UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): February 10, 2015

|

|

Zoetis Inc. |

(Exact name of registrant as specified in its charter) |

|

| | | | |

Delaware | | 001-35797 | | 46-0696167 |

(State or other jurisdiction | | (Commission File | | (I.R.S. Employer |

of incorporation) | | Number) | | Identification No.) |

|

| | |

100 Campus Drive, Florham Park, NJ | | 07932 |

(Address of principal executive offices) | | (Zip Code) |

|

|

(973) 822-7000 |

(Registrant's telephone number, including area code) |

|

|

Not Applicable |

(Former Name or Former Address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2 (b))

| |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 7.01. Regulation FD Disclosure.

On February 10, 2015, Zoetis Inc. issued a press release announcing that it has completed the purchase of the animal health assets of Abbott for a purchase price of $255 million. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated by reference into this Item 7.01.

The information set forth under this Item 7.01, including Exhibit 99.1, shall not be deemed “filed” for purposes of the Securities Exchange Act of 1934, as amended, or incorporated by reference in any filing under the Securities Act of 1933, as amended, regardless of any general incorporation language in such filing, unless expressly incorporated by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibit:

99.1 Press Release of Zoetis Inc. dated February 10, 2015.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

ZOETIS INC. |

| |

By: | | /s/ Heidi C. Chen |

Name: | | Heidi C. Chen |

Title: | | Executive Vice President, |

| | General Counsel and Corporate Secretary |

Dated: February 10, 2015

INDEX OF EXHIBITS

|

| | |

|

Exhibit | | |

Number | | Description |

| | |

99.1 | | Press Release of Zoetis Inc. dated February 10, 2015. |

Exhibit 99.1

For immediate release:

February 10, 2015

|

| | |

Media Contacts: | | Investor Contact: |

Elinore White | | John O'Connor |

1-973-443-2835 (o) | | 1-973-822-7088 (o) |

elinore.y.white@zoetis.com | | john.oconnor@zoetis.com |

| | |

William Price | | |

1-973-443-2742 (o) | | |

william.price@zoetis.com | | |

Zoetis Completes Purchase of Animal Health Assets of Abbott

FLORHAM PARK, N.J. - Feb. 10, 2015 - Zoetis Inc. (NYSE: ZTS) today announced that it has completed the purchase of the animal health assets of Abbott for a purchase price of $255 million, having fulfilled all closing requirements.

The purchase expands Zoetis’ companion animal product portfolio to bring veterinarians solutions for anesthesia and treating pain and serious illnesses such as diabetes. It also brings novel cancer and pain compounds to the Zoetis pipeline for further development.

“We believe Zoetis’ scale, industry-leading field force, and global presence will rapidly expand the reach and penetration of these newly acquired, leading brands for the veterinary surgical suite,” said Zoetis Group President Kristin Peck, who oversees the company’s Strategy and Corporate Development organization. “The acquisition is a prime example of our value creation strategy to deploy capital to acquire products that enhance our portfolio and enable us to deliver more customized solutions to veterinarians.”

In conjunction with the completion of the transaction, Zoetis has commenced integration activities and disclosed the expected impact on its 2015 financial results.

| |

• | Additional revenue of approximately $75 million for full year 2015 |

| |

• | A negative impact of $0.03 cents per share on reported diluted EPS for full year 20151 |

| |

• | A positive impact of $0.01 cent per share on adjusted diluted EPS for full year 20152 |

“Having completed the acquisition of these assets, we expect an accretive benefit to adjusted earnings in 2015 and expect a more significant benefit to be achieved in 2016 as we begin to more fully realize the synergies,” said Zoetis Executive Vice President and Chief Financial Officer Paul Herendeen. “We continue to focus on additional business development opportunities, internal investments, and prudent uses of our capital to create shareholder value.”

The company will provide further comments on the impact of the acquisition on its 2015 full year guidance when it announces fourth quarter and full year 2014 results on Feb. 11, 2015.

About Zoetis

Zoetis (zô-EH-tis) is the leading animal health company, dedicated to supporting its customers and their businesses. Building on more than 60 years of experience in animal health, Zoetis discovers, develops, manufactures and markets veterinary vaccines and medicines, complemented by diagnostic products and genetic tests and supported by a range of services. In 2013, the company generated annual revenues of $4.6 billion. With approximately 9,800 employees worldwide at the beginning of 2014, Zoetis has a local presence in approximately 70 countries, including 27 manufacturing facilities in 10 countries. Its products serve veterinarians, livestock producers and people who raise and care for farm and companion animals in 120 countries. For more information, visit www.zoetis.com.

1 Subject to final purchase price allocation.

2 Adjusted net income and adjusted diluted earnings per share (non-GAAP financial measures) are defined as reported net income attributable to Zoetis and reported diluted earnings per share, excluding purchase accounting adjustments, acquisition-related costs and certain significant items.

DISCLOSURE NOTICES

Forward-Looking Statements: This press release contains forward-looking statements, which reflect the current views of Zoetis with respect to business plans or prospects, future operating or financial performance, expectations regarding products, future use of cash and dividend payments, and other future events. These statements are not guarantees of future performance or actions. Forward-looking statements are subject to risks and uncertainties. If one or more of these risks or uncertainties materialize, or if management's underlying assumptions prove to be incorrect, actual results may differ materially from those contemplated by a forward-looking statement. Forward-looking statements speak only as of the date on which they are made. Zoetis expressly disclaims any obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. A further list and description of risks, uncertainties and other matters can be found in our Annual Report on Form 10-K for the fiscal year ended December 31, 2013, including in the sections thereof captioned Forward-Looking Information and Factors That May Affect Future Results and Item 1A. Risk Factors, in our Quarterly Reports on Form 10-Q and in our Current Reports on Form 8-K. These filings and subsequent filings are available online at www.sec.gov, www.zoetis.com, or on request from Zoetis.

###

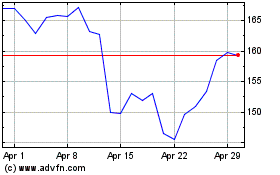

Zoetis (NYSE:ZTS)

Historical Stock Chart

From Jun 2024 to Jul 2024

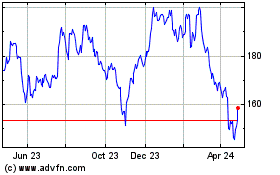

Zoetis (NYSE:ZTS)

Historical Stock Chart

From Jul 2023 to Jul 2024