0001345016false00013450162024-08-082024-08-08

d

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 8, 2024

YELP INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Delaware | | 001-35444 | | 20-1854266 |

| (State of incorporation) | | (Commission File No.) | | (IRS Employer Identification No.) |

350 Mission Street, 10th Floor

San Francisco, California 94105

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (415) 908-3801

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol(s) | | Name of Each Exchange on Which Registered |

| Common Stock, par value $0.000001 per share | | YELP | | New York Stock Exchange LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On August 8, 2024, Yelp Inc. (the “Company”) announced its financial results for the second quarter ended June 30, 2024 by issuing a Letter to Shareholders (the “Letter”) and a press release. Copies of the press release and the Letter are furnished as Exhibits 99.1 and 99.2 to this Current Report on Form 8-K, respectively.

The information in this Item 2.02 and the exhibits attached hereto are furnished to, but not “filed” with, the Securities and Exchange Commission (“SEC”) and shall not be deemed to be incorporated by reference into any of the Company’s filings with the SEC under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits. | | | | | | | | |

Exhibit

Number | | Description |

| | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| Date: | August 8, 2024 | YELP INC. |

| | By: | /s/ David Schwarzbach |

| | | David Schwarzbach |

| | | Chief Financial Officer |

EXHIBIT 99.1

Yelp Achieves Record Net Revenue and Strong Profitability

in the Second Quarter 2024

Net Revenue increased by 6% year over year to $357 million

Net Income increased by 158% year over year to $38 million, reflecting an 11% margin

Adjusted EBITDA grew 9% year over year to $91 million, reflecting a 26% margin

Full-year outlook adjusted to $1.410 billion to $1.425 billion of Net Revenue and $325 million to $335

million of Adjusted EBITDA1

SAN FRANCISCO--(BUSINESS WIRE)-- August 8, 2024-- Yelp Inc. (NYSE: YELP), the trusted platform that connects people with great local businesses, today announced its financial results for the second quarter ended June 30, 2024 in the Q2 2024 Shareholder Letter available on its Investor Relations website at yelp-ir.com.

“Yelp delivered strong profitability and record net revenue in the second quarter,” said Jeremy Stoppelman, Yelp’s co-founder and chief executive officer. “The execution of our product-led strategy continued to drive results, particularly in home services, which grew approximately 15% year over year in the second quarter, as well as in our self-serve channel, which saw revenue increase about 20% year over year to a record level. Looking ahead, we plan to build upon our strong momentum in services as we remain focused on executing against our robust product roadmap to deliver the best experience for consumers and service pros.”

“Yelp delivered a solid second quarter with net revenue increasing by 6% year over year to a record $357 million even as challenges persisted in the operating environment for restaurants, retail and other businesses,” said David Schwarzbach, Yelp’s chief financial officer. “Net income margin increased six percentage points and adjusted EBITDA margin increased one percentage point from the previous year, reflecting our disciplined approach. We’re particularly focused on the opportunity ahead in services to deliver shareholder value over the long term.”

Quarterly Conference Call

Yelp will host a live Q&A session today at 2:00 p.m. Pacific Time to discuss the second quarter financial results and outlook for the third quarter and full year 2024. The webcast of the Q&A can be accessed on the Yelp Investor Relations website at yelp-ir.com. A replay of the webcast will be available at the same website.

About Yelp

Yelp Inc. (yelp.com) is a community-driven platform that connects people with great local businesses. Millions of people rely on Yelp for useful and trusted local business information, reviews and photos to help inform their spending decisions. As a one-stop local platform, Yelp helps consumers easily discover, connect and transact with businesses across a broad range of categories by making it easy to request a quote for a service, book a table at a restaurant, and more. Yelp was founded in San Francisco in 2004.

1 Yelp has not reconciled its Adjusted EBITDA outlook to GAAP Net income (loss) under generally accepted accounting principles in the United States (“GAAP”) because it does not provide an outlook for GAAP Net income (loss) due to the uncertainty and potential variability of Other income, net and Provision for (benefit from) income taxes, which are reconciling items between Adjusted EBITDA and GAAP Net income (loss). Because Yelp cannot reasonably predict such items, a reconciliation of the non-GAAP financial measure outlook to the corresponding GAAP measure is not available without unreasonable effort. We caution, however, that such items could have a significant impact on the calculation of GAAP Net income (loss). For more information regarding the non-GAAP financial measures discussed in this release, please see “Non-GAAP Financial Measures” below.

Yelp intends to make future announcements of material financial and other information through its Investor Relations website. Yelp will also, from time to time, disclose this information through press releases, filings with the Securities and Exchange Commission, conference calls, or webcasts, as required by applicable law.

Forward-Looking Statements

This press release contains forward-looking statements relating to, among other things, Yelp’s future performance, including its expected financial results for 2024 and its ability to drive profitable growth and shareholder value over the long term, as well as its plans to execute against its product roadmap and the expected results of such plans, that are based on its current expectations, forecasts, and assumptions that involve risks and uncertainties.

Yelp’s actual results could differ materially from those predicted or implied by such forward-looking statements and reported results should not be considered as an indication of future performance. Factors that could cause or contribute to such differences include, but are not limited to:

•macroeconomic uncertainty — including related to inflation, interest rates and supply chain issues, as well as severe weather events — and its effect on consumer behavior, user activity and advertiser spending;

•the prevalence of seasonal respiratory illnesses, impact of fears or actual outbreaks of disease and any resulting changes in consumer behavior, economic conditions or governmental actions;

•Yelp’s ability to maintain and expand its base of advertisers, particularly if advertiser turnover substantially worsens and/or consumer demand significantly degrades;

•Yelp’s ability to drive continued growth through its strategic initiatives;

•Yelp’s ability to continue to operate effectively with a primarily remote work force and attract and retain key talent;

•Yelp’s limited operating history in an evolving industry; and

•Yelp’s ability to generate and maintain sufficient high-quality content from its users.

Factors that could cause or contribute to such differences also include, but are not limited to, those factors that could affect Yelp’s business, operating results and stock price included under the captions “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Yelp’s most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q at yelp-ir.com or the SEC’s website at sec.gov.

Investor Relations Contact:

Kate Krieger

ir@yelp.com

Press Contact:

Amber Albrecht

press@yelp.com

YELP INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands)

(Unaudited)

| | | | | | | | | | | |

| June 30,

2024 | | December 31,

2023 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 252,435 | | | $ | 313,911 | |

| Short-term marketable securities | 132,376 | | | 127,485 | |

Accounts receivable, net | 153,869 | | | 146,147 | |

| Prepaid expenses and other current assets | 44,999 | | | 36,673 | |

| Total current assets | 583,679 | | | 624,216 | |

| Property, equipment and software, net | 70,616 | | | 68,684 | |

| Operating lease right-of-use assets | 40,679 | | | 48,573 | |

| Goodwill | 102,488 | | | 103,886 | |

| Intangibles, net | 6,974 | | | 7,638 | |

| | | |

| Other non-current assets | 160,542 | | | 161,726 | |

| Total assets | $ | 964,978 | | | $ | 1,014,723 | |

| | | |

Liabilities and Stockholders’ Equity | | | |

| Current liabilities: | | | |

| Accounts payable and accrued liabilities | $ | 117,762 | | | $ | 132,809 | |

| Operating lease liabilities — current | 35,082 | | | 39,234 | |

| Deferred revenue | 5,229 | | | 3,821 | |

| Total current liabilities | 158,073 | | | 175,864 | |

| Operating lease liabilities — long-term | 32,535 | | | 48,065 | |

| Other long-term liabilities | 39,023 | | | 41,260 | |

| Total liabilities | 229,631 | | | 265,189 | |

| | | |

Stockholders’ equity: | | | |

Common stock | — | | | — | |

| Additional paid-in capital | 1,848,677 | | | 1,786,667 | |

| Treasury stock | (806) | | | (282) | |

| Accumulated other comprehensive loss | (14,134) | | | (12,202) | |

| Accumulated deficit | (1,098,390) | | | (1,024,649) | |

Total stockholders’ equity | 735,347 | | | 749,534 | |

Total liabilities and stockholders’ equity | $ | 964,978 | | | $ | 1,014,723 | |

YELP INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net revenue | $ | 357,016 | | | $ | 337,126 | | | $ | 689,768 | | | $ | 649,564 | |

| | | | | | | |

| Costs and expenses: | | | | | | | |

Cost of revenue(1) | 30,677 | | | 30,184 | | | 58,032 | | | 56,243 | |

Sales and marketing(1) | 150,293 | | | 139,150 | | | 298,084 | | | 286,605 | |

Product development(1) | 82,080 | | | 85,030 | | | 173,307 | | | 173,227 | |

General and administrative(1) | 44,634 | | | 53,405 | | | 89,866 | | | 99,914 | |

| Depreciation and amortization | 9,585 | | | 10,615 | | | 19,515 | | | 21,420 | |

| | | | | | | |

| Total costs and expenses | 317,269 | | | 318,384 | | | 638,804 | | | 637,409 | |

| Income from operations | 39,747 | | | 18,742 | | | 50,964 | | | 12,155 | |

| Other income, net | 10,322 | | | 5,898 | | | 18,046 | | | 11,110 | |

| Income before income taxes | 50,069 | | | 24,640 | | | 69,010 | | | 23,265 | |

| Provision for income taxes | 12,033 | | | 9,911 | | | 16,820 | | | 9,714 | |

| Net income attributable to common stockholders | $ | 38,036 | | | $ | 14,729 | | | $ | 52,190 | | | $ | 13,551 | |

| | | | | | | |

| Net income per share attributable to common stockholders | | | | | | | |

| Basic | $ | 0.56 | | | $ | 0.21 | | | $ | 0.77 | | | $ | 0.19 | |

| Diluted | $ | 0.54 | | | $ | 0.21 | | | $ | 0.73 | | | $ | 0.19 | |

| | | | | | | |

| Weighted-average shares used to compute net income per share attributable to common stockholders | | | | | | | |

| Basic | 67,815 | | | 69,256 | | | 68,187 | | | 69,537 | |

| Diluted | 70,444 | | | 71,238 | | | 71,574 | | | 71,645 | |

| | | | | | | |

(1) Includes stock-based compensation expense as follows: | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Cost of revenue | $ | 1,397 | | | $ | 1,346 | | | $ | 2,798 | | | $ | 2,728 | |

| Sales and marketing | 8,618 | | | 8,607 | | | 17,317 | | | 17,721 | |

| Product development | 22,534 | | | 24,974 | | | 46,187 | | | 50,841 | |

| General and administrative | 8,665 | | | 8,653 | | | 17,622 | | | 18,547 | |

| Total stock-based compensation | $ | 41,214 | | | $ | 43,580 | | | $ | 83,924 | | | $ | 89,837 | |

YELP INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

| | | | | | | | | | | |

| Six Months Ended

June 30, |

| 2024 | | 2023 |

| Operating Activities | | | |

| Net income | $ | 52,190 | | | $ | 13,551 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation and amortization | 19,515 | | | 21,420 | |

| Provision for doubtful accounts | 23,957 | | | 14,636 | |

| Stock-based compensation | 83,924 | | | 89,837 | |

| Amortization of right-of-use assets | 7,662 | | | 15,699 | |

| Deferred income taxes | (2,109) | | | (42,148) | |

| Amortization of deferred contract cost | 12,321 | | | 11,716 | |

| Asset impairment | — | | | 3,555 | |

| Other adjustments, net | (2,995) | | | (64) | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable | (31,679) | | | (34,389) | |

| Prepaid expenses and other assets | (14,914) | | | 12,156 | |

| Operating lease liabilities | (19,434) | | | (20,943) | |

| Accounts payable, accrued liabilities and other liabilities | (15,894) | | | 37,225 | |

| Net cash provided by operating activities | 112,544 | | | 122,251 | |

| | | |

| Investing Activities | | | |

| Purchases of marketable securities — available-for-sale | (53,301) | | | (82,491) | |

| Sales and maturities of marketable securities — available-for-sale | 49,095 | | | 50,613 | |

| Purchases of other investments | (2,500) | | | — | |

| | | |

| | | |

| Purchases of property, equipment and software | (16,574) | | | (15,153) | |

| Other investing activities | 234 | | | 146 | |

| Net cash used in investing activities | (23,046) | | | (46,885) | |

| | | |

| Financing Activities | | | |

| Proceeds from issuance of common stock for employee stock-based plans | 13,436 | | | 26,095 | |

| Taxes paid related to the net share settlement of equity awards | (41,190) | | | (38,201) | |

| Repurchases of common stock | (122,657) | | | (100,000) | |

| Payment of issuance costs for credit facility | — | | | (799) | |

| Net cash used in financing activities | (150,411) | | | (112,905) | |

| | | |

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | (295) | | | 1,175 | |

| | | |

| Change in cash, cash equivalents and restricted cash | (61,208) | | | (36,364) | |

| Cash, cash equivalents and restricted cash — Beginning of period | 314,002 | | | 307,138 | |

| Cash, cash equivalents and restricted cash — End of period | $ | 252,794 | | | $ | 270,774 | |

Non-GAAP Financial Measures

This press release and statements made during the above referenced webcast may include information relating to Adjusted EBITDA, Adjusted EBITDA margin and Free cash flow, each of which the Securities and Exchange Commission has defined as a “non-GAAP financial measure.”

We define Adjusted EBITDA as net income (loss), adjusted to exclude: provision for (benefit from) income taxes; other income, net; depreciation and amortization; stock-based compensation expense; and, in certain periods, certain other income and expense items, such as material litigation settlements, impairment charges and fees related to shareholder activism, and other items that we deem not to be indicative of our ongoing operating performance. We define Adjusted EBITDA margin as Adjusted EBITDA divided by net revenue. We define Free cash flow as net cash provided by (used in) operating activities, less cash used for purchases of property, equipment and software.

Adjusted EBITDA and Free cash flow, which are not prepared under any comprehensive set of accounting rules or principles, have limitations as analytical tools and you should not consider them in isolation or as substitutes for analysis of Yelp’s financial results as reported in accordance with generally accepted accounting principles in the United States (“GAAP”). In particular, Adjusted EBITDA and Free cash flow should not be viewed as substitutes for, or superior to, net income (loss) or net cash provided by (used in) operating activities prepared in accordance with GAAP as measures of profitability or liquidity. Some of these limitations are:

•although depreciation and amortization are non-cash charges, the assets being depreciated and amortized may have to be replaced in the future, and Adjusted EBITDA does not reflect all cash capital expenditure requirements for such replacements or for new capital expenditure requirements;

•Adjusted EBITDA does not reflect changes in, or cash requirements for, Yelp’s working capital needs;

•Adjusted EBITDA does not reflect the impact of the recording or release of valuation allowances or tax payments that may represent a reduction in cash available to Yelp;

•Adjusted EBITDA does not consider the potentially dilutive impact of equity-based compensation;

•Adjusted EBITDA does not take into account certain income and expense items, such as material litigation settlements, impairment charges and fees related to shareholder activism, or other costs that management determines are not indicative of ongoing operating performance;

•Free cash flow does not represent the total residual cash flow available for discretionary purposes because it does not reflect our contractual commitments or obligations; and

•other companies, including those in Yelp’s industry, may calculate Adjusted EBITDA and Free cash flow differently, which reduces their usefulness as comparative measures.

Because of these limitations, you should consider Adjusted EBITDA, Adjusted EBITDA margin and Free cash flow alongside other financial performance measures, including net income (loss), net cash provided by (used in) operating activities and Yelp’s other GAAP results.

The following is a reconciliation of net income to Adjusted EBITDA, as well as the calculation of net income margin and Adjusted EBITDA margin, for each of the periods indicated (in thousands, except percentages; unaudited):

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, | | |

| 2024 | | 2023 | | 2024 | | 2023 | | |

| | | | | | | | | |

| Reconciliation of Net Income to Adjusted EBITDA: | | | | | | | | | |

| Net income | $ | 38,036 | | | $ | 14,729 | | | $ | 52,190 | | | $ | 13,551 | | | |

| Provision for income taxes | 12,033 | | | 9,911 | | | 16,820 | | | 9,714 | | | |

Other income, net(1) | (10,322) | | | (5,898) | | | (18,046) | | | (11,110) | | | |

| Depreciation and amortization | 9,585 | | | 10,615 | | | 19,515 | | | 21,420 | | | |

| Stock-based compensation | 41,214 | | | 43,580 | | | 83,924 | | | 89,837 | | | |

Litigation settlement(2)(3) | — | | | 11,000 | | | — | | | 11,000 | | | |

| | | | | | | | | |

Asset impairment(2) | — | | | — | | | — | | | 3,555 | | | |

Fees related to shareholder activism(2) | 569 | | | — | | | 1,168 | | | — | | | |

| Adjusted EBITDA | $ | 91,115 | | | $ | 83,937 | | | $ | 155,571 | | | $ | 137,967 | | | |

| | | | | | | | | |

| Net revenue | $ | 357,016 | | | $ | 337,126 | | | $ | 689,768 | | | $ | 649,564 | | | |

| Net income margin | 11 | % | | 4 | % | | 8 | % | | 2 | % | | |

| Adjusted EBITDA margin | 26 | % | | 25 | % | | 23 | % | | 21 | % | | |

(1) Includes the release of a $3.1 million reserve related to a one-time payroll tax credit.

(2) Recorded within general and administrative expenses on our condensed consolidated statements of operations.

(3) Represents the loss contingency recorded in connection with the agreement to settle a putative class action lawsuit asserting claims under the California Invasion of Privacy Act. For additional information, see our most recently filed Quarterly Report on Form 10-Q.

The following is a reconciliation of net cash provided by operating activities to Free cash flow for each of the periods indicated (in thousands; unaudited):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Reconciliation of Net Cash Provided by Operating Activities to Free Cash Flow: | | | | | | | |

| Net cash provided by operating activities | $ | 39,689 | | | $ | 48,007 | | | $ | 112,544 | | | $ | 122,251 | |

| Purchases of property, equipment and software | (9,587) | | | (7,635) | | | (16,574) | | | (15,153) | |

| Free cash flow | $ | 30,102 | | | $ | 40,372 | | | $ | 95,970 | | | $ | 107,098 | |

| | | | | | | |

| Net cash used in investing activities | $ | (16,644) | | | $ | (9,605) | | | $ | (23,046) | | | $ | (46,885) | |

| | | | | | | |

| Net cash used in financing activities | $ | (66,577) | | | $ | (58,199) | | | $ | (150,411) | | | $ | (112,905) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Q2 2024 Letter to Shareholders August 8, 2024 | yelp-ir.com EXHIBIT 99.2

Ye lp Q 2 20 24 2 23 Note: Amounts reported in this letter, including margins, are rounded. The year-over-year percentage changes are calculated based on exact amounts and, accordingly, may not recalculate using the rounded amounts presented. 1 Refer to the accompanying financial tables for further details and a reconciliation of the “non-GAAP measures” presented to the most directly comparable measures prepared under generally accepted accounting principles in the United States (“GAAP”). Second Quarter 2024 Financial Highlights > Net revenue was $357 million, up 6% from the second quarter of 2023 and $2 million above the high end of our second quarter outlook range, driven primarily by growth in advertising revenue as we executed against our strategic initiatives. > Net income was $38 million, or $0.54 per diluted share, compared to net income of $15 million, or $0.21 per diluted share, in the second quarter of 2023. Net income margin increased six percentage points from the second quarter of 2023 to reach 11%. > Adjusted EBITDA¹ was $91 million, an increase of $7 million, or 9%, compared to the second quarter of 2023 and $16 million above the high end of our outlook range. Adjusted EBITDA margin¹ increased one percentage point from the second quarter of 2023 to reach 26%. > Cash provided by operating activities was $40 million during the second quarter, and we ended the quarter with cash, cash equivalents and marketable securities of $385 million. > In the second quarter we repurchased approximately 1.7 million shares at an aggregate cost of $63.4 million, reflecting an average price of $37.94 per share. > We are adjusting our outlook for the year and now expect net revenue to be in the range of $1.410 billion to $1.425 billion and adjusted EBITDA to be in the range of $325 million to $335 million. 19% 17% Net Revenue +6% $337M $357M 2Q23 2Q24 Ad Clicks, y/y +9% 2Q23 2Q24 Average CPC, y/y -1% 2Q23 2Q24 Paying Advertising Locations -6% 563k 531k 2Q23 2Q24 Services RR&O Adjusted EBITDA¹ +9% $84M $91M 2Q23 2Q24 M ar gi n 25% 26%8% 7%M ar gi n 8% 7% Net Income +158% $15M $38M 2Q23 2Q24 114

Ye lp Q 2 20 24 3 23 Dear fellow shareholders, In the second quarter, Yelp delivered record net revenue and strong profitability, expanding our net income margin by six percentage points and our adjusted EBITDA margin by one percentage point from the prior-year period. While challenges in the operating environment for Restaurants, Retail & Other (“RR&O”) businesses persisted, our Services categories maintained their momentum, with double-digit revenue growth for the 13th consecutive quarter. At the same time, our product and engineering teams continued to innovate, introducing more than 20 new features and updates in the quarter. As we look forward, we believe in the significant opportunities ahead, particularly in Services, to continue to connect people with great local businesses. We remain focused on driving profitable growth and generating shareholder value over the long term. 2Q23 2Q24 Net Income Margin 11%4% Adjusted EBITDA Margin 26%25% +6% We delivered record net revenue while expanding margins Net Revenue

Ye lp Q 2 20 24 4 23 Q2 Results Second quarter net revenue increased by 6% year over year to a record $357 million, $2 million above the high end of our outlook range. Net income increased by 158% year over year to $38 million, representing an 11% margin and reflecting our disciplined approach. Adjusted EBITDA increased by 9% year over year to $91 million, representing a 26% margin and $16 million above the high end of our outlook range. Underlying our top line results, advertising revenue from Services businesses continued its momentum, increasing 11% year over year to a record $223 million. This increase was driven by growth in paying advertising locations and reflects record average revenue per location¹. The Home Services category remained particularly strong, with revenue growth of approximately 15% year over year. Advertising revenue from RR&O businesses decreased by 3% year over year, reflecting a challenging operating environment for businesses in these categories and, to a lesser extent, competitive pressures from food ordering and delivery providers. With softness in RR&O categories offsetting growth in Services, overall paying advertising locations decreased by 6% year over year to 531,000. Ad clicks increased by 9% year over year, driven by improvements to our advertising technology as well as our efforts to acquire Services projects through paid search, which drove more leads² to service pros compared to the prior-year period. Average cost-per-click (“CPC”) decreased by 1% year over year as we delivered more value to advertisers. We also continued to make progress driving sales through our efficient Self-serve channel, where revenue grew approximately 20% year over year. However, Multi-location channel revenue was approximately flat year over year, as several enterprise clients in our RR&O categories paused or reduced spend due to continued challenges in their operating environment. Net revenue reached another quarterly record Net Revenue +6% $337M 2Q23 3Q23 4Q23 1Q24 2Q24 $357M$345M $342M $333M Services maintained its momentum Services Revenue +11% $200M 2Q23 3Q23 4Q23 1Q24 2Q24 $223M $206M $203M $203M Continued softness in RR&O RR&O Revenue -3% $122M 2Q23 3Q23 4Q23 1Q24 2Q24 $118M$124M $124M $114M ¹ Advertising revenue divided by paying advertising locations. ² Leads include phone calls, requests and website clicks.

Ye lp Q 2 20 24 5 23 Initiatives to drive long-term, profitable growth In the second quarter, we continued to invest in and execute against our strategic initiatives, focusing on driving long-term, profitable growth through product innovation. Deliver the best Home Services experience for consumers and service pros Our Services business is the major focus of our product-led strategy in 2024 and we made consistent progress in these categories in the second quarter. Advertising revenue from Services businesses increased by 11% year over year, driven by approximately 15% year-over-year growth in the Home Services category, to reach 65% of advertising revenue. Our efforts to improve the Request-a-Quote flow and acquire projects through paid search drove an acceleration in year-over-year project growth from approximately 20% in the first quarter to approximately 35% in the second quarter. We have also been pleased with the early performance of Yelp Assistant, which we introduced in the second quarter to help guide consumers to the right service pros for their projects. In addition, Apple Maps now features a button that takes Maps users into the Request-a-Quote flow and to specific business pages, extending access to Request-a-Quote off Yelp. As we scaled our spend on paid project acquisition in Services in the second quarter, we saw strong results at the top of the funnel — including increased projects, more ad clicks and lower average CPCs. At the bottom of the funnel, we saw early indications of retention benefits among businesses with fewer reviews, which often experience difficulty competing with more established advertisers for leads. We plan to leverage this learning to become more precise in lead distribution and narrow our focus towards the opportunities that we believe will have the highest return. We expect this adjustment may moderate the magnitude of Request-a-Quote project growth in future quarters. Request-a-Quote project growth accelerated Approximate Growth in Request-a-Quote Projects, y/y 2Q23 3Q23 4Q23 2Q241Q24 -10% -5% 5% 20% 35% ~15% y/y 2Q23 2Q24 Continued strength in Home Services Home Services Revenue

Ye lp Q 2 20 24 6 23 Provide the most trusted local search and discovery platform Over the last several years, our investments in the consumer experience have enabled users to make more informed decisions when selecting local businesses and have provided them with a more personalized, streamlined search and discovery experience. This year, we have been experimenting with ways to further simplify the user experience, increase searches and ultimately drive more connections with businesses. For example, we rolled out a number of user experience and backend improvements to our mobile and desktop websites this year that together led to a year-over-year increase in page views on these platforms in the second quarter and a more efficient search experience for users. We also updated the Yelp app’s home feed to surface additional sources of our high-quality content, like Collections, and provided contributors with real-time recognition for writing reviews. In addition, we introduced a number of new features to make Yelp more useful for consumers with accessibility needs, including accessibility business attributes and artificial intelligence (“AI”)-powered alternative text for photos. Our updated home feed surfaces additional sources of high-quality content, like Collections Depictions of Yelp's features are provided for illustrative purposes only, and may differ from the actual product.

Ye lp Q 2 20 24 7 23 Optimize advertiser value through our advanced technology Our investments in advanced advertising technologies that leverage machine learning have helped us optimize advertisers’ budgets by displaying more relevant ad content to consumers. In the second quarter, ad clicks increased by 9% year over year, while average CPC declined by 1% year over year, driven by matching improvements and paid project acquisition in Services categories. Enhancements to our ad formats and matching capabilities led to a year-over-year improvement in our retention rate for non-term advertisers’ budgets in the second quarter. We expect to continue to deliver value to our advertisers with a strong product roadmap of improvements ahead. However, we anticipate that trends in the year-over-year changes in ad clicks and average CPC since the second half of 2023 will moderate in the second half of 2024 due to more difficult prior-year comparisons. Off Yelp, we are continuing to experiment with expanding local advertiser reach through a variety of partnerships, such as by surfacing relevant Yelp ads to Facebook users based on their recent Yelp searches. Percentage Change in Ad Clicks and Average CPC, y/y Ad Clicks 0% 2Q23 3Q23 4Q23 1Q24 2Q24 9%9% 9% 8% Average CPC 14% 2Q23 3Q23 4Q23 1Q24 2Q24 -1% 4% -1% 4%

Ye lp Q 2 20 24 8 23 Drive profitable growth through our most efficient channels In the second quarter, we continued to invest in driving growth through our most efficient channels — Self-serve and Multi-location. Improvements to the claim and ad purchase flows together with effective advertiser marketing drove record customer acquisition in our Self-serve channel in the second quarter. To increase customer retention, we provided advertisers with more flexibility to adjust their spend as well as recommendations on how to best optimize their budgets. As a result, Self-serve revenue continued its momentum in the second quarter, increasing by approximately 20% year over year to a record level — the 15th consecutive quarter of year-over-year growth at or above this level. At the same time, our Local sales team continued to deliver solid productivity, driving revenue growth. As we look ahead, we are working on a number of projects to more efficiently acquire and retain small and medium-sized businesses through improved routing and the use of more effective telephony technologies. Self-serve channel revenue ~20% y/y 2Q23 2Q24 2Q21 2Q22 2Q23 2Q24 Self-serve Channel Revenue, y/y ~20%

Ye lp Q 2 20 24 Multi-location revenue was approximately flat year over year, reflecting continued softness in RR&O categories. With just 20% of Services revenue coming from multi-location businesses, we believe that we’re in a strong position to drive growth in this channel by adapting our Services product offerings to better fit the needs of enterprise clients. We recently made a suite of our Services-oriented products, including Request-a-Quote, Yelp Guaranteed, Portfolio and Verified License, available to enterprise customers. We also introduced a new leads API that enables multi-location Services businesses to compete for the millions of consumer projects flowing through Request-a-Quote as well as seamlessly manage leads across multiple locations and business pages. We also expanded our Spotlight Ads video placements to appear among the photos on Yelp business pages in an effort to increase consumer awareness and consideration of both location and non-location-based brand advertisers. With the majority of our brand advertisers in RR&O categories, Yelp Audiences revenue was also flat year over year, maintaining its annual run rate of approximately $45 million in the second quarter. We continue to see growth opportunities for this incremental offering and recently expanded its reach to enable advertisers to connect with our high-intent audience through additional connected TV platforms, such as Hulu, Disney+ and Paramount+. We also expanded the offering to include audio platforms like Spotify, Pandora, SiriusXM and iHeart, enabling advertisers to target audio ads to Yelp users. In addition, we introduced a new conversion API to offer brand advertisers an even more accurate way to measure the value of Yelp ads without third-party cookies. Multi-location channel revenue ~0% y/y 2Q23 2Q24 Request-a-Quote for brands 2Q21 2Q22 2Q23 2Q24 Self-serve Channel Revenue, y/y ~20% As we aim to attract more potential customers interested in moving services, Request-a-Quote has become an important part of our lead generation strategy. Yelp’s leads API enhances our ability to manage leads from Yelp by enabling direct communication with our customers across multiple locations and managing these relationships in real time. This streamlined process makes it easier for our sales team to use, and ultimately drives more business. - Ross Sapir, President, Roadway Moving Yelp Audiences targets our high-intent audience off Yelp 9 23

Ye lp Q 2 20 24 10 23 Delivering profitable growth Our second quarter results demonstrate the margin potential of our business, with a net income margin of 11% and an adjusted EBITDA margin of 26%. We achieved these results by efficiently allocating resources toward high-return areas, even as we invested $12 million in paid Services project acquisition during the quarter. As we continue to lean into our product-led growth strategy while leveraging AI to increase employee efficiency, we expect that headcount will be approximately flat year over year by the end of 2024. In addition, as we implement our learnings from the second quarter and narrow the focus of our paid Services project acquisition efforts, we now expect to spend approximately $35 million in total for the year on paid search. We remain committed to improving the quality of our adjusted EBITDA. Stock-based compensation (“SBC”) expense as a percentage of revenue decreased by one percentage point year over year to 12% in the second quarter and we remain focused on reducing it to below 8% by the end of 2025. We expect the benefit of these efforts, coupled with continued share repurchases, to stack over time and benefit GAAP profitability in the years to come, particularly earnings per share, which more than doubled from the prior-year period to $0.54 on a diluted basis in the second quarter. 8% 2Q23 2Q24 Stock-based compensation 25% 26% Increasing adjusted EBITDA quality Adjusted EBITDA Margin Focused on reducing SBC as a percentage of revenue Stock-based Compensation, % of Revenue 13% ~11% < 8% 2023 2024E 4Q25E

Ye lp Q 2 20 24 11 23 Prudent capital allocation Our capital allocation strategy consists of three main elements: 1) maintaining a healthy cash balance to fund our operations; 2) retaining capacity for potential acquisitions; and 3) returning excess capital to shareholders through share repurchases. In the second quarter, we repurchased $63.4 million worth of shares at an average purchase price of $37.94 per share. As of June 30, 2024, we had $456 million remaining under our existing repurchase authorization. We plan to continue repurchasing shares in the second half of 2024, subject to market and economic conditions. In summary, Yelp’s second quarter results demonstrate the profitability of our broad-based local ad platform amid macro headwinds. Our product-led strategy and focus on Services continue to strengthen our business while our team remains dedicated to innovating for our advertisers and consumers. We remain focused on the significant opportunities ahead to drive profitable growth and shareholder value over the long term. Sincerely, Total Repurchase Authorization Authorization Date Prudent Capital Allocation $2.0B Completed as of June 30, 2024 Remaining Authorization $200M $250M $250M $250M $250M $250M Nov ‘22Jul ‘17 Nov ‘18 Feb ‘19 Jan ‘20 Aug ‘21 Feb ‘24 $500M Jeremy Stoppelman David Schwarzbach

Ye lp Q 2 20 24 12 23 Revenue Net revenue was $357 million in the second quarter of 2024, a 6% increase from the second quarter of 2023. Net revenue was $2 million above the high end of our second quarter outlook range. Advertising revenue was $341 million in the second quarter of 2024, up 6% from the second quarter of 2023, primarily due to the year-over-year increase in ad clicks. Other revenue was $16 million in the second quarter of 2024, up 3% from the second quarter of 2023. The increase in other revenue was primarily driven by higher revenue from the continued growth of our Yelp Fusion, Yelp Guest Manager and Yelp Knowledge programs. This increase was partially offset by a lower volume of food takeout and delivery orders compared to the prior-year period. Second Quarter 2024 Financial Review Three Months Ended June 30, Six Months Ended June 30, 2024 2023 2024 2023 Net revenue by product: Advertising revenue by category: Services $ 222,955 $ 200,274 $ 426,243 $ 383,794 Restaurants, Retail & Other 118,383 121,698 232,733 235,321 Advertising 341,338 321,972 658,976 619,115 Other¹ 15,678 15,154 30,792 30,449 Total net revenue $ 357,016 $ 337,126 $ 689,768 $ 649,564 ¹ For the three and six months ended June 30, 2024, other revenue includes revenue generated from transactions with consumers, which the Company reported separately as transactions revenue in prior periods. Prior period amounts in the table above have been reclassified to conform to the current period presentation. Net Revenue +6% $337M $357M 2Q23 2Q24

Ye lp Q 2 20 24 13 23 Operating expenses, Net income & Adjusted EBITDA Cost of revenue (exclusive of depreciation and amortization) was $31 million in the second quarter of 2024, up 2% from the second quarter of 2023. The increase was primarily driven by higher website infrastructure expenses resulting from investments in maintaining and improving our infrastructure as well as higher employee costs, mainly due to higher cost of labor. The increase was partially offset by lower advertising fulfillment costs, reflecting our more efficient delivery of ads. Sales and marketing expenses were $150 million in the second quarter of 2024, up 8% from the second quarter of 2023. The increase was primarily driven by our increased investments in paid search as well as higher employee costs, mainly due to higher cost of labor. The increase was partially offset by decreases in workplace operating costs due to reductions in our leased office space. Product development expenses were $82 million in the second quarter of 2024, down 3% from the second quarter of 2023. The decrease was mainly driven by a decrease in employee costs as a result of more employee costs being capitalized and lower average headcount compared to the prior-year period. The decrease was partially offset by higher cost of labor. General and administrative expenses were $45 million in the second quarter of 2024, down 16% from the second quarter of 2023. The decrease was primarily driven by a loss contingency recorded in the prior-year period in connection with the settlement of a legal case, as well as a decrease in employee costs mainly driven by lower average headcount. These decreases were partially offset by an increase in the provision for doubtful accounts due to higher anticipated customer delinquencies and the increase in advertising revenue. COR % of Revenue 9% 9% 2Q23 2Q24 S&M % of Revenue 41% 42% 2Q23 2Q24 PD % of Revenue 25% 23% 2Q23 2Q24 G&A % of Revenue 16%* 13% 2Q23 2Q24 *Includes a one-time litigation settlement expense

Ye lp Q 2 20 24 14 23 Total costs and expenses were $317 million in the second quarter of 2024, approximately flat compared to $318 million in the second quarter of 2023. Other income, net was $10 million in the second quarter of 2024, up 75% from the second quarter of 2023. The increase was primarily driven by the release of a reserve related to a one-time payroll tax credit as well as higher interest income from our cash, cash equivalents and marketable securities due to increased federal interest rates. Provision for income taxes was $12 million in the second quarter of 2024, compared to $10 million in the second quarter of 2023. The increase in the provision for income taxes in the second quarter of 2024 was primarily due to an increase in profit before tax for the current-year period, partially offset by a decrease in the annual estimated effective tax rate. Net income was $38 million in the second quarter of 2024 compared to net income of $15 million in the second quarter of 2023. Net income margin increased six percentage points from the second quarter of 2023 to 11% in the second quarter of 2024. Diluted net income per share was $0.54 in the second quarter of 2024, up from $0.21 in the second quarter of 2023, reflecting the increase in net income. Adjusted EBITDA was $91 million in the second quarter of 2024, a 9% increase from $84 million in the second quarter of 2023. Adjusted EBITDA margin increased to 26% in the second quarter of 2024 from 25% in the second quarter of 2023. Balance sheet and cash flow At the end of June 2024, we held $385 million in cash, cash equivalents and marketable securities on our condensed consolidated balance sheet, with no debt. 19% 17% M ar gi n 8% 7% Net Income +158% $15M $38M 2Q23 2Q24 114 Adjusted EBITDA +9% $84M $91M 2Q23 2Q24 M ar gi n 25% 26%

Ye lp Q 2 20 24 15 23 Business Outlook We continue to believe in the significant long-term growth opportunities ahead as we focus our investments on high-return areas that we believe will drive increased profitability. In the second quarter, Services revenue maintained double-digit growth, while RR&O revenue reflected the ongoing operating challenges facing businesses in these categories, with additional pressure as we moved through the second half of the quarter. As we look to the second half of the year, we expect these trends to persist. In the third quarter, we expect net revenue will be in the range of $357 million to $362 million. For the full year, we now expect net revenue will be in the range of $1.410 billion to $1.425 billion, a decrease of $12.5 million at the midpoint. At the same time, our business has continued to demonstrate its underlying profitability and we remain dedicated to disciplined expense management. We expect third quarter adjusted EBITDA to be in the range of $82 million to $87 million. For the full year, we now expect adjusted EBITDA to be in the range of $325 million to $335 million, an increase of $10 million at the midpoint, despite our expectation of continued RR&O headwinds in the second half of the year. As a result of subleasing a portion of our Toronto office space in July, we expect to incur an impairment charge of approximately $4 million in the third quarter related to right-of-use assets and leasehold improvements associated with the underlying operating lease. We expect third quarter net income to be reduced by the full amount of the charge, but do not expect it to impact adjusted EBITDA. Third Quarter 2024 Full Year 2024 (Updated) Net revenue $357M to $362M $1.410B to $1.425B Adjusted EBITDA* $82M to $87M $325M to $335M Stock-based compensation expense as a % of Net revenue ~11% ~11% Depreciation and amortization as a % of Net revenue ~3% ~3% *Yelp has not reconciled its Adjusted EBITDA outlook to Net income (loss) under generally accepted accounting principles in the United States (“GAAP”) because it does not provide an outlook for GAAP Net income (loss) due to the uncertainty and potential variability of Other income, net and Provision for (benefit from) income taxes, which are reconciling items between Adjusted EBITDA and GAAP Net income (loss). Because Yelp cannot reasonably predict such items, a reconciliation of the non-GAAP financial measure outlook to the corresponding GAAP measure is not available without unreasonable effort. We caution, however, that such items could have a significant impact on the calculation of GAAP Net income (loss). For more information regarding the non-GAAP financial measures discussed in this release, please see “Non-GAAP Financial Measures” and “Reconciliation of GAAP to Non-GAAP Financial Measures” below. $330M Adjusted EBITDA Outlook 2023 2024E $325M-$335M 2023 2024E $1.337B $1.410B-$1.425B Net Revenue Outlook

Ye lp Q 2 20 24 16 23 Quarterly Earnings Webcast Yelp will host a live webcast today at 2:00 p.m. PDT to discuss the second quarter 2024 financial results and outlook for the third quarter and full year 2024. The webcast can be accessed on the Yelp Investor Relations website at yelp-ir.com. A replay of the webcast will be available at the same website. About Yelp Yelp Inc. (yelp.com) is a community-driven platform that connects people with great local businesses. Millions of people rely on Yelp for useful and trusted local business information, reviews and photos to help inform their spending decisions. As a one-stop local platform, Yelp helps consumers easily discover, connect and transact with businesses across a broad range of categories by making it easy to request a quote for a service, book a table at a restaurant, and more. Yelp was founded in San Francisco in 2004.

Ye lp Q 2 20 24 17 23 Condensed Consolidated Balance Sheets (In thousands; unaudited) June 30, 2024 December 31, 2023 Assets Current assets: Cash and cash equivalents $ 252,435 $ 313,911 Short-term marketable securities 132,376 127,485 Accounts receivable, net 153,869 146,147 Prepaid expenses and other current assets 44,999 36,673 Total current assets 583,679 624,216 Property, equipment and software, net 70,616 68,684 Operating lease right-of-use assets 40,679 48,573 Goodwill 102,488 103,886 Intangibles, net 6,974 7,638 Other non-current assets 160,542 161,726 Total assets $ 964,978 $ 1,014,723 Liabilities and Stockholders’ Equity Current liabilities: Accounts payable and accrued liabilities $ 117,762 $ 132,809 Operating lease liabilities — current 35,082 39,234 Deferred revenue 5,229 3,821 Total current liabilities 158,073 175,864 Operating lease liabilities — long-term 32,535 48,065 Other long-term liabilities 39,023 41,260 Total liabilities 229,631 265,189 Stockholders’ equity: Common stock — — Additional paid-in capital 1,848,677 1,786,667 Treasury stock (806) (282) Accumulated other comprehensive loss (14,134) (12,202) Accumulated deficit (1,098,390) (1,024,649) Total stockholders’ equity 735,347 749,534 Total liabilities and stockholders’ equity $ 964,978 $ 1,014,723

Ye lp Q 2 20 24 18 23 Condensed Consolidated Statements of Operations (In thousands, except per share data; unaudited) Three Months Ended June 30, Six Months Ended June 30, 2024 2023 2024 2023 Net revenue $ 357,016 $ 337,126 $ 689,768 $ 649,564 Costs and expenses: Cost of revenue¹ 30,677 30,184 58,032 56,243 Sales and marketing¹ 150,293 139,150 298,084 286,605 Product development¹ 82,080 85,030 173,307 173,227 General and administrative¹ 44,634 53,405 89,866 99,914 Depreciation and amortization 9,585 10,615 19,515 21,420 Total costs and expenses 317,269 318,384 638,804 637,409 Income from operations 39,747 18,742 50,964 12,155 Other income, net 10,322 5,898 18,046 11,110 Income before income taxes 50,069 24,640 69,010 23,265 Provision for income taxes 12,033 9,911 16,820 9,714 Net income attributable to common stockholders $ 38,036 $ 14,729 $ 52,190 $ 13,551 Net income per share attributable to common stockholders: Basic $ 0.56 $ 0.21 $ 0.77 $ 0.19 Diluted $ 0.54 $ 0.21 $ 0.73 $ 0.19 Weighted-average shares used to compute net income per share attributable to common stockholders: Basic 67,815 69,256 68,187 69,537 Diluted 70,444 71,238 71,574 71,645 ¹ Includes stock-based compensation expense as follows: Three Months Ended June 30, Six Months Ended June 30, 2024 2023 2024 2023 Cost of revenue $ 1,397 $ 1,346 $ 2,798 $ 2,728 Sales and marketing 8,618 8,607 17,317 17,721 Product development 22,534 24,974 46,187 50,841 General and administrative 8,665 8,653 17,622 18,547 Total stock-based compensation $ 41,214 $ 43,580 $ 83,924 $ 89,837

Ye lp Q 2 20 24 19 23 Condensed Consolidated Statements of Cash Flows (In thousands; unaudited) Six Months Ended June 30, 2024 2023 Operating Activities Net income $ 52,190 $ 13,551 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization 19,515 21,420 Provision for doubtful accounts 23,957 14,636 Stock-based compensation 83,924 89,837 Amortization of right-of-use assets 7,662 15,699 Deferred income taxes (2,109) (42,148) Amortization of deferred contract cost 12,321 11,716 Asset impairment — 3,555 Other adjustments, net (2,995) (64) Changes in operating assets and liabilities: Accounts receivable (31,679) (34,389) Prepaid expenses and other assets (14,914) 12,156 Operating lease liabilities (19,434) (20,943) Accounts payable, accrued liabilities and other liabilities (15,894) 37,225 Net cash provided by operating activities 112,544 122,251 Investing Activities Purchases of marketable securities — available-for-sale (53,301) (82,491) Sales and maturities of marketable securities — available-for-sale 49,095 50,613 Purchases of other investments (2,500) — Purchases of property, equipment and software (16,574) (15,153) Other investing activities 234 146 Net cash used in investing activities (23,046) (46,885) Financing Activities Proceeds from issuance of common stock for employee stock-based plans 13,436 26,095 Taxes paid related to the net share settlement of equity awards (41,190) (38,201) Repurchases of common stock (122,657) (100,000) Payment of issuance costs for credit facility — (799) Net cash used in financing activities (150,411) (112,905) Effect of exchange rate changes on cash, cash equivalents and restricted cash (295) 1,175 Change in cash, cash equivalents and restricted cash (61,208) (36,364) Cash, cash equivalents and restricted cash — Beginning of period 314,002 307,138 Cash, cash equivalents and restricted cash — End of period $ 252,794 $ 270,774

Ye lp Q 2 20 24 20 23 Reconciliation of GAAP to Non-GAAP Financial Measures (In thousands, except percentages; unaudited) 1 Includes the release of a $3.1 million reserve related to a one-time payroll tax credit. 2 Recorded within general and administrative expenses on our Condensed Consolidated Statements of Operations. ³ Represents the loss contingency recorded in connection with the agreement to settle a putative class action lawsuit asserting claims under the California Invasion of Privacy Act. For additional information, see our most recently filed Quarterly Report on Form 10-Q. Three Months Ended June 30, Six Months Ended June 30, 2024 2023 2024 2023 Reconciliation of Net Income to Adjusted EBITDA: Net income $ 38,036 $ 14,729 $ 52,190 $ 13,551 Provision for income taxes 12,033 9,911 16,820 9,714 Other income, net¹ (10,322) (5,898) (18,046) (11,110) Depreciation and amortization 9,585 10,615 19,515 21,420 Stock-based compensation 41,214 43,580 83,924 89,837 Litigation settlement2,3 — 11,000 — 11,000 Asset impairment² — — — 3,555 Fees related to shareholder activism² 569 — 1,168 — Adjusted EBITDA $ 91,115 $ 83,937 $ 155,571 $ 137,967 Net revenue $ 357,016 $ 337,126 $ 689,768 $ 649,564 Net income margin 11 % 4 % 8 % 2 % Adjusted EBITDA margin 26 % 25 % 23 % 21 % Three Months Ended June 30, Six Months Ended June 30, 2024 2023 2024 2023 Reconciliation of Net Cash Provided by Operating Activities to Free Cash Flow: Net cash provided by operating activities $ 39,689 $ 48,007 $ 112,544 $ 122,251 Purchases of property, equipment and software (9,587) (7,635) (16,574) (15,153) Free cash flow $ 30,102 $ 40,372 $ 95,970 $ 107,098 Net cash used in investing activities $ (16,644) $ (9,605) $ (23,046) $ (46,885) Net cash used in financing activities $ (66,577) $ (58,199) $ (150,411) $ (112,905)

Ye lp Q 2 20 24 21 23 Key Financial and Operational Metrics (In thousands, except for percentages; unaudited) 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 Advertising Revenue by Category Services1 $152,522 $157,319 $157,242 $160,263 $174,298 $180,957 $178,292 $183,520 $200,274 $206,178 $203,140 $203,288 $222,955 Restaurants, Retail & Other2 $92,439 $99,511 $104,205 $102,974 $109,220 $112,707 $115,692 $113,623 $121,698 $123,854 $124,231 $114,350 $118,383 Total Advertising Revenue $244,961 $256,830 $261,447 $263,237 $283,518 $293,664 $293,984 $297,143 $321,972 $330,032 $327,371 $317,638 $341,338 Paying Advertising Locations by Category3 Services1 234 231 219 223 232 238 231 238 238 235 245 252 254 Restaurants, Retail & Other2 294 304 309 323 337 334 314 316 325 326 299 278 277 Total Paying Advertising Locations 528 535 528 546 569 572 545 554 563 561 544 530 531 Year-over-Year Percentage Change in Ad Clicks & Average CPC Ad Clicks4 87% 28% 14% 4% -11% -15% -7% 1% 0% 9% 9% 8% 9% Average CPC5 -20% -1% 7% 17% 32% 36% 23% 14% 14% 4% 4% -1% -1% 1 Includes Home, Local, Auto, Professional, Pets, Real Estate, Financial and Event Services categories 2 Includes Restaurants, Shopping, Beauty & Fitness, Health and Other categories 3 On a monthly average basis 4 Ad clicks represent user interactions with our pay-for-performance advertising products, including clicks on advertisements on our website and mobile app, clicks on syndicated advertisements on third-party platforms, and Request-a-Quote submissions. Ad clicks do not include user interactions with ads sold through our advertising partnerships. 5 We define Average CPC as revenue from our performance-based ad products — excluding revenue from our advertising partnerships as well as certain revenue adjustments that do not impact the outcome of an auction for an individual ad click, such as refunds — divided by the total number of ad clicks for a given period. More information about the Company, including the Company’s Key Operational and Financial Metrics definitions can be found in the Company's most recent Quarterly or Annual Report filed with the SEC, available at www.yelp-ir.com or the SEC’s website at www.sec.gov.

Ye lp Q 2 20 24 Non-GAAP Financial Measures This letter and statements made during the above referenced webcast may include information relating to Adjusted EBITDA, Adjusted EBITDA margin and Free cash flow, each of which is a “non-GAAP financial measure.” We define Adjusted EBITDA as net income (loss), adjusted to exclude: provision for (benefit from) income taxes; other income, net; depreciation and amortization; stock-based compensation expense; and, in certain periods, certain other income and expense items, such as material litigation settlements, impairment charges and fees related to shareholder activism, and other items that we deem not to be indicative of our ongoing operating performance. We define Adjusted EBITDA margin as Adjusted EBITDA divided by net revenue. We define Free cash flow as cash flow from operating activities, less cash used for purchases of property, equipment and software. Adjusted EBITDA and Free cash flow, which are not prepared under any comprehensive set of accounting rules or principles, have limitations as analytical tools and you should not consider them in isolation or as substitutes for analysis of Yelp’s financial results as reported in accordance with GAAP. In particular, Adjusted EBITDA and Free cash flow should not be viewed as substitutes for, or superior to, net income (loss) or net cash provided by (used in) operating activities prepared in accordance with GAAP as measures of profitability or liquidity. Some of these limitations are: > although depreciation and amortization are non-cash charges, the assets being depreciated and amortized may have to be replaced in the future, and Adjusted EBITDA does not reflect all cash capital expenditure requirements for such replacements or for new capital expenditure requirements; > Adjusted EBITDA does not reflect changes in, or cash requirements for, Yelp’s working capital needs; > Adjusted EBITDA does not reflect the impact of the recording or release of valuation allowances or tax payments that may represent a reduction in cash available to Yelp; > Adjusted EBITDA does not consider the potentially dilutive impact of equity-based compensation; > Adjusted EBITDA does not take into account certain income and expense items, such as material litigation settlements, impairment charges and fees related to shareholder activism, or other costs that management determines are not indicative of our ongoing operating performance; > Free cash flow does not represent the total residual cash flow available for discretionary purposes because it does not reflect our contractual commitments or obligations; and > other companies, including those in Yelp’s industry, may calculate Adjusted EBITDA and Free cash flow differently, which reduces their usefulness as comparative measures. Because of these limitations, you should consider Adjusted EBITDA, Adjusted EBITDA margin and Free cash flow alongside other financial performance measures, including net income (loss), net cash provided by (used in) operating activities and Yelp’s other GAAP results. Forward-Looking Statements This letter contains, and statements made during the above-referenced webcast will contain, forward-looking statements relating to, among other things, the future performance of Yelp and its consolidated subsidiaries that are based on Yelp’s current expectations, forecasts and assumptions and involve risks and uncertainties. These statements include, but are not limited to, statements regarding: > Yelp’s expected financial results for the third quarter and full year 2024; > Yelp’s product roadmap for the remainder of 2024 and beyond; > Yelp’s ability to continue to drive long-term profitable growth and its focus on strategic initiatives to drive that growth over the long term; > Yelp’s assessment of the opportunities ahead, particularly in Services, to continue connecting people with great local businesses; > Yelp’s plans to leverage the learning from its early efforts to acquire Services projects through paid search to become more precise in lead distribution and narrow its focus towards the opportunities that it believes will have the highest return, and its expectation that such adjustment may moderate the magnitude of Request-a-Quote project growth in future quarters; > Yelp’s plans to continue to deliver value to its advertisers with a strong product roadmap of improvements ahead; > Yelp’s expectation that trends in the year-over-year changes in ad clicks and average CPC since the second half of 2023 will moderate in the second half of 2024 due to more difficult prior-year comparisons; 22 23

Ye lp Q 2 20 24 > Yelp’s pipeline of projects to more efficiently acquire and retain small and medium-sized businesses through improved routing and the use of more effective telephony technologies; > Yelp’s confidence in its ability to drive growth in the Multi-location channel by adapting its Services product offerings to better fit the needs of enterprise clients; > Yelp’s confidence in growth opportunities for Yelp Audiences; > Yelp’s plans to hold its headcount approximately flat in 2024; > Yelp’s expectation that it will spend approximately $35 million in 2024 on paid search; > Yelp’s expected improvement of its GAAP profitability in the years to come as a result of its efforts to reduce SBC as a percentage of revenue and its continued share repurchases; > Yelp’s expectation regarding its reduction of SBC as a percentage of revenue over time as well as the anticipated timing and impact of such efforts; > Yelp’s plans to continue share repurchases under its stock repurchase program in the second half of 2024; > Yelp’s assessment of the opportunities ahead to drive profitable growth and shareholder value over the long term; > Yelp’s belief that its areas of investment will be high return and drive increased profitability; and > Yelp’s expectation that the trends in Services and RR&O revenue observed in the second quarter will persist in the second half of 2024, including its expectation of continued RR&O headwinds. Yelp’s actual results could differ materially from those predicted or implied by such forward-looking statements and reported results should not be considered as an indication of future performance. Factors that could cause or contribute to such differences include, but are not limited to: > macroeconomic uncertainty — including related to inflation, interest rates and supply chain issues, as well as severe weather events — and its effect on consumer behavior, user activity and advertiser spending; > the prevalence of seasonal respiratory illnesses, impact of fears or actual outbreaks of disease and any resulting changes in consumer behavior, economic conditions or governmental actions; > Yelp’s ability to maintain and expand its base of advertisers, particularly if advertiser turnover substantially worsens and/or consumer demand significantly degrades; > the default by any subtenants on their rental payment obligations under the subleases entered into in connection with Yelp’s reduction of its office space; > Yelp’s ability to drive continued growth through its strategic initiatives; > Yelp’s ability to continue to effectively operate with a primarily remote work force and attract and retain key talent; > Yelp’s limited operating history in an evolving industry; > Yelp’s ability to generate and maintain sufficient high-quality content from its users; > potential strategic opportunities and Yelp’s ability to successfully manage the acquisition and integration of new businesses, solutions or technologies, as well as its ability to monetize such acquired products, solutions or technologies; > Yelp’s reliance on traffic to its website from search engines like Google and Bing and the quality and reliability of such traffic; > maintaining a strong brand and managing negative publicity that may arise; and > Yelp’s ability to timely upgrade and develop its systems, infrastructure and customer service capabilities. Factors that could cause or contribute to such differences also include, but are not limited to, those factors that could affect Yelp’s business, operating results and stock price included under the captions “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Yelp’s most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q at www.yelp-ir.com or the SEC’s website at www.sec.gov. Undue reliance should not be placed on the forward-looking statements in this letter or the above-referenced webcast, which are based on information available to Yelp on the date hereof. Such forward-looking statements do not include the potential impact of any acquisitions or divestitures that may be announced and/or completed after the date hereof. Yelp assumes no obligation to update such statements. 23 23

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

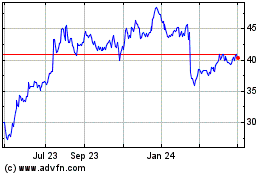

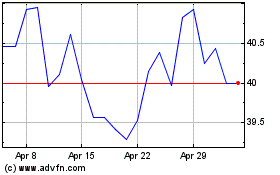

Yelp (NYSE:YELP)

Historical Stock Chart

From Aug 2024 to Sep 2024

Yelp (NYSE:YELP)

Historical Stock Chart

From Sep 2023 to Sep 2024