WeWork Inc. (“WeWork” or the “Company”) (NYSE: WE)

today announced the early tender results of the previously

announced separate offers to exchange (each an “Exchange Offer”

and, together, the “Exchange Offers”) by WeWork Companies LLC (the

“Issuer”) and WW Co-Obligor Inc. (the “Co-Obligor” and together

with the Issuer, the “Issuers”), each a subsidiary of the Company,

any and all of the Issuers’ outstanding 7.875% Senior Notes due

2025 (the “Old 7.875% Notes”) and 5.00% Senior Notes due 2025,

Series II (the “Old 5.00% Notes” and, together with the Old 7.875%

Notes, the “Old Notes”), for a combination of certain securities as

set forth in, and subject to the terms and conditions of, the

offering memorandum and consent solicitation statement dated as of

April 3, 2023 (as supplemented or otherwise modified from time to

time, the “Offering Memorandum”).

As of 5:00 p.m., New York City time, on April 14, 2023 (the

“Early Exchange Time”), the Issuers received from Eligible Holders

(as defined herein) valid and unrevoked tenders and related

consents, as reported by Epiq Corporate Restructuring, LLC (the

“Exchange Agent”), representing 85.7% of the aggregate principal

amount of Old Notes outstanding, as follows: (i) $505.6 million

with respect to the Old 7.875% Notes, representing 75.6% of the

aggregate principal amount thereof outstanding, and (ii) $539.2

million with respect to the Old 5.00% Notes, representing 98.0% of

the aggregate principal amount thereof outstanding, as further

specified in the table below. The Early Exchange Consideration (as

defined in the Offering Memorandum) with respect to the Old Notes

tendered by the Early Exchange Time represents $703.7 million in

aggregate principal amount of New Second Lien Notes (as defined in

the Offering Memorandum), $23.2 million in aggregate principal

amount of New Third Lien Notes (as defined in the Offering

Memorandum) and 230.7 millions of Class A Common Stock (as defined

in the Offering Memorandum). In addition, approximately $399.6

million in aggregate principal amount of New First Lien Notes (as

defined in the Offering Memorandum) were subscribed in the

concurrent New First Lien Notes Issuance (as defined in the

Offering Memorandum) by certain Eligible Holders.

Option Considerations

Title of Series of Old Notes

CUSIPs/ISINs

Aggregate Principal Amount

Outstanding

Principal Amount Tendered by the

Early Exchange Time

Early Exchange Consideration per

$1,000 of Old Notes(1)(2)

First Option

7.875% Senior Notes due 2025

96208LAA9/ US96208LAA98 (Rule

144A) and U96217AA9 / USU96217AA99 (Regulation S)

$669.0 million

$455.8 million

(i) $750 in principal amount of New Second

Lien Notes per $1,000 in principal amount of Old Notes tendered and

(ii) 162 shares of Class A Common Stock per $1,000 in principal

amount of Old Notes tendered (which represents shares of Class A

Common Stock with a value equal to $150 per $1,000 in principal

amount of Old Notes tendered calculated at the Common Equity VWAP

(as defined herein)), subject to the concurrent purchase of the

Eligible Holder’s applicable Pro Rata Portion of New First Lien

Notes via cash payment by the tendering Eligible Holder (each as

defined in the Offering Memorandum).

5.00% Senior Notes due 2025,

Series II

96209BAA0/ US96209BAA08 (Rule

144A) and U9621PAA9/ USU9621PAA94 (Regulation S)

$550.0 million

$482.5 million

Second Option

7.875% Senior Notes due 2025

96208LAA9/ US96208LAA98 (Rule

144A) and U96217AA9 / USU96217AA99 (Regulation S)

$669.0 million

$19.8 million

974 shares of Class A Common Stock per

$1,000 in principal amount of Old Notes tendered (which represents

shares of Class A Common Stock with a value equal to $900 per

$1,000 in principal amount of Old Notes tendered calculated at the

Common Equity VWAP), subject to the concurrent purchase of the

Eligible Holder’s applicable Pro Rata Portion of New First Lien

Notes via cash payment by the tendering Eligible Holder.

5.00% Senior Notes due 2025,

Series II

96209BAA0/ US96209BAA08 (Rule

144A) and U9621PAA9/ USU9621PAA94 (Regulation S)

$550.0 million

$16.1 million

Third Option

7.875% Senior Notes due 2025

96208LAA9/ US96208LAA98 (Rule

144A) and U96217AA9 / USU96217AA99 (Regulation S)

$669.0 million

$25.9 million

(i) $750 in principal amount of New Third

Lien Notes per $1,000 principal amount of Old Notes tendered and

(ii) 162 shares of Class A Common Stock per $1,000 in principal

amount of Old Notes tendered (which represents shares of Class A

Common Stock with a value equal to $150 per $1,000 in principal

amount of Old Notes tendered calculated at the Common Equity

VWAP).

5.00% Senior Notes due 2025,

Series II

96209BAA0/ US96209BAA08 (Rule

144A) and U9621PAA9/ USU9621PAA94 (Regulation S)

$550.0 million

$5.0 million

Fourth Option

7.875% Senior Notes due 2025

96208LAA9/ US96208LAA98 (Rule

144A) and U96217AA9 / USU96217AA99 (Regulation S)

$669.0 million

$4.1 million

974 shares of Class A Common Stock per

$1,000 in principal amount of Old Notes tendered (which represents

shares of Class A Common Stock with a value equal to $900 per

$1,000 in principal amount of Old Notes tendered calculated at the

Common Equity VWAP.

5.00% Senior Notes due 2025,

Series

96209BAA0/ US96209BAA08 (Rule

144A) and U9621PAA9/ USU9621PAA94 (Regulation S)

$550.0 million

$35.6 million

__________________

(1) For each $1,000 principal amount of Old Notes validly

tendered and not validly withdrawn (and accepted for exchange), the

Issuers will pay accrued and unpaid interest in cash in addition to

the Exchange Consideration (as defined in the Offering Memorandum),

as applicable, to, but not including, the Settlement Date (as

defined in the Offering Memorandum). No consideration will be paid

for Consents in the Consent Solicitations (each as defined in the

Offering Memorandum).

(2) The number of shares of Class A Common Stock to be issued as

part of the Exchange Consideration is calculated based on a price

per share equal to the 20-day trading volume weighted average price

of the shares of Class A Common Stock during the period starting 10

trading days prior to the announcement of the Transactions (as

defined in the Offering Memorandum) on March 17, 2023 and ending 10

trading days after such announcement, which has been determined to

be $0.9236 per share (the “Common Equity VWAP”). Shares of Class A

Common Stock delivered as part of the Exchange Consideration will

be rounded down to the nearest whole share. No cash payment will be

received as a result of rounding down.

In addition, as of the Early Exchange Time, the Issuers received

the requisite number of consents in the concurrent consent

solicitations (the “Consent Solicitations”) from holders of Old

7.875% Notes and Old 5.00% Notes to adopt certain proposed

amendments (the “Proposed Amendments”) to the Senior Notes

Indenture, dated as of April 30, 2018, governing the Old 7.875%

Notes (the “2018 Indenture”), and the Amended and Restated

Senior Notes Indenture, dated as of December 16, 2021, governing

the Old 5.00% Notes (the “2021 Indenture” and together with

the 2018 Indenture, the “Old Notes Indentures”), to

eliminate substantially all of the restrictive covenants contained

in the Old Notes Indentures and the Old Notes, eliminate certain

events of default, modify covenants regarding mergers and

consolidations and modify or eliminate certain other provisions,

including certain provisions relating to future guarantors and

defeasance, in each case upon the terms and subject to the

conditions set forth in the Offering Memorandum. The Issuers

entered into supplemental indentures with the applicable trustee

and the guarantors party thereto to reflect the Proposed

Amendments, but the Proposed Amendments will become operative only

upon the consummation of the Exchange Offers on the Settlement

Date.

Further, the Issuers are changing the Late Exchange

Consideration (as defined in the Offering Memorandum) available to

Eligible Holders who validly tender (and do not validly withdraw)

Old Notes after the Early Exchange Time and before the Expiration

Time (as defined below). The Late Exchange Consideration will now

be the same as the Early Exchange Consideration, such that Eligible

Holders who validly tender their Old Notes after the Early Exchange

Time and prior to the Expiration Time will receive the same

consideration as Eligible Holders who validly tendered (and have

not validly withdrawn) Old Notes prior to the Early Exchange Time,

as further set forth in the Offering Memorandum.

As of 5:00 p.m., New York City time, on April 14, 2023, the

right to withdraw tenders of Old Notes and related consents

expired. Accordingly, Old Notes tendered for exchange may not be

validly withdrawn and consents may no longer be revoked, unless

required by applicable law, or the Issuers determine in the future

in their sole discretion to permit withdrawal and revocation

rights.

Each Exchange Offer and the related Consent Solicitation will

expire at 5:00 p.m., New York City time, on May 1, 2023, unless

extended or terminated earlier (such time and date with respect to

the applicable Exchange Offer, as the same may be extended or

terminated earlier, the “Expiration Time”). Subject to the tender

acceptance procedures described in the Offering Memorandum,

Eligible Holders who validly tender Old Notes after the Early

Exchange Time and before the Expiration Time will receive the Late

Exchange Consideration, which will be the same as the Early

Exchange Consideration, as further described in the Offering

Memorandum. No consideration will be paid for Consents in the

Consent Solicitations. Each participating Eligible Holder must

tender all of the Old Notes it holds. Partial tenders of Old Notes

will not be accepted.

The consummation of each of the Exchange Offers, the Consent

Solicitations and the New First Lien Notes Issuance is subject to,

and conditioned upon the satisfaction or waiver by the Issuers of,

the Minimum Participation Condition, the Stockholder Approval

Condition, the Requisite Consents Condition and the General

Conditions (each as defined in the Offering Memorandum). Subject to

applicable law, the Issuers may amend, extend, terminate or

withdraw one of the Exchange Offers and related Consent

Solicitation without amending, extending, terminating or

withdrawing the other, at any time and for any reason, including if

any of the conditions set forth under “Conditions to the Exchange

Offers and the Consent Solicitations” in the Offering Memorandum

with respect to the applicable Exchange Offer is not satisfied as

determined by the Issuers in their sole discretion.

The New First Lien Notes Issuance and each Exchange Offer are

being made, and the Securities (as defined in the Offering

Memorandum) are being offered and issued (i) with respect to the

New Notes (as defined in the Offering Memorandum), (a) in the

United States, to holders of Old Notes who are reasonably believed

to be “qualified institutional buyers” (as defined in Rule 144A

promulgated under the Securities Act of 1933, as amended (the

“Securities Act”)) and (b) outside the United States, to holders of

Old Notes who are persons other than U.S. persons in reliance upon

Regulation S promulgated under the Securities Act and (ii) with

respect to the shares of Class A Common Stock, to institutions that

are “accredited investors” as defined in Rule 501(a)(1), (2), (3),

(7) or (8) of Regulation D under the Securities Act. Holders of Old

Notes who have certified to the Issuers that they are eligible to

participate in the applicable Exchange Offer pursuant to subclauses

(i)(a) or (i)(b) and (ii) of the foregoing conditions are referred

to as “Eligible Holders.” Only Eligible Holders are authorized to

receive or review the Offering Memorandum or to participate in the

Exchange Offers. Copies of all the documents relating to the

Exchange Offers and Consent Solicitations may be obtained from the

Exchange Agent, subject to confirmation of eligibility through the

submission of an Eligibility Letter, available at

https://dm.epiq11.com/wwexchange. Alternatively, you may request

the Eligibility Letter via email to tabulation@epiqglobal.com

(please reference “WeWork” in the subject line).

Eligible Holders of the Old Notes are urged to carefully read

the entire Offering Memorandum, including the information presented

under “Risk Factors,” and “Cautionary Note Regarding

Forward-Looking Statements,” and the documents incorporated by

reference into the Offering Memorandum, including the Company’s

consolidated financial statements and the accompanying notes

thereto included in the Company’s Annual Report on Form 10-K for

the year ended December 31, 2022 as filed with the U.S. Securities

and Exchange Commission (the “SEC”) on March 29, 2023, before

making any decision with respect to the New First Lien Notes

Issuance, the Exchange Offers or the Consent Solicitations. None of

the Issuers, their respective subsidiaries, the Exchange Agent, the

Dealer Manager (as defined below), the applicable trustees and

collateral agents under the indentures governing the Old Notes and

the New Notes, or any of their respective affiliates, makes any

recommendation as to whether Eligible Holders of Old Notes should

participate in the New First Lien Notes Issuance, tender their Old

Notes pursuant to the applicable Exchange Offer or deliver Consents

pursuant to the related Consent Solicitation. Each Eligible Holder

must make its own decision as to whether to participate in the New

First Lien Notes Issuance and whether to tender its Old Notes and

to deliver Consents and, if so, the principal amount of Old Notes

as to which action is to be taken.

The Exchange Offers, the New First Lien Notes Issuance and the

Securities have not been registered under the Securities Act or any

other applicable securities laws and, unless so registered, the

Securities may not be offered, sold, pledged or otherwise

transferred within the United States or to, or for the account or

benefit of, “U.S. persons” (as defined in Rule 902 under the

Securities Act), except in transactions exempt from, or not subject

to, the registration requirements of the Securities Act and any

other applicable securities laws. ADDITIONALLY, THE ISSUANCE OF THE

CLASS A COMMON STOCK AS PART OF THE EXCHANGE CONSIDERATION HAS NOT

BEEN REGISTERED AND SUCH CLASS A COMMON STOCK CANNOT BE RESOLD IN

RELIANCE ON RULE 144A UNDER THE SECURITIES ACT, WHICH WILL

CONSTITUTE A SIGNIFICANT ADDITIONAL RESTRICTION ON THE ABILITY TO

RESELL SUCH CLASS A COMMON STOCK. As a result, the Class A Common

Stock will be issued solely on the books of the Transfer Agent (as

defined in the Offering Memorandum).

The Company will provide customary registration rights for the

resale of Class A Common Stock issued as Exchange Consideration to

all Eligible Holders who participate in the Exchange Offers and who

provide certain required information.

The Company has engaged PJT Partners LP as the dealer manager

(the “Dealer Manager”) for the Exchange Offers and Consent

Solicitations. Epiq Corporate Restructuring, LLC has been appointed

as the Exchange Agent. Questions concerning the Exchange Offers and

the Consent Solicitations may be directed to the Dealer Manager or

the Exchange Agent, in accordance with the contact details shown on

the back cover of the Offering Memorandum.

About WeWork

WeWork (NYSE: WE) was founded in 2010 with the vision to create

environments where people and companies come together and do their

best work. Since then, we’ve become one of the leading global

flexible space providers committed to delivering technology-driven

turnkey solutions, flexible spaces, and community experiences.

No Offer or Solicitation

This press release is not intended to and does not constitute an

offer to sell or the solicitation of an offer to subscribe for or

buy or an invitation to purchase or subscribe for any securities or

the solicitation of any vote, consent or approval in any

jurisdiction in connection with the New First Lien Notes Issuance,

the Exchange Offers, the Consent Solicitations, the Transactions or

the Stockholder Approvals (each as defined in the Offering

Memorandum) or otherwise, nor shall there be any sale, issuance or

transfer of securities in any jurisdiction in contravention of

applicable law. In particular, this communication is not an offer

of securities for sale into the United States. No offer of

securities shall be made in the United States absent registration

under the Securities Act or pursuant to an exemption from, or in a

transaction not subject to, such registration requirements.

Cautionary Note Regarding Forward-Looking Statements

Certain statements made herein may be deemed “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995, as amended, including any statements regarding

the consummation of the Exchange Offers, Consent Solicitations and

other related transactions. These forward-looking statements

generally are identified by the words “believe,” “project,”

“expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,”

“opportunity,” “plan,” “pipeline,” “may,” “should,” “will,”

“would,” “will be,” “will continue,” “will likely result,” and

similar expressions. Forward-looking statements are predictions,

projections and other statements about future events that are based

on current expectations and assumptions and, as a result, are

subject to risks and uncertainties. Although WeWork believes the

expectations reflected in any forward-looking statement are based

on reasonable assumptions, it can give no assurance that its

expectations will be attained, and it is possible that actual

results may differ materially from those indicated by these

forward-looking statements due to a variety of risks, uncertainties

and other factors.

Such factors include, but are not limited to, WeWork’s ability

to complete the Exchange Offers, Consent Solicitations and other

related transactions on the terms contemplated or at all; WeWork’s

ability to satisfy the required conditions for the consummation of

the Exchange Offers, Consent Solicitations and other related

transactions; WeWork’s ability to otherwise refinance, extend,

restructure or repay outstanding debt; its outstanding

indebtedness; its current and projected liquidity needs to operate

its business and execute its strategy, and related use of cash; its

ability to raise capital through equity issuances, asset sales or

the incurrence of debt; WeWork’s expectations regarding its ability

to continue as a going concern; retail and credit market

conditions; higher cost of capital and borrowing costs;

impairments; changes in general economic conditions, including as a

result of the COVID-19 pandemic, the conflict in Ukraine and

disruptions in the banking sector, and the impact of such

conditions on WeWork and its customers; WeWork’s expectations

regarding its exits of underperforming locations, including the

timing of any such exits and ability to retain its members; delays

in customers and prospective customers returning to the office and

taking occupancy, or changes in the preferences of customers and

prospective customers with respect to remote or hybrid working, as

a result of the COVID-19 pandemic leading to a parallel delay, or

potentially permanent change, in receiving the corresponding

revenue; the impact of foreign exchange rates on WeWork’s financial

performance; and WeWork’s inability to implement its business plan

or meet or exceed its financial projections.

Forward-looking statements speak only as of the date they are

made. WeWork discusses these and other risks and uncertainties in

its annual and quarterly periodic reports and other documents filed

with the SEC. WeWork undertakes no duty or obligation to update or

revise these forward-looking statements, whether as a result of new

information, future developments, or otherwise, except as required

by law.

Source: We Work Category: Investor Relations

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230416005084/en/

Investor Relations: Kevin Berry investor@wework.com

Press: Nicole Sizemore press@wework.com

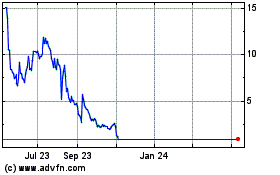

WeWorks (NYSE:WE)

Historical Stock Chart

From Oct 2024 to Nov 2024

WeWorks (NYSE:WE)

Historical Stock Chart

From Nov 2023 to Nov 2024