- 2014 revenues up 8 percent to $12.3

billion

- 2014 gross margin up 70 basis points

to 48.8 percent

- 2014 adjusted EPS, excluding a $396

million pre-tax noncash impairment charge, was up 14 percent to

$3.08 ($2.38 on a GAAP basis)

- 2015 currency neutral revenues

expected to increase 8 percent (up 3 percent reported)

- 2015 gross margin expected to reach

49.2 percent; net of an anticipated 30 basis points of negative

impact from changes in foreign currency

- 2015 currency neutral EPS expected

to increase 12 percent (up 4 percent reported) compared to adjusted

EPS of $3.08 in 2014

- Expect to return more than $1.2

billion to shareholders in 2015 through share repurchases and

dividends

VF Corporation (NYSE: VFC) today reported financial results for

its fourth quarter and full year ended January 3, 2015. All per

share amounts are presented on a diluted basis. Discussions in this

release that refer to “adjusted”, “currency neutral” and “reported”

amounts are described under the “Adjusted Amounts – Excluding

Noncash Impairment Charge” and “Currency Neutral – Excluding the

Impact of Foreign Currency” paragraphs that follow. Reconciliations

of GAAP measures to adjusted and currency neutral amounts are

presented in the supplemental financial information included with

this release, which identifies and quantifies all excluded

items.

“Our powerful brands and the competitive advantage of our

business platforms combined with our relentless focus on

operational excellence delivered another year of strong returns for

our shareholders,” said Eric Wiseman, VF Chairman, President and

Chief Executive Officer. “Our four largest brands: The North Face®,

Vans®, Timberland®, and Wrangler®, along with many of our other

brands, were strong performers as we grew our business in every

region and channel around the world.

“We are very pleased to report that Vans® passed the $2 billion

dollar mark in 2014 to become VF’s second $2 billion brand along

with The North Face®,” Wiseman continued. “As we end the second

year of our five-year plan we’re on track with our 2017

targets.”

Fourth Quarter 2014 Review

- Revenues rose 9 percent to $3.6

billion driven by strong growth in our Outdoor & Action Sports

coalition and our international and direct-to-consumer businesses.

On a currency neutral basis, revenues increased 11 percent over the

2013 quarter. VF uses a 52/53 week fiscal year and the fourth

quarter of 2014 included a 53rd week, which added approximately

$100 million in revenue, representing about 3 percentage points of

growth.

- Gross margin improved 80 basis

points to a record 49 percent driven primarily by the continuing

shift of our revenue mix toward higher margin businesses.

- A $396 million pre-tax, noncash

impairment charge ($0.70 per share) was recorded to reduce the

carrying value of the goodwill and intangible assets related to our

7 For All Mankind®, Ella Moss® and Splendid® brands.

- SG&A as a percent of

revenues was up 20 basis points to 32.9 percent.

- Operating income on an adjusted

basis grew 14 percent to $578 million in the fourth quarter,

compared with $508 million in the same period of 2013. On a GAAP

basis, fourth quarter operating income was $182 million. Adjusted

operating margin improved to 16.2 percent, compared with

15.5 percent in the fourth quarter of 2013. On a GAAP basis,

operating margin was 5.1 percent in 2014.

- Adjusted earnings per share

increased 20 percent to $0.98 per share compared with $0.82 per

share during the same period last year. On a GAAP basis, earnings

per share were $0.28.

Full Year 2014 Review

- Revenues increased 8 percent to

a record $12.3 billion, compared with $11.4 billion in 2013, driven

by continued strength in our Outdoor & Action Sports coalition,

and our international and direct-to-consumer businesses. On a

currency neutral basis, revenue increased 8 percent for the year.

Inclusion of the 53rd week, as previously noted, added

approximately 1 percentage point of growth in 2014.

- Gross margin improved 70 basis

points to a record 48.8 percent, compared with 48.1 percent in

2013. For the full year, the improvement in gross margin reflects

the continued shift in our revenue mix toward higher margin

businesses as well as our previously disclosed change in

classification of retail concession fees.

- SG&A as a percent of full

year revenues was up 30 basis points to 33.9 percent. This increase

was primarily due to the change in classification of retail

concession fees.

- Operating income on an adjusted

basis grew 11 percent to $1.8 billion, compared with $1.6 billion

in 2013. On a GAAP basis, full year operating income was $1.4

billion in 2014. Adjusted operating margin was 14.9 percent

in 2014, compared with 14.4 percent in 2013. On a GAAP basis,

operating margin was 11.7 percent in 2014.

- Adjusted earnings per share

increased 14 percent to $3.08 per share compared with $2.71 per

share in 2013. On a GAAP basis, full year earnings per share were

$2.38.

Coalition Review

Fourth quarter revenues for the Outdoor & Action

Sports coalition increased 13 percent (up 16 percent currency

neutral) to $2.2 billion. Full year Outdoor & Action Sports

revenues increased 13 percent in 2014 (up 14 percent currency

neutral).

Fourth quarter revenues for The North Face® brand rose 12

percent (up 14 percent currency neutral) including a 30 percent

increase in direct-to-consumer sales. By region, The North Face®

brand’s revenues were up at a mid-teen percentage rate in the

Americas, up more than 25 percent in Asia Pacific and down at a mid

single-digit rate in Europe (up at a low single-digit rate currency

neutral). For the full year, revenues for The North Face® brand

grew 11 percent (up 12 percent currency neutral) to reach $2.3

billion.

Revenues for the Vans® brand in the fourth quarter were up 17

percent (up 20 percent currency neutral) with 30 percent growth in

its direct-to-consumer channel and strong wholesale growth.

Revenues in the Americas region were up 20 percent in the quarter,

up more than 50 percent in the Asia Pacific region and down

slightly in Europe due to the changes in foreign currency. On a

currency neutral basis, Vans® brand revenues in Europe were up at a

high single-digit rate in the quarter. Revenues for the Vans® brand

for the full year were up 17 percent, firmly establishing its place

as VF’s second $2 billion brand.

Revenues for the Timberland® brand were up 11 percent (up 15

percent currency neutral) in the fourth quarter driven by balanced

wholesale and direct-to-consumer gains. In the Americas region,

revenues were up nearly 25 percent driven by significant wholesale

growth and strong direct-to-consumer sales. In Asia Pacific, fourth

quarter revenues were up at a mid single-digit percentage rate (up

at a low double-digit rate currency neutral). And in Europe, the

Timberland® brand was down at a low single-digit rate (up at a mid

single-digit rate currency neutral). Full year Timberland® brand

revenues were up 13 percent to $1.8 billion, or an increase of 15

percent on a currency neutral basis.

Fourth quarter operating income for Outdoor & Action Sports

rose 21 percent to $432 million. Operating margin increased 130

basis points to 20 percent in the quarter and improved for the full

year by 90 basis points to 18.2 percent.

Jeanswear fourth quarter revenues were up 3 percent (up 5

percent currency neutral) to $755 million. As anticipated, revenue

comparisons for the Americas region improved with sales up at a low

single-digit rate (up mid single-digit currency neutral). In

Europe, revenues were up at a low single-digit rate (up 10 percent

currency neutral) and in Asia, revenues were up at a mid

single-digit rate. In 2014, global Jeanswear revenues were flat at

$2.8 billion (up 1 percent currency neutral).

Fourth quarter global revenues for the Wrangler® brand were up 3

percent (up 6 percent currency neutral) driven by strength in the

Americas region, including a low-teen increase in its western

specialty business and low single-digit growth in the U.S. mass

channel. Wrangler® brand revenues in Europe were down 4 percent (up

5 percent currency neutral) and down slightly in Asia Pacific. Full

year revenues for the Wrangler® brand increased 2 percent (up 4

percent currency neutral) to reach $1.7 billion.

Global revenues for the Lee® brand in the fourth quarter were up

2 percent (up 5 percent currency neutral) driven by a high

single-digit percentage increase in Asia Pacific and a high

single-digit percentage increase in Europe (up at a high teen rate

currency neutral). This was offset by flat results in the Americas

region where the business continues to work through ongoing

challenges in the U.S. mid-tier channel. For the full year, global

Lee® brand revenues were down 2 percent (down 1 percent currency

neutral) at $1.0 billion.

Operating income for Jeanswear in the fourth quarter rose 5

percent to $142 million. Operating margin increased 40 basis points

to 18.7 percent in the quarter, and was down 60 basis points for

the full year to 18.8 percent due to challenges primarily related

to the U.S. business.

Imagewear revenues were up 4 percent (up 5 percent

currency neutral) in the fourth quarter to $298 million driven by

particular strength in the Licensed Sports Group (LSG) business.

For the full year, revenues for the Imagewear coalition were up 4

percent to $1.1 billion including growth in both the Image business

driven by new product introductions in our Red Kap® and Bulwark®

brands and the LSG business, which had strong demand for National

Football League® and Major League Baseball® products.

Fourth quarter operating income for Imagewear was up 8 percent

to $48 million, with a 60 basis point improvement in operating

margin to 16.2 percent. For the full year, Imagewear operating

margin improved 60 basis points to 14.9 percent.

Sportswear fourth quarter revenues increased 4 percent to

$215 million. Nautica® brand revenues were flat with a low-teen

percentage rate increase in the direct-to-consumer business being

offset by a high single-digit decline in wholesale sales. The

Kipling® brand’s U.S. business achieved a 25 percent increase in

revenues compared with the same period last year. For the year,

Sportswear coalition revenues were up 4 percent. Globally, the

Kipling® brand grew 13 percent in the fourth quarter, up 18 percent

currency neutral.

In the fourth quarter, operating income decreased 10 percent to

$32 million with a 220 basis point decline in operating margin to

15 percent. 2014 operating margin for the Sportswear coalition

declined by 210 basis points to 12 percent, impacted by a

challenging environment in the U.S. department store channel.

Contemporary Brands coalition fourth quarter revenues

were down 1 percent (up 1 percent currency neutral), to $107

million, reflecting continuing challenging consumer trends in

women’s contemporary apparel and premium denim.

International Review

International revenues in the fourth quarter grew 5 percent, or

13 percent on a currency neutral basis. Revenues in Europe were

down 1 percent (up 8 percent currency neutral) and in the Asia

Pacific region were up 17 percent (up 20 percent currency neutral),

including 20 percent growth in China. Revenues in the Americas

(non-U.S.) region were up 9 percent (up 19 percent currency

neutral). International revenues were 33 percent of total VF fourth

quarter sales compared with 34 percent in the same period of 2013.

For the full year, international revenues represented 38 percent of

total VF sales, the same as in fiscal 2013.

Direct-to-Consumer Review

Direct-to-consumer revenues grew 22 percent (up 25 percent

currency neutral) in the fourth quarter with strong double-digit

increases in all regions of the world and growth in every VF brand

with a retail format. Seventy-five stores were opened during the

fourth quarter bringing the total number of VF owned retail stores

to 1,401. As previously discussed, effective in 2014, VF now

includes revenues from its concession locations in its

direct-to-consumer business. Direct-to-consumer revenues reached 32

percent of total revenues in the fourth quarter compared with 29

percent in the 2013 period (27 percent prior to the concession

classification change). Direct-to-consumer revenues were 26 percent

of total VF revenues in 2014 compared with 24 percent in 2013 (22

percent prior to the concession classification change). References

to direct-to-consumer and wholesale revenue growth rates reflect

the change in reporting of concessions in all periods.

Balance Sheet Review

Inventories were up 6 percent compared with December 2013

levels. In 2014, VF’s cash generation from operations reached

nearly $1.7 billion and the company returned over $1.2 billion to

shareholders through dividends and share repurchases.

Adjusted Amounts – Excluding Noncash Impairment

Charge

As a result of our annual review of goodwill and intangible

assets, we recorded a $396 million pre-tax, noncash impairment

charge in the fourth quarter of 2014 to reduce the carrying value

of the goodwill and intangible assets related to our 7 For All

Mankind®, Ella Moss® and Splendid® brands. On an after-tax basis,

the charge totaled $307 million, which decreased fourth quarter and

full year 2014 earnings per share by $0.70. While management

continues to view these brands as compelling and complementary

within the context of VF’s portfolio, it concluded that an

impairment charge was required because the fair values of these

brands were below their respective carrying values. All “adjusted

amounts” referenced herein exclude the effects of this noncash

impairment charge. Reconciliations of GAAP measures to adjusted

amounts for 2014 are presented in the supplemental financial

information included with this release, which identify and quantify

all excluded items.

Currency Neutral – Excluding the Impact of Foreign

Currency

This release refers to “currency neutral”’ amounts. In 2014,

currency neutral amounts only exclude the impact of translating

foreign currencies into U.S. dollars. The net impact of foreign

currency fluctuations on non-U.S. dollar denominated transactions

in 2014 was not material compared to 2013. Reconciliations of GAAP

measures to currency neutral amounts for 2014 are presented in the

supplemental financial information included with this release,

which identify and quantify all excluded items.

Currency neutral amounts for 2015 exclude both the expected

impact of translating foreign currencies into U.S. dollars and the

expected impact of foreign currency rate changes on non-U.S. dollar

denominated transactions. The “transactional” impact from foreign

currency fluctuations is considered in 2015 currency neutral

amounts due to the recent and rapid strengthening of the U.S.

dollar. This release also refers to “reported” amounts in 2015,

which include translation and transactional impacts from foreign

currency based on current estimates of foreign currency exchange

rates.

2015 Outlook

“2015 will be another great year for VF. Our fundamentals have

never been stronger and despite the strength of the U.S. dollar,

which will continue to pressure our reported results, we expect

meaningful growth in every region around the world,” Wiseman

continued. “Our consistent and proven, powerful-brand,

powerful-platform approach to business gives me tremendous

confidence in our ability to further increase competitive

separation for our brands and provide sustainable, long-term

returns for our shareholders.”

Key points related to VF’s full year 2015 outlook include:

- Revenue is expected to increase

by 8 percent on a currency neutral basis (up 3 percent reported).

Revenues for the Outdoor & Action Sports coalition,

including The North Face®, Vans® and Timberland® brands, are

expected to increase at a low double-digit percentage rate currency

neutral (up mid single-digit reported). Imagewear and

Sportswear coalition revenues are expected to grow at a mid

single-digit rate. Jeanswear is expected to grow at a low

single-digit rate and Contemporary Brands revenues are

expected to be nearly flat on a currency neutral basis (down at a

mid single-digit reported rate).

- International revenues are

expected to increase at a low double-digit rate on a currency

neutral basis (up low single-digit reported). Revenues for Europe,

which represents less than a quarter of VF’s total sales, are

expected to be up at a high single-digit rate currency neutral

(down at a mid single-digit rate reported). In the Asia Pacific

region, which is about 10 percent of VF’s total sales, full year

revenues are expected to increase at a mid to high-teen percentage

rate. And in the Americas (non-U.S.) region, which is a little more

than 5 percent of VF’s total sales, revenues are expected to be up

at a mid-teen percentage rate currency neutral (up mid single-digit

reported). International revenues should approximate 37 percent of

total revenues in 2015.

- Direct-to-consumer revenues are

expected to grow at a mid-teen percentage rate currency neutral (up

at a low double-digit percentage rate reported) in 2015 and should

represent about 28 percent of total VF revenues. Direct-to-consumer

growth in 2015 will be driven by approximately 150 store openings,

comp store growth and an expected increase of more than 30 percent

in e-commerce revenues.

- Gross margin is expected to

improve by 40 basis points to reach 49.2 percent, which includes a

30 basis point headwind from changes in foreign currency.

- Operating margin is expected to

reach 15.0 percent, including the negative impact of changes in

foreign currency.

- Earnings per share, on a

currency neutral basis, is expected to increase 12 percent (up 4%

reported) compared to an adjusted EPS of $3.08 in 2014.

- Cash flow from operations should

reach $1.3 billion. The year over year comparison is impacted by a

$250 million contribution to fully fund the company’s U.S. pension

plan made in the first quarter of 2015, the significant cash

received in the 53rd week of 2014 and the negative impact of

changes in foreign currency.

- VF expects to spend approximately $700

million under the company’s share repurchase program; when

combined with the annual dividend, this will return more

than $1.2 billion to shareholders in 2015.

- Other full year assumptions include a

24 percent effective tax rate and capital

expenditures of approximately $225 million.

In terms of revenue comparisons in 2015, on a currency neutral

basis, we expect relatively consistent growth comparisons

quarter-by-quarter throughout the year. Due to the rapid

strengthening of the U.S. dollar in the second half of 2014,

reported revenue comparisons in the second half of 2015 will be

slightly stronger than in the first half.

In terms of earnings cadence in 2015, the negative impact of

currency movements is more pronounced in the first half of the

year, especially in the first quarter when foreign currencies in

2014 were at their strongest level against the U.S. dollar and our

international business mix is particularly high.

Dividend Declared

VF’s Board of Directors declared a quarterly dividend of $0.32

per share, payable on March 20, 2015 to shareholders of record on

March 10, 2015.

Webcast Information

VF will hold its fourth quarter conference call and webcast

today at 8:30 a.m. Eastern Time. Interested parties should call

(888) 240-9334 (domestic) or (913) 312-0381 (international) to

access the call. The conference call will be broadcast live and

accessible at www.vfc.com. A replay of the conference call will be

available from Feb. 13 through Feb. 20, 2015, via telephone at

877-870-5176 (access code: 9238359) or at www.vfc.com.

About VF

VF Corporation (NYSE: VFC) is a global leader in the design,

manufacture, marketing and distribution of branded lifestyle

apparel, footwear and accessories. The company’s highly diversified

portfolio of 30 powerful brands spans numerous geographies, product

categories, consumer demographics and sales channels, giving VF a

unique industry position and the ability to create sustainable,

long-term growth for our customers and shareholders. The company’s

largest brands are The North Face®, Vans®, Timberland®,

Wrangler®, Lee® and Nautica®. For more information,

visit www.vfc.com.

Forward Looking Statements

Certain statements included in this release and the attachments

are "forward-looking statements" within the meaning of the federal

securities laws. Forward-looking statements are made based on our

expectations and beliefs concerning future events impacting VF and

therefore involve a number of risks and uncertainties. You can

identify these statements by the fact that they use words such as

“will,” “anticipate,” “estimate,” “expect,” “should,” and “may” and

other words and terms of similar meaning or use of future dates. We

caution that forward-looking statements are not guarantees and that

actual results could differ materially from those expressed or

implied in the forward-looking statements. Potential risks and

uncertainties that could cause the actual results of operations or

financial condition of VF to differ materially from those expressed

or implied by forward-looking statements in this release include,

but are not limited to, the level of consumer demand for apparel,

footwear and accessories; disruption to VF’s distribution system;

VF's reliance on a small number of large customers; the financial

strength of VF's customers; VF's ability to implement its growth

strategy; VF's ability to grow its international and

direct-to-consumer businesses; VF and its customers’ ability to

maintain the strength and security of information technology

systems; stability of VF's manufacturing facilities and foreign

suppliers; continued use by VF's suppliers of ethical business

practices; VF's ability to protect trademarks and other

intellectual property rights; possible goodwill and other asset

impairment; foreign currency fluctuations; changes in tax

liabilities, and legal, regulatory, political and economic risks in

international markets. More information on potential factors that

could affect VF's financial results is included from time to time

in VF's public reports filed with the Securities and Exchange

Commission, including VF's Annual Report on Form 10-K and Quarterly

Reports on Form 10-Q.

VF CORPORATION

Condensed Consolidated Statements of

Income

(Unaudited)

(In thousands, except per share

amounts)

Three Months Ended December %

Twelve Months Ended December % 2014

2013 Change 2014 2013 Change

Net sales $ 3,544,263 $ 3,258,712 9% $ 12,154,784 $

11,302,350 8%

Royalty income 34,597 31,387 10%

127,377 117,298 9%

Total revenues

3,578,860 3,290,099 9% 12,282,161

11,419,648 8%

Costs and operating expenses Cost of

goods sold 1,823,625 1,704,690 7% 6,288,190 5,931,469 6% Selling,

general and administrative expenses 1,177,229 1,077,027 9%

4,159,885 3,841,032 8% Impairment of goodwill and intangible assets

396,362 - 396,362 - 3,397,216

2,781,717 22% 10,844,437 9,772,501 11%

Operating income 181,644 508,382 (64%) 1,437,724 1,647,147

(13%) Interest, net (19,986) (19,408) (3%) (79,814) (80,632)

1% Other income (expense), net (1,335) (2,302) 42%

(5,544) (4,025) (38%)

Income before income

taxes 160,323 486,672 (67%) 1,352,366 1,562,490 (13%)

Income taxes 38,222 119,005 (68%)

304,861 352,371 (13%)

Net income $ 122,101 $

367,667 (67%) $ 1,047,505 $ 1,210,119 (13%)

Earnings per

common share Basic $ 0.28 $ 0.84 (66%) $ 2.42 $ 2.76 (12%)

Diluted $ 0.28 $ 0.82 (66%) $ 2.38 $ 2.71 (12%)

Weighted

average shares outstanding Basic 431,645 439,023 432,611

438,657 Diluted 439,695 447,746 440,153 446,809

Cash

dividends per common share $ 0.3200 $ 0.2625 22% $ 1.1075 $

0.9150 21%

Basis of presentation: VF operates and

reports using a 52/53 week fiscal year ending on the Saturday

closest to December 31 of each year. Similarly, the fiscal fourth

quarter ends on the Saturday closest to December 31. For

presentation purposes herein, all references to the period ended

December 2014 relate to the 14 week and 53 week fiscal periods

ended January 3, 2015, and all references to the period ended

December 2013 relate to the 13 week and 52 week fiscal periods

ended December 28, 2013.

VF CORPORATION

Condensed Consolidated Balance

Sheets

(Unaudited)

(In thousands)

December December 2014

2013 ASSETS Current assets Cash and

equivalents $ 971,895 $ 776,403 Accounts receivable, net 1,276,224

1,360,443 Inventories 1,482,804 1,399,062 Other current assets

454,931 347,074 Total current assets 4,185,854

3,882,982

Property, plant and equipment 942,181

932,792

Intangible assets 2,433,552 2,960,201

Goodwill 1,824,956 2,021,750

Other assets

593,597 517,718 Total assets $ 9,980,140 $ 10,315,443

LIABILITIES AND STOCKHOLDERS' EQUITY Current

liabilities Short-term borrowings $ 21,822 $ 18,810 Current

portion of long-term debt 3,975 5,167 Accounts payable 690,842

638,732 Accrued liabilities 903,602 905,292 Total

current liabilities 1,620,241 1,568,001

Long-term

debt 1,423,581 1,426,829

Other liabilities 1,305,436

1,243,575

Stockholders' equity 5,630,882

6,077,038 Total liabilities and stockholders' equity $

9,980,140 $ 10,315,443

VF CORPORATION

Condensed Consolidated Statements of

Cash Flows

(Unaudited)

(In thousands)

Twelve Months Ended December 2014

2013 Operating activities Net

income $ 1,047,505 $ 1,210,119 Impairment of goodwill and

intangible assets 396,362 - Depreciation and amortization 274,883

253,273 Other noncash adjustments to net income 18,299 76,708

Changes in operating assets and liabilities (39,420 )

(34,059 ) Cash provided by operating activities 1,697,629 1,506,041

Investing activities Capital expenditures (234,077 )

(271,153 ) Software purchases (67,943 ) (53,989 ) Other, net

(27,235 ) (25,131 ) Cash used by investing activities

(329,255 ) (350,273 )

Financing activities Net

increase in short-term borrowings 4,761 9,032 Payments on long-term

debt (4,760 ) (404,872 ) Purchases of treasury stock (727,795 )

(282,024 ) Cash dividends paid (478,933 ) (402,136 ) Net impact of

stock issuance 99,306 96,169 Cash used

by financing activities (1,107,421 ) (983,831 )

Effect of

foreign currency rate changes on cash and equivalents

(65,461 ) 7,005

Net change in cash and

equivalents 195,492 178,942

Cash and equivalents -

beginning of year 776,403 597,461

Cash and equivalents - end of year $ 971,895 $

776,403

VF CORPORATION

Supplemental Financial

Information

Business Segment Information

(Unaudited)

(In thousands)

Three Months Ended December %

Twelve Months Ended December % 2014

2013 Change 2014 2013 Change

Coalition revenues Outdoor & Action Sports $

2,164,324 $ 1,919,322 13% $ 7,198,994 $ 6,379,167 13% Jeanswear

755,140 734,075 3% 2,801,754 2,810,994 0% Imagewear 298,305 286,888

4% 1,104,038 1,065,952 4% Sportswear 215,154 207,774 4% 650,203

624,693 4% Contemporary Brands 106,694 107,714 (1%) 400,431 415,053

(4%) Other 39,243 34,326 14% 126,741

123,789 2% Total coalition revenues $ 3,578,860 $ 3,290,099

9% $ 12,282,161 $ 11,419,648 8%

Coalition

profit Outdoor & Action Sports $ 432,345 $ 358,247 21% $

1,312,963 $ 1,106,384 19% Jeanswear 141,571 134,331 5% 527,972

544,882 (3%) Imagewear 48,408 44,860 8% 164,352 152,203 8%

Sportswear 32,171 35,676 (10%) 77,972 88,157 (12%) Contemporary

Brands 1,809 8,915 (80%) 23,420 38,825 (40%) Other (603)

1,633 (137%) (2,600) (562) (363%) Total

coalition profit 655,701 583,662 12% 2,104,079 1,929,889 9%

Impairment of goodwill and intangible assets (396,362) -

(396,362) -

Corporate and other expenses (79,030) (77,582)

(2%) (275,537) (286,767) 4%

Interest, net (19,986)

(19,408) (3%) (79,814) (80,632) 1%

Income before income taxes $ 160,323 $ 486,672 (67%) $

1,352,366 $ 1,562,490 (13%)

VF CORPORATION

Supplemental Financial

Information

Business Segment Information – Currency

Neutral Basis

(Unaudited)

(In thousands)

Three Months Ended December 2014 Exclude As

Reported Impact of Foreign under GAAP Currency

Exchange Currency Neutral Coalition

revenues Outdoor & Action Sports $ 2,164,324 $ (65,371 ) $

2,229,695 Jeanswear 755,140 (17,956 ) 773,096 Imagewear 298,305

(1,611 ) 299,916 Sportswear 215,154 - 215,154 Contemporary Brands

106,694 (2,285 ) 108,979 Other 39,243 -

39,243 Total coalition revenues $ 3,578,860

$ (87,223 ) $ 3,666,083

Coalition

profit Outdoor & Action Sports $ 432,345 $ (12,979 ) $

445,324 Jeanswear 141,571 (155 ) 141,726 Imagewear 48,408 (285 )

48,693 Sportswear 32,171 - 32,171 Contemporary Brands 1,809 (32 )

1,841 Other (603 ) - (603 )

Total coalition profit 655,701 (13,451 ) 669,152

Impairment of goodwill and intangible assets (396,362 ) -

(396,362 )

Corporate and other expenses (79,030 ) - (79,030

)

Interest, net (19,986 ) -

(19,986 )

Income before income taxes $ 160,323

$ (13,451 ) $ 173,774

Currency Neutral Financial

Information VF is a global company that reports financial

information in U.S. dollars in accordance with generally accepted

accounting principles. Foreign currency exchange rate fluctuations

affect the amounts reported by VF from translating its foreign

revenues and expenses into U.S. dollars. These rate fluctuations

can have a significant effect on reported operating results. As a

supplement to our reported operating results, we present currency

neutral financial information, which is a non-GAAP financial

measure. We use currency neutral information to provide a framework

to assess how our business performed excluding the effects of

changes in foreign currency translation rates. Management believes

this information is useful to investors to facilitate comparison of

operating results and better identify trends in our businesses.

To calculate coalition revenues and profits on a currency

neutral basis, operating results for the current year period for

entities reporting in currencies other than the U.S. dollar are

translated into U.S. dollars at the average exchange rates in

effect during the comparable period of the prior year (rather than

the actual exchange rates in effect during the current year

period). These currency neutral performance measures should

be viewed in addition to, and not in lieu of or superior to, our

operating performance measures calculated in accordance with GAAP.

The currency neutral information presented may not be comparable to

similarly titled measures reported by other companies.

VF CORPORATION

Supplemental Financial

Information

Business Segment Information – Currency

Neutral Basis

(Unaudited)

(In thousands)

Twelve Months Ended December 2014 Exclude

As Reported Impact of Foreign under GAAP

Currency Exchange Currency Neutral

Coalition revenues Outdoor & Action Sports $ 7,198,994

(43,075 ) $ 7,242,069 Jeanswear 2,801,754 (43,013 ) 2,844,767

Imagewear 1,104,038 (4,267 ) 1,108,305 Sportswear 650,203 - 650,203

Contemporary Brands 400,431 (250 ) 400,681 Other 126,741

- 126,741 Total coalition

revenues $ 12,282,161 $ (90,605 ) $ 12,372,766

Coalition profit Outdoor & Action Sports $ 1,312,963 $

(12,446 ) $ 1,325,409 Jeanswear 527,972 (151 ) 528,123 Imagewear

164,352 (877 ) 165,229 Sportswear 77,972 - 77,972 Contemporary

Brands 23,420 82 23,338 Other (2,600 ) -

(2,600 ) Total coalition profit 2,104,079 (13,392 )

2,117,471

Impairment of goodwill and intangible

assets (396,362 ) - (396,362 )

Corporate and other

expenses (275,537 ) - (275,537 )

Interest, net

(79,814 ) - (79,814 )

Income before

income taxes $ 1,352,366 $ (13,392 ) $ 1,365,758

Currency Neutral Financial Information VF is a global

company that reports financial information in U.S. dollars in

accordance with generally accepted accounting principles. Foreign

currency exchange rate fluctuations affect the amounts reported by

VF from translating its foreign revenues and expenses into U.S.

dollars. These rate fluctuations can have a significant effect on

reported operating results. As a supplement to our reported

operating results, we present currency neutral financial

information, which is a non-GAAP financial measure. We use currency

neutral information to provide a framework to assess how our

business performed excluding the effects of changes in foreign

currency translation rates. Management believes this information is

useful to investors to facilitate comparison of operating results

and better identify trends in our businesses. To calculate

coalition revenues and profits on a currency neutral basis,

operating results for the current year period for entities

reporting in currencies other than the U.S. dollar are translated

into U.S. dollars at the average exchange rates in effect during

the comparable period of the prior year (rather than the actual

exchange rates in effect during the current year period).

These currency neutral performance measures should be viewed in

addition to, and not in lieu of or superior to, our operating

performance measures calculated in accordance with GAAP. The

currency neutral information presented may not be comparable to

similarly titled measures reported by other companies.

VF CORPORATION

Supplemental Financial

Information

Reconciliation of Select GAAP Measures

to Non-GAAP Measures

(Unaudited)

(In thousands, except per share

amounts)

Three Months Three Months

Ended Operating Ended Operating

December 2014 Margin December 2013

Margin Operating income, as reported

under GAAP $ 181,644 5.1% $ 508,382 15.5% Impairment of

goodwill and intangible assets 396,362 -

Operating

income, as adjusted $ 578,006 16.2%

$ 508,382

15.5%

Net income, as reported under GAAP $

122,101 $ 367,667 Impairment of goodwill and intangible

assets, net of tax 306,831 -

Net income, as adjusted

$ 428,932 $ 367,667 Diluted earnings

per share, as reported under GAAP $ 0.28 $ 0.82

Impairment of goodwill and intangible assets, net of tax 0.70 -

Diluted earnings per share, as adjusted $ 0.98 $ 0.82

Twelve Months Twelve Months

Ended Operating Ended Operating

December 2014 Margin December 2013

Margin Operating income, as reported

under GAAP $ 1,437,724 11.7% $ 1,647,147 14.4%

Impairment of goodwill and intangible assets 396,362 -

Operating income, as adjusted $ 1,834,086 14.9%

$

1,647,147 14.4%

Net income, as reported under

GAAP $ 1,047,505 $ 1,210,119 Impairment of goodwill and

intangible assets, net of tax 306,831 -

Net income, as

adjusted $ 1,354,336 $ 1,210,119

Diluted earnings per share, as reported under GAAP $ 2.38 $

2.71 Impairment of goodwill and intangible assets, net of

tax 0.70 -

Diluted earnings per share, as adjusted $

3.08 $ 2.71

Non-GAAP Financial

Information The financial information above has been presented

on a GAAP basis and on an adjusted basis which excludes the impact

of noncash impairment charges for goodwill and intangible assets.

These adjusted presentations are non-GAAP measures. Management

believes these measures provide investors with useful supplemental

information regarding VF's underlying business trends and the

performance of VF's ongoing operations and are useful for

period-over-period comparisons of such operations.

Management uses the above financial measures internally in its

budgeting and review process and, in some cases, as a factor in

determining compensation. While management believes that these

non-GAAP financial measures are useful in evaluating the business,

this information should be considered as supplemental in nature and

should be viewed in addition to, and not in lieu of or superior to,

VF's operating performance measures calculated in accordance with

GAAP. In addition, these non-GAAP financial measures may not be the

same as similarly titled measures presented by other companies.

VF CorporationLance Allega, 336-424-6082Vice President, Investor

RelationsorCraig Hodges, 336-424-5636Director, Public Relations

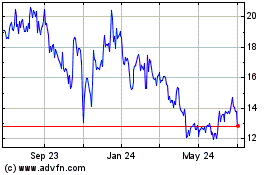

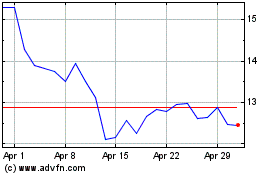

VF (NYSE:VFC)

Historical Stock Chart

From Jun 2024 to Jul 2024

VF (NYSE:VFC)

Historical Stock Chart

From Jul 2023 to Jul 2024