Gran Tierra Energy Inc. (“

Gran Tierra” or the

“

Company”)

(NYSE American:GTE) (TSX:GTE)

(LSE:GTE) today announced the issuance of

US$487,590,000 aggregate principal amount of its 9.500% Senior

Secured Amortizing Notes due 2029 (the “

New

Notes”) as part of its previously announced offers to

exchange (such offers, the “

Exchange Offers”) the

6.250% Senior Notes due 2025 (the

“

2025 Notes”), issued by Gran Tierra Energy

International Holdings Ltd., and the 7.750% Senior Notes due

2027 (the “

2027 Notes”), issued by the

Company.

Gary Guidry, President and Chief Executive

Officer of Gran Tierra, commented:

“We are very pleased with the successful

completion of the Exchange Offers which we believe is highly

beneficial for both Gran Tierra and our stakeholders. The Company’s

balance sheet is now stronger due to an improved amortization

schedule, less restrictive conditions, and overall reduced

leverage. The Exchange Offers, in tandem with our solid operating

cash flow, provide additional financial flexibility and a stronger

platform, as the Company continues to execute its strategy of

delivering profitable production growth, free cash flow generation

and value creation for stakeholders. Our mandate to develop

high-value resource opportunities to deliver top-quartile returns

remains unchanged. We intend to continue to high-grade our

portfolio through our integrated strategy of acquiring, exploring,

developing, producing, and enhancing high-quality oil and gas

assets. We appreciate the support received from our bond investor

base as we believe it demonstrates the underlying confidence in

Gran Tierra’s producing assets as well as our business strategy,

especially in today’s volatile markets.”

Benefits of the Exchange Offers include:

- Maturities

Extension: The issuance of the New Notes results in an

extension of maturity to 2029. The New Notes also reduce Gran

Tierra’s refinancing risk by flattening the debt principal

repayments by amortizing the repayments over a longer period. The

New Notes’ principal repayment schedule also better aligns with the

Company’s projected cash flows.

- Financial

Flexibility: The Exchange Offers unlock capital for

strategic uses and provides additional flexibility on capital

allocation including capital expenditures required for organic

growth, mergers and acquisitions activities, and potential

shareholder returns via share buybacks.

-

Strengthened Balance Sheet and Overall Debt

Reduction: The $60 million of cash deployed as part of the

Exchange Offers reduces Gran Tierra’s overall gross debt.

- Enhanced

Liquidity: Combining both the 2025 Notes and the

2027 Notes into a single series of New Notes with

US$487,590,000 aggregate principal amount enhances trading

liquidity for noteholders.

- Positive

Rating Agency View: Rating agencies are taking a positive

view on the credit due to the new senior secured structure,

pre-payment of 2025 Notes, and the new amortization profile.

- Retaining

Supportive Existing Bondholder Base: The broad investor

base participation in the Exchange Offers is a clear testament to

the market’s confidence in and support of Gran Tierra’s

strategy.

Cautionary Statement Regarding Forward Looking

Statements

This press release contains opinions, forecasts,

projections, and other statements about future events or results

that constitute forward-looking statements within the meaning of

the U.S. Private Securities Litigation Reform Act of 1995, as

amended, Section 27A of the U.S. Securities Act of 1933,

as amended (the “Securities Act”), and Section 21E of the

Securities Exchange Act of 1934, as amended (the “Exchange Act”),

and financial outlook and forward looking information within the

meaning of applicable Canadian securities laws (collectively,

“forward-looking statements”). The use of the words “expect,”

“plan,” “can,” “will,” “should,” “guidance,” “forecast,” “signal,”

“progress,” and “believes,” derivations thereof and similar terms

identify forward-looking statements. In particular, but without

limiting the foregoing, this press release contains forward-looking

statements regarding: the Company’s projected cash flow, financial

flexibility, expected financial condition, expected liquidity, and

relationship with its bondholders. The forward-looking statements

contained in this press release reflect several material factors

and expectations and assumptions of Gran Tierra including, without

limitation, that Gran Tierra will continue to conduct its

operations in a manner consistent with its current expectations,

pricing and cost estimates (including with respect to commodity

pricing and exchange rates), and the general continuance of assumed

operational, regulatory and industry conditions in Colombia and

Ecuador, and the ability of Gran Tierra to execute its business and

operational plans in the manner currently planned.

Among the important factors that could cause

actual results to differ materially from those indicated by the

forward-looking statements in this press release are: our

operations are located in South America and unexpected problems can

arise due to guerilla activity, strikes, local blockades or

protests; technical difficulties and operational difficulties may

arise which impact the production, transport or sale of our

products; other disruptions to local operations; global health

events; global and regional changes in the demand, supply, prices,

differentials or other market conditions affecting oil and gas,

including inflation and changes resulting from a global health

crisis, the Russian invasion of Ukraine, or from the imposition or

lifting of crude oil production quotas or other actions that might

be imposed by OPEC, such as its recent decision to cut production

and other producing countries and resulting company or third-party

actions in response to such changes; changes in commodity prices,

including volatility or a prolonged decline in these prices

relative to historical or future expected levels; the risk that

current global economic and credit conditions may impact oil prices

and oil consumption more than we currently predict. which could

cause further modification of our strategy and capital spending

program; prices and markets for oil and natural gas are

unpredictable and volatile; the effect of hedges; the accuracy of

productive capacity of any particular field; geographic, political

and weather conditions can impact the production, transport or sale

of our products; our ability to execute its business plan and

realize expected benefits from current initiatives; the risk that

unexpected delays and difficulties in developing currently owned

properties may occur; the ability to replace reserves and

production and develop and manage reserves on an economically

viable basis; the accuracy of testing and production results and

seismic data, pricing and cost estimates (including with respect to

commodity pricing and exchange rates); the risk profile of planned

exploration activities; the effects of drilling down-dip; the

effects of waterflood and multi-stage fracture stimulation

operations; the extent and effect of delivery disruptions,

equipment performance and costs; actions by third parties; the

timely receipt of regulatory or other required approvals for our

operating activities; the failure of exploratory drilling to result

in commercial wells; unexpected delays due to the limited

availability of drilling equipment and personnel; volatility or

declines in the trading price of our common stock or bonds; the

risk that we do not receive the anticipated benefits of government

programs, including government tax refunds; our ability to comply

with financial covenants in its credit agreement and indentures and

make borrowings under any credit agreement; and the risk factors

detailed from time to time in Gran Tierra’s periodic reports filed

with the Securities and Exchange Commission, including, without

limitation, under the caption “Risk Factors” in Gran Tierra’s

Annual Report on Form 10-K for the year ended December 31, 2022

filed February 21, 2023 and its other filings with the SEC. These

filings are available on the SEC website at http://www.sec.gov and

on SEDAR at www.sedar.com.

The forward-looking statements contained in this

press release are based on certain assumptions made by Gran Tierra

based on management’s experience and other factors believed to be

appropriate. Gran Tierra believes these assumptions to be

reasonable at this time, but the forward-looking statements are

subject to risk and uncertainties, many of which are beyond Gran

Tierra’s control, which may cause actual results to differ

materially from those implied or expressed by the forward-looking

statements. The unprecedented nature of industry volatility may

make it particularly difficult to identify risks or predict the

degree to which identified risks will impact Gran Tierra’s business

and financial condition. All forward-looking statements are made as

of the date of this press release and the fact that this press

release remains available does not constitute a representation by

Gran Tierra that Gran Tierra believes these forward-looking

statements continue to be true as of any subsequent date. Actual

results may vary materially from the expected results expressed in

forward-looking statements. Gran Tierra disclaims any intention or

obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise,

except as expressly required by applicable law. In addition,

historical, current and forward-looking sustainability-related

statements may be based on standards for measuring progress that

are still developing, internal controls and processes that continue

to evolve, and assumptions that are subject to change in the

future.

The statements related to Gran Tierra’s

financial performance, financial position and cash flow may be

considered to be future-oriented financial information or a

financial outlook for the purposes of applicable Canadian

securities laws. Financial outlook and future oriented financial

information contained in this press release about prospective

financial performance, financial position or cash flows are

provided to give the reader a better understanding of the potential

future performance of the Company in certain areas and are based on

assumptions about future events, including economic conditions and

proposed courses of action, based on management’s assessment of the

relevant information currently available, and to become available

in the future.

Actual results may differ significantly from the

projections presented herein. The actual results of Gran Tierra’s

operations for any period could vary from the amounts set forth in

these projections, and such variations may be material. See above

for a discussion of the risks that could cause actual results to

vary. The future-oriented financial information and financial

outlooks contained in this press release have been approved by

management as of the date of this press release. Readers are

cautioned that any such financial outlook and future-oriented

financial information contained herein should not be used for

purposes other than those for which it is disclosed herein. The

Company and its management believe that the prospective financial

information has been prepared on a reasonable basis, reflecting

management’s best estimates and judgments, and represent, to the

best of management’s knowledge and opinion, the Company’s expected

course of action. However, because this information is highly

subjective, it should not be relied on as necessarily indicative of

future results.

About Gran Tierra Energy Inc.

Gran Tierra Energy Inc. together with its

subsidiaries is an independent international energy company

currently focused on oil and natural gas exploration and production

in Colombia and Ecuador. The Company is currently developing its

existing portfolio of assets in Colombia and Ecuador and will

continue to pursue additional new growth opportunities that would

further strengthen the Company’s portfolio. The Company’s common

stock trades on the NYSE American, the Toronto Stock Exchange and

the London Stock Exchange under the ticker symbol GTE. Additional

information concerning Gran Tierra is available at

www.grantierra.com. Except to the extent expressly stated

otherwise, information on the Company’s website or accessible from

the Company’s website or any other website is not incorporated by

reference into, and should not be considered part of, this press

release. Investor inquiries may be directed to info@grantierra.com

or (403) 265-3221.

Gran Tierra’s filings with (i) the SEC are

available on the SEC website at http://www.sec.gov, (ii) the

Canadian securities regulatory filings are available on SEDAR at

http://www.sedar.com, and (iii) the UK regulatory filings are

available on the National Storage Mechanism (the “NSM”) website at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism.

For investor and media inquiries please contact:

Gary Guidry,President & Chief Executive Officer

Ryan Ellson,Executive Vice President & Chief Financial

Officer

Rodger Trimble,Vice President, Investor Relations

+1-403-265-3221

info@grantierra.com

SOURCE Gran Tierra Energy Inc.

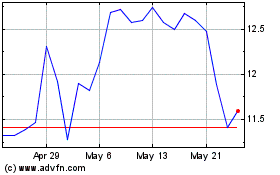

Gran Tierra Energy (TSX:GTE)

Historical Stock Chart

From Nov 2024 to Dec 2024

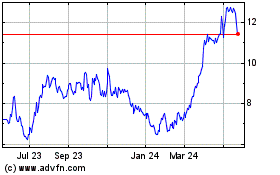

Gran Tierra Energy (TSX:GTE)

Historical Stock Chart

From Dec 2023 to Dec 2024