Equity Alert: Johnson & Weaver, LLP Files Class Action Complaint Against Certain Officers & Directors of Yelp, Inc.; Investor...

August 09 2014 - 1:00PM

Business Wire

Shareholder rights law firm Johnson & Weaver, LLP, who filed

the initial class action complaint alleging violations of the

federal securities laws against Yelp, Inc. (NYSE:YELP) and certain

of its officers and directors, reminds investors that they have

until October 6, 2014 to file a motion seeking to be

appointed lead plaintiff.

If you purchased Yelp common stock securities between October

29, 2013 and April 3, 2014, (the "Class Period") we encourage you

to contact our firm. The case is pending in the United States

District Court for the Northern District of California.

Additional Information about the Lawsuit:

Yelp operates as an online local guide that connects people

primarily with boutiques, mechanics, restaurants, and dentists. The

Company states that reviews of these businesses that appear on its

website are written by people using Yelp to share their everyday

local business experiences, giving voice to consumers and bringing

“word of mouth” online.

The complaint alleges that during the Class Period, defendants

made materially false and misleading statements concerning the

Company’s true business and financial condition, including but not

limited to the true nature of the so-called “firsthand” experiences

and reviews appearing on the Company’s website, the robustness of

its processes and algorithms purportedly designed to screen

unreliable reviews, and the Company’s forecasted financial growth

prospects and the extent to which they were reliant upon

undisclosed business practices, including but not limited to

requiring business customers to pay to suppress negative reviews.

Defendants’ false and misleading statements during the Class Period

caused the Yelp’s stock to trade at artificially inflated prices,

reaching a high of over $98.00 per share on March 4, 2014, and

allowed Company insiders to sell more than 1.16 million shares of

Yelp stock at prices as high as $98.99 per share for insider

trading proceeds of more than $81.5 million.

According to the complaint, as the true facts concerning the

Company’s business practices began to be revealed to the market

through a series of articles and disclosures starting on March 31,

2014, the Company’s stock price declined, falling from a close of

$80.18 per share on April 1, 2014 to a close of $65.76 per share on

April 4, 2014.

Plaintiff seeks to recover damages on behalf of all purchasers

of Yelp common stock during the Class Period. If you wish to serve

as a lead plaintiff, you must move the Court no later than October

6, 2014. If you wish to discuss this action, have any questions

concerning this notice, or your rights or interests, please contact

lead analyst Jim Baker (jimb@johnsonandweaver.com) at

619-814-4471. If you email, please include your phone

number.

Johnson & Weaver, LLP is a nationally recognized shareholder

rights law firm with offices in California, New York and Georgia.

The firm represents individual and institutional investors in

shareholder derivative and securities class action lawsuits. For

more information about the firm and its attorneys, please visit

http://www.johnsonandweaver.com.

Johnson & Weaver, LLPJim Baker,

619-814-4471jimb@johnsonandweaver.com

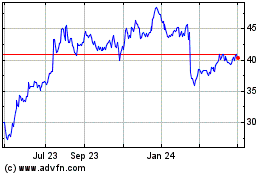

Yelp (NYSE:YELP)

Historical Stock Chart

From Jun 2024 to Jul 2024

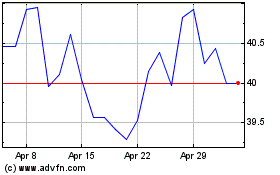

Yelp (NYSE:YELP)

Historical Stock Chart

From Jul 2023 to Jul 2024