|

($ thousands, except per Share figures) |

2024 Q3 |

2023 Q2 |

2024 Q3 LTM |

2023 Q3 LTM |

|

Net loss |

(14,993 |

) |

(39,926 |

) |

(24,190 |

) |

(286,396 |

) |

|

|

|

|

|

|

|

Adjustments, net of tax1, 2 |

|

|

|

|

|

Unrealized foreign exchange (gain) loss |

1,094 |

|

(1,111 |

) |

(3,637 |

) |

(1,030 |

) |

|

Unrealized loss on interest rate swap |

1,915 |

|

1,292 |

|

794 |

|

7,299 |

|

|

Unrealized (gain) loss on Cash Conversion Option |

3,598 |

|

1,055 |

|

1,134 |

|

(1,456 |

) |

|

Unrealized gain on prepayment option of second lien debt3 |

(3,734 |

) |

328 |

|

(6,640 |

) |

328 |

|

|

Accretion in carrying value of long-term debt associated with debt

modification4 |

- |

|

1,014 |

|

- |

|

1,014 |

|

|

Gain on debt modification5 |

- |

|

(7,250 |

) |

1,104 |

|

(7,250 |

) |

|

Accretion associated to gain on debt modification |

(345 |

) |

- |

|

(1,458 |

) |

0 |

|

|

Loss on debt extinguishment6 |

- |

|

- |

|

161 |

|

0 |

|

|

Equity swap settlement fee7 |

- |

|

2,428 |

|

- |

|

2,428 |

|

|

Equity settled stock-based compensation |

638 |

|

467 |

|

1,994 |

|

1,597 |

|

|

Loss (gain) on disposition of property, plant and equipment |

8 |

|

(70 |

) |

(65 |

) |

870 |

|

|

Past service costs and other pension costs8 |

- |

|

- |

|

(4,830 |

) |

3,287 |

|

|

Unrecoverable insurance costs and other9 |

- |

|

- |

|

696 |

|

114 |

|

|

Expenses incurred outside of normal operations10 |

- |

|

213 |

|

(1,191 |

) |

2,582 |

|

|

Other tax adjustments11 |

- |

|

201 |

|

- |

|

22,292 |

|

|

Out of period costs12 |

- |

|

- |

|

- |

|

(1,911 |

) |

|

Accretion in carrying value of convertible debt and cash conversion

option |

1,419 |

|

1,318 |

|

5,511 |

|

5,218 |

|

|

Prior year sales provision13 |

- |

|

42 |

|

28 |

|

42 |

|

|

Impairment loss on goodwill14 |

- |

|

- |

|

- |

|

103,900 |

|

|

Impairment loss on intangible assets15 |

- |

|

- |

|

709 |

|

- |

|

|

Restructuring costs16 |

5,559 |

|

1,664 |

|

6,635 |

|

10,296 |

|

|

Adjusted Net Loss |

(4,841 |

) |

(38,335 |

) |

(23,245 |

) |

(136,776 |

) |

|

|

|

|

|

|

|

Earnings (Loss) per Share (basic) |

(0.13 |

) |

(0.42 |

) |

(0.20 |

) |

(3.52 |

) |

|

Earnings (Loss) per Share (fully diluted) |

(0.13 |

) |

(0.42 |

) |

(0.20 |

) |

(3.52 |

) |

|

|

|

|

|

|

|

Adjusted Net Earnings (Loss) per Share (basic) |

(0.04 |

) |

(0.41 |

) |

(0.20 |

) |

(1.68 |

) |

|

Adjusted Net Earnings (Loss) per Share (fully diluted) |

(0.04 |

) |

(0.41 |

) |

(0.20 |

) |

(1.68 |

) |

|

1. |

Addback items are derived from the historical financial statements

of the Company. |

|

|

|

|

2. |

The Company has utilized a rate of 31.0% to tax effect the

adjustments for the periods above. |

|

|

|

|

3. |

The unrealized gain on the prepayment option is related to the

Company's second lien debt instrument. The gain is the result of an

increase in the options fair value between June 30, 2024 and

September 29, 2024. |

|

|

|

|

4. |

Normalized to exclude the over accretion of transaction costs

relating to the Company's senior secured credit facilities. |

|

|

|

|

5. |

As a result of the Company's comprehensive refinancing, the Company

has recognized an accounting gain stemming from the modification

made to its senior secured credit facilities. |

|

|

|

|

6. |

In 2024 Q2, the Company had recognized an accounting loss on the

debt extinguishment of the amendments made to the MDC Senior

Unsecured Facility. |

|

|

|

|

7. |

During the year the Company settled its equity swaps which were

used to hedge the exposure associated with changes in value of its

Shares with respect to outstanding management restricted units and

a portion of the outstanding performance share units, and deferred

share units. |

|

|

|

|

8. |

Costs and recoveries associated with amendments to, and closures

of, the Company's pension plans. 2022 Q2 includes $7.0 million for

the liability related to the anticipated closure of MCI’s Pembina

facility and withdrawal from the multi-employer pension plan. In

2023 Q4, the Company made the decision to continue operations of

the Pembina facility indefinitely, thereby reversing the above

adjustments made in 2022 Q2. Also included is $4.8 million of

pension past service costs incurred during 2023 Q1. |

|

|

|

|

9. |

Normalized to exclude non-operating costs related to an insurance

event that are not recoverable, or are related to the

deductible. |

|

|

|

|

10. |

Includes adjustments made related to items that occurred outside of

normal operations. This includes specified items purchased in

broker markets at a premium and associated broker fees, which the

Company provided to suppliers, and does not normally directly

purchase. Also included is the additional labour costs associated

with the shortage of the specified item. |

|

|

|

|

11. |

Includes the impact of changes in deferred tax balances as a result

of substantively enacted tax rate changes. The 2022 amounts include

the impact of the revaluation of deferred tax balances due to the

enacted increase in the UK corporate tax rate from 19% to 25% in

2021 Q3. Also included in 2022 Q4 is the impact of the reduction of

deferred tax assets related to the derecognition of loss carry

forwards in Canada, and restricted interest in the UK. |

|

|

|

|

12. |

Includes adjustments made related to expenses that pertain to prior

years. 2022 Q3 and 2022 Q4 includes expenses related to amounts

that should have been capitalized from prior years. |

|

|

|

|

13. |

Provision for sales taxes as a result of a previous state sales tax

review. |

|

|

|

|

14. |

Includes 2022 Q4 impairment charges with respect to ARBOC's

goodwill of $23.2 million and the Alexander Dennis manufacturing

CGU's goodwill of $80.7 million. |

|

|

|

|

15. |

In 2024 Q1, the Company recognized an impairment loss on a NPD

project for $1.0 million. |

|

|

|

|

16. |

Normalized to exclude non-operating restructuring costs. Costs

primarily relate to severance costs, inefficient labour costs,

increased medical costs and right-of-use asset impairments and

inventory impairments associated with other restructuring

initiatives. Free Cash FlowNG reconciling amounts are net of

right-of-use asset and property, plant and equipment

impairments. |

|

|

|

Reconciliation of Shareholders' Equity to

Invested Capital

The following table reconciles Shareholders'

Equity to Invested Capital. The average invested capital for the

last twelve months is used in the calculation of ROICNG. ROICNG is

not a recognized measure under IFRS and does not have a

standardized meaning prescribed by IFRS. Accordingly, ROIC may not

be comparable to similar measures presented by other issuers. See

Non-IFRS Measures for the definition of ROICNG.

|

($ thousands) |

2024 Q3 |

2024 Q2 |

2024 Q1 |

2023 Q4 |

|

Shareholders' Equity |

699,717 |

|

704,031 |

|

697,580 |

|

702,913 |

|

|

|

|

|

|

|

|

Addback |

|

|

|

|

|

Long term debt |

610,624 |

|

576,145 |

|

562,324 |

|

536,037 |

|

|

Second lien debt |

173,309 |

|

172,910 |

|

172,568 |

|

172,396 |

|

|

Obligation under lease |

130,020 |

|

131,382 |

|

135,959 |

|

138,003 |

|

|

Convertible Debentures |

230,453 |

|

225,628 |

|

225,972 |

|

228,985 |

|

|

Senior unsecured debt |

56,210 |

|

54,997 |

|

61,081 |

|

61,796 |

|

|

Derivatives |

2,327 |

|

(2,740 |

) |

(1,783 |

) |

8,010 |

|

|

Cash |

(59,720 |

) |

(77,445 |

) |

(68,491 |

) |

(49,615 |

) |

|

Bank indebtedness |

- |

|

- |

|

- |

|

- |

|

|

Invested Capital |

1,842,940 |

|

1,784,908 |

|

1,785,210 |

|

1,798,525 |

|

|

Average of invested capital over the quarter |

1,813,922 |

|

1,785,059 |

|

1,791,868 |

|

1,802,654 |

|

|

|

|

|

|

|

|

|

2023 Q2 |

2023 Q1 |

2022 Q4 |

2022 Q3 |

|

Shareholders' Equity |

706,177 |

|

495,140 |

|

533,756 |

|

577,575 |

|

|

|

|

|

|

|

|

Addback |

|

|

|

|

|

Long term debt |

583,948 |

|

935,605 |

|

911,203 |

|

896,626 |

|

|

Second lien debt |

172,975 |

|

- |

|

- |

|

- |

|

|

Capital leases |

130,102 |

|

124,405 |

|

127,247 |

|

131,625 |

|

|

Convertible Debentures |

221,427 |

|

225,081 |

|

218,719 |

|

217,516 |

|

|

Senior unsecured debt |

60,838 |

|

87,363 |

|

86,431 |

|

- |

|

|

Derivatives |

6,814 |

|

(9,422 |

) |

(17,164 |

) |

(21,620 |

) |

|

Cash |

(75,498 |

) |

(57,488 |

) |

(59,375 |

) |

(49,987 |

) |

|

Bank indebtedness |

- |

|

- |

|

- |

|

- |

|

|

Invested Capital |

1,806,783 |

|

1,800,684 |

|

1,800,817 |

|

1,751,735 |

|

|

Average of invested capital over the quarter |

1,803,734 |

|

1,800,751 |

|

1,776,276 |

|

1,798,614 |

|

|

|

|

|

|

|

|

|

|

|

Appendix B - Non-IFRS Measures and

Forward-Looking Statements

Non-IFRS Measures

References to “Adjusted EBITDA” are to earnings

before interest, income taxes, depreciation and amortization after

adjusting for the effects of certain non-recurring and/or

non-operations related items and expenses incurred outside the

normal course of operations that do not reflect the current ongoing

cash operations of the Company. These adjustments include gains or

losses on disposal of property, plant and equipment, fair value

adjustment for total return swap, unrealized foreign exchange

losses or gains on non-current monetary items and forward foreign

exchange contracts, costs associated with assessing strategic and

corporate initiatives, past service costs and other pension costs

or recovery, non-operating costs or recoveries related to business

acquisition, fair value adjustment to acquired subsidiary company's

inventory and deferred revenue, proportion of the total return swap

realized, equity settled stock-based compensation, expenses

incurred outside the normal course of operations, recovery of

currency transactions, prior year sales tax provision, COVID-19

costs and impairment loss on goodwill and non-operating

restructuring costs.

References to "NOPAT" are to Adjusted EBITDA

less depreciation of plant and equipment, depreciation of

right-of-use assets and income taxes at a rate of 31%.

“Free Cash Flow” means net cash generated by or

used in operating activities adjusted for changes in non-cash

working capital items, interest paid, interest expense, income

taxes paid, current income tax expense, repayment of obligation

under lease, cash capital expenditures, acquisition of intangible

assets, proceeds from disposition of property, plant and equipment,

costs associated with assessing strategic and corporate

initiatives, fair value adjustment to acquired subsidiary company's

inventory and deferred revenue, defined benefit funding, defined

benefit expense, past service costs and other pension costs or

recovery, expenses incurred outside the normal course of

operations, proportion of total return swap, unrecoverable

insurance costs, prior year sales tax provision, non-operating

restructuring costs, extraordinary COVID-19 costs, foreign exchange

gain or loss on cash held in foreign currency.

References to "ROIC" are to NOPAT divided by

average invested capital for the last twelve month period

(calculated as to shareholders’ equity plus long-term debt,

obligations under leases, other long-term liabilities and

derivative financial instrument liabilities less cash).

References to "Adjusted Net Earnings (Loss)" are

to net earnings (loss) after adjusting for the after tax effects of

certain non-recurring and/or non-operational related items that do

not reflect the current ongoing cash operations of the Company

including: fair value adjustments of total return swap, unrealized

foreign exchange loss or gain, unrealized gain or loss on the

interest rate swap, impairment loss on goodwill, portion of the

total return swap realized, costs associated with assessing

strategic and corporate initiatives, fair value adjustment to

acquired subsidiary company's inventory and deferred revenue,

equity settled stock-based compensation, gain or loss on disposal

of property, plant and equipment, past service costs and other

pension costs or recovery, recovery on currency transactions,

expenses incurred outside the normal course of operations prior

year sales tax provision, COVID-19 costs and non-operating

restructuring costs .

References to "Adjusted Net Earnings (Loss) per

Share" are to Adjusted Net Earnings (Loss) divided by the average

number of Shares outstanding.

Management believes Adjusted EBITDA, ROIC, Free

Cash Flow, Adjusted Net Earnings (Loss) and Adjusted Net Earnings

(Loss) per Share are useful measures in evaluating the performance

of the Company. However, Adjusted EBITDA, ROIC, Free Cash Flow,

Adjusted Net Earnings (Loss) and Adjusted Earnings (Loss) per Share

are not recognized earnings or cash flow measures under IFRS and do

not have standardized meanings prescribed by IFRS. Readers of this

press release are cautioned that ROIC, Adjusted Net Earnings (Loss)

and Adjusted EBITDA should not be construed as an alternative to

net earnings or loss or cash flows from operating activities

determined in accordance with IFRS as an indicator of NFI’s

performance, and Free Cash Flow should not be construed as an

alternative to cash flows from operating, investing and financing

activities determined in accordance with IFRS as a measure of

liquidity and cash flows. A reconciliation of net earnings (loss)

to Adjusted EBITDA, based on the Financial Statements, has been

provided under the headings “Reconciliation of Net Loss to Adjusted

EBITDA and Net Operating Profit After Taxes”. A reconciliation of

net earnings (loss) to Adjusted Net Earnings (Loss) is provided

under the heading “Reconciliation of Net Loss to Adjusted Net

Loss”.

NFI's method of calculating Adjusted EBITDA,

ROIC, Free Cash Flow, Adjusted Net Earnings and Adjusted Net

Earnings per Share may differ materially from the methods used by

other issuers and, accordingly, may not be comparable to similarly

titled measures used by other issuers. Dividends paid from Free

Cash Flow are not assured, and the actual amount of dividends

received by holders of Shares will depend on, among other things,

the Company's financial performance, debt covenants and

obligations, working capital requirements and future capital

requirements, all of which are susceptible to a number of risks, as

described in NFI’s public filings available on SEDAR at

www.sedarplus.ca.

"Total Liquidity" is not a recognized measure

under IFRS and does not have a standardized meaning prescribed by

IFRS. The Company defines liquidity as cash on-hand plus available

capacity under its credit facilities without consideration given to

the $50 minimum liquidity requirement under the Company’s senior

credit facilities.

The value of the Company’s "backlog" is not a

recognized measure under IFRS and does not have a standardized

meaning prescribed by IFRS.

References to NFI's geographic regions for the

purpose of reporting global revenues are as follows: "North

America" refers to Canada, United States, and Mexico; United

Kingdom and Europe refer to the United Kingdom and Europe; and

"Asia Pacific" or "APAC" refers to Hong Kong, Malaysia, Singapore,

Australia, and New Zealand.

Forward-Looking Statements

This press release contains “forward-looking

information” and “forward-looking statements” within the meaning of

applicable Canadian securities laws, which reflect the expectations

of management regarding the Company’s future growth, financial

performance, and liquidity and objectives and the Company’s

strategic initiatives, plans, business prospects and opportunities,

including the impact of and recovery from the COVID-19 pandemic,

supply chain disruptions and plans to address them. The words

“believes”, “views”, “anticipates”, “plans”, “expects”, “intends”,

“projects”, “forecasts”, “estimates”, “guidance”, “goals”,

“objectives”, “targets” and similar words or expressions of future

events or conditional verbs such as “may”, “will”, “should”,

“could”, “would” are intended to identify forward-looking

statements. These forward-looking statements reflect management’s

current expectations regarding future events (including the

temporary nature of the supply chain disruptions and operational

challenges, production improvement, labour supply shortages and

labour rates, the recovery of the Company’s markets and the

expected benefits to be obtained through its “NFI Forward”

initiatives) and the Company’s financial and operating performance

and speak only as of the date of this press release. By their very

nature, forward-looking statements require management to make

assumptions and involve significant risks and uncertainties, should

not be read as guarantees of future events, performance or results,

and give rise to the possibility that management’s predictions,

forecasts, projections, expectations or conclusions will not prove

to be accurate, that the assumptions may not be correct and that

the Company’s future growth, financial condition, ability to

generate sufficient cash flow and maintain adequate liquidity, and

the Company’s strategic initiatives, objectives, plans, business

prospects and opportunities, including the Company’s plans and

expectations relating to the impact of and recovery from the

COVID-19 pandemic, supply chain disruptions, operational

challenges, labour supply shortages and inflationary and labour

rate pressures, will not occur or be achieved.

A number of factors that may cause actual

results to differ materially from the results discussed in the

forward-looking statements include: the Company’s business,

operating results, financial condition and liquidity may be

materially adversely impacted by the aftermath and ongoing impacts

of the global COVID-19 pandemic and related supply chain and

operational challenges, inflationary effects, and labour supply

challenges; while the Company is closely managing its liquidity, it

is possible that various events (such as delayed deliveries and

customer acceptances, delayed customer payments, supply chain

issues, product recalls and warranty claims) could significantly

impair the Company’s liquidity and there can be no assurance that

the Company would be able to obtain additional liquidity when

required in such circumstances; the Company’s business, operating

results, financial condition and liquidity may be materially

adversely impacted by ongoing conflicts in Ukraine, Russia, Israel

and Palestine, due to factors including but not limited to further

supply chain disruptions, inflationary pressures and tariffs on

certain raw materials and components that may be necessary for the

Company’s operations; funding may not continue to be available to

the Company’s customers at current levels or at all; the Company’s

business is affected by economic factors and adverse developments

in economic conditions which could have an adverse effect on the

demand for the Company’s products and the results of its

operations; currency fluctuations could adversely affect the

Company’s financial results or competitive position; interest rates

could change substantially, materially impacting the Company’s

revenue and profitability; an active, liquid trading market for the

Shares and/or the Debentures may cease to exist, which may limit

the ability of securityholders to trade Shares and/or Debentures;

the market price for the Shares and/or the Debentures may be

volatile; if securities or industry analysts do not publish

research or reports about the Company and its business, if they

adversely change their recommendations regarding the Shares or if

the Company’s results of operations do not meet their expectations,

the Share price and trading volume could decline, in addition, if

securities or industry analysts publish inaccurate or unfavorable

research about the Company or its business, the Share price and

trading volume of the Shares could decline; competition in the

industry and entrance of new competitors; current requirements

under U.S. “Buy America” regulations may change and/or become more

onerous or suppliers’ “Buy America” content may change; failure of

the Company to comply with the U.S. Disadvantaged Business

Enterprise (“DBE”) program requirements or the failure to have its

DBE goals approved by the U.S. FTA; absence of fixed term customer

contracts, exercise of options and customer suspension or

termination for convenience; local content bidding preferences in

the United States may create a competitive disadvantage;

requirements under Canadian content policies may change and/or

become more onerous; the Company’s business may be materially

impacted by climate change matters, including risks related to the

transition to a lower-carbon economy; operational risk resulting

from inadequate or failed internal processes, people and/or systems

or from external events, including fiduciary breaches, regulatory

compliance failures, legal disputes, business disruption,

pandemics, floods, technology failures, processing errors, business

integration, damage to physical assets, employee safety and

insurance coverage; the Company may not be able to maintain

performance bonds or letters of credit required by its contracts or

obtain performance bonds and letters of credit required for new

contracts; international operations subject the Company to

additional risks and costs and may cause profitability to decline;

compliance with international trade regulations, tariffs and

duties; dependence on unique or limited sources of supply;

dependence on supply of engines that comply with emission

regulations; a disruption, termination or alteration of the supply

of vehicle chassis or other critical components from third-party

suppliers could materially adversely affect the sales of certain of

the Company’s products; the Company’s profitability can be

adversely affected by increases in raw material and component

costs; the Company may incur material losses and costs as a result

of product warranty costs, recalls, failure to comply with motor

vehicle manufacturing regulations and standards and the remediation

of transit buses and motor coaches; production delays may result in

liquidated damages under the Company’s contracts with its

customers; catastrophic events, including those related to impacts

of climate change, may lead to production curtailments or

shutdowns; the Company may not be able to successfully renegotiate

collective bargaining agreements when they expire and may be

adversely affected by labour disruptions and shortages of labour;

the Company’s operations are subject to risks and hazards that may

result in monetary losses and liabilities not covered by insurance

or which exceed its insurance coverage; the Company may be

adversely affected by rising insurance costs; the Company is

subject to litigation in the ordinary course of business and may

incur material losses and costs as a result of product liability

and other claims; the Company may have difficulty selling pre-owned

coaches and realizing expected resale values; the Company may incur

costs in connection with regulations relating to axle weight

restrictions and vehicle lengths; the Company may be subject to

claims and liabilities under environmental, health and safety laws;

dependence on management information systems and cyber security

risks; the Company’s ability to execute its strategy and conduct

operations is dependent upon its ability to attract, train and

retain qualified personnel, including its ability to retain and

attract executives, senior management and key employees; the

Company may be exposed to liabilities under applicable

anti-corruption laws and any determination that it violated these

laws could have a material adverse effect on its business; the

Company’s risk management policies and procedures may not be fully

effective in achieving their intended purposes; internal controls

over financial reporting, no matter how well designed, have

inherent limitations; there are inherent limitations to the

effectiveness of any system of disclosure controls and procedures,

including the possibility of human error and the circumvention or

overriding of the controls and procedures; ability to successfully

execute strategic plans and maintain profitability; development of

competitive or disruptive products, services or technology;

development and testing of new products or model variants;

acquisition risk; reliance on third-party manufacturers;

third-party distribution/dealer agreements; availability to the

Company of future financing; the Company may not be able to

generate the necessary amount of cash to service its existing debt,

which may require the Company to refinance its debt; the Company’s

substantial consolidated indebtedness could negatively impact the

business; the restrictive covenants in the Company’s credit

facilities could impact the Company’s business and affect its

ability to pursue its business strategies; in December 2022, the

Board made the decision to suspend the payment of dividends given

credit agreement constraints and to support the Company’s focus on

improving its liquidity and financial position and the resumption

of dividends is not assured or guaranteed; a significant amount of

the Company’s cash may be distributed, which may restrict potential

growth; the Company is dependent on its subsidiaries for all cash

available for distributions; Coliseum has a significant influence

over the Company and its interests may not align with those of the

Company’s other securityholders; the Company may not be able to

make principal payments on the Debentures; redemption by the

Company of the Debentures for Shares will result in dilution to

holders of Shares; Debentures may be redeemed by the Company prior

to maturity; the Company may not be able to repurchase the

Debentures upon a change of control as required by the trust

indenture under which the Debentures were issued (the “Indenture”);

conversion of the Debentures following certain transactions could

lessen or eliminate the value of the conversion privilege

associated with the Debentures; future sales or the possibility of

future sales of a substantial number of Shares or Debentures may

impact the price of the Shares and/or the Debentures and could

result in dilution; payments to holders of the Debentures are

subordinated in right of payment to existing and future Senior

Indebtedness (as described under the Indenture) and will depend on

the financial health of the Company and its creditworthiness; if

the Company is required to write down goodwill or other intangible

assets, its financial condition and operating results would be

negatively affected; and income and other tax risk resulting from

the complexity of the Company’s businesses and operations and the

income and other tax interpretations, legislation and regulations

pertaining to the Company’s activities being subject to continual

change.

Factors relating to the aftermath and ongoing

effects of the global COVID-19 pandemic include: ongoing economic

and social disruptions; production rates may not increase as

planned and may decrease; ongoing and future supply delays and

shortages of parts and components, and shipping and freight delays,

and disruption to or shortage of labour supply may continue or

worsen; the pandemic has adversely affected operations of suppliers

and customers and those effects may continue or worsen; the

increase in customers' purchase of Company's products may not

continue and may reverse; the supply of parts and components by

suppliers continues to be challenged and may deteriorate; the

recovery of the Company’s markets in the future may not continue

and demand may be lower than expected; the Company’s ability to

obtain access to additional capital if required may be impaired;

and the Company’s financial performance and condition, obligations,

cash flow and liquidity and its ability to maintain compliance with

the covenants under its credit facilities may be impaired. There

can be no assurance that the Company will be able to maintain

sufficient liquidity for an extended period or have access to

additional capital or government financial support; and there can

be no assurance as to if or when production operations will return

to pre-pandemic production rates. There is also no assurance that

governments will provide continued or adequate stimulus funding for

public transit agencies to purchase transit vehicles or that public

or private demand for the Company’s vehicles will return to

pre-pandemic levels on a sustained basis in the anticipated period

of time.

The Company cautions that the COVID-19 pandemic

may return or worsen or other pandemics or similar events may

arise. Such events are inherently unpredictable and may have severe

and far-reaching impacts on the Company's operations, markets, and

prospects.

Factors relating to the Company's “NFI Forward”

initiatives include: the Company's ability to successfully execute

the initiative and to generate the planned savings in the expected

time frame or at all; management may have overestimated the amount

of savings and production efficiencies that can be generated or may

have underestimated the amount of costs to be expended; the

implementation of the initiative may take longer than planned to

achieve the expected savings; further restructuring and

cost-cutting may be required in order to achieve the objectives of

the initiative; the estimated amount of savings generated under the

initiative may not be sufficient to achieve the planned benefits;

combining business units and/or reducing the number of production

or parts facilities may not achieve the efficiencies anticipated;

and the impact of the continuing global COVID-19 pandemic, supply

chain challenges and inflationary pressures. There can be no

assurance that the Company will be able to achieve the anticipated

financial and operational benefits, cost savings or other benefits

of the initiative.

Factors relating to the Company’s financial

guidance and targets disclosed in this press release include, in

addition to the factors set out above, the degree to which actual

future events accord with, or vary from, the expectations of, and

assumptions used by, the Company’s management in preparing the

financial guidance and targets and the Company’s ability to

successfully execute the “NFI Forward” initiatives and to generate

the planned savings in the expected time frame or at all.

Although the Company has attempted to identify

important factors that could cause actual actions, events or

results to differ materially from those described in

forward-looking statements, there may be other factors that could

cause actions, events or results not to be as anticipated,

estimated or intended or to occur or be achieved at all. Specific

reference is made to “Risk Factors” in the Company’s Annual

Information Form for a discussion of the factors that may affect

forward-looking statements and information. Should one or more of

these risks or uncertainties materialize, or should underlying

assumptions prove incorrect, actual results may vary materially

from those described in forward-looking statements and information.

The forward-looking statements and information contained herein are

made as of the date of this press release (or as otherwise

indicated) and, except as required by law, the Company does not

undertake to update any forward-looking statement or information,

whether written or oral, that may be made from time to time by the

Company or on its behalf. The Company provides no assurance that

forward-looking statements and information will prove to be

accurate, as actual results and future events could differ

materially from those anticipated in such statements. Accordingly,

readers and investors should not place undue reliance on

forward-looking statements and information.

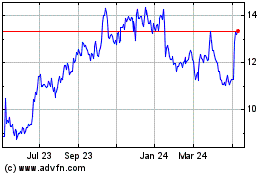

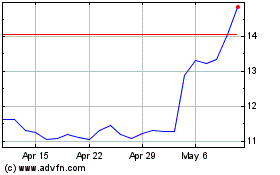

NFI (TSX:NFI)

Historical Stock Chart

From Dec 2024 to Jan 2025

NFI (TSX:NFI)