Crew Energy Inc. (TSX: CR; OTCQB: CWEGF) (“Crew” or the “Company”),

a growth-oriented, liquids rich natural gas producer operating in

the world-class Montney play in northeast British Columbia (“NE

BC”), is pleased to announce our operating and financial results

for the three month period ended March 31, 2023. Crew’s audited

consolidated Financial Statements and Notes, as well as

Management’s Discussion and Analysis (“MD&A”) are available on

Crew’s website and filed on SEDAR at www.sedar.com.

HIGHLIGHTS

-

32,963 boe per day1 (198 mmcfe per day) average

production in Q1/23 neared the top end of Crew’s guidance range of

31,000 to 33,000 boe per day, slightly ahead of Q4/22 volumes. Crew

realized 16% higher condensate production compared to the same

period in 2022, illustrating our ability to rapidly optimize the

production mix to maximize value, along with ongoing operational

success that supports a planned ramp up in light oil and condensate

production during H2/23.

-

155,789 mmcf per day of natural gas production in

Q1/23, 79% of total production, generating 51% of

revenue.

-

4,643 bbls per day of oil and condensate

production in Q1/23, 14% of total production,

generating 41% of revenue.

-

2,355 bbls per day of natural gas liquids5,6

(“NGLs”) production in Q1/23, 7% of total

production, generating 8% of revenue.

-

$74.5 million of Adjusted Funds Flow (“AFF”)2

($0.46 per fully diluted share3) generated in Q1/23, in line with

Q4/22, reflecting strong production volumes and robust combined

liquids pricing which helped drive operating netbacks4 that

averaged $27.22 per boe.

-

AFF2 as a percentage of

petroleum and natural gas sales (“AFF Margin”)3 reached a

record 74%, highlighting the success of our

recently completed two-year growth plan and the strength of our

2023 hedge program.

-

$22.2 million of net capital expenditures4 in

Q1/23, below our previously forecast guidance

range of $25 to $30 million as activity was limited to drilling

surface holes on the 4-32 pad and finalizing equipping of wells

that were completed in Q4/22, with the remainder invested in

facilities, pipelines and other miscellaneous items.

-

$52.4 million of Free AFF4 generated in Q1/23, a

265% increase over Q4/22, which supported Crew’s continued

deleveraging by enabling a 30% reduction in net

debt2 to $105.3 million at quarter-end, with zero drawn on

our $200 million credit facility.

-

Improved net debt2 to trailing last twelve-month

(“LTM”) EBITDA3 ratio which declined to 0.3 times

at March 31, 2023, from 0.4 times at year-end 2022.

-

$41.4 million in positive after-tax net income

($0.26 per fully diluted share) was realized during the quarter,

compared to a loss in the same period of 2022.

-

Cash costs per boe4 of $9.40 in Q1/23 represents a

two percent improvement over $9.61 per boe in Q1/22, reflecting

lower financing expenses.

-

Subsequent to quarter-end, Crew redeemed the

balance of our $172 million of outstanding Senior Unsecured Notes

at par on April 28, 2023, using cash on hand and drawings on the

bank line, and also extended our $200 million bank

facility maturity to May 2025 with no financial maintenance

covenants and no minimum liquidity requirements.

FINANCIAL & OPERATING

HIGHLIGHTS

|

FINANCIAL ($ thousands, except per share

amounts) |

Three monthsendedMar. 31,

2023 |

Three monthsendedMar. 31, 2022 |

|

Petroleum and natural gas sales |

100,681 |

130,432 |

|

| Cash provided by

operating activities |

66,644 |

55,082 |

|

| Adjusted funds

flow2 |

74,517 |

77,660 |

|

| Per share3 – basic |

0.48 |

0.51 |

|

|

– diluted |

0.46 |

0.48 |

|

| Net income

(loss) |

41,354 |

(1,377 |

) |

| Per share – basic |

0.27 |

(0.01 |

) |

|

– diluted |

0.26 |

(0.01 |

) |

| Property, plant and

equipment expenditures |

22,161 |

55,361 |

|

|

Net property dispositions4 |

- |

- |

|

|

Net capital expenditures4 |

22,161 |

55,361 |

|

|

Capital Structure($ thousands) |

As at Mar. 31, 2023 |

As at Dec. 31, 2022 |

|

Working capital surplus2 |

84,386 |

|

21,844 |

|

| Other long-term

obligations |

(18,223 |

) |

- |

|

| Senior

unsecured notes |

(171,448 |

) |

(171,298 |

) |

|

Net debt2 |

(105,285 |

) |

(149,454 |

) |

|

Common shares outstanding (thousands) |

153,494 |

|

154,377 |

|

|

OPERATIONAL |

Three monthsendedMar. 31,

2023 |

Three monthsendedMar. 31, 2022 |

|

Daily production |

|

|

|

Light crude oil (bbl/d)7 |

71 |

116 |

|

Condensate (bbl/d) |

4,572 |

3,926 |

|

Natural gas liquids (“ngl”)5,6 (bbl/d) |

2,355 |

2,856 |

|

Conventional natural gas (mcf/d) |

155,789 |

159,007 |

|

Total (boe/d @ 6:1) |

32,963 |

33,399 |

| Average

realized3 |

|

|

|

Light crude oil price ($/bbl) |

84.56 |

107.35 |

|

Natural gas liquids price ($/bbl) |

38.80 |

48.72 |

|

Condensate price ($/bbl) |

98.33 |

116.27 |

|

Natural gas price ($/mcf) |

3.67 |

5.29 |

|

Commodity price ($/boe) |

33.94 |

43.39 |

|

|

Three monthsendedMar. 31,

2023 |

Three monthsendedMar. 31, 2022 |

|

Netback ($/boe) |

|

|

|

Petroleum and natural gas sales |

33.94 |

|

43.39 |

|

|

Royalties |

(4.13 |

) |

(2.78 |

) |

|

Realized gain (loss) on derivative financial instruments |

4.72 |

|

(5.16 |

) |

|

Net operating costs4 |

(4.02 |

) |

(3.50 |

) |

|

Net transportation costs4 |

(3.29 |

) |

(3.12 |

) |

|

Operating netback4 |

27.22 |

|

28.83 |

|

|

General and administrative (“G&A”) |

(1.14 |

) |

(0.96 |

) |

|

Financing expenses on debt4 |

(0.95 |

) |

(2.03 |

) |

|

Adjusted funds flow2 |

25.13 |

|

25.84 |

|

___________________________

1 See table in the Advisories for production

breakdown by product type as defined in NI 51-101.

2 Capital management measure that does not have

any standardized meaning as prescribed by International Financial

Reporting Standards, and therefore, may not be comparable with the

calculations of similar measures for other entities. See

“Advisories - Non-IFRS and Other Financial Measures” contained

within this press release.

3 Supplementary financial measure that does not

have any standardized meaning as prescribed by International

Financial Reporting Standards, and therefore, may not be comparable

with the calculations of similar measures for other entities. See

“Advisories - Non-IFRS and Other Financial Measures” contained

within this press release.

4 Non-IFRS financial measure or ratio that does

not have any standardized meaning as prescribed by International

Financial Reporting Standards, and therefore, may not be comparable

with calculations of similar measures or ratios for other entities.

See “Advisories - Non-IFRS and Other Financial Measures” contained

within this press release and in our most recently filed MD&A,

available on SEDAR at www.sedar.com.

5 Throughout this news release, NGLs comprise

all natural gas liquids as defined in National Instrument 51-101,

Standards of Disclosure for Oil and Gas Activities (“NI 51-101”),

other than condensate, which is disclosed separately, and natural

gas means conventional natural gas by NI 51-101 product type.

6 Excludes condensate volumes which have been

reported separately.

7 Throughout this news release, light crude oil

refers to light and medium crude oil product type as defined by

National Instrument 51-101 Standards of Disclosure for Oil and Gas

Activities ("NI 51-101").

FOUR-YEAR PLAN UPDATE

Crew’s four-year plan, announced at the end of

2022 (the “Four-Year Plan”8), is designed to leverage our momentum

and strong financial position to significantly increase size and

scale through 2026. Successful implementation of this Four-Year

Plan would enable the Company to meaningfully increase production,

targeting growth in excess of 60,000 boe per day.

A key driver behind the Four-Year Plan is the

expansion of our gas processing infrastructure, including the

construction of an electrified 180 mmcf per day deep-cut gas plant

in the Company’s Groundbirch area which is ideally located to

supply natural gas to Canada’s future liquified natural gas (“LNG”)

export facilities. The progression of our Groundbirch area

development plan is dependent on all necessary permits being

obtained, supportive commodity prices and securing the requisite

financing while maintaining conservative debt leverage metrics.

With current spot and future strip natural gas prices remaining

depressed due largely to an ongoing global supply and demand

imbalance, Crew plans to prudently advance the Four-Year Plan by

monitoring price signals for additional hedging opportunities and

continuing to explore a variety of project financing options.

OPERATIONS UPDATE & AREA OVERVIEW

NE BC Montney (Greater

Septimus)

- Crew’s first

quarter capital program concentrated on drilling surface holes for

four (4.0 net) of a planned five (5.0 net) wells at the 4-32 pad,

which are slated to be drilled through Q2 2023, and finalizing

equipping activities on five wells at the 11-27 pad that were

initially brought on for testing before the end of 2022.

- Average production

from the five (5.0 net) extended reach horizontal (“ERH”)

ultra-condensate rich (“UCR”) wells that that were completed on the

11-27 pad have produced wellhead rates of 1,463 mcf per day of

natural gas and 575 bbls per day of condensate over the first 90

days of production (IP90).

- Engineering work

and equipment purchases commenced for Crew’s condensate

stabilization project at the Septimus Gas Plant in Q1/23, which is

expected to increase the plant’s condensate capacity to 5,000 bbls

per day and facilitate expanded development of our ultra-condensate

rich area. Installation of the condensate stabilization equipment

is expected to be completed in Q3/23.

- Construction was

initiated on the Company’s North Septimus 2-24 UCR pad and North

Septimus 6-18 UCR pad. These wells are planned to be drilled in the

summer of 2023 following the drilling of the five new wells on the

4-32 pad.

Groundbirch

-

The original three wells on the 4-17 pad have produced an average

of 2.94 bcf of natural gas over 440 days, exceeding our independent

reserve evaluator’s year-end 2022 proved plus probable type curve

by 34% to date.

-

The five (5.0 net) ERH wells in the second phase of development at

Crew’s 4-17 pad continue to exceed internal type curve estimates,

with an average per well raw gas production rate over 210 days

(“IP210”) of 6,224 mcf per day.

-

Engineering design is continuing for Crew’s Groundbirch plant which

will expand our gas processing infrastructure and support future

growth in our Four-Year Plan.

-

The Upper Montney at Groundbirch is approximately 470 feet in

thickness and has four prospective zones, all of which were tested

through Crew’s 4-17 exploration and development program in 2021 and

2022, with each zone having generated promising initial commercial

development rates. Drilling and testing results at Groundbirch have

demonstrated the strength of our asset base, positioning the

Company with decades of potential development runway.

-

Crew currently holds 24 well permits in the Groundbirch area, with

60 well permit applications submitted and pending approval.

Other NE BC Montney

-

The Company currently has six drilled but uncompleted ERH wells on

the 15-28 pad at Tower, which are planned to be completed in Q3/23.

The wells target light oil in the upper Montney “B” and “C” zones

and feature lateral lengths of over 4,000 meters.

RISK MANAGEMENT PROFILE

To secure a base level of AFF2 to fund planned

capital projects, Crew continues to utilize hedging to limit

exposure to fluctuations in commodity prices and foreign exchange

rates, while allowing for participation in spot commodity prices.

As of May 8, 2023, the Company’s hedging profile includes:

-

For the remainder of Q2/23, approximately 72,500 GJ per day at

C$4.24 per GJ, or C$5.17 per mcf using Crew’s higher heat content

factor, and 1,500 bbls per day of condensate at an average price of

C$106.08 per bbl.

-

For the second half of 2023, approximately 70,000 GJ per day at

C$4.26 per GJ, or C$5.20 per mcf using Crew’s heat content factor,

and 1,250 bbls per day of condensate at an average price of

C$100.25 per bbl.

SUSTAINABILITY AND ESG INITIATIVES

Crew's commitment to environmental, social and

governance (“ESG”) initiatives remained a key focus in Q1/23 as we

continue to invest in developing sustainable solutions to

complement our corporate growth. Our Q1/23 ESG highlights

include:

- Continued to demonstrate our strong

commitment to safety with no recordable or lost time injuries in

Q1/23.

-

Directed a total of $3.5 million to abandonment and reclamation

activities during Q1/23, with 11 wells cut and capped.

- Recorded no

reportable spills in the first quarter of 2023.

-

Invested 80 volunteer hours as well as financial contributions into

community support initiatives and not-for-profit organizations in

the quarter, geared towards helping the health, well-being, and

economies of our local communities as part of our “Crew Cares”

initiative.

In the summer of 2023, Crew anticipates

releasing an updated digital ESG Report, which will be available

for viewing at www.esg.crewenergy.com. The updated report will

feature Crew’s latest sustainability initiatives and data

performance tables.

OUTLOOK

- 2023

Guidance Reaffirmed - With persistent supply and demand

imbalances across parts of North America and Europe leading to low

natural gas prices, the Company reaffirms guidance which

prioritizes light oil and condensate production over natural gas

production and the maintenance of conservative leverage metrics.

Crew’s full year 2023 net capital expenditures4 budget is

forecasted to be $190 to $210

million, comprising plans to:

- Drill 15 (15.0 net)

Montney wells

- Complete, equip and

tie-in 12 (12.0 net) wells

- Maintain 2023

average production at 30,000 to

32,000 boe per day1 targeting an exit rate of

32,000 to 34,000 boe per

day1

- Hold an inventory

of ten (10.0 net) drilled and uncompleted UCR wells at year end

2023

- Achieve combined

light oil and condensate production over 6,000 bbls per day in

Q4/23, representing over 50% growth from Q4/22

-

To date, Crew has not encountered any infrastructure damage or

production curtailments due to the current wildfires in British

Columbia and northwest Alberta. We continue to monitor the

situation and will provide an update if conditions were to

change.

-

Q2/23 net capital expenditures4 are forecast at

$28 to $32 million with average

production of 28,000 to 30,000

boe per day1, a function of firm transportation restrictions,

natural production declines and shutting in production due to low

natural gas prices.

The following table sets forth Crew’s reaffirmed

guidance and underlying material assumptions:

|

|

2023 Guidance and

Assumptions9 |

|

Net capital expenditures4 ($Millions) |

190-210 |

| Annual average production1

(boe/d) |

30,000–32,000 |

| Adjusted funds flow2

($Millions) |

240-260 |

| Free adjusted funds flow4

($Millions) |

30-70 |

| EBITDA4 ($Millions) |

250-270 |

| Oil price (WTI)($US per

bbl) |

$75.00 |

| Natural gas price (NYMEX) ($US

per mmbtu) |

$3.20 |

| Natural gas price (AECO 5A)

($C per mcf) |

$2.85 |

| Natural gas price (Crew est.

wellhead) ($C per mcf) |

$3.30 |

| Foreign exchange

($US/$CAD) |

$0.74 |

| Royalties |

9–11% |

| Net operating costs4 ($ per

boe) |

$4.50–$5.00 |

| Net transportation costs4 ($

per boe) |

$3.50–$4.00 |

| G&A ($ per boe) |

$1.00–$1.20 |

|

Effective interest rate on long-term debt |

6.5–7.5% |

|

2023 Sensitivities (Q2 to Q4) |

AFF ($MM) |

AFF/Share |

FD AFF/Share |

|

100 bbl per day Condensate |

$3.2 |

$0.02 |

$0.02 |

| C$1.00 per bbl WTI |

$1.2 |

$0.01 |

$0.01 |

| US $0.10 NYMEX (per

mmbtu) |

$3.2 |

$0.02 |

$0.02 |

| 1 mmcf per day natural

gas |

$1.0 |

$0.01 |

$0.01 |

| $0.10 AECO 5A (per GJ) |

$2.3 |

$0.01 |

$0.01 |

| $0.01

FX CAD/US |

$2.6 |

$0.02 |

$0.02 |

| |

|

|

|

ANNUAL SHAREHOLDER MEETING

Crew’s Annual General Meeting will be held in

the Bow River Room/Bow Glacier Room, 3rd floor, 250-5th Street

S.W., Centennial Place, West Tower, Calgary, Alberta on Thursday,

the 11th day of May, 2023 at 3:00 p.m. (Calgary time). Further

meeting details are available within the Company’s 2023 Information

Circular, which can be viewed on our profile on SEDAR at

www.sedar.com and on our website at www.crewenergy.com.

Crew’s world class Montney asset base,

operational excellence and financial strength positions the Company

to succeed in dynamic market conditions by providing optionality to

adjust our capital program to optimize our production mix, ensuring

long term sustainability. Our dedicated team is excited to continue

delivering long-term shareholder value through innovation and

adaptability, supported by a robust risk management program and

proven strategy which enables us to achieve our goals while

maintaining a safe and responsible operating culture. We express

our gratitude to our stakeholders for their commitment and ongoing

support of Crew in this dynamic environment.

ADVISORIES

Forward-Looking Information and

Statements

This news release contains certain

forward–looking information and statements within the meaning of

applicable securities laws. The use of any of the words "expect",

"anticipate", "continue", "estimate", "may", "will", "project",

"should", "believe", "plans", "intends" “forecast” “targets” and

similar expressions are intended to identify forward-looking

information or statements. In particular, but without limiting the

foregoing, this news release contains forward-looking information

and statements pertaining to the following: the ability to execute

on its Four-Year Plan and underlying strategy, plans, goals and

targets, all as more particularly outlined and described in this

press release; our 2023 annual capital budget range (the "2023

Budget"), associated drilling and completion plans, the anticipated

timing thereof, and all associated near term initiatives, goals and

targets, along with all guidance and underlying assumptions related

to the 2023 Budget as outlined in the “Outlook” section in this

press release; production and type-curve estimates and targets

under the 2023 Budget and balance of the Four-Year Plan;

infrastructure plans and anticipated benefits outlined in this

press release including construction of the Groundbirch plant;

completion of the Company’s condensate stabilization project at its

Septimus Gas Plant and anticipated benefits thereof; anticipated

timing and assumed receipt of all regulatory approvals required in

connection therewith; our ability to secure financing for the

Groundbirch plant and timing thereof; forecast improvement in debt

and leverage metrics; commodity price expectations and assumptions;

Crew's commodity risk management programs and future hedging plans;

marketing and transportation and processing plans and requirements;

estimates of processing capacity and requirements; anticipated

reductions in GHG emissions and decommissioning obligations; future

liquidity and financial capacity and ability to finance our

Four-Year Plan; future results from operations and operating and

leverage metrics; targeted debt levels and leverage metrics over

the course of the Four-Year Plan; world supply and demand

projections and long-term impact on pricing; future development,

exploration, acquisition and disposition activities (including our

capital investment model through 2026 and associated drilling and

completion plans, associated receipt of all required regulatory

permits for our Four-Year Plan, development timing and cost

estimates); the potential to serve a Canadian LNG market; the

potential of our Groundbirch area to be a core area of future

development and the anticipated commerciality of up to four

potential prospective zones to be drilled; the successful

implementation of our ESG initiatives and anticipated releases of

our updated ESG Report; and significant emissions intensity

improvements going forward; the amount and timing of capital

projects; and anticipated improvement in our long-term

sustainability and the expected positive attributes discussed

herein attributable to our Four-Year Plan.

The internal projections, expectations, or

beliefs underlying our Board approved 2023 Budget and associated

guidance, as well as management's preliminary strategy, and

associated plans, goals and targets in respect of the balance of

its Four-Year Plan, are subject to change in light of, without

limitation, the Russia/Ukraine conflict and any related actions

taken by businesses and governments, ongoing results, prevailing

economic circumstances, volatile commodity prices, resulting

changes in our underlying assumptions, goals and targets provided

herein and changes in industry conditions and regulations. Crew's

financial outlook and guidance provides shareholders with relevant

information on management's expectations for results of operations,

excluding any potential acquisitions or dispositions, for such time

periods based upon the key assumptions outlined herein. In this

press release reference is made to the Company's longer range 2024

and beyond internal plan and associated economic model. Such

information reflects internal goals and targets used by management

for the purposes of making capital investment decisions and for

internal long-range planning and future budget preparation. Readers

are cautioned that events or circumstances and updates to

underlying assumptions could cause capital plans and associated

results to differ materially from those predicted and Crew's

guidance for 2023, and more particularly its internal plan, goals

and targets for 2024 and beyond which are not based upon Board

approved budget(s) at this time, may not be appropriate for other

purposes. Accordingly, undue reliance should not be placed on

same.

In addition, forward-looking statements or

information are based on several material factors, expectations or

assumptions of Crew which have been used to develop such statements

and information, but which may prove to be incorrect. Although Crew

believes that the expectations reflected in such forward-looking

statements or information are reasonable, undue reliance should not

be placed on forward-looking statements because Crew can give no

assurance that such expectations will prove to be correct. In

addition to other factors and assumptions which may be identified

herein, assumptions have been made regarding, among other things:

that Crew will continue to conduct its operations in a manner

consistent with past operations; results from drilling and

development activities consistent with past operations; the quality

of the reservoirs in which Crew operates and continued performance

from existing wells; the continued and timely development of

infrastructure in areas of new production; the accuracy of the

estimates of Crew’s reserve volumes; certain commodity price and

other cost assumptions; continued availability of debt and equity

financing and cash flow to fund Crew’s current and future plans and

expenditures; the impact of increasing competition; the general

stability of the economic and political environment in which Crew

operates; that future business, regulatory and industry conditions

will be within the parameters expected by Crew; the general

continuance of current industry conditions; the timely receipt of

any required regulatory approvals; the ability of Crew to obtain

qualified staff, equipment and services in a timely and cost

efficient manner; drilling results; the ability of the operator of

the projects in which Crew has an interest in to operate the field

in a safe, efficient and effective manner; the ability of Crew to

obtain financing on acceptable terms; field production rates and

decline rates; the ability to replace and expand oil and natural

gas reserves through acquisition, development and exploration; the

timing and cost of pipeline, storage and facility construction and

expansion and the ability of Crew to secure adequate product

transportation; future commodity prices; currency, exchange and

interest rates; regulatory framework regarding royalties, taxes,

environmental and indigenous matters in the jurisdictions in which

Crew operates; that regulatory authorities in British Columbia

continue granting approvals for oil and gas activities on time

frames, and on terms and conditions, consistent with past

practices; and the ability of Crew to successfully market its oil

and natural gas products.

The forward-looking information and statements

included in this news release are not guarantees of future

performance and should not be unduly relied upon. Such information

and statements, including the assumptions made in respect thereof,

involve known and unknown risks, uncertainties and other factors

that may cause actual results or events to defer materially from

those anticipated in such forward-looking information or statements

including, without limitation: the continuing and uncertain impact

of pandemics and the Russia / Ukraine conflict; changes in

commodity prices; changes in the demand for or supply of Crew's

products, the early stage of development of some of the evaluated

areas and zones and the potential for variation in the quality of

the Montney formation; interruptions, unanticipated operating

results or production declines; changes in tax or environmental

laws, royalty rates; climate change regulations, or other

regulatory matters; changes in development plans of Crew or by

third party operators of Crew's properties, increased debt levels

or debt service requirements; inaccurate estimation of Crew's oil

and gas reserve volumes; limited, unfavourable or a lack of access

to capital markets; increased costs; a lack of adequate insurance

coverage; the impact of competitors; and certain other risks

detailed from time-to-time in Crew's public disclosure documents

(including, without limitation, those risks identified in this news

release and Crew's MD&A and Annual Information Form).

This press release contains future-oriented

financial information and financial outlook information

(collectively, "FOFI") about Crew's prospective capital

expenditures, all of which are subject to the same assumptions,

risk factors, limitations, and qualifications as set forth in the

above paragraphs. The actual results of operations of Crew and the

resulting financial results will likely vary from the amounts set

forth in this press release and such variation may be material.

Crew and its management believe that the FOFI has been prepared on

a reasonable basis, reflecting management's best estimates and

judgments. However, because this information is subjective and

subject to numerous risks, it should not be relied on as

necessarily indicative of future results. Except as required by

applicable securities laws, Crew undertakes no obligation to update

such FOFI. FOFI contained in this press release was made as of the

date of this press release and was provided for the purpose of

providing further information about Crew's anticipated future

business operations. Readers are cautioned that the FOFI contained

in this press release should not be used for purposes other than

for which it is disclosed herein.

The forward-looking information and statements

contained in this news release speak only as of the date of this

news release, and Crew does not assume any obligation to publicly

update or revise any of the included forward-looking statements or

information, whether as a result of new information, future events

or otherwise, except as may be required by applicable securities

laws.

Risk Factors to the Company’s Four-Year

Plan

Risk factors that could materially impact

successful execution and actual results of the Four-Year Plan

include:

- volatility of

petroleum and natural gas prices and inherent difficulty in the

accuracy of predictions related thereto;

- changes in Federal

and Provincial regulations;

- execution of

construction timelines from BC Hydro to support the electrification

of the Groundbirch plant;

- receipt of

high-value regulatory permits required to launch development under

the Four-Year Plan;

- the Company’s

ability to secure financing for the Groundbirch plant sourced from

AFF, bank or other Debt instruments, asset sales, equity issuance,

infrastructure financing or some combination thereof; and

- Those additional

risk factors set forth in the Company’s MD&A and most recent

Annual Information Form filed on SEDAR.

Information Regarding Disclosure on Oil

and Gas Operational Information

All amounts in this news release are stated in

Canadian dollars unless otherwise specified. This press release

contains metrics commonly used in the oil and natural gas industry.

Each of these metrics are determined by Crew as specifically set

forth in this news release. These terms do not have standardized

meanings or standardized methods of calculation and therefore may

not be comparable to similar measures presented by other companies,

and therefore should not be used to make such comparisons. Such

metrics have been included to provide readers with additional

information to evaluate the Company’s performance however, such

metrics are not reliable indicators of future performance and

therefore should not be unduly relied upon for investment or other

purposes. See "Non-IFRS and Other Financial Measures" below for

additional disclosures.

Test Results and Initial Production

Rates

A pressure transient analysis or well-test

interpretation has not been carried out and thus certain of the

test results provided herein should be preliminary until such

analysis or interpretation has been completed. Test results and

initial production (“IP”) rates disclosed herein, particularly

those short in duration, may not necessarily be indicative of

long-term performance or of ultimate recovery.

BOE and Mcfe Conversions

Measurements expressed in barrel of oil

equivalents, BOEs or Mcfe may be misleading, particularly if used

in isolation. A BOE conversion ratio of 6 mcf: 1 bbl and an Mcfe

conversion ratio of 1 bbl:6 Mcf are based on an energy equivalency

conversion method primarily applicable at the burner tip and do not

represent a value equivalency at the wellhead. Given that the value

ratio based on the current price of crude oil as compared to

natural gas is significantly different than the energy equivalency

of 6:1, utilizing the 6:1 conversion ratio may be misleading as an

indication of value.

Non-IFRS and Other Financial

Measures

Throughout this press release and other

materials disclosed by the Company, Crew uses certain measures to

analyze financial performance, financial position and cash flow.

These non-IFRS and other specified financial measures do not have

any standardized meaning prescribed under IFRS and therefore may

not be comparable to similar measures presented by other entities.

The non-IFRS and other specified financial measures should not be

considered alternatives to, or more meaningful than, financial

measures that are determined in accordance with IFRS as indicators

of Crew’s performance. Management believes that the presentation of

these non-IFRS and other specified financial measures provides

useful information to shareholders and investors in understanding

and evaluating the Company’s ongoing operating performance, and the

measures provide increased transparency and the ability to better

analyze Crew’s business performance against prior periods on a

comparable basis.

Capital Management Measures

a) Funds from

Operations and Adjusted Funds Flow (“AFF”)

Funds from operations represents cash provided

by operating activities before changes in operating non-cash

working capital, accretion of deferred financing charges and

transaction costs on property dispositions. Adjusted funds flow

represents funds from operations before decommissioning obligations

settled (recovered). The Company considers these metrics as key

measures that demonstrate the ability of the Company’s continuing

operations to generate the cash flow necessary to maintain

production at current levels and fund future growth through capital

investment and to service and repay debt. Management believes that

such measures provide an insightful assessment of the Company's

operations on a continuing basis by eliminating certain non-cash

charges, actual settlements of decommissioning obligations and

transaction costs on property dispositions, the timing of which is

discretionary. Funds from operations and adjusted funds flow should

not be considered as an alternative to or more meaningful than cash

provided by operating activities as determined in accordance with

IFRS as an indicator of the Company’s performance. Crew’s

determination of funds from operations and adjusted funds flow may

not be comparable to that reported by other companies. Crew also

presents adjusted funds flow per share whereby per share amounts

are calculated using weighted average shares outstanding consistent

with the calculation of income per share. The applicable

reconciliation to the most directly comparable measure, cash

provided by operating activities, is contained under “free adjusted

funds flow” below.

b) Net Debt and

Working Capital Surplus (Deficiency)

Crew closely monitors its capital structure with

a goal of maintaining a strong balance sheet to fund the future

growth of the Company. The Company monitors net debt as part of its

capital structure. The Company uses net debt (bank debt plus

working capital deficiency or surplus, excluding the current

portion of the fair value of financial instruments) as an

alternative measure of outstanding debt. Management considers net

debt and working capital deficiency (surplus) an important measure

to assist in assessing the liquidity of the Company.

Non-IFRS Financial Measures and

Ratios

a) Net Property

Acquisitions (Dispositions)

Net property acquisitions (dispositions) equals

property acquisitions less property dispositions and transaction

costs on property dispositions. Crew uses net property acquisitions

(dispositions) to measure its total capital investment compared to

the Company’s annual capital budgeted expenditures. The most

directly comparable IFRS measures to net property acquisitions

(dispositions) are property acquisitions and property

dispositions.

b) Net Capital

Expenditures

Net capital expenditures equals exploration and

development expenditures less net property acquisitions

(dispositions). Crew uses net capital expenditures to measure its

total capital investment compared to the Company’s annual capital

budgeted expenditures. The most directly comparable IFRS measure to

net capital expenditures is property, plant and equipment

expenditures.

|

($ thousands) |

Three months endedMarch 31,

2023 |

Three months endedDecember 31, 2022 |

Three months endedMarch 31, 2022 |

|

Property, plant and equipment expenditures |

22,161 |

60,639 |

55,361 |

| Less: Net property

dispositions |

- |

(7) |

- |

|

Net capital expenditures |

22,161 |

60,632 |

55,361 |

| |

|

|

|

c) EBITDA

EBITDA is calculated as consolidated net income

(loss) before interest and financing expenses, income taxes,

depletion, depreciation and amortization, adjusted for certain

non-cash, extraordinary and non-recurring items primarily relating

to unrealized gains and losses on financial instruments and

impairment losses. The Company considers this metric as key

measures that demonstrate the ability of the Company’s continuing

operations to generate the cash flow necessary to maintain

production at current levels and fund future growth through capital

investment and to service and repay debt. The most directly

comparable IFRS measure to EBITDA is cash provided by operating

activities.

|

($ thousands) |

Three months endedMarch 31,

2023 |

Three months endedDecember 31, 2022 |

Three months endedMarch 31, 2022 |

|

Adjusted funds flow |

74,517 |

74,994 |

77,660 |

|

Financing expenses on debt |

2,815 |

2,971 |

6,094 |

|

EBITDA |

77,332 |

77,965 |

83,754 |

| |

|

|

|

d) Free Adjusted

Funds Flow

Free adjusted funds flow represents adjusted

funds flow less capital expenditures, excluding acquisitions and

dispositions. The Company considers this metric a key measure that

demonstrates the ability of the Company’s continuing operations to

fund future growth through capital investment and to service and

repay debt. The most directly comparable IFRS measure to free

adjusted funds flow is cash provided by operating activities.

|

($ thousands) |

Three months endedMarch 31,

2023 |

Three months endedDecember 31, 2022 |

Three months endedMarch 31, 2022 |

|

|

|

|

|

|

Cash provided by operating activities |

66,644 |

62,570 |

55,082 |

|

Change in operating non-cash working capital |

4,520 |

7,565 |

19,675 |

|

Accretion of deferred financing charges |

(150) |

(149) |

(246) |

|

Funds from operations |

71,014 |

69,986 |

74,511 |

|

Decommissioning obligations settled excluding government

grants |

3,503 |

5,008 |

3,149 |

|

Adjusted funds flow |

74,517 |

74,994 |

77,660 |

|

Less: property, plant and equipment expenditures |

22,161 |

60,639 |

55,361 |

|

Free adjusted funds flow |

52,356 |

14,355 |

22,299 |

| |

|

|

|

e) Net Operating

Costs

Net operating costs equals operating expenses

net of processing revenue. Management views net operating costs as

an important measure to evaluate its operational performance. The

most directly comparable IFRS measure for net operating costs is

operating expenses.

|

($ thousands, except per boe) |

Three months endedMarch 31,

2023 |

Three months endedDecember 31, 2022 |

Three months endedMarch 31, 2022 |

|

|

|

|

|

| Operating expenses |

12,558 |

11,115 |

11,359 |

|

Processing revenue |

(636) |

(616) |

(830) |

|

Net operating costs |

11,922 |

10,499 |

10,529 |

| Per

boe |

4.02 |

3.47 |

3.50 |

| |

|

|

|

f) Net Operating

Costs per boe

Net operating costs per boe equals net operating

costs divided by production. Management views net operating costs

per boe as an important measure to evaluate its operational

performance. The calculation of Crew’s net operating costs per boe

can be seen in the non-IFRS measure entitled “Net Operating Costs”

above.

g) Net

Transportation Costs

Net transportation costs equals transportation

expenses net of transportation revenue. Management views net

transportation costs as an important measure to evaluate its

operational performance. The most directly comparable IFRS measure

for net transportation costs is transportation expenses. The

calculation of Crew’s net transportation costs can be seen in the

section entitled “Net Transportation Costs” of this MD&A.

|

($ thousands, except per boe) |

Three months endedMarch 31,

2023 |

Three months endedDecember 31, 2022 |

Three months endedMarch 31, 2022 |

|

|

|

|

|

| Transportation expenses |

11,288 |

10,701 |

10,845 |

|

Transportation revenue |

(1,520) |

(1,485) |

(1,453) |

|

Net transportation costs |

9,768 |

9,216 |

9,392 |

| Per

boe |

3.29 |

3.05 |

3.12 |

| |

|

|

|

h) Net

Transportation Costs per boe

Net transportation costs per boe equals net

transportation costs divided by production. Management views net

transportation costs per boe as an important measure to evaluate

its operational performance.

i) Operating

Netback per boe

Operating netback per boe equals petroleum and

natural gas sales including realized gains and losses on commodity

related derivative financial instruments, marketing income, less

royalties, net operating costs and transportation costs calculated

on a boe basis. Management considers operating netback per boe an

important measure to evaluate its operational performance as it

demonstrates its field level profitability relative to current

commodity prices.

|

($/boe) |

Three months endedMarch 31,

2023 |

Three months endedDecember 31, 2022 |

Three months endedMarch 31, 2022 |

|

|

|

|

|

|

Petroleum and natural gas sales |

33.94 |

45.25 |

43.39 |

|

Royalties |

(4.13) |

(6.09) |

(2.78) |

|

Realized gain (loss) on derivative financial instruments |

4.72 |

(5.72) |

(5.16) |

|

Net operating costs |

(4.02) |

(3.47) |

(3.50) |

|

Net transportation costs |

(3.29) |

(3.05) |

(3.12) |

|

Operating netbacks |

27.22 |

26.92 |

28.83 |

|

Production (boe/d) |

32,963 |

32,893 |

33,399 |

| |

|

|

|

j) Cash costs per

boe

Cash costs per boe is comprised of net

operating, transportation, general and administrative and financing

expenses on debt calculated on a boe basis. Management views cash

costs per boe as an important measure to evaluate its operational

performance.

|

($/boe) |

Three months endedMarch. 31,

2023 |

Three months endedDecember. 31, 2022 |

Three months endedMarch. 31, 2022 |

|

|

|

|

|

| Net operating costs |

4.02 |

3.47 |

3.50 |

| Net transportation costs |

3.29 |

3.05 |

3.12 |

| General and administrative

expenses |

1.14 |

1.17 |

0.96 |

|

Financing expenses on debt |

0.95 |

0.98 |

2.03 |

|

Cash costs |

9.40 |

8.67 |

9.61 |

| |

|

|

|

k) Financing

expenses on debt per boe

Financing expenses on debt per boe is comprised

of the sum of interest on bank loan and other, interest on senior

notes and accretion of deferred financing charges, divided by

production. Management views financing expenses on debt per boe as

an important measure to evaluate its cost of debt financing.

|

($ thousands, except per boe) |

Three months endedMarch 31,

2023 |

Three months endedDecember 31, 2022 |

Three months endedMarch 31, 2022 |

|

|

|

|

|

| Interest on bank loan and

other |

(92) |

4 |

1,040 |

| Interest on senior notes |

2,757 |

2,818 |

4,808 |

|

Accretion of deferred financing charges |

150 |

149 |

246 |

|

Financing expenses on debt |

2,815 |

2,971 |

6,094 |

| Production (boe/d) |

32,963 |

32,893 |

33,399 |

|

Financing expenses on debt per boe |

0.95 |

0.98 |

2.03 |

| |

|

|

|

Supplementary Financial

Measures

“Adjusted fund flow margin” is

comprised of adjusted funds flow divided by petroleum and natural

gas sales.

"Adjusted funds flow per basic

share" is comprised of adjusted funds flow divided by the

basic weighted average common shares.

"Adjusted funds flow per diluted

share" is comprised of adjusted funds flow divided by the

diluted weighted average common shares.

"Adjusted funds flow per boe"

is comprised of adjusted funds flow divided by total

production.

"Average realized commodity

price" is comprised of commodity sales from production, as

determined in accordance with IFRS, divided by the Company's

production. Average prices are before deduction of net

transportation costs and do not include gains and losses on

financial instruments.

“Average realized light crude oil

price” is comprised of light crude oil commodity sales

from production, as determined in accordance with IFRS, divided by

the Company’s light crude oil production. Average prices are before

deduction of net transportation costs and do not include gains and

losses on financial instruments.

"Average realized ngl price" is

comprised of ngl commodity sales from production, as determined in

accordance with IFRS, divided by the Company's ngl production.

Average prices are before deduction of net transportation costs and

do not include gains and losses on financial instruments.

“Average realized condensate

price” is comprised of condensate commodity sales from

production, as determined in accordance with IFRS, divided by the

Company’s condensate production. Average prices are before

deduction of net transportation costs and do not include gains and

losses on financial instruments.

"Average realized natural gas

price" is comprised of natural gas commodity sales from

production, as determined in accordance with IFRS, divided by the

Company's natural gas production. Average prices are before

deduction of net transportation costs and do not include gains and

losses on financial instruments.

"Net debt to last twelve months (“LTM”)

EBITDA" is calculated as net debt at a point in time

divided by EBITDA earned from that point back for the trailing

twelve months.

Supplemental Information Regarding

Product Types

References to gas or natural gas and NGLs in

this press release refer to conventional natural gas and natural

gas liquids product types, respectively, as defined in National

Instrument 51-101, Standards of Disclosure for Oil and Gas

Activities ("NI 51-101"), except where specifically noted

otherwise.

The following is intended to provide the product

type composition for each of the production figures provided

herein, where not already disclosed within tables above:

| |

Light & Medium Crude Oil |

Condensate |

Natural Gas Liquids1 |

ConventionalNatural Gas |

Total(boe/d) |

|

Q2 2023 Average |

0 |

% |

13 |

% |

7 |

% |

80 |

% |

28,000-30,000 |

| 2023 Annual

Average |

2 |

% |

13 |

% |

7 |

% |

78 |

% |

30,000-32,000 |

|

2023 Exit Rate |

6 |

% |

14 |

% |

7 |

% |

73 |

% |

32,000-34,000 |

Notes:1) Excludes condensate volumes which

have been reported separately.

Crew is a growth-oriented natural gas and

liquids producer, committed to pursuing sustainable per share

growth through a balanced mix of financially and socially

responsible exploration and development. The Company’s operations

are exclusively located in northeast British Columbia and feature a

vast Montney resource with a large contiguous land base in the

Greater Septimus, Tower and Groundbirch areas in British Columbia,

offering significant development potential over the long-term. Crew

has access to diversified markets with operated infrastructure and

access to multiple pipeline egress options. The Company’s common

shares are listed for trading on the Toronto Stock Exchange (“TSX”)

under the symbol “CR” and on the OTCQB in the US under ticker

“CWEGF”.

FOR DETAILED INFORMATION, PLEASE

CONTACT:

|

Dale Shwed, President and CEO |

Phone: (403) 266-2088 |

| John Leach, Executive Vice

President and CFO |

Email:

investor@crewenergy.com |

___________________________

8 Crew’s plans, goals and targets for 2024 and beyond remain

preliminary in nature and do not, at this time, reflect a Board

approved capital expenditures budget. Accordingly, undue reliance

should not be placed on the same.

9 The actual results of operations of Crew and

the resulting financial results will likely vary from the estimates

and material underlying assumptions set forth in this guidance by

the Company and such variation may be material. The guidance and

material underlying assumptions have been prepared on a reasonable

basis, reflecting management's best estimates and judgments.

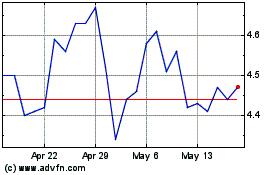

Crew Energy (TSX:CR)

Historical Stock Chart

From Nov 2024 to Dec 2024

Crew Energy (TSX:CR)

Historical Stock Chart

From Dec 2023 to Dec 2024