UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED

SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22608

Virtus Global

Multi-Sector Income Fund

(Exact name of registrant as specified in charter)

101 Munson Street

Greenfield, MA 01301-9683

(Address of principal executive offices) (Zip code)

Jennifer

Fromm, Esq.

Vice President, Chief Legal Officer, Counsel and Secretary for Registrant

One Financial Plaza

Hartford, CT 06103-2608

(Name and address of agent for service)

Registrant’s telephone number, including area code: (866) 270-7788

Date of fiscal year end: November 30

Date of reporting period: November 30, 2023

The Registrant is filing this

amendment to its Form N-CSR for the period ended November 30, 2023, originally filed with the Securities and Exchange Commission on February 5, 2024 (Accession Number

0001193125-24-024157). The purpose of this amendment is to revise the certifications required by Rule 30a-2 in order to

correct the time period referenced therein. Except as set forth above (and the dates included on the signature page and the certifications required by Rule 30a-2(a) and Rule

30a-2(b)), this amendment does not amend, update or change any other items or disclosures found in the original Form N-CSR filing.

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days

after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR

270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this

information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”)

control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC

20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. |

Reports to Stockholders. |

| |

(a) |

The Report to Shareholders is attached herewith. |

Virtus Global Multi-Sector Income Fund

Not FDIC Insured • No Bank Guarantee • May Lose

Value

Table of Contents

Virtus Global Multi-Sector Income Fund

(“Global Multi-Sector Income

Fund”)

|

1

|

|

2

|

|

5

|

|

6

|

|

7

|

|

26

|

|

27

|

|

28

|

|

29

|

|

30

|

|

31

|

|

42

|

|

43

|

|

45

|

|

49

|

|

52

|

|

56

|

Dear Virtus

Global Multi-Sector Income Fund Shareholder:

I am pleased to present this annual report,

which reviews the performance of your fund for the 12 months ended November 30, 2023.

This report contains commentary from the

portfolio management team at Newfleet Asset Management about the financial markets and the performance of the Fund’s investments.

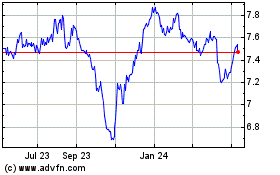

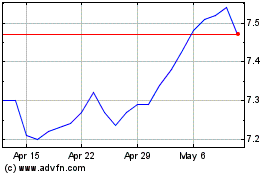

The fiscal year saw a generalized recovery from

the volatility that characterized much of 2022. But investor sentiment swung between optimism and pessimism depending on the outlook for inflation and interest rates. For the 12 months ended November 30, 2023, the Fund’s net asset value

(“NAV”) returned 7.19%, including $0.96 in reinvested distributions, and its market price returned 2.66%. For the same period, the Fund’s benchmark, the Bloomberg Global Aggregate Bond Index, returned 2.05%.

Please call our customer service team at 866-270-7788 if you

have questions about your account or require assistance. We appreciate your business and remain committed to your long-term financial success.

Sincerely,

George R.

Aylward

President, Chief Executive Officer, and Trustee

Virtus Global Multi-Sector Income Fund

January 2024

Refer to the Manager’s Discussion section for your

Fund’s performance. Performance data quoted represents past results. Past performance is no guarantee of future results, and current performance may be higher or lower than the performance shown above. Investing involves risk, including the

risk of loss of principal invested.

GLOBAL MULTI-SECTOR INCOME

FUND

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Unaudited)

November 30, 2023

About the

Fund:

Virtus Global Multi-Sector Income

Fund’s (NYSE: VGI) (the “Fund”) investment objective is to maximize current income while preserving capital. The Fund seeks to achieve its investment objective by applying extensive credit research to capitalize on opportunities

across undervalued areas of the global bond markets. There is no guarantee that the Fund will achieve its investment objective.

The use of leverage allows the Fund to borrow

at short-term rates with the expectation to invest at higher yields on its investments. As of November 30, 2023, the Fund’s leverage consisted of $43 million of borrowings made pursuant to a line of credit, which represented approximately 31%

of the Fund’s total assets.

Manager Comments –

Newfleet Asset Management (Newfleet)

Newfleet’s multi-sector fixed income

strategies team manages the Fund, leveraging the knowledge and skills of investment professionals with expertise in every sector of the bond market, including evolving, specialized, and out-of-favor sectors. The team employs active sector rotation

and disciplined risk management for portfolio construction, avoiding interest rate bets and remaining duration neutral. The following commentary is provided by the respective portfolio team at Newfleet and covers the Fund’s portfolio for the

year ended November 30, 2023.

How did the markets perform

during the Fund’s fiscal year ended November 30, 2023?

As the end of 2023 approached, economic

transitions were proceeding across the globe. China was struggling with a slowing economy amid calls for more stimulus, despite having ended its strict zero-COVID policies earlier in the year. Europe, too, was wrestling with a slowing economy and

inflation that remained above official targets. In the meantime, the U.S. economy proved remarkably resilient – unlike other major world economies, it defied expectations of a slowdown, leading to a growing consensus that the Federal Reserve

(the Fed) might be able to pull off the often-elusive soft landing. The main risk to this scenario remained the unpredictable cumulative effect of 18 months of monetary tightening on the economy. Because monetary policy works on the economy with a

lag, it presents a challenge to central bankers who are trying to return inflation to target without the associated economic pain of higher interest rates.

During the 12 months ended November 30, 2023,

the Fed raised its main policy interest rate by 1.50% in its continuing fight to tame inflation. This resulted in significant progress on headline inflation readings as supply chains healed, demand shifted from goods to services, and energy prices

rebalanced. Core readings of inflation, however, remained stubbornly above targets at the end of the period. That said, market expectations held that most major global central banks were approaching the end of their interest rate increases.

Despite the volatility during the fiscal

year, financial market performance was resilient, with most risk assets outperforming U.S. Treasuries. The U.S. Treasury yield curve shifted higher during the period and remained inverted as of November 30, 2023. The 2-year Treasury yield increased

0.37%, the 5-year Treasury yield increased by 0.53%, the 10-year Treasury yield increased by 0.72%, and the 30-year Treasury yield moved 0.76% higher.

For information regarding the indexes and certain key investment terms, see

Key Investment Terms starting on page 6.

GLOBAL MULTI-SECTOR INCOME

FUND

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Unaudited) (Continued)

November 30, 2023

What

factors affected the Fund’s performance during fiscal year?

For the fiscal year ended November 30, 2023,

the Fund’s net asset value (“NAV”) returned 7.19%, while its market price returned 2.66%. The Bloomberg Global Aggregate Bond Index, which serves as the Fund’s benchmark, returned 2.05%.

The Fund’s underweight to U.S.

Treasuries contributed to performance during the fiscal year. Allocation and positioning within corporate high yield, high yield bank loans, and investment grade corporates had a positive impact on performance for the 12-month period. Issue

selection within emerging markets high yield contributed to performance.

The Fund’s overweight to emerging

markets high yield detracted during the 12-month period. The underweight to non-U.S. dollar-denominated securities also had a negative impact.

Level distribution practice

The Fund has a practice of seeking to

maintain a specified level of monthly distributions to shareholders, which may be changed at any time. As a result of this practice, the Fund may pay distributions in excess of the Fund’s taxable net investment income and net realized gains.

During the most recent fiscal year, the practice did not have a material impact on the Fund’s investment strategy. Please refer to the financial highlights and federal income tax information note in this report for further information about

the Fund’s distributions and its effect on net asset value.

The preceding information is the opinion of

portfolio management only through the end of the period of the report as stated on the cover. Any such opinions are subject to change at any time based upon market conditions and should not be relied upon as investment advice.

The Fund’s portfolio holdings are

subject to change and may not be representative of the portfolio managers’ current or future investment decisions. The mention of individual securities held by the Fund is for informational purposes only and should not be construed as a

recommendation to purchase or sell any securities. Investors seeking financial advice regarding the appropriateness of investing in any securities or investment strategies discussed should consult their financial professional.

For

information regarding the indexes and certain key investment terms, see Key Investment Terms starting on page 6.

GLOBAL MULTI-SECTOR INCOME

FUND

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Unaudited) (Continued)

November 30, 2023

Average Annual Total Returns1 for periods ended 11/30/23

| |

1

Year |

5

Years |

10

Years |

| Market

Value1,2 |

2.66%

|

1.99%

|

3.28%

|

| Net

Asset Value1,2 |

7.19%

|

2.30%

|

3.38%

|

| Bloomberg

Global Aggregate Bond Index1,3 |

2.05%

|

-0.73%

|

-0.09%

|

All returns represent past

performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. Please visit Virtus.com for performance data current to the most recent month-end.

Growth of $10,000

for periods ended 11/30

This graph shows the change in value of a hypothetical

investment of $10,000 in the Fund for the years indicated. For comparison, the same investment is shown in the indicated index.

|

1 |

Past

performance is not indicative of future results. Current performance may be lower or higher than performance in historical periods. |

|

2 |

Total

return on market value is calculated assuming a purchase of common shares on the opening of the first day and sale on the closing of the last day of each period reported. Dividends and distributions are assumed, for purposes of this calculation, to

be reinvested at prices obtained under the Fund’s Automatic Reinvestment and Cash Purchase Plan. Total return on market value is not annualized for periods of less than one year. Brokerage commissions that a shareholder may pay are not

reflected. Total return on market value does not reflect the deduction of taxes that a shareholder may pay on fund distributions or the sale of fund shares. Total return on net asset value uses the same methodology, but with use of net asset value

for the beginning and ending values. |

|

3 |

The

index is unmanaged and not available for direct investment; therefore, its performance does not reflect the expenses associated with active management of an actual portfolio. |

For information

regarding the indexes and certain key investment terms, see Key Investment Terms starting on page 6.

GLOBAL MULTI-SECTOR INCOME

FUND

PORTFOLIO HOLDINGS SUMMARY WEIGHTINGS (Unaudited)

November 30, 2023

The

following tables present the portfolio holdings within certain

sectors

or countries as a percentage of total investments at November 30, 2023.

Asset

Allocations

| Corporate

Bonds and Notes |

|

49%

|

| Energy

|

13%

|

|

| Financials

|

13

|

|

| Materials

|

3

|

|

| All

other Corporate Bonds and Notes |

20

|

|

| Foreign

Government Securities |

|

19

|

| Mortgage-Backed

Securities |

|

10

|

| Leveraged

Loans |

|

9

|

| Asset-Backed

Securities |

|

8

|

| U.S.

Government Securities |

|

2

|

| Municipal

Bonds |

|

2

|

| Other

|

|

1

|

| Total

|

|

100%

|

Country

Weightings

| United

States |

58%

|

| Mexico

|

6

|

| Indonesia

|

3

|

| Canada

|

3

|

| Turkey

|

2

|

| Saudi

Arabia |

2

|

| Netherlands

|

2

|

| Other

|

24

|

| Total

|

100%

|

GLOBAL MULTI-SECTOR INCOME

FUND

KEY INVESTMENT TERMS (Unaudited)

November 30, 2023

Bloomberg Global Aggregate Bond Index

The Bloomberg Global Aggregate Bond Index is a market-weighted

index of global government, government-related agencies, corporate and securitized fixed income investments. The index is calculated on a total return basis. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges,

and it is not available for direct investment.

European

Central Bank (“ECB”)

The ECB is responsible

for conducting monetary policy for the Euro zone. The ECB was established as the core of the Eurosystem and the European System of Central Banks (“ESCB”). The ESCB comprises the ECB and the National Central Banks of all 17 European Union

Member States whether or not they have adopted the Euro.

Exchange-Traded Fund (“ETF”)

An open-end fund that is traded on a stock exchange. Most ETFs

have a portfolio of stocks or bonds that track a specific market index.

Federal Reserve (the “Fed”)

The central bank of the U.S., responsible for controlling money

supply, interest rates, and credit with the goal of keeping the U.S. economy and currency stable. Governed by a seven-member board, the system includes 12 regional Federal Reserve Banks, 25 branches, and all national and state banks that are part of

the system.

Headline Inflation

Headline inflation is the total inflation in an economy,

as measured by inflation in the prices of a basket of goods that includes commodities like food and energy.

London Interbank Offered Rate (“LIBOR”)

A benchmark rate that some of the world’s leading banks

charge each other for short-term loans and that serves as the first step to calculating interest rates on various loans throughout the world.

Risk Assets

Risk assets are those that tend to demonstrate price

volatility, such as equities, high yield bonds, currencies, and commodities.

Secured Overnight Financing Rate (“SOFR”)

A broad measure of the cost of borrowing cash overnight

collateralized by U.S. Treasury securities.

Yield

Curve

A line that plots the interest rates, at a set

point in time, of bonds having equal credit quality, but differing maturity dates. The most frequently reported yield curve compares the three-month, two-year, five-year and 30-year U.S. Treasury debt. This yield curve is used as a benchmark for

other debt in the market, such as mortgage rates or bank lending rates. The curve is also used to predict changes in economic output and growth.

Global Multi-Sector Income

Fund

SCHEDULE OF INVESTMENTS

November 30, 2023

($ reported in thousands)

| |

Par

Value(1) |

|

Value

|

| U.S.

Government Securities—3.1% |

| U.S.

Treasury Bonds |

|

|

|

| 1.250%,

5/15/50 |

$ 1,965

|

|

$

965 |

| 3.625%,

5/15/53 |

1,425

|

|

1,216

|

| U.S.

Treasury Notes |

|

|

|

| 1.375%,

12/31/28 |

475

|

|

411

|

| 3.375%,

5/15/33 |

450

|

|

416

|

Total

U.S. Government Securities

(Identified Cost $3,719) |

|

3,008

|

| |

|

|

|

| |

| Municipal

Bonds—2.2% |

| California—0.7%

|

|

|

State

of California, Build America Bond Taxable

7.500%, 4/1/34 |

570

|

|

667

|

| Florida—0.3%

|

|

|

Broward

County, Water & Sewer Utility Revenue Series A

4.000%, 10/1/47 |

300

|

|

299

|

| Illinois—0.7%

|

|

|

State

of Illinois, Build America Bond Taxable

6.900%, 3/1/35 |

700

|

|

730

|

| New

York—0.5% |

|

|

Metropolitan

Transportation Authority Bidding Group Series A

5.000%, 11/15/45 |

430

|

|

462

|

Total

Municipal Bonds

(Identified Cost $2,249) |

|

2,158

|

| |

|

|

|

| |

| Foreign

Government Securities—27.4% |

| Arab

Republic of Egypt |

|

|

|

144A

7.600%, 3/1/29(2) |

845

|

|

588

|

144A

8.500%, 1/31/47(2) |

715

|

|

407

|

| |

Par

Value(1) |

|

Value

|

| |

|

|

|

| Foreign

Government Securities—continued |

Bolivarian

Republic of Venezuela RegS

7.650%, 4/21/25(3)(4) |

$ 1,380

|

|

$ 215

|

Brazil

Notas do Tesouro Nacional Series F

10.000%, 1/1/29 |

2,680

BRL |

|

533

|

| Dominican

Republic |

|

|

|

144A

4.875%, 9/23/32(2) |

1,565

|

|

1,346

|

144A

6.850%, 1/27/45(2) |

615

|

|

568

|

| Federative

Republic of Brazil |

|

|

|

| 6.000%,

10/20/33 |

715

|

|

695

|

| 4.750%,

1/14/50 |

365

|

|

263

|

Finance

Department Government of Sharjah 144A

6.500%, 11/23/32(2) |

300

|

|

303

|

Hungary

Government International Bond 144A

6.250%, 9/22/32(2) |

585

|

|

597

|

Islamic

Republic of Pakistan 144A

6.875%, 12/5/27(2) |

630

|

|

410

|

Kingdom

of Jordan 144A

5.850%, 7/7/30(2) |

1,450

|

|

1,318

|

| Kingdom

of Morocco |

|

|

|

144A

3.000%, 12/15/32(2) |

200

|

|

157

|

144A

5.500%, 12/11/42(2) |

590

|

|

501

|

Mongolia

Government International Bond 144A

3.500%, 7/7/27(2) |

525

|

|

458

|

Oman

Government International Bond 144A

7.375%, 10/28/32(2) |

595

|

|

655

|

Republic

of Angola 144A

8.250%, 5/9/28(2) |

1,105

|

|

978

|

Republic

of Argentina

3.500%, 7/9/41(5) |

1,350

|

|

440

|

| Republic

of Colombia |

|

|

|

| 3.250%,

4/22/32 |

690

|

|

518

|

See Notes to Financial Statements

Global Multi-Sector Income

Fund

SCHEDULE OF INVESTMENTS (Continued)

November 30, 2023

($ reported in

thousands)

| |

Par

Value(1) |

|

Value

|

| |

|

|

|

| Foreign

Government Securities—continued |

| 4.125%,

5/15/51 |

$ 270

|

|

$ 162

|

Republic

of Ghana RegS

8.125%, 3/26/32(3)(4) |

970

|

|

413

|

| Republic

of Guatemala |

|

|

|

144A

5.250%, 8/10/29(2) |

315

|

|

293

|

144A

3.700%, 10/7/33(2) |

830

|

|

642

|

Republic

of Indonesia

2.850%, 2/14/30 |

1,540

|

|

1,355

|

| Republic

of Ivory Coast |

|

|

|

144A

6.375%, 3/3/28(2) |

385

|

|

370

|

144A

6.125%, 6/15/33(2) |

435

|

|

384

|

Republic

of Kenya 144A

8.000%, 5/22/32(2) |

510

|

|

430

|

Republic

of Nigeria 144A

7.375%, 9/28/33(2) |

525

|

|

416

|

Republic

of Philippines

3.700%, 3/1/41 |

960

|

|

763

|

Republic

of Poland

4.875%, 10/4/33 |

440

|

|

426

|

Republic

of Serbia 144A

6.500%, 9/26/33(2) |

300

|

|

296

|

| Republic

of South Africa |

|

|

|

| 5.875%,

6/22/30 |

530

|

|

492

|

| 5.650%,

9/27/47 |

360

|

|

260

|

| Republic

of Turkiye |

|

|

|

| 7.625%,

4/26/29 |

1,175

|

|

1,160

|

| 9.125%,

7/13/30 |

1,055

|

|

1,104

|

| 4.875%,

4/16/43 |

935

|

|

614

|

| Saudi

International Bond |

|

|

|

144A

3.625%, 3/4/28(2) |

900

|

|

854

|

144A

4.875%, 7/18/33(2) |

445

|

|

435

|

144A

4.500%, 10/26/46(2) |

1,655

|

|

1,340

|

State

of Israel

2.750%, 7/3/30 |

480

|

|

407

|

| State

of Qatar |

|

|

|

144A

3.750%, 4/16/30(2) |

450

|

|

426

|

| |

Par

Value(1) |

|

Value

|

| |

|

|

|

| Foreign

Government Securities—continued |

144A

4.400%, 4/16/50(2) |

$ 365

|

|

$

306 |

| Ukraine

Government |

|

|

|

144A

7.750%, 9/1/26(2)(3) |

300

|

|

83

|

RegS

7.750%, 9/1/26(3)(4) |

350

|

|

97

|

| United

Mexican States |

|

|

|

| 2.659%,

5/24/31 |

310

|

|

253

|

| 6.350%,

2/9/35 |

300

|

|

303

|

| 6.338%,

5/4/53 |

1,177

|

|

1,119

|

Total

Foreign Government Securities

(Identified Cost $30,240) |

|

26,153

|

| |

|

|

|

| |

| Mortgage-Backed

Securities—13.9% |

| Agency—4.4%

|

|

|

| Federal

National Mortgage Association |

|

|

|

Pool

#FS4438

5.000%, 11/1/52 |

905

|

|

872

|

Pool

#MA4785

5.000%, 10/1/52 |

457

|

|

441

|

Pool

#MA4805

4.500%, 11/1/52 |

799

|

|

749

|

Pool

#MA4980

6.000%, 4/1/53 |

1,472

|

|

1,477

|

Pool

#MA5072

5.500%, 7/1/53 |

689

|

|

680

|

| |

|

|

4,219

|

| |

|

|

|

| |

| Non-Agency—9.5%

|

|

|

Ajax

Mortgage Loan Trust 2022-B, A1 144A

3.500%, 3/27/62(2)(5) |

597

|

|

552

|

American

Homes 4 Rent Trust 2014-SFR2, C 144A

4.705%, 10/17/36(2) |

770

|

|

758

|

Arroyo

Mortgage Trust 2019-1, A1 144A

3.805%, 1/25/49(2)(5) |

82

|

|

75

|

See Notes to Financial Statements

Global Multi-Sector Income

Fund

SCHEDULE OF INVESTMENTS (Continued)

November 30, 2023

($ reported in

thousands)

| |

Par

Value(1) |

|

Value

|

| |

|

|

|

| Non-Agency—continued

|

|

|

Benchmark

Mortgage Trust 2023-B38, A2

5.626%, 4/15/56 |

$ 365

|

|

$ 362

|

BPR

Trust 2022-OANA, A (1 month Term SOFR + 1.898%, Cap N/A, Floor 1.898%) 144A

7.221%, 4/15/37(2)(5) |

270

|

|

265

|

BX

Trust 2019-OC11, D 144A

4.075%, 12/9/41(2)(5) |

515

|

|

431

|

| Chase

Mortgage Finance Corp. |

|

|

|

2016-SH1,

M2 144A

3.750%, 4/25/45(2)(5) |

81

|

|

72

|

2016-SH2,

M2 144A

3.750%, 12/25/45(2)(5) |

208

|

|

183

|

CIM

Trust 2022-R2, A1 144A

3.750%, 12/25/61(2)(5) |

329

|

|

299

|

| COLT

Mortgage Loan Trust |

|

|

|

2022-4,

A1 144A

4.301%, 3/25/67(2)(5) |

145

|

|

137

|

2022-5,

A1 144A

4.550%, 4/25/67(2)(5) |

349

|

|

331

|

Ellington

Financial Mortgage Trust 2019-2, A3 144A

3.046%, 11/25/59(2)(5) |

34

|

|

31

|

Extended

Stay America Trust 2021-ESH, C (1 month Term SOFR + 1.814%, Cap N/A, Floor 1.700%) 144A

7.137%, 7/15/38(2)(5) |

268

|

|

262

|

FirstKey

Homes Trust 2020-SFR2, B 144A

1.567%, 10/19/37(2) |

475

|

|

434

|

| |

Par

Value(1) |

|

Value

|

| |

|

|

|

| Non-Agency—continued

|

|

|

Homes

Trust 2023-NQM2, A1 144A

6.456%, 2/25/68(2)(5) |

$ 480

|

|

$ 479

|

INTOWN

Mortgage Trust 2022-STAY, A (1 month Term SOFR + 2.489%, Cap N/A, Floor 2.489%) 144A

7.812%, 8/15/39(2)(5) |

435

|

|

436

|

JPMorgan

Chase Mortgage Trust 2014-5, B2 144A

2.751%, 10/25/29(2)(5) |

163

|

|

143

|

Mill

City Mortgage Loan Trust 2017-3, B1 144A

3.250%, 1/25/61(2)(5) |

338

|

|

272

|

Morgan

Stanley Bank of America Merrill Lynch Trust 2015-C22, AS

3.561%, 4/15/48 |

220

|

|

207

|

| New

Residential Mortgage Loan Trust |

|

|

|

2016-3A,

B1 144A

4.000%, 9/25/56(2)(5) |

163

|

|

150

|

2016-4A,

B1A 144A

4.500%, 11/25/56(2)(5) |

482

|

|

451

|

ORL

Trust 2023-GLKS, A (1 month Term SOFR + 2.350%, Cap N/A, Floor 2.350%) 144A

7.673%, 10/19/36(2)(5) |

375

|

|

375

|

Palisades

Mortgage Loan Trust 2021-RTL1, A1 144A

2.857%, 6/25/26(2)(5) |

150

|

|

147

|

Provident

Funding Mortgage Trust 2019-1, A2 144A

3.000%, 12/25/49(2)(5) |

75

|

|

61

|

See Notes to Financial Statements

Global Multi-Sector Income

Fund

SCHEDULE OF INVESTMENTS (Continued)

November 30, 2023

($ reported in

thousands)

| |

Par

Value(1) |

|

Value

|

| |

|

|

|

| Non-Agency—continued

|

|

|

Starwood

Mortgage Residential Trust 2021-3, A3 144A

1.518%, 6/25/56(2)(5) |

$ 50

|

|

$

39 |

| Towd

Point Mortgage Trust |

|

|

|

2016-4,

B1 144A

3.957%, 7/25/56(2)(5) |

260

|

|

238

|

2017-1,

M1 144A

3.750%, 10/25/56(2)(5) |

265

|

|

249

|

2017-4,

A2 144A

3.000%, 6/25/57(2)(5) |

171

|

|

152

|

2018-6,

A2 144A

3.750%, 3/25/58(2)(5) |

215

|

|

182

|

Tricon

Residential Trust 2021-SFR1, B 144A

2.244%, 7/17/38(2) |

150

|

|

135

|

TVC

Mortgage Trust 2020-RTL1, M 144A

6.193%, 9/25/24(2)(5) |

500

|

|

499

|

| VCAT

LLC |

|

|

|

2021-NPL3,

A1 144A

1.743%, 5/25/51(2)(5) |

216

|

|

203

|

2021-NPL4,

A1 144A

1.868%, 8/25/51(2)(5) |

142

|

|

134

|

Verus

Securitization Trust 2022-4, A1 144A

4.474%, 4/25/67(2)(5) |

299

|

|

285

|

| |

|

|

9,029

|

Total

Mortgage-Backed Securities

(Identified Cost $13,855) |

|

13,248

|

| |

|

|

|

| |

| Asset-Backed

Securities—11.4% |

| Automobiles—4.0%

|

|

|

Avis

Budget Rental Car Funding LLC (AESOP) 2019-2A, D 144A

3.040%, 9/22/25(2) |

480

|

|

462

|

| |

Par

Value(1) |

|

Value

|

| |

|

|

|

| Automobiles—continued

|

|

|

DT

Auto Owner Trust 2023-1A, D 144A

6.440%, 11/15/28(2) |

$ 450

|

|

$ 445

|

| GLS

Auto Receivables Issuer Trust |

|

|

|

2020-3A,

D 144A

2.270%, 5/15/26(2) |

345

|

|

340

|

2020-3A,

E 144A

4.310%, 7/15/27(2) |

550

|

|

537

|

2023-1A,

B 144A

6.190%, 6/15/27(2) |

439

|

|

438

|

| LAD

Auto Receivables Trust |

|

|

|

2021-1A,

D 144A

3.990%, 11/15/29(2) |

470

|

|

444

|

2023-2A,

D 144A

6.300%, 2/15/31(2) |

365

|

|

359

|

OneMain

Direct Auto Receivables Trust 2022-1A, C 144A

5.310%, 6/14/29(2) |

320

|

|

309

|

Santander

Drive Auto Receivables Trust 2022-7, A2

5.810%, 1/15/26 |

131

|

|

131

|

Tesla

Auto Lease Trust 2023-A, B 144A

6.410%, 7/20/27(2) |

363

|

|

364

|

| |

|

|

3,829

|

| |

|

|

|

| |

| Consumer

Loans—0.7% |

|

|

Affirm

Asset Securitization Trust 2023-B, A 144A

6.820%, 9/15/28(2) |

350

|

|

352

|

Marlette

Funding Trust 2023-2A, B 144A

6.540%, 6/15/33(2) |

363

|

|

363

|

| |

|

|

715

|

| |

|

|

|

| |

See Notes to Financial Statements

Global Multi-Sector Income

Fund

SCHEDULE OF INVESTMENTS (Continued)

November 30, 2023

($ reported in

thousands)

| |

Par

Value(1) |

|

Value

|

| |

|

|

|

| Credit

Card—0.5% |

|

|

Avant

Credit Card Master Trust 2021-1A, A 144A

1.370%, 4/15/27(2) |

$ 480

|

|

$ 453

|

| Other—6.2%

|

|

|

Adams

Outdoor Advertising LP 2023-1, A2 144A

6.967%, 7/15/53(2) |

365

|

|

364

|

| Aqua

Finance Trust |

|

|

|

2017-A,

A 144A

3.720%, 11/15/35(2) |

26

|

|

26

|

2020-AA,

D 144A

7.150%, 7/17/46(2) |

400

|

|

348

|

Arby’s

Funding LLC 2020-1A, A2 144A

3.237%, 7/30/50(2) |

465

|

|

414

|

BXG

Receivables Note Trust 2023-A, A 144A

5.770%, 11/15/38(2) |

388

|

|

384

|

Conn’s

Receivables Funding LLC 2022-A, B 144A

9.520%, 12/15/26(2) |

217

|

|

218

|

FAT

Brands Royalty LLC 2021-1A, A2 144A

4.750%, 4/25/51(2) |

478

|

|

444

|

Hardee’s

Funding LLC 2020-1A, A2 144A

3.981%, 12/20/50(2) |

410

|

|

355

|

Jersey

Mike’s Funding 2019-1A, A2 144A

4.433%, 2/15/50(2) |

348

|

|

323

|

Mariner

Finance Issuance Trust 2020-AA, A 144A

2.190%, 8/21/34(2) |

340

|

|

332

|

Octane

Receivables Trust 2023-3A, C 144A

6.740%, 8/20/29(2) |

425

|

|

429

|

Oportun

Funding XIV LLC 2021-A, B 144A

1.760%, 3/8/28(2) |

320

|

|

304

|

Planet

Fitness Master Issuer LLC 2018-1A, A2II 144A

4.666%, 9/5/48(2) |

513

|

|

496

|

| |

Par

Value(1) |

|

Value

|

| |

|

|

|

| Other—continued

|

|

|

Progress

Residential Trust 2021-SFR6, D 144A

2.225%, 7/17/38(2) |

$ 190

|

|

$

167 |

Trinity

Rail Leasing LLC 2019-1A, A 144A

3.820%, 4/17/49(2) |

288

|

|

272

|

VFI

ABS LLC 2022-1A, B 144A

3.040%, 7/24/28(2) |

585

|

|

560

|

ZAXBY’S

Funding LLC 2021-1A, A2 144A

3.238%, 7/30/51(2) |

531

|

|

447

|

| |

|

|

5,883

|

| |

|

|

|

| |

Total

Asset-Backed Securities

(Identified Cost $11,225) |

|

10,880

|

| |

|

|

|

| |

| Corporate

Bonds and Notes—69.0% |

| Communication

Services—4.1% |

|

|

Altice

France Holding S.A. 144A

6.000%, 2/15/28(2) |

185

|

|

75

|

| Altice

France S.A. |

|

|

|

| 144A

5.125%, 7/15/29(2) |

125

|

|

89

|

| 144A

5.500%, 10/15/29(2) |

185

|

|

134

|

AT&T,

Inc.

5.400%, 2/15/34 |

290

|

|

287

|

| CSC

Holdings LLC |

|

|

|

| 5.250%,

6/1/24 |

145

|

|

138

|

| 144A

7.500%, 4/1/28(2) |

295

|

|

202

|

CT

Trust 144A

5.125%, 2/3/32(2) |

550

|

|

455

|

| DISH

DBS Corp. |

|

|

|

| 5.875%,

11/15/24 |

180

|

|

158

|

| 7.750%,

7/1/26 |

170

|

|

101

|

Gray

Television, Inc. 144A

7.000%, 5/15/27(2) |

330

|

|

300

|

Grupo

Televisa SAB

4.625%, 1/30/26 |

525

|

|

511

|

Level

3 Financing, Inc. 144A

3.625%, 1/15/29(2) |

365

|

|

131

|

See Notes to Financial Statements

Global Multi-Sector Income

Fund

SCHEDULE OF INVESTMENTS (Continued)

November 30, 2023

($ reported in

thousands)

| |

Par

Value(1) |

|

Value

|

| |

|

|

|

Communication

Services—continued |

|

|

Millennium

Escrow Corp. 144A

6.625%, 8/1/26(2) |

$ 250

|

|

$ 193

|

Rackspace

Technology Global, Inc. 144A

5.375%, 12/1/28(2) |

275

|

|

83

|

Sprint

Capital Corp.

8.750%, 3/15/32 |

235

|

|

281

|

Telecomunicaciones

Digitales S.A. 144A

4.500%, 1/30/30(2) |

725

|

|

597

|

Telesat

Canada 144A

6.500%, 10/15/27(2) |

180

|

|

84

|

T-Mobile

USA, Inc.

5.050%, 7/15/33 |

151

|

|

146

|

| |

|

|

3,965

|

| |

|

|

|

| |

| Consumer

Discretionary—3.9% |

|

|

Ashtead

Capital, Inc. 144A

2.450%, 8/12/31(2) |

570

|

|

445

|

Carnival

Corp. 144A

7.000%, 8/15/29(2) |

35

|

|

36

|

Churchill

Downs, Inc. 144A

6.750%, 5/1/31(2) |

215

|

|

211

|

| Clarios

Global LP |

|

|

|

| 144A

8.500%, 5/15/27(2) |

245

|

|

246

|

| 144A

6.750%, 5/15/28(2) |

25

|

|

25

|

Ford

Motor Co.

3.250%, 2/12/32 |

120

|

|

96

|

Ford

Motor Credit Co. LLC

7.350%, 3/6/30 |

200

|

|

208

|

Jacobs

Entertainment, Inc. 144A

6.750%, 2/15/29(2) |

164

|

|

147

|

MDC

Holdings, Inc.

3.966%, 8/6/61 |

440

|

|

261

|

Newell

Brands, Inc.

6.625%, 9/15/29 |

227

|

|

221

|

Nissan

Motor Acceptance Co. LLC 144A

7.050%, 9/15/28(2) |

210

|

|

213

|

| |

Par

Value(1) |

|

Value

|

| |

|

|

|

Consumer

Discretionary—continued |

|

|

NMG

Holding Co., Inc. 144A

7.125%, 4/1/26(2) |

$ 220

|

|

$ 206

|

Nordstrom,

Inc.

4.250%, 8/1/31 |

300

|

|

237

|

Ontario

Gaming GTA LP 144A

8.000%, 8/1/30(2) |

175

|

|

177

|

PetSmart,

Inc. 144A

7.750%, 2/15/29(2) |

285

|

|

269

|

Premier

Entertainment Sub LLC 144A

5.625%, 9/1/29(2) |

154

|

|

111

|

Royal

Caribbean Cruises Ltd. 144A

9.250%, 1/15/29(2) |

12

|

|

13

|

Tapestry,

Inc.

7.850%, 11/27/33 |

325

|

|

330

|

Weekley

Homes LLC 144A

4.875%, 9/15/28(2) |

255

|

|

234

|

| |

|

|

3,686

|

| |

|

|

|

| |

| Consumer

Staples—2.2% |

|

|

Anheuser-Busch

InBev Worldwide, Inc.

3.500%, 6/1/30 |

305

|

|

282

|

BAT

Capital Corp.

7.750%, 10/19/32 |

330

|

|

365

|

Central

American Bottling Corp. 144A

5.250%, 4/27/29(2) |

295

|

|

268

|

Coty,

Inc. 144A

6.625%, 7/15/30(2) |

230

|

|

231

|

Minerva

Luxembourg S.A. 144A

8.875%, 9/13/33(2) |

710

|

|

716

|

Pilgrim’s

Pride Corp.

6.250%, 7/1/33 |

230

|

|

226

|

| |

|

|

2,088

|

| |

|

|

|

| |

See Notes to Financial Statements

Global Multi-Sector Income

Fund

SCHEDULE OF INVESTMENTS (Continued)

November 30, 2023

($ reported in

thousands)

| |

Par

Value(1) |

|

Value

|

| |

|

|

|

| Energy—18.4%

|

|

|

Aker

BP ASA 144A

2.000%, 7/15/26(2) |

$ 263

|

|

$ 240

|

Alliance

Resource Operating Partners LP 144A

7.500%, 5/1/25(2) |

269

|

|

268

|

Ascent

Resources Utica Holdings LLC 144A

8.250%, 12/31/28(2) |

255

|

|

255

|

BP

Capital Markets plc

4.875% (6) |

375

|

|

337

|

CITGO

Petroleum Corp. 144A

7.000%, 6/15/25(2) |

95

|

|

94

|

Civitas

Resources, Inc. 144A

8.750%, 7/1/31(2) |

180

|

|

186

|

| Columbia

Pipelines Operating Co. LLC |

|

|

|

| 144A

6.036%, 11/15/33(2) |

215

|

|

217

|

| 144A

6.714%, 8/15/63(2) |

40

|

|

41

|

Coronado

Finance Pty Ltd. 144A

10.750%, 5/15/26(2) |

382

|

|

398

|

CrownRock

LP 144A

5.625%, 10/15/25(2) |

255

|

|

253

|

| Ecopetrol

S.A. |

|

|

|

| 4.625%,

11/2/31 |

695

|

|

554

|

| 8.875%,

1/13/33 |

585

|

|

600

|

Enbridge,

Inc.

7.625%, 1/15/83 |

345

|

|

326

|

Energy

Transfer LP Series H

6.500% (6) |

245

|

|

229

|

Fermaca

Enterprises S de RL de C.V. 144A

6.375%, 3/30/38(2) |

703

|

|

669

|

Flex

Intermediate Holdco LLC 144A

3.363%, 6/30/31(2) |

175

|

|

137

|

Genesis

Energy LP

8.875%, 4/15/30 |

395

|

|

402

|

Greensaif

Pipelines Bidco S.a.r.l. 144A

6.129%, 2/23/38(2) |

235

|

|

235

|

| |

Par

Value(1) |

|

Value

|

| |

|

|

|

| Energy—continued

|

|

|

Helix

Energy Solutions Group, Inc. 144A

9.750%, 3/1/29(2) |

$ 185

|

|

$ 185

|

Hilcorp

Energy I LP 144A

5.750%, 2/1/29(2) |

290

|

|

273

|

| International

Petroleum Corp. |

|

|

|

| 144A,

RegS 7.250%, 2/1/27(2)(4) |

200

|

|

186

|

| 144A,

RegS 7.250%, 2/1/27(2)(4) |

300

|

|

279

|

| KazMunayGas

National Co. JSC |

|

|

|

| 144A

5.375%, 4/24/30(2) |

310

|

|

291

|

| 144A

5.750%, 4/19/47(2) |

640

|

|

509

|

| 144A

6.375%, 10/24/48(2) |

200

|

|

170

|

Kinder

Morgan, Inc.

7.750%, 1/15/32 |

380

|

|

422

|

Korea

National Oil Corp. 144A

4.875%, 4/3/28(2) |

200

|

|

197

|

Magnolia

Oil & Gas Operating LLC 144A

6.000%, 8/1/26(2) |

270

|

|

262

|

Mesquite

Energy, Inc. 144A

7.250%, 2/15/24(2) |

135

|

|

10

|

Nabors

Industries Ltd. 144A

7.250%, 1/15/26(2) |

195

|

|

186

|

Northriver

Midstream Finance LP 144A

5.625%, 2/15/26(2) |

255

|

|

248

|

Occidental

Petroleum Corp.

6.125%, 1/1/31 |

405

|

|

409

|

Odebrecht

Oil & Gas Finance Ltd. 144A

0.000% (2)(6)(7)(8) |

154

|

|

2

|

| Pertamina

Persero PT |

|

|

|

| 144A

2.300%, 2/9/31(2) |

1,075

|

|

874

|

| RegS

6.450%, 5/30/44(4) |

815

|

|

818

|

Petroleos

de Venezuela S.A. 144A

6.000%, 5/16/24(2)(3) |

1,820

|

|

218

|

See Notes to Financial Statements

Global Multi-Sector Income

Fund

SCHEDULE OF INVESTMENTS (Continued)

November 30, 2023

($ reported in

thousands)

| |

Par

Value(1) |

|

Value

|

| |

|

|

|

| Energy—continued

|

|

|

| Petroleos

Mexicanos |

|

|

|

| 6.500%,

3/13/27 |

$ 930

|

|

$ 836

|

| 5.950%,

1/28/31 |

825

|

|

615

|

| 6.700%,

2/16/32 |

935

|

|

727

|

| 6.500%,

6/2/41 |

350

|

|

220

|

| 7.690%,

1/23/50 |

595

|

|

394

|

| 6.375%,

1/23/45 |

1,700

|

|

1,011

|

| 6.350%,

2/12/48 |

520

|

|

307

|

Petronas

Capital Ltd. 144A

3.500%, 4/21/30(2) |

555

|

|

504

|

Reliance

Industries Ltd. 144A

2.875%, 1/12/32(2) |

760

|

|

622

|

State

Oil Co. of the Azerbaijan Republic RegS

6.950%, 3/18/30(4) |

625

|

|

631

|

Teine

Energy Ltd. 144A

6.875%, 4/15/29(2) |

250

|

|

236

|

| Transocean,

Inc. |

|

|

|

| 144A

11.500%, 1/30/27(2) |

9

|

|

9

|

| 144A

8.750%, 2/15/30(2) |

214

|

|

218

|

Venture

Global Calcasieu Pass LLC 144A

4.125%, 8/15/31(2) |

245

|

|

211

|

Viper

Energy, Inc. 144A

7.375%, 11/1/31(2) |

30

|

|

30

|

| |

|

|

17,551

|

| |

|

|

|

| |

| Financials—17.9%

|

|

|

Acrisure

LLC 144A

7.000%, 11/15/25(2) |

370

|

|

365

|

Allianz

SE 144A

6.350%, 9/6/53(2) |

200

|

|

200

|

Allstate

Corp. (The) Series B (3 month Term SOFR + 3.200%)

8.579%, 8/15/53(5) |

391

|

|

386

|

American

Express Co.

5.625%, 7/28/34 |

255

|

|

252

|

| |

Par

Value(1) |

|

Value

|

| |

|

|

|

| Financials—continued

|

|

|

Australia

& New Zealand Banking Group Ltd. 144A

4.400%, 5/19/26(2) |

$ 260

|

|

$ 250

|

Banco

de Credito e Inversiones S.A. 144A

3.500%, 10/12/27(2) |

990

|

|

916

|

Banco

Mercantil del Norte S.A. 144A

6.625% (2)(6) |

780

|

|

645

|

Banco

Nacional de Comercio Exterior SNC 144A

4.375%, 10/14/25(2) |

510

|

|

494

|

Banco

Santander Chile 144A

3.177%, 10/26/31(2) |

150

|

|

125

|

Bancolombia

S.A.

4.625%, 12/18/29 |

300

|

|

270

|

| Bank

of America Corp. |

|

|

|

| 5.015%,

7/22/33 |

295

|

|

280

|

| 2.482%,

9/21/36 |

395

|

|

298

|

Bank

of New York Mellon Corp. (The)

5.834%, 10/25/33 |

385

|

|

392

|

Barclays

plc

7.437%, 11/2/33 |

420

|

|

447

|

BBVA

Bancomer S.A. 144A

5.125%, 1/18/33(2) |

700

|

|

625

|

Blackstone

Private Credit Fund

2.625%, 12/15/26 |

200

|

|

176

|

Blue

Owl Credit Income Corp.

4.700%, 2/8/27 |

259

|

|

238

|

BroadStreet

Partners, Inc. 144A

5.875%, 4/15/29(2) |

160

|

|

146

|

Brookfield

Finance, Inc.

6.350%, 1/5/34 |

345

|

|

348

|

Capital

One Financial Corp.

2.359%, 7/29/32 |

420

|

|

298

|

See Notes to Financial Statements

Global Multi-Sector Income

Fund

SCHEDULE OF INVESTMENTS (Continued)

November 30, 2023

($ reported in

thousands)

| |

Par

Value(1) |

|

Value

|

| |

|

|

|

| Financials—continued

|

|

|

Charles

Schwab Corp. (The) Series H

4.000% (6) |

$ 360

|

|

$ 272

|

Citadel

LP 144A

4.875%, 1/15/27(2) |

270

|

|

261

|

| Citigroup,

Inc. |

|

|

|

| 6.270%,

11/17/33 |

270

|

|

279

|

| 6.174%,

5/25/34 |

204

|

|

202

|

Citizens

Bank N.A.

2.250%, 4/28/25 |

250

|

|

236

|

Cobra

AcquisitionCo. LLC 144A

6.375%, 11/1/29(2) |

162

|

|

118

|

Corebridge

Financial, Inc.

6.875%, 12/15/52 |

337

|

|

324

|

Discover

Bank

4.650%, 9/13/28 |

250

|

|

228

|

Drawbridge

Special Opportunities Fund LP 144A

3.875%, 2/15/26(2) |

585

|

|

528

|

Export-Import

Bank Korea

5.125%, 1/11/33 |

600

|

|

601

|

Fifth

Third Bancorp

4.337%, 4/25/33 |

245

|

|

215

|

First

American Financial Corp.

4.000%, 5/15/30 |

330

|

|

286

|

Global

Atlantic Fin Co. 144A

7.950%, 6/15/33(2) |

137

|

|

148

|

Global

Payments, Inc.

2.900%, 5/15/30 |

395

|

|

336

|

| Goldman

Sachs Group, Inc. (The) |

|

|

|

| 3.102%,

2/24/33 |

175

|

|

144

|

| 6.450%,

5/1/36 |

135

|

|

139

|

Huntington

Bancshares, Inc.

2.550%, 2/4/30 |

280

|

|

230

|

| JPMorgan

Chase & Co. |

|

|

|

| 5.350%,

6/1/34 |

135

|

|

132

|

| 6.254%,

10/23/34 |

200

|

|

209

|

Liberty

Mutual Group, Inc. 144A

4.125%, 12/15/51(2) |

400

|

|

326

|

| |

Par

Value(1) |

|

Value

|

| |

|

|

|

| Financials—continued

|

|

|

Lincoln

National Corp. (3 month LIBOR + 2.040%)

7.717%, 4/20/67(5) |

$ 324

|

|

$ 198

|

MDGH-GMTN

RSC Ltd. 144A

4.500%, 11/7/28(2) |

750

|

|

727

|

MetLife,

Inc. Series G

3.850% (6) |

220

|

|

207

|

Midcap

Financial Issuer Trust 144A

6.500%, 5/1/28(2) |

370

|

|

322

|

| Morgan

Stanley |

|

|

|

| 6.342%,

10/18/33 |

290

|

|

300

|

| 5.948%,

1/19/38 |

174

|

|

169

|

MSCI,

Inc. 144A

3.625%, 9/1/30(2) |

261

|

|

227

|

National

Rural Utilities Cooperative Finance Corp. (3 month Term SOFR + 3.172%)

8.562%, 4/30/43(5) |

165

|

|

163

|

Nationstar

Mortgage Holdings, Inc. 144A

5.750%, 11/15/31(2) |

165

|

|

144

|

NCR

Atleos Corp. 144A

9.500%, 4/1/29(2) |

184

|

|

190

|

Nippon

Life Insurance Co. 144A

6.250%, 9/13/53(2) |

200

|

|

202

|

Prudential

Financial, Inc.

6.750%, 3/1/53 |

220

|

|

219

|

State

Street Corp.

4.821%, 1/26/34 |

300

|

|

282

|

| Synchrony

Financial |

|

|

|

| 4.875%,

6/13/25 |

65

|

|

63

|

| 3.700%,

8/4/26 |

93

|

|

85

|

Toronto-Dominion

Bank (The)

8.125%, 10/31/82 |

435

|

|

437

|

| UBS

Group AG |

|

|

|

| 144A

9.250%(2)(6) |

35

|

|

37

|

| 144A

4.988%, 8/5/33(2) |

310

|

|

285

|

| Wells

Fargo & Co. |

|

|

|

| 5.389%,

4/24/34 |

145

|

|

140

|

See Notes to Financial Statements

Global Multi-Sector Income

Fund

SCHEDULE OF INVESTMENTS (Continued)

November 30, 2023

($ reported in

thousands)

| |

Par

Value(1) |

|

Value

|

| |

|

|

|

| Financials—continued

|

|

|

Series

BB

3.900%(6) |

$ 400

|

|

$ 361

|

| |

|

|

17,123

|

| |

|

|

|

| |

| Health

Care—3.8% |

|

|

Akumin,

Inc. 144A

7.000%, 11/1/25(2)(9) |

235

|

|

189

|

| Bausch

Health Cos., Inc. |

|

|

|

| 144A

6.125%, 2/1/27(2) |

25

|

|

14

|

| 144A

11.000%, 9/30/28(2) |

105

|

|

66

|

| 144A

14.000%, 10/15/30(2) |

20

|

|

11

|

Catalent

Pharma Solutions, Inc. 144A

3.500%, 4/1/30(2) |

255

|

|

213

|

Cheplapharm

Arzneimittel GmbH 144A

5.500%, 1/15/28(2) |

370

|

|

343

|

Community

Health Systems, Inc. 144A

6.125%, 4/1/30(2) |

245

|

|

137

|

DENTSPLY

SIRONA, Inc.

3.250%, 6/1/30 |

335

|

|

287

|

HCA,

Inc.

5.500%, 6/1/33 |

290

|

|

285

|

IQVIA,

Inc. 144A

6.250%, 2/1/29(2) |

250

|

|

254

|

Lannett

Co., Inc. 144A

7.750%, 4/15/26(2)(7) |

60

|

|

3

|

LifePoint

Health, Inc. 144A

9.875%, 8/15/30(2) |

360

|

|

350

|

| Surgery

Center Holdings, Inc. |

|

|

|

| 144A

6.750%, 7/1/25(2) |

84

|

|

83

|

| 144A

10.000%, 4/15/27(2) |

125

|

|

126

|

Team

Health Holdings, Inc. 144A

6.375%, 2/1/25(2) |

220

|

|

184

|

Teva

Pharmaceutical Finance Netherlands III B.V.

5.125%, 5/9/29 |

280

|

|

258

|

| |

Par

Value(1) |

|

Value

|

| |

|

|

|

| Health

Care—continued |

|

|

Universal

Health Services, Inc.

2.650%, 1/15/32 |

$ 400

|

|

$ 315

|

Viatris,

Inc.

2.700%, 6/22/30 |

265

|

|

215

|

Zimmer

Biomet Holdings, Inc.

3.550%, 3/20/30 |

325

|

|

285

|

| |

|

|

3,618

|

| |

|

|

|

| |

| Industrials—4.5%

|

|

|

Alaska

Airlines Pass-Through Trust 2020-1, A 144A

4.800%, 2/15/29(2) |

340

|

|

324

|

Avolon

Holdings Funding Ltd. 144A

4.375%, 5/1/26(2) |

301

|

|

287

|

Beacon

Roofing Supply, Inc. 144A

6.500%, 8/1/30(2) |

90

|

|

90

|

| Boeing

Co. (The) |

|

|

|

| 3.750%,

2/1/50 |

215

|

|

156

|

| 5.930%,

5/1/60 |

160

|

|

155

|

British

Airways Pass-Through Trust 2021-1, A 144A

2.900%, 9/15/36(2) |

376

|

|

315

|

Chart

Industries, Inc. 144A

9.500%, 1/1/31(2) |

200

|

|

213

|

Concentrix

Corp.

6.650%, 8/2/26 |

175

|

|

176

|

CoStar

Group, Inc. 144A

2.800%, 7/15/30(2) |

481

|

|

395

|

GFL

Environmental, Inc. 144A

6.750%, 1/15/31(2) |

15

|

|

15

|

Global

Infrastructure Solutions, Inc. 144A

7.500%, 4/15/32(2) |

265

|

|

231

|

Hertz

Corp. (The) 144A

5.000%, 12/1/29(2) |

180

|

|

138

|

Icahn

Enterprises LP

6.250%, 5/15/26 |

235

|

|

222

|

See Notes to Financial Statements

Global Multi-Sector Income

Fund

SCHEDULE OF INVESTMENTS (Continued)

November 30, 2023

($ reported in

thousands)

| |

Par

Value(1) |

|

Value

|

| |

|

|

|

| Industrials—continued

|

|

|

LBM

Acquisition LLC 144A

6.250%, 1/15/29(2) |

$ 250

|

|

$ 209

|

Neptune

Bidco U.S., Inc. 144A

9.290%, 4/15/29(2) |

175

|

|

162

|

Regal

Rexnord Corp. 144A

6.400%, 4/15/33(2) |

371

|

|

366

|

Sempra

Global 144A

3.250%, 1/15/32(2) |

405

|

|

321

|

United

Airlines Pass-Through Trust 2023-1, A

5.800%, 7/15/37 |

240

|

|

230

|

Veralto

Corp. 144A

5.450%, 9/18/33(2) |

210

|

|

209

|

VistaJet

Malta Finance plc 144A

9.500%, 6/1/28(2) |

155

|

|

129

|

| |

|

|

4,343

|

| |

|

|

|

| |

| Information

Technology—2.1% |

|

|

| Booz

Allen Hamilton, Inc. |

|

|

|

| 144A

3.875%, 9/1/28(2) |

195

|

|

179

|

| 144A

4.000%, 7/1/29(2) |

220

|

|

200

|

CommScope

Technologies LLC 144A

6.000%, 6/15/25(2) |

225

|

|

177

|

| Consensus

Cloud Solutions, Inc. |

|

|

|

| 144A

6.000%, 10/15/26(2) |

35

|

|

33

|

| 144A

6.500%, 10/15/28(2) |

55

|

|

50

|

Dell

International LLC

8.100%, 7/15/36 |

243

|

|

286

|

GTCR

W-2 Merger Sub LLC 144A

7.500%, 1/15/31(2) |

145

|

|

148

|

ION

Trading Technologies S.a.r.l. 144A

5.750%, 5/15/28(2) |

49

|

|

42

|

Kyndryl

Holdings, Inc.

3.150%, 10/15/31 |

180

|

|

143

|

Leidos,

Inc.

2.300%, 2/15/31 |

390

|

|

312

|

| |

Par

Value(1) |

|

Value

|

| |

|

|

|

Information

Technology—continued |

|

|

Oracle

Corp.

3.850%, 4/1/60 |

$ 185

|

|

$ 127

|

Viasat,

Inc. 144A

5.625%, 9/15/25(2) |

345

|

|

330

|

| |

|

|

2,027

|

| |

|

|

|

| |

| Materials—4.9%

|

|

|

ArcelorMittal

S.A.

6.800%, 11/29/32 |

210

|

|

216

|

ASP

Unifrax Holdings, Inc. 144A

5.250%, 9/30/28(2) |

455

|

|

313

|

Bayport

Polymers LLC 144A

5.140%, 4/14/32(2) |

370

|

|

336

|

Cleveland-Cliffs,

Inc. 144A

6.750%, 3/15/26(2) |

295

|

|

295

|

Corp.

Nacional del Cobre de Chile 144A

5.950%, 1/8/34(2) |

235

|

|

230

|

Glencore

Funding LLC 144A

2.850%, 4/27/31(2) |

340

|

|

279

|

Illuminate

Buyer LLC 144A

9.000%, 7/1/28(2) |

202

|

|

190

|

| INEOS

Quattro Finance 2 plc |

|

|

|

| 144A

3.375%, 1/15/26(2) |

147

|

|

138

|

| 144A

9.625%, 3/15/29(2) |

200

|

|

206

|

LSB

Industries, Inc. 144A

6.250%, 10/15/28(2) |

260

|

|

242

|

Mauser

Packaging Solutions Holding Co. 144A

7.875%, 8/15/26(2) |

145

|

|

144

|

New

Enterprise Stone & Lime Co., Inc. 144A

9.750%, 7/15/28(2) |

405

|

|

404

|

| OCP

S.A. |

|

|

|

| 144A

5.625%, 4/25/24(2) |

660

|

|

657

|

| 144A

3.750%, 6/23/31(2) |

200

|

|

165

|

Taseko

Mines Ltd. 144A

7.000%, 2/15/26(2) |

230

|

|

215

|

Teck

Resources Ltd.

6.125%, 10/1/35 |

270

|

|

269

|

See Notes to Financial Statements

Global Multi-Sector Income

Fund

SCHEDULE OF INVESTMENTS (Continued)

November 30, 2023

($ reported in

thousands)

| |

Par

Value(1) |

|

Value

|

| |

|

|

|

| Materials—continued

|

|

|

Trivium

Packaging Finance B.V. 144A

8.500%, 8/15/27(2) |

$ 259

|

|

$ 235

|

WR

Grace Holdings LLC 144A

5.625%, 8/15/29(2) |

172

|

|

145

|

| |

|

|

4,679

|

| |

|

|

|

| |

| Real

Estate—2.3% |

|

|

Ashton

Woods USA LLC 144A

4.625%, 4/1/30(2) |

340

|

|

284

|

| EPR

Properties |

|

|

|

| 4.750%,

12/15/26 |

260

|

|

245

|

| 3.600%,

11/15/31 |

95

|

|

74

|

| GLP

Capital LP |

|

|

|

| 3.250%,

1/15/32 |

132

|

|

106

|

| 6.750%,

12/1/33 |

135

|

|

136

|

Office

Properties Income Trust

4.500%, 2/1/25 |

575

|

|

512

|

Ontario

Teachers’ Cadillac Fairview Properties Trust 144A

2.500%, 10/15/31(2) |

285

|

|

222

|

Service

Properties Trust

4.500%, 3/15/25 |

290

|

|

280

|

| VICI

Properties LP |

|

|

|

| 4.950%,

2/15/30 |

110

|

|

102

|

| 5.125%,

5/15/32 |

185

|

|

170

|

| 144A

4.625%, 6/15/25(2) |

70

|

|

68

|

| |

|

|

2,199

|

| |

|

|

|

| |

| Utilities—4.9%

|

|

|

CMS

Energy Corp.

4.750%, 6/1/50 |

460

|

|

397

|

| Electricite

de France S.A. |

|

|

|

| 144A

6.250%, 5/23/33(2) |

345

|

|

356

|

| 144A

6.900%, 5/23/53(2) |

365

|

|

376

|

Enel

Finance International N.V. 144A

7.500%, 10/14/32(2) |

400

|

|

439

|

| |

Par

Value(1) |

|

Value

|

| |

|

|

|

| Utilities—continued

|

|

|

Eskom

Holdings SOC Ltd. 144A

7.125%, 2/11/25(2) |

$ 640

|

|

$

637 |

| Ferrellgas

LP |

|

|

|

| 144A

5.375%, 4/1/26(2) |

90

|

|

86

|

| 144A

5.875%, 4/1/29(2) |

170

|

|

156

|

KeySpan

Gas East Corp. 144A

5.994%, 3/6/33(2) |

255

|

|

250

|

NRG

Energy, Inc. 144A

7.000%, 3/15/33(2) |

320

|

|

324

|

Perusahaan

Perseroan Persero PT Perusahaan Listrik Negara 144A

4.125%, 5/15/27(2) |

950

|

|

911

|

Southern

Co. (The) Series 21-A

3.750%, 9/15/51 |

490

|

|

429

|

Sunnova

Energy Corp. 144A

5.875%, 9/1/26(2) |

240

|

|

195

|

Vistra

Corp. 144A

8.000% (2)(6) |

125

|

|

122

|

| |

|

|

4,678

|

Total

Corporate Bonds and Notes

(Identified Cost $72,951) |

|

65,957

|

| |

|

|

|

| |

| Leveraged

Loans—13.5% |

| Aerospace—1.0%

|

|

|

Amentum

Government Services Holdings LLC (1 month Term SOFR + 4.000%)

9.331%, 2/15/29(5) |

128

|

|

128

|

Brown

Group Holding LLC (1 month Term SOFR + 2.850%)

8.198%, 6/7/28(5) |

162

|

|

161

|

See Notes to Financial Statements

Global Multi-Sector Income

Fund

SCHEDULE OF INVESTMENTS (Continued)

November 30, 2023

($ reported in

thousands)

| |

Par

Value(1) |

|

Value

|

| |

|

|

|

| Aerospace—continued

|

|

|

| Dynasty

Acquisition Co., Inc. |

|

|

|

2023,

Tranche B-1 (1 month Term SOFR + 4.000%)

9.348%, 8/24/28(5) |

$ 128

|

|

$ 128

|

2023,

Tranche B-2 (1 month Term SOFR + 4.000%)

9.348%, 8/24/28(5) |

55

|

|

55

|

Kestrel

Bidco, Inc. (1 month Term SOFR + 3.100%)

8.443%, 12/11/26(5) |

149

|

|

146

|

Mileage

Plus Holdings LLC (3 month Term SOFR + 5.400%)

10.798%, 6/21/27(5) |

184

|

|

189

|

Peraton

Corp. Tranche B, First Lien (1 month Term SOFR + 3.850%)

9.198%, 2/1/28(5) |

147

|

|

145

|

Transdigm,

Inc. Tranche J (1 month Term SOFR + 3.250%)

0.000%, 2/14/31(5)(10) |

25

|

|

25

|

| |

|

|

977

|

| |

|

|

|

| |

| Chemicals—0.3%

|

|

|

LSF11

A5 Holdco LLC (1 month Term SOFR + 4.350%)

9.698%, 10/15/28(5) |

150

|

|

148

|

Nouryon

Finance B.V. (3 month Term SOFR + 4.100%)

9.467%, 4/3/28(5) |

60

|

|

60

|

Windsor

Holdings III LLC Tranche B (1 month Term SOFR + 4.500%)

9.820%, 8/1/30(5) |

125

|

|

125

|

| |

|

|

333

|

| |

|

|

|

| |

| |

Par

Value(1) |

|

Value

|

| |

|

|

|

| Consumer

Non-Durables—0.6% |

|

|

AI

Aqua Merger Sub, Inc. 2023

0.000%, 7/31/28(5)(10) |

$ 138

|

|

$ 137

|

DS

Parent, Inc. Tranche B (6 month Term SOFR + 6.000%)

11.337%, 12/8/28(5) |

169

|

|

168

|

Kronos

Acquisition Holdings, Inc. Tranche B-1 (3 month Term SOFR + 4.012%)

9.402%, 12/22/26(5) |

294

|

|

291

|

| |

|

|

596

|

| |

|

|

|

| |

| Energy—0.8%

|

|

|

GIP

Pilot Acquisition Partners LP (3 month Term SOFR + 3.000%)

8.388%, 10/4/30(5) |

40

|

|

40

|

Hamilton

Projects Acquiror LLC (1 month Term SOFR + 4.614%)

9.963%, 6/17/27(5) |

157

|

|

158

|

Medallion

Midland Acquisition LLC (3 month Term SOFR + 4.012%)

9.402%, 10/18/28(5) |

156

|

|

156

|

Oryx

Midstream Services Permian Basin LLC 2023 (1 month Term SOFR + 3.364%)

8.694% - 8.710%, 10/5/28(5) |

138

|

|

138

|

Traverse

Midstream Partners LLC 2023, Tranche B (3 month Term SOFR + 3.850%)

9.240%, 2/16/28(5) |

293

|

|

292

|

| |

|

|

784

|

| |

|

|

|

| |

See Notes to Financial Statements

Global Multi-Sector Income

Fund

SCHEDULE OF INVESTMENTS (Continued)

November 30, 2023

($ reported in

thousands)

| |

Par

Value(1) |

|

Value

|

| |

|

|

|

| Financials—0.6%

|

|

|

Acrisure

LLC 2023 (3 month Term SOFR + 4.500%)

9.888%, 10/18/30(5) |

$ 100

|

|

$ 100

|

| AssuredPartners,

Inc. |

|

|

|

2020

(1 month Term SOFR + 3.614%)

0.000%, 2/12/27(5)(10) |

135

|

|

135

|

2023

(1 month Term SOFR + 3.750%)

9.098%, 2/12/27(5) |

20

|

|

20

|

Asurion

LLC Tranche B-9 (1 month Term SOFR + 3.364%)

8.713%, 7/31/27(5) |

135

|

|

132

|

Blackhawk

Network Holdings, Inc. First Lien (3 month Term SOFR + 2.750%)

8.138%, 6/15/25(5) |

152

|

|

151

|

| |

|

|

538

|

| |

|

|

|

| |

| Food

/ Tobacco—1.3% |

|

|

Del

Monte Foods, Inc. (1 month Term SOFR + 4.350% - 3 month PRIME + 3.250%)

9.698% - 11.750%, 5/16/29(5) |

144

|

|

142

|

Froneri

U.S., Inc. Tranche B-2 (1 month Term SOFR + 2.350%)

7.698%, 1/29/27(5) |

224

|

|

223

|

Naked

Juice LLC (3 month Term SOFR + 3.350%)

8.740%, 1/24/29(5) |

233

|

|

218

|

Pegasus

Bidco B.V. Tranche B-2 (3 month Term SOFR + 4.250%)

9.630%, 7/12/29(5) |

119

|

|

119

|

Shearer’s

Foods LLC First Lien (1 month Term SOFR + 3.614%)

8.963%, 9/23/27(5) |

149

|

|

149

|

| |

Par

Value(1) |

|

Value

|

| |

|

|

|

| Food

/ Tobacco—continued |

|

|

Sigma

Bidco B.V. Tranche B-7 (1 month Term SOFR + 3.000%)

0.000%, 1/2/28(5)(10) |

$ 279

|

|

$ 270

|

Triton

Water Holdings, Inc. First Lien (3 month Term SOFR + 3.512%)

8.902%, 3/31/28(5) |

140

|

|

138

|

| |

|

|

1,259

|

| |

|

|

|

| |

| Forest

Prod / Containers—0.1% |

|

|

TricorBraun,

Inc. (1 month Term SOFR + 3.364%)

8.713%, 3/3/28(5) |

136

|

|

133

|

| Gaming

/ Leisure—0.4% |

|

|

ECL

Entertainment LLC Tranche B (3 month Term SOFR + 4.750%)

10.140%, 9/3/30(5) |

155

|

|

154

|

Ontario

Gaming GTA Ltd. Partnership Tranche B (3 month Term SOFR + 4.250%)

9.640%, 8/1/30(5) |

60

|

|

60

|

Playa

Hotels & Resorts B.V. (1 month Term SOFR + 4.250%)

9.580%, 1/5/29(5) |

146

|

|

146

|

| |

|

|

360

|

| |

|

|

|