Startup Raises $4.2 Billion -- WSJ

September 14 2018 - 3:02AM

Dow Jones News

By Joanne Chiu and Liza Lin

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (September 14, 2018).

Chinese startup Meituan Dianping raised about $4.2 billion from

its initial public offering in Hong Kong, according to people

familiar with the situation, defying a weak market to show

investors remain keen on fast-growing technology companies.

Meituan, backed by Tencent Holdings Ltd., caters to China's

growing middle class, which increasingly goes online to do things

as diverse as ordering lunch and booking cinema tickets. Its app

offers services similar to those of Grubhub Inc., Groupon Inc. and

Yelp Inc.

On Thursday, Meituan's fundraising priced near the top of its

target range, contrasting with a lackluster response to

smartphone-maker Xiaomi Corp.'s IPO earlier in the summer, which

ultimately raised $5.4 billion. It also came days after the city's

benchmark Hang Seng Index entered bear-market territory, falling

20% from a January peak, on worries about trade, Chinese growth and

a stronger dollar.

Beijing-based Meituan has yet to turn an annual profit but its

revenue more than doubled last year to about $5 billion. The

company raised 33.14 billion Hong Kong dollars (US$4.2 billion) and

priced its offering at HK$69 a share, according to people familiar

with the situation. That price is in the upper half of an earlier

range of HK$60 to HK$72.

The deal gives the company a market capitalization of close to

$53 billion -- a sharp increase from its $30 billion valuation

during a private capital raise in late 2017. The IPO was supported

by investors including Tencent and OppenheimerFunds. Hong Kong

billionaire Li Ka-shing also plans to purchase some of the shares,

according to a person familiar with the matter.

Meituan shares will start trading in Hong Kong on Sept. 20.

Meituan was formed in 2015 through a combination of two internet

startups. Its previous backers include Singapore's sovereign-wealth

fund GIC Pte. Ltd. and U.S. travel portal Booking Holdings Inc.,

the company previously known as Priceline Group.

Goldman Sachs Group Inc., Morgan Stanley and Bank of America

Merrill Lynch are joint sponsors of Meituan's offering.

Separately, investment bank China Renaissance Holdings Ltd., an

adviser to various mainland startups including Meituan, set the

price range for its own IPO that could raise as much as $377

million ahead of its debut on Sept. 27.

The Beijing-based financial firm is selling about 85 million

shares at HK$31.80 to HK$34.80 apiece, according to a term sheet

seen by The Wall Street Journal. That would give China Renaissance

a market capitalization of as much as $2.74 billion, before an

option to sell more stock.

Fan Bao, a former Credit Suisse and Morgan Stanley banker

originally from Shanghai, co-founded China Renaissance in 2005 and

is its controlling shareholder.

Alipay, China's largest mobile-payment system, which is owned by

Jack Ma's Ant Financial Services Group, intends to purchase $50

million of the firm's shares in the IPO, according to the term

sheet. Other cornerstone investors, which are meant to help support

the offering, include hedge-fund firm Snow Lake, which has pledged

$50 million, and private bank LGT Group, which will buy $25 million

in shares.

Write to Joanne Chiu at joanne.chiu@wsj.com and Liza Lin at

Liza.Lin@wsj.com

(END) Dow Jones Newswires

September 14, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

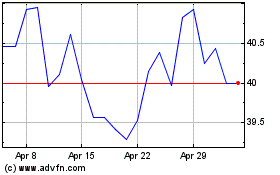

Yelp (NYSE:YELP)

Historical Stock Chart

From Jun 2024 to Jul 2024

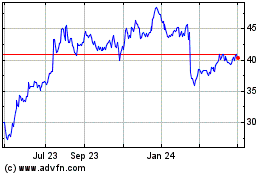

Yelp (NYSE:YELP)

Historical Stock Chart

From Jul 2023 to Jul 2024