Zoetis's Profit and Revenue Rise

May 04 2016 - 8:54AM

Dow Jones News

By Joshua Jamerson

Zoetis Inc.'s profit rose 24% in the latest quarter as revenue

also climbed, thanks in part to more days in the period due to its

accounting calendar.

The company, which also raised its earnings and revenue

forecasts Wednesday, said solid sales of its companion-animal

products business also drove the results, while it experienced

softer growth in its livestock products.

Zoetis, spun off from Pfizer Inc. in 2013, makes vaccines and

treatments for livestock and household pets. The company has been

helped recently by its acquisition of Abbott Laboratories Inc.'s

pet-products business, though foreign-exchange effects have dented

results.

For 2016, Zoetis said it is now expecting revenue of $4.78

billion to $4.88 billion, compared with prior guidance of $4.65

billion to $4.78 billion. The company said the change reflects

currency swings and the current views of its operations. The

company also said it now expects adjusted per-share profit between

$1.83 and $1.90 for the year, compared with prior guidance of $1.71

to $1.81.

For 2017, Zoetis now expects revenue of $5.08 billion to $5.28

billion, compared with a prior range of $4.95 billion to $5.15

billion. The company now expects adjusted per-share profit in a

range of $2.24 to $2.38, compared with prior forecasts of $2.18 to

$2.32.

Pershing Square, founded by William Ackman, took a roughly $2

billion stake in Zoetis in 2014, along with hedge fund Sachem Head

Capital Management LP.

Pershing Square investment team member William Doyle joined the

Zoetis board under a standstill agreement. In April, Pershing

Square said it was pleased with Zoetis's progress and wouldn't keep

Mr. Doyle on the company's board. He will step down after his term

ends in May.

Pershing Square owns 8.4% of Zoetis, according to FactSet.

In all, Zoetis reported a profit of $204 million, or 41 cents a

share, up from $165 million, or 33 cents a share, a year

earlier.

Excluding special items, earnings were 48 cents a share.

Analysts polled by Thomson Reuters had forecast 41 cents a share in

earnings.

Revenue rose 5.4% to $1.16 billion. Analysts had expected $1.1

billion in revenue.

The company said six additional calendar days in the period

compared with the first quarter of 2015 resulted in higher sales,

costs and expenses.

In the U.S. segment, revenue climbed 12% to $582 million on

higher sales of companion-animal products and products attained in

the Abbott acquisition. Livestock revenue declined 4% in the U.S.,

due to decreased sales of cattle and swine products.

Sales in the international segment grew 13% on an operational

basis, which excludes currency impacts, driven by higher livestock

sales due to its acquisition of Pharmaq, a maker of vaccines for

farmed fish.

Shares of Zoetis, up 16% over the past three months, were

inactive in premarket trading.

Write to Joshua Jamerson at joshua.jamerson@wsj.com

(END) Dow Jones Newswires

May 04, 2016 08:39 ET (12:39 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

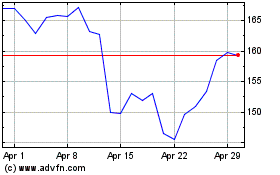

Zoetis (NYSE:ZTS)

Historical Stock Chart

From Jun 2024 to Jul 2024

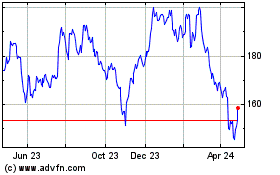

Zoetis (NYSE:ZTS)

Historical Stock Chart

From Jul 2023 to Jul 2024