Yelp Plunges on Sell-off, Faces Probe - Analyst Blog

May 07 2014 - 1:56PM

Zacks

Shares of Yelp Inc. (YELP) plunged 13.4%

($8.06) to $52.13 following a broad sell-off of Internet-based

stocks. Moreover, shareholder rights law firm, Johnson &

Weaver, LLP, announced an investigation against the company.

The law firm will investigate potential violations of the federal

securities laws, which include Yelp’s business practices. The

investigation also focuses on the true nature of the reviews that

appear on the company’s website.

Of late, Yelp’s business practices regarding reviews appearing on

its website have faced significant criticism. In early April, the

Federal Trade Commission (FTC) said that it received an

overwhelming number of complaints about the company’s business

review practices over the last five years.

The FTC announced that it received more than 2,046 complaints

against Yelp. According to The Wall Street Journal, most

of the complaints were lodged by small business owners alleging

that Yelp posts fraudulent reviews that defame their

reputation.

Most of these business owners stated that the negative reviews

posted on the website appeared after they declined to pay Yelp for

sponsorship. Some of them sued the anonymous reviewers and asked

Yelp to reveal their true identities.

Yelp also said that it receives approximately six subpoenas on a

monthly basis, demanding the true identities of the anonymous

reviewers. The company vehemently denied the allegations as well as

any relationship between reviews and sponsorship.

The company argued that the reviews from websites such as Yelp,

Amazon.com (AMZN), Google

(GOOGL), Yahoo! (YHOO) are protected under the

federal Communications Decency 1996 Act, from being sued for the

content they publish.

However, we believe that any negative finding will not only hurt

the company’s reputation but also attract other lawsuits increasing

Yelp’s legal expenses, negatively affecting profitability.

In the recently concluded first quarter, Yelp incurred a loss of 4

cents per share, narrower than the Zacks Consensus Estimate of a

loss of 6 cents. Revenues for the quarter, however, surged 65.6%

from the year-ago quarter to $76.4 million.

Strong growth in user base (particularly mobile), its entry into

new markets (both domestic & international) and new

partnerships are the positives for Yelp. However, as Yelp continues

to explore and expand into new markets, sales & marketing

expenditure is expected to increase significantly, thereby hurting

margins.

Moreover, fierce competition from the likes of

Facebook (FB) in the brand related revenue market

remains a major headwind, going forward.

Currently, Yelp has a Zacks Rank #3 (Hold).

AMAZON.COM INC (AMZN): Free Stock Analysis Report

FACEBOOK INC-A (FB): Free Stock Analysis Report

YELP INC (YELP): Free Stock Analysis Report

YAHOO! INC (YHOO): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

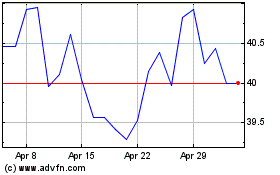

Yelp (NYSE:YELP)

Historical Stock Chart

From Jun 2024 to Jul 2024

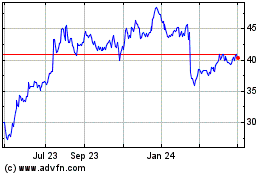

Yelp (NYSE:YELP)

Historical Stock Chart

From Jul 2023 to Jul 2024