Corvus Gold Inc. Signs Definitive Joint Venture Agreement for the Development High Grade Terra Gold Project, Alaska

October 06 2010 - 9:00AM

Marketwired Canada

Corvus Gold Inc. ("Corvus" or the "Company") (TSX:KOR) is pleased to announce

that Raven Gold Alaska Inc., a subsidiary of Corvus ("Raven Gold"), has entered

into a formal Exploration, Development and Mine Operating Agreement with Terra

Gold Corporation ("Terra Gold"), a subsidiary of Terra Mining Corporation

("TMC"), to advance the Terra property in Alaska to production. Terra Gold has

proposed an aggressive program to advance the project toward production. Their

proposed program consists of additional diamond drilling and the collection and

processing of a bulk sample to evaluate the recovery characteristics of the

mineralization.

"We are very excited about finalizing the agreement with Terra Gold

Corporation," said Russell Myers, the President of Corvus. "We believe that

Terra Gold has the technical expertise to successfully take the Terra project to

production and to fully realize the value of this high-grade gold-silver asset,

which has the potential to provide a significant income stream to Corvus in the

near-term."

About the Terra Project

High-grade gold mineralization was discovered in low-sulphidation epithermal

veins at Terra in 1998. The project was advanced by drilling in 2005 by

AngloGold Ashanti (U.S.A.) Exploration Inc. and in 2006 and 2007 by

International Tower Hill Mines Ltd. ("ITH"). The Terra property consists of 236

State of Alaska Mining Claims (approximately 130 km(2)), of which 5 are held

under lease from an individual and the balance are owned 100% by Raven Gold.

Drilling and surface sampling of the Ben Vein has defined high-grade gold

mineralization over a strike distance of over 2 kilometres, with additional

high-grade veins known over a total of 5 kilometres of strike (to view Figure 1,

please click here: http://media3.marketwire.com/docs/KOR1006m.pdf). The Ben Vein

mineralization is continuous down dip to the limits of drilling (approximately

350 metres vertically) without noticeable change in grade (Table 1). A number of

other mineral occurrences have been identified on the property but have not yet

been tested by drilling.

Work by ITH resulted in the completion of a NI 43-101 compliant estimated

Inferred Resource of 428,000 tonnes at a grade of 12.2 g/t gold (168,000

contained gold ounces) and 23.1 g/t silver (318,000 contained silver ounces), at

a cutoff grade of 5.0 g/t gold on the Ben Vein, and the resource remains open

along strike and down dip. The Ben Vein will be the immediate focus of the 2011

development program proposed by Terra Gold.

Table 1

Ben Vein Deposit - Summary of all Drill Holes in the Deposit

(true thickness calculated for each interval, over all Ag-Au ratio is 2-1)

Hole # From (metres) To (metres) True Thickness (metres) Gold (g/t)

TR-05-01 7.47 8.53 0.81 140.75

TR-05-02 12.04 13.87 0.65 4.66

TR-05-03 31.85 33.53 0.54 11.19

TR-05-04 110.34 111.25 0.83 6.61

TR-05-11 105.77 110.95 3.83 10.19

TR-05-12 190.2 193.24 1.40 8.79

TR-06-16 118.17 122.38 3.78 4.40

TR-06-17 128.69 132.89 3.02 22.24

TR-07-18 146.94 149.35 1.38 2.90

TR-07-19 144.53 148.5 3.11 1.75

TR-07-20 125.7 134.72 6.62 4.05

TR-07-21 176.12 177 0.47 3.08

TR-07-22 153.92 157.33 2.05 10.44

TR-07-23 173.4 176.83 2.64 3.69

TR-07-24 198.28 201.47 2.65 3.70

TR-07-25 162.15 163.04 0.66 16.00

TR-07-26 62.01 64.22 2.50 12.00

TR-07-27 99.22 103.34 2.10 17.81

TR-07-28 109.51 113.23 2.10 8.24

TR-07-31 132.9 142.4 5.50 6.26

Joint Venture Agreement

The joint venture agreement, dated effective September 15th, 2010, provides that

Terra Gold will have an initial 51% interest in the Terra Property, subject to

Terra Gold funding an aggregate of USD 6,000,000 in direct exploration and

development expenditures on or before December 31, 2013, with the initial USD

1,000,000 being required prior to December 31, 2011. As part of the funding,

Terra Gold will pay Raven Gold an aggregate of USD 200,000 as payment for the

camp and equipment previously constructed by ITH and acquired by Raven Gold. In

addition, Terra is required to pay to ITH, the former holder of the Terra

property, an aggregate of USD 300,000 (of which USD 50,000 has been paid and an

additional USD 100,000 is due on or before December 31, 2011) in stages to

December 31, 2012, and Terra Gold/TMC are required to deliver to ITH an

aggregate of 750,000 common shares of TMC prior to December 31, 2012, with the

initial 250,000 common shares due on or before September 15, 2011. In addition

Terra Gold has granted Raven a sliding scale "Net Smelter Royalty" (NSR) between

0.5% and 5% on all precious metal production for the Terra property and a 1% NSR

royalty on all base metal production. If Terra Gold fails to fund any portion of

the initial first year commitment and eventual three year commitment, or if the

required payments and shares are not delivered to ITH, Raven Gold will be

entitled to terminate the agreement and retain 100% of the property.

After it has completed its initial USD 6,000,000 contribution, Terra Gold will

have the option to increase its interest in the project by 29% (to 80% total) by

funding an additional USD 3,050,000 of development work. To exercise such

option, Terra Gold/TMC will be required to pay ITH an additional USD 150,000 and

deliver an additional 250,000 common shares of TMC. Following Terra Gold having

completed its initial contribution (if it does not elect to acquire an

additional 29% interest) or having earned an 80% interest (if it does), each

party will be required to contribute its pro rata shares of further

expenditures. Should the interest of Raven be diluted below 10% as a consequence

of it not funding its proportionate share of the joint venture expenditures, the

residual interest of Raven Gold interest will be converted to an additional

property wide 1% NSR royalty on all metals produced.

Qualified Person and Quality Control/Quality Assurance

Jeffrey A. Pontius (CPG 11044), a qualified person as defined by National

Instrument 43-101, has supervised the preparation of the scientific and

technical information that forms the basis for this news release and has

approved the disclosure herein. Mr. Pontius is not independent of Corvus, as he

is the CEO and holds common shares and incentive stock options.

The ITH work programs at Terra were designed and supervised by Russell Myers,

the Vice-President, Exploration of ITH and the President of Corvus. On-site

personnel at the project photographed the core from each individual borehole

prior to preparing the split core. On-site personnel at the project logged and

tracked all samples prior to sealing and shipping. All sample shipments were

sealed and shipped to ALS Chemex in Fairbanks, Alaska, for preparation and then

on to ALS Chemex in Reno, Nevada, or Vancouver, B.C., for assay. ALS Chemex's

quality system complies with the requirements for the International Standards

ISO 9001:2000 and ISO 17025:1999. Analytical accuracy and precision were

monitored by the analysis of reagent blanks, reference material and replicate

samples. Quality control was further assured by the use of international and

in-house standards. Finally, representative blind duplicate samples were

forwarded to ALS Chemex and an ISO compliant third party laboratory for

additional quality control.

About Corvus Gold Inc.

Corvus Gold Inc. is a resource exploration company, focused in Alaska and

Nevada, which controls a number of exploration projects representing a spectrum

from early stage to the advanced gold projects. Corvus is committed to building

shareholder value through new discoveries and leveraging those discoveries via

partner funding into carried or royalty interests that provide its shareholders

significant exposure to produced gold to maximize the value for their

investment.

On behalf of Corvus Gold Inc.

Jeffrey A. Pontius, Chairman and Chief Executive Officer

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements and forward-looking

information (collectively, "forward-looking statements") within the meaning of

applicable Canadian and US securities legislation. All statements, other than

statements of historical fact, included herein including, without limitation,

statements regarding the anticipated content, commencement and cost of

exploration programs, anticipated exploration program results, the discovery and

delineation of mineral deposits/resources/reserves, the potential for the

expansion of the estimated resources at Terra, the potential for any production

at the Terra project, the potential commencement of any development of a mine at

Terra following a production decision, the potential for any income stream to

accrue to Raven Gold or Corvus from the Terra property (either in the near term

or at all), business and financing plans and business trends, are

forward-looking statements. Information concerning mineral resource estimates

also may be deemed to be forward-looking statements in that it reflects a

prediction of the mineralization that would be encountered if a mineral deposit

were developed and mined. Although the Company believes that such statements are

reasonable, it can give no assurance that such expectations will prove to be

correct. Forward-looking statements are typically identified by words such as:

believe, expect, anticipate, intend, estimate, postulate and similar

expressions, or are those, which, by their nature, refer to future events. The

Company cautions investors that any forward-looking statements by the Company

are not guarantees of future results or performance, and that actual results may

differ materially from those in forward looking statements as a result of

various factors, including, but not limited to, variations in the nature,

quality and quantity of any mineral deposits that may be located, variations in

the market price of any mineral products the Company or its joint venture

partners may produce or plan to produce, the Company's or any of its joint

venture partners' inability to obtain any necessary permits, consents or

authorizations required for its activities, the Company's or any of its joint

venture partners' inability to produce minerals from its properties successfully

or profitably, to continue its or their projected growth, to raise the necessary

capital or to be fully able to implement its or their business strategies, and

other risks and uncertainties disclosed in the Information Circular of

International Tower Hill Mines Ltd. dated July 9, 2010 in respect of the ITH

Special Meeting held on August 12, 2010. All of the Company's Canadian public

disclosure filings may be accessed via www.sedar.com and readers are urged to

review these materials, including the technical reports filed with respect to

the Company's mineral properties.

Cautionary Note Regarding References to Resources and Reserves

National Instrument 43 101 - Standards of Disclosure for Mineral Projects ("NI

43-101") is a rule developed by the Canadian Securities Administrators which

establishes standards for all public disclosure an issuer makes of scientific

and technical information concerning mineral projects. Unless otherwise

indicated, all resource estimates contained in or incorporated by reference in

this press release have been prepared in accordance with NI 43-101 and the

guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum

(the "CIM") Standards on Mineral Resource and Mineral Reserves, adopted by the

CIM Council on November 14, 2004 (the "CIM Standards") as they may be amended

from time to time by the CIM.

United States shareholders are cautioned that the requirements and terminology

of NI 43-101 and the CIM Standards differ significantly from the requirements

and terminology of the SEC set forth in the SEC's Industry Guide 7 ("SEC

Industry Guide 7"). Accordingly, the Company's disclosures regarding

mineralization may not be comparable to similar information disclosed by

companies subject to SEC Industry Guide 7. Without limiting the foregoing, while

the terms "mineral resources", "inferred mineral resources", "indicated mineral

resources" and "measured mineral resources" are recognized and required by NI

43-101 and the CIM Standards, they are not recognized by the SEC and are not

permitted to be used in documents filed with the SEC by companies subject to SEC

Industry Guide 7. Mineral resources which are not mineral reserves do not have

demonstrated economic viability, and US investors are cautioned not to assume

that all or any part of a mineral resource will ever be converted into reserves.

Further, inferred resources have a great amount of uncertainty as to their

existence and as to whether they can be mined legally or economically. It cannot

be assumed that all or any part of the inferred resources will ever be upgraded

to a higher resource category. Under Canadian rules, estimates of inferred

mineral resources may not form the basis of a feasibility study or

prefeasibility study, except in rare cases. The SEC normally only permits

issuers to report mineralization that does not constitute SEC Industry Guide 7

compliant "reserves" as in-place tonnage and grade without reference to unit

amounts. The term "contained ounces" is not permitted under the rules of SEC

Industry Guide 7. In addition, the NI 43-101 and CIM Standards definition of a

"reserve" differs from the definition in SEC Industry Guide 7. In SEC Industry

Guide 7, a mineral reserve is defined as a part of a mineral deposit which could

be economically and legally extracted or produced at the time the mineral

reserve determination is made, and a "final" or "bankable" feasibility study is

required to report reserves, the three-year historical price is used in any

reserve or cash flow analysis of designated reserves and the primary

environmental analysis or report must be filed with the appropriate governmental

authority.

This press release is not, and is not to be construed in any way as, an offer to

buy or sell securities in the United States.

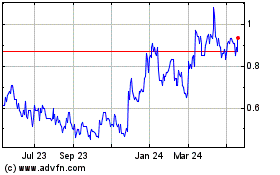

International Tower Hill... (TSX:ITH)

Historical Stock Chart

From Jun 2024 to Jul 2024

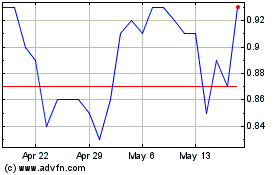

International Tower Hill... (TSX:ITH)

Historical Stock Chart

From Jul 2023 to Jul 2024