Canadian Banc Recovery Corp. Financial Results to November 30, 2009

February 25 2010 - 11:19AM

Marketwired Canada

Canadian Banc Recovery Corp. (formerly Prime Rate Plus Corp) ("the Company")

announces its annual financial results for the year ending November 30, 2009.

The year ending November 30, 2009 was one of the most tumultuous periods in

financial market history. Against this backdrop, the market prices of the

Canadian bank stocks in the portfolio mirrored this activity reaching lows in

early March but recovering significantly by the end of November. The net asset

value as at November 30, 2009 ended $5.63 higher to $21.38 per unit over the

prior year. The complete financial statements are available at

www.primerateplus.com or www.sedar.com.

The Company invests in a portfolio of six publicly traded Canadian Banks as

follows: Bank of Montreal, Canadian Imperial Bank of Commerce, National Bank of

Canada, Royal Bank of Canada, Bank of Nova Scotia, Toronto-Dominion Bank. Shares

held within the portfolio are expected to range between 5-20% in weight but may

vary at any time. To generate additional returns above the dividend income

earned on the portfolio, Prime Plus will engage in a selective covered call

writing program.

Selected Financial Information from the Statement of Financial Operations:

For the year ending November 30, 2009

($ Millions)

Income 8.987

Expenses (2.063)

-------------

Net investment income 6.924

Realized option premiums and gain (loss) on sale of

investments (13.186)

Change in unrealized appreciation of investments 73.452

-------------

Increase in net assets from operations before distributions 67.190

Comparative financial information is available in documents

filed on www.sedar.com.

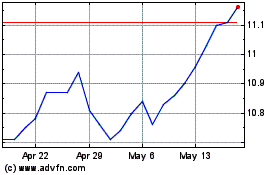

Canadian Banc (TSX:BK)

Historical Stock Chart

From Jun 2024 to Jul 2024

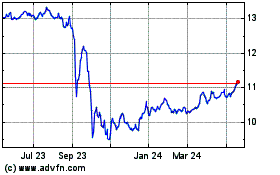

Canadian Banc (TSX:BK)

Historical Stock Chart

From Jul 2023 to Jul 2024