Glacier Media Inc. (TSX: GVC) (“Glacier”) and GVIC Communications

Corp. (TSX: GCT) (“GVIC”) today announced that they have entered

into a definitive arrangement agreement (the “Agreement”) under

which Glacier will acquire all of the Class B common voting shares

and Class C non-voting shares of GVIC not currently held by Glacier

and its subsidiary, or by a wholly-owned limited partnership of

GVIC (the “Arrangement”), subject to GVIC shareholder approval and

other customary closing conditions. Glacier currently owns 37.9% of

the Class B common voting shares and 97.7% of the Class C

non-voting shares of GVIC, excluding shares held by the

wholly-owned limited partnership of GVIC.

Under the terms of the Agreement, each Class B

common voting share (“GVIC B Share”) and Class C non-voting share

(“GVIC C Share” and, together with the GVIC B Share, the “GVIC

Shares”) of GVIC will be exchanged for 0.8 of common shares of

Glacier (“Glacier Shares”). The exchange ratio represents a premium

to the price of the GVIC Shares prior to the announcement of the

Arrangement. Upon completion of the Arrangement, the shareholders

of GVIC, excluding Glacier and its subsidiary, will hold

approximately 7,750,000 Glacier Shares, or 5.7% of the Glacier

Shares outstanding after giving effect to the proposed

transaction.

BENEFITS AND CONSIDERATIONS FOR GVIC

SHAREHOLDERS

The transaction offers the following benefits to

GVIC shareholders

- Provides a premium to the GVIC share price, based on both the

market price and valuation price of GVIC Shares and Glacier

Shares;

- Eliminates the current dual public company structure, which is

expected to:

- Provide a simpler structure for public investors which should

allow for easier investor relations efforts to increase investor

demand; and

- Reduce operating costs;

- Increases liquidity for GVIC shareholders;

- Resolves the inter-company loans that are owed by GVIC to

Glacier; and

- Provides holders of Class C non-voting shares the ability to

become holders of voting common shares in Glacier.

BENEFITS AND CONSIDERATIONS FOR GLACIER

SHAREHOLDERS

The transaction offers the following benefits to

Glacier shareholders:

- Eliminates the current dual public company structure, which is

expected to:

- Provide a simpler structure for public investors which should

allow for easier investor relations efforts to increase investor

demand; and

- Reduce operating costs; and

- Increases ownership in the core businesses owned by GVIC.

OTHER INFORMATION

A description of the Agreement will be set forth

in GVIC’s Material Change Report to be filed on SEDAR at

www.sedar.com.

The Arrangement has been approved by the board

of directors of Glacier.

The board of directors of GVIC (“GVIC Board”)

formed a special committee consisting solely of independent

directors (the “GVIC Special Committee”) to, among other things,

review, evaluate and negotiate the Arrangement on behalf of GVIC.

Calcap Valuation Services Limited, acting as financial advisor to

the GVIC Special Committee, has provided a formal valuation of

GVIC, which included a valuation of the Glacier consideration

shares, as well as its opinion to the GVIC Special Committee

(subject to assumptions and qualifications) that the consideration

to be received by GVIC shareholders (other than Glacier, its

wholly-owned subsidiary and the limited partnership owned by GVIC)

pursuant to the Arrangement is fair, from a financial point of

view, to such GVIC Shareholders (the “Valuation and Fairness

Opinion”). The GVIC Special Committee, after considering, among

other things, the Valuation and Fairness Opinion and the advice of

its financial and legal advisors, has unanimously approved the

Arrangement and recommended approval of the Arrangement to the GVIC

Board. After considering, among other things, the recommendation of

the GVIC Special Committee and its receipt of the Valuation and

Fairness Opinion, the GVIC Board has unanimously (with two

directors abstaining who are directors of Glacier) determined that

the Arrangement is in the best interests of GVIC and fair, from a

financial point of view, to the GVIC shareholders (other than

Glacier, its wholly-owned subsidiary and the limited partnership

owned by GVIC). The GVIC Board unanimously (with two directors

abstaining who are directors of Glacier) recommends that such GVIC

shareholders vote in favour of the Arrangement.

Holders (other than Glacier and its subsidiary)

of 1,744,056 GVIC B Shares (41.4% of GVIC B Shares outstanding) and

of 1,976,553 GVIC C Shares (0.7% of GVIC C Shares outstanding) have

entered into support and voting agreements with Glacier and have

agreed to vote their GVIC Shares for the Arrangement. In addition,

pursuant to the Agreement, Glacier has agreed to vote all of the

1,594,609 GVIC B Shares (37.9% of GVIC B Shares outstanding) and

all of the 289,402,651 GVIC C Shares (97.7% of the GVIC C Shares

outstanding, excluding those held by a limited partnership owned by

GVIC), held by it and its subsidiary for the Arrangement.

The Arrangement is subject to the approval (i)

by 66 2/3% of the votes cast by GVIC Class B common voting

shareholders present in person or by proxy at a special

shareholders meeting (the “Meeting”) called to consider the

Arrangement, and (ii) by a majority of the votes cast by GVIC Class

B common voting shareholders, present in person or by proxy at the

Meeting, after excluding the votes cast by Glacier, its affiliates

and certain other related parties, and (iii) by 66 2/3% of the

votes cast by GVIC Class C non-voting shareholders present in

person or by proxy at the Meeting called to consider the

Arrangement.

Closing of the Arrangement is expected to occur

at the end of March 2021, subject to GVIC shareholder approval at

the Meeting scheduled for March 17, 2021, the approval of the

Supreme Court of British Columbia as required, the approval of the

Toronto Stock Exchange to the listing of Glacier Shares and other

customary closing conditions.

None of the securities to be issued pursuant to

the Arrangement have been or will be registered under the United

States Securities Act of 1933, as amended (the “U.S. Securities

Act”), or any state securities laws, and any securities issuable in

the Arrangement are anticipated to be issued in reliance upon

available exemptions from such registration requirements pursuant

to Section 3(a)(10) of the U.S. Securities Act and applicable

exemptions under state securities laws. This press release does not

constitute an offer to sell or the solicitation of an offer to buy

any securities.

A copy of the Agreement will be filed by Glacier

with Canadian securities regulators, and will be available for

viewing at www.sedar.com. GVIC shareholders will receive a copy of

the Management Information Circular with respect to the Meeting.

The Management Information Circular, as well as other filings

containing information about the Arrangement, including the

Agreement, will also be available, without charge, on GVIC’s

website, www.gviccommunicationscorp.ca, and on www.sedar.com.

The Toronto Stock Exchange has neither reviewed

nor accepts responsibility for the adequacy or accuracy of this

news release.

ADVISORS AND COUNSEL

Calcap Valuation Services Limited acted as

financial advisor to the GVIC Special Committee, while Blake,

Cassels & Graydon LLP acted as legal advisor to the GVIC

Special Committee.

FORWARD LOOKING STATEMENTS

This news release contains forward-looking

statements that relate to, among other things, GVIC and Glacier’s

objectives, goals, strategies, intentions, plans, beliefs,

expectations and estimates. These forward-looking statements

include, among other things, statements relating to GVIC and

Glacier’s expectations regarding the anticipated completion of the

Arrangement and timing for such completion, approval of the

Arrangement by GVIC Shareholders, obtaining approvals and

satisfying closing conditions, the listing of Glacier Shares on the

TSX, the applicability of the exemption under Section 3(a)(10) of

the United States Securities Act of 1933, as amended to the

securities issuable in the Arrangement, reduction of costs, the

effect of marketing efforts, any increase in market demand, the

ability to resolve intercompany loans and the terms of and the

completion of the Arrangement. These forward-looking statements are

based on certain assumptions, including the implementation of cost

reductions and marketing efforts, resolution of intercompany loans

and the satisfaction of the conditions precedent to the completion

of the Arrangement, which are subject to risks, uncertainties and

other factors which may cause results, performance or achievements

of GVIC and Glacier to be materially different from any future

results, performance or achievements expressed or implied by such

forward-looking statements, and undue reliance should not be placed

on such statements.

Important factors that could cause actual

results to differ materially from these expectations include

failure to implement or achieve intended results from cost

reduction and marketing efforts, to resolve intercompany loans,

failure to satisfy the conditions precedent to the completion of

the Arrangement, the ability to consummate the Arrangement, the

ability to obtain requisite GVIC Shareholder approvals, the

satisfaction of other conditions to the consummation of the

Arrangement, general economic, business and political conditions,

including changes in the financial markets, changes in applicable

laws, approval by the TSX for the listing of Glacier Shares,

failure to implement or achieve the intended results from cost

reduction and marketing initiatives, the failure to resolve

intercompany loans and the other risk factors listed in each of

GVIC and Glacier’s Annual Information Forms under the heading “Risk

Factors” and in their respective MD&A under the heading

“Business Environment and Risks”, many of which are out of GVIC and

Glacier’s control. These other risk factors include, but are not

limited to, the impact of Coronavirus, that future cash flow from

operations and the availability under existing banking arrangements

are believed to be adequate to support financial liabilities and

that GVIC expects to be successful in its objection with CRA, the

ability of Glacier and GVIC to sell advertising and subscriptions

related to its publications, foreign exchange rate fluctuations,

the seasonal and cyclical nature of the agricultural and energy

sectors, discontinuation of government grants, general market

conditions in both Canada and the United States, changes in the

prices of purchased supplies including newsprint, the effects of

competition in Glacier’s and GVIC’s markets, dependence on key

personnel, integration of newly acquired businesses, technological

changes, tax risk, financing risk, debt service risk and

cybersecurity risk.

The forward-looking statements made in this news

release relate only to events or information as of the date on

which the statements are made. Except as required by law, neither

GVIC nor Glacier undertakes any obligation to update or revise

publicly any forward-looking statements, whether as a result of new

information, future events or otherwise, after the date on which

the statements are made or to reflect the occurrence of

unanticipated events.

ABOUT GLACIER

Glacier Media Inc. is an information &

marketing solutions company pursuing growth in sectors where the

provision of essential information and related services provides

high customer utility and value. Glacier’s products and services

are focused in two areas: 1) data, analytics and intelligence; and

2) content & marketing solutions.

ABOUT GVIC

GVIC Communications Corp. is an information

& marketing solutions company pursuing growth in sectors where

the provision of essential information and related services

provides high customer utility and value. GVIC’s products and

services are focused in two areas: 1) data, analytics and

intelligence; and 2) content & marketing solutions.

FOR FURTHER INFORMATION PLEASE

CONTACT:

Mr. Orest Smysnuik, Chief Financial Officer,

Glacier Media Inc. 604-708-3264. Mr. Jon Kennedy, President &

Chief Executive Officer, GVIC Communications Corp.

604-708-3276.

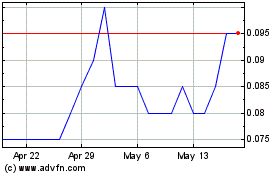

Glacier Media (TSX:GVC)

Historical Stock Chart

From Nov 2024 to Dec 2024

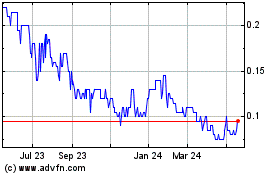

Glacier Media (TSX:GVC)

Historical Stock Chart

From Dec 2023 to Dec 2024