Eastern Platinum Reports Results for the Three Months Ended June 30, 2013

August 14 2013 - 1:57PM

Marketwired Canada

Mr. Ian Rozier, President and CEO of Eastern Platinum Limited ("Eastplats" or

the "Company) (TSX:ELR)(AIM:ELR)(JSE:EPS) reports financial results for the

three months ended June 30, 2013.

Summary of results for the three months ended June 30, 2013 ("Q2 2013"):

-- An impairment charge of $147,787,000 was recorded against Crocodile

River Mine during the quarter.

-- Eastplats recorded a loss attributable to equity shareholders of the

Company of $139,710,000 ($0.15 loss per share) in the quarter ended June

30, 2013 compared to a loss of $86,421,000 ($0.09 loss per share) in the

quarter ended June 30, 2012 ("Q2 2012").

-- Adjusted EBITDA was negative $8,116,000 in Q2 2013 compared to negative

$4,599,000 in Q2 2012.

-- PGM ounces sold decreased 41% to 15,474 ounces in Q2 2013 compared to

26,412 PGM ounces in Q2 2012.

-- The U.S. dollar average delivered price per PGM ounce decreased 1% to

$890 in Q2 2013 compared to $902 in Q2 2012.

-- The Rand average delivered price per PGM ounce increased 15% to R8,428

in Q2 2013 compared to R7,324 in Q2 2012.

-- Total Rand operating cash costs decreased 14% to R202 million in Q2 2013

compared to R235 million in Q2 2012.

-- Total Rand operating cash costs included one-time retrenchment costs at

CRM of approximately R52 million ($5.5 million).

-- Rand operating cash costs net of by-product credits increased 57% to

R11,611 per ounce in Q2 2013 compared to R7,390 per ounce in Q2 2012.

Rand operating cash costs increased 47% to R13,069 per ounce in Q2 2013

compared to R8,881 per ounce in Q2 2012.

-- U.S. dollar operating cash costs net of by-product credits increased 35%

to $1,226 per ounce in Q2 2013 compared to $910 per ounce achieved in Q2

2012. U.S. dollar operating cash costs increased 26% to $1,380 per ounce

in Q2 2013 compared to $1,094 per ounce in Q2 2012.

-- Excluding one-time retrenchment costs, operating cash costs reduced to

R9,694 per ounce ($1,024 per ounce) and operating cash costs net of by-

product credits reduced to R8,251 per ounce ($871 per ounce).

-- The Company's Lost Time Injury Frequency Rate (LTIFR) was 3.44 in Q2

2013 compared to 1.17 in Q2 2012.

-- At June 30, 2013, the Company had a cash position (including cash, cash

equivalents and short term investments) of $104,763,000 (December 31,

2012 - $130,925,000).

For complete details of financial results, please refer to the unaudited

condensed consolidated interim financial statements and accompanying

Management's Discussion and Analysis ("MD&A") for the three months ended June

30, 2013. These financial statements and MD&A, and the comparative financial

statements for the three months ended June 30, 2012 are all available on SEDAR

at www.sedar.com and on the Company's website www.eastplats.com.

The qualified person having reviewed the operating disclosures presented in this

press release is Mr. Brian Montpellier, P. Eng, V.P. Project Development.

Total shares issued and outstanding - 928,187,807

No stock exchange, securities commission or other regulatory authority has

approved or disapproved the information contained herein.

Cautionary Statement on Forward-Looking Information

This press release, which contains certain forward-looking statements, is

intended to provide readers with a reasonable basis for assessing the financial

performance of the Company. All statements, other than statements of historical

fact, are forward-looking statements. The words "believe", "expect",

"anticipate", "contemplate", "target", "plan", "intends", "continue", "budget",

"estimate", "may", "will", "schedule" and similar expressions identify forward

looking statements. Forward-looking statements are necessarily based upon a

number of estimates and assumptions that, while considered reasonable by the

Company, are inherently subject to significant business, economic and

competitive uncertainties and contingencies. Known and unknown factors could

cause actual results to differ materially from those projected in the

forward-looking statements. Such factors include, but are not limited to,

fluctuations in the currency markets such as Canadian dollar, South African Rand

and U.S. dollar, fluctuations in the prices of PGM and other commodities,

changes in government legislation, taxation, controls, regulations and political

or economic developments in Canada, the United States, South Africa, or Barbados

or other countries in which the Company carries or may carry on business in the

future, risks associated with mining or development activities, the speculative

nature of exploration and development, including the risk of obtaining necessary

licenses and permits, and quantities or grades of reserves. Many of these

uncertainties and contingencies can affect the Company's actual results and

could cause actual results to differ materially from those expressed or implied

in any forward-looking statements made by, or on behalf of, the Company. Readers

are cautioned that forward-looking statements are not guarantees of future

performance. There can be no assurance that such statements will prove to be

accurate and actual results and future events could differ materially from those

acknowledged in such statements. Specific reference is made to the Company's

most recent Annual Information Form on file with Canadian provincial securities

regulatory authorities for a discussion of some of the factors underlying

forward-looking statements.

The Company disclaims any intention or obligation to update or revise any

forward-looking statements whether as a result of new information, future events

or otherwise, except to the extent required by applicable laws.

FOR FURTHER INFORMATION PLEASE CONTACT:

Eastern Platinum Limited

Ian Rozier

President & C.E.O.

+1-604-685-6851

+1-604-685-6493 (FAX)

info@eastplats.com

www.eastplats.com

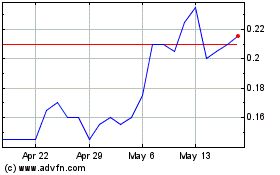

Eastern Platinum (TSX:ELR)

Historical Stock Chart

From Jun 2024 to Jul 2024

Eastern Platinum (TSX:ELR)

Historical Stock Chart

From Jul 2023 to Jul 2024