InterRent REIT Results for the First Quarter of 2011

June 06 2011 - 5:49PM

Marketwired Canada

NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN

THE UNITED STATES

InterRent Real Estate Investment Trust (TSX:IIP.UN)(TSX:IIP.DB) ("InterRent")

today reported financial results for the first quarter ended March 31, 2011

continuing to demonstrate significant progress in repositioning the REIT and

preparing for future growth.

Highlights from operations

-- Operating revenue for the quarter was $9.4 million, up 9.5% compared to

Q1 2010. The average monthly rent for March 2011 increased to $810 per

suite from $780 (March 2010), an increase of 3.8%.

-- Reduction in economic vacancy to 4.5% for March 2011 from 11.5% for

March 2010.

-- Net Operating Income (NOI) has improved significantly increasing to $4.3

million for Q1 2011 compared to $2.9 million for Q1 2010 - an increase

of 47.4%.

-- As a result of the capital investments of over $20 million in 2010, the

REIT began a process of preparing applications for Above Guideline

Increases (AGIs). As of June 3, 2011, 35 applications have been

submitted to the Landlord and Tenant Board and 8 more are in the final

stages of preparation representing approximately two-thirds of the

portfolio.

-- For the quarter, Funds From Operation (FFO) increased to $0.6 million

(or $0.02 per unit) compared to a negative $0.9 million (or negative

$0.03 per unit) for Q1 2010.

-- Distributable Income (DI) for the quarter of $1.1 million (or $0.03 per

unit) was an improvement of $1.8 million (or $0.05 per unit) over Q1

2010.

-- The fair market revaluation of investment properties under International

Financial Reporting Standards (IFRS) resulted in an increase of the

carrying value of the assets as at January 1, 2010 of $17 million (an

increase of 6.1%). For December 31, 2010, the carrying value increased

from $270 million (as reported under previous GAAP for the fourth

quarter of 2010) to $332 million - an increase of $62 million, or 23%.

-- As part of the continuing strategy of re-aligning the assets of the

portfolio, 5 non-core properties were sold in the quarter (totaling 84

suites) and 1 property was acquired (70 suites) in Sarnia (Western

Region) that is well aligned to the growth strategy of the REIT.

Financial Highlights

Selected Financial Information

In $000's, except per Unit amounts 3 Months Ended 3 Months Ended

and Units outstanding March 31, 2011 March 31, 2010

----------------------------------------------------------------------------

Operating revenue $ 9,421 $ 8,604

Operating NOI 4,335 2,940

NOI % 46.0% 34.2%

NOI per unit $ 0.14 $ 0.11

----------------------------------------------------------------------------

Funds from operations (FFO) $ 593 $ (867)

FFO per unit $ 0.02 $ (0.03)

----------------------------------------------------------------------------

Adjusted funds from operations (AFFO) $ 1,121 $ (661)

AFFO per unit $ 0.03 $ (0.02)

----------------------------------------------------------------------------

Distributable income (DI) $ 1,108 $ (679)

DI per unit $ 0.03 $ (0.02)

----------------------------------------------------------------------------

Weighted average units outstanding (WAU) 32,296,780 28,045,435

----------------------------------------------------------------------------

Results for the Quarter

The first quarter of the year is never an easy one as we encounter the

unpredictable effects of mother nature. Winter weather has not only an impact on

our utility costs, but also on operating revenue (as vacancies are more

difficult to fill than during the summer months) and operating expenses (as

heating and snow removal costs increased in many regions).

The REIT has now experienced five consecutive quarters of gross revenue growth

and three consecutive quarters of net revenue growth. This continued increase in

gross and net revenues is as a result of management executing on its strategic

plan that was put in place in late 2009. Management believes that occupancy is

now, for the most part, stabilized and that the repositioning strategy has

positioned InterRent to achieve market rents at the properties as suites

turnover. Furthermore, management is aggressively pursuing above guideline

increases for 2011 based on the capital expenditures in 2010. To date, 35

applications have been submitted to the Landlord and Tenant Board and 8 more are

in the final stages of preparation. The increases being applied for (without

including the guideline increase) range from 1.8% to 9%.

The economic vacancy increased slightly from December 2010 to March 2011. The

0.8% increase was expected as management removed some tenants after completing a

second round of tenant reviews in an ongoing effort to improve the properties.

Improving the tenant base during the off-peak season makes the most sense given

that many of the suites required maintenance. The suites will be repaired and

ready for peak rental season. Management expects some modest increases in the

vacancy rate for the next quarter as it drives gross rents on suite turnover,

rolls out the AGIs and increases parking and locker charges.

Operating expenses decreased by $0.3 million for the quarter compared to 2010.

The decrease in operating expenses was driven mainly by reductions in staffing

as operations were ramping up in 2010 given the deferred maintenance in the

property and the REIT's repositioning strategy. Management believes that the

staffing levels are adequate to address not only the current requirements but

also the integration of planned strategic acquisitions.

NOI for Q1 of 2011 saw significant improvement over Q1 2010 increasing by $1.4

million, or 49.5%. NOI for the stabilized portfolio was 46.1% for the quarter

and NOI excluding the assets held for sale was 47.5%. "We are pleased to see

continued improvement in our NOI for comparative quarters, especially factoring

in the difficult winter we experienced. We believe the improvements in NOI

quarter over comparative quarter will continue. We will continue to grow our NOI

organically by driving out unnecessary costs and increasing our top line through

AGIs and bringing units to market rent on turnover. Our valued team members are

extremely focused on growing our bottom line and on providing a superior level

of customer service that sets us apart." said Mike McGahan.

FFO were $0.6 million, and increase of $1.5 million from the negative $0.9

million of Q1 2010. FFO per REIT unit was $0.02 for the quarter compared to a

negative $0.03 for Q1 2010.

AFFO, which is calculated by adjusting FFO for standardized maintenance capital

expenditure as well as non-cash items affecting earnings (such as straight-line

rent, accretion of discount in convertible debenture, amortization of deferred

finance fee and unit based compensation expense), was $1.1 million for the

quarter compared to negative $0.7 million for Q1 2010. The increase of $1.8

million improves our AFFO from a negative $0.02 per unit in Q1 2010 to $0.03 per

unit for Q1 2011, which matches our distribution in the quarter.

DI was $1.1 million for Q1 2011 as compared to a negative $0.7 million for Q1

2010. The DI of $1.1 million equates to $0.03 per unit which matches the

distributions paid by the REIT in the quarter.

In keeping with management's strategy of maximizing returns for unitholders and

focusing on clusters of buildings within geographical proximity to each other in

order to build operational efficiencies and attract focused, professional staff,

properties are reviewed on a regular basis to determine if they should be kept

or disposed of. Five properties (totalling 84 suites) were sold in the quarter

and sixteen others (totalling 439 suites) were listed for sale. On March 24,

2011 the Trust acquired an investment property (70 suites) for a purchase price

of $3.67 million, or approximately $52,500 per suite.

About InterRent

InterRent is a real estate investment trust engaged in building unitholder value

through the accretive acquisition, ownership and operation of strategically

located income producing multi-residential real estate in Canada.

(i)Non-GAAP Measures

InterRent prepares and releases unaudited quarterly and audited consolidated

annual financial statements prepared in accordance with IFRS (GAAP). In this and

other earnings releases, as a complement to results provided in accordance with

IFRS, InterRent also discloses and discusses certain non-GAAP financial

measures, including NOI, FFO, AFFO, DI and weighted average units. These

non-GAAP measures are further defined and discussed in the MD&A released on June

6, 2011, which should be read in conjunction with this press release. Since NOI,

FFO, AFFO and weighted average units are not determined by IFRS, they may not be

comparable to similar measures reported by other issuers. InterRent has

presented such non-GAAP measures as Management believes these measures are

relevant measures of the ability of InterRent to earn and distribute cash

returns to Unitholders and to evaluate InterRent's performance. These non-IFRS

measures should not be construed as alternatives to net income (loss) or cash

flow from operating activities determined in accordance with GAAP as an

indicator of InterRent's performance.

Cautionary Statements

The comments and highlights herein should be read in conjunction with the most

recently filed annual information form as well as our consolidated financial

statements and management's discussion and analysis for the same period.

InterRent's publicly filed information is located at www.sedar.com.

This news release contains "forward-looking statements" within the meaning

applicable to Canadian securities legislation. Generally, these forward-looking

statements can be identified by the use of forward-looking terminology such as

"plans", "anticipated", "expects" or "does not expect", "is expected", "budget",

"scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not

anticipate", or "believes", or variations of such words and phrases or state

that certain actions, events or results "may", "could", "would", "might" or

"will be taken", "occur" or "be achieved". InterRent is subject to significant

risks and uncertainties which may cause the actual results, performance or

achievements to be materially different from any future results, performance or

achievements expressed or implied by the forward looking statements contained in

this release. A full description of these risk factors can be found in

InterRent's most recently publicly filed information located at www.sedar.com.

InterRent cannot assure investors that actual results will be consistent with

these forward looking statements and InterRent assumes no obligation to update

or revise the forward looking statements contained in this release to reflect

actual events or new circumstances.

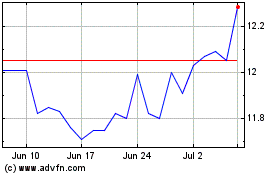

InterRent Real Estate In... (TSX:IIP.UN)

Historical Stock Chart

From Jun 2024 to Jul 2024

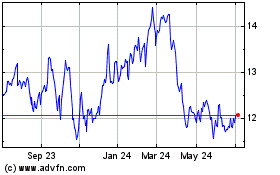

InterRent Real Estate In... (TSX:IIP.UN)

Historical Stock Chart

From Jul 2023 to Jul 2024