HEXO Corp. Announces Proposed Public Offering

August 19 2021 - 4:05PM

HEXO Corp (“HEXO” or the “Company”) (TSX: HEXO; NYSE: HEXO) today

announced that it will be filing a preliminary prospectus

supplement (the "

Preliminary Supplement") to its

amended and restated short form base shelf prospectus

dated May 25, 2021 (the "

Base Shelf

Prospectus") relating to a proposed overnight marketed

public offering (the "

Offering") of units of the

Company (the "

Units").

The Offering is expected to be priced in the

context of the market, with the final terms of the Offering to be

determined at the time of pricing. There can be no assurance as to

whether or when the Offering may be completed, or as to the actual

size or terms of the Offering. The closing of the Offering will be

subject to market and other customary conditions, including

approvals of the Toronto Stock Exchange.

In addition, the Company intends to grant the

underwriters a 30-day option to purchase up to an additional 15% of

the Units offered in the proposed Offering on the same terms and

conditions.

The Company expects to use the net proceeds from

the Offering to satisfy a portion of the cash component of the

purchase price payable to the Redecan shareholders on closing of

the Redecan acquisition and for expenditures in relation to the

Company’s U.S. expansion plans.

A.G.P./Alliance Global Partners and Cantor

Fitzgerald Canada Corporation are acting as joint bookrunners for

the Offering.

The Preliminary Supplement will be filed with

the securities commissions or similar securities regulatory

authorities in each of the provinces and territories

of Canada, and with the U.S. Securities and Exchange

Commission (the "SEC") as part of the Company's

registration statement on Form F-10 (the "Registration

Statement") under the U.S./Canada Multijurisdictional

Disclosure System ("MJDS"). The Preliminary

Supplement, the Base Shelf Prospectus and the Registration

Statement contain important detailed information about the Company

and the proposed Offering. Prospective investors should read the

Preliminary Supplement, the Base Shelf Prospectus and the

Registration Statement and the other documents the Company has

filed before making an investment decision.

Copies of the Preliminary Supplement, following

filing thereof, and the Base Shelf Prospectus will be available on

SEDAR at www.sedar.com and copies of the Preliminary

Supplement and the Registration Statement will be available on

EDGAR at www.sec.gov. Electronic copies of the prospectus

supplement may be obtained, when available, from A.G.P./Alliance

Global Partners, 590 Madison Avenue, 28th Floor, New York, NY

10022, or by telephone at (212) 624-2060, or by email at

prospectus@allianceg.com. Copies of the prospectus supplement may

also be obtained, when available, from Cantor Fitzgerald Canada

Corporation in Canada, by emailing ecmcanada@cantor.com, or Cantor

Fitzgerald & Co. in the U.S., by emailing

prospectus@cantor.com.

No securities regulatory authority has either

approved or disapproved of the contents of this press release. This

press release is for information purposes only and shall not

constitute an offer to sell or the solicitation of an offer to buy,

nor shall there be any sale of these securities in any state or

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such state or jurisdiction.

About HEXO Corp (TSX: HEXO; NYSE:

HEXO)

HEXO is an award-winning licensed producer of

innovative products for the global cannabis market. HEXO serves the

Canadian recreational market with a brand portfolio including HEXO,

UP Cannabis, Original Stash, Bake Sale, Namaste, and REUP brands,

and the medical market in Canada, Israel and Malta. The Company

also serves the Colorado market through its Powered by HEXO®

strategy and Truss CBD USA, a joint venture with Molson Coors. In

the event that the previously announced transactions to acquire

48North and Redecan close, HEXO expects to be the number one

cannabis products company in Canada by recreational market

share.

Forward Looking Statements

This press release contains forward-looking

information and forward-looking statements within the meaning of

applicable securities laws ("forward-looking

statements"), including statements regarding the terms,

timing and potential completion of, and use of proceeds from, the

Offering. Forward-looking statements are based on certain

expectations and assumptions and are subject to known and unknown

risks and uncertainties and other factors that could cause actual

events, results, performance and achievements to differ materially

from those anticipated in these forward-looking statements,

including that the Offering may not be completed on the terms

indicated or at all, the Company may be unsuccessful in satisfying

the conditions to closing of the Offering and the Company's use of

proceeds of the Offering may differ from those indicated. Forward

-looking statements should not be read as guarantees of future

performance or results.

A more complete discussion of the risks and

uncertainties facing the Company appears in the Preliminary

Supplement, the Base Shelf Prospectus and the Registration

Statement and in the Company's Annual Information Form and other

continuous disclosure filings, which are available on SEDAR

at www.sedar.com and EDGAR at www.sec.gov. Readers

are cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date of this press release.

The Company disclaims any intention or obligation, except to the

extent required by law, to update or revise any forward-looking

statements as a result of new information or future events, or for

any other reason.

Investor Relations:

invest@HEXO.com

www.hexocorp.com

Media Relations:

(819) 317-0526

media@hexo.com

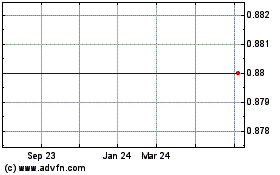

HEXO (TSX:HEXO)

Historical Stock Chart

From Dec 2024 to Jan 2025

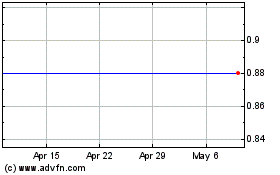

HEXO (TSX:HEXO)

Historical Stock Chart

From Jan 2024 to Jan 2025