Computer Modelling Group Ltd. (“CMG” or the “Company”) announces

its financial results for year ended March 31, 2022.

Annual Performance

| ($

thousands, unless otherwise stated) |

March 31, 2022 |

|

March 31, 2021 |

|

March 31, 2020 |

|

|

Annuity/maintenance license revenue |

53,406 |

|

55,934 |

|

63,974 |

|

|

Perpetual license revenue |

4,819 |

|

3,619 |

|

4,672 |

|

| Software license revenue |

58,225 |

|

59,553 |

|

68,646 |

|

|

Professional service revenue |

7,977 |

|

7,810 |

|

7,140 |

|

| Total revenue |

66,202 |

|

67,363 |

|

75,786 |

|

| Operating profit |

26,080 |

|

30,565 |

|

31,751 |

|

| Operating profit (%) |

39 |

% |

45 |

% |

42 |

% |

| Net income for the year |

18,405 |

|

20,190 |

|

23,485 |

|

| EBITDA(1) |

30,278 |

|

34,836 |

|

36,111 |

|

| Cash dividends declared and

paid |

16,064 |

|

16,055 |

|

32,097 |

|

| Funds flow from

operations |

23,842 |

|

26,283 |

|

28,765 |

|

| Free cash flow (1) |

21,783 |

|

24,473 |

|

26,547 |

|

| Total assets |

125,148 |

|

122,491 |

|

120,866 |

|

| Total shares outstanding |

80,335 |

|

80,286 |

|

80,249 |

|

| Trading price per share at

March 31 |

5.36 |

|

5.75 |

|

3.83 |

|

| Market

capitalization at March 31 |

430,596 |

|

461,645 |

|

307,353 |

|

| Per share amounts –

($/share) |

|

|

|

| Earnings per share – basic and

diluted |

0.23 |

|

0.25 |

|

0.29 |

|

| Cash dividends declared and

paid |

0.20 |

|

0.20 |

|

0.40 |

|

| Funds flow from operations per

share – basic |

0.30 |

|

0.33 |

|

0.36 |

|

| Free

cash flow per share – basic (1) |

0.27 |

|

0.30 |

|

0.33 |

|

(1) This is a non-IFRS financial measure. See

the “Non-IFRS Financial Measures” section.

Quarterly Performance

|

|

Fiscal 2021 |

Fiscal 2022 |

|

($ thousands, unless otherwise stated) |

Q1 |

Q2 |

Q3 |

Q4 |

Q1 |

Q2 |

Q3 |

Q4 |

|

Annuity/maintenance license revenue |

14,523 |

14,144 |

13,477 |

13,790 |

12,286 |

13,239 |

13,575 |

14,306 |

| Perpetual license revenue |

- |

1,775 |

660 |

1,184 |

125 |

846 |

1,497 |

2,351 |

|

Software license revenue |

14,523 |

15,919 |

14,137 |

14,974 |

12,411 |

14,085 |

15,072 |

16,657 |

|

Professional services revenue |

2,149 |

1,933 |

1,901 |

1,827 |

2,003 |

1,864 |

1,973 |

2,137 |

| Total revenue |

16,672 |

17,852 |

16,038 |

16,801 |

14,414 |

15,949 |

17,045 |

18,794 |

| Operating profit |

5,711 |

9,861 |

8,437 |

6,556 |

5,573 |

5,440 |

7,755 |

7,312 |

| Operating profit (%) |

34 |

55 |

53 |

39 |

39 |

34 |

45 |

39 |

| Profit before income and other

taxes |

4,405 |

9,360 |

7,410 |

5,747 |

4,827 |

5,321 |

7,310 |

6,563 |

| Income and other taxes |

1,143 |

2,600 |

1,535 |

1,454 |

1,094 |

1,175 |

1,736 |

1,611 |

| Net income for the period |

3,262 |

6,760 |

5,875 |

4,293 |

3,733 |

4,146 |

5,574 |

4,952 |

| EBITDA(1) |

6,767 |

10,933 |

9,509 |

7,627 |

6,596 |

6,473 |

8,843 |

8,366 |

| Cash dividends declared and

paid |

4,013 |

4,013 |

4,015 |

4,014 |

4,015 |

4,016 |

4,017 |

4,016 |

| Funds flow from

operations |

4,703 |

7,991 |

7,322 |

6,267 |

4,811 |

4,904 |

7,022 |

7,105 |

| Free

cash flow(1) |

4,239 |

7,474 |

7,005 |

5,755 |

4,478 |

4,494 |

6,227 |

6,584 |

| Per share amounts –

($/share) |

|

|

|

|

|

|

|

|

| Earnings per share (EPS) –

basic and diluted |

0.04 |

0.08 |

0.07 |

0.05 |

0.05 |

0.05 |

0.07 |

0.06 |

| Cash dividends declared and

paid |

0.05 |

0.05 |

0.05 |

0.05 |

0.05 |

0.05 |

0.05 |

0.05 |

| Funds flow from operations per

share – basic |

0.06 |

0.10 |

0.09 |

0.08 |

0.06 |

0.06 |

0.09 |

0.09 |

| Free

cash flow per share – basic(1) |

0.05 |

0.09 |

0.09 |

0.07 |

0.06 |

0.06 |

0.08 |

0.08 |

(1) This is a non-IFRS financial measure. See

the “Non-IFRS Financial Measures” section.

Commentary on Quarterly

Performance

|

For the Three Months Ended |

For the Year Ended |

|

March 31, 2022 and compared to the same period of the previous

fiscal year, when appropriate: |

|

|

- Annuity/maintenance license revenue increased by 4%;

|

- Annuity/maintenance license revenue decreased by 5%;

|

- Perpetual license revenue increased by $1.2 million, or

99%;

|

- Perpetual license revenue increased by $1.2 million, or

33%;

|

- Total revenue increased by 12%;

|

- Total revenue decreased by 2%;

|

- Total operating expenses increased by 12%. Adjusted for CEWS

and CERS benefits, operating expenses increased by 8%;

|

- Total operating expenses increased by 9%. Adjusted for CEWS and

CERS benefits and a one-time restructuring charge, operating

expenses decreased by 3%;

|

- Quarterly operating profit margin was 39%, consistent with the

comparative quarter. Adjusted for CEWS and CERS benefits, operating

profit margin was 34% and 32%, respectively;

|

- Year-to-date operating profit margin was 39%, down from the

comparative period’s figure of 45%. Adjusted for CEWS and CERS

benefits and the one-time restructuring charge, operating profit

was 38% and 37%, respectively;

|

- Basic EPS of $0.06 was $0.01 higher than the comparative

quarter;

|

- Basic EPS of $0.23 was lower than the comparative year’s EPS of

$0.25;

|

- Achieved free cash flow per share of $0.08;

|

- Achieved free cash flow per share of $0.27;

|

- Declared and paid a dividend of $0.05 per share.

|

- Declared and paid dividends of $0.20 per share.

|

Revenue

| Three months ended March

31, |

2022 |

|

2021 |

|

$ change |

% change |

|

| ($

thousands) |

|

|

|

|

|

|

|

|

|

|

|

Software license revenue |

16,657 |

|

14,974 |

|

1,683 |

11 |

% |

| Professional services

revenue |

2,137 |

|

1,827 |

|

310 |

17 |

% |

|

Total revenue |

18,794 |

|

16,801 |

|

1,993 |

12 |

% |

| |

|

|

|

|

| Software license revenue as a

% of total revenue |

89 |

% |

89 |

% |

|

|

|

Professional services revenue as a % of total revenue |

11 |

% |

11 |

% |

|

|

| Years ended March 31, |

2022 |

|

2021 |

|

$ change |

|

% change |

|

| ($

thousands) |

|

|

|

|

|

|

|

|

|

|

|

Software license revenue |

58,225 |

|

59,553 |

|

(1,328 |

) |

-2 |

% |

| Professional services

revenue |

7,977 |

|

7,810 |

|

167 |

|

2 |

% |

|

Total revenue |

66,202 |

|

67,363 |

|

(1,161 |

) |

-2 |

% |

| |

|

|

|

|

| Software license revenue as a

% of total revenue |

88 |

% |

88 |

% |

|

|

|

Professional services revenue as a % of total revenue |

12 |

% |

12 |

% |

|

|

CMG’s revenue is comprised of software license sales, which

provides the majority of the Company’s revenue, and fees for

professional services.

Total revenue for the three months ended March 31, 2022

increased by 12%, due to increases in both software license revenue

and professional services revenue.

Total revenue for the year ended March 31, 2022 decreased by 2%,

due to a decrease in software license revenue, slightly offset by

an increase in professional services revenue.

Software License Revenue

| Three months ended March

31, |

2022 |

|

2021 |

|

$ change |

% change |

|

| ($

thousands) |

|

|

|

|

|

|

|

|

|

|

|

Annuity/maintenance license revenue |

14,306 |

|

13,790 |

|

516 |

4 |

% |

| Perpetual license revenue |

2,351 |

|

1,184 |

|

1,167 |

99 |

% |

|

Total software license revenue |

16,657 |

|

14,974 |

|

1,683 |

11 |

% |

| |

|

|

|

|

| Annuity/maintenance as a % of

total software license revenue |

86 |

% |

92 |

% |

|

|

|

Perpetual as a % of total software license revenue |

14 |

% |

8 |

% |

|

|

|

Years ended March 31, |

2022 |

|

2021 |

|

$ change |

|

% change |

|

| ($

thousands) |

|

|

|

|

|

|

|

|

|

|

| Annuity/maintenance license

revenue |

53,406 |

|

55,934 |

|

(2,528 |

) |

-5 |

% |

| Perpetual license revenue |

4,819 |

|

3,619 |

|

1,200 |

|

33 |

% |

|

Total software license revenue |

58,225 |

|

59,553 |

|

(1,328 |

) |

-2 |

% |

| |

|

|

|

|

| Annuity/maintenance as a % of

total software license revenue |

92 |

% |

94 |

% |

|

|

|

Perpetual as a % of total software license revenue |

8 |

% |

6 |

% |

|

|

Total software license revenue for the three months ended March

31, 2022 increased by 11%, compared to the same period of the

previous fiscal year, due to increases in both perpetual license

revenue and annuity/maintenance license revenue.

Annuity/maintenance license revenue increased by 4%, due to

increases in Canada and the Eastern Hemisphere, partially offset by

decreases in the United States and South America.

During the year ended March 31, 2022, CMG’s total software

license revenue decreased by 2%, compared to the previous fiscal

year, due to a decrease in annuity/maintenance license revenue,

partially offset by an increase in perpetual license revenue.

Annuity/maintenance license revenue decreased by 5%, due to

decreases in the United States and the Eastern Hemisphere,

partially offset by increases in South America and Canada.

Software Revenue by Geographic Region

|

Three months ended March 31, |

2022 |

2021 |

$ change |

|

% change |

|

| ($

thousands) |

|

|

|

|

|

Annuity/maintenance license revenue |

|

|

|

|

|

Canada |

3,274 |

3,012 |

262 |

|

9 |

% |

|

United States |

3,408 |

3,580 |

(172 |

) |

-5 |

% |

|

South America |

1,663 |

1,752 |

(89 |

) |

-5 |

% |

|

Eastern Hemisphere(1) |

5,961 |

5,446 |

515 |

|

9 |

% |

|

|

14,306 |

13,790 |

516 |

|

4 |

% |

| Perpetual license

revenue |

|

|

|

|

|

Canada |

- |

- |

- |

|

- |

|

|

United States |

- |

32 |

(32 |

) |

-100 |

% |

|

South America |

- |

- |

- |

|

- |

|

|

Eastern Hemisphere |

2,351 |

1,152 |

1,199 |

|

104 |

% |

|

|

2,351 |

1,184 |

1,167 |

|

99 |

% |

| Total software license

revenue |

|

|

|

|

|

Canada |

3,274 |

3,012 |

262 |

|

9 |

% |

|

United States |

3,408 |

3,612 |

(204 |

) |

-6 |

% |

|

South America |

1,663 |

1,752 |

(89 |

) |

-5 |

% |

|

Eastern Hemisphere |

8,312 |

6,598 |

1,714 |

|

26 |

% |

|

|

16,657 |

14,974 |

1,683 |

|

11 |

% |

| Years ended March 31, |

2022 |

2021 |

$ change |

|

% change |

|

| ($

thousands) |

|

|

|

|

|

Annuity/maintenance license revenue |

|

|

|

|

|

Canada |

12,699 |

12,464 |

235 |

|

2 |

% |

|

United States |

12,910 |

15,113 |

(2,203 |

) |

-15 |

% |

|

South America |

6,858 |

6,164 |

694 |

|

11 |

% |

|

Eastern Hemisphere(1) |

20,939 |

22,193 |

(1,254 |

) |

-6 |

% |

|

|

53,406 |

55,934 |

(2,528 |

) |

-5 |

% |

| Perpetual license

revenue |

|

|

|

|

|

Canada |

- |

- |

- |

|

- |

|

|

United States |

401 |

32 |

369 |

|

1153 |

% |

|

South America |

- |

1,020 |

(1,020 |

) |

-100 |

% |

|

Eastern Hemisphere |

4,418 |

2,567 |

1,851 |

|

72 |

% |

|

|

4,819 |

3,619 |

1,200 |

|

33 |

% |

| Total software license

revenue |

|

|

|

|

|

Canada |

12,699 |

12,464 |

235 |

|

2 |

% |

|

United States |

13,311 |

15,145 |

(1,834 |

) |

-12 |

% |

|

South America |

6,858 |

7,184 |

(326 |

) |

-5 |

% |

|

Eastern Hemisphere |

25,357 |

24,760 |

597 |

|

2 |

% |

|

|

58,225 |

59,553 |

(1,328 |

) |

-2 |

% |

(1) Includes Europe, Africa, Asia and

Australia.

During the three months and year ended March 31, 2022, compared

to the same periods of the previous fiscal year, total software

license revenue increased in the Eastern Hemisphere and Canada and

decreased in the United States and South America.

The Canadian region (representing 22% of annual total software

license revenue) experienced 9% and 2% increases in

annuity/maintenance license revenue during the three months and

year ended March 31, 2022, respectively, due to a returning

customer and increased licensing by some existing customers.

The United States (representing 23% of annual total software

license revenue), experienced decreases of 5% and 15% in

annuity/maintenance license revenue during the three months and

year ended March 31, 2022, compared to the same periods of the

previous fiscal year. The decreases were largely due to the same

factors that affected the region’s revenue in the previous fiscal

year: consolidation in the industry and reduced licensing due to

ongoing challenges experienced by US unconventional shale plays.

Perpetual license revenue decreased slightly during the quarter and

increased during the year, compared to the same periods of the

previous fiscal year.

South America (representing 12% of annual total software license

revenue) showed a decrease of 5% in annuity/maintenance license

revenue during the three months ended March 31, 2022, mainly due to

reactivation of maintenance on perpetual licenses in the

comparative quarter. During the year ended March 31, 2022,

annuity/maintenance license revenue from South America increased by

11%, compared to the previous fiscal year, primarily due to a new

multi-year lease that included CoFlow. There were no perpetual

sales in South America during the current quarter or year.

The Eastern Hemisphere (representing 43% of annual total

software license revenue) experienced a 9% increase in

annuity/maintenance license revenue during the three months ended

March 31, 2022, primarily due to a three-year agreement with a

customer in Asia. During the year ended March 31, 2022,

annuity/maintenance license revenue from the Eastern Hemisphere

decreased by 6%, due to reduced licensing by some customers.

Perpetual revenue during the three months and year ended December

31, 2022 increased by 104% and 72%, respectively, as a result of

perpetual sales realized in Asia and Europe.

Deferred Revenue

|

($ thousands) |

Fiscal 2022 |

Fiscal 2021 |

$ change |

|

% change |

|

|

Deferred revenue at: |

|

|

|

|

|

Q1 (June 30) |

23,451 |

25,492 |

(2,041 |

) |

-8 |

% |

| Q2 (September 30) |

21,242 |

19,549 |

1,693 |

|

9 |

% |

| Q3 (December 31) |

23,056 |

15,347 |

7,709 |

|

50 |

% |

| Q4

(March 31) |

30,454 |

30,461 |

(7 |

) |

0 |

% |

CMG’s deferred revenue consists primarily of amounts for prepaid

licenses. Our annuity/maintenance revenue is deferred and

recognized ratably over the license period, which is generally one

year or less. Amounts are deferred for licenses that have been

provided and revenue recognition reflects the passage of time.

The above table illustrates the normal trend in the deferred

revenue balance from the beginning of the calendar year (which

corresponds with Q4 of our fiscal year), when most renewals occur,

to the end of the calendar year (which corresponds with Q3 of our

fiscal year). Our fourth quarter corresponds with the beginning of

the fiscal year for most oil and gas companies, representing a time

when they enter a new budget year and sign/renew their

contracts.

The deferred revenue balance at the end of Q4 of fiscal 2022 was

comparable to Q4 of fiscal 2021.

Expenses

|

Three months ended March 31, |

2022 |

2021 |

$ change |

|

% change |

|

| ($

thousands) |

|

|

|

|

|

|

|

|

|

|

| Sales, marketing and

professional services |

4,933 |

4,481 |

452 |

|

10 |

% |

| Research and development |

4,106 |

4,036 |

70 |

|

2 |

% |

| General and

administrative |

2,443 |

1,728 |

715 |

|

41 |

% |

|

Total operating expenses |

11,482 |

10,245 |

1,237 |

|

12 |

% |

| |

|

|

|

|

| Direct employee costs(1) |

7,889 |

7,970 |

(81 |

) |

-1 |

% |

| Other

corporate costs(1) |

3,593 |

2,275 |

1,318 |

|

58 |

% |

|

|

11,482 |

10,245 |

1,237 |

|

12 |

% |

| Years ended March 31, |

2022 |

2021 |

$ change |

% change |

|

| ($

thousands) |

|

|

|

|

|

|

|

|

|

|

|

Sales, marketing and professional services |

15,995 |

15,690 |

305 |

2 |

% |

| Research and development |

16,705 |

15,194 |

1,511 |

10 |

% |

| General and

administrative |

7,422 |

5,914 |

1,508 |

25 |

% |

|

Total operating expenses |

40,122 |

36,798 |

3,324 |

9 |

% |

| |

|

|

|

|

| Direct employee costs(1) |

30,592 |

28,227 |

2,365 |

8 |

% |

| Other

corporate costs(1) |

9,530 |

8,571 |

959 |

11 |

% |

|

|

40,122 |

36,798 |

3,324 |

9 |

% |

(1) This is a non-IFRS financial measure. See

the “Non-IFRS Financial Measures” section.

Adjusted total operating expenses, adjusted direct employee

costs and adjusted other corporate costs are non-IFRS financial

measures. They do not have a standard meaning prescribed by IFRS

and, accordingly, may not be comparable to measures used by other

companies. They are calculated by excluding CEWS subsidies, CERS

subsidies and restructuring charges, as applicable, from the

related non-adjusted measures. Management believes that analyzing

the Company’s expenses exclusive of these items illustrates

underlying trends in our costs and provides better comparability

between periods.

The following tables provide a reconciliation of total operating

expenses to adjusted total operating expenses, direct employee

costs to adjusted direct employee costs and other corporate costs

to adjusted other corporate costs:

| |

|

Three months ended March 31 |

|

Years endedMarch 31 |

|

($ thousands) |

2022 |

2021 |

2022 |

|

2021 |

|

|

|

|

|

|

| Total operating

expenses |

11,482 |

10,245 |

40,122 |

|

36,798 |

| CEWS |

916 |

1,116 |

1,499 |

|

5,206 |

| CERS |

- |

109 |

183 |

|

248 |

| Restructuring

charge |

- |

- |

(851 |

) |

- |

|

Adjusted total operating expenses |

12,398 |

11,470 |

40,953 |

|

42,252 |

| |

|

|

|

|

| Direct employee

costs |

7,889 |

7,970 |

30,592 |

|

28,227 |

| CEWS |

916 |

1,116 |

1,499 |

|

5,206 |

|

Restructuring charge |

- |

- |

(851 |

) |

- |

|

Adjusted direct employee costs |

8,805 |

9,086 |

31,240 |

|

33,433 |

|

|

|

|

|

|

| Other corporate

costs |

3,593 |

2,275 |

9,530 |

|

8,571 |

|

CERS |

- |

109 |

183 |

|

248 |

|

Adjusted other corporate costs |

3,593 |

2,384 |

9,713 |

|

8,819 |

For the three months ended March 31, 2022, adjusted direct

employee costs decreased by $0.3 million, or 3%, compared to the

same period of the previous fiscal year, primarily due to lower

headcount. For the year ended March 31, 2022, adjusted direct

employee costs decreased by $2.2 million, or 7%, compared to the

previous fiscal year, due to lower headcount and lower stock-based

compensation expense.

Adjusted other corporate costs increased by 51% and 10% for the

three months and year ended March 31, 2022, compared to the same

periods of the previous fiscal year, primarily due to the write-off

of receivables from Russian customers as a result of the Company’s

decision to suspend doing business in Russia.

Outlook

During fiscal 2022, CMG had to navigate a very volatile economic

environment characterized by fluctuating demand for oil and gas and

volatility in global energy prices, which were influenced by the

uncertainty of the COVID-19 pandemic and geopolitical

instability.

Compared to fiscal 2021, our fiscal 2022 total revenue decreased

by 2%, due to a decrease in software license revenue, which also

decreased by 2%. Total software license revenue decreased as the

headwinds of the first two quarters offset the growth of the last

two quarters of fiscal 2022. On a full-year basis, Canada and the

Eastern Hemisphere grew by 2% each, while the Unites States and

South America experienced decreases. CMG experienced growth in

Canada as a result of increased licensing, and the Eastern

Hemisphere segment grew as a result of strong perpetual sales.

Similar to the previous fiscal year, the United States continued to

be affected by industry consolidation and reduced licensing due to

ongoing challenges experienced by US unconventional shale plays.

While South America was positively impacted by the new multi-year

lease that included CoFlow, it recorded lower perpetual sales in

the current fiscal year.

Annuity and maintenance license revenue decreased by 5% compared

to last year. This was due to decreases in the first two quarters

of fiscal 2022, which were impacted by ongoing oil and gas industry

disruption caused by the pandemic, corporate consolidations,

economic pressures, and lower unconventional shale activity. Our

annuity and maintenance revenue improved in the last two quarters

of fiscal 2022 with a 4% increase experienced in the most recent

quarter, which was supported by improved industry conditions and

the CoFlow lease in South America.

Perpetual license sales increased by 33% compared to last year,

supported by sales in the United States and the Eastern

Hemisphere.

During fiscal 2022, our efforts towards the commercialization of

CoFlow were rewarded with four additional leases, including a

multi-year lease to Petroleo Brasileiro S.A. (Petrobras), one of

the original partners of the CoFlow project. Subsequent to fiscal

year end, we closed another deal with a Middle Eastern customer for

commercial licensing of CoFlow. We are pleased that the revenue

stream from our existing CoFlow commercial customers, combined with

the development funding from Shell, is projected to generate a

positive margin for CoFlow in the upcoming fiscal year.

Fiscal 2022 adjusted total operating expenses decreased by 3%

due to lower headcount and stock-based compensation expense. At the

end of the second quarter, we restructured our Calgary office,

which resulted in lower headcount, incurring a one-time

restructuring cost of $0.9 million before tax. Effective July 1,

2021, we also revised staff compensation, resulting in partial

reinstatements of staff salaries that had been reduced since July

1, 2020. Executives’ and directors’ cash compensation remained

reduced in fiscal 2022.

Adjusted other corporate costs increased in fiscal 2022 compared

to last year primarily due to the write-off of receivables from

Russian customers as a result of CMG’s decision to suspend doing

business in Russia. As we generated approximately 1% of annual

revenue from Russia in the past few years, we do not expect our

decision to have a significant impact on our ongoing

operations.

Adjusted operating profit margin was at 38%, compared to 37%

recorded last year, and adjusted EBITDA was 44% of total revenue,

which is comparable to the last year’s adjusted EBITDA. We are

pleased with this fiscal year’s achievement in profitability

margins, particularly in light of last year’s operating results

being positively affected by the receipt of the wage-related

(“CEWS”) and rent-related (“CERS”) COVID-related subsidies ($5.5

million in fiscal 2021 compared to $1.7 million in fiscal 2022),

and our current fiscal year’s results being negatively affected by

a combination of the one-time restructuring charge and the

write-off of Russian receivables.

Basic earnings per share was $0.23, compared to $0.25 last year,

due to the factors noted in the preceding paragraph.

CMG continues to maintain a strong financial position and closed

the year with $59.7 million of cash and no debt. We generated $0.27

per share of free cash flow, compared to $0.30 per share during the

previous year. The cash flows in the previous year were positively

affected by the CEWS and CERS subsidies received.

As we emerge from the global pandemic, oil prices continue to

strengthen having a positive effect on our customers’ cash flows,

and as new opportunities are created by demand for energy

transition projects, we look forward to fiscal 2023 with increasing

optimism. With fiscal 2022 renewal season mostly behind us, our

focus is on generating customer traction and growth for the

upcoming fiscal year. We are also cautious as we continue to face

complex market conditions with volatile energy prices, geopolitical

challenges, ESG policy tightening, supply and demand imbalances,

and increasing inflation. Despite these challenges, we are

encouraged by the strength of our technology and our team. Our

technology has never been more relevant and important as during

these times. Retaining our employees, prioritizing product

development, and maintaining global customer technical support

continue to be instrumental to our ongoing success. In addition,

our global diversification helps CMG mitigate the effects of

world-wide instability.

On May 10, 2022, Ryan Schneider stepped down as President and

Chief Executive Officer and as a director of CMG, in order to

pursue other opportunities. Ryan made many contributions to CMG

during his eleven-year tenure. CMG’s Board of Directors, and I

personally, thank Ryan for his leadership and commitment to CMG

over the years.

Pramod Jain succeeded Ryan as Chief Executive Officer. Pramod is

a seasoned executive with over 15 years of experience in the

software industry with a demonstrated track record of leading

multiple acquisition businesses and numerous turnarounds. We are

excited for Pramod to join CMG. His history and skillset of leading

diverse teams to international success will be of benefit to CMG

and we look forward to the next chapter of growth and success under

his leadership.

For further details on the results, please refer to CMG’s

Management Discussion and Analysis (“MD&A”) and Consolidated

Financial Statements, which are available on SEDAR at www.sedar.com

or on CMG’s website at www.cmgl.ca.

Additional IFRS Measure

Funds flow from operations is an additional IFRS measure that

the Company presents in its consolidated statements of cash flows.

Funds flow from operations is calculated as cash flows provided by

operating activities adjusted for changes in non-cash working

capital. Management believes that this measure provides useful

supplemental information about operating performance and liquidity,

as it represents cash generated during the period, regardless of

the timing of collection of receivables and payment of payables,

which may reduce comparability between periods.

Non-IFRS Financial Measures

Certain financial measures in this press release – namely,

EBITDA, free cash flow, free cash flow per share, direct employee

costs, other corporate costs, adjusted total operating expenses,

adjusted direct employee costs and adjusted other corporate costs –

do not have a standard meaning prescribed by IFRS and, accordingly,

may not be comparable to measures used by other companies.

Certain additional disclosures for these non-IFRS financial

measures have been incorporated by reference and can be found on

page 2 in the Company’s MD&A for the three months and year

ended March 31, 2022, available on SEDAR at www.sedar.com and on

the Company’s website under the Investors section at

www.cmgl.ca/investors.

Reconciliations of the non-IFRS financial measures to the most

directly comparable IFRS financial measure are presented below:

Free Cash Flow Reconciliation to Funds Flow from

Operations

|

|

|

|

Fiscal 2021 |

Fiscal 2022 |

|

($ thousands, unless otherwise stated) |

Q1 |

|

Q2 |

|

Q3 |

|

Q4 |

|

Q1 |

|

Q2 |

|

Q3 |

|

Q4 |

|

| |

|

|

|

|

|

|

|

|

| Funds flow from

operations |

4,703 |

|

7,991 |

|

7,322 |

|

6,267 |

|

4,811 |

|

4,904 |

|

7,022 |

|

7,105 |

|

| Capital

expenditures |

(149 |

) |

(200 |

) |

(7 |

) |

(41 |

) |

(27 |

) |

(133 |

) |

(481 |

) |

(62 |

) |

|

Repayment of lease liabilities |

(315 |

) |

(317 |

) |

(310 |

) |

(471 |

) |

(306 |

) |

(277 |

) |

(314 |

) |

(459 |

) |

|

Free cash flow |

4,239 |

|

7,474 |

|

7,005 |

|

5,755 |

|

4,478 |

|

4,494 |

|

6,227 |

|

6,584 |

|

|

Weighted average shares – basic(thousands) |

80,249 |

|

80,265 |

|

80,286 |

|

80,286 |

|

80,286 |

|

80,307 |

|

80,335 |

|

80,335 |

|

|

Free cash flow per share – basic |

0.05 |

|

0.09 |

|

0.09 |

|

0.07 |

|

0.06 |

|

0.06 |

|

0.08 |

|

0.08 |

|

| Years ended March 31, |

|

|

|

|

($ thousands) |

2022 |

|

2021 |

|

2020 |

|

|

|

|

|

|

|

Funds flow from operations |

23,842 |

|

26,283 |

|

28,765 |

|

| Capital expenditures |

(703 |

) |

(397 |

) |

(990 |

) |

|

Repayment of lease liabilities |

(1,356 |

) |

(1,413 |

) |

(1,228 |

) |

|

Free cash flow |

21,783 |

|

24,473 |

|

26,547 |

|

|

Weighted average shares – basic (thousands) |

80,316 |

|

80,272 |

|

80,240 |

|

|

Free cash flow per share – basic |

0.27 |

|

0.30 |

|

0.33 |

|

Forward-Looking Information

Certain information included in this press release is

forward-looking. Forward-looking information includes statements

that are not statements of historical fact and which address

activities, events or developments that the Company expects or

anticipates will or may occur in the future, including such things

as investment objectives and strategy, the development plans and

status of the Company’s software development projects, the

Company’s intentions, results of operations, levels of activity,

future capital and other expenditures (including the amount, nature

and sources of funding thereof), business prospects and

opportunities, research and development timetable, and future

growth and performance. When used in this press release, statements

to the effect that the Company or its management “believes”,

“expects”, “expected”, “plans”, “may”, “will”, “projects”,

“anticipates”, “estimates”, “would”, “could”, “should”,

“endeavours”, “seeks”, “predicts” or “intends” or similar

statements, including “potential”, “opportunity”, “target” or other

variations thereof that are not statements of historical fact

should be construed as forward-looking information. These

statements reflect management’s current beliefs with respect to

future events and are based on information currently available to

management of the Company. The Company believes that the

expectations reflected in such forward-looking information are

reasonable, but no assurance can be given that these expectations

will prove to be correct and such forward-looking information

should not be unduly relied upon.

Corporate Profile

CMG is a computer software technology company serving the energy

industry. The Company is a leading supplier of advanced process

reservoir modelling software, with a diverse customer base of

international oil companies and technology centers in approximately

60 countries. CMG’s existing technology has differentiating

capabilities built into its software products that can also be

directly applied to the energy transition needs of its customers.

The Company also provides professional services consisting of

highly specialized support, consulting, training, and contract

research activities. CMG has sales and technical support services

based in Calgary, Houston, London, Dubai, Bogota and Kuala Lumpur.

CMG’s Common Shares are listed on the Toronto Stock Exchange

(“TSX”) and trade under the symbol “CMG”.

Consolidated Statements of Financial

Position

|

(thousands of Canadian $) |

March 31, 2022 |

|

March 31, 2021 |

|

|

|

|

|

| Assets |

|

|

| Current assets: |

|

|

|

Cash |

59,660 |

|

49,068 |

|

|

Trade and other receivables |

17,507 |

|

23,239 |

|

|

Prepaid expenses |

792 |

|

820 |

|

|

Prepaid income taxes |

959 |

|

8 |

|

|

|

78,918 |

|

73,135 |

|

| Property and equipment |

10,908 |

|

12,025 |

|

| Right-of-use assets |

33,113 |

|

35,509 |

|

|

Deferred tax asset |

2,209 |

|

1,822 |

|

|

Total assets |

125,148 |

|

122,491 |

|

|

|

|

|

| Liabilities and

shareholders’ equity |

|

|

| Current liabilities: |

|

|

|

Trade payables and accrued liabilities |

6,819 |

|

6,316 |

|

|

Income taxes payable |

13 |

|

49 |

|

|

Deferred revenue |

30,454 |

|

30,461 |

|

|

Lease liabilities |

1,626 |

|

1,356 |

|

|

|

38,912 |

|

38,182 |

|

| Long-term stock-based

compensation liability |

1,556 |

|

1,281 |

|

|

Long-term lease liabilities |

37,962 |

|

39,606 |

|

|

Total liabilities |

78,430 |

|

79,069 |

|

| |

|

|

| Shareholders’ equity: |

|

|

|

Share capital |

80,248 |

|

80,051 |

|

|

Contributed surplus |

15,009 |

|

14,251 |

|

|

Deficit |

(48,539 |

) |

(50,880 |

) |

|

Total shareholders’ equity |

46,718 |

|

43,422 |

|

|

Total liabilities and shareholders’ equity |

125,148 |

|

122,491 |

|

Consolidated Statements of Operations and Comprehensive

Income

|

Years ended March 31, |

2022 |

|

2021 |

|

|

(thousands of Canadian $ except per share amounts) |

|

|

|

|

|

|

|

Revenue |

66,202 |

|

67,363 |

|

| |

|

|

| Operating

expenses |

|

|

|

Sales, marketing and professional services |

15,995 |

|

15,690 |

|

|

Research and development |

16,705 |

|

15,194 |

|

|

General and administrative |

7,422 |

|

5,914 |

|

|

|

40,122 |

|

36,798 |

|

| Operating

profit |

26,080 |

|

30,565 |

|

| |

|

|

| Finance income |

440 |

|

374 |

|

| Finance costs |

(2,499 |

) |

(4,017 |

) |

|

Profit before income and other taxes |

24,021 |

|

26,922 |

|

| Income

and other taxes |

5,616 |

|

6,732 |

|

| |

|

|

|

Net and total comprehensive income |

18,405 |

|

20,190 |

|

| |

|

|

| Earnings per share – basic and

diluted |

0.23 |

|

0.25 |

|

|

Dividend per share |

0.20 |

|

0.20 |

|

Consolidated Statements of Cash Flows

|

Years ended March 31, |

2022 |

|

2021 |

|

|

(thousands of Canadian $) |

|

|

|

|

|

|

| Operating

activities |

|

|

| Net income |

18,405 |

|

20,190 |

|

| Adjustments for: |

|

|

|

Depreciation |

4,198 |

|

4,271 |

|

|

Deferred income tax recovery |

(386 |

) |

(831 |

) |

|

Stock-based compensation |

1,625 |

|

2,653 |

|

|

Funds flow from operations |

23,842 |

|

26,283 |

|

| Movement in non-cash working

capital: |

|

|

|

Trade and other receivables |

5,732 |

|

3,038 |

|

|

Trade payables and accrued liabilities |

107 |

|

(361 |

) |

|

Prepaid expenses |

28 |

|

93 |

|

|

Income taxes payable |

(987 |

) |

752 |

|

|

Deferred revenue |

(7 |

) |

(3,377 |

) |

|

Decrease in non-cash working capital |

4,873 |

|

145 |

|

|

Net cash provided by operating activities |

28,715 |

|

26,428 |

|

| |

|

|

| Financing

activities |

|

|

| Repayment of lease

liabilities |

(1,356 |

) |

(1,413 |

) |

|

Dividends paid |

(16,064 |

) |

(16,055 |

) |

|

Net cash used in financing activities |

(17,420 |

) |

(17,468 |

) |

| |

|

|

| Investing

activities |

|

|

| Property and equipment

additions |

(703 |

) |

(397 |

) |

|

Increase in cash |

10,592 |

|

8,563 |

|

| Cash,

beginning of period |

49,068 |

|

40,505 |

|

|

Cash, end of period |

59,660 |

|

49,068 |

|

|

|

|

|

| Supplementary cash

flow information |

|

|

| Interest received |

440 |

|

374 |

|

| Interest paid |

2,004 |

|

2,074 |

|

| Income

taxes paid |

6,113 |

|

6,107 |

|

See accompanying notes to consolidated financial statements,

which are available on SEDAR at www.sedar.com or on CMG’s website

at www.cmgl.ca.

For further information, contact:

| Pramod JainChief Executive

Officer(403) 531-1300pramod.jain@cmgl.ca |

or |

Sandra BalicVice President,

Finance & CFO(403) 531-1300sandra.balic@cmgl.ca |

www.cmgl.ca

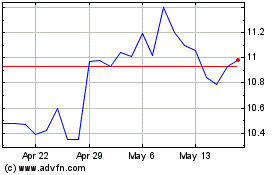

Computer Modelling (TSX:CMG)

Historical Stock Chart

From Dec 2024 to Jan 2025

Computer Modelling (TSX:CMG)

Historical Stock Chart

From Jan 2024 to Jan 2025