Canadian Life Companies Split Corp. Announces Mailing of Notice of Meeting and Management Information Circular

March 21 2012 - 10:16AM

Marketwired

The Board of Directors of Canadian Life Companies Split Corp. (the

"Company") today announced that the Notice of Special Meeting of

Shareholders and Management Information Circular relating to the

previously announced special meeting of the holders of the

Company's Preferred Shares and Class A Shares (the "Shareholders"),

to be held at 10:00 a.m. (Eastern standard time) on April 16, 2012,

has been mailed to the Shareholders. The Company invests in a

portfolio of four publicly traded Canadian life insurance companies

as follows: Great-West Life, Industrial Alliance, Manulife

Financial and Sun Life Financial. Shares held within the portfolio

are expected to range between 10-30% in weight but may vary at any

time.

The purpose of the meeting is to consider and vote upon a

special resolution to reorganize the Company, including a capital

reorganization of the Preferred Shares of the Company and an

extension of the termination date of the Company as described in

the Management Information Circular. Extending the life of the

Company would allow Shareholders to participate in any

strengthening in the Canadian life insurance sector:

-- Preferred Shareholders will receive an increased dividend and the

opportunity to participate in increases in the net asset value as a

result of the issuance of two classes of warrants; and

-- Class A Shareholders could benefit from any market appreciation or

dividend increase over the extended time period;

If the capital reorganization is approved Preferred Shareholders

would receive an increased dividend payment of 6.25% per annum and

the following securities for each Preferred share held on or about

June 28, 2012 (the "Conversion Date"):

One 2012 Preferred Share - paying fixed cumulative preferential

monthly dividends to yield 6.25% per annum on the $10.00 nominal

issue price and having a repayment objective on the termination

date of $10.00;

One 2013 Warrant - each 2013 Warrant can be exercised to

purchase one 2012 Preferred Share and one Class A Share (together a

"Unit") for an exercise price of the lesser of $13.25 and 103% of

the net asset value of the Company on the Conversion Date (the

"2013 Warrant Subscription Price") on any business day during the

period commencing at market open (Eastern time) on the day

following the Conversion Date and ending at 5:00 p.m. (Eastern

time) on June 3, 2013; and

One 2014 Warrant - each 2014 Warrant can be exercised to

purchase one Unit for an exercise price of 105% of the 2013 Warrant

Subscription Price on any business day during the period commencing

at market open (Eastern time) on the day following the Conversion

Date and ending at 5:00 p.m. (Eastern time) on June 2, 2014.

In addition, if the capital reorganization is approved, Class A

Shareholders and Preferred Shareholders will be provided with a

Special Retraction Right as described in the Management Information

Circular which is designed to provide Shareholders with an

opportunity to retract their Shares, if they so wish, and receive a

retraction price that is calculated in the same way that such price

would be calculated if the Company were to terminate on December 1,

2012 as originally contemplated.

The special resolution also allows the Board of Directors to

provide subsequent 6 year extension terms while continuing to

provide all Shareholders with the same retraction right entitlement

at each extension date as they would have had if the term of the

Company were not to be so extended. The ability to extend the

termination date will save the Company all of the associated costs

of holding a special shareholders meeting while still retaining

each Shareholder's right to retract their Shares on the same basis

as if a termination date had occurred. The resolution provides the

Board with the ability to modify the dividend formula for ensuing

extension terms beyond December 1, 2018 if necessary, to reflect

market conditions existing at that time.

For full details, please review the Notice of Special Meeting of

Shareholders and the Management Information Circular which is

available on SEDAR and the Company's website at

www.lifesplit.com.

Certain statements included in this news release constitute

forward-looking statements, including, but not limited to, those

identified by the expressions "expect", "intend", "will" and

similar expressions to the extent they relate to the Company. The

forward-looking statements are not historical facts but reflect the

Company's current expectations regarding future results or events.

These forward-looking statements are subject to a number of risks

and uncertainties that could cause actual results or events to

differ materially from current expectations. Although the Company

believes that the assumptions inherent in the forward-looking

statements are reasonable, forward-looking statements are not

guarantees of future performance and, accordingly, readers are

cautioned not to place undue reliance on such statements due to the

inherent uncertainty therein. The Company undertakes no obligation

to update publicly or otherwise revise any forward-looking

statement or information whether as a result of new information,

future events or other such factors which affect this information,

except as required by law.

Contacts: Canadian Life Companies Split Corp. Investor Relations

416-304-4443 or Toll Free: 1-877-4-Quadra (1-877-478-2372)

www.lifesplit.com

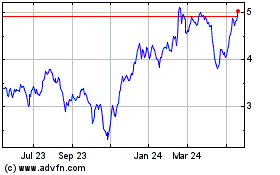

Canadian Life Companies ... (TSX:LFE)

Historical Stock Chart

From Jun 2024 to Jul 2024

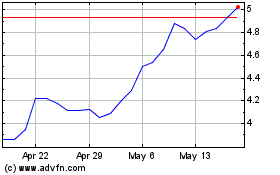

Canadian Life Companies ... (TSX:LFE)

Historical Stock Chart

From Jul 2023 to Jul 2024