All figures in Canadian dollars unless otherwise noted

Investors, analysts and other interested parties can access

Acadian Timber Corp.'s 2011 Fourth Quarter Results conference call

via webcast on Tuesday, February 7, 2012 at 1:00 p.m. ET at

www.acadiantimber.com or via teleconference at 1-800-319-4610, toll

free in North America. For overseas calls please dial

+1-604-638-5340, at approximately 12:50 p.m. ET. The teleconference

taped rebroadcast can be accessed at 1-800-319-6413 or

+1-604-638-9010 and enter passcode 2826.

Acadian Timber Corp. ("Acadian" or the "Company") (TSX:ADN)

today reported financial and operating results(1) for the three

months ended December 31, 2011 (the "fourth quarter").

For the fourth quarter of 2011, Acadian generated net sales of

$15.1 million on sales volume of 284 thousand m3, which represents

a $5.4 million, or 26%, decrease in net sales compared to the same

period in 2010.

EBITDA of $3.8 million for the fourth quarter of 2011 was $2.6

million lower than in the fourth quarter of 2010, and EBITDA margin

decreased to 25% from 31% in the same period of last year. The

decrease in margin is attributed to lower contributions to fixed

costs resulting from reduced sales volume.

For the year ended December 31, 2011, Acadian generated net

sales of $66.2 million on sales volume of 1,293 thousand m3 as

compared to net sales of $71.0 million on sales volume of 1,399

thousand m3 in 2010. EBITDA of $15.5 million during the year ended

December 31, 2011 is $2.2 million lower than 2010 reflecting lower

overall sales volume and higher costs in the Maine Timberlands

operation due to renegotiated contractor rates.

"Acadian's operations were challenged in 2011 by an unusually

wet summer and fall and reduced contractor availability in our

Maine operations both of which led to lower harvest and sales

volumes," said Reid Carter, Chief Executive Officer of Acadian. Mr.

Carter further noted that, "Despite these challenges, Acadian

continued to benefit from strong demand and pricing for its

hardwood and softwood pulpwood, good markets for its hardwood

specialty sawlogs and reasonable markets for most of its softwood

sawlogs."

(1) This news release makes reference to EBITDA and free cash

flow which are key performance measures in evaluating Acadian's

operations and are important in enhancing investors' understanding

of Acadian's operating performance. Acadian's management defines

EBITDA as earnings before interest, taxes, fair value adjustments,

unrealized exchange gain/loss on debt, depreciation and

amortization. For the year ended December 31, 2010 only, EBITDA was

adjusted to remove the gain on corporate conversion. As these

performance measures do not have standardized meanings prescribed

by International Financial Reporting Standards ("IFRS"), they may

not be comparable to similar measures presented by other companies.

As a result, we have provided in this news release reconciliations

of net income, as determined in accordance with IFRS, to EBITDA and

free cash flow.

Review of Operations

Financial and Operating Highlights

Three Months Ended Year Ended

----------------------------------------------------

(CAD thousands, except

per share information) Dec 31, 2011 Dec 31, 2010 Dec 31, 2011 Dec 31, 2010

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Sales volume (000s m3) 283.6 381.9 1,293.4 1,398.7

Net sales $ 15,139 $ 20,581 $ 66,153 $ 70,996

EBITDA 3,843 6,393 15,527 17,775

Free cash flow 2,239 5,358 12,437 13,554

Dividends declared 3,451 836 13,804 3,625

Net income(1) 11,427 2,622 13,759 31,306

Per share - fully

diluted

Net income(1) 0.68 0.16 0.82 1.87

Free cash flow 0.13 0.32 0.74 0.81

Dividends declared 0.21 0.05 0.83 0.22

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(1) Net income for the year ended December 31, 2010 included the gain

resulting from Acadian's corporate conversion on January 1, 2010.

The operating challenges during the year along with a

continuation of the depressed log pricing environment decreased

free cash flow causing Acadian's payout ratio to climb to 111% for

the year ended December 31, 2011. While this exceeds our 95% target

level, the current dividend rate continues to reflect our long-term

view on sales volumes and the return to normalized prices.

International Financial Reporting Standards

Effective fiscal 2011, Acadian's financial results are reported

in accordance with International Financial Reporting Standards

("IFRS"). Comparative figures in this press release, previously

presented in Canadian generally accepted accounting principles,

have been adjusted to conform to IFRS.

New Brunswick Timberlands

The tables below summarize operating and financial results for

New Brunswick Timberlands:

Three Months Ended December Three Months Ended December

31, 2011 31, 2010

-------------------------------------------------------------

Harvest Sales Results Harvest Sales Results

(000s m3) (000s m3) ($000s) (000s m3) (000s m3) ($000s)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Softwood 80.3 78.2 $ 4,195 95.5 109.5 $ 5,667

Hardwood 93.9 80.6 4,952 131.8 136.3 8,233

Biomass 55.3 55.3 1,145 55.2 55.1 572

----------------------------------------------------------------------------

229.5 214.1 10,292 282.5 300.9 14,472

Other sales 986 1,975

----------------------------------------------------------------------------

Net sales $ 11,278 $ 16,447

----------------------------------------------------------------------------

EBITDA $ 3,301 $ 5,628

EBITDA margin 29% 34%

----------------------------------------------------------------------------

Year Ended December 31, 2011 Year Ended December 31, 2010

-------------------------------------------------------------

Harvest Sales Results Harvest Sales Results

(000s m3) (000s m3) ($000s) (000s m3) (000s m3) ($000s)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Softwood 433.1 429.8 $ 22,083 395.4 402.6 $ 21,025

Hardwood 440.2 418.3 24,759 447.7 473.6 27,166

Biomass 219.5 219.5 3,575 231.5 231.4 2,852

----------------------------------------------------------------------------

1,092.8 1,067.6 50,417 1,074.6 1,107.6 51,043

Other sales 3,682 4,829

----------------------------------------------------------------------------

Net sales $ 54,099 $ 55,872

----------------------------------------------------------------------------

EBITDA $ 14,205 $ 15,203

EBITDA margin 26% 27%

----------------------------------------------------------------------------

Softwood, hardwood and biomass shipments were 78 thousand m3, 81

thousand m3 and 55 thousand m3, respectively, during the fourth

quarter, representing a 29% decrease in net sales volume over the

same period in 2010. Strong harvest volumes in the first three

quarters of 2011 aimed at capturing market opportunities resulted

in Acadian reducing harvest levels in the fourth quarter to be in

line with long run sustainable yield projections. Approximately 39%

of sales volume was sold as sawlogs, 35% as pulpwood and 26% as

biomass in the fourth quarter. This compares to 36% of sales volume

sold as sawlogs, 46% as pulpwood and 18% as biomass in the fourth

quarter of 2010.

Net sales for the fourth quarter totaled $11.3 million compared

to $16.4 million for the same period last year. This was primarily

the result of the decrease in sales volume due to managing

Acadian's harvesting within the long run sustainable yield. The

decrease in other sales reflects reduced margins from operations

conducted under Acadian's timberland management services agreement

as a result of higher operating and transportation costs due to

harvesting in areas that are more distant from customer locations

and harvesting on terrain that requires the use of higher cost

logging systems. The weighted average selling price was $48.09 in

the fourth quarter of 2011, consistent with $48.10 in the same

period of 2010.

Costs for the fourth quarter were $8.0 million, compared to

$10.8 million in the same period in 2010 as a result of lower sales

volume.

EBITDA for the fourth quarter was $3.3 million, compared to $5.6

million in the same period in 2010, while EBITDA margin decreased

from 34% to 29% largely due to the lower contribution to fixed

costs resulting from reduced sales volume.

We are pleased to report that during the fourth quarter of 2011,

New Brunswick Timberlands experienced no recordable safety

incidents among employees or contractors.

Maine Timberlands

The tables below summarize operating and financial results for

Maine Timberlands:

Three Months Ended December Three Months Ended December

31, 2011 31, 2010

-------------------------------------------------------------

Harvest Sales Results Harvest Sales Results

(000s m3) (000s m3) ($000s) (000s m3) (000s m3) ($000s)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Softwood 47.4 47.3 $ 2,527 55.7 55.6 $ 2,890

Hardwood 21.4 20.3 1,266 17.2 19.1 1,135

Biomass 1.9 1.9 18 6.1 6.3 59

----------------------------------------------------------------------------

70.7 69.5 3,811 79.0 81.0 4,084

Other sales 50 50

----------------------------------------------------------------------------

Net sales $ 3,861 $ 4,134

----------------------------------------------------------------------------

EBITDA $ 878 $ 1,208

EBITDA margin 23% 29%

----------------------------------------------------------------------------

Year Ended December 31, 2011 Year Ended December 31, 2010

-------------------------------------------------------------

Harvest Sales Results Harvest Sales Results

(000s m3) (000s m3) ($000s) (000s m3) (000s m3) ($000s)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Softwood 161.2 161.4 $ 8,495 208.0 207.6 $ 10,747

Hardwood 51.8 51.9 3,092 68.5 68.3 3,804

Biomass 12.5 12.5 116 15.1 15.2 216

----------------------------------------------------------------------------

225.5 225.8 11,703 291.6 291.1 14,767

Other sales 351 357

----------------------------------------------------------------------------

Net sales $ 12,054 $ 15,124

----------------------------------------------------------------------------

EBITDA $ 2,508 $ 3,877

EBITDA margin 21% 26%

----------------------------------------------------------------------------

Softwood, hardwood and biomass shipments were 47 thousand m3, 20

thousand m3, and 2 thousand m3, respectively, with net sales volume

decreasing by 14% over the fourth quarter of 2010. The decrease in

sales volume reflects contractor availability constraints and

unusually wet weather. Approximately 57% of sales volume was sold

as sawlogs, 40% as pulpwood and 3% as biomass during the fourth

quarter. This compares to 57% of sales volume sold as sawlogs, 35%

as pulpwood and 8% as biomass in the fourth quarter of 2010.

Net sales for the fourth quarter totaled $3.9 million, compared

to $4.1 million for the same period last year. The year-over-year

decrease in net sales is a result of lower shipment volumes which

were somewhat offset by a higher value product mix. The weighted

average price across all products was $54.84 in the fourth quarter,

compared to $50.44 in the same period of 2010, reflecting a 9%

increase in Canadian dollar terms. Weighted average selling prices

increased 8% in U.S. dollar terms as compared to the same period of

2010.

Costs for the fourth quarter were $3.0 million, compared to $2.9

million for the same period in 2010. This increase reflects higher

variable costs per m3 due to renegotiated contractor rates in 2011

and unfavourable foreign exchange movement, offset partially by

lower sales volume.

EBITDA for the fourth quarter was $0.9 million, compared to $1.2

million for the same period in 2010, while EBITDA margin decreased

from 29% to 23%.

During the fourth quarter of 2011, Maine Timberlands experienced

no recordable safety incidents among employees and one recordable

incident among contractors.

Market Outlook

The following Market Outlook contains forward-looking statements

about Acadian Timber Corp.'s market outlook for fiscal 2012.

Reference should be made to the "Forward-looking Statements"

section of this news release. For a description of material factors

that could cause actual results to differ materially from the

forward-looking statements in the following, please see the Risk

Factors section of our management's discussion and analysis of

Acadian's most recent Annual Report and Annual Information Form

available on our website at www.acadiantimber.com or filed with

SEDAR at www.sedar.com.

The U.S. housing market demonstrated slightly more encouraging

signals in the fourth quarter with new home sales rising 2%, sales

of existing homes increasing 4% and housing starts increasing by

9%. The NAHB housing market index also rose with improved buyer

traffic. At the same time the S&P/Case-Shiller 20-city house

pricing index has fallen 6% over the past four months with price

declines in 16 of the 20 markets surveyed. Clearly, the timing of

recovery for the U.S. housing market remains uncertain. Management

believes the housing recovery process will require a further two to

three years before home inventories normalize and new home

construction recovers to trend levels. As a result, Acadian expects

markets for softwood sawlogs to remain weak through 2012 before a

formative recovery begins in earnest in 2013.

Global pulp and paper markets continue to be under pressure,

however, pulp production appears to have come into alignment with

demand resulting in more balanced inventories with stabilizing

prices suggesting pulp prices may have bottomed. Acadian's pulp

customers continue to have high operating rates and markets for

Acadian's pulpwood continue to be very positive providing a

positive offset to weak softwood sawlog markets.

Markets for hardwood sawlogs and specialty products improved

slightly or were stable through 2011 with a similar outlook for

2012. Markets for biomass are expected to be stable although weak

owing to continued low power prices and very low prices for natural

gas.

While the business environment continues to slowly improve, some

of Acadian's significant softwood pulpwood customers have struggled

with challenging market conditions for an extended period of time

resulting in a weakening of their financial position. Management

recognizes that the ongoing financial viability of these customers

is dependent on their continued access to capital and an improved

market environment. We continue to monitor these situations closely

while exploring market alternatives for our logs in the event that

sales to these customers decline or cease. Acadian's financial

results and cash flows to fund future dividends are dependent on

current harvesting levels and sales revenue.

"We expect 2012 to present improving, although uncertain,

conditions and we are confident that Acadian will continue to

demonstrate its adeptness in identifying and accessing market

opportunities while keeping costs low. To address limited

contractor availability in Maine, we have initiated strategies

which we expect to result in increased harvest levels in 2012,"

concluded Mr. Carter.

Quarterly Dividend

Acadian is pleased to announce a dividend of $0.20625 per share,

payable on April 13, 2012 to shareholders of record on March 30,

2012.

Acadian Timber Corp. is a leading supplier of primary forest

products in Eastern Canada and the Northeastern U.S. With a total

of 2.4 million acres of land under management, Acadian is the

second largest timberland operator in New Brunswick and Maine.

Acadian owns and manages approximately 1.1 million acres of

freehold timberlands in New Brunswick and Maine, and provides

management services relating to approximately 1.3 million acres of

Crown licensed timberlands. Acadian also owns and operates a forest

nursery in Second Falls, New Brunswick. Acadian's products include

softwood and hardwood sawlogs, pulpwood and biomass by-products,

sold to approximately 90 regional customers.

Acadian's shares are listed for trading on the Toronto Stock

Exchange under the symbol ADN.

For further information, please visit our website at

www.acadiantimber.com.

Forward-Looking Statements

This News Release contains forward-looking information and other

forward-looking statements within the meaning of applicable

Canadian securities laws that involve known and unknown risks,

uncertainties and other factors that may cause the actual results,

performance or achievements of Acadian Timber Corp. and its

subsidiaries (collectively, "Acadian"), or industry results, to be

materially different from any future results, performance or

achievements expressed or implied by such forward-looking

statements. When used in this News Release, such statements may

contain such words as "may," "will," "intend," "should," "expect,"

"believe," "outlook," "predict," "remain," "anticipate,"

"estimate," "potential," "continue," "plan," "could," "might,"

"project," "targeting" "approximately," or the negative of these

terms or other similar terminology. Forward-looking information in

this News Release includes, without limitation, statements

regarding management's beliefs, intentions, results, performance,

goals, achievements, future events, plans and objectives, business

strategy, access to capital, liquidity and trading volumes,

dividends, taxes, capital expenditures, projected costs, and

similar statements concerning anticipated future events, results,

achievements, circumstances, performance or expectations that are

not historical facts. These statements which reflect management's

current expectations regarding future events and operating

performance are based on information currently available to

management and speak only as of the date of this News Release. All

forward-looking statements in this News Release are qualified by

these cautionary statements. Forward-looking statements involve

significant risks and uncertainties, should not be read as

guarantees of future performance or results, should not be unduly

relied upon, and will not necessarily be accurate indications of

whether or not such results will be achieved. Factors that could

cause actual results to differ materially from the results

discussed in the forward-looking statements include, but are not

limited to: general economic and market conditions; product demand;

future production volumes; concentration of customers; changes in

competition; commodity pricing; interest rate and foreign currency

fluctuations; seasonality; weather and natural conditions;

regulatory, trade or environmental policy changes; changes in

labour costs or other costs of production; changes in Canadian

income tax law; economic situation of key customers; and other

risks and factors discussed under the heading "Risk Factors" in the

Annual Information Form of Acadian Timber Corp. dated March 28,

2012, available on SEDAR at www.sedar.com on or about March 28,

2012, and other filings of Acadian with securities regulatory

authorities available on SEDAR at www.sedar.com.

Forward-looking information is based on various material factors

or assumptions, which are based on information currently available

to Acadian. Material factors or assumptions that were applied in

drawing a conclusion or making an estimate set out in the

forward-looking information may include, but are not limited to:

anticipated financial performance; business prospects; strategies;

regulatory developments; exchange rates; the sufficiency of

budgeted capital expenditures in carrying out planned activities;

the availability and cost of labour and services, which are subject

to change based on commodity prices, market conditions for timber

and wood products, general economic and market conditions; product

demand; concentration of customers; commodity pricing; interst rate

and foreign currency rate fluctuations; seasonality; weather and

natural conditions; regulatory trade or environmental policy

changes; changes in Canadian income tax law; the economic situation

of key customers, and the utilization of the tax basis resulting

from the conversion from an income trust to a corporation. Readers

are cautioned that the preceding list of material factors or

assumptions is not exhaustive. Although the forward-looking

statements contained in this News Release are based upon what

management believes are reasonable assumptions, Acadian cannot

assure readers that actual results will be consistent with these

forward-looking statements. Certain statements in this News Release

may also be considered "financial outlook" for the purposes of

applicable Canadian securities laws, and such financial outlook may

not be appropriate for purposes other than this News Release. Such

information has been included in the News Release to provide

readers with a sense of the future financial outlook of Acadian.

The forward-looking statements contained in this News Release are

made as of the date of this News Release, and should not be relied

upon as representing Acadian's views as of any date subsequent to

the date of this News Release. Acadian assumes no obligation to

update or revise these forward-looking statements to reflect new

information, events, circumstances or otherwise, except as may be

required by applicable law.

Acadian Timber Corp.

Consolidated Statements of Net Income

(unaudited)

----------------------------------------------------------------------------

Three Months Ended Year Ended

----------------------------------------------------------------------------

Dec. 31, Dec. 31, Dec. 31, Dec. 31,

(CAD thousands) 2011 2010 2011 2010

----------------------------------------------------------------------------

Net sales $ 15,139 $ 20,581 $ 66,153 $ 70,996

----------------------------------------------------------------------------

Operating costs and expenses

Cost of sales 9,562 12,277 43,847 46,018

Selling, administration and

other 1,661 1,913 6,346 7,026

Reforestation 73 - 540 217

Depreciation and amortization 139 136 548 499

----------------------------------------------------------------------------

11,435 14,326 51,281 53,760

----------------------------------------------------------------------------

Operating earnings 3,704 6,255 14,872 17,236

Interest expense, net (735) (973) (3,157) (3,791)

Other items

Gain on sale of timberlands - 2 107 40

Fair value adjustments 14,076 2,439 13,501 3,950

Loss on revaluation of roads

and land (1,527) (5,005) (1,527) (5,005)

Unrealized exchange gain

(loss) on long -term debt 455 - (3,473) -

Gain on corporate conversion - - - 21,086

----------------------------------------------------------------------------

Earnings before income taxes 15,973 2,718 20,323 33,516

Deferred income tax expense (4,546) (96) (6,564) (2,210)

----------------------------------------------------------------------------

Net income for the period $ 11,427 $ 2,622 $ 13,759 $ 31,306

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Net income per share - basic and

diluted $ 0.68 $ 0.16 $ 0.82 $ 1.87

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Acadian Timber Corp.

Consolidated Statements of Comprehensive Income

(unaudited)

----------------------------------------------------------------------------

Three Months Ended Year Ended

----------------------------------------------------------------------------

Dec. 31, Dec. 31, Dec. 31, Dec. 31,

(CAD thousands) 2011 2010 2011 2010

----------------------------------------------------------------------------

Net income $ 11,427 $ 2,622 $ 13,759 $ 31,306

----------------------------------------------------------------------------

Other comprehensive income

(loss)

Unrealized foreign currency

translation income (loss) (575) (1,409) 2,559 (2,917)

Amortization of derivatives

designated as hedges (51) 1,134 (321) 1,134

Gain on revaluation of roads

and land (169) 2,354 (169) 2,354

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Comprehensive income $ 10,632 $ 4,701 $ 15,828 $ 31,877

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Acadian Timber Corp.

Consolidated Balance Sheets

(unaudited)

----------------------------------------------------------------------------

As at December 31, December 31, January 1,

(CAD thousands) 2011 2010 2010

----------------------------------------------------------------------------

ASSETS

Current Assets:

Cash and cash equivalents $ 4,019 $ 7,333 $ 2,053

Accounts receivable and other

assets 8,726 7,252 6,265

Inventory 2,263 990 2,289

Derivative asset - 1,557 -

Note receivable - - 4,001

----------------------------------------------------------------------------

15,008 17,132 14,608

Timber 231,370 216,181 216,751

Land, roads and fixed assets 33,438 35,383 37,150

Intangible assets 6,140 6,140 6,140

Deferred income tax asset 3,038 7,522 -

----------------------------------------------------------------------------

$ 288,994 $ 282,358 $ 274,649

----------------------------------------------------------------------------

----------------------------------------------------------------------------

LIABILITIES AND SHAREHOLDERS' EQUITY

Current liabilities

Accounts payable and accrued

liabilities $ 4,534 $ 4,483 $ 4,275

Dividends payable to

shareholders 3,451 837 -

Debt - 73,752 -

----------------------------------------------------------------------------

7,985 79,072 4,275

Long term debt 73,079 - 80,739

Deferred income tax liability 21,572 18,952 34,553

Shareholders' equity 186,358 184,334 155,082

----------------------------------------------------------------------------

$ 288,994 $ 282,358 $ 274,649

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Acadian Timber Corp.

Consolidated Statements of Cash Flows

(unaudited)

----------------------------------------------------------------------------

Three Months Ended Year Ended

----------------------------------------------------------------------------

Dec. 31, Dec. 31, Dec. 31, Dec. 31,

(CAD thousands) 2011 2010 2011 2010

----------------------------------------------------------------------------

Cash provided by (used for):

----------------------------------------------------------------------------

Operating activities

Net income $ 11,427 $ 2,622 $ 13,759 $ 31,306

Adjustments to net income

Deferred income tax expense 4,546 96 6,564 2,210

Depreciation and amortization 139 136 548 499

Fair value adjustments (14,076) (2,439) (13,501) (3,950)

Loss on revaluation of roads

and land 1,527 5,005 1,527 5,005

Unrealized exchange loss on

long term debt (455) - 3,473 -

Interest expense, net 735 973 3,157 3,791

Interest paid, net (1,584) (973) (3,047) (3,791)

Gain on sale of timberlands - - (107) (40)

Gain on corporate conversion - - - (21,086)

----------------------------------------------------------------------------

2,259 5,420 12,373 13,944

Net change in non-cash working

capital balances and other (2,504) 865 (325) 87

----------------------------------------------------------------------------

(245) 6,285 12,048 14,031

----------------------------------------------------------------------------

Financing activities

Repayment of revolving facility - (1,000) - (5,500)

Borrowing of term facility - - 70,608 -

Repayment of bank term credit

facility and term loan - - (73,639) -

Deferred financing costs - (73) (1,205) (73)

Dividends paid to shareholders (3,451) (836) (11,190) (2,788)

----------------------------------------------------------------------------

(3,451) (1,909) (15,426) (8,361)

----------------------------------------------------------------------------

Investing activities

Additions to timber, land, roads

and fixed assets (20) (62) (45) (430)

Proceeds from sale of

timberlands - - 109 40

----------------------------------------------------------------------------

(20) (62) 64 (390)

----------------------------------------------------------------------------

Increase in cash and cash

equivalents during the period (3,716) 4,314 (3,314) 5,280

Cash and cash equivalents,

beginning of period 7,735 3,019 7,333 2,053

----------------------------------------------------------------------------

Cash and cash equivalents, end

of period $ 4,019 $ 7,333 $ 4,019 $ 7,333

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Reconciliation to EBITDA and Free Cash Flow

----------------------------------------------------------------------------

Three Months Ended Year Ended

----------------------------------------------------------------------------

Dec. 31, Dec. 31, Dec. 31, Dec. 31,

(CAD thousands) 2011 2010 2011 2010

----------------------------------------------------------------------------

Net income(1) $ 11,427 $ 2,622 $ 13,759 $ 31,306

Add (deduct):

Interest expense, net 735 973 3,157 3,791

Deferred income tax expense 4,546 96 6,564 2,210

Depreciation and amortization 139 136 548 499

Fair value adjustments (14,076) (2,439) (13,501) (3,950)

Revaluation of roads and land 1,527 5,005 1,527 5,005

Unrealized exchange (gain)

loss on long term debt (455) - 3,473 -

Gain on corporate conversion - - - (21,086)

----------------------------------------------------------------------------

EBITDA 3,843 6,393 15,527 17,775

Add (deduct):

Interest paid on debt, net (1,584) (973) (3,047) (3,791)

Capital expenditures (20) (62) (45) (430)

Proceeds on sale of

timberlands - - 109 40

Gain on sale of timberlands - - (107) (40)

----------------------------------------------------------------------------

Free cash flow $ 2,239 $ 5,358 $ 12,437 $ 13,554

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Dividends declared $ 3,451 $ 836 $ 13,804 $ 3,625

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Payout ratio 154% 16% 111% 27%

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(1) Net income for the year ended December 31, 2010 included the gain

resulting from Acadian's corporate conversion on January 1, 2010.

Contacts: Acadian Timber Corp. Robert Lee Investor Relations and

Communications 604-661-9607rlee@acadiantimber.com

www.acadiantimber.com

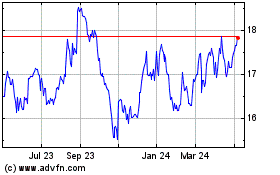

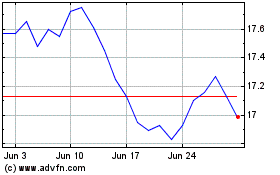

Acadian Timber (TSX:ADN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Acadian Timber (TSX:ADN)

Historical Stock Chart

From Jul 2023 to Jul 2024