HCN Announces Pricing of $750 Million of 4.0% Senior Unsecured Notes

May 20 2015 - 5:01PM

Business Wire

Health Care REIT, Inc. (NYSE:HCN) today announced that it

has priced $750 million in aggregate principal amount of 4.0%

senior unsecured notes due June 1, 2025. The notes were priced at

99.926% of their face amount to yield 4.009%. Subject to customary

closing conditions, the offering is expected to close on May 26,

2015.

The company intends to use the net proceeds from this offering

to repay advances under its primary unsecured credit facility and

for general corporate purposes, including investing in health care

and seniors housing properties. Pending such use, the net proceeds

may be invested in short-term, investment grade, interest-bearing

securities, certificates of deposit or indirect or guaranteed

obligations of the United States.

Citigroup Global Markets Inc., Jefferies LLC, J.P. Morgan

Securities LLC, UBS Securities LLC, Credit Agricole Securities

(USA) Inc., Goldman Sachs & Co., Merrill Lynch, Pierce, Fenner

& Smith Incorporated and Morgan Stanley & Co. LLC are

serving as joint book-running managers for the offering.

HCN is making the offering pursuant to its effective shelf

registration statement filed with the Securities and Exchange

Commission. Copies of the prospectus supplement and accompanying

prospectus relating to the offering will be filed with the

Securities and Exchange Commission. A copy of the prospectus

supplement and accompanying prospectus may be obtained, when

available, by contacting:

- Citigroup Global Markets Inc. c/o

Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood,

NY 11717, telephone: 1-800-831-9146, email:

batprospectusdept@citi.com

- Jefferies LLC, Attention: Prospectus

Department, 520 Madison Avenue, New York, NY 10022, or by calling

1-877-877-0696

- J.P. Morgan Securities LLC, 383 Madison

Avenue, New York, NY 10179, Attn: Investment Grade Syndicate Desk

-3rd floor, or by calling 1-212-834-4533

- UBS Securities LLC, Attention:

Prospectus Specialist, 1285 Avenue of the Americas, New York, NY

10019, telephone: 1-888-827-7275

This press release is not an offer to sell, nor a solicitation

of an offer to buy securities, nor shall there be any sale of these

securities in any state or jurisdiction in which the offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of such state or

jurisdiction.

About Health Care REIT, Inc.

HCN, an S&P 500 company with headquarters in Toledo, Ohio,

is a real estate investment trust that invests across the full

spectrum of seniors housing and health care real estate. The

company also provides an extensive array of property management and

development services. As of March 31, 2015, the company’s broadly

diversified portfolio consisted of 1,384 properties in 46 states,

the United Kingdom and Canada.

Forward-Looking Statements

This press release may contain “forward-looking” statements as

defined in the Private Securities Litigation Reform Act of 1995.

When the company uses words such as “may,” “will,” “intend,”

“should,” “believe,” “expect,” “anticipate,” “project,” “estimate”

or similar expressions that do not relate solely to historical

matters, it is making forward-looking statements. Forward-looking

statements are not guarantees of future performance and involve

risks and uncertainties that may cause the company’s actual results

to differ materially from the company’s expectations discussed in

the forward-looking statements. This may be a result of various

factors, including, but not limited to, those factors discussed in

the prospectus supplement and accompanying prospectus and in the

company's reports filed from time to time with the Securities and

Exchange Commission. Completion of the proposed offering is subject

to various factors, including, but not limited to, the status of

the economy, the status of the capital markets and customary

closing conditions. The company undertakes no obligation to update

or revise publicly any forward-looking statements, whether because

of new information, future events or otherwise, or to update the

reasons why actual results could differ from those projected in any

forward-looking statements.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150520006627/en/

Health Care REIT, Inc.Scott Estes, 419-247-2800Steve Schroeder,

419-247-2800

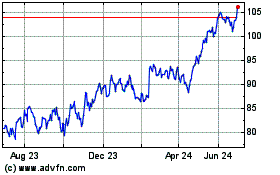

Welltower OP (NYSE:WELL)

Historical Stock Chart

From Dec 2024 to Jan 2025

Welltower OP (NYSE:WELL)

Historical Stock Chart

From Jan 2024 to Jan 2025