Midnight Shopping to Reward Spending: Zip Reveals 2024's US Holiday Trends

November 20 2024 - 9:00AM

Business Wire

Despite inflation concerns, new research

reveals dramatic shifts in consumer behavior, with 40% making

purchases well after bedtime and younger generations shopping to

spite the slump

Zip (ASX: ZIP), the digital financial services company offering

innovative, people-centered products, today released its 2024 US

Holiday Spending Report, highlighting how inflation continues to

impact consumer behavior, while trends like “reward spending” and

“self-gifting” gain momentum.

The survey of over 16,000 Americans conducted from October 7 -

October 17, reveals a clear generational divide in holiday spending

plans. Millennials and Gen Z shoppers are ready to splurge after

years of budget constraints, while Baby Boomers are taking a more

cautious approach amidst the sentiment of economic uncertainty.

"Holiday spending is always a balance between financial

discipline, the joy of giving, and the excitement of scoring

discounts and deals," said Joe Heck, US CEO of Zip. "Our research

shows that while the looming sentiment around inflation is causing

some shoppers to cut back, others are using flexible payment

options like Zip to treat both their loved ones and themselves this

holiday season.”

Key trends from the 2024 Holiday Spending Report:

Boomers hit the brakes – while Gen Z ramps up for reward

spending: Baby Boomers are cutting back on spending, but

younger generations are taking the opposite approach. After years

of careful budgeting, Gen Z and Millennials are now "reward

spending" – making up for lost time due to years of austerity and

budgeting and indulging in some previously-postponed purchases.

This generational divide is happening even as inflation cools, but

negative sentiment around the economy and continued sticker shock

continue to impact everyone's holiday budgets.

- Over a third of Gen Z / Millennial Shoppers (18-34) are

embracing “reward spending” – 31% said they plan to spend more on

gifts than in previous holiday seasons, while 54% said they’d spend

the same as in previous years, and 15% are cutting back.

- Meanwhile, 54% of consumers aged 55 and older are cutting back

on spending due to higher prices and economic uncertainty.

Black Friday Deals vs. Payday Shopping: When Do People Really

Spend?: The question is simple: Do shoppers time their

purchases based on sales events like Black Friday, or do they shop

when they have money in their pockets after payday? The answer

varies:

- Black Friday and Cyber Monday remain popular shopping events,

with 72% of consumers planning to participate. Men are most likely

to go over their budgets during these sales (78%), followed by

shoppers aged 25-34 (75%) and 35-44 (74%).

- Young adults aged 18-24 are also planning their Black Friday

and Cyber Monday purchases, with 69% saying they'll shop during

these events.

- Shopping patterns differ for older consumers: 18% of those aged

55-65 prefer to make their holiday purchases shortly after

receiving their paychecks rather than during major sales

events.

Night Owl Shopping: The New Midnight Spending Trend: A

surprising trend has emerged: 40% of shoppers make their big

purchases at midnight. Why? Many retailers now launch their best

deals and flash sales in the middle of the night, turning

late-night hours into prime time shopping.

- Late-night shopping peaks among 25-34 year olds, with 48%

making purchases during midnight sales.

- Self-gifting is on the rise: 40% of shoppers are buying

themselves tech gadgets, while 23% of women prefer to splurge on

beauty and spa products.

Do Gift Guides work? Depends on the age. Holiday gift

guides, a staple of both media and retail brands, are essential for

some shoppers but irrelevant to others:

- Gift guides are most popular with younger shoppers: 51% of

those aged 25-44 use them, along with 39% of those aged 18-24.

- Interest in gift guides declines with age: only 30% of shoppers

aged 45-54 use them, dropping further to 15% for those aged

55-64.

Unconventional self-gifting: While most people treat

themselves to common items like gadgets, makeup, or fashion, some

shoppers are taking a more eccentric approach to self-gifting. Here

are some unique self-reported examples:

- An infrared sauna

- Night vision goggles

- A pair of the iconic sneakers made famous by Forrest Gump

- White Sox tickets for the whole family

- Tattoos

Why Spouses Top the 'Hard-to-Shop-For' List: Despite

knowing them best, people find buying gifts for their closest

family members—especially spouses—to be the most challenging task

of the holiday season.

- Spouses top the list of challenging gift recipients, with 30%

of both men and women saying their partner is the hardest person to

shop for.

- Children present their own gift-buying challenge: 11% of

parents struggle to keep up with their kids' changing

preferences.

Short-term installment payment services are key for managing

Holiday spending: Consumers are increasingly turning to

short-term installment payment brands to handle their holiday

expenses. These payment plans can help lift the financial burden of

the season by letting shoppers spread their costs over several

installments, removing the need for immediate payment.

- 59% of consumers use short-term installment payment services

for their holiday shopping.

- 1 in 4 Americans (23%) stated they are more likely to shop with

retailers that offer short-term installment payment options at

checkout.

To learn more about Zip, visit http://www.zip.co.

About Zip

ASX-listed Zip Co Limited (ASX: ZIP) is a digital financial

services company, offering innovative and people-centered products.

Operating in two core markets - Australia and New Zealand (ANZ) and

the United States (US), Zip offers access to point-of-sale credit

and digital payment services, connecting millions of customers with

its global network of tens of thousands of merchants.

Founded in Australia in 2013, Zip provides fair, flexible and

transparent payment options, helping customers to take control of

their financial future and helping merchants to grow their

businesses. US loans through the Zip app and Zip Checkout are

originated by WebBank. All loans are subject to credit

approval.

For more information, visit: www.zip.co.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241120491514/en/

Press Contact Zip Co. zip@moxiegrouppr.com

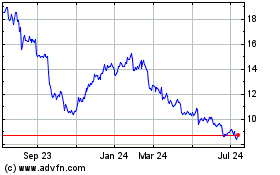

ZipRecruiter (NYSE:ZIP)

Historical Stock Chart

From Nov 2024 to Dec 2024

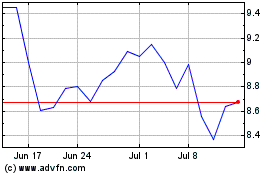

ZipRecruiter (NYSE:ZIP)

Historical Stock Chart

From Dec 2023 to Dec 2024