0000105770false00001057702024-07-252024-07-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) – July 25, 2024

| | |

WEST PHARMACEUTICAL SERVICES, INC. |

(Exact name of registrant as specified in its charter) | | | | | | | | | | | | | | |

| | | | |

Pennsylvania | | 1-8036 | | 23-1210010 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | |

530 Herman O. West Drive, Exton, PA | | | | 19341-1147 |

(Address of principal executive offices) | | | | (Zip Code) |

Registrant’s telephone number, including area code: 610-594-2900 | | |

Not Applicable |

(Former name or address, if changed since last report.) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): | | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, par value $0.25 per share | WST | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On July 25, 2024, West Pharmaceutical Services, Inc. (the “Company”) issued a press release announcing its second-quarter 2024 financial results. A copy of the press release is attached hereto as Exhibit 99.1 and incorporated herein by reference.

Item 7.01 Regulation FD Disclosure.

The information set forth in “Item 2.02 Results of Operations and Financial Condition,” including the exhibit referred to therein, is incorporated herein by reference.

A copy of the Company’s presentation materials used during the call will be available through the Investors link at the Company’s website, http://www.westpharma.com, and is also attached hereto as Exhibit 99.2 and incorporated herein by reference.

The information in this report (including the exhibits attached hereto) is being furnished pursuant to Item 2.02 and Item 7.01 and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (“Exchange Act”), or otherwise subject to the liabilities of that section, nor will it be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific referencing in such filing.

Item 9.01 Financial Statements and Exhibits.

| | | | | | | | |

(d) | Exhibit No. | Description |

| 99.1 | West Pharmaceutical Services, Inc. Press Release, dated July 25, 2024. |

| 99.2 | West Pharmaceutical Services, Inc. Presentation, dated July 25, 2024. |

| 104 | The cover page from the Company’s Current Report on Form 8-K, dated July 25, 2024, formatted in Inline XBRL. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| WEST PHARMACEUTICAL SERVICES, INC. |

| |

| |

| /s/ Bernard J. Birkett |

| Bernard J. Birkett |

| Senior Vice President, Chief Financial Officer |

| |

| |

July 25, 2024 | |

EXHIBIT INDEX

| | | | | | | | |

Exhibit No. | | Description |

99.1 | | |

99.2 | | |

104 | | The cover page from the Company’s Current Report on Form 8-K, dated July 25, 2024, formatted in Inline XBRL. |

Exhibit 99.1

West Announces Second-Quarter 2024 Results

- Conference Call Scheduled for 9 a.m. EDT Today -

Exton, PA, July 25, 2024 – West Pharmaceutical Services, Inc. (NYSE: WST) today announced its financial results for the second-quarter 2024 and updated full-year 2024 financial guidance.

Second-Quarter 2024 Summary (comparisons to prior-year period)

•Net sales of $702.1 million declined 6.9%; organic net sales declined 5.9%.

•Reported-diluted EPS of $1.51, compared to $2.06 in the same period last year.

•Adjusted-diluted EPS of $1.52, compared to $2.11 in the same period last year.

•The Company is updating full-year 2024 net sales guidance to a range of $2.870 billion to $2.900 billion, compared to a prior range of $3.000 billion to $3.025 billion.

•The Company is updating full-year 2024 adjusted-diluted EPS guidance to a range of $6.35 to $6.65, compared to a prior range of $7.63 to $7.88.

"The second quarter continued to be impacted by an elevated level of customer destocking," said Eric M. Green, President, Chief Executive Officer and Chair of the Board. "While the results were below our expectations, we were encouraged to see our second-quarter revenues increase sequentially. Our outlook anticipates that revenues in the second half of the year will be stronger than the first half. Based on our confirmed order book and ongoing customer conversations, we remain confident in a return to organic growth in the fourth quarter and as we move into 2025. We see considerable growth opportunity in the markets we serve, and our investments position us to create continued value for our customers, patients and shareholders well into the future.”

Proprietary Products Segment

Net sales declined by 9.4% to $559.7 million. Organic net sales (excluding changes in currency translation and impact of a prior year divestiture) declined by 8.4%. High-value products (components and devices) represented more than 70% of segment sales in the period led by customer demand for self-injection, Envision® components and NovaPure® products.

The Generics market unit had a double digit organic net sales decline, driven by lower volumes in FluroTec® and Westar® products. The Biologics market unit had a mid-single digit organic net sales decline, driven by lower sales of Daikyo CZ® and Westar® offset by an increase in sales of self-injection device platforms. The Pharma market unit had a low-single digit organic net sales decline, driven by a reduction in sales of Administrative Systems and Westar® products.

Contract-Manufactured Products Segment

Net sales grew by 4.9% to $142.4 million. Organic net sales grew by 5.4% with currency translation decreasing sales growth by 50 basis points. Segment performance was led by growth in sales of components associated with injection-related devices.

Financial Highlights (first six months of 2024)

Operating cash flow was $283.2 million, a decrease of 7.8%. Capital expenditures were $190.8 million, an increase of 21.1% over the same period last year. Free cash flow (operating cash flow minus capital expenditures) was $92.4 million, a decrease of 38.3%.

During the first half of 2024, the Company repurchased 1,239,015 shares for $454.1 million at an average share price of $366.53 under its share repurchase program.

Full-Year 2024 Financial Guidance

•The Company is updating full-year 2024 net sales guidance to a range of $2.870 billion to $2.900 billion, compared to a prior range of $3.000 billion to $3.025 billion.

◦Organic net sales are now expected decrease approximately 1% to 2%.

◦Net sales guidance includes an estimated full-year 2024 headwind of approximately $5.0 million based on current foreign currency exchange rates, compared to prior guidance of approximately $8.0 million.

•Full-year 2024 adjusted-diluted EPS is expected to be in a range of $6.35 to $6.65, compared to prior guidance range of $7.63 to $7.88.

◦Full-year adjusted-diluted EPS guidance range includes an estimated headwind of approximately $0.03 based on current foreign currency exchange rates, compared to prior guidance of $0.04.

◦The updated guidance also includes EPS of $0.22 associated with first-half 2024 tax benefits from stock-based compensation.

◦For the second half of the year, our EPS guidance range assumes a tax rate of 22% and does not include potential tax benefits from stock-based compensation. Any tax benefits associated with stock-based compensation beyond those recorded in the first-half 2024 would provide a positive adjustment to our full-year adjusted-diluted EPS guidance.

•Full-year 2024 capital spending is expected to be $375 million, an increase from the previous estimate of $350 million.

Second-Quarter 2024 Conference Call

The live audio-only webcast will be made available via the Company's Investor Relations website at www.westpharma.com.

To participate in the conference call by asking questions to Management, please register in advance by clicking

https://register.vevent.com/register/BI65b499bd72824ead9276941b4fa490f6.

Upon registration, all telephone participants will receive the dial-in number along with a unique PIN number that will be used to access the call.

Management will refer to a slide presentation during the call, which will be made available on the day of the call. To view the presentation, select "Presentations" in the "Investors" section of the Company's website.

A replay of the conference call and webcast will be available on the Company's website for 30 days.

| | | | | |

| Investor Contact: | Media Contact: |

| John Sweeney, CFA | Michele Polinsky |

| Vice President, Investor Relations | Vice President, Global Communications |

| (610) 594-3318 | (610) 594-3054 |

| John.Sweeney@westpharma.com | Michele.Polinsky@westpharma.com |

Forward-Looking Statements

This release contains statements that constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements may include such words as “raising,” “positioned,” “updating,” “expected,” “assumes,” “unchanged,” “includes,” “would,” “provide” and other similar terminology. These statements reflect management’s current expectations regarding future events and operating performance and speak only as of the date of this release. There is no certainty that actual results will be achieved in-line with current expectations. These forward-looking statements involve a number of risks and uncertainties. The following are some of the factors that could cause our actual results to differ materially from those expressed in or underlying our forward-looking statements: prevailing economic conditions and general uncertainties relating thereto that may be unknown and unforeseeable; customers’ changing inventory requirements and manufacturing plans and customer decisions to move forward with our new products and product categories; disruptions or limitations in the Company’s manufacturing capacity; average profitability, or mix, of the products we sell; dependence on third-party suppliers and partners; increased raw material, energy and labor costs; fluctuations in currency exchange; the ability to meet development milestones with key customers; and the consequences of other geopolitical events, including natural disasters, acts of war, and global health crises. This list of important factors is not all inclusive. For a description of certain additional factors that could cause the Company’s future results to differ from those expressed in any such forward-looking statements, see Part I Item 1A, entitled “Risk Factors,” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, and other filings with the United States Securities and Exchange Commission, including the Company’s quarterly reports on Form 10-Q and current reports on Form 8-K.

Except as required by law or regulation, we undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise.

Non-U.S. GAAP Financial Measures

This release contains certain non-GAAP financial measures, including organic net sales and adjusted-diluted EPS. For the purpose of aiding the comparison of our year-over-year results, we may refer to net sales and other financial results excluding the effects of changes in foreign currency exchange rates. Organic net sales exclude the impact from acquisitions and/or divestitures and translate the current-period reported sales of subsidiaries whose functional currency is other than the U.S. Dollar at the applicable foreign currency exchange rates in effect during the comparable prior-year period. We may also refer to financial results excluding the effects of unallocated items. The re-measured results excluding effects from currency translation and excluding the effects of unallocated items are not in conformity with U.S. generally accepted accounting principles (“U.S. GAAP”) and should not be used as a substitute for the comparable U.S. GAAP financial measures. The non-U.S. GAAP financial measures are incorporated into our discussion and analysis as management uses them in evaluating our results of operations and believes that this information provides users a valuable insight into our overall performance and financial position. A reconciliation of these adjusted non-U.S. GAAP measures to the comparable U.S. GAAP financial measures is included in the accompanying tables.

WEST PHARMACEUTICAL SERVICES, INC.

CONSOLIDATED STATEMENTS OF INCOME

(UNAUDITED)

(in millions, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Net sales | $ | 702.1 | | | 100% | | $ | 753.8 | | | 100% | | $ | 1,397.5 | | | 100% | | $ | 1,470.4 | | | 100% |

| Cost of goods and services sold | 472.1 | | | 67 | | 462.4 | | | 61 | | 937.3 | | | 67 | | 907.7 | | | 62 |

| Gross profit | 230.0 | | | 33 | | 291.4 | | | 39 | | 460.2 | | | 33 | | 562.7 | | | 38 |

| Research and development | 17.5 | | | 2 | | 16.5 | | | 2 | | 35.1 | | | 3 | | 33.6 | | | 2 |

| Selling, general and administrative expenses | 83.0 | | | 12 | | 88.4 | | | 12 | | 169.7 | | | 12 | | 174.4 | | | 12 |

| Other expense (income) | 3.3 | | | 1 | | 4.0 | | | 1 | | 6.4 | | | — | | 16.9 | | | 1 |

| Operating profit | 126.2 | | | 18 | | 182.5 | | | 24 | | 249.0 | | | 18 | | 337.8 | | | 23 |

| Interest (income) expense, net | (2.5) | | | — | | (2.3) | | | — | | (7.1) | | | — | | (4.9) | | | — |

| Other nonoperating (income) expense | — | | | — | | (0.1) | | | — | | — | | | — | | (0.1) | | | — |

| Income before income taxes and equity in net income of affiliated companies | 128.7 | | | 18 | | 184.9 | | | 24 | | 256.1 | | | 18 | | 342.8 | | | 23 |

| Income tax expense | 21.9 | | | 3 | | 34.8 | | | 4 | | 38.3 | | | 3 | | 58.4 | | | 4 |

| Equity in net income of affiliated companies | (4.5) | | | (1) | | (5.0) | | | (1) | | (8.8) | | | (1) | | (10.7) | | | (1) |

| Net income | $ | 111.3 | | | 16% | | $ | 155.1 | | | 21% | | $ | 226.6 | | | 16% | | $ | 295.1 | | | 20% |

| | | | | | | | | | | | | | | |

| Net income per share: | | | | | | | | | | | | | | | |

| Basic | $ | 1.52 | | | | | $ | 2.08 | | | | | $ | 3.09 | | | | | $ | 3.96 | | | |

| Diluted | $ | 1.51 | | | | | $ | 2.06 | | | | | $ | 3.06 | | | | | $ | 3.91 | | | |

| | | | | | | | | | | | | | | |

| Average common shares outstanding | 73.0 | | | | | 74.3 | | | | | 73.3 | | | | | 74.4 | | | |

| Average shares assuming dilution | 73.7 | | | | | 75.4 | | | | | 74.0 | | | | | 75.5 | | | |

| | | | | | | | | | | | | | | |

WEST PHARMACEUTICAL SERVICES

REPORTING SEGMENT INFORMATION

(UNAUDITED)

(in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, | | | | |

Net Sales: | 2024 | | 2023 | | 2024 | | 2023 | | | | |

| Proprietary Products | $ | 559.7 | | | $ | 618.0 | | | $ | 1,119.2 | | | $ | 1,201.1 | | | | | |

| Contract-Manufactured Products | 142.4 | | | 135.8 | | | 278.3 | | | 269.3 | | | | | |

| Eliminations | — | | | — | | | — | | | — | | | | | |

| Consolidated Total | $ | 702.1 | | | $ | 753.8 | | | $ | 1,397.5 | | | $ | 1,470.4 | | | | | |

| | | | | | | | | | | |

| Gross Profit: | | | | | | | | | | | |

| Proprietary Products | $ | 207.0 | | | $ | 271.4 | | | $ | 414.1 | | | $ | 519.2 | | | | | |

| Contract-Manufactured Products | 23.0 | | | 20.9 | | | 46.1 | | | 44.4 | | | | | |

| | | | | | | | | | | |

| Unallocated items | — | | | (0.9) | | | — | | | (0.9) | | | | | |

| Gross Profit | $ | 230.0 | | | $ | 291.4 | | | $ | 460.2 | | | $ | 562.7 | | | | | |

| Gross Profit Margin | 32.8 | % | | 38.7 | % | | 32.9 | % | | 38.3 | % | | | | |

| | | | | | | | | | | |

| Operating Profit (Loss): | | | | | | | | | | | |

| Proprietary Products | $ | 131.0 | | | $ | 194.2 | | | $ | 257.3 | | | $ | 364.9 | | | | | |

| Contract-Manufactured Products | 17.2 | | | 14.9 | | | 34.3 | | | 32.3 | | | | | |

| | | | | | | | | | | |

| Stock-based compensation expense | (4.3) | | | (7.5) | | | (9.3) | | | (16.0) | | | | | |

| General corporate costs | (17.7) | | | (19.1) | | | (33.3) | | | (43.4) | | | | | |

| Reported Operating Profit | $ | 126.2 | | | $ | 182.5 | | | $ | 249.0 | | | $ | 337.8 | | | | | |

| Reported Operating Profit Margin | 18.0 | % | | 24.2 | % | | 17.8 | % | | 23.0 | % | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Unallocated items | 0.2 | | | 2.5 | | | 0.4 | | | 12.1 | | | | | |

| Adjusted Operating Profit | $ | 126.4 | | | $ | 185.0 | | | $ | 249.4 | | | $ | 349.9 | | | | | |

| Adjusted Operating Profit Margin | 18.0 | % | | 24.5 | % | | 17.8 | % | | 23.8 | % | | | | |

WEST PHARMACEUTICAL SERVICES

RECONCILIATION OF NON-U.S. GAAP MEASURES (UNAUDITED)

Please refer to “Non-U.S. GAAP Financial Measures” for more information

(in millions, except per share data)

Reconciliation of Reported and Adjusted Operating Profit, Net Income and Diluted EPS

| | | | | | | | | | | | | | |

| Three months ended June 30, 2024 | Operating

profit | Income

tax

expense | Net

income | Diluted

EPS |

| Reported (U.S. GAAP) | $126.2 | | $21.9 | | $111.3 | | $1.51 | |

| Unallocated items: | | | | |

| | | | |

| | | | |

Amortization of acquisition-related intangible assets (1) | 0.2 | | — | | 0.7 | | 0.01 | |

| Adjusted (Non-U.S. GAAP) | $126.4 | | $21.9 | | $112.0 | | $1.52 | |

| | | | | | | | | | | | | | | |

| Six months ended June 30, 2024 | Operating

profit | Income

tax

expense | Net

income | Diluted

EPS |

| Reported (U.S. GAAP) | $249.0 | | $38.3 | | $226.6 | | $3.06 | |

| Unallocated items: | | | | |

| | | | | |

| | | | | |

| Amortization of acquisition-related intangible assets (1) | 0.4 | | — | | 1.4 | | 0.02 | |

| Adjusted (Non-U.S. GAAP) | $249.4 | | $38.3 | | $228.0 | | $3.08 | |

| | | | | | | | | | | | | | |

| Three months ended June 30, 2023 | Operating

profit | Income

tax

expense | Net

income | Diluted

EPS |

| Reported (U.S. GAAP) | $182.5 | | $34.8 | | $155.1 | | $2.06 | |

| Unallocated items: | | | | |

Amortization of acquisition-related intangible assets (1) | 0.2 | | — | | 0.7 | | 0.01 | |

Loss on disposal of plant (2) | 2.2 | | (0.7) | | 2.9 | | 0.04 | |

Restructuring and other charges (3) | 0.1 | | (0.3) | | 0.4 | | — | |

| Adjusted (Non-U.S. GAAP) | $185.0 | | $33.8 | | $159.1 | | $2.11 | |

| | | | | | | | | | | | | | | |

| Six months ended June 30, 2023 | Operating

profit | Income

tax

expense | Net

income | Diluted

EPS |

| Reported (U.S. GAAP) | $337.8 | | $58.4 | | $295.1 | | $3.91 | |

| Unallocated items: | | | | |

| Amortization of acquisition-related intangible assets (1) | 0.4 | | — | | 1.4 | | 0.02 | |

| Loss on disposal of plant (2) | 11.6 | | (0.7) | | 12.3 | | 0.16 | |

| Restructuring and other charges (3) | 0.1 | | (0.3) | | 0.4 | | — | |

| Adjusted (Non-U.S. GAAP) | $349.9 | | $57.4 | | $309.2 | | $4.09 | |

(1)During the three and six months ended June 30, 2024 and 2023, the Company recorded $0.2 million and $0.4 million, respectively, of amortization expense within operating profit associated with an intangible asset acquired during the second quarter of 2020. During the three and six months ended June 30, 2024 and 2023, the Company recorded $0.5 million and $1.0 million, respectively, of amortization expense in association with an acquisition of increased ownership interest in Daikyo.

(2)During the three and six months ended June 30, 2023, the Company recorded expense of $2.2 million and $11.6 million, respectively, within other expense (income), as a result of the sale of one of the Company’s manufacturing facilities within the Proprietary Products segment. The transaction closed during the second quarter of 2023.

(3)Restructuring and other charges of $0.1 million for both the three and six months ended June 30, 2023 represents the net impact of an inventory write down of $0.9 million within cost of goods and services sold and a $0.8 million benefit within other expense (income) for revised severance estimates in connection with its 2022 restructuring plan.

WEST PHARMACEUTICAL SERVICES

RECONCILIATION OF NON-U.S. GAAP FINANCIAL MEASURES (UNAUDITED)

Please refer to “Non-U.S. GAAP Financial Measures” for more information

(in millions, except per share data)

Reconciliation of Net Sales to Organic Net Sales (4 and 5)

| | | | | | | | | | | | | | |

| Three months ended June 30, 2024 | Proprietary | CM | Eliminations | Total |

| Reported net sales (U.S. GAAP) | $559.7 | | $142.4 | | $— | | $702.1 | |

| Effect of changes in currency translation rates | 5.4 | | 0.7 | | — | | 6.1 | |

Organic net sales (Non-U.S. GAAP) (4) | $565.1 | | $143.1 | | $— | | $708.2 | |

| | | | | | | | | | | | | | |

| Six months ended June 30, 2024 | Proprietary | CM | Eliminations | Total |

| Reported net sales (U.S. GAAP) | $1,119.2 | | $278.3 | | $— | | $1,397.5 | |

| Effect of changes in currency translation rates | 2.6 | | 0.1 | | — | | 2.7 | |

Organic net sales (Non-U.S. GAAP) (4) | $1,121.8 | | $278.4 | | $— | | $1,400.2 | |

| | | | | | | | | | | | | | |

| Three months ended June 30, 2023 | Proprietary | CM | Eliminations | Total |

| Reported net sales (U.S. GAAP) | $618.0 | | $135.8 | | $— | | $753.8 | |

| Effect of divestitures and/or acquisitions | (1.1) | | — | | — | | (1.1) | |

Net sales excluding divestiture (Non-U.S. GAAP) (5) | $616.9 | | $135.8 | | $— | | $752.7 | |

| | | | | | | | | | | | | | |

| Six months ended June 30, 2023 | Proprietary | CM | Eliminations | Total |

| Reported net sales (U.S. GAAP) | $1,201.1 | | $269.3 | | $— | | $1,470.4 | |

| Effect of divestitures and/or acquisitions | (4.3) | | — | | — | | (4.3) | |

Net sales excluding divestiture (Non-U.S. GAAP) (5) | $1,196.8 | | $269.3 | | $— | | $1,466.1 | |

(4)Organic net sales exclude the impact from acquisitions and/or divestitures and translate the current-period reported sales of subsidiaries whose functional currency is other than the U.S. Dollar at the applicable foreign currency exchange rates in effect during the comparable prior-year period.

(5)Net sales excluding divestiture represents the 2023 comparative sales figure used in our organic sales growth calculation to eliminate the impact of our 2023 divestiture.

WEST PHARMACEUTICAL SERVICES

RECONCILIATION OF NON-U.S. GAAP FINANCIAL MEASURES (UNAUDITED)

Please refer to “Non-U.S. GAAP Financial Measures” for more information

(in millions, except per share data)

Reconciliation of Reported-Diluted EPS Guidance to Adjusted-Diluted EPS Guidance

| | | | | | | | | | | |

| 2023 Actual | 2024 Guidance | % Change |

| Reported-diluted EPS (U.S. GAAP) | $7.88 | $6.31 to $6.61 | (19.9%) to (16.1%) |

| Loss on disposal of plant | 0.16 | | |

| Cost investment activity | 0.06 | | |

| Restructuring and other charges | (0.02) | | |

| Amortization of acquisition-related intangible assets | 0.04 | 0.04 | |

| Legal settlement | (0.04) | | |

Adjusted-diluted EPS (Non-U.S. GAAP) (6) | $8.08 | $6.35 to $6.65 | (21.4%) to (17.7%) |

Notes:

See “Full-year 2024 Financial Guidance” and “Non-U.S. GAAP Financial Measures” in today’s press release for additional information regarding adjusted-diluted EPS.

(6)We have opted not to forecast 2024 tax benefits from stock-based compensation in upcoming quarters, as they are out of the Company’s control. Instead, we recognize the benefits as they occur. In the first-half of 2024, tax benefits associated with stock-based compensation increased adjusted-diluted EPS by $0.22. Any future tax benefits associated with stock-based compensation that we receive in 2024 would provide a positive adjustment to our full-year EPS guidance. In full-year 2023, tax benefits associated with stock-based compensation increased adjusted-diluted EPS by $0.42.

WEST PHARMACEUTICAL SERVICES

CASH FLOW ITEMS

(UNAUDITED)

(in millions)

| | | | | | | | | | | |

| | Six Months Ended June 30, |

| | 2024 | | 2023 |

| Depreciation and amortization | $74.5 | | | $65.7 | |

| Operating cash flow | $283.2 | | | $307.3 | |

| Capital expenditures | $190.8 | | | $157.5 | |

| Free cash flow | $92.4 | | | $149.8 | |

WEST PHARMACEUTICAL SERVICES

FINANCIAL CONDITION

(UNAUDITED)

(in millions)

| | | | | | | | | | | |

| | As of

June 30, 2024 | | As of

December 31, 2023 |

| Cash and cash equivalents | $446.2 | | | $853.9 | |

| Accounts receivable, net | $479.4 | | | $512.0 | |

| Inventories | $419.2 | | | $434.7 | |

| Accounts payable | $211.7 | | | $242.4 | |

| Debt | $205.8 | | | $206.8 | |

| Equity | $2,576.8 | | | $2,881.0 | |

| Working capital | $849.3 | | | $1,264.6 | |

Trademark Notices

Trademarks and registered trademarks are the property of West Pharmaceutical Services, Inc., in the United States and other jurisdictions, unless noted otherwise.

Daikyo Crystal Zenith® and Daikyo CZ® are registered trademarks of Daikyo Seiko, Ltd. Daikyo Crystal Zenith technologies are licensed from Daikyo Seiko, Ltd.

1 Second-Quarter 2024 Second Quarter Overall Net Sales $702.1M | 6.9% Diluted Earnings Per Share: $1.51 Adjusted Diluted Earnings Per Share: $1.52 Eric M. Green President and Chief Executive Officer Chair of the Board West Pharmaceutical Services, Inc. WST Q2 2024 Earnings Cautionary Statement Under the Private Securities Litigation Reform Act of 1995 This presentation and any accompanying management commentary contain “forward-looking statements” as that term is defined in the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements about product development and operational performance. Each of these statements is based on preliminary information, and actual results could differ from any preliminary estimates. We caution investors that the risk factors listed under “Cautionary Statement” in our press releases, as well as those set forth under the caption "Risk Factors" in our most recent Annual Report on Form 10-K as filed with the Securities and Exchange Commission and as revised or supplemented by our quarterly reports on Form 10-Q, could cause our actual results to differ materially from those estimated or predicted in the forward-looking statements. You should evaluate any statement in light of these important factors. Except as required by law or regulation, we undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise, therefore you should not rely on these forward-looking statements as representing our views as of any date other than today. Non-U.S. GAAP Financial Measures Certain financial measures included in these presentation materials, or which may be referred to in management’s discussion of the Company’s results and outlook, have not been calculated in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”), and therefore are referred to as non- U.S. GAAP financial measures. Non-U.S. GAAP financial measures should not be considered in isolation or as an alternative to such measures determined in accordance with U.S. GAAP. Please refer to “Reconciliation of Non-U.S. GAAP Financial Measures” at the end of these materials for more information. “The second quarter continued to be impacted by an elevated level of customer destocking. While the results were below our expectations, we were encouraged to see our second-quarter revenues increase sequentially. Our outlook anticipates that revenues in the second half of the year will be stronger than the first half. Based on our confirmed order book and ongoing customer conversations, we remain confident in a return to organic growth in the fourth quarter and as we move into 2025. We see considerable growth opportunity in the markets we serve, and our investments position us to create continued value for our customers, patients and shareholders well into the future.”

West Pharmaceutical Services, Inc. Eric M. Green President & CEO, Chair of the Board Bernard J. Birkett Senior VP & Chief Financial Officer Second-Quarter Results 2024 Analyst Conference Call 9 a.m. Eastern Time | July 25, 2024

3 West Analyst Conference Call 9 a.m. Eastern Time July 25, 2024 A webcast of today’s call can be accessed in the “Investors” section of the Company’s website: www.westpharma.com To participate on the call by asking questions to Management, please register in advance at: https://register.vevent.com/register/BI65b499bd72824ead927 6941b4fa490f6 Upon registration, all telephone participants will receive the dial-in number along with a unique PIN number that will be used to access the call. A replay of the conference call and webcast will be available on the Company’s website for 30 days. These presentation materials are intended to accompany today’s press release announcing the Company’s results for the second quarter 2024 and management’s discussion of those results during today’s conference call. WST Q2 2024 Earnings

4 Safe Harbor Statement This presentation and any accompanying management commentary contain “forward-looking statements” as that term is defined in the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements about product development, operational performance and expectations regarding future events. Each of these statements is based on preliminary information, and actual results could differ from any preliminary estimates. We caution investors that the risk factors listed under our “Forward Looking Statements” in our press releases, as well as those set forth under the caption "Risk Factors" in our most recent Annual Report on Form 10-K as filed with the Securities and Exchange Commission and as revised or supplemented by our quarterly reports on Form 10-Q, could cause our actual results to differ materially from those estimated or predicted in the forward-looking statements. You should evaluate any statement in light of these important factors. Except as required by law or regulation, we undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise, therefore you should not rely on these forward-looking statements as representing our views as of any date other than today. Certain financial measures included in these presentation materials, or which may be referred to in management’s discussion of the Company’s results and outlook, have not been calculated in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”), and therefore are referred to as non-U.S. GAAP financial measures. Non-U.S. GAAP financial measures should not be considered in isolation or as an alternative to such measures determined in accordance with U.S. GAAP. Please refer to “Reconciliation of Non-U.S. GAAP Financial Measures” at the end of these materials for more information. Cautionary Statement Under the Private Securities Litigation Reform Act of 1995 Non-U.S. GAAP Financial Measures Trademarks and registered trademarks used in this report are the property of West Pharmaceutical Services, Inc. or its subsidiaries, in the United States and other jurisdictions, unless noted otherwise. Daikyo Crystal Zenith® and Daikyo CZ® are registered trademarks of Daikyo Seiko, Ltd. Daikyo Crystal Zenith technologies are licensed from Daikyo Seiko, Ltd. Trademarks WST Q2 2024 Earnings

5 Financial Highlights WST Q2 2024 Earnings • Second quarter 2024 net sales of $702.1 million declined 6.9%; organic net sales also declined by 5.9% • Second quarter 2024 reported-diluted EPS of $1.51 compared to $2.06 in the same period last year; adjusted-diluted EPS of $1.52 compared to $2.11 in the same period last year

6 S T RONG L E ADE R SH I P P O SI T ION I N BIOLO GIC S MAR KE T L E ADE R I N C ON TAI N M EN T & DE L IVE RY OF I NJE C TABL E M E DICI N E S FO CUSE D I NVE S T M EN T S I N HVP C OM P ON EN T S , I N T E GR AT E D SYS T E M S & DEVICE S Our growth drivers have us positioned well for the future WST Q2 2024 Earnings

7 Capital investments to support future growth Jurong, Singapore Kinston – Completed Q2 2024 Eschweiler Grand Rapids – Completed Q2 2024 HVP Expansion Progress CM Expansion Progress Jersey Shore Eschweiler Dublin Increasing capacity to meet growing demand for our Proprietary Products and Contract Manufacturing segments WST Q2 2024 Earnings 7

8 Creating a healthier environment through our sustainability efforts ESG Priorities Climate Strategy R&D for the Environment Waste in Operational Processes Responsible Supply Chain Talent Diversity & Attraction Talent Engagement and Retention ESG report published in June 2024 WST Q2 2024 Earnings

9 Second-Quarter 2024 Summary Results ($ millions, except earnings-per-share (EPS) data) Three Months Ended June 30, 2024 2023 Reported Net Sales $702.1 $753.8 Gross Profit Margin 32.8% 38.7% Reported Operating Profit $126.2 $182.5 Adjusted Operating Profit (1) $126.4 $185.0 Reported Operating Profit Margin 18.0% 24.2% Adjusted Operating Profit Margin (1) 18.0% 24.5% Reported-Diluted EPS $1.51 $2.06 Adjusted-Diluted EPS (1) $1.52 $2.11 “Adjusted Operating Profit,” “Adjusted Operating Profit Margin” and “Adjusted-Diluted EPS” are Non-U.S. GAAP financial measures. See accompanying slides and the discussion under the heading “Non-U.S. GAAP Financial Measures” in today’s press release for an explanation and reconciliation of these items. (1) WST Q2 2024 Earnings

10 Overall Organic Net Sales Decline: 5.9% (Q2 2024) Proprietary Products Q2 2024 organic net sales decreased by 8.4% primarily driven by destocking of high-value products. BIOLOGICS GENERICS PHARMA Organic sales decline driven by lower sales in Daikyo CZ® and Westar® products Organic sales decline driven by lower volumes in FluroTec® and Westar® products Organic sales decline due to declines in Administrative Systems and Westar® products CONTRACT MANUFACTURING Organic sales growth of 5.4%, led by growth in sales of components associated with injection-related devices (Mid-Single Digit) (Double Digit) Mid-Single Digit(Low-Single Digit) Second-Quarter 2024 Organic Net Sales WST Q2 2024 Earnings

11 Change in Consolidated Net Sales Second-quarter 2023 to 2024 ($ millions) WST Q2 2024 Earnings

12 Gross Profit Update ($ millions) Three Months Ended June 30, 2024 2023 Proprietary Products Gross Profit $207.0 $271.4 Proprietary Products Gross Profit Margin 37.0% 43.9% Contract-Manufactured Products Gross Profit $23.0 $20.9 Contract-Manufactured Products Gross Profit Margin 16.2% 15.4% Consolidated Gross Profit $230.0 $291.4 Consolidated Gross Profit Margin 32.8% 38.7% WST Q2 2024 Earnings

13 Cash Flow and Balance Sheet Metrics ($ millions) Cash Flow Items YTD Q2 2024 YTD Q2 2023 Depreciation and Amortization $74.5 $65.7 Operating Cash Flow $283.2 $307.3 Capital Expenditures $190.8 $157.5 Free Cash Flow $92.4 $149.8 Financial Condition June 30, 2024 December 31, 2023 Cash and Cash Equivalents $446.2 $853.9 Debt $205.8 $206.8 Equity $2,576.8 $2,881.0 Working Capital $849.3 $1,264.6 WST Q2 2024 Earnings

14 2024 Full-Year Guidance WST Q2 2024 Earnings 2024 Full-Year Guidance Consolidated Net Sales $2.870 - $2.900 billion Adjusted-Diluted EPS $6.35 to $6.65

15 Delivering Unique Value for Customers to Meet Changing Market Needs Significant Capital Investments for Future Growth Making a positive impact on patients’ lives WST Q2 2024 Earnings

16 Eric M. Green President & Chief Executive Officer, Chair of the Board Bernard J. Birkett Senior VP & Chief Financial Officer John Sweeney VP, Investor Relations Q & A WST Q2 2024 Earnings

17 Notes to Non-U.S. GAAP Financial Measures The Non-U.S. GAAP financial measures are incorporated into our discussion and analysis as management uses them in evaluating our results of operations and believes that this information provides users a valuable insight into our overall performance and financial position. A reconciliation of these adjusted Non-U.S. GAAP financial measures to the comparable U.S. GAAP financial measures is included in the accompanying tables. For the purpose of aiding the comparison of our year-over-year results, we may refer to net sales and other financial results excluding the effects of changes in foreign currency exchange rates. Organic net sales exclude the impact from acquisitions and/or divestitures and translate the current-period reported sales of subsidiaries whose functional currency is other than the U.S. Dollar at the applicable foreign exchange rates in effect during the comparable prior-year period. We may also refer to financial results excluding the effects of unallocated items. The re-measured results excluding effects from currency translation, the impact from acquisitions and/or divestitures, and the effects of unallocated items are not in conformity with U.S. GAAP and should not be used as a substitute for the comparable U.S. GAAP financial measures. WST Q2 2024 Earnings

18 Notes to Non-U.S. GAAP Financial Measures RECONCILIATION OF NON-U.S. GAAP FINANCIAL MEASURES (UNAUDITED) See “Notes to Non-U.S. GAAP Financial Measures”, “Safe Harbor Statement” (Slide 4) and today’s press release for an explanation and reconciliation of these items. Reconciliation of Reported and Adjusted Operating Profit, Net Income and Diluted EPS ($ millions, except EPS data) Three months ended June 30, 2024 Operating profit Income tax expense Net income Diluted EPS Reported (U.S. GAAP) $126.2 $21.9 $111.3 $1.51 Unallocated items: Amortization of acquisition-related intangible assets 0.2 - 0.7 0.01 Adjusted (Non-U.S. GAAP) $126.4 $21.9 $112.0 $1.52 Six months ended June 30, 2024 Operating profit Income tax expense Net income Diluted EPS Reported (U.S. GAAP) $249.0 $38.3 $226.6 $3.06 Unallocated items: Amortization of acquisition-related intangible assets 0.4 - 1.4 0.02 Adjusted (Non-U.S. GAAP) $249.4 $38.3 $228.0 $3.08 WST Q2 2024 Earnings

19 Notes to Non-U.S. GAAP Financial Measures RECONCILIATION OF NON-U.S. GAAP FINANCIAL MEASURES (UNAUDITED) See “Notes to Non-U.S. GAAP Financial Measures”, “Safe Harbor Statement” (Slide 4) and today’s press release for an explanation and reconciliation of these items. Reconciliation of Reported and Adjusted Operating Profit, Net Income and Diluted EPS ($ millions, except EPS data) Three months ended June 30, 2023 Operating profit Income tax expense Net income Diluted EPS Reported (U.S. GAAP) $182.5 $34.8 $155.1 $2.06 Unallocated items: Amortization of acquisition-related intangible assets 0.2 - 0.7 0.01 Loss on disposal of plant 2.2 (0.7) 2.9 0.04 Restructuring and other charges 0.1 (0.3) 0.4 - Adjusted (Non-U.S. GAAP) $185.0 $33.8 $159.1 $2.11 Six months ended June 30, 2023 Operating profit Income tax expense Net income Diluted EPS Reported (U.S. GAAP) $337.8 $58.4 $295.1 $3.91 Unallocated items: Amortization of acquisition-related intangible assets 0.4 - 1.4 0.02 Loss on disposal of plant 11.6 (0.7) 12.3 0.16 Restructuring and other charges 0.1 (0.3) 0.4 - Adjusted (Non-U.S. GAAP) $349.9 $57.4 $309.2 $4.09 WST Q2 2024 Earnings

20 Notes to Non-U.S. GAAP Financial Measures RECONCILIATION OF NON-U.S. GAAP FINANCIAL MEASURES (UNAUDITED) See “Notes to Non-U.S. GAAP Financial Measures”, “Safe Harbor Statement” (Slide 4) and today’s press release for an explanation and reconciliation of these items. Reconciliation of Net Sales to Organic Net Sales (1 and 2) ($ millions) Organic net sales exclude the impact from acquisitions and/or divestitures and translate the current-period reported sales of subsidiaries whose functional currency is other than the U.S. Dollar at the applicable foreign exchange rates in effect during the comparable prior-year period. (1) Three months ended June 30, 2024 Proprietary CM Eliminations Total Reported net sales (U.S. GAAP) $559.7 $142.4 - $702.1 Effect of changes in currency translation rates 5.4 0.7 - 6.1 Organic net sales (Non-U.S. GAAP) (1) $565.1 $143.1 - $708.2 Six months ended June 30, 2024 Proprietary CM Eliminations Total Reported net sales (U.S. GAAP) $1,119.2 $278.3 - $1,397.5 Effect of changes in currency translation rates 2.6 0.1 - 2.7 Organic net sales (Non-U.S. GAAP) (1) $1,121.8 $278.4 - $1,400.2 WST Q2 2024 Earnings

21 Notes to Non-U.S. GAAP Financial Measures RECONCILIATION OF NON-U.S. GAAP FINANCIAL MEASURES (UNAUDITED) See “Notes to Non-U.S. GAAP Financial Measures”, “Safe Harbor Statement” (Slide 4) and today’s press release for an explanation and reconciliation of these items. Reconciliation of Net Sales to Organic Net Sales (1 and 2) ($ millions) (2) Net sales excluding divestitures represents the 2023 comparative sales figure used in our organic sales growth calculation to eliminate the impact of our 2023 divestiture. Three months ended June 30, 2023 Proprietary CM Eliminations Total Reported net sales (U.S. GAAP) $618.0 $135.8 - $753.8 Effect of divestitures and/or acquisitions (1.1) - - (1.1) Net sales excluding divestiture (Non-U.S. GAAP) (2) $616.9 $135.8 - $752.7 Six months ended June 30, 2023 Proprietary CM Eliminations Total Reported net sales (U.S. GAAP) $1,201.1 $269.3 - $1,470.4 Effect of divestitures and/or acquisitions (4.3) - - (4.3) Net sales excluding divestiture (Non-U.S. GAAP) (2) $1,196.8 $269.3 - $1,466.1 WST Q2 2024 Earnings

22 Notes to Non-U.S. GAAP Financial Measures RECONCILIATION OF NON-U.S. GAAP FINANCIAL MEASURES (UNAUDITED) See “Notes to Non-U.S. GAAP Financial Measures”, “Safe Harbor Statement” (Slide 4) and today’s press release for an explanation and reconciliation of these items. Reconciliation of Reported-Diluted EPS Guidance to Adjusted-Diluted EPS Guidance 2023 Actual 2024 Guidance % Change Reported-diluted EPS (U.S. GAAP) $7.88 $6.31 to $6.61 (19.9%) to (16.1%) Loss on disposal of plant 0.16 - Cost investment activity 0.06 - Restructuring and other charges (0.02) - Amortization of acquisition-related intangible assets 0.04 0.04 Legal settlement (0.04) - Adjusted-diluted EPS (Non-U.S. GAAP) (1) $8.08 $6.35 to $6.65 (21.4%) to (17.7%) (1) See “Full-year 2024 Financial Guidance” and “Non-U.S. GAAP Financial Measures” in today’s press release for additional information regarding adjusted-diluted EPS. We have opted not to forecast 2024 tax benefits from stock-based compensation in upcoming quarters, as they are out of the Company’s control. Instead, we recognize the benefits as they occur. In the first-half of 2024, tax benefits associated with stock-based compensation increased adjusted-diluted EPS by $0.22. Any future tax benefits associated with stock-based compensation that we receive in 2024 would provide a positive adjustment to our full-year EPS guidance. In full-year 2023, tax benefits associated with stock-based compensation increased adjusted-diluted EPS by $0.42. WST Q2 2024 Earnings

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

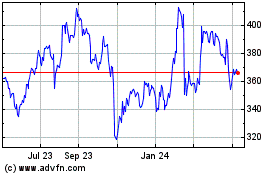

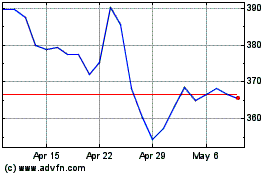

West Pharmaceutical Serv... (NYSE:WST)

Historical Stock Chart

From Jun 2024 to Jul 2024

West Pharmaceutical Serv... (NYSE:WST)

Historical Stock Chart

From Jul 2023 to Jul 2024