Andrew Peller Limited (TSX: ADW.A / ADW.B) (“APL” or the “Company”)

announced today results for the three and nine months ended

December 31, 2024. All amounts are expressed in Canadian dollars

unless otherwise stated.

THIRD QUARTER 2025

HIGHLIGHTS

- Revenue was $105.4 million, up 5.2%

from $100.2 million in the prior year;

- Gross margin of 40.2%, compared

with 34.7% in the prior year;

- EBITA increased to $18.5 million,

from $13.2 million in Q3 2024; and

- Net earnings of $7.7 million ($0.18

per Class A Share), compared to a net loss of $0.4 million (loss of

$0.01 per Class A Share) in Q3 2024.

YTD 2024 HIGHLIGHTS

- Revenue was $314.1 million, up 4.4%

from compared with $300.8 million in the prior year;

- Gross margin of 40.4%, up from

38.2% in the prior year;

- EBITA increased to $49.4 million,

from $41.1 million in Q3 2024; and

- Net earnings of $11.9 million

($0.28 per Class A Share), compared to $4.1 million ($0.10 per

Class A Share) in Q3 2024.

-

Dividend of $0.185 per Class A Share and $0.161 per Class B

Share.

“We are pleased with our strong performance in

the quarter as our team navigated significant changes to the retail

distribution landscape in Ontario, our largest market. Our sales

growth was led by our success in big-box retail which was offset

partially by declines in the LCBO and our Company owned retail

stores as distribution expanded rapidly” said Paul Dubkowski, Chief

Executive Officer. “Our team has been focused on positioning our

business to capitalize on this evolving landscape and grow market

share for our brands. We are confident in our ability to outperform

the category through consumer-centric innovation and by winning in

both core channels and impactful new ones. In addition to the sales

performance, we’re encouraged with the strengthening profitability

and margins this fiscal year, reflecting our efforts on cost

reductions and operating efficiency.”

Financial Highlights(Financial

Statements and the Company’s Management Discussion and Analysis for

the period can be obtained on the Company’s web site at

ir.andrewpeller.com)

| For the three and

nine months ended December 31, |

Three months |

Nine months |

| (in $000,

except per share amounts) |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Revenue |

|

$105,385 |

|

|

$100,192 |

|

|

$314,088 |

|

|

$300,848 |

|

| Gross margin (1) |

|

42,384 |

|

|

34,742 |

|

|

126,890 |

|

|

115,037 |

|

| Gross margin (% of revenue) |

|

40.2 |

% |

|

34.7 |

% |

|

40.4 |

% |

|

38.2 |

% |

| Selling and administrative expenses |

|

23,837 |

|

|

21,494 |

|

|

77,505 |

|

|

73,979 |

|

| EBITA (1) |

|

18,547 |

|

|

13,248 |

|

|

49,385 |

|

|

41,058 |

|

| Interest |

|

4,219 |

|

|

4,802 |

|

|

13,118 |

|

|

12,972 |

|

| Net unrealized loss (gain) on derivative financial

instruments |

|

(556 |

) |

|

2,840 |

|

|

1,175 |

|

|

1,644 |

|

| Loss on debt extinguishment and financing fees |

|

- |

|

|

- |

|

|

- |

|

|

2,172 |

|

| Other expenses |

|

1,637 |

|

|

31 |

|

|

2,845 |

|

|

1,146 |

|

| Net earnings (loss) |

|

7,677 |

|

|

(369 |

) |

|

11,862 |

|

|

4,091 |

|

| Earnings (loss) per share – Class A basic |

|

$0.18 |

|

|

$(0.01 |

) |

|

$0.28 |

|

|

$0.10 |

|

| Earnings (loss) per share – Class B basic |

|

$0.15 |

|

|

$(0.01 |

) |

|

$0.24 |

|

|

$0.08 |

|

| Dividend per share – Class A |

|

|

|

$0.185 |

|

|

$0.185 |

|

| Dividend per share –

Class B |

|

|

|

$0.161 |

|

|

$0.161 |

|

(1) Please refer to the Company’s MD&A concerning “Non-IFRS

Measures”

Financial ReviewRevenue of

$105.4 million for the three months ended December 31, 2024,

increased 5.2% over the prior year period. The increase was

primarily attributable to sales to big box stores, a new sales

channel, partially offset by a decrease in the Company’s retail

stores as a result of the Province of Ontario’s new rules on

beverage alcohol retail distribution. Several of the Company’s

other well-established trade channels also performed well,

particularly restaurants and hospitality locations. This was

partially offset by softness in sales from the Company’s personal

winemaking business. In the third quarter of fiscal 2025, the

Company recognized $3.2 million relating to the revised Ontario VQA

Support Program announced in December 2023.

For the nine months ended December 31, 2024,

revenue was $314.1 million, up 4.4% from the prior year. The

increase was attributable to higher sales in the Company’s retail

stores due to the July strike at the LCBO and sales to big box

stores as described above. The Company’s other well-established

trade channels have performed well on a year-to-date basis,

particularly restaurants and hospitality locations. This strong

performance was offset by softness in sales from the estate

wineries and wine clubs due to lower guest traffic and reduced

consumer discretionary spending due to tightening economic

conditions. In the nine months ending December 31, 2024, the

Company recognized $9.2 million relating to the revised Ontario VQA

Support Program.

Gross margin as a percentage of revenue

increased to 40.2% and 40.4% for the three and nine months ended

December 31, 2024 respectively from 34.7% and 38.2% in the prior

year. Gross margin has benefited from the inclusion of the Ontario

VQA Support program, as described above, as well as lower costs for

glass bottles and inbound freight due to the cost savings programs

implemented by the Company. Gross margin is also continuing to be

impacted by channel mix and inflationary cost pressures in

concentrate, packaging and other raw materials. In response to

these margin pressures, the Company is continuing to execute cost

savings programs and formulation changes relating to these

inputs.

As a percentage of revenue, selling and

administrative expenses increased to 22.6% and 24.7% for the three

and nine months ended December 31, 2024, respectively, compared to

21.5% and 24.6% in the prior year. Selling and administrative

expenses increased due to higher compensation and higher selling

costs as a result of the strong performance in the third quarter of

fiscal 2025.

Earnings before interest, amortization, loss on

debt extinguishment and financing fees, net unrealized gains and

losses on derivative financial instruments, other (income)

expenses, and income taxes (“EBITA”) (see “Non-IFRS Measures”

section of this MD&A) was $18.5 million in the third quarter of

fiscal 2025 compared to $13.2 million in the same prior year

period, an increase of 40%. EBITA increased to $49.4 million for

the nine months ended December 31, 2024 from $41.1 million in the

prior year, an increase of 20.3%.

Interest expense for the three months ended

December 31, 2024 decreased from the prior year due to a lower

average debt balance and lower interest rates compared to prior

year. Interest expense for the nine months ended December 31,2024

increased due to a higher average debt balance compared to the same

period in the prior year and higher interest expense on the

Company’s leases.

The Company recorded a net unrealized non-cash

gain of $0.6 million in the third quarter of fiscal 2025 related to

mark-to-market adjustments on interest rate swaps and foreign

exchange contracts compared to a loss of $2.8 million in the same

quarter in the prior year. The Company recorded a loss in the first

nine months of fiscal 2025 of $1.2 million compared to a loss of

$1.6 million in the prior year. The Company has elected not to

apply hedge accounting and accordingly the change in fair value of

these financial instruments is reflected in the Company’s

consolidated statement of earnings (loss) each reporting period.

These instruments are considered to be effective economic hedges

and are expected to mitigate the short-term volatility of changing

foreign exchange and interest rates.

Other expenses were $1.6 million and $2.8

million for the three and nine months ended December 31, 2024. The

expense in fiscal 2025 related primarily to a restructuring

initiative completed in the fiscal year to align the Company’s

business structure with the changing retail landscape in

Ontario.

In the nine months ended December 31, 2024, the

Company undertook certain tax planning initiatives as it relates to

capital gains with respect to the Port Moody lands. This included

transferring the beneficial interest in the land to a newly

registered limited partnership. All parties associated with the

limited partner are within the consolidated APL group and there has

been no legal ownership change. This transaction resulted in an

additional current tax expense of $4.0 million, with an offsetting

deferred tax recovery.

The Company generated net income of $7.7 million

($0.18 per Class A share) for the third quarter of fiscal 2025

compared to a net loss of $0.4 million (loss of $0.01 per Class A

share) in the prior year and net income of $11.9 million ($0.28 per

Class A share) for the nine months ended December 31, 2024 compared

to $4.1 million ($0.10 per Class A Share) in the prior year.

Long-term debt decreased to $183.3 million at

December 31, 2024 compared to $208.3 million at March 31, 2024 due

to higher levels of cash from operations and stronger working

capital management. For the nine months ended December 31, 2024,

the Company generated cash from operating activities, after changes

in non-cash working capital items, of $59.6 million compared to

$39.9 million in the prior year, primarily due to a decrease in

inventory due to increased sales and cost savings initiatives.

On July 15, 2024, the Company announced its

normal course issuer bid (“NCIB”) had been approved by the Toronto

Stock Exchange. Under the issuer bid the Company can purchase for

cancellation up to 1,000,000 of its outstanding Class A non-voting

shares, representing 2.8% of the Class A shares outstanding at the

time, over the ensuing 12 months. The total number of common shares

repurchased for cancellation under the NCIB for the nine month

period ended December 31, 2024 amounted to 127,300 common shares,

at a weighted average price of $4.04 per common share, for a total

cash consideration of $0.5 million.

Investor Conference CallThe

Company will hold a conference call to discuss the results on

Thursday, February 6, 2025 at 10:00 a.m. ET. Paul Dubkowski, CEO,

Renee Cauchi, Interim CFO and Patrick O’Brien, President and CCO,

will host the call, with a question and answer period following

management’s presentation.

| Conference Call Dial In

Details: |

| Date: |

|

|

Thursday, February 6, 2025 |

| Time: |

|

|

10:00 a.m. (ET) |

| Dial-in numbers: |

|

|

Local Toronto / International: (437) 900-0527 |

| |

|

|

North American Toll Free: (888) 510-2154 |

| |

|

|

RapidConnect: https://emportal.ink/3C1UtVE |

| Webcast: |

|

|

A live webcast will be available at ir.andrewpeller.com |

| Replay: |

|

|

Following the live call, a recording will be available on the

Company’s investor relations website at ir.andrewpeller.com |

| |

|

|

|

About Andrew Peller

LimitedAndrew Peller Limited is one of Canada’s leading

producers and marketers of quality wines and craft beverage alcohol

products. The Company’s award-winning premium and ultra-premium

Vintners’ Quality Alliance brands include Peller Estates, Trius,

Thirty Bench, Wayne Gretzky, Sandhill, Red Rooster, Black Hills

Estate Winery, Tinhorn Creek Vineyards, Gray Monk Estate Winery,

Raven Conspiracy, and Conviction. Complementing these premium

brands are a number of popularly priced varietal offerings,

wine-based liqueurs, craft ciders, and craft spirits. The Company

owns and operates 101 well-positioned independent retail locations

in Ontario under The Wine Shop, Wine Country Vintners, and Wine

Country Merchants store names. The Company also operates Andrew

Peller Import Agency and The Small Winemaker’s Collection Inc.,

importers and marketing agents of premium wines from around the

world. With a focus on serving the needs of all wine consumers, the

Company produces and markets premium personal winemaking products

through its wholly owned subsidiary, Global Vintners Inc., the

recognized leader in personal winemaking products. More information

about the Company can be found at ir.andrewpeller.com.

The Company utilizes EBITA (defined as earnings

before interest, amortization, loss on debt extinguishment and

financing fees, net unrealized gains and losses on derivative

financial instruments, other (income) expenses, and income taxes)

to measure its financial performance. EBITA is not a recognized

measure under IFRS. Management believes that EBITA is a useful

supplemental measure to net earnings, as it provides readers with

an indication of earnings available for investment prior to debt

service, capital expenditures, and income taxes, as well as

provides an indication of recurring earnings compared to prior

periods. Readers are cautioned that EBITA should not be construed

as an alternative to net earnings determined in accordance with

IFRS as indicators of the Company’s performance or to cash flows

from operating, investing, and financing activities as a measure of

liquidity and cash flows. The Company also utilizes gross margin

(defined as sales less cost of goods sold, excluding amortization).

The Company’s method of calculating EBITA and gross margin may

differ from the methods used by other companies and, accordingly,

may not be comparable to measures used by other companies.

Andrew Peller Limited common shares trade on the

Toronto Stock Exchange (symbols ADW.A and ADW.B).

FORWARD-LOOKING

INFORMATIONCertain statements in this news release may

contain “forward-looking statements” within the meaning of

applicable securities laws including the “safe harbour provisions”

of the Securities Act (Ontario) with respect to APL and its

subsidiaries. Such statements include, but are not limited to,

statements about the growth of the business; its launch of new

premium wines and craft beverage alcohol products; sales trends in

foreign markets; its supply of domestically grown grapes; and

current economic conditions. These statements are subject to

certain risks, assumptions, and uncertainties that could cause

actual results to differ materially from those included in the

forward-looking statements. The words “believe”, “plan”, “intend”,

“estimate”, “expect”, or “anticipate”, and similar expressions, as

well as future or conditional verbs such as “will”, “should”,

“would”, “could”, and similar verbs often identify forward-looking

statements. We have based these forward-looking statements on our

current views with respect to future events and financial

performance. With respect to forward-looking statements contained

in this news release, the Company has made assumptions and applied

certain factors regarding, among other things: future grape, glass

bottle, and wine and spirit prices; its ability to obtain grapes,

imported wine, glass, and other raw materials; fluctuations in

foreign currency exchange rates; its ability to market products

successfully to its anticipated customers; the trade balance within

the domestic Canadian and international wine markets; market

trends; reliance on key personnel; protection of its intellectual

property rights; the economic environment; the regulatory

requirements regarding producing, marketing, advertising, and

labelling of its products; the regulation of liquor distribution

and retailing in Ontario; the application of federal and provincial

environmental laws; and the impact of increasing competition.

These forward-looking statements are also

subject to the risks and uncertainties discussed in this news

release, in the “Risks and Uncertainties” section and elsewhere in

the Company’s MD&A and other risks detailed from time to time

in the publicly filed disclosure documents of Andrew Peller Limited

which are available at www.sedar.com. Forward-looking statements

are not guarantees of future performance and involve risks,

uncertainties, and assumptions which could cause actual results to

differ materially from those conclusions, forecasts, or projections

anticipated in these forward-looking statements. Because of these

risks, uncertainties and assumptions, you should not place undue

reliance on these forward-looking statements. The Company’s

forward-looking statements are made only as of the date of this

news release, and except as required by applicable law, the Company

undertakes no obligation to update or revise these forward-looking

statements to reflect new information, future events or

circumstances or otherwise.

For more information, please

contact: Craig

Armitage and Jennifer Smithir@andrewpeller.com

Source: Andrew Peller Limited

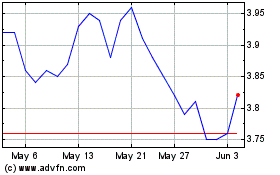

Andrew Peller (TSX:ADW.A)

Historical Stock Chart

From Jan 2025 to Feb 2025

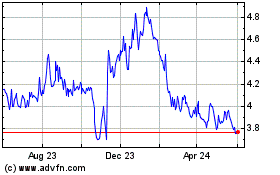

Andrew Peller (TSX:ADW.A)

Historical Stock Chart

From Feb 2024 to Feb 2025