Filed by Vista Outdoor Inc.

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-6(b)

under the Exchange Act of 1934

Subject Company: Revelyst, Inc.

Commission File No.: 001-41793

Vista Outdoor Board of Directors Reiterates Commitment to Sale of The Kinetic Group to CSG in

Open Letter to Stockholders

CSG Transaction Provides Compelling Value for Stockholders and Certainty to Close

MNC Final Indication of Interest Fundamentally Undervalues the Company and Has Significant Execution Risk

Urges Stockholders to Vote “FOR” the CSG Transaction at Upcoming Special Meeting of Vista Outdoor Stockholders

ANOKA, Minn., July 10, 2024 – Vista Outdoor Inc.’s (“Vista Outdoor” or “the Company”) (NYSE: VSTO) Board of Directors today issued an open letter to Vista Outdoor stockholders in connection with its upcoming Special Meeting of Stockholders (the “Special Meeting”) on July 23, 2024. The full text of the letter is as follows:

Dear Vista Outdoor Stockholders,

As members of Vista Outdoor’s Board of Directors and fellow stockholders, we are writing to you about an important decision you will be making at our July 23, 2024 Special Meeting. Our Board has been – and will continue to be – steadfast and singularly focused on maximizing value for Vista Outdoor’s stockholders.

As the upcoming Special Meeting is fast approaching, we believe you all deserve to have a clear understanding of the robust process we underwent to extract tremendous value for The Kinetic Group on behalf of our stockholders and why we are confident this is the best choice for our stockholders by locking in the $2.1 billion dollar value of The Kinetic Group and providing our stockholders the opportunity to participate in Revelyst’s projected growth and margin expansion.

BOARD ENGAGED IN THOROUGH COMPETITIVE PROCESS TO MAXIMIZE STOCKHOLDER VALUE

As you know, we announced the separation of our Outdoor Products and Sporting Products segments in May 2022 in order to optimize both businesses. That resulted in a thorough process that commenced in September 2022 to review several alternatives for unlocking stockholder value. We engaged with 26 counterparties, including 14 strategics and 12 sponsors, that were each given fair and full consideration. As part of this process, Vista Outdoor engaged extensively with MNC Capital (“MNC”), including providing MNC access to approximately 4,900 documents, answering over 1,050 data requests, holding over 35 meetings or calls, giving extensive access to the management team and supporting multiple site tours.

Following this competitive and thorough process and in consultation with our leading financial and legal advisors, we ultimately concluded the sale of The Kinetic Group to Czechoslovak Group a.s. (“CSG”) (the “CSG Transaction”) and the separation of Revelyst as a standalone public

company is the best path to unlock value for our stockholders. We stand by our recommendation to vote “FOR” the CSG Transaction at the upcoming Special Meeting.

A VOTE “FOR” CSG TRANSACTION WILL DELIVER COMPELLING VALUE FOR STOCKHOLDERS AND CERTAINTY TO CLOSE

On July 8, 2024, we entered into an amendment to the merger agreement with CSG, which increased the purchase price for the acquisition of The Kinetic Group to $2.1 billion (an increase of $190 million since CSG’s original purchase price) and increased the cash consideration to $21.00 per share of Vista Outdoor common stock (an increase of $8.10 per share since the original cash consideration).

As a result of the CSG Transaction, stockholders will receive one share of Revelyst common stock and $21.00 in cash, in each case, per share of Vista Outdoor common stock.

A vote “FOR” the CSG Transaction is a vote for:

ü Maximizing the value of The Kinetic Group business, which was the objective the Board set out to achieve all along since we announced the plan to separate the businesses in May 2022. CSG’s $2.1 billion purchase price represents a robust value for the Kinetic Group, resulting from a thorough and competitive process.

ü Enabling stockholders to participate in standalone Revelyst. As a result of the CSG Transaction, Vista Outdoor stockholders will become stockholders of Revelyst and have the ability to participate in the projected growth of Revelyst. The Company reaffirmed its annual guidance to double standalone Revelyst EBITDA in fiscal year 2025 with a clear path to achieve more than $100 million in run-rate cost saving by fiscal year 2027 and mid-teens EBITDA margins long-term. As a pure-play standalone outdoor company, there is significant opportunity for Revelyst to realize superior value for stockholders when separated from The Kinetic Group, with expanded strategic opportunities and the strengthened ability to attract and retain talent.

ü Deal certainty and ability to close in July. Vista Outdoor and CSG have received all regulatory approvals required under the merger agreement and are prepared to close in July 2024, subject to receipt of stockholder approval and satisfaction of other customary closing conditions.

ü The Board is open minded and committed to maximizing value of Revelyst, just as we demonstrated with our ability to maximize value for The Kinetic Group. A standalone Revelyst will benefit from being able to attract its natural owners, and as a result of the CSG Transaction, stockholders retain the ability to realize a potential change of control premium for Revelyst in the future. We are always open to opportunities to maximize stockholder value and may consider pursuing a range of strategic alternatives for Revelyst at the appropriate time and at the appropriate valuation. The Board believes that, if it were strategically beneficial to sell Revelyst, the Board would engage in a thorough and competitive process to do so in order to maximize value for stockholders, just like the Board has done with respect to The Kinetic Group.

Vista Outdoor’s financial advisors each delivered an opinion as to the fairness, from a financial point of view, of the consideration in the CSG Transaction to the stockholders of Vista Outdoor’s common stock. We are confident the CSG Transaction is the most compelling for stockholders.

A VOTE AGAINST THE CSG TRANSACTION DOES NOT MEAN WE WILL NEGOTIATE WITH MNC CAPITAL

The Board thoroughly reviewed and evaluated MNC’s final indication of interest to acquire Vista Outdoor in an all-cash transaction for $42.00 per share (the “MNC Final Indication”). Following consultation with its financial and legal advisors, the Board unanimously rejected MNC’s best and final indication of interest, which:

•Is inadequate and fundamentally undervalues Vista Outdoor, especially the Revelyst business. The MNC Final Indication is opportunistic and seeks to capture Revelyst’s value at a discount outside of a sale process. It does not take into account the significant projected EBITDA expansion at Revelyst under new management or the ability for Vista Outdoor stockholders to realize a potential change of control premium for Revelyst in the future. The CSG Transaction delivers $7-$16 per share more value to stockholders than the MNC Final Indication.

•Involves significant execution risk and would take several months to close. MNC’s Final Indication still remains subject to additional due diligence, despite having engaged with MNC for six weeks in May and June 2024 (in addition to the extensive engagement prior to signing the CSG merger agreement). Additionally, its financing includes new debt and equity partners relative to their prior offer, none of which have been publicly disclosed to the stockholders, as would be customary in similar transactions. In addition, you should know that MNC has never completed a transaction.

•There is no guarantee that MNC will maintain its $42 per share offer - especially in the absence of competition if stockholders vote against the CSG Transaction. MNC has stood in the way of other competition throughout this process.

•The Board determined there is no basis to engage with MNC regarding its final indication of interest given MNC indicated that it “cannot see any possible basis or reason to further raise [its proposal].”

•Importantly, voting against the CSG Transaction at the Special Meeting does NOT mean the Board will decide to negotiate or resume discussions with MNC for the reasons stated above. If the CSG Transaction is not approved at the Special Meeting, the Board will need to consider all strategic alternatives available to Vista Outdoor at that time, in accordance with our fiduciary duties.

Each of Vista Outdoor’s financial advisors has delivered an opinion that the MNC Final Indication is inadequate, from a financial point of view, to the holders of Vista Outdoor’s common stock.

At Vista Outdoor’s upcoming Special Meeting on July 23, 2024, you will be asked to make an important decision regarding the future of your investment. The Board of Directors unanimously recommends that you vote “FOR” the CSG Transaction. We firmly believe this transaction provides compelling value and is in the best interest of all Vista Outdoor stockholders.

Sincerely,

Vista Outdoor Inc.’s Board of Directors

By Michael Callahan, Chairman of the Board of Directors

The special meeting of Vista Outdoor stockholders to, among other things, vote on a proposal to adopt the merger agreement with CSG, is scheduled to be held virtually on July 23, 2024, at 9:00 a.m. Central Time. Additional information can be found in Vista Outdoor’s proxy statement/prospectus and the supplements thereto filed with the U.S. Securities and Exchange Commission (the “SEC”), including the most recent supplement to the proxy statement/prospectus dated June 8, 2024.

Morgan Stanley & Co. LLC is acting as sole financial adviser to Vista Outdoor and Cravath, Swaine & Moore LLP is acting as legal adviser to Vista Outdoor. Moelis & Company LLC is acting as sole financial adviser to the independent directors of Vista Outdoor and Gibson, Dunn & Crutcher LLP is acting as legal adviser to the independent directors of Vista Outdoor.

About Vista Outdoor Inc.

Vista Outdoor (NYSE: VSTO) is the parent company of more than three dozen renowned brands that design, manufacture and market sporting and outdoor products. Brands include Bushnell, CamelBak, Bushnell Golf, Foresight Sports, Fox Racing, Bell Helmets, Camp Chef, Giro, Simms Fishing, QuietKat, Stone Glacier, Federal Ammunition, Remington Ammunition and more. Our reporting segments, Outdoor Products and Sporting Products, provide consumers with a wide range of performance-driven, high-quality and innovative outdoor and sporting products. For news and information, visit our website at www.vistaoutdoor.com.

Forward-Looking Statements

Some of the statements made and information contained in this press release, excluding historical information, are “forward-looking statements,” including those that discuss, among other things: Vista Outdoor Inc.’s (“Vista Outdoor”, “we”, “us” or “our”) plans, objectives, expectations, intentions, strategies, goals, outlook or other non-historical matters; projections with respect to future revenues, income, earnings per share or other financial measures for Vista Outdoor; and the assumptions that underlie these matters. The words “believe,” “expect,” “anticipate,” “intend,” “aim,” “should” and similar expressions are intended to identify such forward-looking statements. To the extent that any such information is forward-looking, it is intended to fit within the safe harbor for forward-looking information provided by the Private Securities Litigation Reform Act of 1995.

Numerous risks, uncertainties and other factors could cause our actual results to differ materially from the expectations described in such forward-looking statements, including the following: risks related to the previously announced transaction among Vista Outdoor, Revelyst, Inc. (“Revelyst”), CSG Elevate II Inc., CSG Elevate III Inc. and CZECHOSLOVAK GROUP a.s. (the “Transaction”), including (i) the failure to receive, on a timely basis or otherwise, the required approval of the Transaction by our stockholders, (ii) the possibility that any or all of the various conditions to the consummation of the Transaction may not be satisfied or waived, including the failure to receive any required regulatory approvals from any applicable governmental entities (or any conditions, limitations or restrictions placed on such approvals), (iii) the possibility that competing offers or acquisition proposals may be made, (iv) the occurrence of any event, change or other circumstance that could give rise to the termination of the merger agreement relating to the Transaction, including in circumstances which would require Vista Outdoor to pay a termination fee, (v) the effect of the announcement or pendency of the Transaction on our ability to attract, motivate or retain key executives and employees, our ability to maintain relationships with our customers, vendors, service providers and others with whom we do business, or our operating results and business generally, (vi) risks related to the Transaction diverting management’s attention from our ongoing business operations and (vii) that the Transaction may not achieve some or all of any anticipated benefits with respect to either business segment and that the Transaction may not be

completed in accordance with our expected plans or anticipated timelines, or at all; impacts from the COVID-19 pandemic on our operations, the operations of our customers and suppliers and general economic conditions; supplier capacity constraints, production or shipping disruptions or quality or price issues affecting our operating costs; the supply, availability and costs of raw materials and components; increases in commodity, energy, and production costs; seasonality and weather conditions; our ability to complete acquisitions, realize expected benefits from acquisitions and integrate acquired businesses; reductions in or unexpected changes in or our inability to accurately forecast demand for ammunition, accessories, or other outdoor sports and recreation products; disruption in the service or significant increase in the cost of our primary delivery and shipping services for our products and components or a significant disruption at shipping ports; risks associated with diversification into new international and commercial markets, including regulatory compliance; our ability to take advantage of growth opportunities in international and commercial markets; our ability to obtain and maintain licenses to third-party technology; our ability to attract and retain key personnel; disruptions caused by catastrophic events; risks associated with our sales to significant retail customers, including unexpected cancellations, delays, and other changes to purchase orders; our competitive environment; our ability to adapt our products to changes in technology, the marketplace and customer preferences, including our ability to respond to shifting preferences of the end consumer from brick and mortar retail to online retail; our ability to maintain and enhance brand recognition and reputation; others’ use of social media to disseminate negative commentary about us, our products, and boycotts; the outcome of contingencies, including with respect to litigation and other proceedings relating to intellectual property, product liability, warranty liability, personal injury, and environmental remediation; our ability to comply with extensive federal, state and international laws, rules and regulations; changes in laws, rules and regulations relating to our business, such as federal and state ammunition regulations; risks associated with cybersecurity and other industrial and physical security threats; interest rate risk; changes in the current tariff structures; changes in tax rules or pronouncements; capital market volatility and the availability of financing; foreign currency exchange rates and fluctuations in those rates; general economic and business conditions in the United States and our markets outside the United States, including as a result of the war in Ukraine and the imposition of sanctions on Russia, the COVID-19 pandemic, conditions affecting employment levels, consumer confidence and spending, conditions in the retail environment, and other economic conditions affecting demand for our products and the financial health of our customers.

You are cautioned not to place undue reliance on any forward-looking statements we make, which are based only on information currently available to us and speak only as of the date hereof. A more detailed description of risk factors that may affect our operating results can be found in Part 1, Item 1A, Risk Factors, of our Annual Report on Form 10-K for fiscal year 2024, and in the filings we make with the SEC from time to time. We undertake no obligation to update any forward-looking statements, except as otherwise required by law.

No Offer or Solicitation

This communication is neither an offer to sell, nor a solicitation of an offer to buy any securities, the solicitation of any vote, consent or approval in any jurisdiction pursuant to or in connection with the Transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable law.

Additional Information and Where to Find It

These materials may be deemed to be solicitation material in respect of the Transaction. In connection with the Transaction, Revelyst, a subsidiary of Vista Outdoor, filed with the SEC a registration statement on Form S-4 in connection with the proposed issuance of shares of common stock of Revelyst to Vista Outdoor stockholders pursuant to the Transaction, which Form S-4 includes a proxy statement of Vista Outdoor that also constitutes a prospectus of Revelyst (the “proxy statement/prospectus”). INVESTORS AND STOCKHOLDERS ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING OUR PROXY STATEMENT/PROSPECTUS, BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE TRANSACTION AND THE PARTIES TO THE TRANSACTION. The registration statement was declared effective by the SEC on March 22, 2024, and we have mailed the definitive proxy statement/prospectus to each of our stockholders entitled to vote at the meeting relating to the approval of the Transaction. Investors and stockholders may obtain the proxy statement/prospectus and any other documents free of charge through the SEC’s website at www.sec.gov. Copies of the documents filed with the SEC by Vista Outdoor are available free of charge on our website at www.vistaoutdoor.com.

Participants in Solicitation

Vista Outdoor, Revelyst, CSG Elevate II Inc., CSG Elevate III Inc. and CZECHOSLOVAK GROUP a.s. and their respective directors, executive officers and certain other members of management and employees, under SEC rules, may be deemed to be “participants” in the solicitation of proxies from our stockholders in respect of the Transaction. Information about our directors and executive officers is set forth in our proxy statement on Schedule 14A for our 2023 Annual Meeting of Stockholders, which was filed with the SEC on June 12, 2023, and subsequent statements of changes in beneficial ownership on file with the SEC. These documents are available free of charge through the SEC’s website at www.sec.gov. Additional information regarding the interests of potential participants in the solicitation of proxies in connection with the Transaction, which may, in some cases, be different than those of our stockholders generally, is also included in the proxy statement/prospectus relating to the Transaction.

Investor Contact:

Tyler Lindwall

Phone: 612-704-0147

Email: investor.relations@vistaoutdoor.com

Media Contact:

Eric Smith

Phone: 720-772-0877

Email: media.relations@vistaoutdoor.com

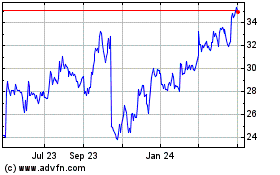

Vista Outdoor (NYSE:VSTO)

Historical Stock Chart

From Jun 2024 to Jul 2024

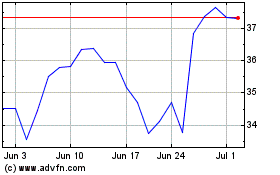

Vista Outdoor (NYSE:VSTO)

Historical Stock Chart

From Jul 2023 to Jul 2024