AGF Management Limited Announces Completion of Substantial Issuer Bid

November 14 2022 - 5:39PM

AGF Management Limited (TSX: AGF.B, “AGF” or the “Company”) today

announced the completion of its substantial issuer bid (the

“Offer”). AGF has taken up and paid for 3,488,646 Class B

non-voting shares (the “Class B Non-Voting Shares”) at a price of

$6.75 per Class B Non-Voting Share (the “Purchase Price”).

The Class B Non-Voting Shares purchased

represent an aggregate purchase price of approximately $23.5

million and represent approximately 5.1% of the total number of

AGF’s issued and outstanding Class B Non-Voting Shares as of

October 3, 2022, the date the Offer was commenced. After giving

effect to the Offer, AGF will have 57,600 Class A voting common

shares and 64,626,189 Class B Non-Voting Shares issued and

outstanding.

Payment for the purchased Class B Non-Voting

Shares will be effected by Computershare Investor Services Inc.

(the “Depositary”) in accordance with the Offer and applicable law.

Any Class B Non-Voting Shares not purchased, including Class B

Non-Voting Shares which were invalidly tendered, will be returned

to shareholders as soon as practicable by the Depositary.

Tax Information

To assist shareholders in determining the tax

consequences of the Offer, AGF has determined that for the purposes

of the Income Tax Act (Canada), the paid-up capital per Class B

Non-Voting Share was $3.30. AGF designates the entire

amount of the deemed dividend arising from its repurchase of the

Class B Non-Voting Shares as an eligible dividend. Dividends are

designated to be eligible dividends pursuant to the Income Tax Act

(Canada) and any applicable provincial legislation pertaining to

eligible dividends.

The "specified amount" of each Class B

Non-Voting Share (for purposes of subsection 191(4) of the Income

Tax Act (Canada)) is $6.44.

The full details of the Offer are described in

the offer to purchase and issuer bid circular dated October 3,

2022, as well as the related letter of transmittal and notice of

guaranteed delivery, copies of which were filed and are available

on SEDAR at www.sedar.com.

This press release is for informational purposes

only and does not constitute an offer to buy or the solicitation of

an offer to sell AGF’s Class A voting common shares or Class B

Non-Voting Shares.

About AGF Management

Limited

Founded in 1957, AGF Management Limited (AGF) is

an independent and globally diverse asset management firm

delivering excellence in investing in the public and private

markets through its three distinct business lines: AGF Investments,

AGF Private Capital and AGF Private Wealth.

AGF brings a disciplined approach focused on

providing an exceptional client experience and incorporating sound

responsible and sustainable practices. The firm’s investment

solutions, driven by its fundamental, quantitative and private

investing capabilities, extends globally to a wide range of

clients, from financial advisors and their clients to high-net

worth and institutional investors including pension plans,

corporate plans, sovereign wealth funds, endowments and

foundations.

Headquartered in Toronto, Canada, AGF has

investment operations and client servicing teams spanning on the

ground in North America, Europe and Asia. With approximately $40

billion in total assets under management and fee-earning assets,

AGF serves more than 800,000 investors. AGF trades on the Toronto

Stock Exchange under the symbol AGF.B.

CAUTION CONCERNING FORWARD-LOOKING STATEMENTS –

Certain statements in this press release about the Offer, including

the timing of payment and settlement for Class B Non-Voting Shares

purchased under the Offer, and other statements that are not

historical facts, constitute "forward-looking statements" within

the meaning of applicable Canadian securities laws. The words

"may", "will", "would", "should", "could", "expects", "plans",

"intends", "trends", "indications", "anticipates", "believes",

"estimates", "predicts", "likely" or "potential" or the negative or

other variations of these words or other comparable words or

phrases, are intended to identify forward-looking statements.

Forward-looking statements are based on estimates and assumptions

made by the Company in light of its experience and perception of

historical trends, current conditions and expected future

developments, as well as other factors that the Company believes

are appropriate and reasonable in the circumstances, but there can

be no assurance that such estimates and assumptions will prove to

be correct or that the Company's expectations regarding this Offer

or the Company's actual results, level of activity, performance or

achievements or future events or developments will be achieved.

Many factors could cause the Company's expectations regarding the

Offer or the Company's actual results, level of activity,

performance or achievements or future events or developments to

differ materially from those expressed or implied by the

forward-looking statements. Further details and descriptions of

these and other factors are disclosed in the offer to purchase and

in AGF’s management’s discussion and analysis for the year ended

November 30, 2021 and 2020, under the heading “Risk Factors and

Management of Risk”.

The purpose of the forward-looking statements is

to provide the reader with a description of management's

expectations and may not be appropriate for other purposes; readers

should not place undue reliance on forward-looking statements made

herein. Furthermore, unless otherwise stated, the forward-looking

statements contained in this press release are made as of the date

hereof, and the Company has no intention and undertakes no

obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise,

except as required by law. The forward-looking statements contained

in this press release are expressly qualified by this cautionary

statement. Further details and descriptions of these and other

factors are disclosed in the Offer and in AGF's public filings with

provincial or territorial securities regulatory authorities, which

may be accessed on SEDAR's website at www.sedar.com.

AGF MANAGEMENT LIMITED SHAREHOLDERS, ANALYSTS

AND MEDIA, PLEASE CONTACT:

Courtney LearmontVice-President,

Finance647-253-6804, InvestorRelations@agf.com

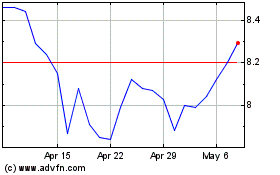

AGF Management (TSX:AGF.B)

Historical Stock Chart

From Mar 2024 to Apr 2024

AGF Management (TSX:AGF.B)

Historical Stock Chart

From Apr 2023 to Apr 2024