Canadian Life Companies Split Corp. Announces Details of Capital Reorganization

April 24 2012 - 4:28PM

Marketwired Canada

Canadian Life Companies Split Corp. (the "Company") previously announced that a

special resolution to reorganize the Company had been approved at the special

meeting of the shareholders (the "Shareholders") held on April 16, 2012.

As part of the capital reorganization, the Company will be creating one new

class of shares to be designated as 2012 Preferred Shares, and two series of

warrants (the "2013 Warrants" and the "2014 Warrants") to acquire one 2012

Preferred Share and one Class A Share (together, a "Unit"). It is intended that

the 2012 Preferred Shares, 2013 Warrants and 2014 Warrants will be issued on or

about June 28, 2012, and will commence trading on the TSX at the opening of

trading on such date.

Holders of the existing Preferred Shares will receive the following securities

for each Preferred Share held on or about June 28, 2012 (the "Conversion Date"):

One 2012 Preferred Share - paying fixed cumulative preferential monthly

dividends to yield 6.25% per annum on the $10.00 nominal issue price and having

a repayment objective on the termination date of $10.00;

One 2013 Warrant - each 2013 Warrant can be exercised to purchase one Unit for

an exercise price of the lesser of $13.25 and 103% of the net asset value of the

Company on the Conversion Date (the "2013 Warrant Subscription Price") on any

business day during the period commencing at market open (Eastern time) on the

day following the Conversion Date and ending at 5:00 p.m. (Eastern time) on June

3, 2013; and

One 2014 Warrant - each 2014 Warrant can be exercised to purchase one Unit for

an exercise price of 105% of the 2013 Warrant Subscription Price on any business

day during the period commencing at market open (Eastern time) on the day

following the Conversion Date and ending at 5:00 p.m. (Eastern time) on June 2,

2014.

Class A Shareholders will continue to hold their current Class A Shares and

would participate in any further increases in the net assets over $10.00 per

Unit.

In connection with the reorganization, the Company's investment manager,

Quadravest Capital Management Inc. ("Quadravest"), will be lowering its annual

management fee from 0.85% to 0.75% per annum of the net asset value of the

Company. In addition, the discount to net asset value applicable to monthly

redemptions of Shares will be decreased from 4% to 2% and the amount of this

reduced discount would be paid to Quadravest and not retained by the Company.

These measures are intended to lower ongoing expenses of the Company and improve

trading prices relative to the net asset value for the Company.

Shareholders are being given a special retraction right (the "2012 Special

Retraction Right") as a result of the approval of this capital reorganization,

which is in addition to the regular monthly retraction at the end of April 2012

and the dissent rights which Shareholders had in respect of the special meeting

under the Business Corporations Act (Ontario).

Shareholders who do not wish to remain invested in the Company under its

reorganized share structure will have until the close of business on May 17,

2012 to provide the Company with notice through their CDS participant that they

wish to have their Preferred Shares or Class A Shares redeemed pursuant to the

2012 Special Retraction Right, and to surrender their Shares for retraction. On

such a special retraction, each holder of a Preferred Share will receive the

lesser of (i) $10.00 and (ii) the net asset value per Unit calculated on May 31,

2012; while holder of a Class A Share will receive the net asset value per Unit

calculated on May 31, 2012, less $10.00. Shareholders interested in exercising

such retraction right should contact the CDS Participant through which they hold

the Shares for further information and instructions as to how to exercise this

right. Shareholders should note that the requirements of any particular CDS

Participant may vary, and that Shareholders may need to inform their CDS

Participant of any intention to exercise this retraction right in advance of the

May 17 deadline. Payment for the Class A Shares or Preferred Shares so tendered

for retraction pursuant to the 2012 Special Retraction Right will be made no

later than June 19, 2012.

If more Class A Shares are tendered for retraction under the 2012 Special

Retraction Right than Preferred Shares, the outstanding Preferred Shares will be

consolidated so that following the retraction pursuant to the 2012 Special

Retraction Right there would be an equal number of Preferred Shares and Class A

Shares outstanding. Similarly, if more Preferred Shares are tendered for

retraction than Class A Shares, the outstanding Class A shares will be

consolidated so that again there would be an equal number of Preferred Shares

and Class A Shares outstanding following implementation of the 2012 Special

Retraction Right. The Company may implement this consolidation by adjusting the

number of 2012 Preferred Shares, 2013 Warrants and 2014 Warrants to be issued to

holders of Preferred Shares, in the event a consolidation of Preferred Shares is

required.

Additional information regarding the capital reorganization is contained in the

Management Information Circular dated March 14, 2012 prepared in respect of the

special meeting, available on SEDAR at www.sedar.com or on the Company's website

www.lifesplit.com.

Certain statements included in this news release constitute forward-looking

statements, including, but not limited to, those identified by the expressions

"expect", "intend", "will" and similar expressions to the extent they relate to

the Company. The forward-looking statements are not historical facts but reflect

the Company's current expectations regarding future results or events. These

forward-looking statements are subject to a number of risks and uncertainties

that could cause actual results or events to differ materially from current

expectations. Although the Company believes that the assumptions inherent in the

forward-looking statements are reasonable, forward-looking statements are not

guarantees of future performance and, accordingly, readers are cautioned not to

place undue reliance on such statements due to the inherent uncertainty therein.

The Company undertakes no obligation to update publicly or otherwise revise any

forward-looking statement or information whether as a result of new information,

future events or other such factors which affect this information, except as

required by law.

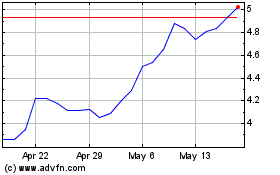

Canadian Life Companies ... (TSX:LFE)

Historical Stock Chart

From Jun 2024 to Jul 2024

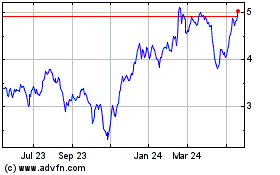

Canadian Life Companies ... (TSX:LFE)

Historical Stock Chart

From Jul 2023 to Jul 2024