Canadian Life Companies Split Corp: Financial Results to May 31, 2008

July 28 2008 - 4:25PM

Marketwired

TORONTO, ONTARIO announces its semi-annual financial results for

the six months ending May 31, 2008.

During the six months, CLC Split achieved its targeted

distribution objectives for both classes of shares. The net asset

value per unit (one Preferred share and one Class A share) was

$23.90 as at May 31, 2008.

CLC Split invests primarily in a core portfolio of four publicly

traded Canadian life insurance companies as follows: Great-West

Life, Industrial Alliance, Manulife Financial and Sun Life

Financial. Shares held within the portfolio are expected to range

between 10-30% in weight but may vary at any time.

Selected Financial Information from the Statement of Financial Operations:

For the six months ending May 31, 2008

($ Millions)

Income 3.262

Expenses (1.585)

--------

Net investment income 1.677

Realized option premiums and gain on sale of investments 1.834

Change in unrealized depreciation of investments (28.252)

--------

Decrease in net assets from operations before distributions (24.741)

Comparative financial information is available in documents filed on

www.sedar.com.

Contacts: Canadian Life Companies Split Corp. Investor Relations

(416) 304-4443 or Toll Free: 1-877-4-Quadra (1-877-478-2372)

Website: www.lifesplit.com

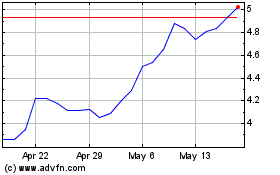

Canadian Life Companies ... (TSX:LFE)

Historical Stock Chart

From Jun 2024 to Jul 2024

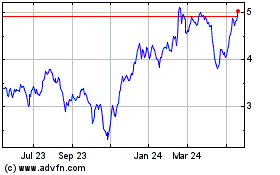

Canadian Life Companies ... (TSX:LFE)

Historical Stock Chart

From Jul 2023 to Jul 2024