All figures in Canadian dollars unless otherwise noted

Investors, analysts and other interested parties can access

Acadian Timber Corp.'s 2011 Second Quarter Results conference call

via webcast on Thursday, July 28, 2011 at 11:00 a.m. ET at

www.acadiantimber.com or via teleconference at 1-800-319-4610, toll

free in North America. For overseas calls please dial

+1-604-638-5340, at approximately 9:50 a.m. ET. The teleconference

taped rebroadcast can be accessed at 1-800-319-6413 or

+1-604-638-9010 and enter passcode 2826.

Acadian Timber Corp. ("Acadian" or the "Company") (TSX: ADN)

today reported financial and operating results(1) for the three

months ended June 25, 2011 (the "second quarter").

"The market for hardwood and softwood sawlogs and pulpwood was

relatively strong during the second quarter with demand and pricing

for hardwood pulpwood being particularly strong", said Reid Carter,

Chief Executive Officer of Acadian. "Regional operating levels

continued to be positive with most sawmills operating and many on

two shifts and all of Acadian's pulp and paper customers operating

at close to full production during the second quarter."

For the second quarter of 2011, Acadian generated net sales of

$11.7 million on sales volume of 243 thousand m(3), which

represents a $0.4 million, or 3%, decrease in net sales compared to

the same period in 2010.

EBITDA of $0.6 million for the second quarter of 2011 was $0.4

million lower than in the second quarter of 2010, while EBITDA

margin decreased to 5% from 8% in the same period of last year.

For the six months ended June 25, 2011, Acadian generated net

sales of $33.5 million on sales volume of 669 thousand m(3) as

compared to net sales of $32.6 million on sales volume of 671

thousand m(3) in the comparable period of 2010. EBITDA of $7.9

million during the six months ended June 25, 2011 is $1.2 million

higher than the first half of 2010 reflecting the strong first

quarter 2011 results.

(1)This news release makes reference to earnings before

interest, taxes, depreciation and amortization, and fair value

adjustments ("EBITDA") and free cash flow. Management believes that

EBITDA and free cash flow are key performance measures in

evaluating Acadian's operations and are important in enhancing

investors' understanding of the Company's operating performance. As

EBITDA and free cash flow do not have a standardized meaning

prescribed by International Financial Reporting Standards ("IFRS"),

they may not be comparable to similar measures presented by other

companies. As a result, we have provided in this news release

reconciliations of net income and cash flow from operations, as

determined in accordance with IFRS, to EBITDA and free cash

flow.

Review of Operations

Financial and Operating Highlights

Three Months Ended Six Months Ended

---------------------------------------------

(CAD thousands, except per June 25, June 26, June 25, June 26,

share information) 2011 2010 2011 2010

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Sales volume (000s m(3)) 242.7 270.0 669.1 671.0

Net sales $ 11,723 $ 12,137 $ 33,479 $ 32,595

EBITDA 608 971 7,873 6,710

Free cash flow (37) (391) 7,015 4,588

Dividends declared 3,451 836 6,902 1,952

Net income (loss)(1) (261) 565 2,673 25,645

Per share - fully diluted

Net income (loss)(1) (0.02) 0.03 0.16 1.53

Free cash flow - (0.02) 0.42 0.27

Dividends declared 0.20 0.05 0.41 0.12

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(1)Net income (loss) includes the impact of deferred income tax,

depreciation and amortization expense, and fair value adjustments which

are non-cash items recorded in each respective period and, for 2010

only, the gain resulting from Acadian's corporate conversion on January

1, 2010.

International Financial Reporting Standards

Effective fiscal 2011, Acadian's financial results are reported

in accordance with International Financial Reporting Standards

("IFRS"). Comparative figures in this press release, previously

presented in GAAP, have been adjusted to conform to IFRS.

Operating Results

Acadian traditionally experiences very low levels of operating,

marketing and selling activity during the second quarter of each

year owing to spring break-up which causes much of the

infrastructure to be temporarily inoperable. Cold weather early in

the first quarter of 2011 allowed Acadian's New Brunswick

operations to continue to harvest into early April allowing log

sales to continue into the early part of the quarter. However, this

benefit was offset by wet weather late in the quarter delaying

production start-up following spring break-up, thereby reducing the

total sales volume for the period.

New Brunswick Timberlands

The table below summarizes operating and financial results for

New Brunswick Timberlands.

Three Months Ended June 25, Three Months Ended June 26,

2011 2010

--------------------------------------------------------------

Harvest Sales Harvest Sales

(000s (000s Results (000s (000s Results

m(3)) m(3)) (thousands) m(3)) m(3)) (thousands)

---------------------------------------------------------------------------

---------------------------------------------------------------------------

Softwood 88.9 96.3 $ 5,131 71.6 72.4 $ 3,888

Hardwood 87.6 91.6 5,315 73.0 99.1 5,633

Biomass 34.2 34.2 472 50.2 50.1 393

---------------------------------------------------------------------------

210.7 222.1 10,918 194.8 221.6 9,914

Other sales (301) (190)

---------------------------------------------------------------------------

Net sales $ 10,617 $ 9,724

---------------------------------------------------------------------------

EBITDA $ 1,139 $ 905

EBITDA margin 11% 9%

---------------------------------------------------------------------------

Six Months Ended June 25, 2011 Six Months Ended June 26, 2010

---------------------------------------------------------------

Harvest Sales Harvest Sales

(000s (000s Results (000s (000s Results

m(3)) m(3)) (thousands) m(3)) m(3)) (thousands)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Softwood 254.8 252.6 $ 12,714 205.8 194.6 $ 10,208

Hardwood 225.2 218.2 12,921 213.9 240.8 13,346

Biomass 103.9 103.9 1,635 108.2 108.1 1,575

----------------------------------------------------------------------------

583.9 574.7 27,270 527.9 543.5 25,129

Other sales 1,278 1,026

----------------------------------------------------------------------------

Net sales $ 28,548 $ 26,155

----------------------------------------------------------------------------

EBITDA $ 7,494 $ 5,981

EBITDA margin 26% 23%

----------------------------------------------------------------------------

Softwood, hardwood and biomass shipments were 96 thousand m(3),

92 thousand m(3) and 34 thousand m(3), respectively, for the second

quarter of 2011. Approximately 37% was sold as sawlogs, 48% as

pulpwood and 15% as biomass. This compares to 36% sold as sawlogs,

41% as pulpwood and 23% as biomass in the second quarter of

2010.

Net sales for the second quarter of 2011 was $10.6 million (2010

- $9.7 million) with an average selling price across all products

of $49.18 per m(3) which compares to an average selling price of

$44.74 per m(3) during the second quarter of 2010. The

year-over-year increase in the average selling price resulted from

improved spruce-fir sawlog demand and strong hardwood pulpwood

markets. Net sales for the first six months ended June 25, 2011

were $28.5 million, an increase of $2.4 million over the first half

of 2010.

Costs for the second quarter were $9.5 million (2010 - $8.8

million). Variable costs per m(3) were 4% higher than the second

quarter of 2010 as a result of sales made to more distant markets,

particularly for hardwood pulpwood.

EBITDA for the second quarter was $1.1 million, compared to $0.9

million in the comparable period of 2010. For the six months ended

June 25, 2011, EBITDA was $7.5 million as compared to $6.0 million

for the first half of 2010. EBITDA margin increased to 11%, as

compared to 9% for the second quarter of 2010, primarily reflecting

the impact of increased proportion of softwood sawlog sales volume

and higher prices for pulpwood.

During the second quarter of 2011, NB Timberlands experienced no

recordable safety incidents among employees and one recordable

incident among contractors from which the individual has fully

recovered.

Maine Timberlands

The table below summarizes operating and financial results for

Maine Timberlands.

Three Months Ended June 25, Three Months Ended June 26,

2011 2010

---------------------------------------------------------------

Harvest Sales Harvest Sales

(000s (000s Results (000s (000s Results

m(3)) m(3)) (thousands) m(3)) m(3)) (thousands)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Softwood 11.7 11.8 $ 627 32.9 33.0 $ 1,623

Hardwood 5.8 6.7 380 10.9 11.7 638

Biomass 2.1 2.1 13 3.7 3.7 52

----------------------------------------------------------------------------

19.6 20.6 1,020 47.5 48.4 2,313

Other sales 86 100

----------------------------------------------------------------------------

Net sales $ 1,106 $ 2,413

----------------------------------------------------------------------------

EBITDA $ (148) $ 257

EBITDA margin (13)% 11%

----------------------------------------------------------------------------

Six Months Ended June 25, 2011 Six Months Ended June 26, 2010

----------------------------------------------------------------------------

Harvest Sales Harvest Sales

(000s (000s Results (000s (000s Results

m(3)) m(3)) (thousands) m(3)) m(3)) (thousands)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Softwood 70.0 70.0 $ 3,685 93.9 93.6 $ 4,755

Hardwood 16.4 17.8 1,045 28.2 27.9 1,394

Biomass 6.6 6.6 57 6.0 6.0 122

----------------------------------------------------------------------------

93.0 94.4 4,787 128.1 127.5 6,271

Other sales 144 169

----------------------------------------------------------------------------

Net sales $ 4,931 $ 6,440

----------------------------------------------------------------------------

EBITDA $ 1,081 $ 1,423

EBITDA margin 22% 22%

----------------------------------------------------------------------------

Softwood, hardwood and biomass shipments were 12 thousand m(3),

7 thousand m(3) and 2 thousand m(3), respectively, for the second

quarter of 2011. Approximately 50% was sold as sawlogs, 40% as

pulpwood and 10% as biomass. This compares to 49% sold as sawlogs,

43% as pulpwood and 8% as biomass in the second quarter of

2010.

Net sales for the second quarter of 2011 were $1.1 million (2010

- $2.4 million) with an average selling price across all products

of $49.61 per m(3) which compares to an average selling price of

$47.79 per m(3) during the second quarter of 2010. This variance in

sales price was primarily attributable to greater demand for

sawlogs of all species groups. A stronger Canadian/U.S. dollar

exchange rate year-over-year reduced the benefit of these market

changes in Canadian dollar terms. Sales volume was limited due a

poor weather conditions in the region resulting in a late start

from spring break up. Net sales for the first six months ended June

25, 2011 were $4.9 million, a decrease of $1.5 million over the

first half of 2010.

Costs for the second quarter were $1.3 million (2010 - $2.2

million). Variable costs per m(3) decreased 6% in Canadian dollar

terms and 2% in U.S. dollar terms. This decrease reflects increased

sales to closer markets in the second quarter of 2011.

EBITDA for the second quarter was negative $0.1 million,

compared to positive $0.3 million in the comparable period of 2010.

For the six months ended June 25, 2011, EBITDA was $1.1 million as

compared to $1.4 million for the first half of 2010.

EBITDA margin averaged negative 13% in the second quarter of

2011 as compared to positive 11% during the second quarter of 2010,

although this negative margin simply reflects the low sales volume

which resulted in lower contribution to fixed costs.

We are pleased to report that during the second quarter of 2011,

Maine Timberlands experienced no recordable safety incidents among

employees or contractors.

Market Outlook

The following Market Outlook contains forward-looking statements

about Acadian Timber Corp.'s market outlook for fiscal 2011.

Reference should be made to the "Forward-looking Statements"

section of this news release. For a description of material factors

that could cause actual results to differ materially from the

forward-looking statements in the following, please see the Risk

Factors section of our management's discussion and analysis of

Acadian's most recent Annual Report and Annual Information Form

available on our website at www.acadiantimber.com or filed with

SEDAR at www.sedar.com.

Signals for recovery of the U.S. housing continue to be very

weak suggesting that any robust recovery of this market remains

somewhat distant. However, Acadian continues to benefit from most

of its softwood sawmilling customers maintaining active operations

and, as a result, demand for spruce-fir sawlogs continues to be

strong causing our outlook to be cautiously optimistic for the

remainder of 2011. Markets for Acadian's other softwood species are

mixed, with demand for hemlock being very strong while markets for

white pine and cedar are softer. Spruce-fir comprises the majority

of softwood sawlog sales.

Markets for hardwood sawlogs remain stable and appear to have a

similar outlook for the foreseeable future.

Markets for both softwood and hardwood pulp logs are strong with

demand and pricing continuing to improve. While consensus

expectations appear to forecast softening pulp markets during the

second half of 2011, Acadian's major hardwood pulpwood customers

are currently operating and actively competing for deliveries

suggesting prices will remain stable through the third quarter with

a possible softening of demand late in the year. Acadian continues

to be able to sell all of its biomass, although more optimistic

expectations for growth of this market have moderated with current

low natural gas prices and little expectation of new economic

incentives for conversion to renewable fuels in the United

States.

Quarterly Dividend

Acadian is pleased to announce a dividend of $0.20625 per share,

payable on October 14, 2011 to shareholders of record on September

30, 2011.

Acadian Timber Corp. is a leading supplier of primary forest

products in Eastern Canada and the Northeastern U.S. With a total

of 2.4 million acres of land under management, Acadian is the

second largest timberland operator in New Brunswick and Maine.

Acadian owns and manages approximately 1.1 million acres of

freehold timberlands in New Brunswick and Maine, and provides

management services relating to approximately 1.3 million acres of

Crown licensed timberlands. Acadian also owns and operates a forest

nursery in Second Falls, New Brunswick. Acadian's products include

softwood and hardwood sawlogs, pulpwood and biomass by-products,

sold to over 100 regional customers.

Acadian's shares are listed for trading on the Toronto Stock

Exchange under the symbol ADN.

For further information, please visit our website at

www.acadiantimber.com.

Forward-Looking Statements

This News Release contains forward-looking information and other

forward-looking statements within the meaning of applicable

Canadian securities laws that involve known and unknown risks,

uncertainties and other factors that may cause the actual results,

performance or achievements of Acadian Timber Corp. and its

subsidiaries (collectively, "Acadian"), or industry results, to be

materially different from any future results, performance or

achievements expressed or implied by such forward-looking

statements. When used in this News Release, such statements may

contain such words as "may," "will," "intend," "should," "expect,"

"believe," "outlook," "predict," "remain," "anticipate,"

"estimate," "potential," "continue," "plan," "could," "might,"

"project," "targeting" or the negative of these terms or other

similar terminology. Forward-looking information in this News

Release includes, without limitation, statements regarding

management's beliefs, intentions, results, performance, goals,

achievements, future events, plans and objectives, business

strategy, access to capital, liquidity and trading volumes,

dividends, taxes, capital expenditures, projected costs, and

similar statements concerning anticipated future events, results,

achievements, circumstances, performance or expectations that are

not historical facts. These statements which reflect management's

current expectations regarding future events and operating

performance are based on information currently available to

management and speak only as of the date of this News Release. All

forward-looking statements in this News Release are qualified by

these cautionary statements. Forward-looking statements involve

significant risks and uncertainties, should not be read as

guarantees of future performance or results, should not be unduly

relied upon, and will not necessarily be accurate indications of

whether or not such results will be achieved. Factors that could

cause actual results to differ materially from the results

discussed in the forward-looking statements include, but are not

limited to: general economic and market conditions; product

demand;

concentration of customers; commodity pricing; interest rate and

foreign currency fluctuations; seasonality; weather and natural

conditions; regulatory, trade or environmental policy changes;

changes in Canadian income tax law; economic situation of key

customers; and other risks and factors discussed under the heading

"Risk Factors" in each of the Annual Information Form dated March

28, 2011 and the Management Information Circular dated March 28,

2011, and other filings of Acadian made with securities regulatory

authorities, which are available on SEDAR at www.sedar.com.

Forward-looking information is based on various material factors or

assumptions, which are based on information currently available to

Acadian. Material factors or assumptions that were applied in

drawing a conclusion or making an estimate set out in the

forward-looking information may include, but are not limited to:

anticipated financial performance; business prospects; strategies;

regulatory developments; exchange rates; the sufficiency of

budgeted capital expenditures in carrying out planned activities;

the availability and cost of labour and services and the ability to

obtain financing on acceptable terms, which are subject to change

based on commodity prices, market conditions for timber and wood

products, and the economic situation of key customers. Readers are

cautioned that the preceding list of material factors or

assumptions is not exhaustive. Although the forward-looking

statements contained in this News Release are based upon what

management believes are reasonable assumptions, Acadian cannot

assure readers that actual results will be consistent with these

forward-looking statements. Certain statements in this News Release

may also be considered "financial outlook" for the purposes of

applicable Canadian securities laws, and such financial outlook may

not be appropriate for purposes other than this News Release. The

forward-looking statements in this News Release are made as of the

date of this News Release, and should not be relied upon as

representing Acadian's views as of any date subsequent to the date

of this News Release. Acadian assumes no obligation to update or

revise these forward-looking statements to reflect new information,

events, circumstances or otherwise, except as may be required by

applicable law.

Acadian Timber Corp.

Interim Consolidated Statement of Net Income

(unaudited)

----------------------------------------------------------------------------

Three Months Ended Six Months Ended

----------------------------------------------------------------------------

June 25, June 26, June 25, June 26,

(CAD thousands) 2011 2010 2011 2010

----------------------------------------------------------------------------

Net sales $ 11,723 $ 12,137 $ 33,479 $ 32,595

----------------------------------------------------------------------------

Operating costs and expenses

Cost of sales 9,237 9,603 22,224 22,446

Selling, administration and other 1,682 1,547 3,187 3,425

Depreciation and amortization 135 121 272 241

----------------------------------------------------------------------------

11,054 11,271 25,683 26,112

----------------------------------------------------------------------------

Operating earnings 669 866 7,796 6,483

Interest expense, net (737) (1,097) (1,677) (1,856)

Interest:

Fair value adjustments 1,235 1,415 (398) 1,427

Unrealized exchange loss on long-

term debt (450) - (987) -

Reforestation (293) (46) (293) (46)

Gain on sale of timberlands 97 30 98 32

Gain on corporate conversion - - - 21,086

----------------------------------------------------------------------------

Earnings before income taxes 521 1,168 4,539 27,126

Deferred tax expense (782) (603) (1,866) (1,481)

----------------------------------------------------------------------------

Net income (loss) for the period $ (261)$ 565 $ 2,673 $ 25,645

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Net income (loss) per share - basic $ (0.02)$ 0.03 $ 0.16 $ 1.53

Net income (loss) per share -

diluted $ (0.02)$ 0.03 $ 0.16 $ 1.53

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Acadian Timber Corp.

Interim Consolidated Statement of Comprehensive Income

(unaudited)

----------------------------------------------------------------------------

Three Months Ended Six Months Ended

----------------------------------------------------------------------------

June 25, June 26, June 25, June 26,

(CAD thousands) 2011 2010 2011 2010

----------------------------------------------------------------------------

Net income (loss) $ (261)$ 565 $ 2,673 $ 25,645

----------------------------------------------------------------------------

Other comprehensive income (loss)

Unrealized foreign currency

translation income (loss) 704 533 (232) (900)

Amortization of derivatives

designated as hedges (77) - (222) -

----------------------------------------------------------------------------

Comprehensive income $ 366 $ 1,098 $ 2,219 $ 24,745

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Acadian Timber Corp.

Interim Consolidated Balance Sheets

(unaudited)

----------------------------------------------------------------------------

As at June 25, December 31, January 1,

(CAD thousands) 2011 2010 2010

----------------------------------------------------------------------------

ASSETS

Current Assets:

Cash and cash equivalents $ 6,546 $ 7,333 $ 2,053

Accounts receivable and other

assets 7,852 7,252 6,265

Inventory 1,403 990 2,289

Derivative asset - 1,557 -

Note receivable - - 4,001

----------------------------------------------------------------------------

15,801 17,132 14,608

Timber 214,725 216,181 216,751

Property, plant and equipment 34,075 34,508 36,275

Investment property 875 875 875

Intangible Assets 6,140 6,140 6,140

Deferred income tax asset 5,906 7,522 -

----------------------------------------------------------------------------

$ 277,522 $ 282,358 $ 274,649

----------------------------------------------------------------------------

----------------------------------------------------------------------------

LIABILITIES AND SHAREHOLDERS' EQUITY

Current liabilities:

Accounts payable and accrued

liabilities $ 4,978 $ 4,483 $ 4,275

Dividends payable to

shareholders 3,451 837 -

Debt - 73,752 -

----------------------------------------------------------------------------

8,429 79,072 4,275

Long-term debt 70,470 - 80,739

Deferred income tax liability 18,972 18,952 34,553

Shareholders' equity 179,651 184,334 155,082

----------------------------------------------------------------------------

$ 277,522 $ 282,358 $ 274,649

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Acadian Timber Corp.

Interim Consolidated Statement of Cash Flows

(unaudited)

---------------------------------------------------------------------------

Three Months Ended Six Months Ended

---------------------------------------------------------------------------

June 25, June 26, June 25, June 26,

(CAD thousands) 2011 2010 2011 2010

---------------------------------------------------------------------------

Cash provided by (used for):

---------------------------------------------------------------------------

Operating activities

Net income (loss) $ (261)$ 565 $ 2,673 $ 25,645

Items not affecting cash:

Deferred tax expense 782 603 1,866 1,481

Depreciation and amortization 135 121 272 241

Fair value adjustments (1,235) (1,415) 398 (1,427)

Unrealized exchange loss on long

term debt 450 - 987 -

Interest expense, net 737 1,097 1,677 1,856

Interest paid (639) (1,097) (844) (1,856)

Gain on sale of timberlands (97) (30) (98) (32)

Gain on corporate conversion - - - (21,086)

---------------------------------------------------------------------------

(128) (156) 6,931 4,822

Net change in non-cash working

capital balances and other (1,265) (2,337) 721 (722)

---------------------------------------------------------------------------

(1,393) (2,493) 7,652 4,100

---------------------------------------------------------------------------

Financing activities

Borrowings, net of repayments - (1,200) (3,031) (3,500)

Deferred financing costs - - (1,205) -

Dividends paid to shareholders (3,450) (836) (4,287) (1,115)

---------------------------------------------------------------------------

(3,450) (2,036) (8,523) (4,615)

---------------------------------------------------------------------------

Investing activities

Additions to timber, property, plant

and equipment (8) (263) (16) (264)

Proceeds from sale of timberlands 99 28 100 30

---------------------------------------------------------------------------

91 (235) 84 (234)

---------------------------------------------------------------------------

Decrease in cash and cash

equivalents during the period (4,752) (4,764) (787) (749)

Cash and cash equivalents, beginning

of period 11,298 6,068 7,333 2,053

---------------------------------------------------------------------------

Cash and cash equivalents, end of

period $ 6,546 $ 1,304 $ 6,546 $ 1,304

---------------------------------------------------------------------------

---------------------------------------------------------------------------

Reconciliation to EBITDA and Free

Cash Flow

----------------------------------------------------------------------------

Three Months Ended Six Months Ended

----------------------------------------------------------------------------

June 25, June 26, June 25, June 26,

(CAD thousands) 2011 2010 2011 2010

----------------------------------------------------------------------------

Net income (loss)(1) $ (261)$ 565 $ 2,673 $ 25,645

Add (deduct):

Interest expense, net 737 1,097 1,677 1,856

Deferred tax expense 782 603 1,866 1,481

Depreciation and amortization 135 121 272 241

Fair value adjustments (1,235) (1,415) 398 (1,427)

Unrealized exchange loss on long-

term debt 450 - 987 -

Gain on corporate conversion - - - (21,086)

----------------------------------------------------------------------------

EBITDA 608 971 7,873 6,710

Add (deduct):

Interest paid on debt, net (639) (1,097) (844) (1,856)

Capital expenditures (8) (263) (16) (264)

Gain on sale of timberlands (97) (30) (98) (32)

Proceeds on sale of timberlands 99 28 100 30

----------------------------------------------------------------------------

Free cash flow $ (37)$ (391)$ 7,015 $ 4,588

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Dividends declared $ 3,451 $ 836 $ 6,902 $ 1,952

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(1)Net income (loss) includes the impact of deferred income tax,

depreciation and amortization expense, and fair value adjustments which are

non-cash items recorded in each respective period and, for 2010 only, the

gain resulting from Acadian's corporate conversion on January 1, 2010.

Contacts: Acadian Timber Corp. Robert Lee Investor Relations and

Communications 604-661-9607 rlee@acadiantimber.com

www.acadiantimber.com

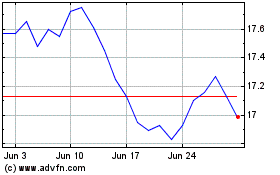

Acadian Timber (TSX:ADN)

Historical Stock Chart

From Jun 2024 to Jul 2024

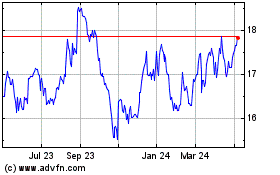

Acadian Timber (TSX:ADN)

Historical Stock Chart

From Jul 2023 to Jul 2024