Crew Energy Inc. (TSX: CR; OTCQB: CWEGF) ("Crew" or the "Company"),

a growth-oriented natural gas weighted producer operating in the

world-class Montney play in northeast British Columbia (“NE BC”),

is pleased to announce the results of our year-end 2023 independent

reserves evaluation along with our 2024 capital expenditure budget

and guidance. Crew’s 2024 budget builds on the success of our 2023

drilling program, efficient execution and asset development, all of

which are demonstrated by growth in our 2023 independent reserves

evaluation. Production averaged

30,928 boe per

day1 in the final quarter of 2023, a

15%

increase from 26,834 boe per day1 in Q3/23 and in-line with

guidance of 30,000 to 32,000 boe per day.

The Company invested approximately $54

million in Q4/23, 17% lower than the

midpoint of guidance of $65 million, while net

debt2 decreased 21% at

year-end to approximately $117 million compared to

year-end 2022. Crew’s 2024 budget aims to maintain current

production levels, support strategic investments to advance

long-term growth plans, and preserve a strong balance sheet.

Together, this is expected to position Crew to take advantage of

what is anticipated to be an improved supply and demand environment

for natural gas as North American LNG export growth accelerates

into 2025 and forward.

Highlights of our independent reserves

evaluation prepared by Sproule Associates Ltd. (“Sproule”) are

provided below, effective December 31, 2023 (the “Sproule Report”).

All finding, development and acquisition (“FD&A”)3,4 costs and

finding and development (“F&D”)3,4 costs below include changes

in future development capital4 (“FDC”), unless otherwise noted.

CREW’S 2023 RESERVES & 2024 BUDGET

HIGHLIGHTS

- 17%

increase in Total Proved (“1P”) reserves and 27%

increase in Total Proved Plus Probable (“2P”) reserves

over 2022, with 1P reserve additions 129% and 2P reserve additions

600% greater than last year, excluding A&D.

- NAV per

share5 of $4.33

(PDP), $9.70 (1P) and $18.61 (2P),

representing a significant discount to Crew’s current enterprise

value.

- Proved

Developed Producing (“PDP”) reserve additions of 7.3 mmboe

driving 3-year F&D3,4 and FD&A3,4 costs of

$11.23 per boe and $8.61 per boe, respectively, with strong 3-year

PDP recycle

ratios3,4,6

of 2.0x and 2.6x, respectively.

- $165 to

$185 million of total net capital expenditures7, expected

to maintain average annual production of between 29,000 to

31,000 boe per day1 (the “2024 Budget”), which is

anticipated to include:

- $105 to

$115 million allocated to the drilling of approximately

6 (6.0 net) wells, and completion of approximately

11 (11.0 net) wells, with an expected inventory of

ten (10.0 net) drilled uncompleted wells remaining at the end of

2024;

- 5,300

bbls per day of anticipated average condensate and light

crude oil production at Greater Septimus, representing a 15%

increase in 2024 over 2023; and

- $60 to

$70 million in strategic infrastructure investments,

including a facility expansion and electrification at West Septimus

as well as site preparation and other preliminary expenditures on a

future Groundbirch gas processing facility

2024 BUDGET DETAIL

Crew’s approved 2024 Budget includes net capital

expenditures7 of $165 to $185 million and

incorporates a conservative drilling and completions program as

well as $60 to $70 million in strategic

electrification and infrastructure expansion projects. These

initiatives support Crew’s longer-term growth prospects while

preserving the upside in our large resource base.

Maintenance Capital

-

Crew’s 2024 development capital of $105 to $115

million is budgeted to maintain production at levels

similar to 2023, between 29,000 and 31,000 boe per

day1, while increasing condensate and light oil production

by 15% to an anticipated 5,300 bbls per day.

-

The Company plans to drill six (6.0 net) wells and to complete 11

(11.0 net) wells, including the completion of six wells previously

drilled on the Tower 15-28 pad and five previously drilled wells on

the Septimus 7-18 pad, with an expected inventory of ten (10.0 net)

drilled uncompleted wells at the end of 2024, setting up for 2025

and aligning with the anticipated improvement in natural gas prices

as LNG export becomes operational on Canada’s west coast.

Infrastructure Investments

-

Approximately $50 million is expected to be directed to West

Septimus for advancing the estimated $80 million facility expansion

and electrification, targeting reduced costs and emissions upon

completion, and increasing the inlet capacity at the West Septimus

plant from 120 mmcf per day to 140 mmcf per day8.

As a result of this project, Crew also expects to connect and

deliver power to the planned future facility at Groundbirch and

reduce electrification costs for the Groundbirch project by

approximately $30 million.

-

Upon completion of the electrification project at West Septimus,

targeted for H2 2025, Crew anticipates recovering approximately 53%

of the project’s estimated costs by recognizing funding and credits

totaling $42 million associated with various

provincial and federal government financial incentives for clean

energy conversion initiatives. The funding and credits are related

to securing a line position and the installation of power to the

West Septimus gas plant. Crew gratefully acknowledges assistance

from the Province of British Columbia’s CleanBC Industry Fund for

their part in supporting this project.

-

Approximately $15 million is planned for investment into site

preparation, front-end engineering and design (“FEED”) and

procuring long-lead items for the planned construction of an

electric drive deep-cut gas plant (the “Groundbirch Plant”) in our

Groundbirch area (the “Groundbirch Project”).

Laying the Groundwork at

Groundbirch

-

Crew has received a permit from the B.C. Energy Regulator (“BCER”)

approving the construction of our planned 180 mmcf per day

Groundbirch Plant as well as 60 well authorization permits,

bringing our total to 85 well authorizations in

the Groundbirch area.

-

The Groundbirch Plant supports our longer-term development and

expanded scale, and with permitting now in place, this longer-range

strategic plan can commence with the electrification of West

Septimus, which represents the first step to full Groundbirch

development.

-

In addition to surface preparations and FEED work, Crew also plans

to allocate capital in 2024 and 2025 for the construction of 20

kilometers of a 12-inch and a 10-inch pipeline from West Septimus

to Groundbirch, upon receipt of regulatory approval.

With ongoing supply and demand imbalances in

global natural gas, the current spot and future strip prices have

remained under pressure. In response, we are investing prudently to

advance key milestones of the Groundbirch Project while deferring

large capital outlays until they are supported by an improved

natural gas pricing environment.

2024 Budget Underlying

Assumptions

|

|

20249 |

|

Net capital expenditures7 ($Millions) |

165-185 |

|

Annual average production1 (boe/d) |

29,000-31,000 |

|

Liquids Production (%) |

26 |

|

Royalty Rate (%) |

8-10 |

|

Net operating costs7 ($ per boe) |

4.50-5.00 |

|

Net transportation costs7 ($ per boe) |

3.50-4.00 |

|

General and administrative (“G&A”) ($ per boe) |

1.00-1.20 |

|

Effective interest rate on long-term debt (%) |

8-10 |

OPERATIONS UPDATE

We would like to recognize our Crew’s

commitment to safety in our field operations. We

are extremely proud to report that over

1.568-million-person hours of work were

undertaken to the end of 2023 without a single recordable

injury, further extending our corporate record and

underscoring the Company’s firm commitment to safety.

NE BC Montney (Greater

Septimus)

- Crew drilled seven

(7.0 net) Montney wells during Q4/23.

- Over the first 30

days on production (“IP30”), four (4.0 net) ultra-condensate rich

(“UCR”) natural gas wells which were completed on the 1-24 pad in

Q4/23 have produced average raw wellhead rates of

2,625 mcf per day of natural gas

and 1,037 bbls per day of condensate. Crew

achieved our target by averaging over 7,000 bbls per day of

condensate and light crude oil production in

November.

- During Q1/24, Crew

plans to complete five (5.0 net) Montney UCR wells, equip and

tie-in 11 (11.0 net) Montney UCR wells and drill six (6.0 net)

Montney wells.

Groundbirch

-

The original three (3.0 net) wells on the 4-17 pad have completed

lateral lengths averaging 3,000 meters and have produced an average

of over 4 bcf of natural gas over the first 720 days, exceeding

Sproule’s year-end 2023 proved plus probable undeveloped

Groundbirch type curve by approximately 33% to date.

-

The second phase of development at Crew’s 4-17 pad has completed

lateral lengths averaging 2,650 meters, featuring a three-zone

development with five (5.0 net) wells that have continued to exceed

the 3,000-meter lateral length type curve estimates with average

raw gas Expected Ultimate Recovery (EUR) of 12 BCF per well.

Other NE BC Montney

- The

Company has six (6.0 net) drilled Extended Reach Horizontal wells

on the 15-28 pad at Tower, targeting light crude oil and featuring

lateral lengths of over 4,000 meters. Of these wells, four (4.0

net) Upper Montney “B” wells and two (2.0 net) Upper Montney “C”

wells are now planned for completion in Q3/24.

OUTLOOK

-

With near- and medium-term natural gas prices remaining under

pressure, Crew plans to focus on the development of our

condensate-rich assets at Greater Septimus with plans to

increase average condensate and light oil production by

approximately 15% from 2023 levels, while allowing 2024

natural gas production to decline by an average of approximately 5%

compared to the prior year. This strategy sets up an active Q1/24

capital program for Crew, with plans to invest $75

to $85 million and drill six (6.0 net) wells,

complete five (5.0 net) wells and equip and tie-in 11 (11.0 net)

Montney wells. This level of activity is expected to result in

forecast average production of 29,000 to 31,000 boe per

day1 for the first quarter, which includes the impact of

an anticipated 2,100 boe per day of production that is shut-in for

offsetting completion and construction operations.

-

Our long-range plans are designed to generate maximum value from

the strategic location, target zone optionality, commodity

diversity and multiple egress options that are offered by our

large, contiguous Montney land base. The Company is well positioned

to be an active participant in what is expected to be an improved

natural gas supply and demand dynamic when LNG Canada is

commissioned in 2025, and we are targeting a continued improvement

in per unit costs, increasing margins and expanding Adjusted Funds

Flow (“AFF”). Crew intends to continue advancing development of the

Company’s large inventory of over 2,500 identified potential

drilling locations10, of which only 238 are booked within our

year-end 2023 independent reserves evaluation.

- Given

this significant flexibility and ideal positioning, Crew’s asset

base offers a perfect fit for the future of Canadian energy.

Throughout 2024, we will remain committed to building on the

positive momentum realized over the last three years and focusing

on responsible growth and operational excellence in the further

development of our top-tier, strategically located assets. We

extend our appreciation to all stakeholders for their ongoing

support of Crew while we continue to unlock value from our

expansive inventory of Montney well locations.

2023 RESERVES DETAIL

The detailed reserves data set forth below is

based upon the Sproule Report. The following presentation

summarizes the Company’s crude oil, natural gas liquids and

conventional natural gas reserves and the net present values before

income tax of future net revenue for the Company’s reserves using

the forecast prices and costs reflected in the Sproule Report. The

Sproule Report has been prepared in accordance with definitions,

standards, and procedures contained in the Canadian Oil and Gas

Evaluation Handbook (“COGE Handbook”) and National Instrument

51-101 – Standards of Disclosure for Oil and Gas Activities (“NI

51-101”). The reserves evaluation was based on an arithmetic

average of the published escalated price forecasts of Sproule,

McDaniel & Associates Consultants (“McDaniel”) and GLJ Ltd.

(“GLJ”) (the “IC3 Average”) and Sproule’s foreign exchange rates at

December 31, 2023 as outlined in the table below entitled "Price

Forecast".

See "Information Regarding Disclosure on Oil and

Gas Reserves and Operational Information" for additional cautionary

language, explanations and discussion and "Forward Looking

Information and Statements" for principal assumptions and risks

that may apply.

Corporate

Reserves11,12,13

|

|

Light & Medium Crude Oil |

Natural Gas Liquids |

Conventional Natural Gas14 |

Barrels of oil equivalent15 |

|

|

(mbbl) |

(mbbl) |

(mmcf) |

(mboe) |

|

Proved |

|

|

|

|

|

Developed Producing |

289 |

15,103 |

417,067 |

84,903 |

|

Developed Non-producing |

- |

675 |

17,475 |

3,587 |

|

Undeveloped |

3,180 |

28,089 |

767,866 |

159,247 |

|

Total Proved |

3,469 |

43,867 |

1,202,408 |

247,737 |

| Total

Probable |

5,146 |

33,157 |

1,122,959 |

225,462 |

|

Total Proved plus Probable |

8,615 |

77,024 |

2,325,367 |

473,199 |

Reserves

Values12,13,16,17

The estimated before tax net present value

(“NPV”) of future net revenues associated with Crew’s reserves

effective December 31, 2023, and based on the Sproule Report and

the published IC3 Average future price forecast, are summarized in

the following table:

|

(M$) |

0% |

5% |

10% |

15% |

20% |

|

Proved |

|

|

|

|

|

|

Developed Producing |

1,420,905 |

1,023,887 |

795,360 |

652,861 |

556,750 |

|

Developed Non-producing |

68,211 |

44,028 |

31,526 |

24,171 |

19,395 |

|

Undeveloped |

2,606,680 |

1,390,732 |

808,917 |

492,904 |

303,203 |

| Total

Proved |

4,095,795 |

2,458,647 |

1,635,804 |

1,169,936 |

879,348 |

| Total Probable |

5,010,049 |

2,393,791 |

1,394,993 |

914,608 |

647,455 |

|

Total Proved plus Probable |

9,105,844 |

4,852,438 |

3,030,797 |

2,084,544 |

1,526,803 |

Price

Forecast18,19

The IC3 Average December 31, 2023, price

forecast used for the purposes of preparing the Sproule Report is

summarized as follows:

|

Year |

Exchange Rate |

WTI @ Cushing |

Canadian Light Sweet |

Henry Hub |

Natural gas at AECO/NIT spot |

Westcoast Station 2 |

|

|

($US/$/Cdn) |

(US$/bbl) |

(C$/bbl) |

(US$/mmbtu) |

(C$/mmbtu) |

(C$/mmbtu) |

|

2024 |

0.750 |

73.67 |

92.91 |

2.75 |

2.20 |

2.06 |

|

2025 |

0.750 |

74.98 |

95.04 |

3.64 |

3.37 |

3.25 |

|

2026 |

0.760 |

76.14 |

96.07 |

4.02 |

4.05 |

3.93 |

|

2027 |

0.760 |

77.66 |

97.99 |

4.10 |

4.13 |

4.01 |

|

2028 |

0.760 |

79.22 |

99.95 |

4.18 |

4.21 |

4.09 |

|

2029 |

0.760 |

80.80 |

101.94 |

4.27 |

4.30 |

4.17 |

|

2030 |

0.760 |

82.42 |

103.98 |

4.35 |

4.38 |

4.25 |

|

2031 |

0.760 |

84.06 |

106.06 |

4.44 |

4.47 |

4.34 |

|

2032 |

0.760 |

85.74 |

108.18 |

4.53 |

4.56 |

4.42 |

|

2033 |

0.760 |

87.46 |

110.35 |

4.62 |

4.65 |

4.51 |

|

2034+(18) |

|

+2.0%/yr |

+2.0%/yr |

+2.0%/yr |

+2.0%/yr |

+2.0%/yr |

Reserves

Reconciliation13,20

The following reconciliation of Crew’s gross

reserves compares changes in the Company’s independently evaluated

reserves as at December 31, 2023, relative to the reserves as at

December 31, 2022.

|

|

MBOE |

|

FACTORS |

Total Proved |

Total Probable |

Total Proved + Probable |

|

December 31, 2022 |

210,882 |

163,136 |

374,018 |

|

Extensions and Improved Recovery21 |

42,354 |

62,763 |

105,117 |

|

Infill Drilling |

- |

- |

- |

|

Technical Revisions |

4,868 |

(10) |

4,858 |

|

Discoveries |

- |

- |

- |

|

Acquisitions |

- |

- |

- |

|

Dispositions |

- |

- |

- |

|

Economic Factors |

648 |

(427) |

221 |

|

Production |

(11,015) |

- |

(11,015) |

|

December 31, 2023 |

247,737 |

225,462 |

473,199 |

Corporate level technical revisions on a boe

basis were 2% at the Proved level and 1% at the Proved plus

Probable level. Technical revisions were primarily due to the

additional facility capacity available with the development of the

Groundbirch Plant, as well as operating cost and well performance

changes.

Material changes in other categories were

attributable to extensions, which incorporated the addition of 56

locations in the Groundbirch area to fill the new Groundbirch Plant

to capacity by 2027.

Capital Program Efficiency – Including

FDC

|

|

2023 |

|

|

PDP |

1P |

2P |

|

Exploration and Development Expenditures22,23 ($ thousands) |

217,027 |

217,027 |

217,027 |

|

Acquisitions/(Dispositions)22,23 ($ thousands) |

(1,015) |

(1,015) |

(1,015) |

|

Change in Future Development Capital4,22 ($ thousands) |

|

|

|

|

- Exploration and Development |

1,127 |

462,771 |

637,564 |

|

- Acquisitions/Dispositions |

- |

- |

- |

|

Reserves Additions with Revisions and Economic Factors (mboe) |

|

|

|

|

- Exploration and Development |

7,331 |

47,870 |

110,197 |

|

- Acquisitions/Dispositions |

- |

- |

- |

|

|

2023 |

|

|

PDP |

1P |

2P |

|

Finding & Development

Costs4,24,25

($ per boe) |

29.76 |

14.20 |

7.76 |

|

- with revisions and economic factors |

| Finding, Development

& Acquisition

Costs4,24,25

($ per boe) |

29.62 |

14.18 |

7.75 |

|

- with revisions and economic factors |

| Recycle

Ratio25 (F&D) |

0.8 |

1.6 |

2.9 |

|

Reserves Replacement3 |

67% |

435% |

1000% |

All evaluations and summaries of future net

revenue are stated prior to provision for interest, debt service

charges and general administrative expenses, the input of hedging

activities and after deduction of royalties, operating costs,

estimated well abandonment and reclamation costs ("ARC") associated

with the Company’s assets in the reserve report and estimated

future capital expenditures associated with reserves. It should not

be assumed that the estimates of net present value of future net

revenues presented in the tables below represent the fair market

value of the reserves. There is no assurance that the forecast

prices and cost assumptions will be attained, and variances could

be material. The recovery and reserve estimates of our crude oil,

natural gas liquids and conventional natural gas reserves provided

herein are estimates only and there is no guarantee that the

estimated reserves will be recovered. Actual crude oil,

conventional natural gas and natural gas liquids reserves may be

greater than or less than the estimates provided herein. Reserves

included herein are stated on a company gross basis (working

interest before deduction of royalties without including any

royalty interests) unless noted otherwise. In addition to the

detailed information disclosed in this news release, more detailed

information as prescribed by NI 51-101 will be included in the

Company's Annual Information Form (the “AIF”) for the year ended

December 31, 2023, which will be filed on the Company's profile at

www.sedar.com on or before March 31, 2024.

ABOUT CREW

Crew is a growth-oriented natural gas and

liquids producer, committed to pursuing sustainable per share

growth through a balanced mix of financially and socially

responsible exploration and development. The Company’s operations

are exclusively located in northeast British Columbia and feature a

vast Montney resource with a large contiguous land base in the

Greater Septimus and Groundbirch areas in British Columbia,

offering significant development potential over the long-term. Crew

has access to diversified markets with operated infrastructure and

access to multiple pipeline egress options. The Company’s common

shares are listed for trading on the Toronto Stock Exchange (“TSX”)

under the symbol “CR” and on the OTCQB in the US under ticker

“CWEGF”.

FOR FURTHER INFORMATION, PLEASE

CONTACT:

|

Dale Shwed, President and CEO |

Phone: 403-266-2088 |

| John Leach, Executive Vice

President and CFO |

Email:

investor@crewenergy.com |

ADVISORIES

Unaudited Financial

Information

Certain financial and operating information

included in this press release for the quarter and year ended

December 31, 2023, including, without limitation, exploration and

development expenditures, acquisitions / dispositions, finding and

development costs, finding, development and acquisition costs,

recycle ratio, reserves replacement, operating netbacks and net

debt are based on estimated unaudited financial results for the

quarter and year then ended, and are subject to the same

limitations as discussed under Forward Looking Information set out

below. These estimated amounts may change upon the completion of

audited financial statements for the year ended December 31, 2023

and changes could be material.

Information Regarding Disclosure on Oil

and Gas Reserves and Operational Information

All amounts in this news release are stated in

Canadian dollars unless otherwise specified. Our oil and gas

reserves statement for the year ended December 31, 2023, which will

include complete disclosure of our oil and gas reserves and other

oil and gas information in accordance with NI 51-101, will be

contained within our Annual Information Form which will be

available on our SEDAR profile at www.sedar.com on or before March

31, 2024. The recovery and reserve estimates contained herein are

estimates only and there is no guarantee that the estimated

reserves will be recovered. In relation to the disclosure of

estimates for individual properties or subsets thereof, such

estimates may not reflect the same confidence level as estimates of

reserves and future net revenue for all properties, due to the

effects of aggregation.

This press release contains metrics commonly

used in the oil and natural gas industry, such as "recycle ratio",

"finding and development costs", "finding", development and

acquisition costs, “future development capital”, “maintenance

capital”, “operating netback per boe”, “exploration and development

expenditures” and “reserves replacement”. Each of these metrics are

determined by Crew as specifically set forth in this news release.

These terms do not have standardized meanings or standardized

methods of calculation and therefore may not be comparable to

similar measures presented by other companies, and therefore should

not be used to make such comparisons. Such metrics have been

included to provide readers with additional information to evaluate

the Company’s performance however, such metrics are not reliable

indicators of future performance and therefore should not be unduly

relied upon for investment or other purposes. Recycle Ratio is

calculated as operating netback per boe divided by F&D costs on

a per boe basis. Exploration and development expenditures as used

herein is equivalent to property, plant and equipment expenditures,

a term with a standardized meaning prescribed under IFRS. Reserves

Replacement is calculated as total reserve additions (including

acquisitions net of dispositions) divided by annual production.

Crew’s annual 2023 production averaged 30,178 boe per day1.

Management uses these metrics for its own performance measurements

and to provide readers with measures to compare Crew’s performance

over time.

Both F&D3,4 and FD&A3,4 costs take into

account reserves revisions during the year on a per boe basis. The

aggregate of the costs incurred in the financial year and changes

during that year in estimated FDC may not reflect total F&D

costs related to reserves additions for that year. Finding and

development costs both including and excluding acquisitions and

dispositions have been presented in this press release because

acquisitions and dispositions can have a significant impact on our

ongoing reserves replacement costs and excluding these amounts

could result in an inaccurate portrayal of our cost structure.

Net Asset Value (“NAV”)

The following table sets out the calculation of

the Company's NAV referred to herein based on the before-tax

estimated net present value of future net revenue discounted at 10%

("NPV10 BT") associated with the PDP, 1P and 2P reserves, as

evaluated in the Sproule Report:

|

|

Proved

Developed Producing |

Total Proved |

Total Proved + Probable |

|

NPV10 BT (MM$) |

795.4 |

1,635.8 |

3,030.8 |

|

Estimated net debt December 31, 2023 (MM$) |

117.4 |

117.4 |

117.4 |

|

Net Asset Value (MM$) |

678.0 |

1,518.4 |

2,913.4 |

|

Common shares* (MM) |

156.6 |

156.6 |

156.6 |

|

Estimated NAV per basic share ($) |

4.33 |

9.70 |

18.61 |

* Issued and outstanding as at December 31,

2023, on a non-diluted basis

Reserves Reconciliation by Product

Types

|

TOTAL PROVED |

Light/Med Crude Oil (mbbls) |

NGL's (mbbls) |

Conventional Natural Gas (mmcf) |

Oil Equivalent (mboe) |

|

December 31, 2022 |

2,628 |

40,420 |

1,007,002 |

210,882 |

|

Extensions |

1,590 |

6,244 |

207,122 |

42,354 |

| Infill

Drilling |

0 |

0 |

0 |

0 |

| Improved

Recovery |

0 |

0 |

0 |

0 |

| Technical

Revisions |

(721) |

(416) |

36,033 |

4,868 |

|

Discoveries |

0 |

0 |

0 |

0 |

|

Acquisitions |

0 |

0 |

0 |

0 |

|

Dispositions |

0 |

0 |

0 |

0 |

| Economic

Factors |

0 |

118 |

3,182 |

648 |

|

Production |

(28) |

(2,498) |

(50,930) |

(11,015) |

|

December 31, 2023 |

3,469 |

43,867 |

1,202,409 |

247,737 |

|

TOTAL PROBABLE |

Light/Med Crude Oil (mbbls) |

NGL's (mbbls) |

Conventional Natural Gas (mmcf) |

Oil Equivalent (mboe) |

|

December 31, 2022 |

5,530 |

28,641 |

773,793 |

163,136 |

|

Extensions |

(920) |

3,745 |

359,629 |

62,763 |

| Infill

Drilling |

0 |

0 |

0 |

0 |

| Improved

Recovery |

0 |

0 |

0 |

0 |

| Technical

Revisions |

539 |

855 |

(8,422) |

(10) |

|

Discoveries |

0 |

0 |

0 |

0 |

|

Acquisitions |

0 |

0 |

0 |

0 |

|

Dispositions |

0 |

0 |

0 |

0 |

| Economic

Factors |

(2) |

(84) |

(2,042) |

(427) |

|

Production |

0 |

0 |

0 |

0 |

|

December 31, 2023 |

5,146 |

33,157 |

1,122,958 |

225,462 |

|

TOTAL PROVED PLUS PROBABLE |

Light/Med Crude Oil (mbbls) |

NGL's (mbbls) |

Conventional Natural Gas (mmcf) |

Oil Equivalent (mboe) |

|

December 31, 2022 |

8,158 |

69,061 |

1,780,795 |

374,018 |

|

Extensions |

670 |

9,989 |

566,751 |

105,117 |

| Infill

Drilling |

0 |

0 |

0 |

0 |

| Improved

Recovery |

0 |

0 |

0 |

0 |

| Technical

Revisions |

(183) |

439 |

27,611 |

4,858 |

|

Discoveries |

0 |

0 |

0 |

0 |

|

Acquisitions |

0 |

0 |

0 |

0 |

|

Dispositions |

0 |

0 |

0 |

0 |

| Economic

Factors |

(2) |

34 |

1,139 |

221 |

|

Production |

(28) |

(2,498) |

(50,930) |

(11,015) |

|

December 31, 2023 |

8,615 |

77,024 |

2,325,366 |

473,199 |

Forward-Looking Information and

Statements

This news release contains certain

forward–looking information and statements within the meaning of

applicable securities laws. The use of any of the words "expect",

"anticipate", "continue", "estimate", "may", "will", "project",

"should", "believe", "plans", "intends", "forecast", targets, goals

and similar expressions are intended to identify forward-looking

information or statements. In particular, but without limiting the

foregoing, this news release contains forward-looking information

and statements pertaining to the following: the potential

recognition of significant additional reserves under the heading

2023 Reserves Detail; the volumes and estimated value of Crew's oil

and gas reserves, the future net value of Crew's reserves, the

future development capital and costs, the future ARC, the life of

Crew's reserves, the estimated volumes, and production mix of

Crew's oil and gas production; the ability to execute on its

four-year strategic plan and underlying strategy, associated plans,

goals and targets, all as more particularly outlined and described

in this press release; our annual capital budget range (the "2024

Budget"), associated drilling, completion and infrastructure plans,

the anticipated timing thereof, and all associated strategies,

initiatives, goals and targets, along with all forecasts, guidance

and underlying assumptions and sensitivities related to the 2024

Budget as outlined in this press release; production estimates and

targets under the 2024 Budget and balance of the longer range plan

including, without limitation, Crew’s goal to double annual average

production volumes to over 60,000 boe per day through the coming

years; infrastructure plans and anticipated benefits associated

therewith as outlined in this press release including, without

limitation, the planned expansion and electrification of the West

Septimus gas plant and anticipated economic and other benefits

thereof, expectations in regards to the extent of provincial and

federal government grants, credits and financial incentives related

thereto, the planned construction of the Groundbirch Plant and

anticipated benefits thereof, anticipated timing and assumed

receipt of all regulatory approvals required in connection with our

infrastructure plans and our ability to secure financing for these

plans as may be required, from time to time, and the potential

costs associated therewith; commodity price expectations and

assumptions; Crew's commodity risk management programs and future

hedging plans; marketing and transportation and processing plans

and requirements; estimates of processing capacity and

requirements; anticipated reductions in GHG emissions and

decommissioning obligations; future liquidity and financial

capacity and ability to finance our longer range strategic plan;

potential hedging opportunities and plans related thereto; future

results from operations and operating and leverage metrics; world

supply and demand projections and long-term impact on pricing;

future development, exploration, acquisition, disposition and

infrastructure activities, development timing and cost estimates;

the potential to serve a Canadian LNG market including the

anticipated start-up of LNG Canada in 2025 and the anticipated

benefits thereof to the Corporation both strategically and

economically; the number of estimated potential identified drilling

locations outlined in this press release; the potential of our

Groundbirch area to be a core area of future development and the

anticipated commerciality of up to four potential prospective zones

to be drilled; the successful implementation of our ESG

initiatives, and significant emissions intensity improvements going

forward; the amount and timing of capital projects; and anticipated

improvement in our long-term sustainability and the expected

positive attributes discussed herein attributable to our long range

strategic plan.

The internal projections, expectations, or

beliefs underlying our Board approved 2024 Budget and associated

guidance, as well as management's strategy, and associated plans,

goals and targets in respect of the balance of its strategic plan,

are subject to change in light of, without limitation, the

continuing impact of the Russia/Ukraine conflict, war in the Middle

East and any related actions taken by businesses and governments,

ongoing results, prevailing economic circumstances, volatile

commodity prices, resulting changes in our underlying assumptions,

goals and targets provided herein and changes in industry

conditions and regulations. Crew's financial outlook and guidance

provides shareholders with relevant information on management's

expectations for results of operations, excluding any potential

acquisitions or dispositions, for such time periods based upon the

key assumptions outlined herein. In this press release reference is

made to the Company's longer range 2025 and beyond internal plan

and associated economic model. Such information reflects internal

goals and targets used by management for the purposes of making

capital investment decisions and for internal long-range planning

and future budget preparation. Readers are cautioned that events or

circumstances and updates to underlying assumptions could cause

capital plans and associated results to differ materially from

those predicted and Crew's guidance for 2024, and more particularly

its internal plan, goals and targets for 2025 and beyond which are

not based upon Board approved budget(s) at this time, may not be

appropriate for other purposes. Accordingly, undue reliance should

not be placed on same.

In addition, forward-looking statements or

information are based on a number of material factors, expectations

or assumptions of Crew which have been used to develop such

statements and information, but which may prove to be incorrect.

Although Crew believes that the expectations reflected in such

forward-looking statements or information are reasonable, undue

reliance should not be placed on forward-looking statements because

Crew can give no assurance that such expectations will prove to be

correct. In addition to other factors and assumptions which may be

identified herein, assumptions have been made regarding, among

other things: that Crew will continue to conduct its operations in

a manner consistent with past operations; results from drilling and

development activities consistent with past operations; the quality

of the reservoirs in which Crew operates and continued performance

from existing wells; the continued and timely development of

infrastructure in areas of new production; the accuracy of the

estimates of Crew's reserve volumes; certain commodity price and

other cost assumptions; continued availability of debt and equity

financing and cash flow to fund Crew's current and future plans and

expenditures; the impact of increasing competition; the general

stability of the economic and political environment in which Crew

operates; that future business, regulatory and industry conditions

will be within the parameters expected by Crew; the general

continuance of current industry conditions; the timely receipt of

any required regulatory approvals; the ability of Crew to obtain

qualified staff, equipment and services in a timely and cost

efficient manner; drilling results; the ability of the operator of

the projects in which Crew has an interest in to operate the field

in a safe, efficient and effective manner; the ability of Crew to

obtain financing on acceptable terms; field production rates and

decline rates; the ability to replace and expand oil and natural

gas reserves through acquisition, development and exploration; the

timing and cost of pipeline, storage and facility construction and

expansion and the ability of Crew to secure adequate product

transportation; future commodity prices; currency, exchange and

interest rates; regulatory framework regarding royalties, taxes,

environmental and indigenous matters in the jurisdictions in which

Crew operates; that regulatory authorities in British Columbia

continue granting approvals for oil and gas activities on time

frames, and on terms and conditions, consistent with past

practices; and the ability of Crew to successfully market its oil

and natural gas products.

The forward-looking information and statements

included in this news release are not guarantees of future

performance and should not be unduly relied upon. Such information

and statements, including the assumptions made in respect thereof,

involve known and unknown risks, uncertainties and other factors

that may cause actual results or events to defer materially from

those anticipated in such forward-looking information or statements

including, without limitation: the continuing and uncertain impact

of the Russia / Ukraine conflict and war in the Middle East;

changes in commodity prices; changes in the demand for or supply of

Crew's products, the early stage of development of some of the

evaluated areas and zones and the potential for variation in the

quality of the Montney formation; interruptions, unanticipated

operating results or production declines; changes in tax or

environmental laws, royalty rates; climate change regulations, or

other regulatory matters; changes in development plans of Crew or

by third party operators of Crew's properties, increased debt

levels or debt service requirements; inaccurate estimation of

Crew's oil and gas reserve volumes and identified drilling

inventory; limited, unfavourable or a lack of access to capital

markets; increased costs; a lack of adequate insurance coverage;

the impact of competitors; and certain other risks detailed from

time-to-time in Crew's public disclosure documents (including,

without limitation, those risks identified in this news release and

Crew's MD&A and Annual Information Form).

This press release contains future-oriented

financial information and financial outlook information

(collectively, "FOFI") about Crew's prospective capital

expenditures and associated guidance, all of which are subject to

the same assumptions, risk factors, limitations, and qualifications

as set forth in the above paragraphs. The actual results of

operations of Crew and the resulting financial results will likely

vary from the amounts set forth in this press release and such

variation may be material. Crew and its management believe that the

FOFI has been prepared on a reasonable basis, reflecting

management's best estimates and judgments. However, because this

information is subjective and subject to numerous risks, it should

not be relied on as necessarily indicative of future results.

Except as required by applicable securities laws, Crew undertakes

no obligation to update such FOFI. FOFI contained in this press

release was made as of the date of this press release and was

provided for the purpose of providing further information about

Crew's anticipated future business operations. Readers are

cautioned that the FOFI contained in this press release should not

be used for purposes other than for which it is disclosed

herein.

The forward-looking information and statements

contained in this news release speak only as of the date of this

news release, and Crew does not assume any obligation to publicly

update or revise any of the included forward-looking statements or

information, whether as a result of new information, future events

or otherwise, except as may be required by applicable securities

laws.

Risk Factors to the Company's Four-Year

Plan

Risk factors that could materially impact

successful execution and actual results of the Four-Year Plan

include:

- volatility of

petroleum and natural gas prices and inherent difficulty in the

accuracy of predictions related thereto;

- changes in Federal

and Provincial regulations;

- execution of

construction timelines from BC Hydro to support the electrification

of the West Septimus and Groundbirch plants;

- receipt of

high-value regulatory permits required to launch development under

the Four-Year Plan;

- the Company's

ability to secure financing for the Groundbirch plant; and

- Those additional

risk factors set forth in the Company's MD&A and most recent

Annual Information Form filed on SEDAR.

Drilling Locations

This press release discloses internally

identified "potential drilling locations" which are comprised of:

(i) proved locations; (ii) probable locations; and (iii) unbooked

locations. Proved locations and probable locations are derived from

the Company's independent reserve evaluator's report effective

December 31, 2023 (the "Sproule Report") and account for drilling

inventory that have associated proved and/or probable reserves

assigned by Sproule. Unbooked locations are internally identified

potential drilling opportunities based on the Company's prospective

acreage and an assumption as to the number of wells that can be

drilled per section based on industry practice and internal review.

Unbooked locations do not have reserves or resources attributed to

them and are not estimates of drilling locations which have been

evaluated by a qualified reserves evaluator performed in accordance

with the COGE Handbook. There is no certainty that the Company will

drill any of these potential drilling opportunities and if drilled

there is no certainty that such locations will result in additional

oil and gas reserves, resources or production. The drilling

locations on which we actually drill wells will ultimately depend

upon the availability of capital, regulatory approvals, seasonal

restrictions, oil and natural gas prices, costs, actual drilling

results, additional reservoir information that is obtained and

other factors.

The following table provides a detailed breakdown of the

identified gross potential drilling locations presented herein:

|

|

Total Drilling Locations |

Proved Locations |

Probable Locations |

Unbooked Locations |

|

Montney Total Drilling Locations |

2,537 |

132 |

106 |

2,299 |

| Groundbirch Locations |

1,717 |

37 |

66 |

1,614 |

| West Septimus Locations |

483 |

59 |

28 |

396 |

| Septimus Locations |

191 |

36 |

9 |

146 |

| Tower

Locations |

146 |

- |

3 |

143 |

Test Results and Initial Production

Rates

A pressure transient analysis or well-test

interpretation has not been carried out and thus certain of the

test results provided herein should be considered to be preliminary

until such analysis or interpretation has been completed. Test

results and initial production (“IP”) rates disclosed herein,

particularly those short in duration, may not necessarily be

indicative of long-term performance or of ultimate recovery.

Type Curves/Wells

The Groundbirch type curves referenced herein

reflect the average per well proved plus probable undeveloped raw

gas assignments (EUR) for Crew's area of operations, as derived

from the Company's year-end independent reserve evaluations

prepared by Sproule in accordance with the definitions and

standards contained in the COGE Handbook. Unless otherwise stated,

the type wells are based upon all Crew producing wells in the area

as well as non-Crew wells determined by the independent evaluator

to be analogous for purposes of the reserve assignments. There is

no guarantee that Crew will achieve the estimated or similar

results derived therefrom and therefore undue reliance should not

be placed on them. Such information has been prepared by

Management, where noted, for purposes of making capital investment

decisions and for internal budget preparation only.

BOE and Mcfe Conversions

Measurements expressed in barrel of oil

equivalents, BOEs or Mcfe may be misleading, particularly if used

in isolation. A BOE conversion ratio of 6 mcf: 1 bbl and an Mcfe

conversion ratio of 1 bbl:6 Mcf are based on an energy equivalency

conversion method primarily applicable at the burner tip and do not

represent a value equivalency at the wellhead. Given that the value

ratio based on the current price of crude oil as compared to

natural gas is significantly different than the energy equivalency

of 6:1, utilizing the 6:1 conversion ratio may be misleading as an

indication of value.

Non-IFRS and Other Financial

Measures

Throughout this press release and other

materials disclosed by the Company, Crew uses certain measures to

analyze financial performance, financial position and cash flow.

These non-IFRS and other specified financial measures do not have

any standardized meaning prescribed under IFRS and therefore may

not be comparable to similar measures presented by other entities.

The non-IFRS and other specified financial measures should not be

considered alternatives to, or more meaningful than, financial

measures that are determined in accordance with IFRS as indicators

of Crew’s performance. Management believes that the presentation of

these non-IFRS and other specified financial measures provides

useful information to shareholders and investors in understanding

and evaluating the Company’s ongoing operating performance, and the

measures provide increased transparency and the ability to better

analyze Crew’s business performance against prior periods on a

comparable basis.

Capital Management Measures

- Funds from Operations and Adjusted Funds Flow

(“AFF”)Funds from operations represents cash provided by

operating activities before changes in operating non-cash working

capital, accretion of deferred financing costs and transaction

costs on property dispositions. Adjusted funds flow represents

funds from operations before decommissioning obligations settled

(recovered). The Company considers these metrics as key measures

that demonstrate the ability of the Company’s continuing operations

to generate the cash flow necessary to maintain production at

current levels and fund future growth through capital investment

and to service and repay debt. Management believes that such

measures provide an insightful assessment of the Company's

operations on a continuing basis by eliminating certain non-cash

charges, actual settlements of decommissioning obligations and

transaction costs on property dispositions, the timing of which is

discretionary. Funds from operations and adjusted funds flow should

not be considered as an alternative to or more meaningful than cash

provided by operating activities as determined in accordance with

IFRS as an indicator of the Company’s performance. Crew’s

determination of funds from operations and adjusted funds flow may

not be comparable to that reported by other companies. Crew also

presents adjusted funds flow per share whereby per share amounts

are calculated using weighted average shares outstanding consistent

with the calculation of income per share.

- Net Debt and Working Capital Surplus

(Deficiency)Crew closely monitors its capital structure

with a goal of maintaining a strong balance sheet to fund the

future growth of the Company. The Company monitors net debt as part

of its capital structure. The Company uses net debt (bank debt plus

working capital deficiency or surplus, excluding the current

portion of the fair value of financial instruments) as an

alternative measure of outstanding debt. Management considers net

debt and working capital deficiency (surplus) an important measure

to assist in assessing the liquidity of the Company.

Non-IFRS Financial Measures and

Ratios

- Operating Netback per boeOperating netback per

boe equals petroleum and natural gas sales including realized gains

and losses on commodity related derivative financial instruments,

marketing income, less royalties, net operating costs and

transportation costs calculated on a boe basis. Management

considers operating netback per boe an important measure to

evaluate its operational performance as it demonstrates its field

level profitability relative to current commodity prices.

Supplemental Information Regarding

Product Types

References to gas or natural gas and NGLs in

this press release refer to conventional natural gas and natural

gas liquids product types, respectively, as defined in National

Instrument 51-101, Standards of Disclosure for Oil and Gas

Activities ("NI 51-101"), except where specifically noted

otherwise.

The following is intended to provide the product

type composition for each of the production figures provided

herein, where not already disclosed within tables above:

|

|

Light and Medium Crude

Oil |

Condensate |

Natural Gas Liquids1 |

Conventional Natural

Gas |

Total (boe/d) |

| Q3 2023

Average |

0% |

14% |

8% |

78% |

26,834 |

| Q4 2023

Average |

0% |

20% |

8% |

72% |

30,928 |

| Q1 2024

Average |

0% |

16% |

8% |

76% |

29,000-31,000 |

|

2024 Annual Average |

3% |

15% |

8% |

74% |

29,000-31,000 |

Notes:1) Excludes condensate volumes which

have been reported separately.

1 See table in the Advisories for production

breakdown by product type as detailed in NI 51-101.2 Capital

management measure that does not have any standardized meaning as

prescribed by International Financial Reporting Standards, and

therefore, may not be comparable with the calculations of similar

measures for other entities. See “Advisories – Non-IFRS and Other

Financial Measures” contained within this press release.3 "Finding,

Development and Acquisitions costs" or "FD&A costs", "Finding

and Development costs" or "F&D costs", “Reserves Replacement”,

“Operating Netback” and “recycle ratio” do not have standardized

meanings. See “Capital Program Efficiency” and “Advisories -

Information Regarding Disclosure on Oil and Gas Reserves, and

Operational Information”.4 The 2023 change in Future Development

Capital (FDC) used in the calculation of Crew’s 1P and 2P F&D

and FD&A costs does not include approximately $190 million

(undiscounted) in the 1P case and $220 million (undiscounted) in

the 2P case of maintenance capital that was reclassified as a

capital expense in the December 31, 2021, Sproule Report and

maintained the same classification in the December 31, 2023 Sproule

Report.5 Calculated based on the Sproule Report before-tax

estimated net present value of future net revenue associated with

the reserves and discounted at 10% (“NPV10 BT”), debt adjusted per

share. See “Advisories – Net Asset Value” contained within this

press release for details of the NAV calculations used in this

press release.6 Estimated operating netback per boe in Q4 2023,

used in the above calculations, averaged $22.47 per boe

(unaudited). See ‘Advisories - Unaudited Financial Information’ and

‘Advisories - Information Regarding Disclosure on Oil and Gas

Reserves and Operational Information’.7 Non-IFRS financial measure

or ratio that does not have any standardized meaning as prescribed

by International Financial Reporting Standards, and therefore, may

not be comparable with calculations of similar measures or ratios

for other entities. See “Advisories - Non-IFRS and Other Financial

Measures” contained within this press release and in our most

recently filed MD&A, available on SEDAR at www.sedar.com.8

Estimated inlet capacity increase reflects internally generated

forecasts and is dependent on operating conditions.9 The actual

results of operations of Crew and the resulting financial results

will likely vary from the estimates and material underlying

assumptions set forth in this guidance by the Company and such

variation may be material. The guidance and material underlying

assumptions have been prepared based on information currently

available on a reasonable basis, reflecting management's best

estimates and judgments.10 See “Drilling Locations” in the

Advisories.11 Reserves have been presented on a “gross” basis which

is defined as Crew’s working interest (operating and non-operating)

share before deduction of royalties and without including any

royalty interest of the Company.12 Based on the IC3 Average

December 31, 2023, escalated price forecast as used in the Sproule

Report.13 Columns may not add due to rounding.14 Reflects 100%

Conventional Natural Gas by product type.15 Oil equivalent amounts

have been calculated using a conversion rate of six thousand cubic

feet of natural gas to one barrel of oil.16 The estimated future

net revenues are stated prior to provision for interest, debt

service charges, general administrative expenses, the impact of

hedging activities, and after deduction of royalties, operating

costs, ARC associated with the Company’s assets and estimated

future capital expenditures.17 The after-tax net present values of

future net revenue attributed to Crew’s reserves will be included

in the Company’s 2023 AIF to be filed on or before March 31,

2024.18 Escalated at 2.0% per year starting in 2034 with the

exception of foreign exchange which remains constant.19 Product

sale prices will reflect these reference prices with further

adjustments for quality and transportation to point of sale.20 See

the tables under “Reserves Reconciliation by Product Types”

contained in this news release for a reconciliation by product type

in accordance with NI 51-10121 Increases to Extensions and Improved

Recovery are the result of step-out locations drilled or proposed

to be drilled by Crew. Reserves additions for improved recovery and

extensions are combined and reported as "Extensions and Improved

Recovery".22 The aggregate of the exploration and development

expenditures incurred in the most recent financial year and the

change during that year in estimated future development capital

generally will not reflect total finding and development costs

related to reserve additions for that year.23 All 2023 financial

amounts are unaudited. See “Advisories – Unaudited Financial

Information”.24 F&D and FD&A costs above are calculated, as

noted, after changes in FDC required to bring proved undeveloped

and developed reserves into production, by dividing the identified

capital expenditures by the applicable reserves additions.25

Recycle ratio is defined as operating netback per boe divided by

F&D costs on a per boe basis. Operating netback per boe is a

Non-IFRS Measure and is calculated as revenue (excluding realized

hedging gains and losses) minus royalties, operating expenses, and

transportation expenses. Crew’s estimated operating netback per boe

in fourth quarter 2023, used in the above calculations, averaged

$22.47 per boe (unaudited). This amount is an estimate and is

subject to audit verification. See ‘Advisories - Unaudited

Financial Information’ and ‘Advisories - Information Regarding

Disclosure on Oil and Gas Reserves and Operational

Information’.

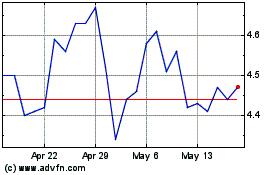

Crew Energy (TSX:CR)

Historical Stock Chart

From Nov 2024 to Dec 2024

Crew Energy (TSX:CR)

Historical Stock Chart

From Dec 2023 to Dec 2024