Gildan Activewear Inc. (TSX: GIL)(NYSE: GIL) today announced its

financial results for its third fiscal quarter ended July 6, 2008.

The Company also reconfirmed its most recent full year EPS guidance

for fiscal 2008, which it had revised on April 29, 2008.

Third Quarter Sales and Earnings

Gildan reported net earnings of U.S. $54.0 million and diluted

EPS of U.S. $0.44 for the third quarter of fiscal 2008. Results for

the third quarter include U.S. $2.3 million or U.S. $0.02 per share

of restructuring charges, related to ongoing carrying costs

pursuant to the closure of Canadian and U.S. manufacturing

facilities, and a planned consolidation of sewing operations in

Haiti. In the third quarter of fiscal 2007, the Company reported

net earnings of U.S. $52.4 million or U.S. $0.43 per share,

including $4.6 million or U.S. $0.04 per share of restructuring

charges related to manufacturing closures. Before reflecting the

impact of restructuring charges in both fiscal years, adjusted net

earnings and adjusted diluted EPS were U.S. $56.3 million and U.S.

$0.46 respectively, compared to adjusted net earnings of U.S. $57.0

million and EPS of U.S. $0.47 in the third quarter of fiscal

2007.

The change in adjusted EPS, before restructuring charges, was

due primarily to higher activewear selling prices and unit sales

volumes, which were more than offset by higher cotton and energy

costs, more unfavourable activewear product-mix, higher selling,

general and administrative and depreciation expenses, the

non-recurrence of a prior year income tax recovery which positively

impacted EPS by U.S. $0.05 in the third quarter of last year, a

provision for a doubtful receivable account, and charges to write

off or dispose of surplus fixed assets.

As reflected in the Company's guidance for the year, the third

quarter of the 2008 fiscal year comprised 14 weeks instead of the

normal 13 weeks for a fiscal quarter. The inclusion of an extra

week is required in every fifth or sixth fiscal year to maintain

the alignment of the Company's financial reporting cycle with the

calendar year. Consistent with the Company's prior practice, the

extra week is included in the third quarter.

The Company's results for its third fiscal quarter were in line

with its most recent EPS guidance. More favourable than projected

activewear selling prices, unit volumes and product-mix were offset

by a provision for a doubtful receivable account, and charges to

write off or dispose of surplus fixed assets.

Sales in the third quarter amounted to U.S. $380.8 million, up

30.6% from U.S. $291.6 million in the third quarter of last year.

The increase in sales revenues was due to an increase of U.S. $43.8

million in sock sales due to the acquisition of V.I. Prewett &

Son in the first quarter of fiscal 2008, an approximate 6% increase

in activewear unit selling prices and a 10.4% increase in unit

sales volumes for activewear and underwear. Growth in activewear

unit sales was significantly constrained by lack of inventory, as a

result of lower than anticipated production from the Company's

Dominican Republic textile manufacturing facility. The Company has

made good progress in improving the performance of the Dominican

Republic facility during the third quarter, although its inventory

levels for activewear continue to be very low.

The growth in activewear unit sales in the third fiscal quarter

was due to the additional week of shipments and continuing market

share penetration in all product categories in the U.S. wholesale

distributor channel. The table below summarizes data from the

S.T.A.R.S. report produced by ACNielsen Market Decisions, which

tracks unit volume shipments from U.S. wholesale distributors to

U.S. screenprinters, for the quarter ended June 30, 2008.

Gildan Gildan Gildan Industry

Market Share Market Share Unit Growth Unit Growth

Q3 2008 Q3 2007 Q3 2008 vs. Q3 2008 vs.

Q3 2007 Q3 2007

51.9% 47.6% All activewear products 5.5% (3.5)%

52.6% 48.3% T-shirts 5.5% (3.2)%

51.7% 42.2% Fleece 23.4% 0.3%

34.6% 34.0% Sport shirts (10.6)% (12.6)%

Although overall industry shipments from distributors to

screenprinters declined by 3.5% during the June quarter, according

to the S.T.A.R.S. report, distributor demand for Gildan products

remained very strong. The Company had a high open order position

throughout the quarter, which has continued into the fourth

quarter. Overall inventories in the channel continue to be in good

balance in relation to expected industry demand.

During the third quarter, the Company began shipment of its

first retail underwear program. The Company is pleased with

consumer demand for its retail products during the third quarter,

and with the improvement in its service levels to mass retailers.

Also, the Company has continued to implement its strategy to

rationalize its sock product-mix, in order to focus on basic

higher-volume products and programs which capitalize on Gildan's

modern large-scale manufacturing capacity.

Gross margins in the third quarter of fiscal 2008 declined

slightly to 31.6%, compared to 32.4% in the third quarter of fiscal

2007. The positive gross margin impact of higher activewear selling

prices and favourable manufacturing efficiencies arising from the

consolidation of textile facilities in the fourth quarter of fiscal

2007 was more than offset by higher cotton, energy, chemicals and

transportation costs, the impact of production inefficiencies in

the Dominican Republic textile facility, as inventories produced in

the second fiscal quarter were consumed in cost of sales, a lower

proportion of high-valued sport shirt sales, and the impact of the

acquisition of Prewett. Socks manufactured by Gildan in the U.S.

have lower gross margins than activewear and sock products

manufactured in the Company's Honduran manufacturing facilities,

and therefore dilute overall gross margins.

Selling, general and administrative expenses were U.S. $43.9

million, or 11.5% of sales, compared to U.S. $28.4 million, or 9.7%

of sales in the third quarter of fiscal 2007. The increase in

selling, general and administrative expenses was due to the

acquisition of Prewett, higher distribution and transportation

expenses, a provision of U.S. $2.6 million for non-collection of

accounts receivable from a U.S. retail customer, which filed for

bankruptcy protection during the third quarter, higher corporate

infrastructure costs, including the impact of the higher-valued

Canadian dollar, a charge for the disposal of surplus fixed assets,

and professional fees for special projects. The increase of U.S.

$5.1 million in depreciation and amortization expenses was

primarily due to the ramp-up of major capacity expansion projects

and the acquisition of Prewett, including the amortization of

acquired intangible assets, as well as a charge to write down

surplus fixed assets.

Year-to-date Sales and Earnings

Sales for the first nine months of fiscal 2008 were U.S. $925.0

million, up 30.4% compared to the same period last year. The

increase in sales was due to a U.S. $115.6 million increase in sock

sales due to the acquisition of Prewett, a 10.7% increase in unit

sales volumes for activewear and underwear, higher activewear

selling prices and a higher valued product-mix for activewear.

For the first nine months of fiscal 2008, net earnings amounted

to U.S. $123.2 million, or U.S. $1.01 per share on a diluted basis,

compared to net earnings of U.S. $89.2 million, or U.S. $0.73 per

share, for the same period in fiscal 2007. Before the impact of

restructuring and other charges, adjusted net earnings in the first

nine months of fiscal 2008 amounted to U.S. $127.1 million, or U.S.

$1.04 per share on a diluted basis, compared to adjusted net

earnings of U.S. $111.5 million, or U.S. $0.92 per share on a

diluted basis, for the same period last year. The increase in

adjusted net earnings and adjusted diluted EPS in fiscal 2008 was

primarily due to growth in unit sales volumes for activewear and

underwear, higher activewear selling prices, more favourable

activewear product-mix and further manufacturing efficiencies for

activewear. These positive factors were partially offset by

increases in cotton, energy, chemicals and transportation costs,

production inefficiencies in the Dominican Republic textile

facility, higher selling, general and administrative and

depreciation and amortization expenses, and the non-recurrence of

the income tax recovery in the third quarter of fiscal 2007. Net

earnings and diluted EPS for the first nine months of fiscal 2008

were also negatively impacted by additional costs to service

mass-market retailers in the second quarter during the integration

of retail information systems, a write-down of inventories of

discontinued sock product-lines in the second quarter, a provision

for non-collection of accounts receivable from a U.S. retail

customer in the third quarter, and charges in the third quarter for

the write-down or disposal of surplus assets.

Cash Flow

Net earnings before depreciation and other non-cash items in the

third quarter amounted to U.S. $73.6 million, which, together with

increased accounts payable, was used to finance seasonal increases

in accounts receivable, and capital expenditures amounting to U.S.

$19.8 million. Free cash flow in the third quarter amounted to U.S.

$21.5 million. Free cash flow for the first nine months of fiscal

2008 amounted to U.S. $92.2 million. At the end of the third

quarter, the Company continued to have significant unused financing

capacity to be able to pursue its organic growth plans and to be in

a position to implement selective acquisition opportunities.

Outlook

The Company continues to be comfortable with its previous

guidance of EPS of U.S. $1.45 - U.S. $1.50 for the full 2008 fiscal

year.

The Company has determined that it is not yet in a position to

provide earnings guidance for fiscal 2009, due to lack of

visibility on certain key external factors impacting the Company's

results. The Company continues to believe that it will generate

significant manufacturing efficiencies in fiscal 2009 from the

improved performance of the Dominican Republic textile facility and

the successful ramp-up of the Rio Nance II and III capacity

expansions in Honduras, as well as from the assumed non-recurrence

of acquisition integration issues which negatively impacted results

in fiscal 2008. The Company also expects to benefit from a more

favourable product-mix, as a result of a higher proportion of

ring-spun products and fleece, and continuing to rationalize its

sock product-mix. However, even with these positive factors,

further increases in selling prices will be required in order to

offset the impact of projected significant increases in cotton and

energy costs, as well as inflation in other cost inputs such as

chemicals, dyestuffs and labour rates. The Company has yet to

purchase a significant portion of its cotton requirements for

fiscal 2009. In this environment, the Company will seek to obtain

selling price increases in both the wholesale and retail channels,

and expects to provide earnings guidance at such time as it has

sufficient visibility on all of the major assumptions impacting its

gross margins and EPS.

The Company currently expects to have production capacity for

activewear and underwear combined of approximately 51 million

dozens in fiscal 2009, based on its projected product-mix,

including a higher than previously projected proportion of fleece

and ring-spun products. A portion of the Company's activewear

capacity in fiscal 2009 is projected to be utilized to rebuild

inventories from current low levels. Capital expenditures for

fiscal 2009 are projected at approximately U.S. $160 million,

primarily for the Rio Nance IV and V capacity expansion

projects.

Disclosure of Outstanding Share Data

As of July 31, 2008, there were 120,525,039 common shares issued

and outstanding along with 884,071 stock options and 906,800

dilutive restricted share units (Treasury RSUs) outstanding. Each

stock option entitles the holder to purchase one common share at

the end of the vesting period at a pre-determined option price.

Each Treasury RSU entitles the holder to receive one common share

at the end of the vesting period, without any monetary

consideration being paid to the Company. However, the vesting of

50% of the restricted share grant is dependent upon the financial

performance of the Company, relative to a benchmark group of

Canadian publicly-listed companies.

Information for shareholders

This release should be read in conjunction with Gildan's 2008

Third Quarter MD&A dated August 12, 2008 (available at

http://gildan.com/corporate/IR/quarterlyReports.cfm) which is

incorporated by reference in this release, filed by Gildan with the

Canadian securities regulatory authorities and with the U.S.

Securities and Exchange Commission.

Gildan Activewear Inc. will hold a conference call to discuss

these results today at 8:30 AM Eastern Time. The conference call

can be accessed by dialing 800-261-3417 (Canada & U.S.) or

617-614-3673 (international) and entering passcode 90911731, or by

live sound webcast on Gildan's Internet site ("Investor Relations"

section) at the following address: www.gildan.com. If you are

unable to participate in the conference call, a replay will be

available starting that same day at 10:30 AM EDT by dialing

888-286-8010 (Canada & U.S.) or 617-801-6888 (international)

and entering passcode 23643734, until Wednesday, August 20, 2008 at

midnight, or by sound web cast on Gildan's Internet site for 30

days.

Profile

Gildan is a vertically-integrated marketer and manufacturer of

quality branded basic apparel. The Company is the leading supplier

of activewear for the wholesale imprinted sportswear market in the

U.S. and Canada, and also a leading supplier to this market in

Europe. The Company sells T-shirts, sport shirts and fleece in

large quantities to wholesale distributors as undecorated "blanks",

which are subsequently decorated by screenprinters with designs and

logos. Consumers ultimately purchase the Company's products, with

the Gildan label, in venues such as sports, entertainment and

corporate events, and travel and tourism destinations. Other

end-uses include work uniforms and similar applications to convey

individual, group and team identity. In addition to continuing its

growth within the wholesale channel, Gildan is implementing a major

growth initiative to sell athletic socks, underwear and activewear

to mass-market retailers in North America.

Forward-Looking Statements

Certain statements included in this press release, in particular

the "Outlook" section, constitute "forward-looking statements"

within the meaning of the U.S. Private Securities Litigation Reform

Act of 1995 and Canadian securities legislation and regulations,

and are subject to important risks, uncertainties and assumptions.

This forward-looking information includes amongst others,

information with respect to our objectives and the strategies to

achieve these objectives, as well as information with respect to

our beliefs, plans, expectations, anticipations, estimates and

intentions. Forward-looking statements generally can be identified

by the use of conditional or forward-looking terminology such as

"may", "will", "expect", "intend", "estimate", "project", "

assume", "anticipate", "plan", "foresee", "believe" or "continue"

or the negatives of these terms or variations of them or similar

terminology. We refer you to the Company's filings with the

Canadian securities regulatory authorities and the U.S. Securities

and Exchange Commission, as well as the "Risks and Uncertainties"

section of the 2007 Annual MD&A, as subsequently updated in our

first, second and third quarter 2008 MD&A, for a discussion of

the various factors that may affect the Company's future results.

Material factors and assumptions that were applied in drawing a

conclusion or making a forecast or projection are also set out

throughout this press release, in particular the "Outlook"

section.

The results or events predicted in such forward-looking

information may differ materially from actual results or events.

Material factors, which could cause actual results or events to

differ materially from a conclusion, forecast or projection in such

forward-looking information, include, but are not limited to:

general economic conditions such as commodity prices, currency

exchange rates, interest rates and other factors over which we have

no control; the impact of economic and business conditions,

industry trends and other external, political and social factors in

the countries in which we operate; the intensity of competitive

activity; changes in environmental, tax, trade, employment and

other laws and regulations; our ability to implement our strategies

and plans; our ability to complete and successfully integrate

acquisitions; our reliance on a small number of significant

customers; changes in consumer preferences, customer demand for our

products and our ability to maintain customer relationships and

grow our business; our customers do not commit to minimum quantity

purchases; the seasonality of our business; our ability to attract

and retain key personnel; high reliance on computerized information

systems; changes in accounting policies and estimates; and

disruption to manufacturing and distribution activities due to

labour disruptions, bad weather, natural disasters and other

unforeseen adverse events.

This may cause the Company's actual performance and financial

results in future periods to differ materially from any estimates

or projections of future performance or results expressed or

implied by such forward-looking statements. Forward-looking

statements do not take into account the effect that transactions or

non-recurring or other special items announced or occurring after

the statements are made have on the Company's business. For

example, they do not include the effect of business dispositions,

acquisitions, other business transactions, asset writedowns or

other charges announced or occurring after forward-looking

statements are made. The financial impact of such transactions and

non-recurring and other special items can be complex and

necessarily depends on the facts particular to each of them.

We believe that the expectations represented by our

forward-looking statements are reasonable, yet there can be no

assurance that such expectations will prove to be correct. The

purpose of the forward-looking statements is to provide the reader

with a description of management's expectations regarding the

Company's fiscal 2008 and 2009 financial performance and may not be

appropriate for other purposes. Furthermore, unless otherwise

stated, the forward-looking statements contained in this press

release are made as of the date of this press release, and we do

not undertake any obligation to update publicly or to revise any of

the included forward-looking statements, whether as a result of new

information, future events or otherwise unless required by

applicable legislation or regulation. The forward-looking

statements contained in this press release are expressly qualified

by this cautionary statement.

Non-GAAP Financial Measures

This release includes reference to certain non-GAAP financial

measures such as adjusted net earnings, adjusted diluted earnings

per share and free cash flow. These non-GAAP measures do not have

any standardized meanings prescribed by Canadian GAAP and are

therefore unlikely to be comparable to similar measures presented

by other companies. Accordingly, they should not be considered in

isolation. The terms and definitions of the non-GAAP measures used

in this press release and a reconciliation of each non-GAAP measure

to the most directly comparable GAAP measure are provided

below.

Adjusted net earnings and adjusted diluted earnings per share

are calculated as net earnings and earnings per share excluding

restructuring and other charges, as discussed in Note 7 to the

unaudited interim consolidated financial statements. The Company

uses and presents these non-GAAP measures to assess its operating

performance from one period to the next without the variation

caused by restructuring and other charges that could potentially

distort the analysis of trends in our business performance.

Excluding these items does not imply they are necessarily

non-recurring.

(in US$ millions, except per share amounts)

---------------------------------------------------------------------------

Q3 2008 Q3 2007 YTD 2008 YTD 2007

---------------------------------------------------------------------------

Net earnings 54.0 52.4 123.2 89.2

Restructuring and other charges 2.3 4.6 3.9 22.3

Less: income tax effect thereon - - - -

---------------------------------------------------------------------------

Adjusted net earnings 56.3 57.0 127.1 111.5

---------------------------------------------------------------------------

---------------------------------------------------------------------------

Diluted EPS 0.44 0.43 1.01 0.73

Restructuring and other charges,

net of tax 0.02 0.04 0.03 0.18

---------------------------------------------------------------------------

Adjusted diluted EPS 0.46 0.47 1.04 0.92

---------------------------------------------------------------------------

Certain minor rounding variances exist between the financial statements and

this summary. EPS may not add due to rounding.

Free cash flow is defined as cash from operating activities

including net changes in non-cash working capital balances, less

cash flow used in investing activities excluding business

acquisitions. We consider free cash flow to be an important

indicator of the financial strength and performance of our

business, because it shows how much cash is available after capital

expenditures to repay debt and to reinvest in our business. We

believe this measure is commonly used by investors and analysts

when valuing a business and its underlying assets.

(in US$ millions)

Q3 2008 Q3 2007 YTD 2008 YTD 2007

--------------------------------------------------------------------------

Cash flows from operating activities 40.7 32.3 168.4 72.1

Cash flows from investing activities (19.2) (29.2) (213.0) (103.7)

Add back:

Acquisition of Prewett - - 126.8 -

Restricted cash related to acquisition - - 10.0 -

--------------------------------------------------------------------------

Free cash flow 21.5 3.1 92.2 (31.6)

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Certain minor rounding variances exist between the financial statements

and this summary.

Gildan Activewear Inc.

Interim Consolidated Balance Sheets

(in thousands of U.S. dollars)

July 6, 2008 September 30, July 1, 2007

2007

-----------------------------------------------------------------------

(unaudited) (audited) (unaudited)

Assets

Current assets:

Cash and cash equivalents $13,195 $9,250 $7,537

Accounts receivable 254,511 206,088 183,557

Inventories 290,845 239,963 231,538

Prepaid expenses and

deposits 11,255 7,959 9,573

Future income taxes 3,765 2,610 4,601

-----------------------------------------------------------------------

573,571 465,870 436,806

Property, plant and equipment 426,781 377,617 368,477

Goodwill and identifiable

intangible assets 63,910 2,024 9,030

Assets held for sale (note 7) 12,603 6,610 2,434

Other assets 18,227 11,426 8,266

Future income taxes 10,489 10,939 -

-----------------------------------------------------------------------

Total assets $1,105,581 $874,486 $825,013

-----------------------------------------------------------------------

-----------------------------------------------------------------------

Liabilities and Shareholders'

Equity

Current liabilities:

Bank indebtedness $- $- $3,500

Accounts payable and accrued

liabilities 149,486 116,683 120,229

Income taxes payable 9,238 2,949 2,054

Current portion of long-term

debt 3,762 3,689 3,934

-----------------------------------------------------------------------

162,486 123,321 129,717

Long-term debt 104,677 55,971 38,979

Future income taxes 41,265 24,612 28,221

Non-controlling interest in

consolidated joint venture 7,289 6,932 6,279

Contingencies (note 13)

Shareholders' equity:

Share capital 89,147 88,061 87,686

Contributed surplus 5,910 3,953 3,361

Retained earnings 668,559 545,388 504,522

Accumulated other

comprehensive income 26,248 26,248 26,248

-----------------------------------------------------------------------

694,807 571,636 530,770

-----------------------------------------------------------------------

789,864 663,650 621,817

Total liabilities and

shareholders' equity $1,105,581 $874,486 $825,013

-----------------------------------------------------------------------

-----------------------------------------------------------------------

See accompanying notes to interim consolidated financial statements.

Gildan Activewear Inc.

Interim Consolidated Statements of Earnings and Comprehensive Income

(In thousands of U.S. dollars, except per share data)

Three months ended Nine months ended

July 6, 2008 July 1, 2007 July 6, 2008 July 1, 2007

--------------------------------------------------------------------------

(unaudited) (unaudited) (unaudited) (unaudited)

Sales $380,774 $291,610 $924,994 $709,573

Cost of sales 260,418 197,221 626,051 482,558

--------------------------------------------------------------------------

Gross profit 120,356 94,389 298,943 227,015

Selling, general and

administrative

expenses 43,893 28,430 113,096 83,080

Restructuring and other

charges (note 7) 2,289 4,589 3,929 22,339

--------------------------------------------------------------------------

Earnings before the

undernoted items 74,174 61,370 181,918 121,596

Depreciation and

amortization (note 9a) 15,326 10,272 43,249 28,521

Interest, net (note 10b) 1,204 1,453 6,065 3,501

Non-controlling interest

of consolidated joint

venture 185 503 357 625

--------------------------------------------------------------------------

Earnings before income

taxes 57,459 49,142 132,247 88,949

Income tax expense

(recovery) (note 12) 3,448 (3,255) 9,076 (205)

--------------------------------------------------------------------------

Net earnings and

comprehensive income $54,011 $52,397 $123,171 $89,154

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Basic EPS (note 8) $0.45 $0.44 $1.02 $0.74

Diluted EPS (note 8) $0.44 $0.43 $1.01 $0.73

See accompanying notes to interim consolidated financial statements.

Gildan Activewear Inc.

Interim Consolidated Statements of Cash Flows

(In thousands of U.S. dollars)

Three months ended Nine months ended

July 6, 2008 July 1, 2007 July 6, 2008 July 1, 2007

--------------------------------------------------------------------------

(unaudited) (unaudited) (unaudited) (unaudited)

Cash flows from

operating activities:

Net earnings $54,011 $52,397 $123,171 $89,154

Adjustments for:

Restructuring charges

related to assets

held for sale

and property, plant

and equipment

(note 7) 1,662 708 1,334 4,616

Depreciation and

amortization

(note 9a) 15,326 10,272 43,249 28,521

Loss (gain) on

disposal of assets

held for sale and

property, plant and

equipment 861 (60) 987 (20)

Stock-based

compensation costs 599 371 2,083 1,149

Future income taxes 1,718 (4,689) 203 (3,210)

Non-controlling

interest 185 503 357 625

Unrealized foreign

exchange (gain) loss (762) 3,029 253 1,441

--------------------------------------------------------------------------

73,600 62,531 171,637 122,276

Changes in non-cash

working capital

balances:

Accounts receivable (68,707) (45,712) (18,837) (16,266)

Inventories 9,212 11,051 (7,459) (30,885)

Prepaid expenses and

deposits (2,266) (2,499) (1,926) (3,816)

Accounts payable and

accrued liabilities 27,741 5,354 18,822 1,119

Income taxes payable 1,081 1,607 6,156 (338)

--------------------------------------------------------------------------

40,661 32,332 168,393 72,090

Cash flows (used in)

from financing

activities:

(Decrease) increase in

amounts drawn under

revolving long-term

credit facility (37,000) (13,000) 51,000 30,000

Decrease in bank

indebtedness - - (1,261) -

Net decrease in other

long-term debt (896) (18,266) (2,221) (20,948)

Proceeds from the

issuance of shares 351 180 960 949

--------------------------------------------------------------------------

(37,545) (31,086) 48,478 10,001

Cash flows used in

investing activities:

Purchase of property,

plant and equipment (19,773) (32,864) (79,791) (108,315)

Acquisition of V.I.

Prewett & Son, Inc.

(note 4) - - (126,819) -

Restricted cash related

to acquistion (note 4) - - (10,000) -

Proceeds on disposal of

assets held for sale 10 4,429 1,124 6,424

Net decrease (increase)

in other assets 565 (778) 2,532 (1,786)

--------------------------------------------------------------------------

(19,198) (29,213) (212,954) (103,677)

Effect of exchange

rate changes on cash and

cash equivalents

denominated in foreign

currencies (34) 23 28 116

--------------------------------------------------------------------------

Net (decrease) increase

in cash and cash

equivalents during the

period (16,116) (27,944) 3,945 (21,470)

Cash and cash equivalents,

beginning of period 29,311 35,481 9,250 29,007

--------------------------------------------------------------------------

Cash and cash equivalents,

end of period $13,195 $7,537 $13,195 $7,537

--------------------------------------------------------------------------

--------------------------------------------------------------------------

See accompanying notes to interim consolidated financial statements.

Supplemental disclosure of cash flow information (note 9)

Gildan Activewear Inc.

Interim Consolidated Statement of Shareholders' Equity and Comprehensive

Income

Nine months ended July 6, 2008 and July 1, 2007

(in thousands and thousands of U.S. dollars)

Share Capital Contributed

--------------------- surplus

Number Amount

--------------------------------------------------------------------------

Balance, September 30, 2007 120,419 $88,061 $3,953

Stock-based compensation related

to stock options and Treasury

restricted share units - - 2,083

Shares issued under employee

share purchase plan 16 543 -

Shares issued pursuant to

exercise of stock options 81 417 -

Shares issued pursuant to the

settlement of Treasury

restricted share units 8 126 (126)

Net earnings - - -

--------------------------------------------------------------------------

Balance, July 6, 2008 (unaudited) 120,524 $89,147 $5,910

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Share Capital Contributed

--------------------- surplus

Number Amount

--------------------------------------------------------------------------

Balance, October 1, 2006 120,228 $86,584 $2,365

Stock-based compensation related

to stock options and Treasury

restricted share units - - 1,149

Shares issued under employee

share purchase plan 13 378 -

Shares issued pursuant to

exercise of stock options 117 571 -

Shares issued pursuant to the

settlement of Treasury

restricted share units 18 153 (153)

Net earnings - - -

--------------------------------------------------------------------------

Balance, July 1, 2007 (unaudited) 120,376 $87,686 $3,361

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Accumulated

other Total

comprehensive Retained shareholders'

income earnings equity

--------------------------------------------------------------------------

Balance, September 30, 2007 $26,248 $545,388 $663,650

Stock-based compensation related

to stock options and Treasury

restricted share units - - 2,083

Shares issued under employee

share purchase plan - - 543

Shares issued pursuant to

exercise of stock options - - 417

Shares issued pursuant to the

settlement of Treasury

restricted share units - - -

Net earnings - 123,171 123,171

--------------------------------------------------------------------------

Balance, July 6, 2008 (unaudited) $26,248 $668,559 $789,864

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Accumulated

other Total

comprehensive Retained shareholders'

income earnings equity

--------------------------------------------------------------------------

Balance, October 1, 2006 $26,248 $415,368 $530,565

Stock-based compensation related

to stock options and Treasury

restricted share units - - 1,149

Shares issued under employee

share purchase plan - - 378

Shares issued pursuant to

exercise of stock options - - 571

Shares issued pursuant to the

settlement of Treasury

restricted share units - - -

Net earnings - 89,154 89,154

--------------------------------------------------------------------------

Balance, July 1, 2007 (unaudited) $26,248 $504,522 $621,817

--------------------------------------------------------------------------

--------------------------------------------------------------------------

NOTES TO INTERIM CONSOLIDATED FINANCIAL STATEMENTS

(For the period ended July 6, 2008)

(Tabular amounts in thousands or thousands of U.S. dollars, except per

share data or unless otherwise noted)

(unaudited)

1. Basis of presentation:

The accompanying unaudited interim consolidated financial

statements have been prepared in accordance with Canadian generally

accepted accounting principles for interim financial information

and include all normal and recurring entries that are necessary for

a fair presentation of the financial statements. Accordingly, they

do not include all of the information and footnotes required by

Canadian generally accepted accounting principles for annual

financial statements, and should be read in conjunction with the

Company's most recently prepared annual consolidated financial

statements for the year ended September 30, 2007.

The Company's revenues and income are subject to seasonal

variations. Consequently, the results of operations for the third

fiscal quarter are traditionally not indicative of the results to

be expected for the full fiscal year.

Certain comparative figures have been reclassified in order to

conform with the current period's presentation.

All amounts in the attached notes are unaudited unless

specifically identified.

2. Significant accounting policies:

Except for the adoption of the new accounting standards

described in Note 3, the Company applied the same accounting

policies in the preparation of the interim consolidated financial

statements, as disclosed in Note 1(a) and Note 2 of its audited

consolidated financial statements in the Company's annual report

for the year ended September 30, 2007.

3. Adoption of new accounting standards:

Effective the commencement of its 2008 fiscal year, the Company

has adopted the Canadian Institute of Chartered Accountants

("CICA") Handbook Section 1535, Capital Disclosures, CICA Handbook

Section 3862, Financial Instruments - Disclosure, and CICA Handbook

Section 3863, Financial Instruments - Presentation. These new

Handbook Sections apply to fiscal years beginning on or after

October 1, 2007. These Sections relate to disclosure and

presentation only and did not have an impact on our financial

results. See Notes 10 and 11.

4. Business acquisition:

On October 15, 2007, the Company acquired 100% of the capital

stock of V.I.Prewett & Son, Inc. ("Prewett"), a U.S. supplier

of basic family socks primarily to U.S. mass-market retailers.

Prewett's corporate headquarters are located in Fort Payne,

Alabama. The acquisition is intended to enhance further the

Company's position as a full-product supplier of socks, activewear

and underwear for the retail channel.

The aggregate purchase price of $126.8 million (including

transaction costs of $1.5 million) paid in cash on closing is

subject to adjustments based on working capital balances as at the

date of acquisition, which have not yet been finalized. In

addition, the purchase agreement provides for an additional

purchase consideration of $10 million contingent on specified

future events. This amount was paid into escrow by the Company and

is included in "Other assets" on the consolidated balance sheet.

Any further purchase price consideration paid by the Company will

be accounted for as additional goodwill.

The Company accounted for this acquisition using the purchase

method and the results of Prewett have been consolidated with those

of the Company from the date of acquisition.

The Company has allocated the purchase price on a preliminary

basis to the assets acquired and the liabilities assumed based on

management's best estimate of their fair values and taking into

account all relevant information available at that time. Since the

Company is still in the process of finalizing the independent

valuation of certain intangible assets and other assets acquired

and liabilities assumed at the date of acquisition, the allocation

of the purchase price is subject to change. The Company expects to

finalize the purchase price by the end of fiscal 2008.

The following table summarizes the estimated fair value of

assets acquired and liabilities assumed at the date of

acquisition:

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Assets acquired:

Accounts receivable $28,805

Inventories 43,423

Prepaid expenses 1,370

Property, plant and equipement 20,202

Goodwill and identifiable intangible assets 64,376

Other assets 176

Liabilities assumed:

Bank indebtedness $(1,261)

Accounts payable and accrued liabilities (14,178)

Future income taxes (16,094)

--------------------------------------------------------------------------

Net assets acquired $126,819

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Consideration:

Cash $125,294

Transaction costs 1,525

--------------------------------------------------------------------------

Purchase price $126,819

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Goodwill recorded in connection with this acquisition is not

deductible for tax purposes. Identifiable intangible assets

consists primarily of customer contracts and customer relationships

and are currently being amortized on a straight-line basis over a

period of 15 years based on preliminary estimates of the useful

life of these assets.

Goodwill represents the excess of the purchase price over the

fair value of net assets acquired. Goodwill is not amortized and is

tested for impairment annually, or more frequently if events or

changes in circumstances indicate that the asset might be impaired.

When the carrying amount of a reporting unit exceeds the estimated

fair value of the reporting unit, an impairment loss is recognized

in an amount equal to the excess of the carrying value over the

fair value of the goodwill, if any.

5. Stock-based compensation:

The Company's Long Term Incentive Plan (the "LTIP") includes

stock options and restricted share units. The LTIP allows the Board

of Directors to grant stock options, dilutive restricted share

units ("Treasury RSUs") and non-dilutive restricted share units

("Non-Treasury RSUs") to officers and other key employees of the

Company and its subsidiaries.

Changes in outstanding stock options were as follows:

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Weighted average

Number exercise price

--------------------------------------------------------------------------

(in Canadian dollars)

Options outstanding, September 30, 2007 853 10.08

Granted 127 39.37

Exercised (81) 5.32

Forfeited (13) 32.41

--------------------------------------------------------------------------

Options outstanding, July 6, 2008 886 14.42

--------------------------------------------------------------------------

--------------------------------------------------------------------------

As at July 6, 2008, 625,200 of the outstanding options were

exercisable at the weighted average price of CA$6.67. Based on the

Black-Scholes option pricing model, the grant date weighted average

fair value of the options granted during the nine months ended July

6, 2008 was CA$12.98.

Changes in outstanding Treasury RSUs were as follows:

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Weighted average

Number fair value per

unit

--------------------------------------------------------------------------

(in Canadian dollars)

Treasury RSUs outstanding, September 30, 2007 941 18.83

Granted 43 36.47

Settled through the issuance of common shares (8) 17.89

Forfeited (69) 27.85

--------------------------------------------------------------------------

Treasury RSUs outstanding, July 6, 2008 907 18.99

--------------------------------------------------------------------------

--------------------------------------------------------------------------

As at July 6, 2008, none of the awarded and outstanding Treasury

RSUs were vested.

The compensation expense recorded for the three-month periods

ended July 6, 2008 and July 1, 2007, respectively, was $0.6 million

and $0.4 million, in respect of the Treasury RSUs and stock

options. The compensation expense recorded for the nine-month

periods ended July 6, 2008 and July 1, 2007, respectively, was $2.1

million and $1.2 million, in respect of the Treasury RSUs and stock

options. The counterpart has been recorded as contributed surplus.

When the common shares are issued to the employees, the amounts

previously credited to contributed surplus are reclassified to

share capital.

Changes in outstanding non-Treasury RSUs were as follows:

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Number

--------------------------------------------------------------------------

Non-Treasury RSUs outstanding, September 30, 2007 56

Granted 50

Forfeited (4)

--------------------------------------------------------------------------

Non-Treasury RSUs outstanding, July 6, 2008 102

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Non-Treasury RSUs have the same features as Treasury RSUs except

that their vesting period is a maximum of three years and they will

be settled in cash at the end of the vesting period. The settlement

amount is based on the Company's stock price at the vesting date.

As of July 6, 2008, the weighted average fair value per

non-Treasury RSU was CA$24.36. No common shares are issued from

treasury under such awards and they are therefore non-dilutive. As

of July 6, 2008, none of the awarded and outstanding non-Treasury

RSUs were vested.

The compensation (recovery) expense recorded for the three-month

periods ended July 6, 2008 and July 1, 2007, respectively, was

$(0.1) million and $0.1 million, in respect of the non-Treasury

RSUs. The compensation expense recorded for the nine-month periods

ended July 6, 2008 and July 1, 2007, respectively, was $0.4 million

and $0.4 million, in respect of the non-Treasury RSUs. The

counterpart has been recorded in accounts payable and accrued

liabilities.

6. Guarantees:

The Company, and certain of its subsidiaries, have granted

corporate guarantees, irrevocable standby letters of credit and

surety bonds to third parties to indemnify them in the event the

Company and certain of its subsidiaries do not perform their

contractual obligations. As at July 6, 2008, the maximum potential

liability under these guarantees was $17.4 million, of which $5.2

million was for surety bonds and $12.2 million was for corporate

guarantees and standby letters of credit. The standby letters of

credit mature at various dates during 2008, the surety bonds are

automatically renewed on an annual basis and the corporate

guarantees mature at various dates up to fiscal 2010.

As at July 6, 2008, the Company has recorded no liability with

respect to these guarantees, as the Company does not expect to make

any payments for the aforementioned items. Management has

determined that the fair value of the non-contingent obligations

requiring performance under the guarantees in the event that

specified triggering events or conditions occur approximates the

cost of obtaining the standby letters of credit and surety

bonds.

7. Restructuring and other charges, and assets held for

sale:

The following table summarizes the components of restructuring

and other charges:

Three months ended Nine months ended

July 6, July 1, July 6, July 1,

2008 2007 2008 2007

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Accelerated depreciation $- $766 $- $2,892

Gain on disposal of long-lived

assets (38) (58) (366) (1,836)

Asset impairment loss 1,700 - 1,700 3,560

Severance 400 1,234 400 13,296

Other 227 2,647 2,195 4,427

--------------------------------------------------------------------------

$2,289 $4,589 $3,929 $22,339

--------------------------------------------------------------------------

In fiscal 2006 and 2007, the Company announced the closure,

relocation and consolidation of manufacturing and distribution

facilities in Canada, the United States and Mexico, as well as the

relocation of its corporate office. The costs incurred in

connection with these announcements have been recorded as

restructuring and other charges, and included severance and other

costs, asset impairment losses and accelerated depreciation

resulting from the reduction in the estimated remaining economic

lives of property, plant and equipment at these facilities. Other

costs relate primarily to exit costs incurred in connection with

the closures noted above, including carrying and dismantling costs

associated with assets held for sale. During the third quarter of

fiscal 2008, the Company recorded an impairment loss on property,

plant and equipment of $1.7 million resulting from a planned

consolidation of its sewing operations in Haiti.

Assets held for sale of $12.6 million as at July 6, 2008

(September 30, 2007 - $6.6 million; July 1, 2007 - $2.4 million)

primarily related to closed facilities at these various locations

and are recorded at the lower of their carrying value or fair value

less costs to sell. Additional carrying costs related to these

closed facilities and any gains or losses on the disposition of the

assets held for sale will be accounted for as restructuring charges

as incurred.

8. Earnings per share:

A reconciliation between basic and diluted earnings per share is

as follows:

Three months ended Nine months ended

July 6, July 1, July 6, July 1,

2008 2007 2008 2007

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Basic earnings per share:

Basic weighted average number

of common shares outstanding 120,492 120,359 120,462 120,319

--------------------------------------------------------------------------

Basic earnings per share $0.45 $0.44 $1.02 $0.74

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Diluted earnings per share:

Basic weighted average number

or common shares outstanding 120,492 120,359 120,462 120,319

Plus impact of stock options

and Treasury RSUs 1,130 1,240 1,181 1,206

--------------------------------------------------------------------------

Diluted weighted average number

of common shares outstanding 121,622 121,599 121,643 121,525

--------------------------------------------------------------------------

Diluted earnings per share $0.44 $0.43 $1.01 $0.73

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Excluded from the above calculation for the three months ended

July 6, 2008 are 123,565 stock options, which were deemed to be

anti-dilutive because the exercise prices were greater than the

average market price of the common shares for the period. Excluded

from the above calculation for the nine months ended July 6, 2008

are 81,968 stock options, which were deemed to be anti-dilutive

because the exercise prices were greater than the average market

price of the common shares for the period. All stock options

outstanding for the three months ended December 30, 2007 and for

fiscal 2007 were dilutive.

9. Other information:

(a) The following items were Three months ended Nine months ended

included in depreciation July 6, July 1, July 6, July 1,

and amortization: 2008 2007 2008 2007

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Depreciation of property,

plant and equipment $13,155 $9,612 $38,673 $26,791

Impairment loss and writedown

of property, plant and equipment 700 - 700 -

Amortization expense of deferred

start-up costs and other 454 499 1,385 1,247

Amortization expense of

intangible assets 1,017 161 2,491 483

--------------------------------------------------------------------------

$15,326 $10,272 $43,249 $28,521

--------------------------------------------------------------------------

--------------------------------------------------------------------------

(b) Cash paid during the period

for:

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Interest $1,459 $1,842 $6,515 $4,065

Income taxes 461 482 2,799 3,798

--------------------------------------------------------------------------

--------------------------------------------------------------------------

July 6, 2008 September 30, July 1, 2007

2007

(c) Non-cash transactions as at: (audited)

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Additions to property, plant

and equipment included in

accounts payable and accrued

liabilities $500 $2,566 $2,652

Ascribed value credited to

share capital from issuance

of Treasury RSUs 126 226 153

Reversal of valuation allowance

on acquired future income

tax assets credited to intangible

assets - 7,340 -

Proceeds on disposal of long-

lived assets in other assets 1,477 1,855 1,943

Proceeds on disposal of long-

lived assets in accounts

receivable 1,380 1,050 -

--------------------------------------------------------------------------

--------------------------------------------------------------------------

(d) Cash and cash equivalents

consist of:

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Cash balances with banks $10,237 $9,250 $7,537

Short-term investments 2,958 - -

--------------------------------------------------------------------------

$13,195 $9,250 $7,537

--------------------------------------------------------------------------

--------------------------------------------------------------------------

10. Financial instruments:

In the first quarter of fiscal 2008, the Company adopted the

requirements of the CICA Handbook Section 3862, "Financial

Instruments Disclosures", which apply to fiscal years beginning on

or after October 1, 2007. This new Handbook Section requires

disclosures to enable users to evaluate the significance of

financial instruments for the entity's financial position and

performance, and the nature and extent of an entity's exposure to

risks arising from financial instruments, including how the entity

manages those risks.

Disclosures relating to exposure to risks, in particular credit

risk, liquidity risk, foreign currency risk and interest rate risk,

are included in the section entitled "Financial Risk Management" of

the Management's Discussion and Analysis of the Company's

operations, performance and financial condition as at and for the

three months and nine months ended July 6, 2008, which is included

in the Gildan Q3 2008 Quarterly Report to Shareholders along with

these interim consolidated financial statements. Accordingly, these

disclosures are incorporated into these interim consolidated

financial statements by cross-reference.

(a) Financial instruments - carrying values and fair values:

The fair values of financial assets and liabilities, together

with the carrying amounts included in the consolidated balance

sheets, are as follows:

July 6, 2008 September 30, 2007

Carrying Fair Carrying Fair

amount value amount value

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Financial assets

Available-for-sale financial

assets:

Cash and cash equivalents $13,195 $13,195 $9,250 $9,250

Loans and receivables:

Accounts receivable - trade 236,912 236,912 189,070 189,070

Accounts receivable - other 17,599 17,599 17,018 17,018

Long-term receivable included

in other assets 1,477 1,477 1,855 1,855

Restricted cash related to

Prewett acquisition included

in other assets 10,000 10,000 - -

Forward foreign exchange

contracts 123 123 293 293

Financial liabilities

Other financial liabilities:

Accounts payable and accrued

liabilities 147,428 147,428 115,596 115,596

Long-term debt - bearing

interest at variable rates:

Revolving long-term credit

facility 100,000 100,000 49,000 49,000

Other long-term debt 6,727 6,727 8,803 8,803

Long-term debt - bearing

interest at fixed rates 1,712 1,712 1,857 1,857

Forward foreign exchange

contracts 2,058 2,058 1,087 1,087

--------------------------------------------------------------------------

--------------------------------------------------------------------------

The Company has determined that the fair value of its short-term

financial assets and liabilities approximates their respective

carrying amounts as at the balance sheet dates because of the

short-term maturity of those instruments. The fair values of the

long-term receivable and the restricted cash related to the

acquisition of Prewett, and the Company's interest-bearing

financial liabilities also approximate their respective carrying

amounts. The fair value of forward foreign exchange contracts was

determined using quoted market values.

(b) Financial income and expense:

The following components of income and expense relating to

financial instruments are included in the consolidated statement of

earnings:

(i) Interest income and expense:

Three months ended Nine months ended

July 6, July 1, July 6, July 1,

2008 2007 2008 2007

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Interest expense on long-term

indebtedness $1,294 $1,393 $6,357 $3,578

Interest expense on short-term

indebtedness 4 79 38 219

Interest income on available-

for-sale financial assets (106) (85) (349) (400)

Interest income on loans and

receivables (20) - (60) -

Other interest 32 66 79 104

--------------------------------------------------------------------------

Interest expense - net $1,204 $1,453 $6,065 $3,501

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Interest income on available-for-sale financial assets consists

of interest earned from cash and cash equivalents invested in

short-term deposits. Interest income on loans and receivables

relates to interest earned on the Company's long-term receivable

included in other assets.

(ii) Foreign exchange gain (loss):

Three months ended Nine months ended

July 6, July 1, July 6, July 1,

2008 2007 2008 2007

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Gain (loss) relating to financial

assets and liabilities,

excluding forward foreign

exchange contracts $120 $(759) $1,321 $344

Gain (loss) relating to forward

exchange contracts, including

amounts realized on contract

maturity and changes in fair

value of open positions 185 2,333 (2,189) 2,659

--------------------------------------------------------------------------

Foreign exchange gain (loss)

relating to financial instruments 305 1,574 (868) 3,003

Other foreign exchange gain (loss) 26 (2,282) 222 (1,319)

--------------------------------------------------------------------------

Foreign exchange gain (loss) $331 $(708) $(646) $1,684

--------------------------------------------------------------------------

--------------------------------------------------------------------------

(iii) Impairment losses recognized on trade receivables:

The Company recorded bad debt expense (recovery) of $2.5 million

(2007 - $(0.2) million) for the three month period ended July 6,

2008 and $2.6 million (2007 - $0.1 million) for the nine month

period ended July 6, 2008. Bad debt expense is included in

"Selling, general and administrative expenses" in the interim

consolidated statements of earnings and comprehensive income.

(c) Forward foreign exchange contracts:

The following table summarizes the Company's derivative

financial instruments relating to commitments to buy and sell

foreign currencies through forward foreign exchange contracts as at

July 6, 2008 and September 30, 2007:

Notional foreign Average

July 6, 2008 Maturity currency amount exchange rate

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Buy CAD/Sell USD 0-6 months 35,500 0.9923

Sell EUR/Buy USD 0-6 months 8,485 1.3963

6-12 months 2,650 1.4743

Sell GBP/Buy USD 0-6 months 5,172 1.9952

--------------------------------------------------------------------------

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Notional foreign Average

September 30, 2007 Maturity currency amount exchange rate

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Buy EUR/Sell USD 0-6 months 4,425 1.3616

Sell EUR/Buy USD 0-6 months 4,899 1.3626

6-12 months 9,081 1.3677

Sell GBP/Buy USD 0-6 months 4,781 1.9988

6-12 months 6,019 1.9841

Sell CAD/Buy USD 0-6 months 3,800 1.0055

--------------------------------------------------------------------------

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Notional USD Carrying & fair value

July 6, 2008 equivalent Asset Liability

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Buy CAD/Sell USD $35,225 $- $(457)

Sell EUR/Buy USD 11,848 - (1,404)

3,907 - (197)

Sell GBP/Buy USD 10,319 123 -

--------------------------------------------------------------------------

$61,299 $123 $(2,058)

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Notional USD Carrying & fair value

September 30, 2007 equivalent Asset Liability

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Buy EUR/Sell USD $6,025 $293 $-

Sell EUR/Buy USD 6,675 - (278)

12,421 - (467)

Sell GBP/Buy USD 9,558 - (146)

11,942 - (196)

Sell CAD/Buy USD 3,821 - -

--------------------------------------------------------------------------

$50,442 $293 $(1,087)

--------------------------------------------------------------------------

--------------------------------------------------------------------------

The forward exchange contracts are reported on a mark-to-market

basis and the gains or losses are included in earnings as the

Company has elected not to follow hedge accounting for these

derivatives.

11. Capital disclosures:

The Company's objective in managing capital is to ensure

sufficient liquidity to pursue its organic growth strategy and

undertake selective acquisitions, while at the same time taking a

conservative approach towards financial leverage and management of

financial risk.

The Company's capital is composed of net debt and shareholders'

equity. Net debt consists of interest-bearing debt less cash and

cash equivalents. The Company's primary uses of capital are to

finance increases in non-cash working capital and capital

expenditures for capacity expansion as well as acquisitions. The

Company currently funds these requirements out of its

internally-generated cash flows and the periodic use of its

revolving long-term bank credit facility.

The primary measure used by the Company to monitor its financial

leverage is its ratio of net debt to earnings before interest,

taxes, depreciation and amortization, non-controlling interest, and

restructuring and other charges ("EBITDA"), which it aims to

maintain at less than 3.0:1. Net debt is computed as at the most

recent quarterly balance sheet date. EBITDA is based on the last

four quarters ending on the same date as the balance sheet date

used to compute net debt. The net debt to EBITDA ratio as at July

6, 2008, September 30, 2007 and July 1, 2007 was as follows:

July 6, 2008 September 30, July 1, 2007

2007

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Bank indebtedness $- $- $3,500

Current portion of long-term

debt 3,762 3,689 3,934

Long-term debt 104,677 55,971 38,979

Less: cash and cash equivalents (13,195) (9,250) (7,537)

--------------------------------------------------------------------------

Net debt $95,244 $50,410 $38,876

--------------------------------------------------------------------------

--------------------------------------------------------------------------

For the last four quarters ending on

July 6, 2008 September 30, July 1, 2007

2007

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Net earnings $164,037 $130,020 $105,942

Restructuring and other charges 9,602 28,012 42,725

Depreciation and amortization 53,505 38,777 37,593

Interest, net 7,462 4,898 4,540

Income tax expense (recovery) 4,466 (4,815) 917

Non-controlling interest in

income of consolidated joint

venture 1,010 1,278 645

--------------------------------------------------------------------------

EBITDA $240,082 $198,170 $192,362

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Net debt to EBITDA ratio 0.4:1 0.3:1 0.2:1

--------------------------------------------------------------------------

--------------------------------------------------------------------------

The terms of the revolving credit facility require the Company

to maintain a net debt to EBITDA ratio below 3.0:1, although this

limit may be exceeded under certain circumstances. The Company used

its revolving credit facility to finance the acquisition of

Prewett, which closed on October 15, 2007. The financing of the

acquisition resulted in debt leverage, which is well below the

Company's maximum net debt to EBITDA ratio. The Company does not

currently plan to refinance its revolving credit facility, or a

portion thereof, with debt of longer maturities or to raise

additional equity capital.

In order to maintain or adjust its capital structure, the

Company, upon approval from its Board of Directors, may issue or

repay long-term debt, issue shares, repurchase shares, pay

dividends or undertake other activities as deemed appropriate under

the specific circumstances. The Company does not currently pay a

dividend. However, the Company's Board of Directors periodically

evaluates the merits of introducing a dividend.

The Company is not subject to any capital requirements imposed

by a regulator.

12. Income taxes:

The Canada Revenue Agency ("CRA") is currently conducting an

audit of the Company's income tax returns for its 2000, 2001, 2002

and 2003 fiscal years, the scope of which includes a review of

transfer pricing and the allocation of income between the Company's

Canadian legal entity and its foreign subsidiaries. In the third

quarter of fiscal 2008, management met with the CRA for the first

time to discuss preliminary transfer pricing audit issues and, in

particular, explain the roles and responsibilities performed in the

Company's foreign subsidiaries where the majority of its taxable

income is earned. The Company is continuing its discussion with the

CRA and is confident that the merits of its transfer pricing

methodology, which is supported by annual transfer pricing studies

conducted by external experts, and the economic substance of its

legal and operating structure support its tax filings. While the

outcome of the audit cannot be predicted with certainty, the

Company believes that its tax filing positions will be sustained

and that the final resolution of this matter will not materially

affect the Company's results of operations or financial

position.

The income tax recovery of $3.3 million for the three-month

period ended July 1, 2007 and of $0.2 million for the nine-month

period ended July 1, 2007 includes the recognition of previously

unrecorded tax benefits in the amount of $5.7 million relating to a

prior taxation year.

13. Contingencies:

The Company and certain of its senior officers have been named

as defendants in a number of proposed class action lawsuits filed

in the United States District Court for the Southern District of

New York. These U.S. lawsuits will likely be consolidated into one

proposed class action with a lead plaintiff. A proposed class

action has also been filed in the Ontario Superior Court of Justice

and a petition for authorization to commence a class action has

been filed in the Quebec Superior Court. Each of these U.S. and

Canadian lawsuits, which have yet to be certified as a class action

by the respective courts at this stage, seek to represent a class

comprised of persons who acquired the Company's common shares

between August 2, 2007 and April 29, 2008 and allege, among other

things, that the defendants misrepresented the Company's financial

prospects in its financial guidance concerning the 2008 fiscal

year, subsequently revised on April 29, 2008. The U.S. lawsuits are

based on United States federal securities laws. In addition to

pursuing common law claims, the Ontario action proposes to seek

leave from the Ontario court to also bring statutory

misrepresentation civil liability claims under Ontario's Securities

Act. The Company strongly contests the basis upon which these

actions are predicated and intends to vigorously defend its

position. However, due to the inherent uncertainties of litigation,

it is not possible to predict the final outcome of these lawsuits

or determine the amount of any potential losses, if any. No

provision for contingent loss has been recorded in the interim

consolidated financial statements.

14. Segmented information:

The Company manufactures and sells activewear, socks and

underwear. The Company operates in one business segment, being

high-volume, basic, frequently replenished, non-fashion

apparel.

The company has two customers Three months ended Nine months ended

accounting for at least 10% July 6, July 1, July 6, July 1,

2008 2007 2008 2007

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Company A 25.1% 22.2% 23.2% 22.2%

Company B 11.7% 2.6% 15.5% 5.5%

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Sales were derived from customers

located in the following

geographic areas:

--------------------------------------------------------------------------

--------------------------------------------------------------------------

United States $338,130 $255,281 $833,230 $627,758

Canada 19,604 16,456 42,217 39,021

Europe and other 23,040 19,873 49,547 42,794

--------------------------------------------------------------------------

$380,774 $291,610 $924,994 $709,573

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Sales by major product group:

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Activewear and underwear $306,407 $261,087 $703,457 $603,646

Socks 74,367 30,523 221,537 105,927

--------------------------------------------------------------------------

$380,774 $291,610 $924,994 $709,573

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Property, plant and equipment July 6, 2008 September 30, July 1, 2007

by geographic areas are as 2007

follows: (audited)

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Caribbean Basin and Central

America $321,613 $294,063 $276,000

United States 80,486 65,399 69,163

Canada and other 24,682 18,155 23,314

--------------------------------------------------------------------------

$426,781 $377,617 $368,477

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Assets held for sale by July 6, 2008 September 30, July 1, 2007

geographic areas are as 2007

follows: (audited)

--------------------------------------------------------------------------

--------------------------------------------------------------------------

United States $2,200 $2,278 $1,934

Canada and other 10,403 4,332 500

--------------------------------------------------------------------------

$12,603 $6,610 $2,434

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Goodwill and intangible assets relate to acquisitions located in the United

States.

Contacts: Gildan Activewear Inc. Laurence G. Sellyn, Executive

Vice-President, Chief Financial and Administrative Officer

514-343-8805 lsellyn@gildan.com Gildan Activewear Inc. Sophie

Argiriou, Director, Investor Communications 514-343-8815

sargiriou@gildan.com

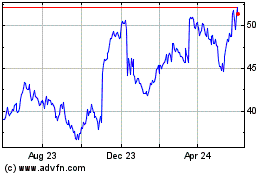

Gildan Activewear (TSX:GIL)

Historical Stock Chart

From Jun 2024 to Jul 2024